Professional Documents

Culture Documents

Diamond Chemicals Case Exhibits

Uploaded by

abhi422Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diamond Chemicals Case Exhibits

Uploaded by

abhi422Copyright:

Available Formats

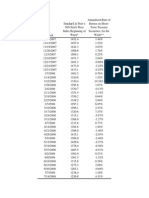

Exhibit 2

UVA-F-1351

DIAMOND CHEMICALS (A)

Frank Greystock's DCF Analysis of Merseyside Project

(Financial values in millions of British Pounds)

Assumptions

Annual Output (metric tons)

Output Gain/Original Output

Price/ton (pounds sterling)

Inflation Rate (prices and costs)

Gross Margin (ex. Deprec.)

Old Gross Margin

Tax Rate

Investment Outlay (mill.)

Energy Savings/Sales

Yr. 1-5

Yr. 6-10

Yr. 11-15

250,000

7.0%

541

3.0%

12.50%

11.5%

30.0%

9.00

1.25%

0.8%

0.0%

1

Year

Now

2001

1. Estimate of Incremental Gross Profit

New Output (tons)

267,500

Lost Output--Construction

(33,438)

New Sales (Millions)

126.63

New Gross Margin

13.8%

New Gross Profit

17.41

Old Output

Old Sales

Old Gross Profit

250,000

135.25

15.55

Lost sales in Rotterdam

Incremental Gross Profit

1.86

2. Estimate of Incremental Depreciation

New Depreciation

1.20

New Depreciation on tank cars

Old Depreciation on tank cars

3. Overhead

0.32

4. Prelim. Engineering Costs

0.50

5. Pretax Incremental Profit

-0.16

6. Tax Expense

-0.05

Discount rate

Depreciable Life (years)

Overhead/Investment

Salvage Value

WIP Inventory/Cost of Goods

Months Downtime, Construction

After-tax Scrap Proceeds

Preliminary Engineering Costs

2

2002

267,500

149.06

13.8%

20.50

3

2003

267,500

153.53

13.8%

21.11

4

2004

267,500

158.14

13.8%

21.74

5

2005

267,500

162.88

13.8%

22.40

10.0%

15

3.5%

0

3.0%

1.5

0

0.5

6

2006

267,500

167.77

13.3%

22.23

7

2007

267,500

172.80

13.3%

22.90

<== Note that discount rate should be set to 10 % for

exact comparability to case exhibit.

8

2008

267,500

177.98

13.3%

23.58

9

2009

267,500

183.32

13.3%

24.29

10

2010

267,500

188.82

13.3%

25.02

11

2011

267,500

194.49

12.5%

24.31

12

2012

267,500

200.32

12.5%

25.04

13

2013

267,500

206.33

12.5%

25.79

14

2014

267,500

212.52

12.5%

26.57

15

2015

267,500

218.90

12.5%

27.36

250,000

139.31

16.02

250,000

143.49

16.50

250,000

147.79

17.00

250,000

152.23

17.51

250,000

156.79

18.03

250,000

161.50

18.57

250,000

166.34

19.13

250,000

171.33

19.70

250,000

176.47

20.29

250,000

181.76

20.90

250,000

187.22

21.53

250,000

192.83

22.18

250,000

198.62

22.84

250,000

204.58

23.53

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

9.47

4.48

4.61

4.75

4.89

4.20

4.32

4.45

4.59

4.72

3.41

3.51

3.62

3.72

3.84

1.04

0.90

0.78

0.40

0.68

0.32

0.51

0.20

0.34

0.32

0.44

0.16

0.27

0.32

0.38

0.13

0.22

0.32

0.33

0.13

0.17

0.32

0.43

0.13

0.14

0.32

0.43

0.13

0.14

0.32

0.43

0.13

0.14

0.32

0.43

0.43

0.14

0.32

0.14

0.32

0.32

0.32

0.32

0.32

0.59

0.26

0.42

0.32

3.12

0.94

3.39

1.02

3.65

1.10

3.90

1.17

3.30

0.99

3.50

1.05

3.70

1.11

3.89

1.17

4.08

1.22

2.66

0.80

2.77

0.83

2.87

0.86

2.98

0.89

3.09

0.93

7. After-tax Profit

8. Cash Flow Adjustments

Less Capital Expenditures -9.00

Add back Depreciation

Less Added WIP inventory

Add inventory Rotterdam

After-tax Scrap Proceeds

-0.11

2.18

2.38

-2.00

2.56

2.73

2.12

2.31

2.45

2.59

2.72

2.86

1.86

1.94

2.01

2.09

2.16

1.20

0.31

1.04

-0.58

0.90

-0.12

0.78

0.00

0.68

0.00

0.59

0.00

0.51

0.00

0.44

0.00

0.38

0.00

0.33

0.00

0.43

0.00

0.43

0.00

0.43

0.00

0.43

0.00

0.43

-0.38

8. Free Cash Flow

-9.00

1.40

2.64

3.16

3.34

3.41

2.89

2.96

3.03

3.11

3.19

2.29

2.37

2.44

2.52

2.21

NPV =

IRR =

11.80

28.5%

0.00

Exhibit 1

UVA-F-1352

DIAMOND CHEMICALS (B)

ANALYSIS OF ROTTERDAM PROJECT

(Values in British Pounds)

Assumptions

Annual Output (metric tons)

250,000

Output Gain Per Year/Prior Year

2.0%

Maximum Possible Output

267,500

Price/ton (pounds sterling)

541

Inflation (prices and costs)

0.0%

Gross Margin Growth Rate/Year

0.80%

Maximum Possible Gross Margin

16.0%

Old Gross Margin

11.5%

Tax Rate

30.0%

Investment Outlay (millions)

Now

3.5

End, 2001

2.5

2002

1

2003

1

Setup and Labor Savings/Sales (yr.1)

Discount rate

Depreciable Life (years)

Overhead/Investment

Salvage Value

WIP Inventory/Cost of Goods Sold

Terminal Value of Right-of-Way

Months Downtime, Construction

2001

2002

2003

2004

0.0%

10.0%

15

3.5%

0

3.0%

35

5

4

3

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Year

Now

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

1. Estimate of Incremental Gross Profit

New Output

255,000 260,100 265,302 267,500 267,500 267,500 267,500 267,500 267,500 267,500 267,500 267,500 267,500 267,500 267,500

Lost Output--Construction

(106,250) (86,700) (66,326)

0

New Sales (Millions)

80.47

93.81

107.65

144.72

144.72

144.72

144.72

144.72

144.72

144.72

144.72

144.72

144.72

144.72

144.72

New Gross Margin

11.6%

11.8%

12.1%

12.5%

13.0%

13.6%

14.4%

15.3%

16.0%

16.0%

16.0%

16.0%

16.0%

16.0%

16.0%

New Gross Profit

9.33

11.05

12.99

18.02

18.76

19.67

20.80

22.17

23.15

23.15

23.15

23.15

23.15

23.15

23.15

Old Output

250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000 250,000

Old Sales

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

135.25

Old Gross Profit

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

15.55

Incremental Gross Profit

-6.23

-4.50

-2.57

2.47

3.20

4.12

5.25

6.62

7.60

7.60

7.60

7.60

7.60

7.60

7.60

2. Estimate of Incremental Depreciation

Yr. 1 Outlays

0.33

0.29

0.25

0.22

0.19

0.16

0.14

0.12

0.11

0.09

0.12

0.12

0.12

0.12

0.12

Yr. 2 Outlays

0.14

0.12

0.10

0.09

0.08

0.07

0.06

0.05

0.04

0.05

0.05

0.05

0.05

0.05

Yr. 3 Outlays

0.15

0.13

0.11

0.09

0.08

0.07

0.06

0.05

0.05

0.05

0.05

0.05

0.05

Total, New Depreciation

0.33

0.43

0.53

0.45

0.39

0.33

0.29

0.25

0.21

0.18

0.22

0.22

0.22

0.22

0.22

3. Overhead

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

4. Pretax Incremental Profit

-6.56

-4.94

-3.09

2.02

2.81

3.79

4.96

6.37

7.39

7.42

7.38

7.38

7.38

7.38

7.38

5. Tax Expense

-1.97

-1.48

-0.93

0.61

0.84

1.14

1.49

1.91

2.22

2.23

2.21

2.21

2.21

2.21

2.21

6. After-tax Profit

-4.59

-3.46

-2.17

1.41

1.97

2.65

3.47

4.46

5.17

5.19

5.17

5.17

5.17

5.17

5.17

7. Cash Flow Adjustments

Add back Depreciation

0.33

0.43

0.53

0.45

0.39

0.33

0.29

0.25

0.21

0.18

0.22

0.22

0.22

0.22

0.22

Less added WIP inventory

1.46

-0.35

-0.36

-0.96

0.02

0.03

0.03

0.04

0.03

0.00

0.00

0.00

0.00

0.00

0.00

Capital Spending

3.50

2.50

1.00

1.00

Terminal Value, land

35.00

8. Free Cash Flow

-3.50

-8.21

-3.68

-2.28

2.83

2.34

2.96

3.73

4.67

5.35

5.38

5.39

5.39

5.39

5.39

40.39

DCF, Rotterdam =

14.01

IR, Rotterdam =

17.9%

9. Adjustment for erosion in Merseyside volume:

Lost Merseyside Output

Lost Merseyside Revenue

Lost Merseyside Gross Profits

Lost Gross Profits after Taxes

Change in Merseyside Inventory

Total Effect on Free Cash Flow

DCF, Erosion Merseyside

(2.45)

DCF, Rotterdam Adjusted for Full

Erosion at Merseyside =

11.57

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

17,500

9.47

1.09

0.76

0.28

(0.48)

You might also like

- Airbus A3XXDocument2 pagesAirbus A3XXPriyanka Agarwal0% (1)

- Past BillsDocument9 pagesPast BillsRahul BhatiaNo ratings yet

- Asset Beta AnalysisDocument13 pagesAsset Beta AnalysisamuakaNo ratings yet

- American Chemical Corporation Case StudyDocument11 pagesAmerican Chemical Corporation Case StudyRahul Pandey100% (6)

- Sealed Air's Leveraged Recapitalization Drives Improved PerformanceDocument3 pagesSealed Air's Leveraged Recapitalization Drives Improved Performancenishant kumarNo ratings yet

- American Chemical CompanyDocument7 pagesAmerican Chemical Companycmarshall22340% (5)

- Financial analysis of American Chemical Corporation plant acquisitionDocument9 pagesFinancial analysis of American Chemical Corporation plant acquisitionBenNo ratings yet

- American Chemical CorporationDocument8 pagesAmerican Chemical CorporationAnastasiaNo ratings yet

- Do Something - He's About To SnapDocument9 pagesDo Something - He's About To Snapabhi422100% (2)

- Diamond Chemicals Team 6's DCF Analysis of Merseyside ProjectDocument1 pageDiamond Chemicals Team 6's DCF Analysis of Merseyside Projectkwarden13No ratings yet

- Diamond Chemicals DCF AnalysisDocument2 pagesDiamond Chemicals DCF AnalysisShikha KanwarNo ratings yet

- The Feasibility of Establishing A Tax and Accounting Firm in Digos CityDocument2 pagesThe Feasibility of Establishing A Tax and Accounting Firm in Digos Citylorren4jeanNo ratings yet

- The Brita Products Company Case ReportDocument3 pagesThe Brita Products Company Case ReportSojung Yoon100% (1)

- 13 American Chemical Corporation - Group 13Document5 pages13 American Chemical Corporation - Group 13Anonymous MpSSPQi0% (1)

- Victoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XDocument4 pagesVictoria Chemicals PLC (B) - The Merseyside and Rotterdam Projects (SPREADSHEET) F-1544XPaco ColínNo ratings yet

- EPC Modernization Project RejectionDocument3 pagesEPC Modernization Project Rejectiondontcare32100% (1)

- Sampa Video Inc.Document8 pagesSampa Video Inc.alina8763No ratings yet

- Facebook, Inc: The Initial Public OfferingDocument5 pagesFacebook, Inc: The Initial Public OfferingHanako Taniguchi PoncianoNo ratings yet

- Ocean Carriers ExerciseDocument13 pagesOcean Carriers ExercisesafderNo ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- Ectn - XLS: InstructorDocument12 pagesEctn - XLS: Instructorcamr2015100% (1)

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Concerns with DCF analysis for Intermediate Chemicals Group projectDocument2 pagesConcerns with DCF analysis for Intermediate Chemicals Group projectJia LeNo ratings yet

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- Sector Analysis Architecture Building and Construction 2014Document9 pagesSector Analysis Architecture Building and Construction 2014PritNo ratings yet

- Diamond Chemicals Capital Program AnalysisDocument3 pagesDiamond Chemicals Capital Program AnalysisSagar Vatkar25% (4)

- Group B&D Case 19 FonderiaDocument12 pagesGroup B&D Case 19 FonderiaVinithi ThongkampalaNo ratings yet

- SpyderDocument3 pagesSpyderHello100% (1)

- Case 3 Empirical ChemicalsDocument4 pagesCase 3 Empirical ChemicalsStephanie Morgan67% (3)

- Advanced Accounting Test Bank Questions Chapter 8Document19 pagesAdvanced Accounting Test Bank Questions Chapter 8Ahmed Al EkamNo ratings yet

- Case 22 Victoria Chemicals A DONEDocument14 pagesCase 22 Victoria Chemicals A DONEJordan Green100% (5)

- Case 3 Empirical ChemicalsDocument4 pagesCase 3 Empirical Chemicalssmorga30No ratings yet

- DCF Analysis of Merseyside and Rotterdam ProjectsDocument3 pagesDCF Analysis of Merseyside and Rotterdam ProjectsRakesh100% (2)

- FINAN 6220 - Target Case Study AnswersDocument2 pagesFINAN 6220 - Target Case Study AnswerschandanaNo ratings yet

- Time Value of MoneyDocument18 pagesTime Value of MoneyJunaid SubhaniNo ratings yet

- Overview of Stock Transfer Configuration in SAP-WMDocument11 pagesOverview of Stock Transfer Configuration in SAP-WMMiguel TalaricoNo ratings yet

- Victoria Chemicals PLC Case AnalysisDocument12 pagesVictoria Chemicals PLC Case AnalysisLesika Q. Mintz100% (5)

- Brita Should Launch Faucet Filter to CompeteDocument7 pagesBrita Should Launch Faucet Filter to Competeabhi422No ratings yet

- Ocean Carries HBS Case StudyDocument4 pagesOcean Carries HBS Case StudyRatul EsrarNo ratings yet

- Victoria Chemicals Plc. (A) The Merseyside ProjectDocument9 pagesVictoria Chemicals Plc. (A) The Merseyside ProjectAs17 As17No ratings yet

- VICTORIA ChemicalDocument24 pagesVICTORIA ChemicalekkyNo ratings yet

- Sealed Air Co Case Study Queestions Why Did Sealed Air Undertake A LeveragDocument9 pagesSealed Air Co Case Study Queestions Why Did Sealed Air Undertake A Leveragvichenyu100% (1)

- Diamond Chemicals Group 5Document14 pagesDiamond Chemicals Group 5Gressiadi80% (5)

- Victoria Chemicals Part 5Document3 pagesVictoria Chemicals Part 5cesarvirata100% (1)

- Victoria Chemicals DCF analysis of Merseyside projectDocument2 pagesVictoria Chemicals DCF analysis of Merseyside projecttipo_de_incognito75% (4)

- Case 4 - Victoria ChemicalsDocument18 pagesCase 4 - Victoria ChemicalsYale Brendan CatabayNo ratings yet

- Air Asia - Flying High With Low Cost HopesDocument3 pagesAir Asia - Flying High With Low Cost HopesSheng Wei Yeo0% (1)

- Victoria ChemicalsDocument10 pagesVictoria Chemicalshookemvic67% (3)

- TN20 Diamond Chemicals PLC A and BDocument39 pagesTN20 Diamond Chemicals PLC A and Bsimoon1100% (5)

- Diamond Chemicals Case Study11 - FinalDocument20 pagesDiamond Chemicals Case Study11 - FinalJoao0% (1)

- Diamond ChemicalsDocument2 pagesDiamond ChemicalsshengNo ratings yet

- Victoria Chemicals Plc Project Selection: Merseyside vs RotterdamDocument6 pagesVictoria Chemicals Plc Project Selection: Merseyside vs RotterdamRivki MeitriyantoNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Victoria Chemicals BriefDocument3 pagesVictoria Chemicals Briefdobaid1No ratings yet

- American Chemical Corp (ACC) Case Study Executive SummaryDocument1 pageAmerican Chemical Corp (ACC) Case Study Executive SummaryNatasha SuddhiNo ratings yet

- Case 1 SolDocument22 pagesCase 1 Solstig2lufetNo ratings yet

- Ocean Carriers 2020 - A5Document10 pagesOcean Carriers 2020 - A5Mohith ChowdharyNo ratings yet

- Case 24 Victoria Chemicals PLC A The Merseyside ProjectDocument3 pagesCase 24 Victoria Chemicals PLC A The Merseyside ProjectAbdullahIsmailNo ratings yet

- Diamond Chemicals Merseyside ProjectDocument12 pagesDiamond Chemicals Merseyside ProjectHimanshu DubeyNo ratings yet

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- Sure CutDocument37 pagesSure Cutshmuup1100% (4)

- Sealed Air CorporationDocument7 pagesSealed Air Corporationhadil_1No ratings yet

- Victoria Chemicals Case - Merseyside Polypropylene Project Go/No-Go DecisionDocument2 pagesVictoria Chemicals Case - Merseyside Polypropylene Project Go/No-Go DecisionS r kNo ratings yet

- Frank's DCF analysis of Merseyside projectDocument2 pagesFrank's DCF analysis of Merseyside projectriders29No ratings yet

- Victoria Chemicals - Student TemplateDocument1 pageVictoria Chemicals - Student TemplateBobYuNo ratings yet

- Exhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropeDocument10 pagesExhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropeFadlan AfandiNo ratings yet

- Exhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropeDocument7 pagesExhibit 1 Comparative Information On The Seven Largest Polypropylene Plants in EuropetimbulmanaluNo ratings yet

- Group 5 - Diamond Chemicals AssignmentDocument11 pagesGroup 5 - Diamond Chemicals AssignmentRijul AgrawalNo ratings yet

- CF Assignment FauxDocument48 pagesCF Assignment Fauxmaazali12No ratings yet

- News Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsDocument25 pagesNews Release: Arcelormittal Reports Full Year and Fourth Quarter 2008 ResultsRobert Edward BallNo ratings yet

- Aero Structures 2Document11 pagesAero Structures 2abhi422No ratings yet

- Infosys Consulting's Disruptive Global Delivery ModelDocument12 pagesInfosys Consulting's Disruptive Global Delivery Modelabhi422No ratings yet

- American Home Products D - Workbook For Student AnalyDocument2 pagesAmerican Home Products D - Workbook For Student Analyabhi4220% (1)

- Cooling Minds Winning HeartDocument3 pagesCooling Minds Winning Heartabhi422No ratings yet

- Bayou Petroleum SpreadsheetDocument5 pagesBayou Petroleum Spreadsheetabhi422No ratings yet

- Business Development Manager Research in Chicago IL Resume Christine HorwitzDocument2 pagesBusiness Development Manager Research in Chicago IL Resume Christine HorwitzChristineHorwitzNo ratings yet

- Regina+SD+No +4+2021-22+Annual+ReportDocument117 pagesRegina+SD+No +4+2021-22+Annual+ReportpomNo ratings yet

- Case Studies 1Document3 pagesCase Studies 1Kenny Ang0% (2)

- NewfundoptionextpitchesDocument6 pagesNewfundoptionextpitchesSunil GuptaNo ratings yet

- Case Study on Prime Bank's Customer Service StrategyDocument8 pagesCase Study on Prime Bank's Customer Service StrategyjeankoplerNo ratings yet

- 13-0389 Bus Times 157Document7 pages13-0389 Bus Times 157Luis DíazNo ratings yet

- Auditor's Cup Questions-2Document8 pagesAuditor's Cup Questions-2VtgNo ratings yet

- Renaming of The Dept. of Geology, Univ. of Kerala.Document6 pagesRenaming of The Dept. of Geology, Univ. of Kerala.DrThrivikramji KythNo ratings yet

- Synopsis Transport NagarDocument5 pagesSynopsis Transport NagarTazeem Ahmad ChishtiNo ratings yet

- Power PSU's in INDIADocument53 pagesPower PSU's in INDIAUjjval JainNo ratings yet

- Carlin e Soskice (2005)Document38 pagesCarlin e Soskice (2005)Henrique PavanNo ratings yet

- El Al.Document41 pagesEl Al.Chapter 11 DocketsNo ratings yet

- NABJ Finance Committee PresentationDocument26 pagesNABJ Finance Committee PresentationGabriel AranaNo ratings yet

- A Preliminary Feasibility Study About High-Speed Rail in CanadaDocument16 pagesA Preliminary Feasibility Study About High-Speed Rail in CanadamaxlentiNo ratings yet

- Chapter 3 - Project SelectionDocument15 pagesChapter 3 - Project SelectionFatin Nabihah100% (2)

- Managing Account PortfoliosDocument14 pagesManaging Account PortfoliosDiarra LionelNo ratings yet

- Airline Industry Metrics - MA - Summer 2017Document21 pagesAirline Industry Metrics - MA - Summer 2017Yamna HasanNo ratings yet

- 7 Unemployment Mankiw9e Lecture Slides Chap14Document21 pages7 Unemployment Mankiw9e Lecture Slides Chap14Kwesi WiafeNo ratings yet

- Small Business & Entrepreneurship - Chapter 14Document28 pagesSmall Business & Entrepreneurship - Chapter 14Muhammad Zulhilmi Wak JongNo ratings yet

- Print Control PageDocument1 pagePrint Control PageCool Friend GksNo ratings yet

- Kisan Diwas - 2013Document9 pagesKisan Diwas - 2013sumeetchhabriaNo ratings yet

- 7.1 Ec PDFDocument2 pages7.1 Ec PDFEd Z0% (1)

- IGCT PresentationDocument14 pagesIGCT PresentationNinAd Pund100% (2)