Professional Documents

Culture Documents

Joycemengresume PDF

Uploaded by

DanishevOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joycemengresume PDF

Uploaded by

DanishevCopyright:

Available Formats

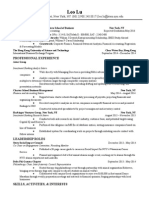

JOYCE S.

MENG

E-mail: joycemeng@gmail.com, Home Address: 67 Wall Street, Apt 2L, New York City, NY 10005; Cell Phone (US):703.463.7383

Oxford University, Balliol College

MSc Financial Economics (Said Business School)

June 2010

o

Graduated with distinction (given to approximately ~10% of class), Deans List, served as Course Representative

o

Studied asset pricing models, corporate finance theory, and financial econometrics (volatility modeling and time series analysis in Matlab)

MSc Economics for Development (Awarded Distinction, given to approximately ~10% of class)

June 2009

o

Awarded the George Webb Medley Prize for Best Overall Performance and Arthur Lewis Prize for Excellence in Development Economics

o

Extended Essay: Aspirations and Schooling: The formation and intra-household impact of educational aspirations in rural China

University of Pennsylvania: Huntsman Joint Degree Program: Graduated summa-cum laude (4.0 GPA)

May 2008

The Wharton School: B.S in Economics; Concentration: Finance

College of Arts and Sciences: B.A in International Studies, Minors: Mathematics, Spanish

Universidad Pontifica Comillas (ICADE: Facultad de Ciencias Econmicas y Empresariales) Madrid, Spain

Fall 2006

Undergraduate GPA: 4.0/4.0; Honors: Rhodes Scholar 2008, Selected as a Marshall Scholar 2008, Forbes 30 Under 30 Changing the World 2014

(Education), Philadelphia 76ers Heroes Among Us Recipient (November 2013), Phi Beta Kappa, Beta Gamma Sigma, Joseph Wharton Scholar, Benjamin

Franklin Scholar, University Scholar, Wharton Research Scholar, StartingBloc, Premio Ellacuria (Prize in Studies of Social Interest at ICADE), James

Howard Weiss Memorial Award (given to one Penn senior demonstrating academic excellence), Delta Sigma Pi Scholarship Key (presented to graduating

senior with the highest GPA at Wharton), St. Gallen Wings of Excellence Award

PRIVATE SECTOR EXPERIENCE:

Vernier Capital (New York City), Co-Founding Member and Senior Analyst

January 2014 present

Joined former GSIP colleagues to launch a global long/short fundamental hedge fund focused on consumer-facing businesses. Vernier has a philosophy

of investing in high quality compounding companies with business moats and strong capital allocation track record at a discount to intrinsic value

Identified and made investments in global healthcare companies, domestic retail/consumer businesses, and secular emerging markets share gainers. For

shorts, developed a proprietary negative momentum and earnings inflection screen which has generated alpha

MSD Capital (New York City), Investment Analyst

February 2012 December 2013

Conducted due diligence and made long/short investments in global chemicals, midstream/MLP, E&P, coal, basic materials, and other energy subsectors

Delivered differentiated investment valuations and returns by identifying attractive risk-reward opportunities across the global energy value chain,

investing in structural global winners and losers from shale oil and gas development in the United States for long and short themes

Developed proprietary screens for idea generation, leveraged statistical knowledge for portfolio analytics and risk management

Goldman Sachs Investment Partners (New York City), Analyst

Summer 2009, August 2010-February 2012

Built financial valuation models and analyzed equity, derivatives, and debt investment opportunities in the industrials and energy sectors

Created grounds-up models to identify attractive sub-sector shorts. GSIP is a $9bn long-short equity fund utilizing fundamental investing strategies

Focused particularly on short themes and bottoms-up supply and demand analysis to identify over-earning industries and structural changes

Bain Capital, Sankaty Advisors (Boston), Summer Analyst

Summer 2008

Analyzed credit investment opportunities in the automotive and healthcare sectors at Sankaty Advisors, a $30bn credit hedge fund of Bain Capital

Created valuation models, analyzed industry fundamentals, and prepared sensitivity cases to determine investment positions

Goldman Sachs (New York City), Investment Banking Summer Analyst in Natural Resources Leveraged Finance (Commodity Finance)

Created LBO and construction financing models, prepared sensitivity cases and industry analyses about the power and O&G sectors

Aided in the preparation of transaction marketing materials, analyzed financial statements, assisted in the execution of various live deals

Summer 2007

Credit Suisse (Hong Kong), Investment Banking Summer Analyst in Debt Capital Markets

Summer 2006

Wrote daily and weekly market commentary, created pitch-books covering all of Non-Japan Asia, created Asia bond database with VBA

Taishin International Bank (Taipei), Intern in the Retail Banking Marketing and Product Development Division

Summer 2005

Applied data mining techniques using SAS and SQL to perform marketing campaign post-mortem analysis for CRM, created database models

ECONOMIC DEVELOPMENT AND RESEARCH EXPERIENCE:

Givology (www.givology.org), Co-Founder and Chief Executive Officer

Spring 2008-present

Founded an online P2P giving marketplace that connects donors to grassroots education projects and student scholarships in the developing world

Raised ~$400,000 to help ~3,100 students in 28+ countries through 48+ grassroots partnerships. Givology has 11,000+ donors and receives ~30,000 web

hits daily, with 18 chapters worldwide (highly active in NYC), 100+ volunteers, and a partnership with the M Night Shyamalan Foundation

Selected as one of the Top 100 Student-Run Companies by the Kairos Society and won the Intelius Award for Social Entrepreneurship

Featured by Nicholas Kristof in the NYT and Half the Sky, Forbes Magazine, Philadelphia 76es, Knowledge@Wharton, MTVAct, among other media

Co-authored a book A Guide to Giving (available on Amazon.com) sold 6,000+ copies; launching product line www.giveinspiration.org

General Enterprise (www.generationenterprise.org), Co-Founder and Chief Financial Officer

Spring 2007-Fall 2010

Founded a microbusiness incubator for street youth in Lagos, Nigeria, which piloted in August 2009 (Formerly named YouthBank)

Developed the business plan and operational model, conducted market analyses, created budget and accounting system, raised $43,000+ for launch

Opportunity International, Intern

Fall 2008-Summer 2009

Used econometrics to evaluate a financial literacy campaign in Malawi, designed child savings product and baseline surveys for Mozambique

World Bank, Consultant in the Finance and Private Sector Development Research Group

Summer 2008-Fall 2008

Analyzed patterns of international capital raisings and determinants of debt issuance. Performed cross sectional and multinomial logit regressions

Foundation for International Community Assistance (FINCA) Microfinance, Client Assessment Fellow, Data Analyst

Spring 2006- Summer 2007

Conducted 800 client interviews in rural villages of four different Mexican states, presented poverty reach findings to FINCA Mexico head

Performed quantitative statistical analysis of social metric impact assessment data of village banking programs in Latin America

Nantik Lum Microfinance Institute (Madrid), Project Manager/Scholar Grant Recipient

Created an action plan for changing the Chiapas collective projects into a full group solidarity lending model

Supervised the writing, translation, and publication of the Nantik Lum research monograph for the European Microfinance Network

Fall 2006

OTHER COMMUNITY EXPERIENCES:

Speech and Debate (National Forensics Association), Debate Captain & Coach

Fall 2000-Spring 2008

Placed 1st and 2nd respectively in the 2006 and 2007 Pennsylvania State Championship Tournament, led team to 4th place victory in the 2007 National

Forensic League Championships

Captained the only student-led team in the National Forensics League Circuit, serving dual roles as coach and captain

Computer Skills Proficient with Microsoft Suite, STATA, Matlab, SQL, html, CSS, VBA, Photoshop, basic Java, elementary SAS

Language Skills Fluent in Spanish (11 years intensive training), Heritage speaker of Mandarin Chinese

Other Interests Ice Hockey (Awarded Most Valuable Player at Oxford University, continues to play at Chelsea Piers), Violin, Piano, Social

Entrepreneurship, Development Economics

You might also like

- Nyu Stern Mpa Resume - Book 2011 SpringDocument12 pagesNyu Stern Mpa Resume - Book 2011 Springsamirnajeeb0% (1)

- Princeton MF Resume BookDocument11 pagesPrinceton MF Resume BookAlex Hang Li100% (2)

- WSO FT Banking ResumeDocument1 pageWSO FT Banking ResumeJohn MathiasNo ratings yet

- Experienced Investment Banker Resume Template Transaction PageDocument3 pagesExperienced Investment Banker Resume Template Transaction PageMohamed AbdullaNo ratings yet

- Dardenresume PEDocument36 pagesDardenresume PEkk235197No ratings yet

- WSO Resume 119861Document1 pageWSO Resume 119861John MathiasNo ratings yet

- Wharton MBADocument23 pagesWharton MBANur Al AhadNo ratings yet

- WSO ReviewDocument1 pageWSO ReviewJohn MathiasNo ratings yet

- M&A Course SyllabusDocument8 pagesM&A Course SyllabusMandip LuitelNo ratings yet

- Investment Banking Cover Letter TemplateDocument2 pagesInvestment Banking Cover Letter TemplateBrian OuNo ratings yet

- IB Interview Guide, Module 2 AccessDocument4 pagesIB Interview Guide, Module 2 AccessKerr limNo ratings yet

- Investment Banking Generic Cover LetterDocument1 pageInvestment Banking Generic Cover LetterbreakintobankingNo ratings yet

- Access Top IB Interview Guide ModuleDocument24 pagesAccess Top IB Interview Guide ModuleSuhasNo ratings yet

- WSO Resume - DemolishedDocument1 pageWSO Resume - DemolishedJack JacintoNo ratings yet

- Investment Banking Resume III - AfterDocument1 pageInvestment Banking Resume III - AfterbreakintobankingNo ratings yet

- Private Equity Resume GuideDocument7 pagesPrivate Equity Resume GuideJack JacintoNo ratings yet

- Undergraduate Story Templates for IBDocument4 pagesUndergraduate Story Templates for IBKerr limNo ratings yet

- 2007 Resume BookDocument14 pages2007 Resume BooknachiketaaaNo ratings yet

- M&a Interview QuestionsDocument1 pageM&a Interview QuestionsJack JacintoNo ratings yet

- IBIG 01 01 Quick Start Guide PDFDocument4 pagesIBIG 01 01 Quick Start Guide PDFdanielNo ratings yet

- WST University Training MALBODocument5 pagesWST University Training MALBOJason ToopNo ratings yet

- WSO Resume Nov3Document1 pageWSO Resume Nov3John MathiasNo ratings yet

- Merger Model GuideDocument118 pagesMerger Model GuideAsa GellerNo ratings yet

- VP Investors Relations in New York City Resume Marlin ReyesDocument1 pageVP Investors Relations in New York City Resume Marlin ReyesMarlin ReyesNo ratings yet

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- Investment Banking Personal Cover LetterDocument1 pageInvestment Banking Personal Cover LetterbreakintobankingNo ratings yet

- Wharton Resume Advice EntrepreneurshipDocument2 pagesWharton Resume Advice EntrepreneurshipSumant MeherNo ratings yet

- Ibig 04 08Document45 pagesIbig 04 08Russell KimNo ratings yet

- Cover Letter Goldman SachsDocument1 pageCover Letter Goldman SachsAnonymous GL6svDNo ratings yet

- Vault Guide PEDocument155 pagesVault Guide PENéné Oumou BARRYNo ratings yet

- Investment Banking Cover Letter TemplateDocument2 pagesInvestment Banking Cover Letter TemplateMihnea CraciunescuNo ratings yet

- Spring Week GuideDocument32 pagesSpring Week Guidevimanyu.tanejaNo ratings yet

- Annotated Investment Banking Graduate Job Covering LetterDocument1 pageAnnotated Investment Banking Graduate Job Covering LetterNuttyahNo ratings yet

- Consolidated Interview Questions (IB) PDFDocument7 pagesConsolidated Interview Questions (IB) PDFEric LukasNo ratings yet

- Finance and Math Student Seeking Analyst RoleDocument1 pageFinance and Math Student Seeking Analyst RoleDevin MaaNo ratings yet

- StreetOfWalls - Question Set PDFDocument21 pagesStreetOfWalls - Question Set PDFEric LukasNo ratings yet

- Lu Leo ResumeDocument2 pagesLu Leo ResumeLeo LuNo ratings yet

- 03 03 Technical Interview Basic PDFDocument9 pages03 03 Technical Interview Basic PDFAgung Racers WeightliftingNo ratings yet

- LBO TutorialDocument8 pagesLBO Tutorialissam chleuhNo ratings yet

- Elevator Pitch DraftDocument2 pagesElevator Pitch DraftJack JacintoNo ratings yet

- Chris Warley ResumeDocument1 pageChris Warley ResumechriswarleyNo ratings yet

- IB Interview Guide, Module 2: Undergraduate and Recent Graduate Story Templates - Liberal Arts To Investment BankingDocument3 pagesIB Interview Guide, Module 2: Undergraduate and Recent Graduate Story Templates - Liberal Arts To Investment BankingKerr limNo ratings yet

- IB Interview Guide, Module 3: Deal Discussion Example - ADT (Leveraged Buyout)Document3 pagesIB Interview Guide, Module 3: Deal Discussion Example - ADT (Leveraged Buyout)Sofia MouraNo ratings yet

- MBA Investment Banking Resume TemplateDocument2 pagesMBA Investment Banking Resume TemplatesensibledeveshNo ratings yet

- Paper LBO Model Solutions BIWSDocument10 pagesPaper LBO Model Solutions BIWSDorian de GrubenNo ratings yet

- WSO ResumeDocument1 pageWSO ResumeJohn MathiasNo ratings yet

- Investment Banking Resume II - AfterDocument1 pageInvestment Banking Resume II - AfterbreakintobankingNo ratings yet

- Valuing A Business: Corporate Finance Directors' BriefingDocument4 pagesValuing A Business: Corporate Finance Directors' BriefingRupika SharmaNo ratings yet

- PE Interview Technical Collection - 0Document4 pagesPE Interview Technical Collection - 0Politics RedefinedNo ratings yet

- Investment Banking Interview Guide: Course OutlineDocument20 pagesInvestment Banking Interview Guide: Course OutlineTawhid SyedNo ratings yet

- Yan Zhichao John CVDocument1 pageYan Zhichao John CVJohn MathiasNo ratings yet

- Stanford Book 1 PDFDocument117 pagesStanford Book 1 PDFAnuprava ChatterjeeNo ratings yet

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- The Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsFrom EverandThe Handbook of Financing Growth: Strategies, Capital Structure, and M&A TransactionsNo ratings yet

- JoycemengresumeDocument1 pageJoycemengresumebmehlerNo ratings yet

- Proctor and Gamble Case Study PDFDocument2 pagesProctor and Gamble Case Study PDFDanishevNo ratings yet

- Branding Definitions ExplainedDocument4 pagesBranding Definitions ExplainedDanishevNo ratings yet

- + Koe,-Costello-and-Taylor-2016-Luxury-Branding-Review-of-the-LiteratureDocument9 pages+ Koe,-Costello-and-Taylor-2016-Luxury-Branding-Review-of-the-LiteratureDanishevNo ratings yet

- Proctor and Gamble Case Study PDFDocument2 pagesProctor and Gamble Case Study PDFDanishevNo ratings yet

- IFRS9 Print PDFDocument86 pagesIFRS9 Print PDFSergiu Boldurescu100% (1)

- + Brand Equity Pyramid HandoutDocument2 pages+ Brand Equity Pyramid HandoutDanishevNo ratings yet

- Oral Presentation Handout - OriginalDocument6 pagesOral Presentation Handout - OriginalAlina PopescuNo ratings yet

- Proctor and Gamble Case Study PDFDocument2 pagesProctor and Gamble Case Study PDFDanishevNo ratings yet

- Carlton Presentations PDFDocument21 pagesCarlton Presentations PDFVenkat Subba Rao YammaniNo ratings yet

- Justin Chak: EducationDocument1 pageJustin Chak: EducationDanishevNo ratings yet

- 001 Bup 0Document20 pages001 Bup 0DanishevNo ratings yet

- Primary Care Quality Management in UZBDocument91 pagesPrimary Care Quality Management in UZBDanishevNo ratings yet

- Mgt501-Mba501 Lecture 11Document8 pagesMgt501-Mba501 Lecture 11DanishevNo ratings yet

- Introduction To Accounting & Accounting Concepts and Policies IDocument24 pagesIntroduction To Accounting & Accounting Concepts and Policies IDanishevNo ratings yet

- Introduction To Accounting & Accounting Concepts and Policies IDocument24 pagesIntroduction To Accounting & Accounting Concepts and Policies IDanishevNo ratings yet

- Department of Economics Yale UniversityDocument30 pagesDepartment of Economics Yale UniversityDanishevNo ratings yet

- McKinsey-USPS Future Business ModelDocument39 pagesMcKinsey-USPS Future Business ModeljavenegasNo ratings yet

- Ifrsresources (Dec 2012)Document10 pagesIfrsresources (Dec 2012)DanishevNo ratings yet

- 6Document17 pages6DanishevNo ratings yet

- The World BankDocument8 pagesThe World BankDanishevNo ratings yet

- Sample of Assurance of Independent Research Carried Out by The StudentDocument1 pageSample of Assurance of Independent Research Carried Out by The StudentDanishevNo ratings yet

- Yale College Student Recent Graduate ResumesDocument12 pagesYale College Student Recent Graduate ResumesDanishev100% (1)

- 180 Succesful Business School EssaysDocument129 pages180 Succesful Business School EssaysscagneasNo ratings yet

- RMDocument15 pagesRMDanishevNo ratings yet

- Customer Satisfaction Measurement in Letterkenny HotelsDocument6 pagesCustomer Satisfaction Measurement in Letterkenny HotelsDanishevNo ratings yet

- 10 033 PDFDocument36 pages10 033 PDFDanishevNo ratings yet

- Measuring Service Quality in The Hotel Industry A Study in A Business HotelDocument23 pagesMeasuring Service Quality in The Hotel Industry A Study in A Business HotelMyrna RiveraNo ratings yet

- 1205 R Quart PDFDocument12 pages1205 R Quart PDFDanishevNo ratings yet

- Working Paper: Anselmo Rubiralta Center For Globalization and Strategy Center For Business in SocietyDocument19 pagesWorking Paper: Anselmo Rubiralta Center For Globalization and Strategy Center For Business in SocietyJhora PataNo ratings yet

- Controls in Revenue - Expenditure CycleDocument28 pagesControls in Revenue - Expenditure CycleKhen CaballesNo ratings yet

- E Office UO Note FormatDocument2 pagesE Office UO Note Formatvksgaur4_219583758No ratings yet

- BPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988 Ruling on Contract of DepositDocument4 pagesBPI vs. Intermediate Appellate Court GR# L-66826, August 19, 1988 Ruling on Contract of DepositaldinNo ratings yet

- CV QU Contoh CVDocument2 pagesCV QU Contoh CVroonzNo ratings yet

- Industry ProfileDocument15 pagesIndustry ProfileP.Anandha Geethan80% (5)

- Secretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFDocument2 pagesSecretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFPratik TekawadeNo ratings yet

- Small BusinessDocument11 pagesSmall BusinessSaahil LedwaniNo ratings yet

- Crabbe The Owner of The Ocean Hotel Is Concerned AboutDocument2 pagesCrabbe The Owner of The Ocean Hotel Is Concerned AboutAmit PandeyNo ratings yet

- FxPulse 3 User ManualDocument13 pagesFxPulse 3 User ManualAsepSopandiNo ratings yet

- 14th Annual Book PDFDocument78 pages14th Annual Book PDFAbhayNo ratings yet

- Apsee 327Document2 pagesApsee 327manikanta2235789No ratings yet

- 2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalDocument54 pages2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalAdedimeji FredNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Reliable Exports Lease DeedDocument27 pagesReliable Exports Lease DeedOkkishoreNo ratings yet

- Gravestone DojiDocument2 pagesGravestone Dojilaba primeNo ratings yet

- Business Finance - ModuleDocument33 pagesBusiness Finance - ModuleMark Laurence FernandoNo ratings yet

- Tax DoctrinesDocument67 pagesTax DoctrinesMinang Esposito VillamorNo ratings yet

- Revenue Regulations on Cooperative Tax ExemptionsDocument5 pagesRevenue Regulations on Cooperative Tax ExemptionsmatinikkiNo ratings yet

- Hajj Rituals - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPDocument140 pagesHajj Rituals - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPIslamicMobilityNo ratings yet

- A Study On Brand Image of Icici Prudential Life Insurance LTDDocument44 pagesA Study On Brand Image of Icici Prudential Life Insurance LTDRanjit PandaNo ratings yet

- Introduction To MacroeconomicsDocument38 pagesIntroduction To MacroeconomicsadrianrivalNo ratings yet

- Cebu People's Multi-Purpose Cooperative V Carbonilla JRDocument15 pagesCebu People's Multi-Purpose Cooperative V Carbonilla JRPrecious Ditucalan - TungcalingNo ratings yet

- FAFSA Help Guide: A Publication of The Student Loan NetworkDocument54 pagesFAFSA Help Guide: A Publication of The Student Loan NetworkeniteworkNo ratings yet

- Older Adults and BankruptcyDocument28 pagesOlder Adults and BankruptcyvictorNo ratings yet

- ECON 1012 - ProductionDocument62 pagesECON 1012 - ProductionTami GayleNo ratings yet

- History of 3M India LTD., Company - GoodreturnsDocument4 pagesHistory of 3M India LTD., Company - GoodreturnsGaganNo ratings yet

- Credit Rating Report G.P. 2 PDFDocument16 pagesCredit Rating Report G.P. 2 PDFMohammad AdnanNo ratings yet

- Option Pricing Models - BinomialDocument10 pagesOption Pricing Models - BinomialSahinNo ratings yet

- Leading by ExampleDocument5 pagesLeading by ExampleNorazuan Rozali0% (1)

- Nikon Annual ReportDocument15 pagesNikon Annual Reportksushka89No ratings yet