Professional Documents

Culture Documents

Chapter 09

Uploaded by

Muhammad YasirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 09

Uploaded by

Muhammad YasirCopyright:

Available Formats

PRACTICE TEST

EXERCISE 1

ABC Company produced 25,000 units of Product XP-1 during 2000. Each product required 6 pounds of

material at $11 per pound and 2 hours of direct labor at $15 per hour. During 2003, 160,000 pounds of material

were purchased and used for $1,750,000; payroll totaled $743,900 for 49,000 hours.

Required:

Calculate the direct materials price and usage variances and the direct labor rate and efficiency variances.

EXERCISE 2

Acme Corp. applies overhead to production using a rate of $75 per machine hour ($35 variable, $40 fixed).

Acme produced 15,000 units and incurred overhead of $3,710,000 (of which $1,495,000 was variable

overhead) while using 43,500 machine hours. The overhead standards assumed each product would use 3

machine hours. The practical capacity of 18,000 units was used as the denominator activity.

Required:

Calculate the overhead variances using a four-variance analysis.

EXERCISE 3

XYZ Company produces a compound by mixing 3 gallons of AB-5 (costing $2.25 per gallon) and 4 gallons

of CR-3 (costing $7.50 per gallon). The output is 5 gallons of the compound. During August, 21,000

gallons of AB-5, costing $46,500, were purchased and used; 26,000 gallons of

CR-3, costing $198,000, were purchased and used. A total of 37,000 gallons of output were obtained.

Required:

1. Calculate the direct materials price and usage variances.

2. Calculate the direct materials mix and yield variances.

EXERCISE 4

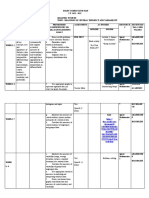

Scooter Company has the following standard cost sheet using an expected capacity of 120,000 units:

Direct materials..........................

25 pounds@$1.20

$30.00

Direct labor................................

2 hours@12.50

25.00

Overhead:

Variable..................................

3 machine hours@8.00

24.00

Fixed......................................

3 machine hours@12.00

36.00

Total...........................................

$115.00

During the year, 125,000 units were produced. Actual costs included the following:

Direct materials..........................

Direct labor................................

Overhead....................................

Machine hours............................

3,200,000 pounds purchased for $3,725,000.

3,110,000 pounds were used in production.

260,000 hours worked; payroll totaled $3,320,000.

Variable:$3,025,000

Fixed:$4,275,000

378,000 actually used

Required:

Calculate as many variances as possible.

Chapter9

PRACTICE TEST

EXERCISE 1 (ABC Company)

MPV: $1,750,000 (160,000 $11) = $1,750,000 $1,760,000 = $10,000 Favorable

MUV: (160,000 $11) (25,000 6 $11) = $1,760,000 $1,650,000 = $110,000 Unfavorable

LRV: $743,900 (49,000 $15) = $743,900 $735,000 = $8,900 Unfavorable

LEV: (49,000 $15) (25,000 2 $15) = $735,000 $750,000 = $15,000 Favorable

EXERCISE 2(Acme Corp.)

VOH spending:

Actual VOH Budgeted VOH

$1,495,000 (43,500 $35) = $1,495,000 $1,522,500 = $27,500 Favorable

VOH efficiency:

Budgeted VOH Applied VOH

(43,500 $35) (15,000 3 $35) = $1,522,500 $1,575,000 = $52,500 Favorable

FOH spending:

Actual FOH Budgeted FOH

$2,215,000 (18,000 3 $40) = $2,215,000 $2,160,000 = $55,000 Unfavorable

FOH volume:

Budgeted FOH Applied FOH

$2,160,000 (15,000 3 $40) = $2,160,000 $1,800,000 = $360,000 Unfavorable

EXERCISE 3(XYZ Company)

1. MPV:

AB-5: $46,500 (21,000 $2.25) = $46,500 $47,250 = $750 Favorable

CR-3: $198,000 (26,000 $7.50) = $198,000 $195,000 = $3,000 Unfavorable

MUV: Total standard input = Actual yield / Yield ratio = 37,000 / [5/(3 + 4)] = 37,000 / .714 = 51,800*

SQ(AB-5) = 51,800 3/7 = 22,200

SQ(CR-3) = 51,800 4/7 = 29,600

*rounded

AQ

SQ

AQ SQ

(AQ SQ)SP

21,000

22,200

1,200

$2,700

26,000

29,600

3,600

27,000

$29,700 Favorable

2. Mix variance

AQ

21,000

26,000

a

b

SQ

20,143 a

26,857 b

AQ SQ

857

857

SP

$2.25

$7.50

(AQ SQ)SP

$1,928.25

6,427.50

$4,499.25 Favorable

(21,000 + 26,000) 3/(3 + 4) = 20,143

(21,000 + 26,000) 4/(3 + 4) = 26,857

Yield variance = (Standard yield Actual yield) SP y

= (33,571 37,000) $7.35 = 3,429 $7.35 = $25,203.15 Favorable

where Standard yield = (21,000 + 26,000) 5/7 = 33,571

SPy = [(3 $2.25) + (4 $7.50)] / 5 gallons = $36.75 / 5 = $7.35

EXERCISE 4 (Scooter Company)

MPV:

$3,725,000 (3,200,000 $1.20) = $3,725,000 $3,840,000 = $115,000 Favorable

MUV:

[3,110,000 (125,000 25)] $1.20 = (3,110,000 3,125,000) $1.20 = 15,000 $1.20 = $18,000 Favorable

LRV:

$3,320,000 (260,000 $12.50) = $3,320,000 $3,250,000 = $70,000 Unfavorable

LEV:

[260,000 (125,000 2)] $12.50 = (260,000 250,000) $12.50 = 10,000 $12.50 = $125,000 Unfavorable

VOSV: $3,025,000 (378,000 $8) = $3,025,000 $3,024,000 = $1,000 Unfavorable

VOEV: [378,000 (125,000 3)] $8 = (378,000 375,000) $8 = 3,000 $8 = $24,000 Unfavorable

FOSV: $4,275,000 (120,000 $36) = $4,275,000 $4,320,000 = $45,000 Favorable

FOVV: $4,320,000 (125,000 $36) = $4,320,000 $4,500,000 = $180,000 Favorable

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Neural Network Ensemble 정리 자료Document15 pagesNeural Network Ensemble 정리 자료이성령No ratings yet

- 4 - Mathematical ExpectationsDocument40 pages4 - Mathematical ExpectationsRemylin De GuzmanNo ratings yet

- 7 Variance Reduction Techniques: 7.1 Common Random NumbersDocument5 pages7 Variance Reduction Techniques: 7.1 Common Random NumbersjarameliNo ratings yet

- ASTM D2137 11 - Standard Test Methods For Rubber Property-Brittleness Point of Flexible Polymers and Coated FabricsDocument7 pagesASTM D2137 11 - Standard Test Methods For Rubber Property-Brittleness Point of Flexible Polymers and Coated FabricsAndre SpirimNo ratings yet

- 6 Hansen ModelDocument26 pages6 Hansen ModelSemíramis LimaNo ratings yet

- Course Outline - Probability & Statistics (05-03-2021)Document4 pagesCourse Outline - Probability & Statistics (05-03-2021)Munawar Hussain FastNUNo ratings yet

- 2020, The Relationship Between General Aviation Pilot Age Andaccident RateDocument11 pages2020, The Relationship Between General Aviation Pilot Age Andaccident Rateabbas6063No ratings yet

- Multi-Criteria Analysis of The Environmental Vulnerability of The Cotton Zone of Mali: Case of The Northeast Subsidiary of KoutialaDocument10 pagesMulti-Criteria Analysis of The Environmental Vulnerability of The Cotton Zone of Mali: Case of The Northeast Subsidiary of KoutialaMamta AgarwalNo ratings yet

- Module 5 Random Sampling For StudentsDocument21 pagesModule 5 Random Sampling For StudentsJohn Marvin D AmilNo ratings yet

- Andy Field Using SpssDocument115 pagesAndy Field Using SpssRomer GesmundoNo ratings yet

- Random VariablesDocument10 pagesRandom Variablesarsenal GunnerNo ratings yet

- Chapter 1Document16 pagesChapter 1Cheng WLNo ratings yet

- Emailing BHU Syllabus M.Sc.Document25 pagesEmailing BHU Syllabus M.Sc.Prateek NaikNo ratings yet

- Chapter 11 Risk and ReturnDocument100 pagesChapter 11 Risk and ReturnChessking Siew HeeNo ratings yet

- Impact of Promotional Activities On Consumers' Behaviour at Shopping Malls in Coimbatore CityDocument6 pagesImpact of Promotional Activities On Consumers' Behaviour at Shopping Malls in Coimbatore Citybolly woodNo ratings yet

- Islamic Studies: Curriculum of BSDocument143 pagesIslamic Studies: Curriculum of BSMohammad Jibran ChangiNo ratings yet

- Effect Size For ANOVA Designs PDFDocument82 pagesEffect Size For ANOVA Designs PDFMarco CarranzaNo ratings yet

- Notes Part 2 PDFDocument63 pagesNotes Part 2 PDFPraveen KumarNo ratings yet

- Ebook Fundamentals of Analytical Chemistry Student Solution Manual PDF Full Chapter PDFDocument67 pagesEbook Fundamentals of Analytical Chemistry Student Solution Manual PDF Full Chapter PDFjesse.moore314100% (22)

- Weatherwax Theodoridis Solutions PDFDocument212 pagesWeatherwax Theodoridis Solutions PDFMahdi ZafarmandNo ratings yet

- Sae MethodologyDocument35 pagesSae MethodologyessentialstatNo ratings yet

- Jose Rizal High School Gov. W. Pascual Ave., Malabon City Tel/Fax 921-27-44 PACUCOA Accredited: Level II Senior High School DepartmentDocument10 pagesJose Rizal High School Gov. W. Pascual Ave., Malabon City Tel/Fax 921-27-44 PACUCOA Accredited: Level II Senior High School DepartmentBhoxzs Mel Ikaw LngNo ratings yet

- 40 Interview Questions On Machine Learning - AnalyticsVidhyaDocument21 pages40 Interview Questions On Machine Learning - AnalyticsVidhyaKaleab Tekle100% (1)

- Curriculum Map - Math 7 q4Document3 pagesCurriculum Map - Math 7 q4Dhevy LibanNo ratings yet

- CHEMOMETRICS and STATISTICS Multivariate Classification Techniques-21-27Document7 pagesCHEMOMETRICS and STATISTICS Multivariate Classification Techniques-21-27Jose GarciaNo ratings yet

- Data Analysis Tools and Approaches DATADocument133 pagesData Analysis Tools and Approaches DATAKeerthi BandaraNo ratings yet

- QT MCQ SolveDocument68 pagesQT MCQ SolvePrasun Naskar100% (1)

- Mean and Variance of The Sampling Distribution ofDocument31 pagesMean and Variance of The Sampling Distribution ofSaclangan Nobel0% (1)

- The Young Person's Guide To The Theil Index: Suggesting Intuitive Interpretations and Exploring Analytical ApplicationsDocument54 pagesThe Young Person's Guide To The Theil Index: Suggesting Intuitive Interpretations and Exploring Analytical ApplicationsHuuChi N'guyenNo ratings yet

- 954 Mathematics T (PPU) Semester 1 TopicsDocument11 pages954 Mathematics T (PPU) Semester 1 TopicsJosh, LRTNo ratings yet