Professional Documents

Culture Documents

20130916a 008101003

Uploaded by

viveknayee0 ratings0% found this document useful (0 votes)

10 views1 pageits give an idea for the buying a house.

Original Title

20130916a_008101003_(1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentits give an idea for the buying a house.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 page20130916a 008101003

Uploaded by

viveknayeeits give an idea for the buying a house.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Not desperate to

buy? Defer

You may be offered discounts and freebies but property prices

could fall if you wait for a few more months

PRIYA NAIR & JOYDEEP GHOSH

umanta Rudra, head of infrastructure

and administration at VFS Global, has

decided to defer buying a property. I am

expecting a correction in property prices. I will

only take a call about buying after the

elections.

With the festival season coming, there will

be a plethora of advertisements in newspapers

and your email boxes will be flooded with promotional mailers goading you to buy property

with catchy lines such as Buy before property prices go up further, Get the best discount, etc.

However, many like Rudra are unwilling to

get carried away. They feel deferring the decision will work in their favour. Of course, there

are other issues. As a banker says, Given the

tough economic conditions, most people are

unwilling to part with liquidity. So, even if

there are great deals, the feeling is lets wait for

some more time. Add to that the Reserve Bank

of Indias (RBI) red flagging of the 20:80

schemes due to fears of default from builder

and people are unwilling to commit, at least for

the time being.

It is not that corrections havent taken place.

Prospective buyers are offered teaser price cuts

of 5-10 per cent in Mumbai and Delhi and

slightly over 10-15 per cent in other cities.

For example, in February 2012, a four-bedroom flat in Jolly Maker 1 at Cuffe Parade, one

of Mumbai's most expensive residential areas,

was sold for ~29 crore. The transaction was

reported widely as the highest-ever price for a

residential apartment. Today, a similar flat in

the same building will not fetch more than

~24-26 crore.

According to National Housing Banks

Residex, an index for property prices, property prices at Cuffe Parade and Malabar Hill of

South Mumbai have fallen by almost nine per

cent in April-June 2013 compared to JanuaryMarch 2013. Even for Mumbai as a whole, the

Residex shows a slight dip in prices. The trend

is similar in 24 out of the 26 cities for which the

National Housing Bank provides data.

In order to sell, some builders are giving

free car parking and/or bearing the stamp duty

and registration. However, no builder will

admit to it since it will send out distress signals

to other potential customers, points out Om

Ahuja, CEO-Residential Services, Jones Lang

LaSalle, India.

The question, for the likes of Rudra, is

whether it will fall further. V K Sharma, managing director and CEO of LIC Housing

Finance, feels if you are buying property for

investment, then you should wait for some

time. A major appreciation in prices from the

current levels looks difficult. If you are not in

urgent need, then it is better to hold your buying decision for now, he says.

If you are looking at buying your first property and, more important, one in which you

intend to stay, the traditional answer is: Dont

look at prices. The answer stays the same, but

with a caveat prices are unlikely to run away

in the near future, so delaying the decision is

unlikely to hurt substantially. If you want to

buy now, ask for discounts. Faced with oversupply, developers will be more than willing if

they are convinced you are a serious buyer.

Little appreciation in the near future

The real estate sector has been in trouble for

some time. However, prices have been

resilient because builders have received funding from potential buyers (through home

loans), private equity and investors.

Meanwhile, builders have launched projects,

which are yet to be sold. In Mumbai itself,

COOLING OFF

Source: National Housing Bank Residex

TO GET A GOOD DEAL ON

YOUR HOUSE:

| Convince the builder of your intention to buy

| Go with your family and carry your cheque book;

be prepared to make immediate downpayment

| Bargain since the builder will not offer discounts

up-front

| Factor in loading, freebies like free kitchen

cabinet or airconditioners, waiver

of stamp duty

while asking for

discount

| Have a preapproved home

loan if you can

WHATS ON THE MENU: Since October-January is considered an auspicious time to buy

property, this is when builders offer discounts on the price or give benefits such as stamp

duty waiver or freebies such as kitchen cabinet or air-conditioners in the house. So, if your

builder is not offering any of these facilities, you can bargain and ask him to reduce the

price to that extent

some 10 million-plus flats priced at over ~1

crore are said to be lying unsold.

Meanwhile, new projects have been

launched even as existing projects havent sold

out completely. Obviously, capital appreciation is not something most experts expect.

Anand Moorthy, head (real estate services) at

RBS Financial Services, says there is humongous supply in most residential areas, even in

the secondary market. Investors should not

expect more than five-to-eight per cent growth

in prices in most cities for the coming one-two

year horizon for realistic gains. Another reason

to wait, especially for investors, is because real

estate is not liquid.

Anuj Nangpal, managing director (investor

services ) at DTZ India, says: The anticipated

downward pressure on prices is expected to

prevail in the short-term owing to significant

inventory overhand across most micro markets. Additionally, the recent hike in home

loan interest rates along with continued slow-

down in economic environment has further

dampened sentiments amongst prospective

end users. The consequent drop in demand

has further limited any opportunity for price

appreciation in near future, he says.

Is this a buyers market?

Some feel that buyers are on a stronger wicket. Lalit Jain, chairman of the Confederation

of Real Estate Developers Associations of

India, says: Our costs have increased substantially. In fact, we have sent an advisory to

our members saying they can sell at the lowest prices due to the liquidity crunch. What

customers are getting today is the best price

and at the first possible trigger, at the first

signs of economic situation improving, prices

will go up. Developers are giving good bargains even to individual buyers.

There are some things that will work in your

favour while bargaining. While those looking to

buy should bargain for good rates, they should

not hope for the developer to offer it to them.

There is very high probability that you can get

discounts. In a market like Mumbai, a discount

of even five per cent is good. In other markets,

you can get 10-15 per cent or even 20 per cent,

says Sanjay Dutt, executive managing director (south Asia) of Cushman & Wakefield.

Buyers with pre-approved home loans in hand

are in a position to bargain for a better price. In

fact, simple things such as going with your

family members and with a cheque book to

make the downpayment will show you are a

serious buyer and ensure good discounts.

Since October-January is considered an

auspicious time to buy property, this is when

builders offer discounts on the price or give

benefits such as stamp duty waiver or freebies

such as kitchen cabinet or air-conditioners in

the house. So, if your builder is not offering any

of these facilities, you can bargain and ask him

to reduce the price to that extent.

If you are looking to buy a property in a

premium project, going with an up-front payment will ensure you get discounts. The retail

market is largely broker-driven. So if you

approach the builder directly, you can straightway ask for a two per cent discount on the

price. You can also ask to include the loading

and ask the builder for a discount. Loading is

the carpet area (the actual usable area of the

house) minus the super built-up area (nonhabitable area such as staircase, veranda etc).

In Mumbai, Thane and Pune, the loading is

40-50 per cent; in Chennai, Bangalore and

Hyderabad it is about 30-35 per cent, while in

Gurgaon it is 35-40 per cent.

Compare carpet loading factor and amenities cost. Builders have a decent spread and

now they are willing to sacrifice some of it,

says Moorthy of RBS Financial Services.

Waiting period

According to Dutt, the good time to invest in

real estate is between now and March 2014,

the festival period starting with Ganesh

Chathurthi and ending with Gudi Padwa.

There is also a good chance of getting attractive

deals in land and residential apartments

because of the market conditions, with lower

sales and new supply hitting the market.

Once the general elections are over and there

is some political and economic stability, the window of opportunity will be over, says Dutt.

In fact, with harder rules on project

approvals, land acquisition and taxation on

property coming in, developers will have to

raise prices to stay relevant in the market and

solvent in their businesses. However, there are

enough existing projects and inventory with

many builders, which will have to be cleared

before the impact of the Land Acquisition Bill

comes into play.

You might also like

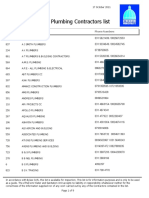

- Registered Plumbing Contractors List: Phone Numbers Number Company Name Phone NumbersDocument9 pagesRegistered Plumbing Contractors List: Phone Numbers Number Company Name Phone NumbersviveknayeeNo ratings yet

- Basic InformationDocument8 pagesBasic InformationviveknayeeNo ratings yet

- Localk Traveling BusinessDocument1 pageLocalk Traveling BusinessviveknayeeNo ratings yet

- Azeem and Haq, 2012Document18 pagesAzeem and Haq, 2012viveknayeeNo ratings yet

- Chanda KochharDocument39 pagesChanda KochharviveknayeeNo ratings yet

- ClearasilDocument4 pagesClearasilviveknayeeNo ratings yet

- 8th Year PlanDocument13 pages8th Year PlanviveknayeeNo ratings yet

- Ceramic IndustryDocument90 pagesCeramic IndustryJadavNikulkumarJNo ratings yet

- Bamboo Prefab HousesDocument70 pagesBamboo Prefab HousesshreerishimunniNo ratings yet

- Five Year PlanDocument7 pagesFive Year PlanviveknayeeNo ratings yet

- Adr GDRDocument4 pagesAdr GDRviveknayeeNo ratings yet

- List of Companies in IndiaDocument17 pagesList of Companies in IndiaviveknayeeNo ratings yet

- Indonesia - A Dynamic Mining IndustryDocument1 pageIndonesia - A Dynamic Mining IndustryviveknayeeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Seabank Statement 20220726Document4 pagesSeabank Statement 20220726Alesa WahabappNo ratings yet

- Multimodal Essay FinalDocument8 pagesMultimodal Essay Finalapi-548929971No ratings yet

- Mosharaf HossainDocument2 pagesMosharaf HossainRuhul RajNo ratings yet

- Arduino Uno CNC ShieldDocument11 pagesArduino Uno CNC ShieldMărian IoanNo ratings yet

- Jee MainsDocument32 pagesJee Mainsjhaayushbhardwaj9632No ratings yet

- Genomic Tools For Crop ImprovementDocument41 pagesGenomic Tools For Crop ImprovementNeeru RedhuNo ratings yet

- Transportasi Distribusi MigasDocument25 pagesTransportasi Distribusi MigasDian Permatasari100% (1)

- Biological Assets Sample ProblemsDocument4 pagesBiological Assets Sample ProblemsKathleenNo ratings yet

- Hydro Electric Fire HistoryDocument3 pagesHydro Electric Fire HistorygdmurfNo ratings yet

- Alternative Network Letter Vol 7 No.1-Apr 1991-EQUATIONSDocument16 pagesAlternative Network Letter Vol 7 No.1-Apr 1991-EQUATIONSEquitable Tourism Options (EQUATIONS)No ratings yet

- Chapter 4 - Basic ProbabilityDocument37 pagesChapter 4 - Basic Probabilitynadya shafirahNo ratings yet

- 385C Waw1-Up PDFDocument4 pages385C Waw1-Up PDFJUNA RUSANDI SNo ratings yet

- Epreuve Anglais EG@2022Document12 pagesEpreuve Anglais EG@2022Tresor SokoudjouNo ratings yet

- Who Trs 993 Web FinalDocument284 pagesWho Trs 993 Web FinalAnonymous 6OPLC9UNo ratings yet

- AssignmentDocument47 pagesAssignmentHarrison sajorNo ratings yet

- Current Concepts in Elbow Fracture Dislocation: Adam C Watts, Jagwant Singh, Michael Elvey and Zaid HamoodiDocument8 pagesCurrent Concepts in Elbow Fracture Dislocation: Adam C Watts, Jagwant Singh, Michael Elvey and Zaid HamoodiJoão Artur BonadimanNo ratings yet

- 2-1. Drifting & Tunneling Drilling Tools PDFDocument9 pages2-1. Drifting & Tunneling Drilling Tools PDFSubhash KediaNo ratings yet

- Editan - Living English (CD Book)Document92 pagesEditan - Living English (CD Book)M Luthfi Al QodryNo ratings yet

- UM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Document154 pagesUM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Antony Jacob AshishNo ratings yet

- Understanding and Teaching Fractions: Sybilla BeckmannDocument26 pagesUnderstanding and Teaching Fractions: Sybilla Beckmannjhicks_mathNo ratings yet

- Experiment - 1: Batch (Differential) Distillation: 1. ObjectiveDocument30 pagesExperiment - 1: Batch (Differential) Distillation: 1. ObjectiveNaren ParasharNo ratings yet

- Odisha State Museum-1Document26 pagesOdisha State Museum-1ajitkpatnaikNo ratings yet

- Myanmar 1Document3 pagesMyanmar 1Shenee Kate BalciaNo ratings yet

- Top 100 Chemical CompaniesDocument11 pagesTop 100 Chemical Companiestawhide_islamicNo ratings yet

- Retail Banking Black BookDocument95 pagesRetail Banking Black Bookomprakash shindeNo ratings yet

- 928 Diagnostics Manual v2.7Document67 pages928 Diagnostics Manual v2.7Roger Sego100% (2)

- Native VLAN and Default VLANDocument6 pagesNative VLAN and Default VLANAaliyah WinkyNo ratings yet

- Wallem Philippines Shipping Inc. v. S.R. Farms (Laxamana)Document2 pagesWallem Philippines Shipping Inc. v. S.R. Farms (Laxamana)WENDELL LAXAMANANo ratings yet

- Student Management SystemDocument232 pagesStudent Management Systemslu_mangal73% (37)

- Practising Modern English For Life Sciences Students Caiet Exercitii-1Document77 pagesPractising Modern English For Life Sciences Students Caiet Exercitii-1Robert BobiaNo ratings yet