Professional Documents

Culture Documents

Power Sector in Pakistan

Uploaded by

sodakraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Power Sector in Pakistan

Uploaded by

sodakraCopyright:

Available Formats

Power sector development in Pakistan

Letter of Transmittal

Date: October 30th, 2009

Sir Rafique

Instructor, Economic development,

KUBS

Dear Sir,

With reference to the topic assigned, this report is being submitted to you on

October 31st 2009, as requested. It is based on the Power sector

development. The report has been drafted to provide a perspective on the

past considerations and current scenario of power development in Pakistan.

The report includes the supply and demand of the electricity and methods of

electricity generation and their respective sectorial distribution. The report

also includes the expansion plan of government regarding the power

development in Pakistan.

We have tried our level best to use the basic concepts taught in this course.

Hope you enjoy viewing our work and it is satisfactory.

Thank You

Sincerely,

Shazhad Rafique # 25

Sohaib Akram # 13

Economic Development - KUBS Page 1

Power sector development in Pakistan

Table of contents

S.NO. PARTICULARS PAGE

NO.

1 Introduction 3

Economic Development - KUBS Page 2

Power sector development in Pakistan

2 Overview of electricity sector 4

3 Installed generation capacity 6

4 Supply sources of electricity 7

1.WAPDA 7

2.KESC 11

3.Nuclear Energy 11

4.Independent power projects 12

5 Transmission &Distribution 14

6 Consumption of electricity 15

7 Growth in consumers 17

8 Village electrification 19

9 Expansion of generating 21

capacities

10 conclusion 21

INTRODUCTION

Pakistan’s energy infrastructure is under-developed, insufficient and poorly

managed. Presently

Pakistan has been facing severe energy crisis. Despite strong economic

growth and rising energy demand during the past decade, no serious efforts

have been made to install new capacity of generation. Consequently, the

demand exceeds supply and hence load-shedding is a common phenomenon

through power shutdown. Pakistan needs around 14,000 to 15,000 MW

electricity per day, and the demand is likely rise to approximately to 20,000

MW per day by 2010. Presently, it can produce about 11,500 MW per day

Economic Development - KUBS Page 3

Power sector development in Pakistan

and there is a shortfall of about 3000 to 4000 MW per day. This shortage is

badly affecting industry, commerce, daily life and posing risks to the

economic growth. The overall requirement of Pakistan is expected to be

about 80 MTOE in 2010, up by 50% from the 54 MTOE of the current year.

During the past 25 years energy supply in Pakistan has been increased by

about 40 times but still the demand outstrips supply. With the increase in

economic activities, per capita energy consumption had also been increased.

Industrialization, growth in agriculture and services sectors, urbanization,

rising per capita income and rural electrification has resulted in a

phenomenal rise in energy demand (NBP, 2008). Inefficient use of energy

and its wastages has further widened the demand-supply gap and exerts

strong pressure on the energy resources in the country. The annual growth

of primary energy supply increased from 3.17% to 4.3% during 1997-98 to

2006-07. The share of natural gas reached to 48.5%, followed by oil 30.0%,

hydro electricity 12.6%, coal 7.3%, nuclear electricity 0.9%, LPG 0.5% and

imported electricity by 0.1% during the year 2006-07.

In Pakistan the current energy crisis stems from the decline in hydro sources

of energy and over reliance on the expansive source of electricity. Presently,

oil-based thermal plants accounts for 68% of generating capacity,

hydroelectric plants for 30% and nuclear plants for only 2% This has led to a

huge generation costs, which in turn adversely affect the economy over the

past eight years. Rise in the oil prices pushing electricity tariff very high. As a

result, manufacturing costs and inflation are at the rising trend, export

competitiveness is eroded and the pressure on the balance of payments is

increasing. These factors adversely affect the present growth trajectory of

the economy .

OVERVIEW OF ELECTRICITY SECTOR IN PAKISTAN

At the time of independence in 1947, the power generation capacity of

Pakistan was only 60 MW for a population of 31.5 million, with a per capita

consumption of 4.5 units. However, the power sector gained momentum in

Economic Development - KUBS Page 4

Power sector development in Pakistan

1970, and the installed capacity rose from 636 MW in 1970 to 1331 MW in

1975. In 1980, the system capacity touched 3000 MW, and thereafter it

rapidly grew to over 8000 MW by 1990–1991 (Government of Pakistan,

2008).

At present, electricity demand is 13,021 MW, which is expected to increase

in the coming years. Responsibility for the generation and supply of

electricity rests with two utilities—the Pakistan Water and Power

Development Authority (WAPDA) and the Karachi Electricity Supply

Corporation (KESC).WAPDA supplies electricity throughout the country while

KESC is responsible for supplying electricity to Karachi and its adjoining

areas. The Pakistan Atomic Energy Commission owns nuclear power plants,

which are connected to WAPDA and KESC networks. The Independent Power

Plants (IPPs) are connected to the national grids at various locations.

The total installed generation capacity is around 19,420 MW and the

customer base is about 17.73 million in 2007–2008 (Government of Pakistan,

2008). The current installed capacity of electricity is about 19,420 MW.

During the year 2006–2007, the power system generated 98,213 million kWh

of electricity (Table 6) of which 64.3 per cent comes from thermal plants,

while hydroelectricity and nuclear power account for 33.4 and 2.4 per cent,

respectively. Pakistan’s total generation capacity has increased rapidly due

to the establishment of IPPs; this almost eliminated the power shortage in

the 1990s. The supply of hydroelectricity is season dependent and decreases

by about 3000–4000 MW when the water level in the dams gets low during

winter. The effective generating capacity of WAPDA’s power plants has

decreased slightly. In the past several years, the installed capacity has been

insufficient to meet the demand. Current supply is estimated at 15,055 MW

against demand of more than 17,600 MW.A deficit of 2500 MW was recorded

through load shedding, which reduced the industrial growth and adversely

affected the economy. Many villages do not enjoy access to electricity, and

only 60 per cent of the population are connected to the national grid.

During the period 1970–2000, the industrial sector consumed 35 percent of

electricity, followed by households (33 per cent), agriculture sector (17 per

cent), 8 per cent by bulk and the commercial sector by 6 per cent. However,

during 2001–2006, the electricity consumption of households dramatically

increased to 47 per cent. During the same period, the industrial and

agriculture sectors consumption reduced to 33 and 11 per cent, respectively.

Commercial sector consumption remained at 6 per cent while bulk share in

consumption reduced to 6 per cent. Similarly, during 2006–2007, household

electricity consumption remained dominant (46 per cent), followed by

industrial sector (29 per cent), agriculture sector (11 per cent), commercial

sector (7 per cent), bulk supplies (6 per cent) and street lights (1 per cent)

(Hydrocarbon Development Institute of Pakistan, 2007). Thus, the huge

increase in household consumption of electricity is the major reason for the

Economic Development - KUBS Page 5

Power sector development in Pakistan

demand–supply gap. The total installed power generation capacity is

insufficient to meet the growing needs of the country and has hit the

economy badly. The growing electricity demand–supply gap has forced the

authorities to resort to load shedding for very long duration. This has

adversely affected the public, businesses and trading communities. To tackle

the power crisis, the government has to come up with mega hydroelectric

projects and encourage domestic and foreign investors to invest in the

energy sector and extend and improve the nuclear power generation.

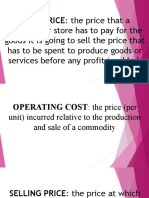

Installed Capacity of Electricity by source

Economic Development - KUBS Page 6

Power sector development in Pakistan

Sectorial Consumption of Electricity from 1970-2000

INSTALLED GENERATION CAPACITY

In 1947 the total installed generation capacity, hydro and thermal was 70

MW, 60 MW in now WAPDA system and 10 MW in Karachi. It is 19754 MW in

2009, hydro 6555 MW; thermal 13119 MW which includes conventional

steam and combined cycle power plants and nuclear 462 MW owner

Pakistan atomic energy commission.

The total installed generation capacity of WAPDA in 2008-09 is 11,454 MW,

including 6,555 Hydel and 4,899 Thermal. Other sources of generation are

KESC 1,884 MW and IPPs 5,954 MW.

Total Installed Generation Capacity(MW)

Power Company Installed Share(%)

Capacity(2008-

2009)

1. WAPDA 11,454 58

2. Hydel 6,555 57.2 (share in WAPDA

System)

3. Thermal 4,899 42.8 (share in WAPDA

System)

4. KESC 1,884 9.5

5. IPPs 5,954 30.1

6. Nuclear 462 2.3

Economic Development - KUBS Page 7

Power sector development in Pakistan

Total 19,754 100.0

Source: Hydrocarbon Development Institute of Pakistan

SUPPLY SOURCES OF ELECTRICITY

1.WAPDA

The installed capacity of PEPCO system is 18,019 MW as of March 2009 with

hydro 6555 MW and thermal 11,464 MW. The hydropower capacity accounts

for 36.38 percent and thermal 63.62 percent. Out of 11,464 MW of thermal

power, 4899 MW is owned by ex-WAPDA GENCOs 285 MW by rental, 325 by

PAEC and 5954 by IPPs.

Addition in Installed Generation Capacity in Pakistan (Megawatt)

Year Hydro Share(%) Thermal Share(%) Total

1959-63 267 67.0 130 33.0 397

1964-68 300 45.4 361 54.6 661

1969-73 100 51.0 96 49.0 196

1974-78 900 67.2 438 32.8 1338

1979-83 980 74.3 339 25.7 1319

1984-88 350 22.0 1245 78.0 1595

1989-93 864 32.7 1782 67.3 2646

1994-98 1064 31.2 2350 68.8 3414

Electricity Generation by WAPDA(GWh)

Year Hydro Share(%) Thermal Share(%) Total

1998-99 22,448 41.8 31,235 58.2 53,683

1999-00 19,288 34.3 36,585 65.5 55,873

2000-01 17,259 29.5 41,196 70.5 58,455

2001-02 19,056 31.3 41,804 68.7 60,860

Economic Development - KUBS Page 8

Power sector development in Pakistan

2002-03 22,350 34.9 41,690 65.1 64,064

2003-04 27,477 39.8 41,617 60.2 69,094

2004-05 25,671 34.9 47,849 65 73,520

2005-06 30,855 37.5 51,370 62.5 82,225

2006-07 31,942 36.4 55,895 63.6 87,837

2007-08 28,667 33.23 57,602 66.77 86,269

July-March

2007-08 21,606 33.5 42,963 66.5 64,569

2008-09 20,665 33.7 40,653 66.3 61,318

Source: PEPCO

WAPDA THERMAL ELECTRICITY GENERATION

WAPDA's Thermal Power Generation is mainly based on generation of power

from its Steam Turbo-Generators, Gas Turbines (simple as well as Combined

Cycle Units) installed at different Power Stations located in Sindh, Punjab and

Balochistan provinces. Indigenous Gas & Coal is the main fuel whereas

Furnace oil and HSD are also used as alternative fuel. The total installed

capacity is 4664 MW.

Thermal power plants generated a total of 21.593 Billion units (kwh) of

energy during the year 2006-07. The energy generated during 2008 was

62% on gas,37% on furnace oil and 1% on coal.

As per Government of Pakistan policy all thermal power generation has been

restructured and four corporative companies namely Jamshoro Power

Generation Company Limited (GENCO-1) head quarter at Jamshoro district

Dadu near Hyderabad Sindh, Central Power Generation Company Limited

(GENCO-2) head quarter at Guddu district Jacobabad Sindh and Northern

Power Generation Company Limited (GENCO-3) head quarters at

Muzaffargarh and Lakhra Power Generation Company Limited (GENCO-IV) at

Khanote (Sindh) have been formed and registered. Functioning of GENCO’s

has commenced.

Economic Development - KUBS Page 9

Power sector development in Pakistan

WAPDA HYDEL ELECTRICITY GENERATION

As a consequence of partition of the Indo-Pakistan Sub-Continent in 1947,

India and Pakistan became two independent sovereign states. Hydel

generation capacity of only 10.7 MW (9.6 MW - Malakand Power Station & 1.1

MW - Renala Power Station) existed in the territory of Pakistan. With the

passage of time, new Hydel Power Projects of Small and Medium capacities

were commissioned including the first water storage dam and power house

at Warsak due to which country's Hydel capability raised to about 267 MW

up till 1963. The Irrigation System which existed at the time of partition in

1947 was divided between the two countries without any regards to the

irrigation boundaries which resulted in an international water dispute which

was finally resolved by signing of the Indus Water Treaty in 1960 under the

aegis of World Bank. The Treaty assigned three Eastern rivers (Ravi, Beas

and Sutlej) to India and three Western rivers (Indus, Jhelum & Chenab) to

Pakistan. It also provided construction of replacement works called Indus

Basin Projects (IBP) to compensate for perpetual loss of Eastern rivers' water.

The works proposed under the Treaty included two multipurpose dams i.e.

Mangla Dam on Jhelum river and Tarbela Dam on Indus river having the

provision of power generation. These were commissioned in 1967 & 1977

respectively. However, their capacities were subsequently extended in

different phases

HYDEL GENERATION CAPACITY

The total capacity of 13 No. Hydel Stations as of today is 6444 MW which is

35.88% of total installed generation capacity of WAPDA. During 2008~2009,

aggregate energy sharing during the year was 33.07%.

SEASONAL VARIATIONS OF HYDEL GENERATION

The seasonal variations of reservoir levels and consequent reduction in

Power outputs of storage type hydel projects in Pakistan are very

pronounced. Tarbela with maximum head of 450 ft. experiences variation of

181 ft. while Mangla has 162 ft. variation against the maximum head of 360

ft.

The lean flow period of Tarbela reservoir is from November to June when the

Capability reduces to as low as about 1884 MW against the maximum of

3714 MW during high head period i.e. August to September (15% permissible

overloading on Units 1~10).

Lean flow period of Mangla reservoir is observed from October to March

when the minimum generating capability is 496 MW. The capability rises to

as high as 1150 MW during 'high head' period (15% permissible overloading).

Economic Development - KUBS Page 10

Power sector development in Pakistan

In all, WAPDA's Hydel generating capability varies between the two

extremities of 3506 MW and 6750 MW over the cycle of a year.

SALIENT FEATURES OF WAPDA HYDEL STATIONS

Station Water Way Units No. Capacity of Installed Date of

(River/Canal) Unit Capacity Commissioning

(MW) (MW)

Tarbela Indus 1~4 175 700 Jul. 1977

(Reservoir) 5~8 175 700 Dec. 1982

9~10 175 350 Apr. 1985

11 432 432 Feb. 1993

12~14 432 1296 Nov.1992

Total 3478

Barotha Indus 1 290 290 July. 2003

(D/S Tarbela) 2 290 290 Aug. 2003

3 290 290 Oct. 2003

4 290 290 Dec. 2003

5 290 290 April. 2004

Total 1450

Mangla Jhelum 1~4 100 400 1967 - 1969

(Reservoir) 5~6 100 200 Mar. 1974

7~8 100 200 Apr. 1981

9 100 100 Sep. 1993

10 100 100 Jul. 1994

Total 1000

Warsak Kabul 1~4 40.0 160 Jul. 1960

(Reservoir) 5~6 41.48 83 Mar. 1981

Total 243

Chashma Chashma 1 23 23 Jun. 2001

(Barrage) 2~3 23 46 Apr. 2001

4~5 23 46 Mar. 2001

6 23 23 Feb. 2001

7~8 23 46 Dec. 2000

Total 184

Upper Jhelum Canal from River 1~2 11.0 22.0 Jul. 1952

Rasul Jhelum

Swat canal from River Swat 1~4 5.0 20.0 Dec.1952

Dargai

Upper Chenab Canal from River 1~3 4.6 13.8 Mar. 1963

Nandipur Chenab

Upper Jhelum Canal from River 1~2 6.75 13.5 Jan. 1961

Shadiwal Jhelum

Upper Chenab Canal from River 1~3 4.4 13.2 Aug. 1959

Chichoki Chenab

Lower Bari Doab Canal from 1~5 0.22 1.1 Mar. 1925

Renala Balloki Headworks on Ravi

Economic Development - KUBS Page 11

Power sector development in Pakistan

Kachkot Canal from River 1~4 1.0 4.0 Feb. 1958

K/Garhi Kurram

Ludko 1~2 0.3 0.6 1975

Chitral 3~4 0.2 0.4 1982

Total 1.0

2.KARACHI ELECTRIC SUPPLY COMPANY (KESC):

KESC fleet has 1890 MWs of installed capacity to cater to the city load

requirement. The main generation units consisting of Bin Qasim Power

Station, Korangi Thermal Power Station, Site Gas Turbines and Korangi Gas

Turbines, with a new power plant at Korangi (Combined Cycle Power

Plant).Presently the situation is as under

S. Name of Power Plant Location Available

No. Capacity

(MW)

1 Bin Qasim Power Port Qasim Industrial 1021

Station Area

2 Korangi Thermal Power Korangi Creek 55

Station

3 GEJB- 1 SITE, Karachi 80

4 GEJB- 2 Korangi Industrial 35

Area

5 Combined Cycle Power Korangi Creek 160

Station

GRAND TOTAL

=1351

3.NUCLEAR ENERGY:

Pakistan Atomic Energy Commission (PAEC) is responsible for the planning,

construction and operation of nuclear power plants in the country. Presently,

two nuclear power plants; Karachi

Nuclear Power Plant (K-1) and Chashma Nuclear Power Plant unit-1 (C-1) are

operational, while

construction of a third plant, Chashma Nuclear Power Plant unit-2 (C-2), is in

progress. K1, has

Economic Development - KUBS Page 12

Power sector development in Pakistan

been in commercial operation since 1971. After completing its design life of

30 years, K-1 is

operating on extended life at 90 MWe. K-1 generated 317 million kWh of

electricity during

the period July-March 2008-09, raising its life-time generation to 12.21 billion

kWh. C-1, a PWR type plant with a gross capacity of 325 MWe, and has been

in commercial operation since September 2000. C-1 generated 602 million

kWh of electricity during July-March 2008-09, raising its lifetime generation

to 16.86 billion kWh. The construction and installation activities of C-2 are in

progress as per schedule. The commercial operation of C-2 is expected in

2011.

In Pakistan, nuclear power makes a small contribution to total energy

production and requirements, supplying only 2.34% of the country's

electricity. Total generating capacity is 20 GWe and in 2006, 98 billion kWh

gross was produced, 37% of it from gas, 29% from oil.

Its first nuclear power reactor is a small (125 MWe) Canadian pressurized

heavy water reactor (PHWR) which started up in 1971 and which is under

international safeguards - KANUPP near Karachi, which is operated at

reduced power.

The second unit is Chashma-1 in Punjab, a 325 MWe (300 MWe net)

pressurised water reactor (PWR) supplied by China's CNNC under safeguards.

The main part of the plant was designed by Shanghai Nuclear Engineering

Research and Design Institute (SNERDI), based on Qinshan-1. It started up in

May 2000 and is also known as CHASNUPP-1.Construction of its twin,

Chashma-2, started in December 2005. It is reported to cost PKR 51.46

billion (US$ 860 million, with $350 million of this financed by China). A

safeguards agreement with IAEA was signed in 2006 and grid connection is

expected in 2011.

Reacto Typ MW Construct Commer Plann

r e e ion start cial ed

net operatio close

n

Karach PHW 125 1966 12/72

i R

Chash PWR 300 1993 6/00

ma 1

Chash PWR 300 2005 2011

ma 2

Total 425 operating

Economic Development - KUBS Page 13

Power sector development in Pakistan

5. INDEPENDENT POWER PROJECTS:

The 17 largest independent power producers in Pakistan all operate thermal

generating plants only . The two largest privately owned power producers

are the HUB Company (HUBCO) and the Kot Addu Power Company (KAPCO).

HUBCO belongs to a consortium formed by National Power (Great Britain),

Xenal (Saudi Arabia) and Mitsui Corporation (Japan) and possesses just under

1,300 MW of generating capacity. KAPCO, with more than 1,600 MW of

power generating capacity, was privatized in 1996 and now belongs to the

British enterprise National Power. Between 1994 and 1997, 19 IPP projects

amounting to an overall capacity of 3,158 MW and a total investment volume

of some US$ 4 billion were awarded competitive bidding contracts. By the

end of March 2003, 2,728 MW of the total had already been installed. The

power-producing volume was so large that the Pakistani electricity market

began to exhibit intermittent overcapacities. The city of Karachi receives all

its electricity from KESC, while WAPDA serves the rest of the country. In the

medium to long term, though, the sale of electricity is also supposed to be

liberalized.

Detail of the IPPs Projects commissioned and under commercial

operations is as under

Sr. Name of Technology Commercial Gross Net Energy Received

# Project Operation Capacity Capacity July, 2006 to June,

Date (MW) (MW) 2007 (GWh)

1 KAPCO GTs, Combined 27.06.1996 1638 1345 8183

cycle, Steam

Turbine on

LSFO/Gas/ Diesel

2 Hubco Steam Turbine on 31.03.1997 1292 1207.3 7212

Fuel Oil

3 Kohinoor Diesel engines on 20.06.1997 131 124 806

Energy Ltd fuel oil

4 AES Lalpir Steam turbines on 06.11.1997 362 350.7 1356

fuel oil

5 AES Pakgen Steam turbines on 01.02.1998 365 350.5 1943

fuel oil

6 Southern Diesel engines on 10.03.1999 117 103.791 539

Electric fuel oil

Economic Development - KUBS Page 14

Power sector development in Pakistan

Power

7 Habibullah Combined cycle on 11.09.1999 140 129.15 966

Coastal natural gas

Power

8 Fauji Combined cycle on 21.10.1999 157 151.2 1184

Kabirwala gas

Power

9 Rousch Combined cycle on 11.12.1999 450 395 3090

(Pakistan) fuel oil

Power

10 Saba Power Steam turbine on 31.12.1999 134 125.55 868

fuel oil

11 Japan Power Diesel engines on 14.03.2000 135 107.0 528

Generation fuel oil

12 Uch Power Combined cycle on 18.10.2000 586 551.25 3889

low Btu gas

13 Altern Flared gas/Gas 06.06.2001 10.5 5.13 0

Energy Engine

14 Liberty Combined cycle on 10.09.2001 235 210.341 1305

Power natural gas

15 CHASNUPP Nuclear 325 300 1944

16 JAGRAN Hydel 23.10.2000 30 30 96

17 RETNAL Gas Turbine 22.02.2007 150 150 213

POWER

STATION

18 TAVANIR, Import from Iran Sep. 2003 39 39 171

IRAN

Total: 6296.5 5674.912 34293

TRANSMISSION & DISTRIBUTION

In 1947, we had only 1200 KMs Transmission Lines. The total length of

transmission lines now stands about 4665 Km. WAPDA's Power Transmission

Lines system is interconnected through a National Grid which extends power

from Peshawar to Karachi - Quetta and Azad Kashmir linking all important

cities of the country.

Economic Development - KUBS Page 15

Power sector development in Pakistan

There are 9 Distribution Supply Companies namely Each Distribution

Company is headed by Chief Executive. Area of Jurisdiction in respect of each

Distribution Company is as under

Name of Area of Jurisdiction

Distributio

n

Company

LESCO Sheikhupura , Kasur , Lahore , Okara .

GEPCO Gujranwala, Sialkot, Mandi Bahauddin ,

Hafizabad , Narowal , Gujrat .

FESCO Faisalabad , Sargodha , Khushab , Jhang , Toba

Tek Singh , Bhalwal , Mianwali , Bhakkar

Districts of Punjab Province .

IESCO Islamabad , Rawalpindi , Attock , Jhelum ,

Chakwal .

MEPCO Rahim Yar Khan , Multan , Khanewal , Sahiwal,

Pakpattan , Vehari , Muzaffargarh , Dera Ghazi

Khan , Leiah , Rajan Pur , Bahawalpur , Lodhran

, Bahawalnagar .

PESCO Whole Province of NWFP .

HESCO Whole Province of Sindh except Karachi where

KESC is responsible for distribution of power .

QESCO Whole Province of Balochistan .

Economic Development - KUBS Page 16

Power sector development in Pakistan

CONSUMPTION OF ELECTRICITY

With the sole exception of fiscal year 1998/99, power consumption has

grown steadily in recent

years. Between 1990/91 and 2003/04, total consumption increased by more

than 84%, from 31 TWh to 57 TWh. Again, with a single exception - fiscal

year 1990/91 – the domestic sector was the consumer group with the largest

proportion of consumption, followed by industry and agriculture. The demand

for electricity will continue to rise in the years to come. An average annual

increase of 7% has been postulated.

After recording at an average rate of 6.1 percent per annum since 1999-00

to 2007-08, the electricity consumption by different sectors increased merely

by 0.7 percent during July-March 2008-09 against the comparable period last

year. This trend of the decelerating growth of electricity consumption started

in 2006-07. With the exception of Other Government Sector, all remaining

sectors witnessed a negative growth during July-March 2008-09 over the

same period last year. Reduction in consumption of electricity by different

sectors is due to a shortage of electricity, its higher cost due to gradual

phasing out of a subsidy on electricity, and the circular debt problem.

Economic Development - KUBS Page 17

Power sector development in Pakistan

CONSUMPTION OF ELECTRICITY

Fiscal ELECTRICITY (Gwh) Increase (%)

Year

1998-99 43,296 -

1999-00 45,586 5.3

2000-01 48,584 6.6

2001-02 50,622 4.2

2002-03 52,656 4.0

2003-04 57,491 9.2

2004-05 61,327 6.7

2005-06 67,603 10.2

2006-07 72,712 7.6

2007-08 73,400 0.9

Avg. 10 6.1

Yrs

CONSUMPTION OF ELECTRICITY BY SECTORS Gwh (000)

Year Househ Commer Industri Agricult Street Other

old cial al ure Light Govt.

Gwh(00

Gwh(00 Gwh(00 Gwh(00 Gwh Gwh(00

0)

0) 0) 0) 0)

1998-99 19.4 2.4 12.0 5.6 224 3.6

1999-00 21.4 2.5 13.2 4.5 239 3.6

2000-01 22.8 2.8 14.3 4.9 213 3.5

Economic Development - KUBS Page 18

Power sector development in Pakistan

2001-02 23.2 3.0 15.1 5.6 212 3.5

2002-03 23.7 3.2 16.2 6.0 244 3.4

2003-04 25.8 3.7 17.4 6.7 262 3.7

2004-05 27.6 4.1 18.6 7.0 305 3.8

2005-06 30.7 4.7 19.8 7.9 353 4.0

2006-07 33.3 5.4 21.1 8.2 387 4.4

2007-08 33.7 5.6 20.7 8.5 415 4.5

GROWTH IN CONSUMERS

The pattern of consumption underwent a gradual transformation during the

period 1960–98 The major beneficiaries of power sector development in

Pakistan were the general populace, i.e., the households. Its share went from

12.81 percent in 1960 to 42.08 percent in 1998.

Electricity Used By Consumers Category

(MLN Kilowatt Hours)

Year Domesti Commer Industri Agricult Others Total

c cial al ure

1959- 120 66 531 67 77 860

1960

1964- 258 179 1409 277 278 2401

1965

1969- 546 337 2299 965 590 4737

1970

1974- 917 468 3056 1539 851 6831

1975

1979- 2012 595 4056 2067 1069 9799

1980

1984- 5091 1375 6317 2795 2030 17608

Economic Development - KUBS Page 19

Power sector development in Pakistan

1985

1989- 9402 1964 10333 5027 2469 29195

1990

1994- 15583 1941 12528 6252 5360 41664

1995

1997- 18724 2333 12297 7004 4143 44501

1998

Source: WAPDA & KESC power system statistics

With the expansion of the electricity network, the number of consumers has

increased by 7,675

thousands since 1998-99. During July-march 2008-09, the growth of

consumers stood at 4.2 percent as it reached 18.5 million consumers during

July- March 2008-09 as compared to 17.7 million in same period last year.

The share of domestic consumers remained 84.9 percent followed by the

commercial and industrial sectors having a 12.3 percent and a 1.4 percent

share respectively

CONSUMERS BY ECONOMIC GROUP(thousands)

Year Domesti Commerc Industri Agricultu Others Total

c ial al ral

1998-99 8,912 1,517 190 173 8 10,800

1999-00 9,554 1,654 195 175 8 11,586

2000-01 10,045 1,737 196 180 8 12,166

2001-02 10,483 1,803 200 184 8 12,678

2002-03 11,044 1,867 206 192 9 13,318

2003-04 11,737 1,935 210 199 10 14,092

2004-05 12,490 1,983 212 201 10 14,896

2005-06 13,390 2,068 222 220 10 15,911

2006-07 14354 2,152 233 236 11 16,987

2007-08 15,226 2,229 242 245 11 17,955

Source:WAPDA & KESC power system statistics

Economic Development - KUBS Page 20

Power sector development in Pakistan

VILLAGE ELECTRIFICATION

Pakistan’s increasing demand for energy is due in part to efforts designed to

promote the process of rural electrification. Until 1995/96, the number of

villages with access to grid power grew by 9 to 11% annually. Since then,

however, the increasing connection costs have driven the growth rate down

to about 2% per year. As of March 2003, approximately 73,000 (59%) of

Pakistan’s roughly 125,000 villages were receiving electricity (compared with

approximately 46,000 villages, or 37%, in mid-1993. Recently the

Government of Pakistan has publicly announced an ambitious plan to provide

basic power to all the citizens through out the country by the end of 2007.

About 67.0 percent of the population of the country resides in rural areas

with agriculture being the main occupation Keeping this fact in view and in

order to increase the productivity of a majority of the population, the village

electrification programme is being highlighted as a central component of the

total power sector development programme. The number of villages

electrified has increased to 66,280 since 1998-99. Furthermore, the village

electrification facility has increased by 5.7 percent during the period of July-

March 2008-09 as compared to same period last year. The detailed trend of

village electrification is.

VILLAGE ELECTRIFICATION (in numbers)

Year Total Cumulative Total

Pre WAPDA 609 609

1960-1963 1041 1650

1964-1968 557 2207

1969-1973 719 2926

1974-1978 4691 7617

1979-1983 7622 15239

1984-1988 12452 27691

1989-1993 17953 45644

1994-1997 18924 64568

Economic Development - KUBS Page 21

Power sector development in Pakistan

1997-1998 1383 65951

VILLAGE ELECTRIFICATION (in numbers)

Year Addition Progressive Growth(%)

during the total

year

1998 1,232 67,183

1999 1,109 68,292 1.7

2000 1,595 69,887 2.3

2001 1,674 71,561 2.4

2002 2,246 73,807 3.1

2003 7,193 81,000 9.7

2004 9,467 90,467 11.7

2005 12,764 103,231 14.1

2006 14,203 117,456 13.8

2007 10,441 127,897 8.9

July-March

2007-08 8,840 126,296

2008-09 5,566 133,463 5.7

The electrification of villages manifests transformation of the rural economy

in checking the influx of rural workforce in search of work to the already

Economic Development - KUBS Page 22

Power sector development in Pakistan

populous cities and towns where the essential services supplied by the

utilities are already over capacitated

EXPANSION OF GENERATING CAPACITIES (FUTURE

OUTLOOK)

By reason of the projected increase in the demand for electricity by some

10,000 MW by the year 2010. To keep that from happening, or at least to

minimize future supply deficits, Pakistan has adopted a systematic

development plan called ‘Vision 2025’ that targets a long-term capacity

increase of around 35,000 MW by the year 2025. That would be nearly twice

as much power as was available at the end of 2002. Around two thirds of the

additional power (22,563 MW) is slated to come from hydroelectric power

plants. New gas-fired power plants are supposed to contribute 13% (4,680

MW), the same percentage as that to be generated by coal fired power

plants (4,350 MW). New nuclear power plants with a total installed capacity

of 1,800 MW (5%) are planned3. Finally, renewable sources of energy are

supposed to account for more than 4% (1,500 MW) of the overall newly

installed capacity. The planned expansion will cost approximately US$ 30

billion. In view of Pakistan's high national debt and persistent budget deficit,

the government is intensifying its efforts to attract private investors.

Economic Development - KUBS Page 23

Power sector development in Pakistan

CONCLUSION

In Pakistan the current energy crisis stems from the decline in hydro sources

of energy and over reliance on the expansive source of electricity. Presently,

oil-based thermal plants accounts for 68% of generating capacity,

hydroelectric plants for 30% and nuclear plants for only 2%

This has led to a huge generation costs, which in turn adversely affect the

economy over the past eight years. Rise in the oil prices pushing electricity

tariff very high. As a result, manufacturing costs and inflation are at the

rising trend, export competitiveness is eroded and the pressure on the

balance of payments is increasing. These factors adversely affect the present

growth trajectory of the economy.

Economic Development - KUBS Page 24

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Keynes' Liquidity Preference Theory of Interest Rate - ppt1Document17 pagesKeynes' Liquidity Preference Theory of Interest Rate - ppt1Bhagyashree Chauhan100% (1)

- Ch13 Responsibility Accounting and Transfer PricingDocument39 pagesCh13 Responsibility Accounting and Transfer PricingChin-Chin Alvarez SabinianoNo ratings yet

- Sheba XyzDocument22 pagesSheba XyzAjnanNo ratings yet

- Commodities As An Asset ClassDocument7 pagesCommodities As An Asset ClassvaibhavNo ratings yet

- Brazil UnileverDocument5 pagesBrazil Unileverinterpon07100% (1)

- COST PRICE: The Price That ADocument47 pagesCOST PRICE: The Price That AAlma Agnas100% (3)

- Smart Money Concept Cryptocurrency Day Trading For A LivingDocument27 pagesSmart Money Concept Cryptocurrency Day Trading For A LivingZack Ming67% (3)

- 1 - Basic Economic ConceptsDocument4 pages1 - Basic Economic ConceptsEric NgNo ratings yet

- CH9-Capacity Planning and Location DecisionDocument35 pagesCH9-Capacity Planning and Location DecisionChristian John Linalcoso Arante100% (1)

- Economics - Revision Notes - Jocelyn Blink and Ian Dorton - Second Edition - Oxford 2012 (Dragged) 5Document1 pageEconomics - Revision Notes - Jocelyn Blink and Ian Dorton - Second Edition - Oxford 2012 (Dragged) 5Noblest PersonNo ratings yet

- 7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFDocument6 pages7995-2010-BIR - Ruling - No. - 008-1020190219 - (Job Order Contract Employee) PDFanorith88No ratings yet

- Asset-Based Valuation - Blk2Document45 pagesAsset-Based Valuation - Blk2Kim GeminoNo ratings yet

- Safe Minimum StandardsDocument3 pagesSafe Minimum StandardsAyodejiNo ratings yet

- Strategic ManagementDocument32 pagesStrategic ManagementRuslan A GaniNo ratings yet

- Net Present Value MethodDocument7 pagesNet Present Value MethodSUMEDHA RNo ratings yet

- What Good Is A Volatility Model?: Esearch AperDocument9 pagesWhat Good Is A Volatility Model?: Esearch AperstkipNo ratings yet

- 3Document4 pages3Rahmatullah Mardanvi100% (3)

- The Secrets of Trading Chart Patterns Like The Pros 29 Jan 24Document51 pagesThe Secrets of Trading Chart Patterns Like The Pros 29 Jan 24VERO NICANo ratings yet

- Goldoni Special Lux 140 PartsDocument3 pagesGoldoni Special Lux 140 PartsErik0% (1)

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Community Organisation EoI Application Form 29 JuneDocument3 pagesCommunity Organisation EoI Application Form 29 JuneifyjoslynNo ratings yet

- Iaadfs 2011 SMALLDocument165 pagesIaadfs 2011 SMALLchris2541No ratings yet

- Multiple Choice QuestionsDocument21 pagesMultiple Choice QuestionsMichael AyadNo ratings yet

- Lecture 7 - Public Goods and Common Resources - Cost of ProductionDocument45 pagesLecture 7 - Public Goods and Common Resources - Cost of Productionvillaverdev01No ratings yet

- Study On Pricing StrategiesDocument8 pagesStudy On Pricing Strategiessara philipNo ratings yet

- Questions of CGSDocument4 pagesQuestions of CGSaneel72No ratings yet

- Indiegogo Campaigner Field GuideDocument22 pagesIndiegogo Campaigner Field GuidejanNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- RRL - DraftDocument2 pagesRRL - DraftJp CombisNo ratings yet

- Strategic Management 1Document112 pagesStrategic Management 1Aashish Mehra0% (1)