Professional Documents

Culture Documents

Monetary Economics Assignment 1

Uploaded by

Mohammad Jibran ChangiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monetary Economics Assignment 1

Uploaded by

Mohammad Jibran ChangiCopyright:

Available Formats

Monetary Economics

Assignment 1

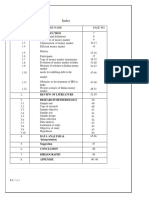

MONETARY ECONOMICS ASSIGNMENT 1

Submitted as a group: Talha Nadeem, M. Ali Raza, Sana Ahmed, M. Jibran Changi

-----------------------------------------------------------------------------------------------------------------------------------------1)

Definitions:

M1: Also known as Narrow Money, it is an indicator used to measure money supply in the economy and

includes currency in circulation, highly liquid financial assets (like checkable deposits, travelers checks

etc.) other deposits with State Bank of Pakistan and demand deposits (including resident foreign

currency deposits) with scheduled banks.

M2: Also known as Broad Money, it is an indicator used to measure money supply in the economy and

includes currency in circulation, other deposits with State Bank of Pakistan (such as unclaimed deposits

and NBFIs deposits with SBP), demand and time deposits (including resident foreign currency deposits)

with scheduled banks. M2 is the key economic indicator used to forecast inflation.

M3: A measure of money supply that includes M2 as well as large time deposits, institutional money

market funds, short-term repurchase agreements and other larger liquid assets. The definition of their

M3 is changing from year to year, as initially they were using Deposits of NBFIs, then moved to deposits

of Federal Banks for Co-operatives (FBC) (during FY03), and now to deposits of Punjab Public

Cooperative Banks (PPCB). This definition suffers from a serious problem of double counting as M2

definition of monetary aggregate includes the deposits of all scheduled banks (including FCB in past and

PPCB at present).

Values:

2014

2013

2012

2011

2010

M1 (Million PKR)

7,684,158

6,672,408

5,526,428

4,852,502

4,131,206

M2 (Million PKR)

9,778,624

8,668,480

7,433,179

6,555,481

5,615,061

M3 (Million PKR)

12,428,816

11,077,597

9,460,909

8,394,741

7,218,663

Monetary Economics

Assignment 1

2)

Commercial banks

1

Allied Bank Limited

Bank Al Habib

Bank Alfalah

Barclays Bank Pakistan

Faysal Bank

Habib Bank Limited

JS Bank

SILKBANK Limited

MCB Bank Limited

10

SCB Pakistan

Money market

mutual funds

UBL Money Market

Fund

Atlas Money Market

Fund

NAFA Money Market

Fund

Faysal Money Market

Fund

Lakson Money Market

Fund

HBL Money Market

Fund

HBL Islamic Money

Market Fund

PIML Islamic Money

Market Fund

Primus Daily Reserve

Fund

Savings & loan

associations

Asian Housing Finance

Limited

Grays Leasing Limited

IGI Money Market

Fund

House Building

Finance Company

NBP Leasing Limited

Orix Leasing Pakistan

Limited

Pak Gulf Leasing

Company Ltd.

Saudi Pak Leasing

Company Ltd.

Security Leasing

Corporation Ltd.

Sigma Leasing Limited

Standard Chartered

Leasing Ltd.

Savings and credit

associations

Escort Investment

Bank Ltd.

First Credit

Investment Bank Ltd.

First Dawood

Investment Bank Ltd.

IGI Investment Bank

Limited

Invest Capital

Investment Bank Ltd.

Security Investment

Bank Ltd.

Trust Investment

Bank Limited

PICIC Ltd.

Saudi-Pak Industrial

& Agricultural

Investment Co.

National Investment

Trust Limited

3)

2014

2013

2012

2011

2010

M1 multiplier

14.52031

14.08737

13.98047

13.91986

14.30355

M2 multiplier

18.4781

18.30166

18.80407

18.80501

19.44112

M3 multiplier

23.48602

23.388

23.93371

24.0811

24.9933

Formula used:

Multipliern = Mn/M0

Required reserve ratio

5%

5%

5%

5%

5%

Monetary Economics

Assignment 1

5)

Velocity of circulation:

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Velocity: M1

9.984553

9.459729

8.743972

8.70156

8.133868

7.206826

7.085836

7.629419

7.164987

5.539319

4.914653

4.918519

4.473009

3.810709

3.348702

4.750407

4.42413

2.448931

2.602395

2.430508

2.208501

1.962221

1.78474

1.538819

1.394174

Velocity: M2

7.026676

6.260326

5.238887

4.791083

4.148672

3.697547

3.381896

3.212996

2.852946

2.781642

2.59318

2.454135

2.226735

2.027985

1.847226

2.6011

2.383424

2.103031

1.891198

1.770941

1.624875

1.452477

1.32692

1.184478

1.095558

Velocity of Mn= GDP (constant prices)/Mn

For M3, data was not available for the years 2007 or before.

Graphs on the next page.

Velocity: M3

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

1.52036

1.38641

1.263914

1.134244

1.042525

0.926882

0.861953

Monetary Economics

Assignment 1

Monetary Economics

Assignment 1

References:

Analytical Accounts of State Bank

http://www.sbp.org.pk/ecodata/index2.asp

Glossary of terms, State Bank

http://www.sbp.org.pk/reports/stat_reviews/Bulletin/2012/Sep/Glossary.pdf

Mutual Funds Association of Pakistan

www.mufap.com.pk

Securities and Exchange Commission of Pakistan

www.secp.gov.pk

World Bank Data

http://databank.worldbank.org/

Pakistan Economy Handbook, State Bank of Pakistan

http://www.sbp.org.pk/departments/stats/PakEconomy_HandBook/

Stability of Money Demand Function in Pakistan, Muhammad Omer SBP Working Paper

Series, No. 36, August 2010

http://www.sbp.org.pk/publications/wpapers/2010/wp36.pdf

(All websites accessed on 12th Sept 2014 and 13th Sept 2014)

You might also like

- Swagat 2010 2011 Training BookletDocument108 pagesSwagat 2010 2011 Training Bookletbitus92No ratings yet

- State Bank of Pakistan & Its FunctionsDocument85 pagesState Bank of Pakistan & Its FunctionsAyeshaRasheedNo ratings yet

- Money Market WordDocument18 pagesMoney Market Wordshrikant_b1No ratings yet

- Chapter 8 Unit 2 - UnlockedDocument23 pagesChapter 8 Unit 2 - UnlockedSanay ShahNo ratings yet

- 10a - Raj Kamlesh MehtaDocument15 pages10a - Raj Kamlesh MehtaRaj MehtaNo ratings yet

- Final Hard Copy of Money and BankingDocument17 pagesFinal Hard Copy of Money and BankingMohammad Zahirul IslamNo ratings yet

- Liquidity Management Through Sukuk Report 2016Document24 pagesLiquidity Management Through Sukuk Report 2016Miaser El MagnoonNo ratings yet

- 2) Overview of BankingDocument48 pages2) Overview of BankingAltamashNo ratings yet

- The Structure of Financial System of BangladeshDocument9 pagesThe Structure of Financial System of BangladeshHn SamiNo ratings yet

- 07 Chapter 1Document72 pages07 Chapter 1Motiram paudelNo ratings yet

- 02 Stock and Bond Markets in MyanmarDocument33 pages02 Stock and Bond Markets in MyanmarKyaw Moe ThuNo ratings yet

- Project 1 KishanDocument24 pagesProject 1 KishanVivekNo ratings yet

- Islamic Finance in Malaysia - Evolution & Current Development - MIFCDocument12 pagesIslamic Finance in Malaysia - Evolution & Current Development - MIFCmohammedzaidiNo ratings yet

- Chap 2 - BNMDocument17 pagesChap 2 - BNMMasha Naizli MenhatNo ratings yet

- Financial System of BangladeshDocument24 pagesFinancial System of Bangladeshmoin06100% (2)

- FINANCIALMARKETSINNIGERIADocument16 pagesFINANCIALMARKETSINNIGERIAJennifer LaurettaNo ratings yet

- Nishant Black BookDocument93 pagesNishant Black BookFayazNo ratings yet

- Insurance & BankingDocument33 pagesInsurance & BankingbobbyhandsomeNo ratings yet

- THE Structure of Malaysian Financial SystemDocument21 pagesTHE Structure of Malaysian Financial SystemHazlina HusseinNo ratings yet

- Financial Management 1 (Bbpw3103) : May Semester 2021Document17 pagesFinancial Management 1 (Bbpw3103) : May Semester 2021Freshlynero JonalNo ratings yet

- Introduction To Financial SystemsDocument402 pagesIntroduction To Financial SystemsAdeel SajjadNo ratings yet

- Welcome To Our Presentation Monetary System in BangladeshDocument22 pagesWelcome To Our Presentation Monetary System in BangladeshHasan RishaNo ratings yet

- Funds % of Par Value of Rs. 50/-Dividend (RS.)Document11 pagesFunds % of Par Value of Rs. 50/-Dividend (RS.)Salman ArshadNo ratings yet

- Prime Commercial Bank LimitedDocument48 pagesPrime Commercial Bank LimitedakhlaqNo ratings yet

- Emfs Project: ROLL NO.-50Document25 pagesEmfs Project: ROLL NO.-50Ishaan TalwarNo ratings yet

- Capital Market-49pagesDocument54 pagesCapital Market-49pagesSiddhartha MehtaNo ratings yet

- RFM Lecture 1-Introduction To Fin Mkts-CompleteDocument55 pagesRFM Lecture 1-Introduction To Fin Mkts-CompleteUmme HaniNo ratings yet

- Money - MultiplierDocument10 pagesMoney - MultiplierSparsh JainNo ratings yet

- Chapter 1structre of Malaysian FinancialDocument19 pagesChapter 1structre of Malaysian FinancialdipanajnNo ratings yet

- IBE Module 6Document84 pagesIBE Module 6Siddanagouda BiradarNo ratings yet

- CH 4 Money Market (Bharti Pathak)Document24 pagesCH 4 Money Market (Bharti Pathak)Mehak Ayoub0% (1)

- Syllabus: The Economic Markets (4 Sessions)Document30 pagesSyllabus: The Economic Markets (4 Sessions)Deepak R GoradNo ratings yet

- Indian Money MarketDocument11 pagesIndian Money MarketPradeepKumarNo ratings yet

- Unit - Vii: Money and Banking: Material Downloaded From SUPERCOP 1/6Document6 pagesUnit - Vii: Money and Banking: Material Downloaded From SUPERCOP 1/6Aasif NengrooNo ratings yet

- Semester 6 (UG) Subject: Business Environment: Unit Iv Money MarketDocument7 pagesSemester 6 (UG) Subject: Business Environment: Unit Iv Money MarketManohar SumathiNo ratings yet

- CIA 1a (Final)Document15 pagesCIA 1a (Final)MAHIR RUPELANo ratings yet

- Islamic Finance: Opportunities, Challenges, and Policy OptionsDocument10 pagesIslamic Finance: Opportunities, Challenges, and Policy OptionsInternational Monetary FundNo ratings yet

- Chapter - III Financial System and Non-Banking Financial Companies - The Structure and Status ProfileDocument55 pagesChapter - III Financial System and Non-Banking Financial Companies - The Structure and Status Profilechirag10pnNo ratings yet

- Project On UCO Bank FinalDocument69 pagesProject On UCO Bank FinalMilind Singh100% (1)

- Foreign Exchange Reserves Trends and Data Analysis EBEN MESM 10 12Document26 pagesForeign Exchange Reserves Trends and Data Analysis EBEN MESM 10 12merchantraza14No ratings yet

- 2453 CapitalDocument19 pages2453 CapitalNaveen KsNo ratings yet

- Islamic Finance HubDocument72 pagesIslamic Finance Hubhafiz1979No ratings yet

- Money Supply: Basic ConceptsDocument27 pagesMoney Supply: Basic ConceptsSandeep SinghNo ratings yet

- BFM Special Notes PDFDocument197 pagesBFM Special Notes PDFyogambica0% (1)

- Money Supply - Kinds of Money and Monetary AggregatesDocument11 pagesMoney Supply - Kinds of Money and Monetary AggregatesprateekNo ratings yet

- 2013 Annual Report PDFDocument348 pages2013 Annual Report PDFMadalina CojocariuNo ratings yet

- Subject EconomicsDocument12 pagesSubject Economicsamitava deyNo ratings yet

- Advance Financial MarketsDocument5 pagesAdvance Financial Marketsomershahid405No ratings yet

- Capital MarketDocument19 pagesCapital MarketMiskatul ArafatNo ratings yet

- Chapter 1 - Islamic Banking PrinciplesDocument89 pagesChapter 1 - Islamic Banking PrinciplesFarah Dina FazialNo ratings yet

- Principles & Practices of BankingDocument33 pagesPrinciples & Practices of BankingKunal AggarwalNo ratings yet

- Final IFM PresentationDocument29 pagesFinal IFM PresentationSatheash SekarNo ratings yet

- UNIT 2 Fms NCDocument17 pagesUNIT 2 Fms NCHemalathaNo ratings yet

- Asia Credit Compendium 2014 04 12 13 05 19Document500 pagesAsia Credit Compendium 2014 04 12 13 05 19BerezaNo ratings yet

- International Liquidity & International ReservesDocument17 pagesInternational Liquidity & International ReservesPrabu ManoharanNo ratings yet

- Indian Money MarketDocument73 pagesIndian Money MarketPriya ShahNo ratings yet

- Money and BankingDocument7 pagesMoney and BankingBishal GuptaNo ratings yet

- ASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicFrom EverandASEAN+3 Bond Market Guide 2017 Lao People's Democratic RepublicNo ratings yet

- Next Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumFrom EverandNext Steps for ASEAN+3 Central Securities Depository and Real-Time Gross Settlement Linkages: A Progress Report of the Cross-Border Settlement Infrastructure ForumNo ratings yet

- Dawn-ePaper - Jan 21, 2021Document1 pageDawn-ePaper - Jan 21, 2021Mohammad Jibran ChangiNo ratings yet

- Forecast Comparison of Competing Macro-Econometric Models of Pakistan EconomyDocument43 pagesForecast Comparison of Competing Macro-Econometric Models of Pakistan EconomyMohammad Jibran ChangiNo ratings yet

- Islamic Studies: Curriculum of BSDocument143 pagesIslamic Studies: Curriculum of BSMohammad Jibran ChangiNo ratings yet

- Curriculum of StatisticsDocument109 pagesCurriculum of StatisticsMohammad Jibran ChangiNo ratings yet

- History Bs & MS: Curriculum OFDocument83 pagesHistory Bs & MS: Curriculum OFMohammad Jibran ChangiNo ratings yet

- International Relations PHDDocument20 pagesInternational Relations PHDMohammad Jibran ChangiNo ratings yet

- Economics MSDocument73 pagesEconomics MSMohammad Jibran ChangiNo ratings yet

- Labour Economics: Group 1 Muhammad Ali Raza Mohammad Jibran ChangiDocument11 pagesLabour Economics: Group 1 Muhammad Ali Raza Mohammad Jibran ChangiMohammad Jibran ChangiNo ratings yet

- Good Debt ManagementDocument29 pagesGood Debt ManagementMohammad Jibran ChangiNo ratings yet

- Muhammad Jahanzeb Changi Cover LetterDocument1 pageMuhammad Jahanzeb Changi Cover LetterMohammad Jibran ChangiNo ratings yet

- Tech Uni CertificationDocument1 pageTech Uni CertificationMohammad Jibran ChangiNo ratings yet

- Invitation Letter.Document1 pageInvitation Letter.Mohammad Jibran ChangiNo ratings yet

- Labour Economics: Group 1 Muhammad Ali Raza Mohammad Jibran ChangiDocument11 pagesLabour Economics: Group 1 Muhammad Ali Raza Mohammad Jibran ChangiMohammad Jibran ChangiNo ratings yet

- Nepal: Economic Freedom ScoreDocument2 pagesNepal: Economic Freedom ScoreMohammad Jibran ChangiNo ratings yet

- (Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Document223 pages(Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Felippe RochaNo ratings yet

- Strategic Elements of Competitive Advantage Session 5-6: by Dr. Jitarani Udgata Ph.D. IIFT-DDocument41 pagesStrategic Elements of Competitive Advantage Session 5-6: by Dr. Jitarani Udgata Ph.D. IIFT-Dcastro dasNo ratings yet

- Option One 2006-1 Jul07Document72 pagesOption One 2006-1 Jul07janisnagobadsNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- 26912Document47 pages26912EMMANUELNo ratings yet

- Solution Jan 2018Document8 pagesSolution Jan 2018anis izzatiNo ratings yet

- ISO Certification in NepalDocument9 pagesISO Certification in NepalAbishek AdhikariNo ratings yet

- Marico Equity Research ReportDocument47 pagesMarico Equity Research ReportamitNo ratings yet

- FABM2 Q2W5 TaxationDocument8 pagesFABM2 Q2W5 TaxationDanielle SocoralNo ratings yet

- Reverse Pricing ProcedureDocument4 pagesReverse Pricing ProcedureAnonymous 13sDEcwShTNo ratings yet

- Project Management ConceptsDocument8 pagesProject Management ConceptsAnkita RautNo ratings yet

- Class 10th - The Great DepressionDocument12 pagesClass 10th - The Great DepressionT A N Y A T I W A R INo ratings yet

- Lesson 2 Global EconomyDocument18 pagesLesson 2 Global EconomyEngr. Kimberly Shawn Nicole SantosNo ratings yet

- Sip ReportDocument70 pagesSip ReportsuyogladdaNo ratings yet

- IV Sem MBA - TM - Strategic Management Model Paper 2013Document2 pagesIV Sem MBA - TM - Strategic Management Model Paper 2013vikramvsuNo ratings yet

- Ch12 TB RankinDocument6 pagesCh12 TB RankinAnton VitaliNo ratings yet

- Exercise - Chapter 5 - QuestionDocument7 pagesExercise - Chapter 5 - QuestionIzzah AdninNo ratings yet

- July 2014 Top 40 Cores BankingDocument5 pagesJuly 2014 Top 40 Cores BankingSolineth Batista AsprillaNo ratings yet

- Global SOUTH & Global NORTHDocument13 pagesGlobal SOUTH & Global NORTHswamini.k65No ratings yet

- Helios Power Solutions: Presented byDocument28 pagesHelios Power Solutions: Presented bylalith vamsiNo ratings yet

- EXEC 870-3 e - Reader - 2016Document246 pagesEXEC 870-3 e - Reader - 2016Alexandr DyadenkoNo ratings yet

- Foundation of Economics NotesDocument16 pagesFoundation of Economics Notesrosa100% (1)

- 5d6d01005f325curriculum MPSM LatestDocument51 pages5d6d01005f325curriculum MPSM LatestMostafa ShaheenNo ratings yet

- Free Printable Financial Affidavit FormDocument3 pagesFree Printable Financial Affidavit FormfatinNo ratings yet

- Name: Qasem Abdullah Ali ID: 162917157Document3 pagesName: Qasem Abdullah Ali ID: 162917157عبدالله المريبيNo ratings yet

- Ashish Chugh Reveals Top Secrets To Finding Multibagger StocksDocument10 pagesAshish Chugh Reveals Top Secrets To Finding Multibagger StocksSreenivasulu E NNo ratings yet

- Sahil Tiwari Personality Develpoment Assignment PDFDocument5 pagesSahil Tiwari Personality Develpoment Assignment PDFsahiltiwari0777No ratings yet

- A Platform For Innovation: Speech Given by Mark Carney, Governor Bank of EnglandDocument7 pagesA Platform For Innovation: Speech Given by Mark Carney, Governor Bank of EnglandHao WangNo ratings yet

- Accomplisment Letter 120611Document3 pagesAccomplisment Letter 120611Latisha WalkerNo ratings yet

- Ans: Q2 Moon Manufacturing Company (Dec31, 2017) : Cost of Goods Manufactured StatementDocument3 pagesAns: Q2 Moon Manufacturing Company (Dec31, 2017) : Cost of Goods Manufactured StatementAsma HatamNo ratings yet