Professional Documents

Culture Documents

Astenbeck Commodities Performance 09-30-2014

Uploaded by

ZerohedgeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Astenbeck Commodities Performance 09-30-2014

Uploaded by

ZerohedgeCopyright:

Available Formats

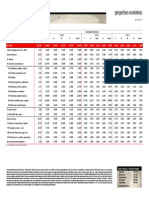

Astenbeck Offshore Commodities Fund II Ltd

September 30, 2014 Performance Report

The attached performance report (the Report) of Astenbeck Offshore Commodities

Fund II Ltd (the Fund) is for the cumulative period beginning January 1, 2008 and

ending September 30, 2014.

If you have any questions regarding the contents of this Report, please contact Chris

Chapman at (203) 221-6686.

Disclaimer: This Report has been furnished on a confidential basis solely for the

information of the person to whom it has been delivered and may not be reproduced,

distributed or used for any other purposes. Any views expressed herein are solely those

of Astenbeck Capital Management LLC (Astenbeck) as of the date of this Report and

are subject to change without notice. This Report is not an offer to sell or a solicitation of

an offer to buy any security or other instrument. Any offer to invest in the Fund managed

by Astenbeck can only be made pursuant to the confidential private placement

memorandum for the Fund. The data used in this Report is not audited and may contain

estimates. This Report is not prepared as, or intended to be, investment advice and is

issued without regard to the investment objectives, financial situation or particular needs

of any recipient. Recipients should consult their own advisors, including legal and tax

advisors, before making any investment decision. The delivery of this Report will under

no circumstances create any implication that the information herein has been updated or

corrected as of any time subsequent to the date of publication or, as the case may be, the

date as of which such information is stated. The Funds investment program is

speculative and entails substantial risk. There can be no assurance that the investment

objectives of the Fund will be achieved. The past investment performance of Astenbeck,

its affiliates, the funds they manage and any of their members, principals, or employees

may not be indicative of future results.

23432312v1

Astenbeck Offshore Commodities Fund II Ltd

Performance Report

For the period from the date of initial operation (January 1, 2008) through September 30, 2014

Net asset value (See Note A)

Net increase/(decrease) in net assets

resulting from operations

(after deducting management

and incentive fees payable

to the investment manager)

Total return (See Notes B, C, D, E, F and G):

Class A Shares (2% management fee; currently offered)

Class B Shares (1% management fee; no longer offered)

Class C Shares (1.75% management fee, currently offered)

Twelve Months Ended

December 31, 2008

Twelve Months Ended

December 31, 2009

Twelve Months Ended

December 31, 2010

As of and for the

Twelve Months Ended

December 31, 2011

Twelve Months Ended

December 31, 2012

Twelve Months Ended

December 31, 2013

Nine Months Ended

September 30, 2014

$206,149,863

$425,358,005

$1,741,175,516

$2,258,429,638

$1,988,750,302

$1,247,780,882

$926,551,202

$9,188,629

$74,992,584

$239,607,511

($171,373,108)

$80,054,603

($134,527,196)

$141,187,497

4.98%

6.11%

N/A

28.46%

29.36%

N/A

12.01%

13.91%

See Note (D)

-3.83%

-2.27%

-4.20%

3.41%

4.34%

3.87%

-8.31%

-7.37%

-8.03%

11.75%

12.09%

12.25%

Note (A): Net Asset Value represents the fair value, as defined in Accounting Standards Codification No. 820 as of the date indicated, as determined by the Administrator in good faith. The procedures used by the Administrator in connection with the

determination of fair value are more fully discussed in the Memorandum under "Valuation of Fund Assets and Shares." Actual value may differ from such estimated value and these differences may be material and adverse. NAV is net of accrued management

fees and incentive fees and other allocable fund expenses. No representations or warranties are made as of any other date. The prices of many of the commodities, currencies and securities in which the Fund trades, including derivative instruments, can be

highly volatile and market movements are difficult to predict. Prospective investors should review the information in the Confidential Private Placement Memorandum of the Feeder Fund under the headings "Certain Risk Factors" and "Potential Conflicts of

Interest."

Note (B): Class B represents the seed investor that pays a management fee of 1% instead of the current fee of 2% for Class A Shares or 1.75% for Class C Shares. The 1% rate is no longer offered to investors.

Note (C): Total return has been calculated separately for each class of shares without annualization and is based on the time-weighted rate of return methodology. The time-weighted rate of return removes the effects of cash flows which are generally investordriven. If capital cash flows occur during the period, returns are geometrically linked based on capital cash flow dates. In general, geometrically linking requires the computation of performance for each discrete period in which invested capital is constant (that is

for each period between investor cash flow dates), then multiplying those performance computations together to obtain the total return for a constant investment outstanding for the period. An individual investor's return may vary from the total and monthly

returns (see Note D) shown based on different management fee arrangements and the timing of capital transactions.

Note (D): Monthly returns are calculated by taking the change in the net asset value during the month, exclusive of any capital transactions, divided by the net asset value at the beginning of the month (see Note A). Since capital redemptions and contributions

normally occur at the end/beginning of each month, the time-weighted methodology described in Note C is not applicable to monthly returns. Monthly returns (net of management fees and incentive fees) since inception are as follows:

January 2008

February 2008

March 2008

April 2008

May 2008

June 2008

July 2008

August 2008

September 2008

October 2008

November 2008

December 2008

January 2009

February 2009

March 2009

April 2009

May 2009

June 2009

July 2009

August 2009

September 2009

October 2009

November 2009

December 2009

January 2010

February 2010

March 2010

April 2010

May 2010

June 2010

July 2010

August 2010

September 2010

October 2010

November 2010

December 2010

January 2011

February 2011

March 2011

April 2011

May 2011

June 2011

July 2011

August 2011

September 2011

October 2011

November 2011

December 2011

January 2012

February 2012

March 2012

April 2012

May 2012

June 2012

July 2012

August 2012

September 2012

October 2012

November 2012

December 2012

January 2013

February 2013

March 2013

April 2013

May 2013

June 2013

July 2013

August 2013

September 2013

October 2013

November 2013

December 2013

January 2014

February 2014

March 2014

April 2014

May 2014

June 2014

July 2014

August 2014

September 2014

Class A shares with Class B shares with

Class C shares with

2% mgt fee and 20% 1% mgt fee and 20% 1.75% mgt fee and 20%

incentive fee

incentive fee

incentive fee

-2.23%

-2.15%

N/A

8.64%

8.57%

N/A

-3.88%

-3.76%

N/A

4.84%

4.84%

N/A

7.62%

7.75%

N/A

5.99%

6.11%

N/A

-9.87%

-9.78%

N/A

-0.60%

-0.51%

N/A

-2.58%

-2.40%

N/A

-0.87%

-0.74%

N/A

-0.23%

-0.14%

N/A

-0.40%

-0.30%

N/A

-0.63%

-0.55%

N/A

-3.13%

-3.06%

N/A

4.11%

4.13%

N/A

3.48%

3.35%

N/A

17.34%

17.37%

N/A

-4.30%

-4.26%

N/A

1.94%

2.03%

N/A

-1.41%

-1.33%

N/A

1.72%

1.80%

N/A

3.21%

3.33%

N/A

4.04%

4.19%

N/A

0.47%

0.55%

N/A

-6.71%

-6.63%

N/A

2.61%

2.75%

N/A

3.51%

3.74%

N/A

1.17%

1.24%

N/A

-10.06%

-10.03%

N/A

-2.22%

-2.14%

N/A

2.71%

2.83%

2.76%

-2.76%

-2.70%

-2.76%

9.00%

9.63%

9.16%

3.76%

3.99%

3.92%

2.55%

2.61%

2.56%

9.69%

9.73%

9.69%

3.15%

3.22%

3.16%

4.56%

4.63%

4.57%

2.61%

2.69%

2.62%

6.77%

6.87%

6.74%

-6.41%

-6.28%

-6.36%

-3.79%

-3.62%

-3.98%

5.26%

5.20%

5.51%

-2.47%

-2.36%

-2.51%

-18.78%

-18.24%

-19.19%

12.29%

12.23%

12.27%

-0.17%

-0.09%

-0.16%

-3.28%

-3.04%

-3.23%

6.40%

6.09%

6.55%

6.46%

6.20%

6.76%

-2.22%

-2.06%

-2.29%

-1.28%

-1.14%

-1.31%

-14.41%

-13.81%

-14.60%

-0.64%

-0.56%

-0.61%

3.65%

3.78%

3.70%

5.41%

5.60%

5.54%

1.85%

1.64%

1.90%

-5.38%

-5.09%

-5.45%

5.06%

4.99%

5.21%

0.51%

0.54%

0.57%

4.43%

4.25%

4.78%

-2.25%

-2.06%

-2.37%

1.83%

1.80%

1.98%

-8.82%

-8.47%

-9.03%

3.71%

3.81%

3.74%

-5.78%

-5.71%

-5.76%

7.29%

7.40%

7.33%

2.84%

2.65%

3.04%

-4.35%

-4.02%

-4.49%

-2.86%

-2.78%

-2.84%

-3.57%

-3.50%

-3.56%

0.14%

0.22%

0.16%

-2.06%

-1.98%

-2.04%

7.66%

7.77%

7.69%

2.38%

2.42%

2.41%

3.07%

2.80%

3.14%

3.89%

3.76%

4.07%

3.69%

3.72%

3.70%

-6.85%

-6.57%

-6.76%

0.81%

0.83%

0.81%

-0.72%

-0.60%

-0.68%

Note (E): Past performance is not indicative of future results. An investment in the Fund is highly speculative and investors must be prepared to bear the risk of a total loss of their investment.

Note (F): This is not an offer of or solicitation for the purchase of shares in the Fund. Any offer will be made only through the Memorandum and Subscription Agreement for the Fund and is subject to the terms contained in such documents.

Note (G): The 2008 annual return figures as stated in the audited financial statements are slightly higher than the figures stated above. The differences are due to the method of calculation used in the different reports and are considered immaterial. Subsequent

to 2008, the method used in this report will be followed.

Note (H): Performance presented prior to 2010 represents the track record established by Astenbeck Capital Management LLC's portfolio manager under Phibro LLC, the Funds prior investment adviser. The portfolio manager was the primary individual

responsible for achieving the Funds performance results.

You might also like

- AQR FundDocument14 pagesAQR Fundthundercoder9288100% (1)

- San Dieguito Water District PensionDocument104 pagesSan Dieguito Water District PensionEncinitasProjectNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173No ratings yet

- Birla Sun Life Cash ManagerDocument6 pagesBirla Sun Life Cash ManagerrajloniNo ratings yet

- Perspectivas Económicas: Proyecciones de Producto Interno BrutoDocument1 pagePerspectivas Económicas: Proyecciones de Producto Interno Brutoramses2mNo ratings yet

- Performance %: Unit Price (30/06/2015) : Rs. 10.1642Document1 pagePerformance %: Unit Price (30/06/2015) : Rs. 10.1642Ahmer KhanNo ratings yet

- ABL Half Yearly 2015Document52 pagesABL Half Yearly 2015hamzaNo ratings yet

- RkriDocument19 pagesRkriKalai Vani KarthiNo ratings yet

- Fundcard L&TCashDocument4 pagesFundcard L&TCashYogi173No ratings yet

- 2014 09 September Monthly Report TPOIDocument1 page2014 09 September Monthly Report TPOIValueWalkNo ratings yet

- NAFA Govt FundDocument1 pageNAFA Govt FundSAna KhAnNo ratings yet

- (Associate of The State Bank of India) : TH STDocument6 pages(Associate of The State Bank of India) : TH STkaran_tiffNo ratings yet

- 2013 PERS Valuation Report FINAL-1 PDFDocument46 pages2013 PERS Valuation Report FINAL-1 PDFthe kingfishNo ratings yet

- 11 15 16 Asset AllocationDocument60 pages11 15 16 Asset AllocationZerohedge100% (1)

- Reliance Industries: 2 QTR Results UpdateDocument9 pagesReliance Industries: 2 QTR Results UpdatesonujangirNo ratings yet

- USD Wealth Premier 2023 Fund: February 2014 Investment ObjectiveDocument1 pageUSD Wealth Premier 2023 Fund: February 2014 Investment ObjectiveErwin Dela CruzNo ratings yet

- Harness Performance and AttributionsDocument12 pagesHarness Performance and AttributionsyochamNo ratings yet

- Asset Allocation Webcast: Live Webcast Hosted byDocument60 pagesAsset Allocation Webcast: Live Webcast Hosted bysuperinvestorbulletiNo ratings yet

- HDFC Prudence Fund Leaflet-July 2016 14072016Document4 pagesHDFC Prudence Fund Leaflet-July 2016 14072016J.K. GarnayakNo ratings yet

- Global High Yield: Schroder International Selection FundDocument2 pagesGlobal High Yield: Schroder International Selection FundabandegenialNo ratings yet

- GIPS Compliant Performance Report: September 30, 2013Document23 pagesGIPS Compliant Performance Report: September 30, 2013HIRA -No ratings yet

- NAFA GIPS Mar 2015 Report PDFDocument26 pagesNAFA GIPS Mar 2015 Report PDFHIRA -No ratings yet

- Karnataka BankDocument76 pagesKarnataka BankRandhir Shah100% (1)

- Combined Factsheet Nov11Document17 pagesCombined Factsheet Nov11friendrocks20079017No ratings yet

- PLTVF Factsheet October 2015Document4 pagesPLTVF Factsheet October 2015gadiyaranandNo ratings yet

- Perspectivas Económicas: Proyecciones de Producto Interno BrutoDocument1 pagePerspectivas Económicas: Proyecciones de Producto Interno BrutoGianfranco Muzante MorenoNo ratings yet

- File 28052013214151 PDFDocument45 pagesFile 28052013214151 PDFraheja_ashishNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Net Long Short Net Long Short Exposure P&L YTD: June Exposure & Performance PerformanceDocument1 pageNet Long Short Net Long Short Exposure P&L YTD: June Exposure & Performance PerformancenabsNo ratings yet

- Example Individual Risk DashboardDocument1 pageExample Individual Risk DashboardanthonyconnorNo ratings yet

- 2023 Riverside County Pension Advisory Review Committee ReportDocument24 pages2023 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Canara Robeco Balance: (Open Ended Balance Scheme)Document2 pagesCanara Robeco Balance: (Open Ended Balance Scheme)Sushant SaxenaNo ratings yet

- NAFA GIPS Dec 2015 ReportDocument26 pagesNAFA GIPS Dec 2015 ReportHIRA -No ratings yet

- Understanding Mutual Fund AccountingDocument6 pagesUnderstanding Mutual Fund AccountingSwati MishraNo ratings yet

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument20 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationAmirul UmarNo ratings yet

- Unit 7 Cash and Funds Flow StatementsDocument85 pagesUnit 7 Cash and Funds Flow StatementsASIFNo ratings yet

- Annual Report Avenue CapitalDocument44 pagesAnnual Report Avenue CapitalJoel CintrónNo ratings yet

- 16.02 RWC GIAA PresentationDocument35 pages16.02 RWC GIAA PresentationGIAANo ratings yet

- Sundaram Select MidcapDocument2 pagesSundaram Select Midcapredchillies7No ratings yet

- KEPCO Consolidated FY20 4Q Final Clean (Eng)Document206 pagesKEPCO Consolidated FY20 4Q Final Clean (Eng)Darryl Farhan WidyawanNo ratings yet

- Icahn Enterprises - May 2015 Investor PresentationDocument41 pagesIcahn Enterprises - May 2015 Investor PresentationCanadianValue100% (2)

- HLA Cash Fund Feb 23Document3 pagesHLA Cash Fund Feb 23Ivy VooNo ratings yet

- AP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Document6 pagesAP GIS GO NO 131 W.E.F Oct 2018 - 30-06-2019Sivareddy50% (2)

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument19 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationhilmiyaidinNo ratings yet

- BSBFIM601 - Assessment 2 ProjectDocument8 pagesBSBFIM601 - Assessment 2 ProjectSaanjit KcNo ratings yet

- DocxDocument16 pagesDocxzakiatalhaNo ratings yet

- Internal Audit Report SampleDocument34 pagesInternal Audit Report SampleAvishek Agarwal80% (5)

- CCT Ar-2015Document184 pagesCCT Ar-2015Sassy TanNo ratings yet

- JANUARY 2016: Bond FundDocument2 pagesJANUARY 2016: Bond FundFaiq FuatNo ratings yet

- GL Annual Report SUPPLEMENTAL STAFF REPORT FY 2006-07 Mar 2008 PDFDocument6 pagesGL Annual Report SUPPLEMENTAL STAFF REPORT FY 2006-07 Mar 2008 PDFRecordTrac - City of OaklandNo ratings yet

- 2013 6 June Monthly Report TPOUDocument1 page2013 6 June Monthly Report TPOUSharonWaxmanNo ratings yet

- ACC 101 - Module 4Document12 pagesACC 101 - Module 4Kyla Renz de LeonNo ratings yet

- Budgetory ControlDocument6 pagesBudgetory ControlJash SanghviNo ratings yet

- FPA Crescent Fund: 2019 Year-End CommentaryDocument22 pagesFPA Crescent Fund: 2019 Year-End CommentaryKan ZhouNo ratings yet

- 2014 10 October Monthly Report TPRE v001 s6dl3pDocument1 page2014 10 October Monthly Report TPRE v001 s6dl3pValueWalkNo ratings yet

- Earnings PresentationDocument18 pagesEarnings PresentationBVMF_RINo ratings yet

- Thame and London Quarterly Report To Note Holders 2019 Q3 FINALDocument40 pagesThame and London Quarterly Report To Note Holders 2019 Q3 FINALsaxobobNo ratings yet

- JPM Q1 2024 PresentationDocument14 pagesJPM Q1 2024 PresentationZerohedgeNo ratings yet

- Fomc Minutes 20240320Document11 pagesFomc Minutes 20240320ZerohedgeNo ratings yet

- Earnings Presentation Q1 2024Document18 pagesEarnings Presentation Q1 2024ZerohedgeNo ratings yet

- Fomc Minutes 20240131Document11 pagesFomc Minutes 20240131ZerohedgeNo ratings yet

- Warren Buffett's Annual Letter To ShareholdersDocument16 pagesWarren Buffett's Annual Letter To ShareholdersFOX Business100% (3)

- 2404 Fs Milex 2023Document12 pages2404 Fs Milex 2023ZerohedgeNo ratings yet

- NSF Staff ReportDocument79 pagesNSF Staff ReportZerohedge Janitor100% (1)

- Hunter Biden Indictment 120723Document56 pagesHunter Biden Indictment 120723New York PostNo ratings yet

- BOJ Monetary Policy Statemetn - March 2024 Rate HikeDocument5 pagesBOJ Monetary Policy Statemetn - March 2024 Rate HikeZerohedge0% (1)

- Fomc Minutes 20231213Document10 pagesFomc Minutes 20231213ZerohedgeNo ratings yet

- Fomc Minutes 20231101Document10 pagesFomc Minutes 20231101ZerohedgeNo ratings yet

- TSLA Q4 2023 UpdateDocument32 pagesTSLA Q4 2023 UpdateSimon AlvarezNo ratings yet

- TBAC Basis Trade PresentationDocument34 pagesTBAC Basis Trade PresentationZerohedgeNo ratings yet

- Rising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumDocument51 pagesRising US Government Debt: What To Watch? Treasury Auctions, Rating Agencies, and The Term PremiumZerohedge100% (1)

- Tesla Inc Earnings CallDocument20 pagesTesla Inc Earnings CallZerohedge100% (1)

- 3Q23 PresentationDocument12 pages3Q23 PresentationZerohedgeNo ratings yet

- Jerome Powell SpeechDocument6 pagesJerome Powell SpeechTim MooreNo ratings yet

- X V Media Matters ComplaintDocument15 pagesX V Media Matters ComplaintZerohedge Janitor100% (1)

- BofA The Presentation Materials - 3Q23Document43 pagesBofA The Presentation Materials - 3Q23Zerohedge100% (1)

- Earnings Presentation Q3 2023Document21 pagesEarnings Presentation Q3 2023ZerohedgeNo ratings yet

- Fomc Minutes 20230726Document10 pagesFomc Minutes 20230726ZerohedgeNo ratings yet

- AMD Q3'23 Earnings SlidesDocument33 pagesAMD Q3'23 Earnings SlidesZerohedgeNo ratings yet

- TBAC Presentation Aug 2Document44 pagesTBAC Presentation Aug 2ZerohedgeNo ratings yet

- Powell 20230825 ADocument16 pagesPowell 20230825 AJuliana AméricoNo ratings yet

- Yellow Corporation Files Voluntary Chapter 11 PetitionsDocument2 pagesYellow Corporation Files Voluntary Chapter 11 PetitionsZerohedgeNo ratings yet

- November 2021 Secretary Schedule RedactedDocument62 pagesNovember 2021 Secretary Schedule RedactedNew York PostNo ratings yet

- SCA Transit FeesDocument2 pagesSCA Transit FeesZerohedgeNo ratings yet

- 2023-09-14 OpinionDocument42 pages2023-09-14 OpinionZerohedgeNo ratings yet

- Hunter Biden ReportDocument64 pagesHunter Biden ReportZerohedge50% (2)

- Earnings Presentation Q4 2022Document21 pagesEarnings Presentation Q4 2022ZerohedgeNo ratings yet

- Afzal ResumeDocument4 pagesAfzal ResumeASHIQ HUSSAINNo ratings yet

- ProbDocument10 pagesProbKashif JawaidNo ratings yet

- PNGRB - Electrical Safety Audit ChecklistDocument4 pagesPNGRB - Electrical Safety Audit ChecklistKritarth SrivastavNo ratings yet

- Cpar ReviewerDocument6 pagesCpar ReviewerHana YeppeodaNo ratings yet

- Watch One Piece English SubDub Online Free On Zoro - ToDocument1 pageWatch One Piece English SubDub Online Free On Zoro - ToSadeusuNo ratings yet

- RESEARCH 10 Module 1 Lesson 1 (WEEK 1-2)Document5 pagesRESEARCH 10 Module 1 Lesson 1 (WEEK 1-2)DennisNo ratings yet

- AMO Exercise 1Document2 pagesAMO Exercise 1Jonell Chan Xin RuNo ratings yet

- Assignment RoadDocument14 pagesAssignment RoadEsya ImanNo ratings yet

- Strategic Audit of VodafoneDocument35 pagesStrategic Audit of VodafoneArun Guleria89% (9)

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S Chargeskumarvaibhav301745No ratings yet

- STARCHETYPE REPORT ReLOADED AUGURDocument5 pagesSTARCHETYPE REPORT ReLOADED AUGURBrittany-faye OyewumiNo ratings yet

- Ice 3101: Modern Control THEORY (3 1 0 4) : State Space AnalysisDocument15 pagesIce 3101: Modern Control THEORY (3 1 0 4) : State Space AnalysisBipin KrishnaNo ratings yet

- Islamiyat ProjectDocument21 pagesIslamiyat ProjectSubhan Khan NiaziNo ratings yet

- Using Visual Rating To Diagnose DementiaDocument10 pagesUsing Visual Rating To Diagnose DementiaImágenes Rosendo GarcíaNo ratings yet

- Allegro Delivery Shipping Company Employment Application FormDocument3 pagesAllegro Delivery Shipping Company Employment Application FormshiveshNo ratings yet

- Mindray PM 9000 User ID10240 PDFDocument378 pagesMindray PM 9000 User ID10240 PDFJuan FernandoNo ratings yet

- 2.1 DRH Literary Translation-An IntroductionDocument21 pages2.1 DRH Literary Translation-An IntroductionHassane DarirNo ratings yet

- What Is Product Management?Document37 pagesWhat Is Product Management?Jeffrey De VeraNo ratings yet

- Ethiopian Airlines-ResultsDocument1 pageEthiopian Airlines-Resultsabdirahmanguray46No ratings yet

- 2001 Ford F150 ManualDocument296 pages2001 Ford F150 Manualerjenkins1100% (2)

- Dept & Sem: Subject Name: Course Code: Unit: Prepared byDocument75 pagesDept & Sem: Subject Name: Course Code: Unit: Prepared by474 likithkumarreddy1No ratings yet

- Channel & Lomolino 2000 Ranges and ExtinctionDocument3 pagesChannel & Lomolino 2000 Ranges and ExtinctionKellyta RodriguezNo ratings yet

- CH 15Document58 pagesCH 15Chala1989No ratings yet

- MSC ACFN2 RD4 ClassDocument25 pagesMSC ACFN2 RD4 Classmengistu jiloNo ratings yet

- Malling DemallingDocument25 pagesMalling DemallingVijay KumarNo ratings yet

- Inspection Report For Apartment Building at 1080 93rd St. in Bay Harbor IslandsDocument13 pagesInspection Report For Apartment Building at 1080 93rd St. in Bay Harbor IslandsAmanda RojasNo ratings yet

- D. Das and S. Doniach - Existence of A Bose Metal at T 0Document15 pagesD. Das and S. Doniach - Existence of A Bose Metal at T 0ImaxSWNo ratings yet

- English For General SciencesDocument47 pagesEnglish For General Sciencesfauzan ramadhanNo ratings yet

- Phy Mock SolDocument17 pagesPhy Mock SolA PersonNo ratings yet

- Work Site Inspection Checklist 1Document13 pagesWork Site Inspection Checklist 1syed hassanNo ratings yet

- Free & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageFrom EverandFree & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageRating: 2 out of 5 stars2/5 (3)

- Automated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and SidewaysFrom EverandAutomated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and SidewaysRating: 5 out of 5 stars5/5 (1)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (242)

- Scalping is Fun! 3: Part 3: How Do I Rate my Trading Results?From EverandScalping is Fun! 3: Part 3: How Do I Rate my Trading Results?Rating: 3.5 out of 5 stars3.5/5 (18)

- How to Trade a Range: Trade the Most Interesting Market in the WorldFrom EverandHow to Trade a Range: Trade the Most Interesting Market in the WorldRating: 4 out of 5 stars4/5 (5)

- Systematic Trading: A unique new method for designing trading and investing systemsFrom EverandSystematic Trading: A unique new method for designing trading and investing systemsRating: 3.5 out of 5 stars3.5/5 (12)

- The Bull, the Bear and the Planets: Trading the Financial Markets Using AstrologyFrom EverandThe Bull, the Bear and the Planets: Trading the Financial Markets Using AstrologyRating: 3.5 out of 5 stars3.5/5 (5)

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioFrom EverandInvesting 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioRating: 4.5 out of 5 stars4.5/5 (38)

- Stock Market Investing for Beginners & DummiesFrom EverandStock Market Investing for Beginners & DummiesRating: 4.5 out of 5 stars4.5/5 (25)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- Scalping is Fun! 4: Part 4: Trading Is Flow BusinessFrom EverandScalping is Fun! 4: Part 4: Trading Is Flow BusinessRating: 4 out of 5 stars4/5 (13)

- Building Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesFrom EverandBuilding Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesNo ratings yet

- The Real Estate Property Management GuideFrom EverandThe Real Estate Property Management GuideRating: 4.5 out of 5 stars4.5/5 (6)

- Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any MarketFrom EverandTrade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any MarketRating: 5 out of 5 stars5/5 (52)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedFrom EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedRating: 5 out of 5 stars5/5 (1)

- Stock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketFrom EverandStock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketRating: 4 out of 5 stars4/5 (26)

- Leveraged Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all tradersFrom EverandLeveraged Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all tradersRating: 4.5 out of 5 stars4.5/5 (6)

- The Art of Execution: How the world's best investors get it wrong and still make millionsFrom EverandThe Art of Execution: How the world's best investors get it wrong and still make millionsRating: 5 out of 5 stars5/5 (21)

- The Only Guide to a Winning Bond Strategy You'll Ever Need: The Way Smart Money Preserves Wealth TodayFrom EverandThe Only Guide to a Winning Bond Strategy You'll Ever Need: The Way Smart Money Preserves Wealth TodayRating: 4 out of 5 stars4/5 (7)

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionFrom EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionRating: 4.5 out of 5 stars4.5/5 (2)

- Scalping is Fun! 2: Part 2: Practical examplesFrom EverandScalping is Fun! 2: Part 2: Practical examplesRating: 4.5 out of 5 stars4.5/5 (26)

- Forex: Trading Strategies & Analysis for Beginners; Learn Market Strategy Basics with this Fundamental GuideFrom EverandForex: Trading Strategies & Analysis for Beginners; Learn Market Strategy Basics with this Fundamental GuideRating: 5 out of 5 stars5/5 (77)