Professional Documents

Culture Documents

Investment Mantra: Equities As An Asset Class & Investor Behaviour

Uploaded by

nnsriniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Mantra: Equities As An Asset Class & Investor Behaviour

Uploaded by

nnsriniCopyright:

Available Formats

Investment Mantra

Equities as an asset class & Investor behaviour **

Equities are a volatile asset class. However volatility in returns reduces as holding period

increases. Good times and bad times, typically follow each other

Returns from Equity investment is a function of earnings growth and changes in valuation

Investors generally invest more in good times when valuations are rich (high PE) and refrain

in bad times when valuations are cheap/reasonable (low PE). This leads to unsatisfactory

returns

On investments made in bad times(where PE <15), typically returns over next 3 years or

more are better due to earnings growth & improvement in valuation

(**illustrated in the table overleaf)

Mantra for Investing in Equity Mutual Funds:

Equities help create wealth over long term

Enjoy the benefit of diversification by investing in equity mutual funds

Take advantage of Ups and Down in the market by regularly investing systematically

Rely on professional money managers with sound track record

To know more, visit www.hdfcfund.com/InvestorEducation or contact your financial advisor.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

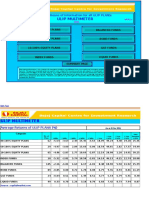

Why Invest in bad times...

S&P BSE SENSEX Yearly Rolling Returns vis-a-vis Equity Inows in Mutual Fund Schemes at different valuations across different time periods

Any person invested or planning to invest in the equity markets in India needs to evaluate the following table and summarise its results.

S&P BSE SENSEX Returns

1 YEAR

Forward P/E

Equity Net

Inows for the

Year (Rs. in Cr)*

Absolute 1 Yr

CAGR 3 Yrs

(3)

(4)

(5)

(6)

(7)

(8)

(9)

100

129

173

218

212

245

354

574

510

398

714

781

1168

4285

2281

3779

3261

3367

3361

3893

3740

5001

3604

3469

3049

5591

6493

11280

13072

15644

9709

17528

19445

17404

18836

22386

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

13.2

40.6

15.7

19.9

24.7

23.3

20.6

24.6

19.7

24.2

15.8

12.1

9.2

12.4

12.0

15.9

15.4

20.3

12.1

17.7

17.4

14.2

14.0

14.4

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

NA

10,058

22,161

8,763

118

7,205

7,398

36,155

29,916

52,701

4,084

1,456

-11,795

504

-14,371

-11,255

29%

35%

26%

-3%

16%

44%

62%

-11%

-22%

79%

9%

50%

267%

-47%

66%

-14%

3%

-0.2%

16%

-4%

34%

-28%

-4%

-12%

83%

16%

74%

16%

20%

-38%

81%

11%

-10%

8%

19%

N.A.

30%

18%

12%

18%

39%

28%

4%

8%

15%

43%

82%

43%

48%

-9%

14%

-4%

6%

4%

14%

-3%

-2%

-15%

16%

23%

55%

33%

34%

-5%

10%

8%

21%

2%

5%

N.A.

N.A.

N.A.

20%

22%

27%

19%

13%

24%

17%

15%

53%

42%

40%

33%

24%

-5%

11%

-0.2%

9%

1%

1%

-5%

8%

5%

26%

30%

39%

12%

22%

12%

6%

4%

18%

N.A.

N.A.

N.A.

N.A.

N.A.

22%

20%

21%

35%

27%

31%

25%

19%

21%

26%

18%

20%

12%

-2%

3%

4%

7%

13%

15%

15%

10%

13%

18%

18%

20%

15%

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Sr. No.

Investment

made at

YEAR END

S&P BSE

SENSEX

(1)

(2)

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

Mar-79

Mar-80

Mar-81

Mar-82

Mar-83

Mar-84

Mar-85

Mar-86

Mar-87

Mar-88

Mar-89

Mar-90

Mar-91

Mar-92

Mar-93

Mar-94

Mar-95

Mar-96

Mar-97

Mar-98

Mar-99

Mar-00

Mar-01

Mar-02

Mar-03

Mar-04

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Mar-13

Mar-14

CAGR 5 Yrs CAGR 10 Yrs

SENSEX returns are computed for 1,3,5 & 10 years from the date of investment. Source: BSE Ltd, AMFI. 1 Year forward P/E - Source: CLSA. NA - Not Available. /N.A.- Not Applicable.

* Net Inows in Equity Mutual Fund Schemes: Equity, Balanced, ELSS. Period having P/E less than 15 is highlighted for reference. CAGR: The rate at which an investment grows annually over a

specied period of time.

Column 3: shows the value of SENSEX at the end of month of the respective period. Column 4: shows the 1 year Forward Price to Earnings ratio: It is the ratio of SENSEX with the future estimate

earnings of the companies listed in the SENSEX. Column 5: Represents the net inows in equity mutual funds for the year.

Column 6 to 9: Represents the return earned on the investment for the referred period. For e.g. If you invested in Mar-79 when SENSEX Index was 100, then 1 year returns (in Mar-80) would have

been 29%, 3 years returns (in Mar-82) would have been 30%, 5 years returns (in Mar-84) would have been 20% and 10 year returns (in Mar-89) would have been 22%.

To know more, visit www.hdfcfund.com/InvestorEducation or contact your financial advisor.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

You might also like

- Beyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementFrom EverandBeyond Smart Beta: Index Investment Strategies for Active Portfolio ManagementNo ratings yet

- Capital Mall TrustDocument7 pagesCapital Mall TrustChan Weng HongNo ratings yet

- Singtel - : No Myanmar, No ProblemDocument4 pagesSingtel - : No Myanmar, No Problemscrib07No ratings yet

- Sanlam Stratus Funds-January 10 2017Document2 pagesSanlam Stratus Funds-January 10 2017Tiso Blackstar GroupNo ratings yet

- Insurance Company Funds Sanlam: Stratus Internet:: Markets and Commodity FiguresDocument2 pagesInsurance Company Funds Sanlam: Stratus Internet:: Markets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- Daily Technical Report, 08.07.2013Document4 pagesDaily Technical Report, 08.07.2013Angel BrokingNo ratings yet

- Mutual Funds Basics: - Money Through WisdomDocument68 pagesMutual Funds Basics: - Money Through Wisdombarakkat72No ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- Arrow Funds RElative StrengthDocument30 pagesArrow Funds RElative Strengthompomp13No ratings yet

- Cfa Research PaperDocument5 pagesCfa Research Paperfvey0xan100% (1)

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksrajdeeppawarNo ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- Insurance Company Funds Sanlam: Stratus Internet:: Markets and Commodity FiguresDocument2 pagesInsurance Company Funds Sanlam: Stratus Internet:: Markets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- 2017-10 Evaluating PerformanceDocument26 pages2017-10 Evaluating PerformancejsandbulteNo ratings yet

- BIMBSec - QL 4QFY12 Results Review 20120523Document3 pagesBIMBSec - QL 4QFY12 Results Review 20120523Bimb SecNo ratings yet

- Daily Technical Report, 01.07.2013Document4 pagesDaily Technical Report, 01.07.2013Angel BrokingNo ratings yet

- Daily Technical Report, 04.07.2013Document4 pagesDaily Technical Report, 04.07.2013Angel BrokingNo ratings yet

- Kase Fund Letter To Investors-Q1 14Document4 pagesKase Fund Letter To Investors-Q1 14CanadianValue100% (1)

- Wah Seong 4QFY11 20120223Document3 pagesWah Seong 4QFY11 20120223Bimb SecNo ratings yet

- Confident Guidance CG 09-2013Document4 pagesConfident Guidance CG 09-2013api-249217077No ratings yet

- Daily Technical Report, 22.04.2013Document4 pagesDaily Technical Report, 22.04.2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- 7jul11 - Tiger AirwaysDocument3 pages7jul11 - Tiger AirwaysmelyeapNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksKabeer ChawlaNo ratings yet

- Daily Technical Report, 03.07.2013Document4 pagesDaily Technical Report, 03.07.2013Angel BrokingNo ratings yet

- Sure Dividend 2023 07 July Newsletter Q9R1Document65 pagesSure Dividend 2023 07 July Newsletter Q9R1Ivone De LorenziNo ratings yet

- Tata Retirement Savings Fund - Final RoadshowDocument70 pagesTata Retirement Savings Fund - Final RoadshowViral ShuklaNo ratings yet

- SIP Study by WhiteOak Capital MF - October 2023Document6 pagesSIP Study by WhiteOak Capital MF - October 2023Akshay JainNo ratings yet

- Daily Technical Report 15.03.2013Document4 pagesDaily Technical Report 15.03.2013Angel BrokingNo ratings yet

- JF - India 31 01 07 PDFDocument3 pagesJF - India 31 01 07 PDFstavros7No ratings yet

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- Technical Format With Stock 05.11.2012Document4 pagesTechnical Format With Stock 05.11.2012Angel BrokingNo ratings yet

- Daily Technical Report 18.03.2013Document4 pagesDaily Technical Report 18.03.2013Angel BrokingNo ratings yet

- CTRN (Citi Trends) Investment AnalysisDocument7 pagesCTRN (Citi Trends) Investment Analysismclennan68_13No ratings yet

- Weekly Trends Nov 21Document5 pagesWeekly Trends Nov 21dpbasicNo ratings yet

- Daily Technical Report, 03.04.2013Document4 pagesDaily Technical Report, 03.04.2013Angel BrokingNo ratings yet

- An Extra Benefit For An Extra Wide SmileDocument2 pagesAn Extra Benefit For An Extra Wide SmileAmandeep SharmaNo ratings yet

- Daily Technical Report, 16.04.2013Document4 pagesDaily Technical Report, 16.04.2013Angel BrokingNo ratings yet

- Daily Technical Report, 21.06.2013Document4 pagesDaily Technical Report, 21.06.2013Angel BrokingNo ratings yet

- Daily Technical Report, 10.07.2013Document4 pagesDaily Technical Report, 10.07.2013Angel BrokingNo ratings yet

- Daily Technical Report, 22.03.2013Document4 pagesDaily Technical Report, 22.03.2013Angel BrokingNo ratings yet

- 2013-3-22 SREITs Roundup 2203131Document12 pages2013-3-22 SREITs Roundup 2203131phuawlNo ratings yet

- One From Everyone NEWDocument14 pagesOne From Everyone NEWPratik KathuriaNo ratings yet

- Technical Format With Stock 17.09Document4 pagesTechnical Format With Stock 17.09Angel BrokingNo ratings yet

- Daily Technical Report, 29.04.2013Document4 pagesDaily Technical Report, 29.04.2013Angel BrokingNo ratings yet

- Daily Technical Report, 23.04.2013Document4 pagesDaily Technical Report, 23.04.2013Angel BrokingNo ratings yet

- Safal Niveshaks Stock Analysis ExcelDocument26 pagesSafal Niveshaks Stock Analysis ExcelUmesh KamathNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- A Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Document4 pagesA Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Logical InvestNo ratings yet

- Media Chinese Intn'L: Company ReportDocument5 pagesMedia Chinese Intn'L: Company ReportAlan Chan Tee SiongNo ratings yet

- Derivatives Report 24 Sep 2012Document3 pagesDerivatives Report 24 Sep 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19270) / NIFTY (5680)Document4 pagesDaily Technical Report: Sensex (19270) / NIFTY (5680)Angel BrokingNo ratings yet

- Daily Technical Report, 07.05.2013Document4 pagesDaily Technical Report, 07.05.2013Angel BrokingNo ratings yet

- ICICIdirect Pledgedshares November2011Document4 pagesICICIdirect Pledgedshares November2011Atul TandonNo ratings yet

- Technical Format With Stock 29.10.2012Document4 pagesTechnical Format With Stock 29.10.2012Angel BrokingNo ratings yet

- Technical Format With Stock 15.10Document4 pagesTechnical Format With Stock 15.10Angel BrokingNo ratings yet

- Ibbotsoin 2011 Risk Premia Over Time Report (20110207135556)Document43 pagesIbbotsoin 2011 Risk Premia Over Time Report (20110207135556)Paúl SalazarNo ratings yet

- Aegis Logistics: Volumes Inching Up Capacity Expansion Augurs Well BuyDocument6 pagesAegis Logistics: Volumes Inching Up Capacity Expansion Augurs Well BuynnsriniNo ratings yet

- 20051600013463voltas Result UpdateDocument6 pages20051600013463voltas Result UpdatennsriniNo ratings yet

- Shareholding Pattern As On 30th June 2017Document5 pagesShareholding Pattern As On 30th June 2017nnsriniNo ratings yet

- Voltamp Transformers LTDDocument12 pagesVoltamp Transformers LTDnnsriniNo ratings yet

- Annual Report Can Reveal The Secrets A Company Wants To Hide: Here's How To UncoverDocument15 pagesAnnual Report Can Reveal The Secrets A Company Wants To Hide: Here's How To UncovernnsriniNo ratings yet

- 23803care - Health Insurance Plan BrochureDocument16 pages23803care - Health Insurance Plan BrochureNitish SinghNo ratings yet

- RBI Permits Foreign Investments in REITs, Invits and Alternative Investment Funds - Government, Public Sector - IndiaDocument4 pagesRBI Permits Foreign Investments in REITs, Invits and Alternative Investment Funds - Government, Public Sector - IndiannsriniNo ratings yet

- Persistent Systems: In-Line Q1 Revenue Growth Should Help To Better Margins BuyDocument9 pagesPersistent Systems: In-Line Q1 Revenue Growth Should Help To Better Margins BuynnsriniNo ratings yet

- PMS Portfolio Plus Final (31st May 2016)Document9 pagesPMS Portfolio Plus Final (31st May 2016)nnsriniNo ratings yet

- Blue StarDocument39 pagesBlue StarnnsriniNo ratings yet

- India FMCG Review SU 6 June 2016Document12 pagesIndia FMCG Review SU 6 June 2016nnsriniNo ratings yet

- Sundaram Rural Presentation May2016Document45 pagesSundaram Rural Presentation May2016nnsriniNo ratings yet

- Structured Products MayDocument16 pagesStructured Products MaynnsriniNo ratings yet

- Industrial Production: Low Growth, But Better Than Hoped ForDocument9 pagesIndustrial Production: Low Growth, But Better Than Hoped FornnsriniNo ratings yet

- KRBL - Q4FY17 - Result Update - 09-06-2017 - 10Document4 pagesKRBL - Q4FY17 - Result Update - 09-06-2017 - 10nnsriniNo ratings yet

- Accelya Kale Solutions Limited Offer Letter PDFDocument56 pagesAccelya Kale Solutions Limited Offer Letter PDFnnsriniNo ratings yet

- 23803care - Health Insurance Plan BrochureDocument16 pages23803care - Health Insurance Plan BrochureNitish SinghNo ratings yet

- Escorts: Expectation of Significant Recovery Due To A Better Monsoon BuyDocument7 pagesEscorts: Expectation of Significant Recovery Due To A Better Monsoon BuynnsriniNo ratings yet

- Aggressive Recommended Basket 02 Mar 16Document25 pagesAggressive Recommended Basket 02 Mar 16nnsriniNo ratings yet

- Sundaram Balanced Fund: PortfolioDocument1 pageSundaram Balanced Fund: PortfolionnsriniNo ratings yet

- DHFL Result UpdateDocument9 pagesDHFL Result UpdatennsriniNo ratings yet

- Accelya Kale Solutions Limited Offer LetterDocument56 pagesAccelya Kale Solutions Limited Offer LetternnsriniNo ratings yet

- Granuels India Corporate PDFDocument16 pagesGranuels India Corporate PDFnnsriniNo ratings yet

- India FMCG Review SU 6 June 2016Document12 pagesIndia FMCG Review SU 6 June 2016nnsriniNo ratings yet

- The Byke Hospitality - Initiating CoverageDocument23 pagesThe Byke Hospitality - Initiating CoveragennsriniNo ratings yet

- Product Construct MayDocument8 pagesProduct Construct MaynnsriniNo ratings yet

- India Strategy 2qfy17 20161010 Mosl RP Pg300Document300 pagesIndia Strategy 2qfy17 20161010 Mosl RP Pg300nnsriniNo ratings yet

- Granuels India CorporateDocument16 pagesGranuels India CorporatennsriniNo ratings yet

- IDirect ConsolidatedPreview Q1FY18Document80 pagesIDirect ConsolidatedPreview Q1FY18nnsriniNo ratings yet

- Ashokley Result UpdateDocument7 pagesAshokley Result UpdatennsriniNo ratings yet

- Gap PDFDocument201 pagesGap PDFREXIL M. LADIGOHONNo ratings yet

- Lect 4 What - Is - Innovarion-2Document41 pagesLect 4 What - Is - Innovarion-2Johnson Lozano JimenezNo ratings yet

- Reflection-Paper Chapter 2 Advance Strategic ManagementDocument5 pagesReflection-Paper Chapter 2 Advance Strategic ManagementJouhara G. San JuanNo ratings yet

- Solution of CFDocument4 pagesSolution of CFMuhammad TaimurNo ratings yet

- Avl SHP Q4 31 03 2023Document18 pagesAvl SHP Q4 31 03 2023jlsinghNo ratings yet

- QUESTION:-Discuss The Limitations of The Barter System. in Light of These Limitations, Explain How Many Evolve and It's Various FunctionsDocument5 pagesQUESTION:-Discuss The Limitations of The Barter System. in Light of These Limitations, Explain How Many Evolve and It's Various FunctionstempNo ratings yet

- Janney Montgomery Scott - ORCC - Initiation - ORCC Initiating Coverage at - 17 PagesDocument17 pagesJanney Montgomery Scott - ORCC - Initiation - ORCC Initiating Coverage at - 17 PagesSagar PatelNo ratings yet

- International Financial Management 13th Edition Madura Test BankDocument30 pagesInternational Financial Management 13th Edition Madura Test Bankaprilhillwoijndycsf100% (28)

- MGAC 2 MidtermDocument63 pagesMGAC 2 MidtermJoana TrinidadNo ratings yet

- OTC Trading - Impact of CCP Cognizant White PaperDocument12 pagesOTC Trading - Impact of CCP Cognizant White PaperGest DavidNo ratings yet

- Reaction Paper I.Plot: Game LevelsDocument4 pagesReaction Paper I.Plot: Game LevelsAira AmorosoNo ratings yet

- Walmart in JapanDocument13 pagesWalmart in JapanAbu Bakar ManafNo ratings yet

- Central Depository Services (India) Limited: Convenient Dependable Secure Communiqué To Depository ParticipantsDocument4 pagesCentral Depository Services (India) Limited: Convenient Dependable Secure Communiqué To Depository ParticipantsPSPLNo ratings yet

- Ecommerce OverviewDocument29 pagesEcommerce OverviewharithaghantasalaNo ratings yet

- Private Equity Interview Questions - Answers To The Top PE QuestionsDocument8 pagesPrivate Equity Interview Questions - Answers To The Top PE QuestionsRahul SainiNo ratings yet

- Daisy English PPT Final Version2Document33 pagesDaisy English PPT Final Version2Afaceri AllNo ratings yet

- Ulip MultimeterDocument17 pagesUlip MultimeterRaghu RaoNo ratings yet

- 5-4 Greek LettersDocument30 pages5-4 Greek LettersNainam SeedoyalNo ratings yet

- Marketing Plan Vinasoy CollagenDocument24 pagesMarketing Plan Vinasoy CollagenNguyễn Ngọc Quỳnh AnhNo ratings yet

- Bishop Stuart University: NameDocument5 pagesBishop Stuart University: Namemujuni brianmjuNo ratings yet

- Fixed Income Mid TermDocument12 pagesFixed Income Mid TermRattan Preet SinghNo ratings yet

- Beams11 ppt09Document19 pagesBeams11 ppt09Mario RosaNo ratings yet

- Liquidity ManagementDocument60 pagesLiquidity ManagementRomil Parikh100% (1)

- Redefining A BrandDocument16 pagesRedefining A BrandRd Indra AdikaNo ratings yet

- Stock Investing Mastermind - Zebra Learn-91Document2 pagesStock Investing Mastermind - Zebra Learn-91RGNitinDevaNo ratings yet

- VRIO Analysis of Vintage CoffeeDocument3 pagesVRIO Analysis of Vintage CoffeePui YanNo ratings yet

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Revenue Growth - Car Rental Company: Problem Statement and QuestionsDocument4 pagesRevenue Growth - Car Rental Company: Problem Statement and QuestionsRafaelNo ratings yet

- Myanmar Stock ExchangeDocument4 pagesMyanmar Stock ExchangeNikhil ChandrikapureNo ratings yet

- MKTM508 Sales & Distribution: Rajeev GuptaDocument25 pagesMKTM508 Sales & Distribution: Rajeev GuptaShanu SinghNo ratings yet