Professional Documents

Culture Documents

UT Dallas Syllabus For Aim2302.004 06s Taught by Tai-Yuan Chen (txc015100)

Uploaded by

UT Dallas Provost's Technology GroupOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UT Dallas Syllabus For Aim2302.004 06s Taught by Tai-Yuan Chen (txc015100)

Uploaded by

UT Dallas Provost's Technology GroupCopyright:

Available Formats

AIM 2302 – Introduction to Management Accounting

Spring 2006

Instructor

Tai-Yuan (Ted) Chen

Office: SOM4.429

Phone: 972-883-4434

Email: txc015100@utdallas.edu or via WebCT

Office Hours: Monday and Wednesday 3:30pm – 4:30pm

Required Material: Horngren, Sundem, and Stratton, Introduction to Management

Accounting, 13th edition

Course Objectives: This course introduces the field of management accounting, which

has been defined by the Institute of Management Accountants as:

. . . process of planning, designing, measuring and

operating non-financial and financial information systems

that guides management action, motivates behavior, and

supports and creates the cultural values necessary to

achieve an organization’s strategic, tactical and operating

objectives.

While management and financial accounting share some common

ground the emphases are different. Management accounting is

primarily concerned with information for decision-makers within the

organization managers and those who work with them. Financial

accounting provides information for decision-makers outside

(external to) the organization.

One of the main objectives of this course is to familiarize you with

the requisite technical skills for basic business analysis. For

example, you will learn to determine unit product costs, calculate

the costs of goods manufactured, conduct cost-volume-profit

analyses, create budgets, and measure performance against

budgets.

Unless you understand managerial accounting, you cannot have a

thorough understanding of a company’s internal operations. What

you learn in this course will help you understand the operations of

your future employer, and help you understand other companies

you encounter in your role as competitor, consultant, or investor.

Course Operation: Part of the class time will be spent discussing concepts, part will be

spent solving applied problems, and part will be spent answering

questions. You are expected to have read all assigned material for

that class BEFORE attending the lectures. You should take notes

during the lectures.

Working problems is key to your success. Management accounting

is an applied discipline; the more problems you do, the better you

should be at applying your knowledge. Pay attention to the

problems solved in the class and the homework problems. If you

have trouble solving a homework problem, ask about it in the next

class, as others may also have had difficulty.

Web CT: I will post the lecture notes and class handouts on WebCT

(webct.utdallas.edu). You need your UTD username and password

to log in to WebCT. Periodically, I may post extra problems and/or

solutions on WebCT.

Grading: Your final grades will be determined as follows:

1. Classroom Attendance: 10%

2. 3 Exams

Exam I: 30%

Exam II: 30%

Exam III: 30%

Attendance: Attendance will be randomly taken.

Exams: There will be 3 exams. The exams are not cumulative and they

will be 90 minutes long. Practice exams will not be distributed

or posted on the internet. The exams are closed book and

closed note. Exams are multiple choice and many questions will

require calculations. Please mark your answers on both the

exam itself and the scantron.

Academic Integrity: In order to ensure fairness and on behalf of the overwhelming

majority of honest students, I will refer anyone suspected of

academic dishonesty to the Office of Student Conduct. There

are no exceptions to this policy under any circumstances. If a

student is found guilty of academic dishonesty by the Office of

Student Conduct, the student will receive an F for the course in

addition to any punishment determined by the Office of Student

Conduct.

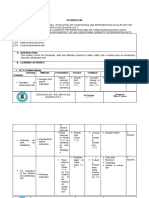

Course Outline

Date Reading Topic

Mon. 1/09 Ch. 1 Course overview

Wed. 1/11 Ch. 1 Introduction to management accounting

Mon 1/16 Holiday

Wed. 1/18 Ch. 2 Cost behavior and cost-volume relationship

Mon. 1/23 Ch. 2 Cost behavior and cost-volume relationship

Wed. 1/25 Ch. 2 Cost behavior and cost-volume relationship

Mon. 1/30 Ch. 3 Measurement of cost behavior

Wed. 2/01 Ch. 3 Measurement of cost behavior

Mon. 2/06 Review

Wed. 2/08 Exam #1

Mon. 2/13 Ch. 5 Relevant information and decision making

Wed. 2/15 Ch. 5 Relevant information and decision making

Mon. 2/20 Ch. 5 Relevant information and decision making

Wed. 2/22 Ch. 6 Relevant information and decision making

Mon. 2/27 Ch. 6 Relevant information and decision making

Wed. 3/01 Ch. 6 Relevant information and decision making

Mon. 3/06 Spring Break

Wed. 3/08 Spring Break

Mon. 3/13 Ch. 4 Cost management systems and activity-based costing

Wed. 3/15 Ch. 4 Cost management systems and activity-based costing

Mon. 3/20 Review

Wed. 3/22 Exam #2

Mon. 3/27 Ch. 13 Accounting for overhead costs

Wed. 3/29 Ch. 13 Accounting for overhead costs

Mon. 4/03 Ch. 14 Job-costing and process-costing systems

Wed. 4/05 Ch. 14 Job-costing and process-costing systems

Mon. 4/10 Ch. 14 Job-costing and process-costing systems

Wed. 4/12 Ch. 7 Master budget

Mon. 4/17 Ch. 7 Master budget

Wed. 4/19 Review

Mon. 4/24 Exam # 3

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Teacher's Service RecordDocument4 pagesTeacher's Service Recordemmancastro78% (27)

- Maintenance Manual: Models 8300, 8400, and 8500 Pallet Trucks and Model 8600 Tow TractorDocument291 pagesMaintenance Manual: Models 8300, 8400, and 8500 Pallet Trucks and Model 8600 Tow TractorJosé Luis Ang Soto92% (13)

- Calculation of Induction Motor Starting Parameters Using MatlabDocument6 pagesCalculation of Induction Motor Starting Parameters Using MatlabДејан ПејовскиNo ratings yet

- Online Shopping RequirementsDocument19 pagesOnline Shopping Requirementsbruh tesheme100% (1)

- Oscillation SDocument485 pagesOscillation SSabir Ali100% (1)

- Process Control Valves TrainingDocument12 pagesProcess Control Valves TrainingpptmnltNo ratings yet

- UT Dallas Syllabus For Arts3373.501.11f Taught by Greg Metz (Glmetz)Document7 pagesUT Dallas Syllabus For Arts3373.501.11f Taught by Greg Metz (Glmetz)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Huas6391.501.10f Taught by Greg Metz (Glmetz)Document7 pagesUT Dallas Syllabus For Huas6391.501.10f Taught by Greg Metz (Glmetz)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For hdcd6315.001.11f Taught by Cherryl Bryant (clb015400)Document6 pagesUT Dallas Syllabus For hdcd6315.001.11f Taught by Cherryl Bryant (clb015400)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Arts3367.001.11f Taught by Greg Metz (Glmetz)Document10 pagesUT Dallas Syllabus For Arts3367.001.11f Taught by Greg Metz (Glmetz)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Opre6372.pjm.11f Taught by James Szot (jxs011100)Document15 pagesUT Dallas Syllabus For Opre6372.pjm.11f Taught by James Szot (jxs011100)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Ee3120.105.11f Taught by Tariq Ali (Tma051000)Document5 pagesUT Dallas Syllabus For Ee3120.105.11f Taught by Tariq Ali (Tma051000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Mech4110.101.11f Taught by Mario Rotea (Mar091000)Document4 pagesUT Dallas Syllabus For Mech4110.101.11f Taught by Mario Rotea (Mar091000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For cs1336.501.11f Taught by Feliks Kluzniak (fxk083000)Document8 pagesUT Dallas Syllabus For cs1336.501.11f Taught by Feliks Kluzniak (fxk083000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Ob6301.001.11f Taught by David Ford JR (Mzad)Document11 pagesUT Dallas Syllabus For Ob6301.001.11f Taught by David Ford JR (Mzad)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Opre6271.pjm.11f Taught by James Szot (jxs011100)Document8 pagesUT Dallas Syllabus For Opre6271.pjm.11f Taught by James Szot (jxs011100)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Ce3120.105.11f Taught by Tariq Ali (Tma051000)Document4 pagesUT Dallas Syllabus For Ce3120.105.11f Taught by Tariq Ali (Tma051000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Ba3361.502.11f Taught by David Ford JR (Mzad)Document13 pagesUT Dallas Syllabus For Ba3361.502.11f Taught by David Ford JR (Mzad)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Stat1342.001.11f Taught by Qiongxia Song (qxs102020)Document6 pagesUT Dallas Syllabus For Stat1342.001.11f Taught by Qiongxia Song (qxs102020)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For cs6390.001.11f Taught by Kamil Sarac (kxs028100)Document5 pagesUT Dallas Syllabus For cs6390.001.11f Taught by Kamil Sarac (kxs028100)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For cs6322.501.11f Taught by Sanda Harabagiu (Sanda)Document6 pagesUT Dallas Syllabus For cs6322.501.11f Taught by Sanda Harabagiu (Sanda)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For cs6390.001.11f Taught by Kamil Sarac (kxs028100)Document5 pagesUT Dallas Syllabus For cs6390.001.11f Taught by Kamil Sarac (kxs028100)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Atec3351.002.11f Taught by Timothy Christopher (Khimbar)Document3 pagesUT Dallas Syllabus For Atec3351.002.11f Taught by Timothy Christopher (Khimbar)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For cs6320.001.11f Taught by Sanda Harabagiu (Sanda)Document5 pagesUT Dallas Syllabus For cs6320.001.11f Taught by Sanda Harabagiu (Sanda)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)Document8 pagesUT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)Document8 pagesUT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Math1316.001.11f Taught by Manjula Foley (mxf091000)Document8 pagesUT Dallas Syllabus For Math1316.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology Group0% (1)

- UT Dallas Syllabus For Atec3351.003.11f Taught by Timothy Christopher (Khimbar)Document3 pagesUT Dallas Syllabus For Atec3351.003.11f Taught by Timothy Christopher (Khimbar)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Atec6341.501.11f Taught by Timothy Christopher (Khimbar)Document3 pagesUT Dallas Syllabus For Atec6341.501.11f Taught by Timothy Christopher (Khimbar)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)Document8 pagesUT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)Document8 pagesUT Dallas Syllabus For Math2312.001.11f Taught by Manjula Foley (mxf091000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Atec3351.001.11f Taught by Timothy Christopher (Khimbar)Document3 pagesUT Dallas Syllabus For Atec3351.001.11f Taught by Timothy Christopher (Khimbar)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Math4301.001.11f Taught by Wieslaw Krawcewicz (wzk091000)Document7 pagesUT Dallas Syllabus For Math4301.001.11f Taught by Wieslaw Krawcewicz (wzk091000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For cldp3494.001.11f Taught by Shayla Holub (sch052000)Document4 pagesUT Dallas Syllabus For cldp3494.001.11f Taught by Shayla Holub (sch052000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Psy2301.hn1.11f Taught by James Bartlett (Jbartlet, sch052000)Document3 pagesUT Dallas Syllabus For Psy2301.hn1.11f Taught by James Bartlett (Jbartlet, sch052000)UT Dallas Provost's Technology GroupNo ratings yet

- UT Dallas Syllabus For Psy2301.001.11f Taught by James Bartlett (Jbartlet, sch052000)Document3 pagesUT Dallas Syllabus For Psy2301.001.11f Taught by James Bartlett (Jbartlet, sch052000)UT Dallas Provost's Technology GroupNo ratings yet

- Anshul BhelDocument96 pagesAnshul BhelMessieurs Avinash PurohitNo ratings yet

- 20 Questions On Aircraft Asked in Indian Air Force InterviewDocument9 pages20 Questions On Aircraft Asked in Indian Air Force InterviewPreran PrasadNo ratings yet

- Atheros Valkyrie BT Soc BriefDocument2 pagesAtheros Valkyrie BT Soc BriefZimmy ZizakeNo ratings yet

- Websphere Application Server Runtime Architecture: Welcome ToDocument24 pagesWebsphere Application Server Runtime Architecture: Welcome ToluweinetNo ratings yet

- BW17V1D24Document5 pagesBW17V1D24Lye YpNo ratings yet

- Ds - PDF Circuito Integrado Driver Par La Bobina D IgnicionDocument8 pagesDs - PDF Circuito Integrado Driver Par La Bobina D Ignicionjavy_846058987No ratings yet

- Session Plan (Julaps)Document10 pagesSession Plan (Julaps)Wiljhon Espinola JulapongNo ratings yet

- Southwire Mining Product CatalogDocument32 pagesSouthwire Mining Product Catalogvcontrerasj72No ratings yet

- PRISM Proof Cloud Email ServicesDocument11 pagesPRISM Proof Cloud Email ServiceshughpearseNo ratings yet

- Olympus Industrial Endoscopes Offer Reliable InspectionsDocument16 pagesOlympus Industrial Endoscopes Offer Reliable InspectionsYeremia HamonanganNo ratings yet

- Conscious Competence Learning ModelDocument2 pagesConscious Competence Learning ModelMaanveer SinghNo ratings yet

- Timeouts PT8.5xDocument21 pagesTimeouts PT8.5xJack WangNo ratings yet

- SIP Trunking Turnup GuideDocument8 pagesSIP Trunking Turnup Guideashok7No ratings yet

- Daikin Ceiling Suspended Air ConditioningDocument11 pagesDaikin Ceiling Suspended Air ConditioningWeb Design Samui100% (4)

- Amu Resume by KKMDocument2 pagesAmu Resume by KKMapi-457874888No ratings yet

- 1.1.3.4 Lab - Visualizing The Black HatsDocument3 pages1.1.3.4 Lab - Visualizing The Black HatsCordis CordisNo ratings yet

- Strategic MGMT 4Document33 pagesStrategic MGMT 4misbahaslam1986No ratings yet

- Construction Quality Control Manager in Baltimore MD Resume Mary Kathleen WilsonDocument3 pagesConstruction Quality Control Manager in Baltimore MD Resume Mary Kathleen WilsonMaryKathleenWilsonNo ratings yet

- Nitin FicoDocument3 pagesNitin Ficoapi-3806547100% (1)

- The Apparatus of RepressionDocument221 pagesThe Apparatus of RepressionAndrew Charles Hendricks100% (3)

- Vibration Measuring Instrument: Assignment of Subject NVHDocument28 pagesVibration Measuring Instrument: Assignment of Subject NVHSandeep Kadam60% (5)

- Altera 5M1270ZF256C5N DatasheetDocument30 pagesAltera 5M1270ZF256C5N DatasheetIonut Daniel FigherNo ratings yet

- Training Estimator by VladarDocument10 pagesTraining Estimator by VladarMohamad SyukhairiNo ratings yet

- Terra Point White PaperDocument10 pagesTerra Point White Paperobi SalamNo ratings yet