Professional Documents

Culture Documents

Sap Taxation 2 - Even 2014-2015 - Rev1

Uploaded by

Septian Bayu KristantoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sap Taxation 2 - Even 2014-2015 - Rev1

Uploaded by

Septian Bayu KristantoCopyright:

Available Formats

OUTLINE COURSE STUDY

Subject Code

: ACC 93227/ ACC 13227

Subject

: TAXATION 2 + LAB

Number of credits

: 3 credits

Program Study

: Accounting

Academic Year

: Even Semester Year of 2014/2015

UNIVERSITAS PELITA HARAPAN

Description

This subject is aimed to discuss various legitimate taxation rules and its effect for the financial statement of a company and the company itself. The

discussion does not only emphasize on the control of taxation regulations but also on the rule of its application in the company.

The students are expected to have a deeper understanding of the general provisions, rules of taxation in Indonesia such as tax subject, object Tax,

Tax Tariff, Calculating taxes, cuts, deposit fees and tax reporting. The discussion in this course includes understanding of taxation, General

Provisions and Tax Procedures, Corporate Income Tax (PPh), Value Added Tax (PPN), Sales Tax on Luxury Goods (PPnBM), Land and Building

Tax (PBB) and The Customs and Duty (Bea Materai) .

This subject also provides the students an understanding of the role of taxes as a source of state revenue and its function to support national

development so that they can look at taxes in Indonesia are more extensive and detailed.

Course Objectives

Afters tudying this course students are expected to be:

o Capable to describe a range of functions both the Indonesian tax on corporate income tax, VAT and Sales Tax and tax courts.

o Capable to describe the rights, obligations, and legal sanctions related to taxation more wisely with the more extensive and detailed perspective

o Capable to criticize the issues developed in the field of taxation widely and detailed.

o Understand the importance of ethics in taxation, especially in Income Tax.

o Understand the tax return for Personal Income Tax

o Will be able to analyze government policies and regulations related to the formal and material tax laws and regulations, and applying the tax law

system in Indonesia.

1 Taxation 2 Universitas Pelita Harapan

CourseMethods

Media

(a). Face-to-face presentation

(b). Problem solving

(c). Discussion

(d). Descriptive analysis

Session

CourseAssessment

(a) White board

(b) Internet resources

(c) LCD Projector

Learning Objective

Topic

(a) Mid Test

: 30%

(b) Final Test : 30%

(c) Group Ass: 15%

(d) Quizzes: 10 %

(e) Private Assg: 15%

Subject

References

Income Tax Law No.

36/2008 and The

Government Regulation

www.pajak.go.id

Income Tax Law No.

36/2008 and The

Government Regulation

www.pajak.go.id

Income Tax Law No.

36/2008 dan The

Government Regulation No.

46/2013 for Small Medium

Enterprise (SME)

www.pajak.go.id

Income Tax Law No.

36/2008 dan The

Government Regulation No.

46/2013 for Small Medium

Enterprise (SME)

www.pajak.go.id

Income Tax Law No.

36/2008 dan The

Government Regulation No.

46/2013 for Small Medium

Enterprise (SME)

www.pajak.go.id

Students will be able to explain the

definition and function of Personal

Income Tax in Indonesia.

Personal Income Tax

Reconciliation of fiscal (Fixed

and Temporary)

Students will be able to explain the

definition and function of Personal

Income Tax in Indonesia.

Personal Income Tax

Students will be able to explain the

definition and function of Corporate

Income Tax in Indonesia.

Corporate Income Tax

- The Cost of which can not

be deducted.

- Method Depreciation and

inventory are allowed.

- The compensation loss

- Discussion of the tax credit

(installment pph art 25 and

other tax credits, including

the final tax)

Students will be able to explain the

definition and function of Corporate

Income Tax in Indonesia.

Corporate Income Tax

- The compensation loss

- Discussion of the tax credit

(installment pph art 25 and

other tax credits, including

the final tax)

Students will be able to explain the

definition and function of Corporate

Income Tax in Indonesia.

Corporate Income Tax

- The compensation loss

- Discussion of the tax credit

(installment pph art 25

and other tax credits,

including the final tax)

2 Taxation 2 Universitas Pelita Harapan

Student will able to understand the

installment calculation in the current year

and tax calculation the end of the year

Corporate Income Tax

and filling Returns

Income Tax Corporate

Income Tax Law No.

36/2008 dan The

Government Regulation No.

46/2013 for Small Medium

Enterprise (SME)

www.pajak.go.id

MID TEST

7

Session

- The compensation loss

- Discussion of the tax credit

(installment PPh article 25

and other tax credits,

including the final tax)

- Filling SPT Corporate

Income Tax both manual

and online.

Learning Objective

Topic

Students will able to understand and

calculate VAT and Sales Tax on Luxury

Goods in Indonesia.

VAT and Sales Tax on

Luxury Goods

Students will able to understand, explain

and calculate VAT and Sales Tax on

Luxury Goods in Indonesia.

VAT and Sales Tax on

Luxury Goods

10

Students will able to understand, explain

and calculate VAT and Sales Tax on

Luxury Goods in Indonesia and filling

Value Added Tax and Sales Tax return

period..

VAT and Sales Tax on

Luxury Goods.

Fill in Value Added Tax

and Sales Tax return

period.

11

Students will able to understand, explain

and calculate the Stamp Duty and

BPHTB

Stamp Duty and Land

and BPHTB

3 Taxation 2 Universitas Pelita Harapan

Subject

- The Characteristics of VAT.

- Objects VAT & Subject VAT

- DPP and mechanism of VAT

collection.

- Tax invoice

- Points of VAT payable below case

study in Indonesia.

- VAT in and VAT out

- Restitution and compensation

mechanisms

- VAT and Sales Tax on Luxury

Goods Facilities

- Submission of BKP and or a

specific JKP.

- Fill in Value Added Tax and

Sales Tax return period

manually

- Fill in Value Added Tax and

Sales Tax return period

Automatically

- Stamp duty

- BPHTB

References

Waluyo Ch.1-5

www.pajak.go.id

Waluyo Ch.6-12

www.pajak.go.id

Waluyo Ch.13-16

www.pajak.go.id

Waluyo Ch.17&19

www.pajak.go.id

12

Students will able to understand, explain

and calculate the Stamp Duty and Land

and Building Tax (PBB)

13

Students are able to understand and

explain the procedures and the

procedures of tax audit and tax Court

Land and Building Tax

(PBB),

Sector P3, the plantation,

the Forestry and the

Mining.

Tax Audit and the Tax

Court

- Land and Building Tax (PBB)

Waluyo Ch.18

www.pajak.go.id

- Procedures of Tax Audit

- The Tax Court

Waluyo Ch. 21

www.pajak.go.id

FINAL TEST

14

Main Reference:

1.

2.

3.

4.

5.

6.

Waluyo, 2011. Perpajakan Indonesia, Buku 2 Edisi 10, Penerbit Salemba Empat.

General Provisions and Procedures of Taxation, Indonesia Republic Law No.16; 2009.

Income Tax, Indonesia Republic Law, No.36 year 2008.

Indonesia Government Tax Regulations

Minister of Finance of The Republic of Indonesia, Regulation of the Finance Minister of the Republic of Indonesia.

Indonesia Directorate General of Tax Regulations, Circular Letter of the Directorate General of Tax.

Other reference:

1. Rudi Wirawan B, Ilyas, 2010. Ketentuan Umumdan Tata Cara Perpajakan, Penerbit Salemba Empat.

2. Primandita Fitriandi, Yuda A, Agus Puji Priyono, 2010. Kompilasi Undang - Undang Perpajakan, Penerbit Salemba Empat.

3. Other literatures

Prepared by,

Witnessed by,

Approved by,

Yohanes Mardinata R, SE., Ak., M.Ak., CA.

Subject Coordinator

Student Name:

NIM:

Dr. Anthonius Herusetya, Ak., MM., CA.

Accounting Department Head

4 Taxation 2 Universitas Pelita Harapan

You might also like

- AK0PP011 - Recent Activity - Pertemuan6 PDFDocument5 pagesAK0PP011 - Recent Activity - Pertemuan6 PDFSeptian Bayu KristantoNo ratings yet

- SAP Akuntansi Perpajakan Genap 2019 - 2020Document13 pagesSAP Akuntansi Perpajakan Genap 2019 - 2020Septian Bayu KristantoNo ratings yet

- UU PPH Nomor 36 Tahun 2008 - English Version PDFDocument76 pagesUU PPH Nomor 36 Tahun 2008 - English Version PDFAgnesTheresiaSianturiNo ratings yet

- Introduction and OverviewDocument10 pagesIntroduction and OverviewSeptian Bayu KristantoNo ratings yet

- SAP Akuntansi Perpajakan Genap 2019 - 2020Document13 pagesSAP Akuntansi Perpajakan Genap 2019 - 2020Septian Bayu KristantoNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Introduction and OverviewDocument10 pagesIntroduction and OverviewSeptian Bayu KristantoNo ratings yet

- Chapter 12Document17 pagesChapter 12Septian Bayu KristantoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 5.4 Arrests Press ReleasesDocument4 pages5.4 Arrests Press Releasesnpdfacebook7299No ratings yet

- Faculty of Law 2017/2018Document21 pagesFaculty of Law 2017/2018Juin KerkNo ratings yet

- Unit Nature of ContractDocument102 pagesUnit Nature of ContractdanielNo ratings yet

- PwC Webinar on the Extractive Sector Transparency Measures Act (ESTMADocument40 pagesPwC Webinar on the Extractive Sector Transparency Measures Act (ESTMAShravan EtikalaNo ratings yet

- UGC GrievanceRedressalRegulationsDocument9 pagesUGC GrievanceRedressalRegulationsmurkyNo ratings yet

- Lgu-Zaragoza OpmaDocument11 pagesLgu-Zaragoza OpmaArrah BautistaNo ratings yet

- Application For Subsequent Release of Educational Assistance LoanDocument2 pagesApplication For Subsequent Release of Educational Assistance LoanNikkiQuiranteNo ratings yet

- Rarest RareDocument4 pagesRarest RareAdv. Govind S. TehareNo ratings yet

- Introduction to Statutory Valuation in MalaysiaDocument11 pagesIntroduction to Statutory Valuation in MalaysiaQayyumNo ratings yet

- 01 Social Rights in The CharterDocument43 pages01 Social Rights in The CharterLich_king2No ratings yet

- Retirement AgreementDocument12 pagesRetirement AgreementckoenisNo ratings yet

- Digest PP vs. UBIÑADocument1 pageDigest PP vs. UBIÑAStef OcsalevNo ratings yet

- Lahore High Court, Lahore: Judgment SheetDocument12 pagesLahore High Court, Lahore: Judgment SheetM Xubair Yousaf XaiNo ratings yet

- Resolution On Standing Committee ChairmanshipDocument3 pagesResolution On Standing Committee ChairmanshipNikki BautistaNo ratings yet

- Sample Motion To Vacate Default Judgment For Extrinsic Fraud or Mistake in CaliforniaDocument4 pagesSample Motion To Vacate Default Judgment For Extrinsic Fraud or Mistake in CaliforniaStan Burman70% (10)

- ENP LawDocument15 pagesENP LawArnoldAlarcon100% (1)

- Personnel Action FormDocument1 pagePersonnel Action Formsheila yutucNo ratings yet

- Chapter 3 Case DigestDocument7 pagesChapter 3 Case DigestAudreyNo ratings yet

- NCSBE 2023 Order Implementation Funding Letter - 2023-05-12Document3 pagesNCSBE 2023 Order Implementation Funding Letter - 2023-05-12Daniel WaltonNo ratings yet

- RR 3-02Document6 pagesRR 3-02matinikkiNo ratings yet

- G R - No - 157547Document1 pageG R - No - 157547Noel Christopher G. BellezaNo ratings yet

- IpmsDocument2 pagesIpmsmutu_bunutNo ratings yet

- Consitutional and Statutory Basis of TaxationDocument50 pagesConsitutional and Statutory Basis of TaxationSakshi AnandNo ratings yet

- Sample Comfort Letter - CPA Response To Financial InquiryDocument2 pagesSample Comfort Letter - CPA Response To Financial InquiryJake BourqueNo ratings yet

- Matibag Vs BenipayoDocument7 pagesMatibag Vs BenipayoMichael DonascoNo ratings yet

- The Case Geluz vs. Court of AppealsDocument5 pagesThe Case Geluz vs. Court of AppealsJhaquelynn DacomosNo ratings yet

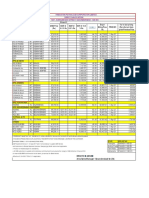

- HPCL PRICE LIST FOR VISAKH, MUMBAI, CHENNAI, VIJAYAWADA AND SECUNDERABAD DEPOTSDocument1 pageHPCL PRICE LIST FOR VISAKH, MUMBAI, CHENNAI, VIJAYAWADA AND SECUNDERABAD DEPOTSaee lweNo ratings yet

- 216sp-Engl-1302-10 47464075 Hgamez Rhetorical Analysis Final DraftDocument4 pages216sp-Engl-1302-10 47464075 Hgamez Rhetorical Analysis Final Draftapi-317700316No ratings yet

- Pangilinan v. CayetanoDocument16 pagesPangilinan v. CayetanoSharen Ilyich EstocapioNo ratings yet

- General (Plenary) Legislative PowerDocument162 pagesGeneral (Plenary) Legislative PowerBrenda de la GenteNo ratings yet