Professional Documents

Culture Documents

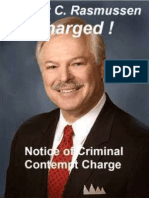

Robert R. Maddox Is Charged With Indirect Criminal Contempt, Fraud, Conspiracy

Uploaded by

Christopher Stoller EDOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Robert R. Maddox Is Charged With Indirect Criminal Contempt, Fraud, Conspiracy

Uploaded by

Christopher Stoller EDCopyright:

Available Formats

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 20

(Page 1 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 2 of 20

(Page 2 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 3 of 20

(Page 3 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 4 of 20

(Page 4 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 5 of 20

(Page 5 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 6 of 20

(Page 6 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 7 of 20

(Page 7 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 8 of 20

(Page 8 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 9 of 20

(Page 9 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 10 of 20

(Page 10 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 11 of 20

(Page 11 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 12 of 20

(Page 12 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 13 of 20

(Page 13 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 14 of 20

(Page 14 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 15 of 20

(Page 15 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 16 of 20

(Page 16 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 17 of 20

(Page 17 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 18 of 20

(Page 18 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 19 of 20

(Page 19 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 20 of 20

(Page 20 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 11

SUPREME COURT OF ARIZONA

En Banc

IVO QUEIROZ, an unmarried man,

)

)

Plaintiff-Counterdefendant/

)

Appellant,

)

)

v.

)

)

DANIEL HARVEY,

)

)

Defendant-Counterplaintiff/

)

Appellee.

)

)

)

)

_________________________________ )

Arizona Supreme Court

No. CV-08-0308-PR

Court of Appeals

Division One

No. 1 CA-CV 07-0309

Maricopa County

Superior Court

No. CV2005-004469

O P I N I O N

Appeal from the Superior Court in Maricopa County

The Honorable Colin F. Campbell, Judge

The Honorable Bethany G. Hicks, Judge

AFFIRMED

________________________________________________________________

Opinion of the Court of Appeals, Division One

___ Ariz. ___, ___ P.3d ___ (App. 2008)

2008 WL 2058233 (May 15, 2008)

VACATED

________________________________________________________________

GUST ROSENFELD, P.L.C.

By

Charles W. Wirken

Attorneys for Ivo Queiroz

Phoenix

JENNINGS, STROUSS, & SALMON, P.L.C.

By

David B. Earl

David Brnilovich

Attorneys for Daniel Harvey

Phoenix

THOMAS, THOMAS & MARKSON, P.C.

Phoenix

By

Neal B. Thomas

Attorneys for Amici Curiae Arizona Association of Realtors,

West USA Realty, Inc., and John Hall & Associates

________________________________________________________________

1

(Page 21 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 2 of 11

R Y A N, Justice

1

In

this

opinion,

we

address

whether

court

may

consider a real estate agents inequitable conduct in deciding

if the agents principal is entitled to specific performance of

a contract for the sale of real estate.

We conclude that the

agents inequitable acts may be imputed to the principal whether

or not the principal knew of the agents misconduct.

I1

2

Daniel Harvey listed ten acres of land in Tonopah for

sale.

Through his agent, Charles Harrison, Ivo Queiroz offered

to purchase the land, along with an additional ten acres.

The

purchase offer called for a $1,000 earnest-money payment and a

closing date of February 15, 2005.

was

$150,000,

with

$68,000

due

finance the balance of $82,000.

The proposed purchase price

at

closing.

Harvey

was

to

A counteroffer, faxed the next

day and accepted by Queiroz, retained the closing date and the

earnest-money requirement, but changed escrow agents.

Harrison

faxed the contract to the escrow agent on December 10, but sent

no earnest money during the following week.

3

Harvey and his agent became concerned about Queirozs

Because this case was tried to the bench and findings of

fact were entered, we defer to the superior courts findings of

fact unless clearly erroneous.

Valley Med. Specialists v.

Farber, 194 Ariz. 363, 367, 11, 982 P.2d 1277, 1281 (1999).

2

(Page 22 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

failure to deposit the earnest money.

Harrison were unavailing.

Harveys

agent

cancelled.

told

the

Page 3 of 11

Repeated efforts to reach

Finally, on Friday of that week,

escrow

agent

that

the

contract

was

Either that night or the next day, Harrison learned

that Harvey had cancelled the contract.

Nevertheless, on the

next Monday morning, Harrison took two money orders amounting to

$1,000 to a branch of the escrow company.

Several hours later,

Harveys written notice of the cancellation arrived at another

branch of the escrow agents office.2

Harveys agent returned

Harrisons earnest money, informing him that the contract had

been cancelled.

4

Queiroz sued Harvey, seeking specific performance of

the contract.

The superior court found that Harrison had acted

inequitably and thus denied Queiroz specific performance.

The

court determined that Harrison lied about the source of the

earnest money, testifying that it was Queirozs when in fact it

was Harrisons.

The court found that in providing the earnest

money Harrison either made an undisclosed loan to Queiroz or

commingled

his

own

money

with

Queirozs

funds.

The

court

The contract called for written notice before cancellation.

The superior court concluded that the failure to timely pay the

earnest money was a material breach.

The court of appeals,

however, concluded that payment of the earnest money before the

written notice of cancellation had been received cured the

breach. See Queiroz v. Harvey, __ Ariz. __, __, 18, 22, __

P.3d __, __ (App. 2008).

Harvey did not seek review of this

holding.

3

(Page 23 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 4 of 11

further found that Harrisons subterfuge went further when he

printed his name, rather than signing it, on the purchase offer

because he did not have the required earnest-money check, failed

to return phone calls, and raced to the escrow agent to deposit

the

funds,

Finally,

knowing

the

court

that

Harvey

found

that

had

cancelled

Harrison

had

the

contract.

not

testified

truthfully.

5

The court of appeals reversed.

__, 18, 22, __ P.3d at __.

fraudulent

or

dishonest

principal

for

purposes

acts

of

Queiroz, __ Ariz. at

The court held that an agents

could

an

not

equitable

be

attributed

defense

absent

personal involvement or knowledge of the principal.

31.

to

the

Id. at

The court concluded that it could not determine whether

Queiroz

knew

of

Harrisons

conduct

and

therefore

could

not

decide whether the superior court would have reached the same

result based solely on Harrisons misrepresentations about the

escrow

check.

Id.

further proceedings.

6

We

granted

at

32.

It

consequently

remanded

for

Id.

review

because

whether

an

agents

inequitable conduct is chargeable to the principal is an issue

of statewide importance and is likely to recur.

ARCAP 23(c).

We

5(3)

have

jurisdiction

under

Article

6,

Section

of

the

Arizona Constitution and Arizona Revised Statutes (A.R.S.)

12-120.24 (2003).

4

(Page 24 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 5 of 11

II

7

trial

courts

grant

or

refusal

of

performance is reviewed for an abuse of discretion.

Statler, 20 Ariz. 81, 84, 176 P. 843, 844 (1918).

specific

Kimball v.

Queiroz does

not dispute that specific performance, although a routine remedy

in actions involving contracts for the sale of real property,

may properly be refused on the basis of unclean hands.

See

MacRae v. MacRae, 57 Ariz. 157, 161, 112 P.2d 213, 215 (1941)

(It is a cardinal rule of equity that [one] who comes into a

court of equity seeking equitable relief must come with clean

hands.).

Rather,

Queiroz

argues

that

mere

agency

relationship does not suffice to establish inequitable conduct

and that such conduct should not be imputed to an innocent

principal.

8

of

We reject these arguments.

agency

E.g.,

law,

an

Restatement

agents

(Third)

acts

of

Under ordinary principles

bind

Agency

the

agents

6.01

principal.

(2006)

(stating

general rule that principal may work through an agent to secure

contract with third party); id. at 1.01 (agent acts on the

principals behalf); see also id. at 4.01 (explaining that

manifestation

representation

of

by

assent

an

ratifies

agent

made

an

agents

incident

to

conduct).

or

contract

conveyance is attributed to a disclosed . . . principal as if

the principal made the representation directly when the agent

5

(Page 25 of Total)

USCA Case #14-5265

had

actual

conveyance

or

.

circumstances

affect

Document #1527076

apparent

under

authority

Id.

which

principals

at

to

make

6.11.

legal

position

the

This

representations

enforce or rescind a contract.

9

Filed: 12/14/2014

in

Page 6 of 11

contract

includes

made

by

actions

an

or

the

agent

brought

to

Id. at cmt. a.

Other courts have similarly concluded that a principal

seeking

specific

performance

inequitable conduct.

may

be

bound

by

an

agents

E.g., Handelman v. Arquilla, 95 N.E.2d

910, 913 (Ill. 1951) (rejecting specific performance based on

agents material misrepresentation);

Alexander v. Hughes, 472

P.2d 818, 819-20 (Or. 1970) (affirming the denial of specific

performance when agent misled opposing party about nature of

document signed).

10

The

Restatement

and

the

cited

cases

are

consistent

with the duties both agents and principals owe to third parties

in the context of the sale of real property.

See Lombardo v.

Albu, 199 Ariz. 97, 100-01, 13-15, 14 P.3d 288, 291-92 (2000)

(noting common law and regulatory duties).

rule

that

the

consistent

principal

with

is

bound

long-established

by

his

In addition, the

agents

principles

of

conduct

equity.

is

See

Dawson v. McNaney, 71 Ariz. 79, 87, 223 P.2d 907, 912 (1950)

(equitable

justice

rule

and

will

not

perpetrate

be

a

applied

fraud);

to

defeat

Giovani

v.

the

ends

of

Rescorla,

69

Ariz. 20, 25, 207 P.2d 1124, 1127 (1949) (equity denies title to

6

(Page 26 of Total)

USCA Case #14-5265

property

Document #1527076

obtained

concealments,

or

through

through

Filed: 12/14/2014

actual

fraud,

undue

Page 7 of 11

misrepresentations,

influence,

duress,

taking

advantage of ones weakness or necessities, or through any other

similar means or under any other similar circumstances).

of these cases stands for an unexceptionable rule:

Each

Principals

may not benefit from the inequitable conduct of their agents.

III

11

The court of appeals, however, declined to apply this

rule.

The

implicates

court

the

moral

equitable relief.

at __.

concluded

that

the

blameworthiness

unclean

of

the

hands

party

doctrine

who

seeks

Queiroz, __ Ariz. at __, 25, 31, __ P.3d

Thus, the court held that imputing inequitable conduct

of an agent to a principal is not appropriate absent a showing

that the principal knew of the agents misconduct.

court

found

support

for

this

proposition

Id.

principally

Arizona case and two cases from other jurisdictions.

in

The

one

None of

these cases, however, is apposite.

12

v.

For example, the court of appeals reasoned that Weiner

Romley,

94

conclusion.

Ariz.

40,

381

P.2d

581

(1963),

supported

its

In Weiner, this Court held that when inequitable

conduct was not willful, unclean hands would not apply.

Id.

at 42-43, 381 P.2d at 582-83.

The court of appeals understood

this

must

to

mean

that

principals

themselves

act

willfully.

Queiroz, __ Ariz. at ___, 29-30, __ P.3d at __.

The court

7

(Page 27 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 8 of 11

reasoned that if an individuals act must be willful for an

equitable defense to apply, then, a fortiori, a principal who

does not act at all, because his agent does, cannot be found to

have acted willfully.

Id. at 31.

Weiner, however, does not

speak to the issue in this case, which is whether an agents

conduct may be imputed to his or her principal.

13

Closer to the point, yet nevertheless distinguishable,

are Vulcan Detinning Co. v. American Can Co., 67 A. 339, 340-41

(N.J. 1907), and Associated Press v. International News Service,

240 F. 983 (S.D.N.Y. 1917).

In the former, the New Jersey court

simply rejected imputing the conduct of a defendants agent in a

prior transaction to the defendant in the separate transaction

before the court.

Vulcan Detinning, 67 A. at 341.

In this

case, however, the alleged misconduct occurred within the very

transaction that was the subject of the litigation.

14

one

Associated Press is also inapposite, as it addresses

companys

effort

to

defend

itself

against

charges

of

inequitable conduct by pointing out the inequitable conduct of

its opponents agents.

Queiroz

seeks

inequitable

contract.

specific

acts

240 F. at 984, 989.

performance

committed

by

his

by

own

Here, in contrast,

relying

agent

on

to

the

secure

very

the

Associated Press does not countenance employing the

inequitable conduct of ones own agent as a sword.

8

(Page 28 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 9 of 11

IV

15

Queirozs

ineffectual.

additional

arguments

are

equally

First, he claims that we should protect innocent

principals from the misconduct of the agents they choose to

hire.

There

are

cases

in

which,

as

matter

of

fact,

principal cannot be charged with the acts or knowledge of his or

her agent.

E.g., Restatement (Third) of Agency 6.10 cmt. b

(outlining situations in which purported principal may not be

bound by agent).

This is not such a case.

The principles of

agency discussed above refute Queirozs policy argument that we

should protect all principals from liability, especially given

that without Harrisons acts, the deal here would not have been

completed.

As

between

the

principal

who

has

retained

an

unscrupulous agent and an innocent third party who relies on the

agents misrepresentation, it is the third party who deserves

protection.

16

Queiroz also argues that, notwithstanding Harrisons

inequitable conduct, Harvey has suffered no harm and thus he

should

This

be

forced

claim,

of

to

perform

course,

is

the

belied

sale-and-financing

by

the

contract.

transaction,

which

requires Harvey not only to sell the property, but also to carry

the mortgage for Queiroz.

Thus, ordering specific performance

in this case would effectively place Harvey in a continuing

9

(Page 29 of Total)

USCA Case #14-5265

relationship

Document #1527076

with

Queiroz.

Filed: 12/14/2014

Cf.

Copylease

Corp.

Page 10 of 11

of

Am.

v.

Memorex Corp., 408 F. Supp. 758, 759 (S.D.N.Y. 1976) (refusing

to

order

specific

performance

of

contracts

which

are

not

capable of immediate enforcement, but which require a continuing

series

of

acts

and

cooperation

between

the

parties

for

the

successful performance of those acts) (internal quotation marks

omitted) (applying California law).

V

17

In his response to the petition for review, Queiroz

preserved the issue of whether, assuming Harrisons conduct may

be

imputed,

superior

it

was

courts

actually

inequitable.

findings

that

We

Harrisons

defer

to

conduct

the

was

inequitable and that his statements and actions were dishonest

and misleading.

Valley Med. Specialists, 194 Ariz. at 367,

11, 982 P.2d at 1281.

Consequently, we are in no different

position than the court of appeals would have been in reviewing

the record.

26,

City of Phoenix v. Fields, 219 Ariz. 568, ___,

201 P.3d 529, 535 (2009).

supports

the

inequitably.

superior

Harrisons

courts

We conclude that the evidence

finding

conduct

that

misled

Harrison

Harvey

acted

regarding

Queirozs capacity to go forward with the earnest-money payment

and concealed his potential inability to make payments on an

ongoing basis.

See Lombardo, 199 Ariz. at 100, 12-13, 14

P.3d at 291 (noting that the ability of the buyer to perform

10

(Page 30 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 11 of 11

goes to the heart of the transaction and that both principal

and agent have a duty to disclose).

VI

18

For

the

foregoing

reasons,

we

vacate

the

court

of

appeals opinion and affirm the judgment of the superior court.

Because the contract here requires the prevailing party to be

awarded reasonable attorneys fees, we grant Harveys request

for attorneys fees.

_______________________________________

Michael D. Ryan, Justice

CONCURRING:

_______________________________________

Ruth V. McGregor, Chief Justice

_______________________________________

Rebecca White Berch, Vice Chief Justice

_______________________________________

Andrew D. Hurwitz, Justice

_______________________________________

W. Scott Bales, Justice

11

(Page 31 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 1

(Page 32 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 1

(Page 33 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 1

(Page 34 of Total)

USCA Case #14-5265

B18 (Official Form 18)(12/07)

Document #1527076

Filed: 12/14/2014

Page 1 of 2

United States Bankruptcy Court

District of New Mexico

Case No. 1011558j7

Chapter 7

In re: Debtor(s) (name(s) used by the debtor(s) in the last 8 years, including married, maiden, trade, and address):

Philip B. Stone

Charlotte A. Stone

P.O. Box 2626

P.O. Box 2626

Santa Fe, NM 87504

Santa Fe, NM 87504

Last four digits of Social Security or other

Individual TaxpayerIdentification No(s)., (if any):

xxxxx5986

xxxxx6044

Employer's TaxIdentification No(s)., /Other No(s) (if any):

DISCHARGE OF DEBTOR

It appearing that the debtor is entitled to a discharge,

IT IS ORDERED:

The debtor is granted a discharge under section 727 of title 11 United States Code (the Bankruptcy Code).

BY THE COURT

Dated: 7/19/10

Robert H. Jacobvitz

United States Bankruptcy Judge

SEE THE BACK OF THIS ORDER FOR IMPORTANT INFORMATION.

Case 10-11558-j7

Doc 20

Filed 07/19/10

Entered 07/19/10 05:00:29 Page

(Page

1 of35

2 of Total)

USCA Case #14-5265

FORM B18 continued (12/07)

Document #1527076

Filed: 12/14/2014

Page 2 of 2

EXPLANATION OF BANKRUPTCY DISCHARGE

IN A CHAPTER 7 CASE

This court order grants a discharge to the person named as the debtor. It is not a dismissal of the case and it

does not determine how much money, if any, the trustee will pay to creditors.

Collection of Discharged Debts Prohibited

The discharge prohibits any attempt to collect from the debtor a debt that has been discharged. For example, a

creditor is not permitted to contact a debtor by mail, phone, or otherwise, to file or continue a lawsuit, to attach wages

or other property, or to take any other action to collect a discharged debt from the debtor. [In a case involving

community property: There are also special rules that protect certain community property owned by the debtor's

spouse, even if that spouse did not file a bankruptcy case.] A creditor who violates this order can be required to pay

damages and attorney's fees to the debtor.

However, a creditor may have the right to enforce a valid lien, such as a mortgage or security interest, against

the debtor's property after the bankruptcy, if that lien was not avoided or eliminated in the bankruptcy case. Also, a

debtor may voluntarily pay any debt that has been discharged.

Debts That are Discharged

The chapter 7 discharge order eliminates a debtor's legal obligation to pay a debt that is discharged. Most, but

not all, types of debts are discharged if the debt existed on the date the bankruptcy case was filed. (If this case was

begun under a different chapter of the Bankruptcy Code and converted to chapter 7, the discharge applies to debts

owed when the bankruptcy case was converted.)

Debts That are Not Discharged.

Some of the common types of debts which are not discharged in a chapter 7 bankruptcy case are:

a. Debts for most taxes;

b. Debts incurred to pay nondischargeable taxes;

c. Debts that are domestic support obligations;

d. Debts for most student loans;

e. Debts for most fines, penalties, forfeitures, or criminal restitution obligations;

f. Debts for personal injuries or death caused by the debtor's operation of a motor vehicle, vessel, or aircraft

while intoxicated;

g. Some debts which were not properly listed by the debtor;

h. Debts that the bankruptcy court specifically has decided or will decide in this bankruptcy case are not

discharged;

i. Debts for which the debtor has given up the discharge protections by signing a reaffirmation agreement in

compliance with the Bankruptcy Code requirements for reaffirmation of debts; and

j. Debts owed to certain pension, profit sharing, stock bonus, other retirement plans, or to the Thrift Savings

Plan for federal employees for certain types of loans from these plans.

This information is only a general summary of the bankruptcy discharge. There are exceptions to these

general rules. Because the law is complicated, you may want to consult an attorney to determine the exact

effect of the discharge in this case.

Case 10-11558-j7

Doc 20

Filed 07/19/10

Entered 07/19/10 05:00:29 Page

(Page

2 of36

2 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 3

(Page 37 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 2 of 3

(Page 38 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 3 of 3

(Page 39 of Total)

8/13/2014

Print USCA Case #14-5265

Outlook.com Print Message

Document #1527076

Filed: 12/14/2014

Page 1 of 8

Close

RE: Form submission from: Consumer Complaint Form

From: ConsumerInfo (ConsumerInfo@azag.gov)

Sent: Wed 8/13/14 6:20 PM

To: 'Ldms4@hotmail.com' (Ldms4@hotmail.com)

Dear Consumer, PLEASE DO NOT REPLY TO THIS E-MAIL

This e-mail is to acknowledge that your consumer complaint has been received by the

Consumer Information & Complaints Unit of the Arizona Attorney Generals Office.

Thank you for bringing this issue to our attention. We will work as quickly as

possible to process your complaint; however, the initial processing can take 2-3

weeks. Please be assured that once the initial processing is complete, you will

receive additional written correspondence via U.S. mail regarding your complaint.

For future inquiries on your complaint, please contact our office and one of our

staff members will be happy to assist you in obtaining the information you need.

You can reach our office at:

602.542.5763 - Phoenix Area

520.628.6504 - Tucson Area

1.800.352.8431 - Toll Free outside of Maricopa and Pima Counties

Sincerely,

Consumer Information and Complaints Unit

Arizona Attorney General

CONFIDENTIALITY NOTICE: This e-mail message, including any attachments, is for the

sole use of the intended recipient(s) and may contain confidential and privileged

information. Any unauthorized review, use, disclosure or distribution is

prohibited. If you are not the intended recipient, please contact the sender by

reply e-mail and destroy all copies of the original message.

-----Original Message----From: webmaster@azag.gov [mailto:webmaster@azag.gov]

Sent: Wednesday, August 13, 2014 9:25 AM

To: OnlineComplaints

Subject: Form submission from: Consumer Complaint Form

Full Name: Christopher Stoller

Street Address: P.O. Box 60645

City: Chicago

State: Illinois

Zip Code: 60660

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 40 of Total)

1/8

8/13/2014

Outlook.com Print Message

USCA

#14-5265

Document

#1527076

Filed: 12/14/2014

Page 2 of 8

Best N

umberCase

to Ca

ll During D

ay: 312 8

34 9717

Phone: 312-545-4554

E-mail Address: Ldms4@hotmail.com

Name: Western Progressive Arizona Inc./Ocwen Loan Servicing Arizona Street Address:

2002 Summit Blvd Suite

City: Alanta

State: Georgia 30319

Zip Code: 30319

Phone: 866 960 8299

E-mail Address:

Website Address: http://www.altisource.com/ May we send a copy of this to the

person or firm you are complaining against?

Yes

Please explain the entire circumstances surrounding your complaint below:

CHRISTOPHER STOLLER

P.O. BOX 60645

CHICAGO, ILLINOIS 60660

312-545-4554

Ldms4@hotmail.com

August 14, 2014

SERVICE LIST OF ARIZONA ATTORNEY GENERAL COMPLAINT

TO: RESPONDENTS

Ronald M. Faris

CEO/President

Ocwen Loan Servicing Arizona

1661 Worthington Road

West Palm Beach, Fl 33409

877-596-8580

www.ocwencustomers.com

William C. Erbey

Chairman of Altisource Portfolio Solutions S.A.

http://www.altisource.com/

888-255-1791

William Shepro, Director

F. Brian Sachnidermman

Mel-Ling Mitchell

Roland Muller Ineichen

Timo Vatto,

W. Michael Linn

Michelle Esterman

Keven J. Wilcox, Esq.,

Joseph Davila

Mark Hynes

C Martin Cliff

Western Progressive Arizona,

2002 Summit Blvd, suite 600

Atlanta, Ga 30319

Western Progressive-Arizona, Inc.

1150 E. University Drive

Tempe, AZ 85281

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 41 of Total)

2/8

8/13/2014

Outlook.com Print Message

USCA

Case

#14-5265

Document #1527076

Phone:

866-9

60-82

99

stephanie.spurlock@altisource.com

http://www.altisource.com

Filed: 12/14/2014

Page 3 of 8

ARIZONA ATTORNEY GENERAL COMPLAINT

OBJECTION TO NOTICE OF TRUSTEE SALE

Formal notice is hereby served upon the parties listed in the Service List that I

am filing an objection to the Notice of the Trustee Sale (Exhibit 1) with the

Arizona Attorney General's Office, pursuant to the legally described trust

propertythat will be sold, pursuant to the power of sale under that certain Deed

of Trust dated 05/02/2006 and recorded on 05/09/2006 as Instrument No. 20060627298,

Book----Page---and recorded on as in the official records of Maricopa County,

Arizona.

I am objection to the fraudulent Notice of trustee Sale (Exhibit 1) filed by

Western Progressive- Arizona, Inc., with the Maricopa County Recorder's Office on

7/23/2014 Document no. 20140480249 announcing that the my property known as 28437

N. 112fth Way, Scottsdale, Az 85262-4725 will be sold at public auction to the

highest bidder. At the main entrance of the Superior Court Building 201 W.

Jefferson, Phoenix Az 85003, on 11/12/2014 at 12:30PM of said day. at 1,

Document 20140480249.

The Trustee has no power and/or authority to convey the deed of trust dated

05/02/2006 because Philip Stone quit claimed his interest to Christopher Stoller

Pension and Profit Sharing Plan Limited (CSPPSP) on September 19, 2008, recorded in

the Maricopa County Recorders Office 2008-0815422 on 09/22/08. The successor

trustee was divested of its power of sale after 09/22/08. On September 19, 2008,

Philip Stone transfers and conveys to CSPPSP a Bahamas Corporation, and/or

Christopher Stoller and/or Leo Stoller (collectively, Assignees), under the Law of

Assignments of Causes of Action, insofar as permitted by law, forever, any and all

causes of action, remedies, or claims, now or in the future, that Assignor CSPPSP

have against any party, not limited to financial institution, contractors,

builders, and their employees, affiliates, successors and assigns, et al., as well

as the right to prosecute such causes of action in the name of Assignor or

Assignees or any of them , and the right to settle or otherwise resolve such causes

of action as Assignees sees fit, regarding the following real property in Maricopa

County, State of Arizona:

Lot 3, Pinnacle Foothills, according to Book 398 of Maps, Page 50, and

Affidavit of Correction recorded in Document No. 96-0145582, records of

Maricopa County, Arizona.

Assessor's Parcel Number: 216-74-044

Commonly known as: 28437 N. 112th Way, Scottsdale, Az 85262.

Claim(s) shall mean any claim, liability, right, demand, suit, matter, obligations,

damage, loss, cost, action k,or cause of action, of every kind and description that

Assignor has or may have, including assigned claims, whether known or unknown,

asserted or unasserted, latent or patent, that is, has been, could reasonably have

been, or in the future might reasonably be asserted, by Assignor in any action or

proceeding in court, regardless of legal theory and regardless of the type of

amount of relief or damages claimed, against any, known or unknown, arising from or

in any way relating to said property.

A full Release and Full Re-conveyance of said Deed of Trust and all other debts in

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 42 of Total)

3/8

8/13/2014

Outlook.com Print Message

USCA

Case

#14-5265

Document

#1527076

Filed:

Page

4eof

connec

tion w

ith s

ame, includ

ing the A

djustable Rate

Note12/14/2014

secured by t

he De

d8

of

Trust was filed with the Maricopa County Recorder Office

2014-0512240 08/04/14.

Notice(s) of Liz Pendens was filed on the subject real estate on 12/29/2008

2008-1090943 with the Maricopa Counter Recorders Office and again another Liz

Pendens was filed on 12/02/2013 2013-1025435.

CSPPSP, Christopher Stoller and Leo Stoller have served notice pursuant to the (1)

Three Day Notice of Rescission, (2) Three Year Notice of Rescission and (3) General

Claims Notice of Rescission or Nullification. (4) There are defects in the Trustee

Sale Notice (a) Philip B. Stone, as of 7/23/2014 does not owe a delinquency payment

of of $197,142.49. Nor does Philip B. Stone, as of July 25, 2014 owe unpaid

principle balance of $646,683.87,plus interest from 02/01/2008.

Philip B. Stone's promissory note secured by a Deed of trust and the adjustable

rate note together with the deed of trust securing same was canceled as a result of

the United States Bankruptcy Case 10-11558-17, District of New Mexico and the debt

discharge, July 19, 2010.

The former Trustee, Reconstruct Co NA, was not registered as a loan servicer,

broker with the Arizona Department of Financial Institutions as of September 9,

2011 and pursuant to their Notice of Trustee Sale Arizona recorded in the Maricopa

Recorders Office 20110752511 on 09/09/2011 and lacked the authority to transact

business within the State of Arizona. The Trustee Sale Arizona was void ab initio

and canceled by the Trustee.

ALTISOURCE PROFOLIO SOLUTIONS S.A /Western Progressive Arizona Inc., Western

Progressive LLC., William Shepro, Director, F. Brian Sachnidermman, C. Martin

Cliff, William Erbey, herein after referred to as(WPAI) (Substitution Trustee) is

not registered with the Arizona Department of Financial Institutions and is not

licensed as a broker or servicer of mortgages as of the date July 02, 2014 that

WPAI filed with the Maricopa Recorders Office its Substitution of Trustee (

20140433956).

Christiana Trust, a division of Wilmington Savings Fund Society, Trustee of ARLP

Trust 3, s not registered with the Arizona Department of financial institutions and

is not licensed as a broker or servicer of mortgages as of the date July 02, 2014.

Nor are they registered with the Arizona Corporation Division and they do not have

a corporation certificate of authority to transact business within the State of

Arizona.

On July 21, 2014 WPAI filed their Notice Notice of Trustee Sale and Debt Validation

Notice, Statement of breach and non performance, and these documents were recorded

with the Maricopa Recorders Offices on July 23, 2014 20140480249.

The successor Trustee WPAI does not qualify as a Trustee of the deed of Trust in

the Trustees capacity as an escrow agent as required by A.R.S.

33-803 (A)(6) according to the Arizona Department of Financial Institutions.

WAPI is not a registered Trustee, they have no license.

The statement of breach or non performance falsely claiming that Philip Stone is in

foreclosure because he is delinquent in payments is a false and misleading

statement, because Philip Stone debts have been discharged in Bankruptcy Case No.

10-11558-17 District of New Mexico. The Debt discharge date was July 19, 2010.

The beneficiary or substitute Trustee lacks the authority under the release and

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 43 of Total)

4/8

8/13/2014

Outlook.com Print Message

USCA

Case

#14-5265

Document

#1527076

Filed:

Page

of

full c

onveya

nce o

f the Trust

ee Deed a

nd the cancell

ation12/14/2014

of all of de

bts,5i

nc8

luding

the adjustable rate note, secured by the Deed of Trust and the Title of the Subject

Property being in the name of CSPPHP and cannot not be sold under the conveyance of

the Deed of Trust.

Pursuant to the Substitution of Trustee dated June 9th, 2014 Recorders Number

20140433956, Mel-Ling Mitchell, Contact Management Coordinator, is not an Officer

of Ocwen Loan Servicing LLC and is a unauthorized robo

signer.

BAC Home Loans Servicing, LP., (BAC) the successor to Countrywide Bank Na, was not

registered with the Arizona Corporation Division, was not registered as a Limited

Liability Partnership as of April 9, 2009. BAC was not registered with the Arizona

Department of Financial Institutions. BAC had no authority to convey any assignment

to RECONSTRUCT COMPANY, N.A. or Ocwen Loan Servicing LLC.

On June 3rd, 2014, the Maricopa Country Recorders Office recorded a fraudulent

assignment The record beneficial interest under said Deed of Trust as a result of

the last (fraudulent) recorded assignment thereof is Christiana Trust, A Division

of Wilmington Savings Fund Society FSB, not in its individual capacity but as

Trustee of ARLP Trust 3, by an unlawful instrument Recorded on June 3, 2014, in

Maricopa County Records at Recorder's No. 14-360515 c/o Ocwen Loan Servicing LLC

5720 Premier Park Dr West Palm Beach Fl 33407.

A representative of Ocwen Loan Servicing LLC, who claimed to be an agent, Chirag

Patel, on March 26, 20141, informed Christopher Stoller, that he was required to

have insurance for his property pursuant to a residential mortgage and since

Christopher Stoller has refused to provide a copy of the insurance, Ocwen was

placing insurance on the subject property and would be charging $3,000 annually,

for a home owners insurance policy that would generally cost about $300.00 per

year.

The alleged successor Trustee WAPI did not perform due diligence as to who the

current owner of the subject property is and is attempting to unlawfully foreclose

on Stoller's property.

WAPI is not entitled to enforce the said note or mortgage, which has been released

with a full re-conveyance of the Deed Trust and cancellation of the promissory note

and the Adjustable Rate Note securing the Deed of Trust. See

Re-conveyance of said Deed of Trust, Maricopa County Recorder Office

2014-0512240 08/04/14.

Ocwen Loan Servicing Arizona, WAPI are in violation of the Fair Debt Collection

Practices Act and the Federal Fair Debt Collection Practices Act by attempting to

collect on a debt from Philip B. Stone that is not owed.

In the fraudulent Substitution of Trustee Document Recording Requested by Premium

Title Agency, Inc., filed in the Maricopa County Recorder's office on July 2, 2014

20140433956, states that The successor trustee (Western Progressive -Arizona,

Inc.) appointed herein qualifies as trustee of the trust Deed in the trustee's

capacity as an Insurance Company as required by ARS Section 33-803, Subsection (A)

(6). The above is a fraudulent statement.

As of August 7, 2014 Western Progressive -Arizona, Inc., is not registered with the

Arizona Department of Insurance to do business in Arizona as an Insurance Company

according to Ruth Ojeda.

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 44 of Total)

5/8

8/13/2014

Outlook.com Print Message

USCA

Case

Document

#1527076

Filed:

Page

6 of

WAPI (

also k

nown#14-5265

as Altisour

ce Portfo

lio SA Solutio

ns), 12/14/2014

William D. Sh

epro,

Wi8

lliam

Erbey, Roland Muller Ineichen, Timo Vatto, W. Michael Linn, Michelle Esterman,

Keven J. Wilcox, Esq., Joseph Davila, Mark Hynes, breached their fiduciary duty to

the CCPS and Leo and Christopher Stoller, committing acts of gross negligence, Mal

practice, and Ocwen Loan Servicing Arizona, WAPI is liable for criminal land civil

remedies for attempted conversation, tortuous interference with the CSPPSP's

tenant, the Arizona and Illinois Consumer fraud and Deceptive Practice Act, Civil

Fraud, Aiding and Abetting, Slander of title,

NEGLIGENT HIRING AND SUPERVISION, FRAUDULENT MISREPRESENTATION/CONCEALMENT,

VIOLATION OF A.R.S. 13-2314.04, TORTUROUS INTERFERENCE WITH PLAINTIFFS CONTRACTUAL

RIGHTS, CONVERSION, PARTICIPATION IN A RICO ENTERPRISE THROUGH A PATTERN OF

RACKETEERING ACTIVITY:18 U.S.C. 1961(5), 1962, CONSPIRACY TO ENGAGE IN A PATTERN

OF RACKETEERING ACTIVITY:

18 U.S.C. 1961(5), 1962(D)

The lender does not own, control, possess, the note or the mortgage which

has been satisfied in full. The Title Agent(s), Premium Title Agency

Inc., Premium Title Services Inc., its officers, directors including but not

limited to Steven A. Nielsen, Donald A. O'Neill, Brian F. Schneiderman, Robert D.

Stile, Keven J. Wilcox2 (General Counsel) which may be the same as the Trustee, is

liable and also has insurance for errors and omissions for Title Insurance

Companies including the named agents, that issued the Policy and/or commitment will

have total liability for this fraudulent transaction to the extent it has knowledge

through its agents WAPI and/or Altisource Portfolio SA Solutions/WAPI is obligated

under Arizona State and Federal Law to immediately resend the said Notice of

Trustee Sale for November 12, 2014.

Under the State and Federal Law the promissory note and said Adjustable Rate Note

and the mortgage is now extinguished. You rights under the Trustee Deed have been

terminated.

Formal Notice is hereby served upon the Arizona Attorney General Office to forward

this Complaint to the named respondents.

Please confirm the retraction of the said Notice of Trustee Sale.

Dated 13TH day of August 2014

Christopher Stoller

State of Illinois )

) ss

County of Cook )

CERTIFICATE OF SERVICE

Service of this document is being made to all of the parties listed below by

depositing it in an envelope addressed to the person(s) above shown, with proper

postage prepaid, via certified mail and depositing the envelope in the U.S. Mail at

Chicago, Illinois on August 13, 2014.

Christopher Stoller

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 45 of Total)

6/8

8/13/2014

Outlook.com Print Message

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 7 of 8

William C. Erbey

Chairman of Altisource Portfolio Solutions S.A. Loretta E Lynch

William Shepro, Director U.S. Attorney

F. Brian Sachnidermman Eastern

District

of New York

Mel-Ling Mitchell Richard K. Hayes

Roland Muller Ineichen Kenneth M. Abell

Timo Vatto, 271 Cadman

Plaza

East, 7th Floor

W. Michael Linn Brooklyn, NY 11201

Michelle Esterman

Keven J. Wilcox, Esq., Benjamin

M.

Lawsky,

Joseph Davila New

York Superintendent of Financial Services

One State Street

Mark Hynes New

York, NY 10004-1511

C Martin Cliff

Altisource Portfolio Solutions S.A. Ramona Elliott

Western Progressive Arizona, General Counsel

2002 Summit Blvd, suite 600 Executive Office for

U.S. Trustees

Altanta, Ga 30319 20

Massachusetts Ave., NW Suite 8000

Washington, DC 20530

Complaint Department

Arizona Department of Insurance

2910 N. 44th Street, Ste. 210 (2nd Floor) Phoenix, AZ 85018-7269

ARIZONA ATTORNEY GENERAL TOM HORNE

OFFICE OF THE ATTORNEY GENERAL

Phoenix Office

1275 West Washington Street

Phoenix, AZ 85007-2926

(602) 542-5025

Have you complained to the firm/agency/business? Yes What was their response? They

failed to respond Was an oral or written warranty given? Yes Did you sign any

documents? No Date of Transaction: 07/23/2014 Place of Transaction: Letter setting

a Notice of trustee Sale Total Amount of Damages: The Value Salesperson's Name:

Witness to Transaction:

Was the product or service advertised? : No If yes, indicate the date and how it

was advertised:

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 46 of Total)

7/8

8/13/2014

Outlook.com Print Message

USCA

#14-5265

Filed: 12/14/2014

Page 8 of 8

Do you

haveCase

an at

torney? NoDocument #1527076

If yes, please provide the attorney's name and address:

Is any legal action pending? : No

List any other consumer agencies contacted:

May we provide your name and telephone number to the media in the event of an

inquiry about this matter? : Yes May we send a copy of your complaint to another

government agency for their review or investigation? : Yes Additional Comments: My

home is being unlawfully foreclosures upon. There is no debt owed. Please forward

my complaint to the appropriate agency.

Your Age: Over the age of 60

Military/Veteran Status:

How did you hear about our complaint form (please choose only one): Called Phoenix

AG Office Declaration 2: Christopher Stoller

Date: 08/14/2014

The results of this submission may be viewed at:

https://www.azag.gov/node/1112/submission/22960

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 47 of Total)

8/8

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 3

(Page 48 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 2 of 3

(Page 49 of Total)

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 3 of 3

(Page 50 of Total)

8/16/2014

Print USCA Case #14-5265

Outlook.com Print Message

Document #1527076

Filed: 12/14/2014

Page 1 of 2

Close

Ocwen alleged Loan Number #7130908499 Philip B. Stone, 28437

N. 112th Way Scottsdale, Arizona 85262

From: << L>> (ldms40@gmail.com)

Sent: Sat 8/16/14 11:58 AM

To: hrd343@ocewn.com; william.shepro@altisource.com; William.Erbey@altisource.com;

businessdevelopment@altisource.com; chicago@sec.gov; atlanta@sec.gov; Ask Doj

(askdoj@usdoj.gov); 2020 abc (2020@abc.com); Assig cbs (assignment@cbsnews.com); editors

newsweek (editors@newsweek.com); editor weeklystandard (editor@weeklystandard.com); editor

usatoday (editor@usatoday.com); Editor Tribune (ctc-editor@tribune.com); Editor StLouisPaper

(siteeditor@stltoday.com); editor NewYork Times (executive-editor@nytimes.com);

webmaster@altisource.com

7 attachments

112th way forclosure.pdf (164.2 KB) , Affidavit Release Reconveyance.pdf (57.0 KB) ,

Consumer Complaint Form _ Arizona Attorney General.pdf (80.8 KB) , Florida Attorney General

- Contact Form.pdf (327.9 KB) , Arizona2 AG Complaint 8-13-14.odt (26.5 KB) , Letter2 to

WPAI.odt (32.6 KB) , Letter to Ocwen.odt (27.5 KB)

RE: #7130908499 Philip B. Stone, 28437 N. 112th Way Scottsdale, Arizona 85262

Mr. Chirag Patel

Confirming your telephonic conversation Thursday, August 21, 2014. You confirmed that the Notice of Trustee

dated July 23, 2014 and recorded at the Maricopa County Recorder's Office document Number

20140480249 violates the Fari Debt Collection Act by attempting to collect a debt of Philip B. Stone that was

discharged in a New Mexico Bankruptcy proceeding. Mr. Patel you stated that Ocwen is aware of the Deed

of Re-Conveyance by certified mail. That Ocwen has no lawful insterest in the property known as 28437 N.

112th Way Scottsdale, Arizona 85262 and Ocwen Loan and/or its agent Western Progressive-Arizona, Inc.,

will immediately forward Notice to: 28437 N. 112th Way Scottsdale, Arizona 85262 that the Notice of

Trustee's Sale for November 12, 2014. You stated that you would immediately email Ocwen Loan to confirm

that the Notice of Trustee Sale has been permanently canceled.

You failure to notify us that this unlawful attempt to collect a debt and the Trustee Sale for November 12, 2014

will subject you personally to liability and being named in a U.S. Federal Racketeering Lawsuit.

You have up and until Thursday August 21, 2014 to respond. Please see attached confirming

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 51 of Total)

1/2

8/16/2014

Outlook.com Print Message

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 2 of 2

documents

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 52 of Total)

2/2

12/14/2014

Print USCA Case #14-5265

Outlook.com Print Message

Document #1527076

Filed: 12/14/2014

Page 1 of 5

Close

Ocwen is violating the consent decree Case No 13-cv-02025

From: Leo Stoller (ldms4@hotmail.com)

Sent: Wed 10/01/14 11:45 AM

To: lucy.morris@cfpb.gov (lucy.morris@cfpb.gov); jeremy.shorbe@azag.gov

(jeremy.shorbe@azag.gov); sellis@atg.state.il.us (sellis@atg.state.il.us); cara.petersen@cfpb.gov

(cara.petersen@cfpb.gov); kirsten.ivey-colson@cfpb.gov (kirsten.ivey-colson@cfpb.gov);

jstump@law.ga.gov (jstump@law.ga.gov)

Cc: William.Erbey@Ocwen.com (william.erbey@ocwen.com); ronald.faris@ocwen.com

(ronald.faris@ocwen.com); ronald.korn@ocwen.com (ronald.korn@ocwen.com);

william.lacy@ocwen.com (william.lacy@ocwen.com); wilbur.ross@ocwen.com

(wilbur.ross@ocwen.com); robert.salcetti@ocwen.com (robert.salcetti@ocwen.com);

barry.wish@ocwen.com (barry.wish@ocwen.com); timothy.hayes@ocwen.com

(timothy.hayes@ocwen.com)

15 attachments

wilcox complaint.doc (79.0 KB) , Letter to Ocwen.odt (27.5 KB) , William B. Shepro2

complaint.doc (79.0 KB) , Consumer Complaint Form _ Arizona Attorney General.pdf (80.8

KB) , Affidavit Release Reconveyance.pdf (57.0 KB) , Exhibit 2 Liz Pendens Objection 8-914.odt (29.3 KB) , Objection2 to trustee Sale.odt (32.1 KB) , email to Patel 8-15-14.pdf (118.5

KB) , Letter to WPAI.odt (32.8 KB) , wilcox email 8-16-14.pdf (447.6 KB) , Order of

Discharge.pdf (17.8 KB) , 112th way forclosure (1).pdf (164.2 KB) , Philip Bankruptcy

schedules.pdf (307.7 KB) , Receipt 8-14-14 collection complaint.pdf (119.2 KB) , 8-14-14 debt

collection complaint.pdf (164.7 KB)

Lucy Morris cfbp Deputy Director

Cara M. Petersen

Kirsten A. Ivey-Colson

Matthew F. Linter, Director Consumer Protection Div.

Jeffrey W. Stump, AG Georgia Department of Law jstump@law.ga.gov

Susan N. Ellis, Chief, Consumer Fraud, AG Illinois

Re: Ocwen violation of the Consent Decree, continuing to file fraudulent Notice(s) of Trustee Sales See

attached documents.

Dear Ms. Lucy Morris

Ocwen is violating the consent decree Case No. 13-cv-02025. Ocwen has caused to be filed a fraudulent

Notice of Trustee Sale (Nov. 12,2014) on my family home located Scottsdale Arizona.

Ocwen and its third party agents Western Progressive Arizona, Inc., are attempting to foreclose on my family

home in which I do not owe any money. Ocwen through its third party agent has filed a fraudulent Notice of

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 53 of Total)

1/5

12/14/2014

Outlook.com Print Message

Case

Document

Filed: is12/14/2014

Page

2 of 5 owner,

TrusteeUSCA

Sale with

the #14-5265

Arizona Maracopa

Counter#1527076

Recorders office which

attached, against

the former

Philip Stone, of the said real estate, who's debts were discharged in bankruptcy.

Ocwen is in complete violation of the consent decree which is evidences by their latest Notice of Trustee Sale

documents which are attached. Ocwen is in contempt of court by the said filing.

I have contacted Ocwen, their third party agents, their attorneys, Robert R. Maddox, J.Riley Key, who are

aidding and abetting, Ocwen in their wrongful conduct (Thornwood, Inc. v. Jenner & Block, 799 N.E.2d 756

(Ill. App. Ct. 2003)) and Indirect Criminal Contempt of a criminal (Rule 42(b) is not to be tested by the more

stringent standards set for an indictment. See Bullock v. United States, 265 F.2d 683, 691-92 (6th

Cir.), cert. denied, 360 U.S. 909 (1959)).

I have demanded that Ocwen and its attorneys Robert R. Maddox, J.Riley Key, take the necessary

remedial action and withdraw the Notice of Trustee Sale for November 12, 2014 and Ocwen and their

attorneys have thus far refused in violation of the said consent decree. . I have filed attorney disciplinary

complaints against their lawyers in Florida. See attached.

The Alabama Bar has advised me that if Ocwen's attorneys Robert R. Maddox, J.Riley Key do not

immediately take the necessary remedial action to advise their client Ocwen to issue a

letter permanently rescinding the Notice of Trustee Sale attached hereto, the Alabama bar will

seek disciplinary action against Robert R. Maddox, J.Riley Key and the Georgia Bar will seek

disciplinary action against Timothy M. Hayes, General Counsel to Ocwen.

I have contacted Office of Mortgage Settlement Oversight, Monitor Joseph Smith, who informed me

that I should contact your Office of the Consumer Financial Protection Bureau and make them aware of

Ocwen's violation of the consent decree, evidence by the attached fraudulent Notice of trustee Sale. Mr. Smith

also directed me to the respective State Attorney Generals who have an interest in Ocwen's violating the consent

decree.

I am requesting that you direct a letter immediately to Ocwen, its officers and directors demanding that Ocwen

issue a letter to Christopher Stoller advising that the Notice of Trustee Sale set for November 12, 2014 is

permanently vacated otherwise we will be forced to file a Petition for Indirect Criminal Contempt against all of

the officers, directors and attorneys who represent Ocwen (a criminal contempt petition filed under Rule 42(b) is

not to be tested by the more stringent standards set for an indictment. See Bullock v. United States, 265 F.2d

683, 691-92 (6th Cir.), cert. denied, 360 U.S. 909 (1959).

Please respond by October 5th, 2014.

Most Cordially,

/s/ Christopher Stoller

6045 W. Grand Avenue Apt 414

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 54 of Total)

2/5

12/14/2014

USCA

#14-5265

Chicago,

IllinoisCase

60660

Outlook.com Print Message

Document #1527076

Filed: 12/14/2014

Page 3 of 5

312-834-9717

email Ldms4@hotmail.com

cc:

Timothy Hayes timothy.hayes@ocwen.com

General Counsel

Ocwen Financial Corporation

1661 Worthington Road, Suite 100

West Palm Beach, FL 33409

cc: William C. Erbey, Executive Chairman, Ocwen Board of Directors

Ronald M. Faris, Ocwen Board of Directors ronald.faris@ocwen.com

Ronald J. Korn, Ocwen Board of Directors ronald.korn@ocwen.com

William H. Lacy, Ocwen Board of Directors william.lacy@ocwen.com

Wilbur L. Ross, Jr., Ocwen Board of Directors wilbur.ross@ocwen.com

Robert A. Salcetti, Ocwen Board of Directors robert.salcetti@ocwen.com

Barry N. Wish, Ocwen Board of Directors barry.wish@ocwen.com

Mitra Hormozi, Zuckerman Spaeder LLP

James Sottile, Zuckerman Spaeder LLP

________________________________________________________________________

From: info@mortgageoversight.com

To: ldms4@hotmail.com

Subject: RE: Ocwen is violating the consent decree Case No 13-cv-02025

Date: Wed, 1 Oct 2014 13:05:31 +0000

Mr. Stoller:

Thank you for your email. The Office of Mortgage Settlement Oversight has been created to assist Monitor

Joseph Smith in his court-appointed role to oversee the participating banks compliance with the national mortgage

settlement (NMS). The Monitors role is dictated by Exhibit D of the Consent Judgments with Ocwen and,

unfortunately, we are unable to intervene on behalf of individual homeowners. However, there are some

(Page 55 of Total)

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

3/5

12/14/2014

Outlook.com Print Message

USCA

Case

Document

12/14/2014

Page

of 5

resources

available

to #14-5265

help homeowners

and your #1527076

best option would beFiled:

to continue

working with

your4 states

Attorney General. In addition, you may also contact the Consumer Financial Protection Bureau at

http://www.consumerfinance.gov or 855-411-2372.

Thank you.

Office of Mortgage Settlement Oversight

P.O. Box 2091

Raleigh, NC 27602

(919)825-4748

From: ldms4@hotmail.com

To: info@mortgageoversight.com

CC: lucy.morris@cfpb.gov; jeremy.shorbe@azag.gov; gary.tan@dc.gov

Subject: Ocwen is violating the consent decree Case No 13-cv-02025

Date: Mon, 29 Sep 2014 17:33:01 -0500

:Joseph

A. Smith Jr

Office of Mortgage Settlement Oversight

301 Fayetteville St., Suite 1801

Raleigh, NC 27601

Phone: 919-825-4748

Email: info@mortgageoversight.com

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 56 of Total)

4/5

12/14/2014

Outlook.com Print Message

USCA

Case #14-5265

Document

#1527076

Re: Ocwen

is violating

the Consent decree

in Case

No. 13-cv-0202Filed: 12/14/2014

Page 5 of 5

Mr. Smith

Ocwen caused a fraudulent Notice of Trustee Sale of my family home in Scottsdale Arizona. I have advised

Ocwen and their third party representatives to immediately withdraw the Notice of Trustee Sale scheduled for

November 12, 2014 see attached documents, notices of complaints, attorney disciplinary complaints etc.

Please direct Ocwen to vacate the said Notice of Trustee Sale which is scheduled for Nov. 12, 2014 see

attached. The said notice of Trustee Sale is a fraudulent document filed with the Maricopa County Recorders

Office in clear violations of numerous terms of the said consent decree which Ocwen signed and you are

responsible for enforcing. The accompanying documents support my claims. I need you help to enforce the

Consent Decree against Ocwen, because they have ignored all of my correspondence.

If you need any other documents, please call me 312-283-9717

Most Cordially,

Christopher Stoller

6045 w Grand Ave Apt 414

Chicago, Illinois 60639

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 57 of Total)

5/5

10/16/2014

Outlook.com Print Message

Print USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 1 of 9

Close

RE: Ocwen is violating the consent decree Case No 13-cv-02025

From: Ombudsman (Ombudsman3@ocwen.com)

Sent: Thu 10/16/14 4:27 PM

To: ldms4@hotmail.com (ldms4@hotmail.com)

3 attachments

Stone Adjustable Rate Note.pdf (449.8 KB) , Stone Deed of Trust.pdf (1437.4 KB) , Stone

Ocwen PRH.pdf (12.3 KB)

Dear Christopher Stoller:

Ocwen Loan Servicings office of the CEO and President acknowledges receipt of your e-mail

correspondence dated October 1, 2014. As the Consumer/Customer Advocate, the Office of the

Ombudsman welcomes the opportunity to respond to your inquiry.

Attached are copies of the signed original Adjustable Rate Note and Deed of Trust signed by Mr.

Philip B. Stone indicating that the loan originated on May 2, 2006, with Countrywide Bank, N.A.

Ocwen commenced servicing this loan from Bank of America (BOA) on September 8, 2012, with

the last payment satisfied on the loan being February 1, 2008 payment.

Please be advised that Quit Claim Deed only transfers the title of the property to the person named

in the deed but it does not relinquish the person who signed the Adjustable Rate Note from their

responsibilities to a lender. However, please note that you did not sign the original collateral

documents.

A review of the loan indicates that Mr. Stone filed for protection under Bankruptcy Chapter 7 on

March 30, 2010, which was eventually discharged on July 19, 2010. As the bankruptcy has been

discharged, Mr. Stone is no longer personally liable for the debt. However, this is still a valid lien

and Ocwen may foreclose its security interest in the Real Property under the terms of the original

loan documents if the required payments are not received in a timely manner.

Please note foreclosure proceedings can be initiated if the loan is delinquent by three (3) or more

payment. Consequently, foreclosure proceedings were initiated on the loan on February 21, 2014; at

that time last payment satisfied on the loan was February 1, 2008 payment.

(Page 58 of Total)

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

1/9

10/16/2014

Outlook.com Print Message

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 2 of 9

Attached for your review is the Ocwen Payment Reconciliation History (PRH), which indicates that

Ocwen has not received any payments on the loan since they commenced servicing of the loan and

the resulting loan status.

In order to permanently remove Mr. Stones name from the loan, you may opt to either refinance or

assume the loan. In order to confirm if the loan is assumable and request for an Assumption

Package, you may send in a written request along with a clear copy of the Driver's License to the

fax number at (407) 737-5802. Please note that Ocwen is not in a position to refinance the loans

directly. However, you may wish to approach other financial institutions, in order to refinance the

loan or if required you may contact Ocwens Customer Care Center at (800) 746-2936 for further

assistance regarding this matter.

As of the date of this email, the last payment satisfied on the loan is the February 1, 2008 payment.

The foreclosure is presently on hold. Please note Ocwen will continue to service the loan according

to the terms and conditions of the signed loan documents in order to protect its lien position and

interest in the property.

If you and/or Mr. Stone require any further assistance regarding the loan, you may contact Ocwens

Customer Care Center.

The Office of the Consumer Ombudsman is an advocate in ensuring that Ocwen's servicing of the

loan remains fair, reasonable and proper. If you still have unresolved issues, please feel free to

contact this Office at (800) 390-4656.

Sincerely,

Nilekha Ghate

Consumer Account Analyst

Office of the Consumer Ombudsman

Ocwen Loan Servicing, LLC

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 59 of Total)

2/9

10/16/2014

Outlook.com Print Message

USCA Case #14-5265

NMLS#1852

Document #1527076

Filed: 12/14/2014

Page 3 of 9

Please Note: This is an attempt to collect a debt and any information obtained will be used for that purpose. However, if

you have an active bankruptcy case or have received an Order of Discharge from a Bankruptcy Court, the following

Notice Regarding Bankruptcy applies.

Notice Regarding Bankruptcy: Please be advised that if you are part of an active Bankruptcy case or if you have

received an Order of Discharge from a Bankruptcy Court, this letter is in no way an attempt to collect either a prepetition, post petition or discharged debt. If your bankruptcy case is still active, no action will be taken in willful

violation of the Automatic Stay. If you have received an Order of Discharge in a Chapter 7 case, any action taken by us

is for the sole purpose of protecting our lien interest in the underlying mortgaged property and is not an attempt to

recover any amounts from you personally. Finally, if you are in an active Chapter 11, 12 or 13 bankruptcy case and an

Order for Relief from the Automatic Stay has not been issued, you should continue to make payments in accordance

with your plan.

P.O. Box 785061, Orlando, FL 32878-5061

Telephone: (800) 390-4656

Fax: (866) 771-5152

NMLS # 1852

From: Faris, Ronald

Sent: Wednesday, October 01, 2014 1:23 PM

Subject: Fwd: Ocwen is violating the consent decree Case No 13-cv-02025

Sent from my iPad

Begin forwarded message:

From: "Leo Stoller" <ldms4@hotmail.com>

To: "lucy.morris@cfpb.gov" <lucy.morris@cfpb.gov>, "jeremy.shorbe@azag.gov"

<jeremy.shorbe@azag.gov>, "sellis@atg.state.il.us" <sellis@atg.state.il.us>,

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 60 of Total)

3/9

10/16/2014

Outlook.com Print Message

USCA"cara.petersen@cfpb.gov"

Case #14-5265

Document

#1527076

Filed:

12/14/2014

<cara.petersen@cfpb.gov>,

"kirsten.ivey-

Page 4 of 9

colson@cfpb.gov" <kirsten.ivey-colson@cfpb.gov>, "jstump@law.ga.gov"

<jstump@law.ga.gov>

Cc: "Erbey, William" <William.Erbey@ocwen.com>, "Faris, Ronald"

<Ronald.Faris@ocwen.com>, "ronald.korn@ocwen.com"

<ronald.korn@ocwen.com>, "william.lacy@ocwen.com"

<william.lacy@ocwen.com>, "wilbur.ross@ocwen.com"

<wilbur.ross@ocwen.com>, "robert.salcetti@ocwen.com"

<robert.salcetti@ocwen.com>, "barry.wish@ocwen.com"

<barry.wish@ocwen.com>, "Hayes, Timothy M" <Timothy.Hayes@ocwen.com>

Subject: Ocwen is violating the consent decree Case No 13-cv-02025

Lucy Morris cfbp Deputy Director

Cara M. Petersen

Kirsten A. Ivey-Colson

Matthew F. Linter, Director Consumer Protection Div.

Jeffrey W. Stump, AG Georgia Department of Law jstump@law.ga.gov

Susan N. Ellis, Chief, Consumer Fraud, AG Illinois

Re: Ocwen violation of the Consent Decree, continuing to file fraudulent Notice(s) of

Trustee Sales See attached documents.

Dear Ms. Lucy Morris

Ocwen is violating the consent decree Case No. 13-cv-02025. Ocwen has caused

to be filed a fraudulent Notice of Trustee Sale (Nov. 12,2014) on my family home

located Scottsdale Arizona.

Ocwen and its third party agents Western Progressive Arizona, Inc., are attempting

to foreclose on my family home in which I do not owe any money. Ocwen through

its third party agent has filed a fraudulent Notice of Trustee Sale with the Arizona

Maracopa Counter Recorders office which is attached, against the former owner,

Philip Stone, of the said real estate, who's debts were discharged in bankruptcy.

Ocwen is in complete violation of the consent decree which is evidences by their

latest Notice of Trustee Sale documents which are attached. Ocwen is in contempt

of court by the said filing.

I have contacted Ocwen, their third party agents, their attorneys, Robert R.

Maddox, J.Riley Key, who are aidding and abetting, Ocwen in their wrongful

conduct (Thornwood, Inc. v. Jenner & Block, 799 N.E.2d 756 (Ill. App. Ct.

2003)) and Indirect Criminal Contempt of a criminal (Rule 42(b) is not to be tested

by the more stringent standards set for an indictment. See Bullock v. United States,

265 F.2d 683, 691-92 (6th Cir.), cert. denied, 360 U.S. 909 (1959)).

I have demanded that Ocwen and its attorneys Robert R. Maddox, J.Riley Key,

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 61 of Total)

4/9

10/16/2014

Outlook.com Print Message

USCA take

Casethe#14-5265

Document

Filed: 12/14/2014

Page 5 of 9

necessary remedial

action#1527076

and withdraw the Notice

of Trustee Sale for

November 12, 2014 and Ocwen and their attorneys have thus far refused in

violation of the said consent decree. . I have filed attorney disciplinary complaints

against their lawyers in Florida. See attached.

The Alabama Bar has advised me that if Ocwen's attorneys Robert R. Maddox,

J.Riley Key do not immediately take the necessary remedial action to advise their

client Ocwen to issue a letter permanently rescinding the Notice of Trustee Sale

attached hereto, the Alabama bar will seek disciplinary action against Robert R.

Maddox, J.Riley Key and the Georgia Bar will seek disciplinary action against

Timothy M. Hayes, General Counsel to Ocwen.

I have contacted Office of Mortgage Settlement Oversight, Monitor Joseph Smith,

who informed me that I should contact your Office of the Consumer Financial

Protection Bureau and make them aware of Ocwen's violation of the consent

decree, evidence by the attached fraudulent Notice of trustee Sale. Mr. Smith also

directed me to the respective State Attorney Generals who have an interest in

Ocwen's violating the consent decree.

I am requesting that you direct a letter immediately to Ocwen, its officers and

directors demanding that Ocwen issue a letter to Christopher Stoller advising that the

Notice of Trustee Sale set for November 12, 2014 is permanently vacated

otherwise we will be forced to file a Petition for Indirect Criminal Contempt against

all of the officers, directors and attorneys who represent Ocwen (a criminal contempt

petition filed under Rule 42(b) is not to be tested by the more stringent standards set

for an indictment. See Bullock v. United States, 265 F.2d 683, 691-92 (6th Cir.),

cert. denied, 360 U.S. 909 (1959).

Please respond by October 5th, 2014.

Most Cordially,

/s/ Christopher Stoller

6045 W. Grand Avenue Apt 414

Chicago, Illinois 60660

312-834-9717

email Ldms4@hotmail.com

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 62 of Total)

5/9

10/16/2014

Outlook.com Print Message

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 6 of 9

cc:

Timothy Hayes timothy.hayes@ocwen.com

General Counsel

Ocwen Financial Corporation

1661 Worthington Road, Suite 100

West Palm Beach, FL 33409

cc: William C. Erbey, Executive Chairman, Ocwen Board of Directors

Ronald M. Faris, Ocwen Board of Directors ronald.faris@ocwen.com

Ronald J. Korn, Ocwen Board of Directors ronald.korn

@ocwen.com

William H. Lacy, Ocwen Board of Directors william.lacy

@ocwen.com

Wilbur L. Ross, Jr., Ocwen Board of Directors wilbur.ross@ocwen.com

Robert A. Salcetti, Ocwen Board of Directors robert.salcetti@ocwen.com

Barry N. Wish, Ocwen Board of Directors barry.wish@ocwen.com

Mitra Hormozi, Zuckerman Spaeder LLP

James Sottile, Zuckerman Spaeder LLP

________________________________________________________________________

From: info@mortgageoversight.com

To: ldms4@hotmail.com

Subject: RE: Ocwen is violating the consent decree Case No 13-cv-02025

Date: Wed, 1 Oct 2014 13:05:31 +0000

Mr. Stoller:

Thank you for your email. The Office of Mortgage Settlement Oversight has been

created to assist Monitor Joseph Smith in his court-appointed role to oversee the

participating banks compliance with the national mortgage settlement (NMS). The

Monitors role is dictated by Exhibit D of the Consent Judgments with Ocwen and,

unfortunately, we are unable to intervene on behalf of individual homeowners.

However, there are some resources available to help homeowners and your best

option would be to continue working with your states Attorney General. In addition,

you may also contact the Consumer Financial Protection Bureau at

http://www.consumerfinance.gov or 855-411-2372.

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 63 of Total)

6/9

10/16/2014

Outlook.com Print Message

USCA Case #14-5265

Document #1527076

Filed: 12/14/2014

Page 7 of 9

Thank you.

________________________________

Office of Mortgage Settlement Oversight

P.O. Box 2091

Raleigh, NC 27602

(919)825-4748

________________________________

From: ldms4@hotmail.com

To: info@mortgageoversight.com

CC: lucy.morris@cfpb.gov; jeremy.shorbe@azag.gov; gary.tan@dc.gov

Subject: Ocwen is violating the consent decree Case No 13-cv-02025

Date: Mon, 29 Sep 2014 17:33:01 -0500

:Joseph A. Smith Jr<http://nationalmortgageprofessional.com/joseph-smith-jr>

Office of Mortgage Settlement Oversight

301 Fayetteville St., Suite 1801

Raleigh, NC 27601

Phone: 919-825-4748

Email: info@mortgageoversight.com<mailto:info@mortgageoversight.com>

Re: Ocwen is violating the Consent decree in Case No. 13-cv-0202

https://blu173.mail.live.com/ol/mail.mvc/PrintMessages?mkt=en-us

(Page 64 of Total)

7/9

10/16/2014

Outlook.com Print Message

USCAMr.

Case

#14-5265

Smith

Document #1527076

Filed: 12/14/2014

Page 8 of 9