Professional Documents

Culture Documents

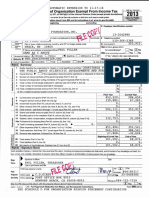

2012 Audit Report

Uploaded by

Space Frontier FoundationOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012 Audit Report

Uploaded by

Space Frontier FoundationCopyright:

Available Formats

Space Frontier Foundation, Inc.

Financial Statements

December 31, 2012

(With Independent Auditors Report thereon)

Space Frontier Foundation, Inc.

Table of Contents

Independent Auditors Report

Financial Statements

Statement of Financial Position

Statement of Activities

Statements of Changes in Net Assets

Statement of Cash Flows

Notes to Financial Statements

C.D. GIEDT, CPA

Member

BUSINESS DEVELOPMENT & TAX CONSULTANTS

American Institute and California

Society of Certified Public Accountants

www.cdgiedtcpa.com

FAX: 760.747.0588

1030 East Pennsylvania Avenue

Escondido, California 92025.4017

TELEPHONE: 760.747.0539

Independent Auditors Report

Board of Directors

Space Frontier Foundation, Inc.

Nyack, New York

We have audited the accompanying statement of financial position of the Space Frontier Foundation,

Inc. (a non-profit corporation) as of December 31, 2012 and the related statements of activities,

changes in net assets and cash flows for the year then ended. These financial statements are the

responsibility of the Space Frontier Foundation, Inc. management. Our responsibility is to express an

opinion on these financial statements based on our audit.

We conducted our audit in accordance with generally accepted auditing standards in the United States

of America. Those standards require that we plan and perform the audit to obtain reasonable assurance

about whether the financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement presentation. We believe

that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the

financial position of the Space Frontier Foundation, Inc. as of December 31, 2011 and the results of its

operations for the year then ended, in conformity with generally accepted accounting principles in the

United States of America.

Information for the year ended December 31, 2011 is presented for comparative purposes only and

was extracted from the financial statements presented by fund for the year, in which an unqualified

opinion dated October 19, 2012 was expressed.

CDGiedt,CPA

Escondido, California

November 19, 2013

Space Frontier Foundation, Inc.

Statement of Financial Position

December 31, 2012

Unrestricted

Temporarily

Restricted

Permanently

Restricted

2012

Total

2011

Total

$101,502

-

$73,634

-

101,502

73,634

101,502

73,634

Assets

Current assets

Cash and

equivalents

Due from/(to)

101,502

-

Total current assets

101,502

Total assets

101,502

Liabilities

Current liabilities

Accounts payable

Accrued liabilities

Total current

liabilities

Total liabilities

101,502

101,502

73,634

$101,502

$73,634

Total net assets

Total liabilities &

net assets

101,502

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Activities

For the year ended December 31, 2012

Unrestricted

Temporarily

Restricted

2012

Total

2011

Total

$150

$6,563

$6,563

1,000

Income

Direct Support

Vision Project

Communications

General Operations

$58,111

Space Ventures

Teachers in Space

FlamingMir

40,726

1,230

760

28,878

28,878

9,636

1,400

1,400

61

61

426

38,132

96,243

$52,698

355,986

355,986

227,502

139,882

139,882

111,207

495,868

495,868

338,709

58,111

534,000

592,111

391,407

42,607

91,666

1,461

Direct Support - Other

Total Direct Support

58,111

1,230

58,111

Donations/Grants

Program Service Revenue

NewSpace Conferences/BPC

Total Program Service Revenue

Total Income

Expense by Programs

Program support

42,607

High Frontier

Communications

Teachers in Space

7,262

7,262

3,757

206,329

206,329

157,450

2,112

135,111

135,111

160,018

4,345

318

318

368

161,000

161,000

2,085

2,085

Space Enterprise

NewSpace conferences/BPC

Space Ventures

Vision Project

Business Plan Competition

FlamingMir

IASE

Return to the Moon

The Watch

Total Expense

Increase (decrease) in net assets

299

299

7,232

7,232

2,000

42,607

521,636

2,000

564,243

421,176

$15,504

$12,364

$ 27,868

$ (29,769)

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Changes in Net Assets

For the year ended December 31, 2012

Unrestricted

Temporarily

Restricted

Permanently

Restricted

Net assets, beginning of year

Unrestricted net assets

$ 53,634

2012

Total

2011

Total

$ 53,634

$118,753

Temporarily restricted

(48,600)

Permanently restricted

Prior adjustments

Restrictions pending

(13,250)

17,085

(17,085)

15,504

12,364

86,223

($17,971)

20,000

20,000

33,250

13,250

-

Increase(decrease)

in net assets

Net assets, end of year

27,868

(29,769)

33,250

$ 101,502

$ 73,634

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Statement of Cash Flows

For the year ended December 31, 2012

Increase(decrease)net assets

Adjustments to reconcile

increase (decrease) in net assets

to net cash provided by

operating activities

Changes in:

Net cash provided(used) by operating

activities

Transfers/adjustments, net

Net increase (decrease)

in cash and cash equivalents

2012

Total

2011

Total

27,868

($29,769)

none

none

27,868

53,370

27,868

(29,769)

73,634

103,403

$101,502

$73,634

Cash & cash equivalents:

Beginning of year

End of year

See accompanying notes to financial statements.

Space Frontier Foundation, Inc.

Notes to Financial Statements

December 31, 2012

Note A- Organization and nature of activities

The Space Frontier Foundation, Inc. (the Foundation) was incorporated on October 6, 1988 (reinstated

February 13, 1996) and began operations in 1988. The corporation is a Georgia non-profit public benefit

corporation and is not organized for the private gain of any person. It is organized under the Non-profit Public

Benefit Corporation Law for charitable purposes. The charitable purpose of the corporation is to engage in the

process of educating the public about scientific developments and promote active pursuit of scientific research

toward expansion of the human presence in a space faring civilization.

Some of its programs are as follows:

Advocates- this program involves key participants that commit $180 annually plus they actively engage in one

or more specific programs as discussed below.

New Space Conferences- annual 3-day conferences that focus on the current, near term and future potential and

challenges of the emerging commercial space industry.

Space Business Plan Competition(BPC) - Helping entrepreneurs create NewSpace start-ups and firms that

develop technologies in support of the NewSpace industry by competing for cash prizes.

Teachers in Space - Stimulating student interest in science, technology, engineering and mathematics

(STEM) by engaging their teachers through actual suborbital spaceflight for some teachers, and

extraordinary space-related experiences and unique teaching materials for others.

Space Ventures / TEDxMidTownNY A multidisciplinary presentation / discussion series, featuring

speakers who are actively engaged in the advancement of field research, exploration, and opening the space

frontier.

High Frontier the Foundation has permanently restricted and reserved funds to provide for the future

publishing of the book about future space colonization, "High Frontier" by Gerard K. ONeill. This amounts to

$20,000, and is included in permanently restricted assets.

Notes to Financial Statements (continued)

December 31, 2012

Note B - Summary of significant accounting policies

Basis of Presentation

In accordance with Statement of Financial Accounting Standards No. 116 (SFAS No. 116) Accounting for

Contributions Received and Contributions Made, contributions, including unconditional promises to give, are

recognized as revenue in the period received.

In accordance with Statement of Financial Accounting Standards No. 117 (SFAS No. 117), Financial

Statements of Not-for-Profit Organizations, net assets and revenues, expenses, gains and losses are classified

based on the existence or absence of donor imposed restrictions. Accordingly, net assets of the Foundation and

changes therein are classified and report as follows:

Unrestricted net assets- net assets that are not subject to donor imposed stipulations.

Temporarily restricted net assets - net assets that are subject to donor-imposed stipulations that require

passage of time or the occurrence of a specific event. When the purpose restrictions are accomplished,

the temporarily restricted net assets are reclassified to unrestricted net assets.

Permanently restricted net assets- net assets that are subject to donor-imposed restrictions that they be

maintained permanently while permitting the Foundation to use or expend part or all of the income

derived from the donated assets. The Foundation shows its income and expense in two columns

because it believes this more effectively matches restricted income and allowed expenses.

Accordingly, the Foundation records gifts of cash and other assets as temporarily restricted contributions if

they are received with donor stipulations that limit their use of the donated assets. When a donor restriction

expires, or when a stipulated time restriction ends or the purpose of the restriction is accomplished,

temporarily restricted net assets are reclassified to unrestricted net assets and reported in the statement of

activities as net assets released from donor restrictions. Contributions with permanent (long-term) donor

imposed restrictions that received are recorded as permanently restricted in the statement of activities.

The financial statements of the Foundation have been prepared on the accrual basis of accounting.

The Foundations support comes primarily from individual donors contributions and grant(s) income. Annual

campaign contributions are generally available for unrestricted use in the related campaign year unless

specifically restricted by the donor.

Pledges receivable are recorded as received and recorded at their net realizable value as of the end of the fiscal

year. Allowance for uncollectible pledges is provided based on managements evaluation of potential

uncollectible pledges at year-end. As of year-end there are no receivables and no allowance has been provided.

Endowment contributions and investments are permanently restricted by the donor. Investment earnings are

recorded separately and available for distribution in accordance with donor restrictions.

Contributions of non-cash assets are recorded at their fair values in the period received. There are no material

contributions of donated services. Volunteer time and services (material for some projects) has not been

quantified and collected or valued.

The Foundation considers all liquid investments such as certificates of deposit with maturity of 12 months or less

to be cash equivalents.

Investments are composed of mutual funds investing primarily in equity and debt securities and are carried at fair

value.

Notes to Financial Statements (continued)

December 31, 2012

Note C Cash & cash equivalents

Cash & cash equivalents are summarized at year ends as follows:

Checking

Wells Fargo Bank

Total

2012

$ 101,502

$ 101,502

K:\CDGESC2013\SPACEFRONTIER2012AUDITREPORT.docx

2011

$ 73,634

$ 73,634

You might also like

- Form 11-K: United States Securities and Exchange CommissionDocument15 pagesForm 11-K: United States Securities and Exchange CommissionSurya PermanaNo ratings yet

- NIF 2011 Financial StatermentsDocument33 pagesNIF 2011 Financial StatermentsWeAreNIFNo ratings yet

- Accounting and Financial Management 1a Tutorial Work wk2 HWDocument4 pagesAccounting and Financial Management 1a Tutorial Work wk2 HWS MNo ratings yet

- Chapter ThreeDocument71 pagesChapter Threeyared gebrewoldNo ratings yet

- Finance Report2Document8 pagesFinance Report2Sadman Sharar 1931037030No ratings yet

- AnswerDocument8 pagesAnswerShamik SenghaniNo ratings yet

- Proactive CPA and Consulting FirmDocument23 pagesProactive CPA and Consulting FirmPando DailyNo ratings yet

- Chapter 4 Financial Statement AnalysisDocument44 pagesChapter 4 Financial Statement AnalysisChala EnkossaNo ratings yet

- Unit 1 Written Assignment - Updated VersionDocument6 pagesUnit 1 Written Assignment - Updated VersionSimran Pannu100% (1)

- Detroit Historical Society (A Michigan Non-Profit Corporation)Document21 pagesDetroit Historical Society (A Michigan Non-Profit Corporation)lolNo ratings yet

- Accounting Chapter 13 Summary Statement of Cash FlowsDocument5 pagesAccounting Chapter 13 Summary Statement of Cash FlowsAndrew PhilipsNo ratings yet

- TMX Cds Annual Report 2013 enDocument56 pagesTMX Cds Annual Report 2013 enbhagathnagarNo ratings yet

- BHWMF FS14Document20 pagesBHWMF FS14Anonymous jrDocJlGNo ratings yet

- FINMA - Tools of Financial Analysis and ControlDocument15 pagesFINMA - Tools of Financial Analysis and ControlChloekurtj DelNo ratings yet

- Financial Statement Analysis DemoDocument51 pagesFinancial Statement Analysis DemoMylene SalvadorNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- C Preciousmetal - Annual Results Announcement For The Year Ended 31 December 2012 PDFDocument28 pagesC Preciousmetal - Annual Results Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Ananta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowDocument40 pagesAnanta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowKania SyahraNo ratings yet

- Review of Chapter 9/10Document36 pagesReview of Chapter 9/10Dakshin SooryaNo ratings yet

- Chap2+3 1Document36 pagesChap2+3 1Tarif IslamNo ratings yet

- Chapter 5 - Cash Flows - HandoutDocument53 pagesChapter 5 - Cash Flows - HandoutĐứcAnhLêVũ100% (1)

- Introduction To Financial Accounting: Key Terms and Concepts To KnowDocument16 pagesIntroduction To Financial Accounting: Key Terms and Concepts To KnowAmit SharmaNo ratings yet

- Presentation On Fund Flow Statement: Presented byDocument20 pagesPresentation On Fund Flow Statement: Presented byAnurag BhargavaNo ratings yet

- Financial StatementsDocument10 pagesFinancial StatementsSergei DragunovNo ratings yet

- Essentials of Accounting For Governmental and Non-Profit OrganizationDocument17 pagesEssentials of Accounting For Governmental and Non-Profit OrganizationCikaro' 斯那No ratings yet

- OMF Financial Review 2012Document0 pagesOMF Financial Review 2012jetiradoNo ratings yet

- ZPI Audited Results For FY Ended 31 Dec 13Document1 pageZPI Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Module 3 - Understanding Financial Statements PDFDocument25 pagesModule 3 - Understanding Financial Statements PDFemmanvillafuerteNo ratings yet

- ACF - Audited-Financials-2021Document23 pagesACF - Audited-Financials-2021ejazahmad5No ratings yet

- Financial Accounting: Fakhri Mammadov Azerbaijan State Economic UniversityDocument39 pagesFinancial Accounting: Fakhri Mammadov Azerbaijan State Economic UniversityFaxri MammadovNo ratings yet

- Chapter 2 (Basic Financial Statements)Document25 pagesChapter 2 (Basic Financial Statements)Brylle Leynes100% (1)

- Company Profile: Liberty Plywood Pvt. Ltd. Is A Quality Driven Organization Offering A Wide Range of PreDocument50 pagesCompany Profile: Liberty Plywood Pvt. Ltd. Is A Quality Driven Organization Offering A Wide Range of PreparveenbilangNo ratings yet

- 2022 Sem 1 ACC10007 Topic 3Document45 pages2022 Sem 1 ACC10007 Topic 3JordanNo ratings yet

- CF Lecture 0 Working With FS v1Document51 pagesCF Lecture 0 Working With FS v1Tâm NhưNo ratings yet

- San Diego City Employees' Retirement System: Popular Annual Financial ReportDocument6 pagesSan Diego City Employees' Retirement System: Popular Annual Financial Reportapi-201256435No ratings yet

- Fin 311 Chapter 02 HandoutDocument7 pagesFin 311 Chapter 02 HandouteinsteinspyNo ratings yet

- INDEPENDENT AUDITOR'S REPORT OF THE FIRST CHILDREN'S EMBASSY IN THE WORLD - MEGJASHI Skopje 2012Document16 pagesINDEPENDENT AUDITOR'S REPORT OF THE FIRST CHILDREN'S EMBASSY IN THE WORLD - MEGJASHI Skopje 2012FIRST CHILDREN'S EMBASSY IN THE WORLD MEGJASHI MACEDONIANo ratings yet

- Current Rate MethodDocument28 pagesCurrent Rate MethodMusadiq AliNo ratings yet

- Cash Flows, Financial Planning and BudgetingDocument34 pagesCash Flows, Financial Planning and BudgetingKarl LuzungNo ratings yet

- Verizon Foundation - IRS 990 - Year 2008Document317 pagesVerizon Foundation - IRS 990 - Year 2008CaliforniaALLExposedNo ratings yet

- Solved 1 The Petty Cash Fund of The Brooks Agency Is PDFDocument1 pageSolved 1 The Petty Cash Fund of The Brooks Agency Is PDFAnbu jaromiaNo ratings yet

- 2 Statement of Financial PositionDocument51 pages2 Statement of Financial PositionMarlon Ladesma100% (2)

- Ch02 - Introduction To Published Accounts - v2Document16 pagesCh02 - Introduction To Published Accounts - v2Davy KHSCNo ratings yet

- CH 02 Financial Analysis - RatiosDocument37 pagesCH 02 Financial Analysis - RatiosMichelle Davinna Michael HerryNo ratings yet

- Town of Blue River, ColoradoDocument13 pagesTown of Blue River, ColoradoblueriverdocNo ratings yet

- Week 4Document5 pagesWeek 4Erryn M. ParamythaNo ratings yet

- Glosario de FinanzasDocument9 pagesGlosario de FinanzasRaúl VargasNo ratings yet

- Financial Statement AnalysisDocument68 pagesFinancial Statement Analysisammar123No ratings yet

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsFarahin SyedNo ratings yet

- Chapter 3Document29 pagesChapter 3Yonatan WadlerNo ratings yet

- CH All Access - Annual Results Announcement For The Year Ended 31 December 2012 PDFDocument29 pagesCH All Access - Annual Results Announcement For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Document15 pagesContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (40)

- Financial Statement AnalysisDocument58 pagesFinancial Statement AnalysisManmeet KaurNo ratings yet

- Lecture 5 - Cash Flow StatementDocument60 pagesLecture 5 - Cash Flow StatementMutesa Chris100% (1)

- LMUDA 2009 AuditDocument12 pagesLMUDA 2009 AuditOaklandCBDsNo ratings yet

- Kelompok 10 - Tugas P3 - Completing The Audit Assignment (WUP 13-15) - REVISIDocument26 pagesKelompok 10 - Tugas P3 - Completing The Audit Assignment (WUP 13-15) - REVISIRayhan Dewangga SaputraNo ratings yet

- Acc 255 Final Exam Review Packet (New Material)Document6 pagesAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNo ratings yet

- NewSpace 2014 ProgramDocument47 pagesNewSpace 2014 ProgramSpace Frontier FoundationNo ratings yet

- Space Frontier Foundation - Space Frontier Conference XII: SynopsisDocument14 pagesSpace Frontier Foundation - Space Frontier Conference XII: SynopsisSpace Frontier FoundationNo ratings yet

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- NSE2002 ProgramDocument10 pagesNSE2002 ProgramSpace Frontier FoundationNo ratings yet

- 2001 Arthur C. Clarke Gala: Space Frontier Foundation - 2001 Clarke Gala Report and PhotosDocument5 pages2001 Arthur C. Clarke Gala: Space Frontier Foundation - 2001 Clarke Gala Report and PhotosSpace Frontier FoundationNo ratings yet

- Space Frontier Conference 9: Odyssey's HorizonDocument5 pagesSpace Frontier Conference 9: Odyssey's HorizonSpace Frontier FoundationNo ratings yet

- SFC2004 Program13Document8 pagesSFC2004 Program13Space Frontier FoundationNo ratings yet

- Space Frontier Foundation - SFC 11 Report and PhotosDocument4 pagesSpace Frontier Foundation - SFC 11 Report and PhotosSpace Frontier FoundationNo ratings yet

- Space Frontier Foundation - Space Frontier Conference 8Document7 pagesSpace Frontier Foundation - Space Frontier Conference 8Space Frontier FoundationNo ratings yet

- Space Frontier Conference 7 - Space: The Revolution Is Now!Document6 pagesSpace Frontier Conference 7 - Space: The Revolution Is Now!Space Frontier FoundationNo ratings yet

- SettlementEnablingTest Constellation Data Report PreVoteDocument10 pagesSettlementEnablingTest Constellation Data Report PreVoteSpace Frontier FoundationNo ratings yet

- NewSpace 2011 ProgramDocument52 pagesNewSpace 2011 ProgramSpace Frontier FoundationNo ratings yet

- Space Frontier Conference 10: in Search of 2001Document9 pagesSpace Frontier Conference 10: in Search of 2001Space Frontier FoundationNo ratings yet

- Space Frontier Conference 14: Another Successful Event From The Space Frontier Foundation!Document11 pagesSpace Frontier Conference 14: Another Successful Event From The Space Frontier Foundation!Space Frontier FoundationNo ratings yet

- Return of Organization Exempt From Income Tax: 13-3542980 NameDocument20 pagesReturn of Organization Exempt From Income Tax: 13-3542980 NameSpace Frontier FoundationNo ratings yet

- Space Enterprise SymposiumDocument4 pagesSpace Enterprise SymposiumSpace Frontier FoundationNo ratings yet

- Settlement Enabling TestDocument4 pagesSettlement Enabling TestSpace Frontier FoundationNo ratings yet

- RTM2004 ProgramVDocument8 pagesRTM2004 ProgramVSpace Frontier FoundationNo ratings yet

- 1987 Summer Symposium, 3-4 Aug 87ocrDocument36 pages1987 Summer Symposium, 3-4 Aug 87ocrSpace Frontier FoundationNo ratings yet

- Outpost Tech Details OcrDocument4 pagesOutpost Tech Details OcrSpace Frontier FoundationNo ratings yet

- History of Anthropology in India by Dr. Abhik GhoshDocument50 pagesHistory of Anthropology in India by Dr. Abhik GhoshVishal hingeNo ratings yet

- (Digest) Marcos II V CADocument7 pages(Digest) Marcos II V CAGuiller C. MagsumbolNo ratings yet

- Roman-Macedonian Wars Part 1Document2 pagesRoman-Macedonian Wars Part 1Alxthgr8No ratings yet

- 04 Chapter 3Document13 pages04 Chapter 3Danica Marie Baquir PadillaNo ratings yet

- Math Review 10 20222023Document1 pageMath Review 10 20222023Bui VyNo ratings yet

- Sources of Criminal LawDocument7 pagesSources of Criminal LawDavid Lemayian SalatonNo ratings yet

- Fundamental Rights India Us South AfricaDocument3 pagesFundamental Rights India Us South Africaaishwarya jamesNo ratings yet

- Internship Final Students CircularDocument1 pageInternship Final Students CircularAdi TyaNo ratings yet

- A Brief History & Development of Banking in India and Its FutureDocument12 pagesA Brief History & Development of Banking in India and Its FutureMani KrishNo ratings yet

- BPM at Hindustan Coca Cola Beverages - NMIMS, MumbaiDocument10 pagesBPM at Hindustan Coca Cola Beverages - NMIMS, MumbaiMojaNo ratings yet

- Student Notice 2023-07-15 Attention All StudentsDocument1 pageStudent Notice 2023-07-15 Attention All StudentsTanmoy SinghaNo ratings yet

- Kansai Survival Manual CH 15Document2 pagesKansai Survival Manual CH 15Marcela SuárezNo ratings yet

- Name: Nitesh Bagla Enrollment No: 19Bsp1776 IBS Campus: Kolkata Mobile No: 9681759023 E-Mail Id: SIP Proposal I. SIP ProposedDocument3 pagesName: Nitesh Bagla Enrollment No: 19Bsp1776 IBS Campus: Kolkata Mobile No: 9681759023 E-Mail Id: SIP Proposal I. SIP ProposedNitesh BaglaNo ratings yet

- Case LawsDocument4 pagesCase LawsLalgin KurianNo ratings yet

- 173 RevDocument131 pages173 Revmomo177sasaNo ratings yet

- Rhode Island College: M.Ed. in TESL Program Language Group Specific Informational ReportsDocument14 pagesRhode Island College: M.Ed. in TESL Program Language Group Specific Informational ReportsAdrian KrebsNo ratings yet

- Mini Flour Mill KarnalDocument9 pagesMini Flour Mill KarnalAnand Kishore100% (2)

- Hospitals' EmailsDocument8 pagesHospitals' EmailsAkil eswarNo ratings yet

- The Ery Systems of South India: BY T.M.MukundanDocument32 pagesThe Ery Systems of South India: BY T.M.MukundanDharaniSKarthikNo ratings yet

- Republic Act. 10157Document24 pagesRepublic Act. 10157roa yusonNo ratings yet

- Employee Self Service ESS User Manual: Enterprise Resource Planning (ERP) ProjectDocument57 pagesEmployee Self Service ESS User Manual: Enterprise Resource Planning (ERP) ProjectJorge CadornaNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingHassaan NasirNo ratings yet

- Army Aviation Digest - Jan 1994Document56 pagesArmy Aviation Digest - Jan 1994Aviation/Space History Library100% (1)

- 35 Childrens BooksDocument4 pages35 Childrens Booksapi-710628938No ratings yet

- Earth Blox BrochureDocument8 pagesEarth Blox BrochureLionel Andres Corzo MoncrieffNo ratings yet

- Conditions of The Ahmediya Mohammediya Tijaniya PathDocument12 pagesConditions of The Ahmediya Mohammediya Tijaniya PathsamghanusNo ratings yet

- Case Exercise On Layer Unit (2000 Birds)Document2 pagesCase Exercise On Layer Unit (2000 Birds)Priya KalraNo ratings yet

- Affidavit of ExplanationDocument2 pagesAffidavit of ExplanationGerwinNo ratings yet

- Mastery Problem (L04, 5, 6), 27: 2,500 500 0 200 100 1,300 1,500 (Expense) 2,000 0 200 100 1,300 1,000Document2 pagesMastery Problem (L04, 5, 6), 27: 2,500 500 0 200 100 1,300 1,500 (Expense) 2,000 0 200 100 1,300 1,000Paulina OlivaresNo ratings yet

- Social Inequality and ExclusionDocument3 pagesSocial Inequality and ExclusionAnurag Agrawal0% (1)