Professional Documents

Culture Documents

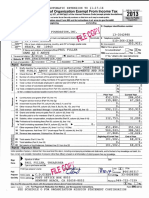

2011 Audit Report

Uploaded by

Space Frontier FoundationCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 Audit Report

Uploaded by

Space Frontier FoundationCopyright:

Available Formats

Space Frontier Foundation, Inc.

Financial Statements

December 31, 2011

(With Independent Auditors Report thereon)

Space Frontier Foundation, Inc.

Table of Contents

Independent Auditors Report

Financial Statements

Statement of Financial Position

Statement of Activities

Statements of Changes in Net Assets

Statement of Cash Flows

Notes to Financial Statements

C.D. GIEDT, CPA

Member

BUSINESS DEVELOPMENT & TAX CONSULTANTS

American Institute and California

Society of Certified Public Accountants

www.cdgiedtcpa.com

FAX: 760.747.0588

1030 East Pennsylvania Avenue

Escondido, California 92025.4017

TELEPHONE: 760.747.0539

Independent Auditors Report

Board of Directors

Space Frontier Foundation, Inc.

Nyack, New York

We have audited the accompanying statement of financial position of the Space Frontier Foundation,

Inc. (a non-profit corporation) as of December 31, 2011 and the related statements of activities,

changes in net assets and cash flows for the year then ended. These financial statements are the

responsibility of the Space Frontier Foundation, Inc. management. Our responsibility is to express an

opinion on these financial statements based on our audit.

We conducted our audit in accordance with generally accepted auditing standards in the United States

of America. Those standards require that we plan and perform the audit to obtain reasonable assurance

about whether the financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement presentation. We believe

that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the

financial position of the Space Frontier Foundation, Inc. as of December 31, 2011 and the results of its

operations for the year then ended, in conformity with generally accepted accounting principles in the

United States of America.

Information for the year ended December 31, 2010 is presented for comparative purposes only and

was extracted from the financial statements presented by fund for the year, in which an unqualified

opinion dated November 20, 2011 was expressed.

CDGiedt,CPA

Escondido, California

October 19, 2012

Space Frontier Foundation, Inc.

Statement of Financial Position

December 31, 2011

Unrestricted

Temporarily

Restricted

Permanently

Restricted

2011

Total

2010

Total

$ 73,634

$103,403

Assets

Current assets

Cash and equivalents

Due from/(to)

73,634

(20,000)

Total current assets

20,000

53,634

Total assets

$53,634

20,000

73,634

103,403

$20,000

$73,634

103,403

Liabilities

Current liabilities

Accounts payable

Accrued liabilities

Total current liabilities

Total liabilities

Total net assets

Total liabilities &

net assets

53,634

53,634

$ -

20,000

73,634

103,403

20,000

$ 73,634

$103,403

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Activities

For the year ended December 31, 2011

Unrestricted

Temporarily

Restricted

2010

Total

2011

Total

Income

Direct Support

Vision Project

Communications

General Operations

150

150

1,000

1,000

5,000

40,726

64,669

40,726

Space Enterprise

2000

Space Solar Power

1,341

Space Ventures

Teachers in Space

760

760

700

9,636

9,636

37,679

340

86

426

287

Total Direct Support

41,067

11,632

$52,698

111,676

Grants

64,501

163,001

227,502

50,000

111,207

111,207

65,071

Direct Support - Other

Program Service Revenue

NewSpace Conferences/BPC

Total Program Service Revenue

64,501

274,208

338,709

115,071

105,567

285,840

391,407

226,746

91,417

249

91,666

43,015

High Frontier

1,461

1,461

612

Communications

3,757

3,757

4,094

154

157,450

157,450

24,350

Total Income

Expense by Programs

Program support

Overview Institute

Teachers in Space

Space Enterprise

NewSpace conferences/BPC

82,153

Space Ventures

Vision Project

Total Expense

Increase (decrease) in net assets

173,570

$

(68,003)

2,112

2,112

77,865

160,018

4,345

4,345

368

368

247,607

421,176

38,232

(29,769)

101,152

173,376

$

See accompanying notes to financial statements.

53,370

Space Frontier Foundation, Inc.

Statement of Changes in Net Assets

For the year ended December 31, 2011

Unrestricted

Temporarily

Restricted

Permanently

Restricted

2011

Total

2010

Total

$118,753

$96,899

(48,600)

(80,116)

33,250

33,250

(29,769)

53,370

20,000

$ 73,634

$103,403

Net assets, beginning of year

Unrestricted net assets

$ 118,753

Temporarily restricted

$(48,600)

Permanently restricted

Released restrictions

(10,367)

33,250

10,367

13,250

Increase(decrease)

in net assets

Net assets, end of year

(13,250)

(68,003)

38,233

53,634

$( -)

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Cash Flows

For the year ended December 31, 2011

Increase(decrease)net assets

Adjustments to reconcile

increase (decrease) in net assets

to net cash provided by

operating activities

Changes in:

2011

Total

2010

Total

($29,769)

$53,370

none

-

(29,769)

53,370

(29,769)

53,370

Beginning of year

103,403

50,033

End of year

$73,634

$103,403

Net cash provided(used) by operating

activities

Transfers/adjustments, net

Net increase (decrease)

in cash and cash equivalents

Cash & cash equivalents:

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Notes to Financial Statements

December 31, 2011

Note A- Organization and nature of activities

The Space Frontier Foundation, Inc. (the Foundation) was incorporated on October 6, 1988 (reinstated

February 13, 1996) and began operations in 1988. The corporation is a Georgia non-profit public benefit

corporation and is not organized for the private gain of any person. It is organized under the Non-profit Public

Benefit Corporation Law for charitable purposes. The charitable purpose of the corporation is to engage in the

process of educating the public about scientific developments and promote active pursuit of scientific research

toward expansion of the human presence in a space faring civilization.

Some of its programs are as follows:

Advocates- this program involves key participants that commit $180 annually plus they actively engage in one

or more specific programs as discussed below.

New Space Conferences- annual 3-day conferences that focus on the current, near term and future potential and

challenges of the emerging commercial space industry.

Space Business Plan Competition(BPC) - Helping entrepreneurs create NewSpace start-ups and firms that

develop technologies in support of the NewSpace industry by competing for cash prizes.

Teachers in Space - Stimulating student interest in science, technology, engineering and mathematics

(STEM) by engaging their teachers through actual suborbital spaceflight for some teachers, and

extraordinary space-related experiences and unique teaching materials for others.

Space Ventures / TEDxMidTownNY A multidisciplinary presentation / discussion series, featuring

speakers who are actively engaged in the advancement of field research, exploration, and opening the space

frontier.

High Frontier the Foundation has permanently restricted and reserved funds to provide for the future

publishing of the book about future space colonization, "High Frontier" by Gerard K. ONeill. This amounts to

$20,000 in permanently restricted assets.

Notes to Financial Statements (continued)

December 31, 2011

Note B - Summary of significant accounting policies

Basis of Presentation

In accordance with Statement of Financial Accounting Standards No. 116 (SFAS No. 116) Accounting for

Contributions Received and Contributions Made, contributions, including unconditional promises to give, are

recognized as revenue in the period received.

In accordance with Statement of Financial Accounting Standards No. 117 (SFAS No. 117), Financial

Statements of Not-for-Profit Organizations, net assets and revenues, expenses, gains and losses are classified

based on the existence or absence of donor imposed restrictions. Accordingly, net assets of the Foundation and

changes therein are classified and report as follows:

Unrestricted net assets- net assets that are not subject to donor imposed stipulations.

Temporarily restricted net assets - net assets that are subject to donor-imposed stipulations that require

passage of time or the occurrence of a specific event. When the purpose restrictions are accomplished,

the temporarily restricted net assets are reclassified to unrestricted net assets.

Permanently restricted net assets- net assets that are subject to donor-imposed restrictions that they be

maintained permanently while permitting the Foundation to use or expend part or all of the income

derived from the donated assets. The Foundation shows its income and expense in two columns

because it believes this more effectively matches restricted income and allowed expenses.

Accordingly, the Foundation records gifts of cash and other assets as temporarily restricted contributions if

they are received with donor stipulations that limit their use of the donated assets. When a donor restriction

expires, or when a stipulated time restriction ends or the purpose of the restriction is accomplished,

temporarily restricted net assets are reclassified to unrestricted net assets and reported in the statement of

activities as net assets released from donor restrictions. Contributions with permanent (long-term) donor

imposed restrictions that received are recorded as permanently restricted in the statement of activities.

The financial statements of the Foundation have been prepared on the accrual basis of accounting.

The Foundations support comes primarily from individual donors contributions and grant(s) income. Annual

campaign contributions are generally available for unrestricted use in the related campaign year unless

specifically restricted by the donor.

Pledges receivable are recorded as received and recorded at their net realizable value as of the end of the fiscal

year. Allowance for uncollectible pledges is provided based on managements evaluation of potential

uncollectible pledges at year-end. As of year-end there are no receivables and no allowance has been provided.

Endowment contributions and investments are permanently restricted by the donor. Investment earnings are

recorded separately and available for distribution in accordance with donor restrictions.

Contributions of non-cash assets are recorded at their fair values in the period received. There are no material

contributions of donated services. Volunteer time and services (material for some projects) has not been

quantified and collected or valued.

The Foundation considers all liquid investments such as certificates of deposit with maturity of 12 months or less

to be cash equivalents.

Investments are composed of mutual funds investing primarily in equity and debt securities and are carried at fair

value.

Notes to Financial Statements (continued)

December 31, 2011

Note C Cash & cash equivalents

Cash & cash equivalents are summarized at year ends as follows:

Checking

Wells Fargo Bank

Total

K:\CDGESC2012\SPACEFRONTIER2011AUDITREPORT.docx

2011

2010

$ 73,634 $ 103,403

$ 73,634 $ 103,403

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2013 Audit ReportDocument10 pages2013 Audit ReportSpace Frontier FoundationNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- NewSpace 2014 ProgramDocument47 pagesNewSpace 2014 ProgramSpace Frontier FoundationNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- NewSpace 2013 ProgramDocument49 pagesNewSpace 2013 ProgramSpace Frontier FoundationNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 2012 Audit ReportDocument10 pages2012 Audit ReportSpace Frontier FoundationNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Space Settlement Act of 1988Document5 pagesSpace Settlement Act of 1988Space Frontier FoundationNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- NewSpace 2013 ProgramDocument49 pagesNewSpace 2013 ProgramSpace Frontier FoundationNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- NewSpace 2012 ProgramDocument47 pagesNewSpace 2012 ProgramSpace Frontier FoundationNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- NSE2002 ProgramDocument10 pagesNSE2002 ProgramSpace Frontier FoundationNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Space Frontier Foundation - Space Frontier Conference XII: SynopsisDocument14 pagesSpace Frontier Foundation - Space Frontier Conference XII: SynopsisSpace Frontier FoundationNo ratings yet

- CATSSymposium1997 ReportDocument36 pagesCATSSymposium1997 ReportSpace Frontier FoundationNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Space Frontier Foundation - SFC 11 Report and PhotosDocument4 pagesSpace Frontier Foundation - SFC 11 Report and PhotosSpace Frontier FoundationNo ratings yet

- 2001 Arthur C. Clarke Gala: Space Frontier Foundation - 2001 Clarke Gala Report and PhotosDocument5 pages2001 Arthur C. Clarke Gala: Space Frontier Foundation - 2001 Clarke Gala Report and PhotosSpace Frontier FoundationNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- SFC2004 Program13Document8 pagesSFC2004 Program13Space Frontier FoundationNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Space Enterprise SymposiumDocument4 pagesSpace Enterprise SymposiumSpace Frontier FoundationNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Space Frontier Foundation - Space Frontier Conference 6: U.S. Air Force Phillips Laboratory ProspaceDocument10 pagesSpace Frontier Foundation - Space Frontier Conference 6: U.S. Air Force Phillips Laboratory ProspaceSpace Frontier FoundationNo ratings yet

- Space Frontier Conference 9: Odyssey's HorizonDocument5 pagesSpace Frontier Conference 9: Odyssey's HorizonSpace Frontier FoundationNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Space Frontier Conference 7 - Space: The Revolution Is Now!Document6 pagesSpace Frontier Conference 7 - Space: The Revolution Is Now!Space Frontier FoundationNo ratings yet

- RTM2001 ProgramIIIDocument1 pageRTM2001 ProgramIIISpace Frontier FoundationNo ratings yet

- Space Frontier Foundation - Space Frontier Conference 8Document7 pagesSpace Frontier Foundation - Space Frontier Conference 8Space Frontier FoundationNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Space Frontier Conference 10: in Search of 2001Document9 pagesSpace Frontier Conference 10: in Search of 2001Space Frontier FoundationNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Silicon Valley Space Enterprise SymposiumDocument2 pagesSilicon Valley Space Enterprise SymposiumSpace Frontier FoundationNo ratings yet

- Space Frontier Conference 14: Another Successful Event From The Space Frontier Foundation!Document11 pagesSpace Frontier Conference 14: Another Successful Event From The Space Frontier Foundation!Space Frontier FoundationNo ratings yet

- The Space Frontier Foundation's Fourth Annual Return To The Moon Conference "Crossroads To The Cosmos"Document7 pagesThe Space Frontier Foundation's Fourth Annual Return To The Moon Conference "Crossroads To The Cosmos"Space Frontier FoundationNo ratings yet

- 2011 Annual ReviewDocument17 pages2011 Annual ReviewSpace Frontier FoundationNo ratings yet

- 2012 Annual ReviewDocument17 pages2012 Annual ReviewSpace Frontier FoundationNo ratings yet

- Return of Organization Exempt From Income Tax: 13-3542980 NameDocument20 pagesReturn of Organization Exempt From Income Tax: 13-3542980 NameSpace Frontier FoundationNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- AeroSpace Economy in North CarolinaDocument30 pagesAeroSpace Economy in North CarolinaSpace Frontier FoundationNo ratings yet

- 2013 Annual ReviewDocument19 pages2013 Annual ReviewSpace Frontier FoundationNo ratings yet

- 6 - European Cluster Partnership For Excellence - European Cluster Collaboration PlatformDocument5 pages6 - European Cluster Partnership For Excellence - European Cluster Collaboration PlatformDaniela DurducNo ratings yet

- Windows Insider ProgramDocument10 pagesWindows Insider ProgramVasileBurcuNo ratings yet

- Molde Soldadura TADocument1 pageMolde Soldadura TAMarcos Ivan Ramirez AvenaNo ratings yet

- Small Business and Entrepreneurship ProjectDocument38 pagesSmall Business and Entrepreneurship ProjectMădălina Elena FotacheNo ratings yet

- Chapter I. Scope of Distributive Trade StatisticsDocument11 pagesChapter I. Scope of Distributive Trade StatisticsNguyễn Hà Diệu LinhNo ratings yet

- Frequently Asked Questions: Lecture 7 To 9 Hydraulic PumpsDocument5 pagesFrequently Asked Questions: Lecture 7 To 9 Hydraulic PumpsJatadhara GSNo ratings yet

- WellaPlex Technical 2017Document2 pagesWellaPlex Technical 2017Rinita BhattacharyaNo ratings yet

- 1 - DIASS Trisha Ma-WPS OfficeDocument2 pages1 - DIASS Trisha Ma-WPS OfficeMae ZelNo ratings yet

- RADMASTE CAPS Grade 11 Chemistry Learner GuideDocument66 pagesRADMASTE CAPS Grade 11 Chemistry Learner Guideamajobe34No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Newsela Teacher Review - Common Sense EducationDocument1 pageNewsela Teacher Review - Common Sense EducationJessicaNo ratings yet

- Gics-In-India Getting Ready For The Digital WaveDocument81 pagesGics-In-India Getting Ready For The Digital Wavevasu.gaurav75% (4)

- Marine-Derived Biomaterials For Tissue Engineering ApplicationsDocument553 pagesMarine-Derived Biomaterials For Tissue Engineering ApplicationsDobby ElfoNo ratings yet

- Under Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisDocument13 pagesUnder Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisMahmud RahmanNo ratings yet

- Operator'S Manual PM20X-X-X-BXX: 2" Diaphragm PumpDocument12 pagesOperator'S Manual PM20X-X-X-BXX: 2" Diaphragm PumpOmar TadeoNo ratings yet

- Investing in Granada's Property Market - Gaspar LinoDocument1 pageInvesting in Granada's Property Market - Gaspar LinoGaspar LinoNo ratings yet

- Alufix Slab Formwork Tim PDFDocument18 pagesAlufix Slab Formwork Tim PDFMae FalcunitinNo ratings yet

- Issue15 - Chirag JiyaniDocument6 pagesIssue15 - Chirag JiyaniDipankar SâháNo ratings yet

- PixiiDocument3 pagesPixiiFoxNo ratings yet

- Spring 12 ECON-E370 IU Exam 1 ReviewDocument27 pagesSpring 12 ECON-E370 IU Exam 1 ReviewTutoringZoneNo ratings yet

- NATO Obsolescence Management PDFDocument5 pagesNATO Obsolescence Management PDFluisNo ratings yet

- You're reading a free preview. Pages 4 to 68 are not shown in this preview. Leer la versión completa You're Reading a Free Preview Page 4 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 5 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 6 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 7 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 8 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 9 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 10 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 11 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 12 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 13 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 14 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 15 is notDocument9 pagesYou're reading a free preview. Pages 4 to 68 are not shown in this preview. Leer la versión completa You're Reading a Free Preview Page 4 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 5 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 6 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 7 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 8 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 9 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 10 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 11 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 12 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 13 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 14 is not shown in this preview. DESCARGA You're Reading a Free Preview Page 15 is notFernando ToretoNo ratings yet

- 2022 NEDA Annual Report Pre PubDocument68 pages2022 NEDA Annual Report Pre PubfrancessantiagoNo ratings yet

- Eaai S 23 02045 PDFDocument28 pagesEaai S 23 02045 PDFAnjali JainNo ratings yet

- Subject: PSCP (15-10-19) : Syllabus ContentDocument4 pagesSubject: PSCP (15-10-19) : Syllabus ContentNikunjBhattNo ratings yet

- LET-English-Structure of English-ExamDocument57 pagesLET-English-Structure of English-ExamMarian Paz E Callo80% (5)

- Patricio Gerpe ResumeDocument2 pagesPatricio Gerpe ResumeAnonymous 3ID4TBNo ratings yet

- BS 215-2-1970-Aluminium Conductors and Aluminium Conductors Steel-Reinforced For Overhead Power TransmissionDocument16 pagesBS 215-2-1970-Aluminium Conductors and Aluminium Conductors Steel-Reinforced For Overhead Power TransmissionDayan Yasaranga100% (2)

- MikoritkDocument6 pagesMikoritkChris Jonathan Showip RouteNo ratings yet

- Paper 4 Material Management Question BankDocument3 pagesPaper 4 Material Management Question BankDr. Rakshit Solanki100% (2)

- Xii Mathematics CH 01 Question BankDocument10 pagesXii Mathematics CH 01 Question BankBUNNY GOUDNo ratings yet

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)