Professional Documents

Culture Documents

Starboard Value Investment in Office Depot (Dec. 10)

Uploaded by

JoelHoffmannCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Starboard Value Investment in Office Depot (Dec. 10)

Uploaded by

JoelHoffmannCopyright:

Available Formats

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

240.13d-2(a)

(Amendment No. 14)1

Office Depot, Inc.

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

676220106

(CUSIP Number)

JEFFREY C. SMITH

STARBOARD VALUE LP

777 Third Avenue, 18 th Floor

New York, New York 10017

(212) 845-7977

STEVE WOLOSKY, ESQ.

OLSHAN FROME WOLOSKY LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 10, 2014

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box .

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7 for

other parties to whom copies are to be sent.

_______________

1

The remainder of this cover page shall be filled out for a reporting persons initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be filed for the purpose of Section 18 of the Securities

Exchange Act of 1934 (Act) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE LP

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

53,312,311

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

53,312,311

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,312,311 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

PN

___________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

2

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

WC

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

(a) o

(b) o

CAYMAN ISLANDS

7

SOLE VOTING POWER

8

15,532,199

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

15,532,199

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

15,532,199 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

2.9%

TYPE OF REPORTING PERSON

CO

___________________

* Includes 1,373,600 Shares underlying call options exercisable within 60 days hereof.

3

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE AND OPPORTUNITY S LLC

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

WC

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

3,463,210

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

3,463,210

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

3,463,210 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

Less than 1%

TYPE OF REPORTING PERSON

OO

___________________

* Includes 306,200 Shares underlying call options exercisable within 60 days hereof.

4

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE AND OPPORTUNITY C LP

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

WC

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

1,677,841

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

1,677,841

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

1,677,841 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

Less than 1%

TYPE OF REPORTING PERSON

PN

___________________

* Includes 148,400 Shares underlying call options exercisable within 60 days hereof.

5

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE R LP

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

1,677,841

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

1,677,841

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

1,677,841 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

Less than 1%

TYPE OF REPORTING PERSON

PN

___________________

* Includes 148,400 Shares underlying call options exercisable within 60 days hereof.

6

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE R GP LLC

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

1,677,841

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

1,677,841

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

1,677,841 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

Less than 1%

TYPE OF REPORTING PERSON

OO

___________________

* Includes 148,400 Shares underlying call options exercisable within 60 days hereof.

7

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD VALUE GP LLC

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

53,312,311

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

53,312,311

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,312,311 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

OO

____________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

8

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD PRINCIPAL CO LP

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

53,312,311

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

53,312,311

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,312,311 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

PN

____________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

9

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

STARBOARD PRINCIPAL CO GP LLC

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

DELAWARE

7

(a) o

(b) o

SOLE VOTING POWER

53,312,311

SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

53,312,311

SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,312,311 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

OO

____________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

10

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

JEFFREY C. SMITH

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

(a) o

(b) o

USA

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

SOLE VOTING POWER

45,836

SHARED VOTING POWER

53,312,311

SOLE DISPOSITIVE POWER

10

45,836

SHARED DISPOSITIVE POWER

11

53,312,311

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,358,147 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

IN

____________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

11

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

MARK R. MITCHELL

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

(a) o

(b) o

USA

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

SOLE VOTING POWER

-0 SHARED VOTING POWER

53,312,311

SOLE DISPOSITIVE POWER

10

-0 SHARED DISPOSITIVE POWER

11

53,312,311

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,312,311 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

IN

____________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

12

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

PETER A. FELD

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

OO

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

(a) o

(b) o

USA

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

SOLE VOTING POWER

-0 SHARED VOTING POWER

53,312,311

SOLE DISPOSITIVE POWER

10

-0 SHARED DISPOSITIVE POWER

11

53,312,311

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

53,312,311 *

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

9.9%

TYPE OF REPORTING PERSON

IN

____________________

* Includes 4,100,000 Shares underlying call options exercisable within 60 days hereof.

13

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

T-S CAPITAL PARTNERS, LLC

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

CALIFORNIA

7

(a) o

(b) o

SOLE VOTING POWER

- 0SHARED VOTING POWER

- 0SOLE DISPOSITIVE POWER

10

- 0SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

- 0CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

0%

TYPE OF REPORTING PERSON

OO

14

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

DAVID SIEGEL

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

PF

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

(a) o

(b) o

USA

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

SOLE VOTING POWER

1,250

SHARED VOTING POWER

- 0SOLE DISPOSITIVE POWER

10

1,250

SHARED DISPOSITIVE POWER

11

- 0AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

1,250

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

Less than 1%

TYPE OF REPORTING PERSON

IN

15

CUSIP NO. 676220106

1

NAME OF REPORTING PERSON

ROBERT TELLES

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

SEC USE ONLY

SOURCE OF FUNDS

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d)

OR 2(e)

CITIZENSHIP OR PLACE OF ORGANIZATION

(a) o

(b) o

USA

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

SOLE VOTING POWER

-0 SHARED VOTING POWER

-0 SOLE DISPOSITIVE POWER

10

-0 SHARED DISPOSITIVE POWER

11

-0 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12

-0 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

13

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14

0%

TYPE OF REPORTING PERSON

IN

16

CUSIP NO. 676220106

The following constitutes Amendment No. 14 to the Schedule 13D filed by the undersigned (Amendment No. 14). This Amendment No.

14 amends the Schedule 13D as specifically set forth herein.

Item 3.

Source and Amount of Funds or Other Consideration.

Item 3 is hereby amended and restated to read as follows:

The Shares purchased by each of Starboard V&O Fund, Starboard S LLC and Starboard C LP and held in the Starboard Value LP Accounts

were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business) in

open market purchases. The aggregate purchase price of the 14,158,599 Shares beneficially owned by Starboard V&O Fund is approximately $29,990,527,

excluding brokerage commissions. The aggregate purchase price of certain call options exercisable into 1,373,600 Shares beneficially owned by Starboard

V&O Fund, as further described in Item 6 below, is approximately $1,406,498, excluding brokerage commissions. The aggregate purchase price of the

3,157,010 Shares beneficially owned by Starboard S LLC is approximately $7,347,305, excluding brokerage commissions. The aggregate purchase price of

certain call options exercisable into 306,200 Shares beneficially owned by Starboard S LLC, as further described in Item 6 below, is approximately $313,533,

excluding brokerage commissions. The aggregate purchase price of the 1,529,441 Shares beneficially owned by Starboard C LP is approximately $7,864,243,

excluding brokerage commissions. The aggregate purchase price of certain call options exercisable into 148,400 Shares beneficially owned by Starboard C

LP, as further described in Item 6 below, is approximately $151,954, excluding brokerage commissions. The aggregate purchase price of the 30,367,261

Shares held in the Starboard Value LP Accounts is approximately $72,426,979, excluding brokerage commissions. The aggregate purchase price of certain

call options exercisable into 2,271,800 Shares held in the Starboard Value LP Accounts, as further described in Item 6 below, is approximately $2,326,210,

excluding brokerage commissions. The 45,836 Shares directly owned by Mr. Smith were granted to Mr. Smith by the Issuer in his capacity as a director of the

Issuer.

The Shares owned directly by Mr. Siegel were purchased with personal funds in open market purchases. The aggregate purchase price of

the 1,250 Shares directly owned by Mr. Siegel is approximately $5,023, excluding brokerage commissions.

Item 4.

Purpose of Transaction.

Item 4 is hereby amended and restated to read as follows:

The Reporting Persons purchased the Shares based on the Reporting Persons belief that the Shares, when purchased, were undervalued and

represented an attractive investment opportunity. Depending upon overall market conditions, other investment opportunities available to the Reporting

Persons, and the availability of Shares at prices that would make the purchase or sale of Shares desirable, the Reporting Persons may endeavor to increase or

decrease their position in the Issuer through, among other things, the purchase or sale of Shares on the open market or in private transactions or otherwise, on

such terms and at such times as the Reporting Persons may deem advisable.

No Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j)

of Item 4 of Schedule 13D except as set forth herein or such as would occur upon or in connection with completion of, or following, any of the actions

discussed herein. The Reporting Persons intend to review their investment in the Issuer on a continuing basis. Depending on various factors including,

without limitation, the Issuers financial position and investment strategy, the price levels of the Shares, conditions in the securities markets and general

economic and industry conditions, the Reporting Persons may in the future take such actions with respect to their investment in the Issuer as they deem

appropriate including, without limitation, continuing to engage in communications with management and the Board of Directors of the Issuer, engaging in

discussions with shareholders of the Issuer and others about the Issuer and the Reporting Persons investment, making recommendations or proposals to the

Issuer concerning changes to the capitalization, ownership structure, board structure (including board composition), industry consolidation or potential

business combinations involving the Issuer, or operations of the Issuer, purchasing additional Shares, selling some or all of their Shares, entering into

financial instruments or other agreements that increase or decrease the Reporting Persons economic or beneficial exposure with respect to their investment in

the Issuer, engaging in short selling of or any hedging or similar transaction with respect to the Shares, including swaps and other derivative instruments, or

changing their intention with respect to any and all matters referred to in Item 4.

17

CUSIP NO. 676220106

Item 5.

Interest in Securities of the Issuer.

Items 5(a) - 5(c) are hereby amended and restated to read as follows:

The aggregate percentage of Shares reported owned by each person named herein is based upon 538,621,477 Shares outstanding, as of

September 27, 2014, which is the total number of Shares outstanding as reported in the Issuers Quarterly Report on Form 10-Q, filed with the Securities and

Exchange Commission on November 4, 2014.

A.

Starboard V&O Fund

(a)

As of the close of business on December 10, 2014, Starboard V&O Fund beneficially owned 15,532,199 Shares, including 1,373,600 Shares

underlying certain call options.

Percentage: Approximately 2.9%

B.

(b)

1. Sole power to vote or direct vote: 15,532,199

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 15,532,199

4. Shared power to dispose or direct the disposition: 0

(c)

The transactions in the Shares by Starboard V&O Fund during the past sixty days are set forth in Schedule A and are incorporated herein by

reference.

Starboard S LLC

(a)

As of the close of business on December 10, 2014, Starboard S LLC beneficially owned 3,463,210 Shares, including 306,200 Shares

underlying certain call options.

Percentage: Less than 1%

(b)

1. Sole power to vote or direct vote: 3,463,210

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 3,463,210

4. Shared power to dispose or direct the disposition: 0

18

CUSIP NO. 676220106

(c)

C.

The transactions in the Shares by Starboard S LLC during the past sixty days are set forth in Schedule A and are incorporated herein by

reference.

Starboard C LP

(a)

As of the close of business on December 10, 2014, Starboard C LP beneficially owned 1,677,841 Shares, including 148,400 Shares

underlying certain call options.

Percentage: Less than 1%

D.

(b)

1. Sole power to vote or direct vote: 1,677,841

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 1,677,841

4. Shared power to dispose or direct the disposition: 0

(c)

The transactions in the Shares by Starboard C LP during the past sixty days are set forth in Schedule A and are incorporated herein by

reference.

Starboard R LP

(a)

Starboard R LP, as the general partner of Starboard C LP, may be deemed the beneficial owner of the 1,677,841 Shares owned by Starboard

C LP, including 148,400 Shares underlying certain call options.

Percentage: Less than 1%

E.

(b)

1. Sole power to vote or direct vote: 1,677,841

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 1,677,841

4. Shared power to dispose or direct the disposition: 0

(c)

Starboard R LP has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of

Starboard C LP during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

Starboard R GP

(a)

Starboard R GP, as the general partner of Starboard R LP, may be deemed the beneficial owner of the 1,677,841 Shares owned by Starboard

C LP, including 148,400 Shares underlying certain call options.

Percentage: Less than 1%

(b)

1. Sole power to vote or direct vote: 1,677,841

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 1,677,841

4. Shared power to dispose or direct the disposition: 0

(c)

Starboard R GP has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of

Starboard C LP during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

19

CUSIP NO. 676220106

F.

Starboard Value LP

(a)

As of the close of business on December 10, 2014, 32,639,061 Shares were held in the Starboard Value LP Accounts, including 2,271,800

Shares underlying certain call options. Starboard Value LP, as the investment manager of Starboard V&O Fund, Starboard C LP and the

Starboard Value LP Accounts and the manager of Starboard S LLC, may be deemed the beneficial owner of the (i) 15,532,199 Shares owned

by Starboard V&O Fund, (ii) 3,463,210 Shares owned by Starboard S LLC, (iii) 1,677,841 Shares owned by Starboard C LP, and (iv)

32,639,061 Shares held in the Starboard Value LP Accounts.

Percentage: Approximately 9.9%

G.

(b)

1. Sole power to vote or direct vote: 53,312,311

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 53,312,311

4. Shared power to dispose or direct the disposition: 0

(c)

The transactions in the Shares by Starboard Value LP through the Starboard Value LP Accounts and on behalf of each of Starboard V&O

Fund, Starboard S LLC and Starboard C LP during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

Starboard Value GP

(a)

Starboard Value GP, as the general partner of Starboard Value LP, may be deemed the beneficial owner of the (i) 15,532,199 Shares owned

by Starboard V&O Fund, (ii) 3,463,210 Shares owned by Starboard S LLC, (iii) 1,677,841 Shares owned by Starboard C LP, and (iv)

32,639,061 Shares held in the Starboard Value LP Accounts.

Percentage: Approximately 9.9%

H.

(b)

1. Sole power to vote or direct vote: 53,312,311

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 53,312,311

4. Shared power to dispose or direct the disposition: 0

(c)

Starboard Value GP has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf

of each of Starboard V&O Fund, Starboard S LLC, Starboard C LP and through the Starboard Value LP Accounts during the past sixty days

are set forth in Schedule A and are incorporated herein by reference.

Principal Co

(a)

Principal Co, as a member of Starboard Value GP, may be deemed the beneficial owner of the (i) 15,532,199 Shares owned by Starboard

V&O Fund, (ii) 3,463,210 Shares owned by Starboard S LLC, (iii) 1,677,841 Shares owned by Starboard C LP, and (iv) 32,639,061 Shares

held in the Starboard Value LP Accounts.

Percentage: Approximately 9.9%

20

CUSIP NO. 676220106

I.

(b)

1. Sole power to vote or direct vote: 53,312,311

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 53,312,311

4. Shared power to dispose or direct the disposition: 0

(c)

Principal Co has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of each

of Starboard V&O Fund, Starboard S LLC, Starboard C LP and through the Starboard Value LP Accounts during the past sixty days are set

forth in Schedule A and are incorporated herein by reference.

Principal GP

(a)

Principal GP, as the general partner of Principal Co, may be deemed the beneficial owner of the (i) 15,532,199 Shares owned by Starboard

V&O Fund, (ii) 3,463,210 Shares owned by Starboard S LLC, (iii) 1,677,841 Shares owned by Starboard C LP, and (iv) 32,639,061 Shares

held in the Starboard Value LP Accounts.

Percentage: Approximately 9.9%

J.

(b)

1. Sole power to vote or direct vote: 53,312,311

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 53,312,311

4. Shared power to dispose or direct the disposition: 0

(c)

Principal GP has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of each

of Starboard V&O Fund, Starboard S LLC, Starboard C LP and through the Starboard Value LP Accounts during the past sixty days are set

forth in Schedule A and are incorporated herein by reference.

Mr. Smith

(a)

As of the close of business on December 10, 2014, Mr. Smith directly owned 45,836 Shares. Mr. Smith, as a member of Principal GP and as a

member of each of the Management Committee of Starboard Value GP and the Management Committee of Principal GP, may be deemed the

beneficial owner of the (i) 15,532,199 Shares owned by Starboard V&O Fund, (ii) 3,463,210 Shares owned by Starboard S LLC, (iii)

1,677,841 Shares owned by Starboard C LP, and (iv) 32,639,061 Shares held in the Starboard Value LP Accounts.

Percentage: Approximately 9.9%

(b)

1. Sole power to vote or direct vote: 45,836

2. Shared power to vote or direct vote: 53,312,311

3. Sole power to dispose or direct the disposition: 45,836

4. Shared power to dispose or direct the disposition: 53,312,311

(c)

Mr. Smith has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of each of

Starboard V&O Fund, Starboard S LLC, Starboard C LP and through the Starboard Value LP Accounts during the past sixty days are set

forth in Schedule A and are incorporated herein by reference.

21

CUSIP NO. 676220106

K.

Messrs. Mitchell and Feld

(a)

Each of Messrs. Mitchell and Feld, as a member of Principal GP and as a member of each of the Management Committee of Starboard Value

GP and the Management Committee of Principal GP, may be deemed the beneficial owner of the (i) 15,532,199 Shares owned by Starboard

V&O Fund, (ii) 3,463,210 Shares owned by Starboard S LLC, (iii) 1,677,841 Shares owned by Starboard C LP, and (iv) 32,639,061 Shares

held in the Starboard Value LP Accounts.

Percentage: Approximately 9.9%

L.

(b)

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 53,312,311

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 53,312,311

(c)

None of Messrs. Mitchell or Feld has entered into any transactions in the Shares during the past sixty days. The transactions in the Shares

on behalf of each of Starboard V&O Fund, Starboard S LLC, Starboard C LP and through the Starboard Value LP Accounts during the past

sixty days are set forth in Schedule A and are incorporated herein by reference.

T-S Capital

(a)

As of the close of business on December 10, 2014, T-S Capital did not own any Shares.

Percentage: 0%

M.

(b)

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0

(c)

The transactions in the Shares by T-S Capital during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

Mr. Siegel

(a)

As of the close of business on December 10, 2014, Mr. Siegel directly owned 1,250 Shares.

Percentage: Less than 1%

(b)

1. Sole power to vote or direct vote: 1,250

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 1,250

4. Shared power to dispose or direct the disposition: 0

(c)

Mr. Siegel has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of T-S

Capital during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

22

CUSIP NO. 676220106

N.

Mr. Telles

(a)

As of the close of business on December 10, 2014, Mr. Telles did not own any Shares.

Percentage: 0%

Item 6.

(b)

1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0

(c)

Mr. Telles has not entered into any transactions in the Shares during the past sixty days. The transactions in the Shares on behalf of T-S

Capital during the past sixty days are set forth in Schedule A and are incorporated herein by reference.

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 is hereby amended to add the following:

Starboard V&O Fund purchased in the over the counter market American-style call options referencing an aggregate of (i) 686,800 Shares,

which have an exercise price of $7.00 per Share and expire on July 17, 2015, and (ii) 686,800 Shares, which have an exercise price of $8.00 per Share and

expire on July 17, 2015.

Starboard S LLC purchased in the over the counter market American-style call options referencing an aggregate of (i) 153,100 Shares,

which have an exercise price of $7.00 per Share and expire on July 17, 2015, and (ii) 153,100 Shares, which have an exercise price of $8.00 per Share and

expire on July 17, 2015.

Starboard C LP purchased in the over the counter market American-style call options referencing an aggregate of (i) 74,200 Shares, which

have an exercise price of $7.00 per Share and expire on July 17, 2015, and (ii) 74,200 Shares, which have an exercise price of $8.00 per Share and expire on

July 17, 2015.

Starboard Value LP through the Starboard Value LP Accounts purchased in the over the counter market American-style call options

referencing an aggregate of (i) 1,135,900 Shares, which have an exercise price of $7.00 per Share and expire on July 17, 2015, and (ii) 1,135,900 Shares,

which have an exercise price of $8.00 per Share and expire on July 17, 2015.

Depending on market conditions and other factors, the Reporting Persons may alter the mix of their collective beneficial ownership

position in the Issuer, which is currently composed of 49,212,311 Shares and 4,100,000 Shares underlying the American-style call options described in this

Item 6, by, among other things, exercising certain of the American-style call options, purchasing or selling Shares, and/or purchasing or selling options.

23

CUSIP NO. 676220106

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Dated: December 11, 2014

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

By: Starboard Value LP,

its investment manager

STARBOARD VALUE GP LLC

By: Starboard Principal Co LP,

its member

STARBOARD VALUE AND OPPORTUNITY S LLC

By: Starboard Value LP,

its manager

STARBOARD PRINCIPAL CO LP

By: Starboard Principal Co GP LLC,

its general partner

STARBOARD VALUE AND OPPORTUNITY C LP

By: Starboard Value R LP

its general partner

STARBOARD PRINCIPAL CO GP LLC

STARBOARD VALUE R GP LLC

STARBOARD VALUE R LP

By: Starboard Value R GP LLC,

its general partner

STARBOARD VALUE LP

By: Starboard Value GP LLC,

its general partner

By:

/s/ Jeffrey C. Smith

Name:

Jeffrey C. Smith

Title:

Authorized Signatory

/s/ Jeffrey C. Smith

JEFFREY C. SMITH

Individually and as attorney-in-fact for Mark R. Mitchell, Peter

A. Feld, T-S Capital Partners, LLC, David Siegel and Robert

Telles

24

CUSIP NO. 676220106

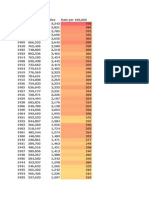

SCHEDULE A

Transactions in the Shares During the Past 60 Days

Nature of the

Transaction

Amount of Securities

Purchased / (Sold)

Price Per

Share/ Premium per

Option($)

Date of

Purchase / Sale

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Sale of Common Stock

Purchase of Call Option

Purchase of Call Option

100,433

199,067

494,187

242,177

45,227

165,326

182,913

217,755

(611,221)

686,800*

686,800*

4.4371

4.5278

4.5440

4.5453

6.6500

6.7398

6.8716

6.5931

6.8000

1.1990**

0.8489**

10/15/2014

10/15/2014

10/15/2014

10/15/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

STARBOARD VALUE AND OPPORTUNITY S LLC

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

*

22,467

44,533

110,553

54,176

10,084

36,864

4.4371

4.5278

4.5440

4.5453

6.6500

6.7398

10/15/2014

10/15/2014

10/15/2014

10/15/2014

12/10/2014

12/10/2014

Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on July 17, 2015.

This amount represents the cost of an applicable American-style call option to purchase one Share. The per share exercise price of this call option is $7.00

and $8.00, respectively.

**

CUSIP NO. 676220106

Purchase of Common Stock

Purchase of Common Stock

Sale of Common Stock

Purchase of Call Option

Purchase of Call Option

40,785

48,554

(136,287)

153,100*

153,100*

6.8716

6.5931

6.8000

1.1990**

0.8489**

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

STARBOARD VALUE AND OPPORTUNITY C LP

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Sale of Common Stock

Purchase of Call Option

Purchase of Call Option

12,240

24,260

60,227

29,514

4,885

17,859

19,759

23,522

(66,025)

74,200*

74,200*

4.4371

4.5278

4.5440

4.5453

6.6500

6.7398

6.8716

6.5931

6.8000

1.1990**

0.8489**

10/15/2014

10/15/2014

10/15/2014

10/15/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

STARBOARD VALUE LP

(Through the Starboard Value LP Accounts)

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

*

32,527

64,473

937,931

459,633

74,804

4.4371

4.5278

4.5440

4.5453

6.6500

10/15/2014

10/15/2014

10/15/2014

10/15/2014

12/10/2014

Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on July 17, 2015.

This amount represents the cost of an applicable American-style call option to purchase one Share. The per share exercise price of this call option is $7.00

and $8.00, respectively.

**

CUSIP NO. 676220106

Purchase of Common Stock

Purchase of Common Stock

Purchase of Common Stock

Sale of Common Stock

Purchase of Call Option

Purchase of Call Option

273,451

302,543

360,169

(1,010,967)

1,135,900*

1,135,900*

6.7398

6.8716

6.5931

6.8000

1.1990**

0.8489**

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

12/10/2014

T-S CAPITAL PARTNERS, LLC

Sale of Common Stock

Sale of Common Stock

Sale of Common Stock

(25,000)

(25,000)

(50,000)

6.5346

6.4600

6.5051

11/06/2014

11/07/2014

11/10/2014

Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on July 17, 2015.

This amount represents the cost of an applicable American-style call option to purchase one Share. The per share exercise price of this call option is $7.00

and $8.00, respectively.

**

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Protecting Patients From PredatorsDocument7 pagesProtecting Patients From PredatorsJoelHoffmannNo ratings yet

- Coal Mining Deaths 1900-2013Document3 pagesCoal Mining Deaths 1900-2013JoelHoffmannNo ratings yet

- Starboard Value Investment in Staples (Dec. 10)Document38 pagesStarboard Value Investment in Staples (Dec. 10)JoelHoffmannNo ratings yet

- Federal Reserve Report On Consumer Credit (October 2014)Document3 pagesFederal Reserve Report On Consumer Credit (October 2014)JoelHoffmannNo ratings yet

- Clery Act Complaint Against University of VirginiaDocument4 pagesClery Act Complaint Against University of VirginiaJoelHoffmannNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Problem 14-4 (IAA)Document8 pagesProblem 14-4 (IAA)NIMOTHI LASE0% (1)

- Early-Stage Startup Valuation - Jeff FaustDocument15 pagesEarly-Stage Startup Valuation - Jeff FausthelenaNo ratings yet

- Ash and Cash EquivalentsDocument2 pagesAsh and Cash EquivalentsYassi CurtisNo ratings yet

- Particulars Yes NoDocument18 pagesParticulars Yes Nokashyappathak01No ratings yet

- Performance and Evaluation of SBI Mutual Funds in IndiaDocument8 pagesPerformance and Evaluation of SBI Mutual Funds in IndiaAnonymous izrFWiQNo ratings yet

- Chapter 1 Derivatives An IntroductionDocument10 pagesChapter 1 Derivatives An Introductiongovindpatel1990No ratings yet

- Short Questions-Central BankDocument6 pagesShort Questions-Central BanksadNo ratings yet

- Iqmethod ValuationDocument48 pagesIqmethod ValuationAkash VaidNo ratings yet

- IF Sem IV Word Success and ThakurDocument28 pagesIF Sem IV Word Success and ThakurSanket MhetreNo ratings yet

- Forex Price Action Trading Plan - Rev 0Document13 pagesForex Price Action Trading Plan - Rev 0nbbarath1988No ratings yet

- OnlinevsinstoreshoppingDocument26 pagesOnlinevsinstoreshoppingDiana PanaNo ratings yet

- 08dps9u 1204720010545138 680917Document1 page08dps9u 1204720010545138 680917dharnaNo ratings yet

- Suggested Day Trading Plan - Fibonacciqueen: 8 Ema Crosses Above The 34 Ema and A Prior Swing High Is Taken OutDocument2 pagesSuggested Day Trading Plan - Fibonacciqueen: 8 Ema Crosses Above The 34 Ema and A Prior Swing High Is Taken Outbrent100% (1)

- Ronty 2Document61 pagesRonty 2Techboy RahulNo ratings yet

- 1908GMPb PDFDocument41 pages1908GMPb PDFKirillNo ratings yet

- Paper20A Set2Document8 pagesPaper20A Set2Ramanpreet KaurNo ratings yet

- (Merrill Lynch, Youssfi) Convexity Adjustment For Volatility SwapsDocument18 pages(Merrill Lynch, Youssfi) Convexity Adjustment For Volatility Swapsm325075No ratings yet

- A PROJECT REPORT On "Kotak Mahindra Mutul Fund"Document69 pagesA PROJECT REPORT On "Kotak Mahindra Mutul Fund"jai786063% (16)

- Indian Hotel JPMDocument25 pagesIndian Hotel JPMViet VuNo ratings yet

- Arbitrage Calculator 3Document4 pagesArbitrage Calculator 3Eduardo MontanhaNo ratings yet

- Fabozzi Chapter01Document18 pagesFabozzi Chapter01Syed Imtinan AhmedNo ratings yet

- Market Wise Reversal Entry StrategiesDocument21 pagesMarket Wise Reversal Entry StrategiesnettideNo ratings yet

- Chapter 3 Solution ManualDocument14 pagesChapter 3 Solution ManualAhmed FathelbabNo ratings yet

- выписка месяцDocument3 pagesвыписка месяцeskanderzunisbaevNo ratings yet

- Financial Stability Committee DraftDocument379 pagesFinancial Stability Committee DraftLogisticsMonsterNo ratings yet

- Impact of Oil Prices On The Stock MarketDocument18 pagesImpact of Oil Prices On The Stock MarketDhruv AghiNo ratings yet

- J.P. Morgan Reiterates OREX With Overweight and $12 Price Target - May 8Document9 pagesJ.P. Morgan Reiterates OREX With Overweight and $12 Price Target - May 8MayTepper100% (1)

- Liam Mescall Imp ProbsDocument3 pagesLiam Mescall Imp ProbsLiam MescallNo ratings yet

- Earnings Per Share PDFDocument56 pagesEarnings Per Share PDFYuan ZhongNo ratings yet

- CH 15 Equity LanjutanDocument35 pagesCH 15 Equity LanjutanKalyana MittaNo ratings yet