Professional Documents

Culture Documents

Ijettcs 2014 12 18 120

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ijettcs 2014 12 18 120

Copyright:

Available Formats

International Journal of Emerging Trends & Technology in Computer Science (IJETTCS)

Web Site: www.ijettcs.org Email: editor@ijettcs.org

Volume 3, Issue 6, November-December 2014

ISSN 2278-6856

Design and Study of Security Model for Core

Financial System

Vaibhav R. Bhedi1, Shrinivas P. Deshpande2 and Ujwal A. Lanjewar3

1

Assistant Professor

VMV Commerce, JMT Arts and JJP Science College, Nagpur

2

Associate Professor

P.G.D.C.S.T, D.C.P.E, H.V.P.M, Amravati

3

Assistant Professor

VMV Commerce, JMT Arts and JJP Science College, Nagpur

Abstract

The need of security model is to provide secure data

warehouse for core financial institutes. Security model for

core financial system is a scheme for specifying and enforcing

security policies. A security model is a statement that outlines

the requirements necessary to properly support and implement

a certain security policy. A security model provides a deeper

explanation of various types of access rights by various ways.

The security model of data warehouse for financial institutes

will provide different level of security to data warehouse. The

security model will be secured data warehouse from different

illegal accessed and provide security policy for customer,

financial institutes, data warehouse and different authorities.

The security model will overcome all the drawbacks and will

provide the complete solution over the present system.

Security model is designed to unite all financial institutes in a

network securely.

Keywords:- BUID, CORE, OLTP, OLAP.

1. INTRODUCTION

Security model for financial institute uses core banking

applications to support their operations where CORE

stands for "centralized online real-time exchange".[1]

These applications now also have the capability to address

the needs of corporate customers, providing a

comprehensive financial solution by security model. The

security model is designed for core financial system using

nine layers with customer BUID and biometric details.

The data of customer is stored in Data Warehouse through

data mart with BUID. Banks will make available all

transactions across multiple channels like ATMs, Internet

Banking, Insurances, and etc. using customer BUID

through security model. All these facilities have made

available to customers using the concept of Data

Warehouse where it is a repository of subjectively selected

and adapted operational data, which can successfully

answer any ad-hoc, complex, statistical or analytical

queries. It is situated at the centre of a decision support

system of an organization and contains integrated

historical data; both summarized and detailed information

by providing security. Using BUID card of proposed

system,[7] the customers can manages his financial needs

and transactions following security level. Security model

provide role wise security to government authorities like

Income Tax department, Financial Industry Regulatory

Volume 3, Issue 6, November-December 2014

Authority, Financial Services Authority, Reserve Bank of

India (RBI), Securities and Exchange Board of India

(SEBI), Forward Markets Commission (India) (FMC),

Insurance Regulatory and Development Authority

(IRDA), etc can easily centralized managed and overall

control on all financial system through maintaining data

warehouse of either individual or a group. Core banking

solutions is new jargon frequently used in banking

circles.[2] The advancement in technology, especially

Internet and information technology has led to new ways

of doing in financial system. The security model is

designed for transaction process using overall financial

system and the data of customer is stored in Data

Warehouse through data mart with BUID. Banks will

make available all transactions across multiple channels

like ATMs, Kiosk, Funds, Call center, Internet, Portal and

Mobile using customer BUID by security model. Data

warehouse architecture for financial institute will help to

control and monitor the Income details, Transaction

details, tax department and other details of the

customers.[6] The Data warehouse architecture for

financial institute will overcome all the drawbacks and

will provide the complete solution over the present system.

Here the data warehouse architecture for financial institute

is designed to connect all financial institutes in a network

under one roof and the data of customers are stored in

Data Warehouse through data mart. Security model will

facilitate Data warehouse architecture for financial

institute by providing security.

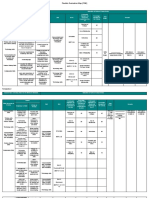

2. DATA WAREHOUSE ARCHITECTURE

FOR FINANCIAL INSTITUTES

The data warehouse architecture for financial institute has

seven vertical layers and different process to complete the

task. This architecture will help to control and monitor the

Income details, Transaction details, tax department and

other details of the customers.[6] The architecture will

overcome all the drawbacks and will provide the complete

solution over the present system. Here the data warehouse

architecture for financial institute is designed to connect

all financial institutes in a network and the data of

customers are stored in Data Warehouse through data

mart. As we are maintaining Data Warehouse, the data

will be stored in a centralized form and can maintain

historical data. Due to Data Warehouse, The Online

Page 189

International Journal of Emerging Trends & Technology in Computer Science (IJETTCS)

Web Site: www.ijettcs.org Email: editor@ijettcs.org

Volume 3, Issue 6, November-December 2014

transaction processing (OLTP) and Online Analytical

Processing (OLAP) can be used for efficient decision

making process. The main advantage of data warehouse

architecture for financial institute with BUID will become

dynamic to perform a role to boost up the present financial

system. Here data warehouse architecture for financial

institutes needs security that why we introduced security

model of data warehouse architecture for financial

instit

utes.

3. NEED OF SECURITY MODEL

The channels, financial institutes and customers will

access proposed data warehouse for financial institutes.

Data warehouse architecture for financial institutes needed

security from illegal access through unauthorized user.

Several security levels should provide to data warehouse

from illegal access. There should be security level between

customers and all financial institutes to make safe every

transaction happen using BUID. The BUID based system

needs security to customers while opening new account

and making transactions. Security model will provide

security to customers while opening new account and

making transactions. Security model will identify

biometric detail of customer and make allow for

transaction. Security model should provide security for

online, mobile, kiosk, green computing and financial

institute etc transaction of customers using BUID. All

financial institutes required security for employees

because they have biometric details and user ID password

according to his role in financial institutes which will be

stored in data warehouse for authentication to fulfill the

request. The security model will check authentication of

each financial institute employees while giving rights to

make transaction by verifying biometric detail and user

ID. Channels like Government accountant and auditors,

government legal regulatory and authority, income tax

department, all tax departments, atm/kiosk/portal and all

financial institutes are required security. The channels

employees also have biometric details and user ID

password according to their role in particular department

will have authority to view the financial transaction of

Volume 3, Issue 6, November-December 2014

ISSN 2278-6856

particular person or organization. Data warehouse and its

maintenance need Security from illegal access. Every

transaction required final authentication point of security

through security model for all customers, financial

institute employees and all channels employee. The

security model will help to address the issues related

security like illegal access, authentication, verification etc.

4. SECURITY

MODEL

OF

DATA

WAREHOUSE

ARCHITECTURE FOR

FINANCIAL INSTITUTES

The security model of data warehouse for financial

institutes will provide different level of security to data

warehouse by authenticating biometric details and BUID.

The security control model has nine vertical layers

included four different level of security i.e. Level 1, Level

2, Level 3 and Level 4 and maintenance of data

warehouse. Security level will control different type of

user in different way. The security model will be secured

Page 190

International Journal of Emerging Trends & Technology in Computer Science (IJETTCS)

Web Site: www.ijettcs.org Email: editor@ijettcs.org

Volume 3, Issue 6, November-December 2014

data warehouse from different illegal accessed. The

security model will provide security policy for customer,

financial institutes, data warehouse and different

authorities. The security model will overcome all the

drawbacks and will provide the complete solution over the

present system. Here the security model is designed to

connect all financial institutes in a network securely. Due

to Data Warehouse, The Online transaction processing

(OLTP) and Online Analytical Processing (OLAP) can be

used for efficient decision making process by different

level of security in security model.

4.1 Model Description

The model has nine layers, these are customer with BUID,

all financial institutes, security control and maintenance,

OLAP engine, front end tools and channels defined in

well manner and process pursues exactly each and every

one steps. The description about various layers of security

model of data warehouse for financial institutes is as

follows:LAYER 1. Customer with BUID: Every financial institute

will be provided and worked through customers BUID

(Bank unique Identification) coded card. The BUID can be

easily unified in current financial system. ATM, Kiosk,

Funds, Call Center, Internet, Portal and Mobile, etc with

BUID will be used to make transaction using data

warehouse architecture for financial institute in overall

financial system. The BUID will be well-built to execute a

position to augment the present financial core system for

Bank, Insurance, Shares, Bonds, Post Office, Income tax,

Import/Export and loans through several channels.[7]

LAYER 2. Security Level 1: It is second layer of security

model. The security level 1 is a wall between customers

and all financial institutes. Every transaction will be

happened using BUID. It will provide security to

customers while opening new account and making

transactions. Security level 1 will identify biometric detail

of customer while making transactions using BUID. Every

transaction will be happened using BUID through security

level 1. It will identify customer BUID and make allow for

transaction. Security level 1 is providing security for

online, mobile, kiosk, green computing and financial

institute etc transaction of customers using BUID.

LAYER 3. All Financial Institutes: In this layer all

financial institutes included Banks, Insurance, Shares,

Bonds, Post Office, Income tax, Import/ Export, Loan etc

in security model will have branches. Suppose, Bank has

branches like B1, B2, B3.Bn. The branch B1 have sub

branches like Sub B1.1, Sub B1.2, Sub B1.3Sub

B1.n. The structure will be same for B2, B3 and Bn. The

branch B2 will have sub branches like Sub B2.1, Sub

B2.2, Sub B2.3Sub B2.n, branch B3 will have Sub

B3.1, Sub B3.2, Sub B3.3Sub B3.n and branch Bn

will have Sub Bn.1, Sub Bn.2, Sub Bn.3Sub Bn.n.

The remaining financial institute like Insurance, Shares,

Bonds, Post Office, Import/Export etc in financial

transaction model will also be followed the same above

said structure of branches to maintain the transparency

and financial transaction of particular financial

institute.[8]

Volume 3, Issue 6, November-December 2014

ISSN 2278-6856

LAYER 4. Security Level 2: The security level 2 is placed

in between all financial institutes and data warehouse

layer. All financial institute employees have biometric

details and user ID password according to his role in

financial institutes. The role of employee will vary

according to their designations in financial institutes. The

employee of all financial institutes will be provided user

ID and password with cross checking of their biometric

detail, which will be stored in data warehouse for

authentication to fulfill the request. The security level 2

will check authentication of each financial institute

employee while giving rights to make transaction by

verifying biometric detail and user ID. Security level 2

will pass request to security level 4 associate with data

warehouse for further access.

LAYER 5. Channels: It is a seventh layer of security

model. It included with Government accountant and

auditors, government legal regulatory and authority,

income

tax

department,

all

tax department,

atm/kiosk/portal and all financial institutes. They are end

users of proposed security model.

LAYER 6. Security Level 3: The security level 3 is placed

in between front end tools of data warehouse and various

channels like Government accountant and auditors,

government legal regulatory and authority, income tax

department, all tax departments, atm/kiosk/portal and all

financial institutes. All various channels employees have

biometric details and user ID password according to their

role in particular department will have authority to view

the financial transaction of particular person or

organization and The biometric detail and user ID of

employee will be stored in data warehouse for

authentication purpose. The security level 4 will check

authentication of each employee of particular department

while giving rights to view transaction of person or

organization by verifying biometric detail and user ID.

LAYER 7. Front End Tool: It is a seventh layer of

security model included report writer, EIS/DSS, data

miming and alert system. Data query and reporting tools

used for deliver warehouse-wide data access through

simple interfaces that hide the SQL language from all

financial institute end users. These tools are designed for

list-oriented queries, basic drill-down analysis and report

generation. EIS and Decision support systems (DSS) are

packaged applications that run against warehouse data.

EIS and DSS are development tools that enable the rapid

development and maintenance of custom-made decisional

system. Data mining tools search for inconspicuous patters

in transaction-grained data to shed new light on the

operations of the financial institute. Alert system provides

alerts from the data warehouse database to support

strategic decisions. It will also highlight and get users

attention based on defined exceptions.

LAYER 8. OLAP Engine: It is a sixth layer of data

warehouse for financial institutes. OLAP applications

share a set of user of all financial institutes. An OLAP

server provides functionality and performance that

leverages the proposed data warehouse for reporting,

analysis, modeling and planning requirements.[12] These

Page 191

International Journal of Emerging Trends & Technology in Computer Science (IJETTCS)

Web Site: www.ijettcs.org Email: editor@ijettcs.org

Volume 3, Issue 6, November-December 2014

processes mandate that the financial institute looks not

only at past performance, but more importantly, at the

future performance of the business. It is essential to create

operational scenarios that are shaped by the past yet also

include planned and potential changes that will impact

tomorrows financial institute performance.[6]

LAYER 9. Security Level 4: Security level 4 is associate

with data warehouse and its maintenance. It is final

authentication point of security model for all customers,

financial institute employees and all channels employee.

Security level 4 will have already stored biometric detail

and user ID of all customers, all financial institute

employees and all channels authorize employee. Every

branch of financial institutes will maintain their data

individual level and maintained data will store in data

warehouse through security level 2 and security level 4.[8]

Security level 1, Security level 2 and Security level 3 will

pass request to security level 4 associate with data

warehouse for further access. It will give permission after

final authentication to access the data warehouse for view

or make transaction in account.

5. ADVANTAGES OF SECURITY MODEL

OF DATA WAREHOUSE ARCHITECTURE

FOR FINANCIAL INSTITUTES

Data warehouse architecture for financial institutes will be

out of harm's way by four layers of security model.

Security model provide security to customer while making

transaction and opening the account by security level 1 to

data warehouse. Security Model of Data warehouse

Architecture for Financial Institutes will identify

biometric detail of customer while making transactions

using BUID. Every transaction will be happened using

BUID through security model. Security model is providing

security for online, mobile, kiosk, green computing and

financial institute etc transaction of customers using

BUID. The employee of all financial institutes will be

provided user ID and password with cross checking of

their biometric detail, which will be stored in data

warehouse for authentication. The security model will

check authentication of each financial institute employees

while giving rights to make transaction by verifying

biometric detail and user ID. All various channels

employees can view the financial transaction of particular

person or organization by authenticating biometric details

and user ID password according to their role in particular

department. Security model have already stored biometric

detail and user ID of all customers, all financial institute

employees and all channels employee. It gives permission

after final authentication to access the data warehouse for

view or make transaction in account.

6. CONCLUSION

The security model of data warehouse architecture for

financial institutes has provided several level of security to

financial institute data warehouse. Every transaction of

financial institute has happened using BUID through

security model. Security model is providing security for

online, mobile, kiosk, green computing and financial

institute etc transaction of customers using BUID. The

Volume 3, Issue 6, November-December 2014

ISSN 2278-6856

employee of all financial institutes has provided user ID

and password with cross checking of their biometric

detail, which is stored in data warehouse for

authentication to fulfill the request of customer. All

authorized employees of government can view the

financial transaction of particular person or organization

by authenticating biometric details and user ID password

according to their role in particular department. The

proposed security model serves comprehensive security to

core financial system to make secure transaction using

BUID.

REFERENCE

[1] Scott Simmons, Modernizing banking core systems

online

available:

http://www.ibm.com/developerworks/websphere/techj

ournal/0809_col_simmons/0809_col_simmons.html

[2] Role of core banking solutions - EY - India - Ernst &

Young,

available

on

:www.ey.com/IN/en/.../Techbytes---Role-of-corebanking-solutions

[3] Vaibhav R Bhedi, Ujwal A Lanjewar and Shrinivas P

Deshpande, Design and Study of 7 - Tier

Architecture Model for Opening Account in Present

Financial System. International Journal of Computer

Applications (0975 8887) 37(3):25-29, January

2012. Published by Foundation of Computer Science,

New York, USA.

[4] Oracle FLEXCUBE Core Banking Brochure.

Available

on:

http://www.oracle.com/us/industries/financialservices/046059.pdf

[5] Core Banking Modernization , For improved

operating leverage, increased flexibility and

sustainable competitive differentiation available on:

http://www05.ibm.com/cz/businesstalks/pdf/Core_Banking_Mod

ernization_Point_of_View.PDF

[6] Vaibhav R Bhedi, Shrinivas P Deshpande and Ujwal

A Lanjewar Data Warehouse Architecture for

Financial Institutes to Become Robust Integrated Core

Financial System using BUID. International Journal

of Advanced Research in Computer and

Communication Engineering Vol. 3, Issue 3, March

2014. ISSN (Online) : 2278-102, ISSN (Print) : 23195940

[7] Vaibhav R Bhedi, Ujwal A Lanjewar and Shrinivas P

Deshpande, BUID: A Virtual Agent to Become

Robust Integrated Core Financial System.

International Journal of Advanced Research in

Computer Science Volume 3, No. 3, May-June 2012.

[8] Vaibhav R Bhedi. Design and Study of Financial

Transaction Model for BUID. International Journal

of Computer Applications (0975 8887) ISBN: 97393-80870-28-,57(13):12-15,

November

2012.

Published by Foundation of Computer Science, New

York, USA.

Page 192

International Journal of Emerging Trends & Technology in Computer Science (IJETTCS)

Web Site: www.ijettcs.org Email: editor@ijettcs.org

Volume 3, Issue 6, November-December 2014

ISSN 2278-6856

[9] Reliable Implementation Frameworks for Core

Banking

Transformation,

available

on:

http://www.infosys.com/finsights/Documents/pdf/issu

e5/09-reliable-transformation-framework.pdf

[10] M/S S. Sathnanakrishanan, 2005. Information System

for Banks, 2005, M/S/, Taxman publication, Pvt. Ltd.

[11] C.S.R. Prabhu, Data warehousing concepts,

Techniques, Product & Application, Third Edition,

April 2011, PHI publication.

[12] The Role of the OLAP Server in a Data

Warehousing Solution Online available on:

http://www.oracle.com/technetwork/middleware/bifoundation/olap-in-a-data-warehousing-solution128690.pdf

Volume 3, Issue 6, November-December 2014

Page 193

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Experimental Investigations On K/s Values of Remazol Reactive Dyes Used For Dyeing of Cotton Fabric With Recycled WastewaterDocument7 pagesExperimental Investigations On K/s Values of Remazol Reactive Dyes Used For Dyeing of Cotton Fabric With Recycled WastewaterInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Detection of Malicious Web Contents Using Machine and Deep Learning ApproachesDocument6 pagesDetection of Malicious Web Contents Using Machine and Deep Learning ApproachesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- THE TOPOLOGICAL INDICES AND PHYSICAL PROPERTIES OF n-HEPTANE ISOMERSDocument7 pagesTHE TOPOLOGICAL INDICES AND PHYSICAL PROPERTIES OF n-HEPTANE ISOMERSInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Customer Satisfaction A Pillar of Total Quality ManagementDocument9 pagesCustomer Satisfaction A Pillar of Total Quality ManagementInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- An Importance and Advancement of QSAR Parameters in Modern Drug Design: A ReviewDocument9 pagesAn Importance and Advancement of QSAR Parameters in Modern Drug Design: A ReviewInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Analysis of Product Reliability Using Failure Mode Effect Critical Analysis (FMECA) - Case StudyDocument6 pagesAnalysis of Product Reliability Using Failure Mode Effect Critical Analysis (FMECA) - Case StudyInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Study of Customer Experience and Uses of Uber Cab Services in MumbaiDocument12 pagesStudy of Customer Experience and Uses of Uber Cab Services in MumbaiInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Soil Stabilization of Road by Using Spent WashDocument7 pagesSoil Stabilization of Road by Using Spent WashInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Staycation As A Marketing Tool For Survival Post Covid-19 in Five Star Hotels in Pune CityDocument10 pagesStaycation As A Marketing Tool For Survival Post Covid-19 in Five Star Hotels in Pune CityInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- THE TOPOLOGICAL INDICES AND PHYSICAL PROPERTIES OF n-HEPTANE ISOMERSDocument7 pagesTHE TOPOLOGICAL INDICES AND PHYSICAL PROPERTIES OF n-HEPTANE ISOMERSInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Study of Customer Experience and Uses of Uber Cab Services in MumbaiDocument12 pagesStudy of Customer Experience and Uses of Uber Cab Services in MumbaiInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Customer Satisfaction A Pillar of Total Quality ManagementDocument9 pagesCustomer Satisfaction A Pillar of Total Quality ManagementInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Detection of Malicious Web Contents Using Machine and Deep Learning ApproachesDocument6 pagesDetection of Malicious Web Contents Using Machine and Deep Learning ApproachesInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Analysis of Product Reliability Using Failure Mode Effect Critical Analysis (FMECA) - Case StudyDocument6 pagesAnalysis of Product Reliability Using Failure Mode Effect Critical Analysis (FMECA) - Case StudyInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Experimental Investigations On K/s Values of Remazol Reactive Dyes Used For Dyeing of Cotton Fabric With Recycled WastewaterDocument7 pagesExperimental Investigations On K/s Values of Remazol Reactive Dyes Used For Dyeing of Cotton Fabric With Recycled WastewaterInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- An Importance and Advancement of QSAR Parameters in Modern Drug Design: A ReviewDocument9 pagesAn Importance and Advancement of QSAR Parameters in Modern Drug Design: A ReviewInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Mexican Innovation System: A System's Dynamics PerspectiveDocument12 pagesThe Mexican Innovation System: A System's Dynamics PerspectiveInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Impact of Effective Communication To Enhance Management SkillsDocument6 pagesThe Impact of Effective Communication To Enhance Management SkillsInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Design and Detection of Fruits and Vegetable Spoiled Detetction SystemDocument8 pagesDesign and Detection of Fruits and Vegetable Spoiled Detetction SystemInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Challenges Faced by Speciality Restaurants in Pune City To Retain Employees During and Post COVID-19Document10 pagesChallenges Faced by Speciality Restaurants in Pune City To Retain Employees During and Post COVID-19International Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- A Comparative Analysis of Two Biggest Upi Paymentapps: Bhim and Google Pay (Tez)Document10 pagesA Comparative Analysis of Two Biggest Upi Paymentapps: Bhim and Google Pay (Tez)International Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Digital Record For Privacy and Security in Internet of ThingsDocument10 pagesA Digital Record For Privacy and Security in Internet of ThingsInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Performance of Short Transmission Line Using Mathematical MethodDocument8 pagesPerformance of Short Transmission Line Using Mathematical MethodInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Impact of Covid-19 On Employment Opportunities For Fresh Graduates in Hospitality &tourism IndustryDocument8 pagesImpact of Covid-19 On Employment Opportunities For Fresh Graduates in Hospitality &tourism IndustryInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Anchoring of Inflation Expectations and Monetary Policy Transparency in IndiaDocument9 pagesAnchoring of Inflation Expectations and Monetary Policy Transparency in IndiaInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Synthetic Datasets For Myocardial Infarction Based On Actual DatasetsDocument9 pagesSynthetic Datasets For Myocardial Infarction Based On Actual DatasetsInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Advanced Load Flow Study and Stability Analysis of A Real Time SystemDocument8 pagesAdvanced Load Flow Study and Stability Analysis of A Real Time SystemInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- A Deep Learning Based Assistant For The Visually ImpairedDocument11 pagesA Deep Learning Based Assistant For The Visually ImpairedInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Secured Contactless Atm Transaction During Pandemics With Feasible Time Constraint and Pattern For OtpDocument12 pagesSecured Contactless Atm Transaction During Pandemics With Feasible Time Constraint and Pattern For OtpInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Predicting The Effect of Fineparticulate Matter (PM2.5) On Anecosystemincludingclimate, Plants and Human Health Using MachinelearningmethodsDocument10 pagesPredicting The Effect of Fineparticulate Matter (PM2.5) On Anecosystemincludingclimate, Plants and Human Health Using MachinelearningmethodsInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Christine Jocson - EFAA1 - FEM - TemplateDocument3 pagesChristine Jocson - EFAA1 - FEM - TemplateRomano Jocson100% (1)

- Liao 2004Document14 pagesLiao 2004graynaNo ratings yet

- GSM KPI'sDocument38 pagesGSM KPI'sMorteza MoradiNo ratings yet

- 6 Naos Eng Rev01Document2 pages6 Naos Eng Rev01eduardoNo ratings yet

- Calculate Size of Circuit Breaker or Fuse For Transformer (As Per NEC)Document4 pagesCalculate Size of Circuit Breaker or Fuse For Transformer (As Per NEC)erson1981No ratings yet

- Hannstar Product Specification: Model: Hsd101Pfw2Document26 pagesHannstar Product Specification: Model: Hsd101Pfw2massipoedNo ratings yet

- Omnisphere 2Document4 pagesOmnisphere 2Seo StudioNo ratings yet

- Epsilon 140z DatasheetDocument2 pagesEpsilon 140z DatasheetRiga RingsNo ratings yet

- Laser Level-Kll0001 - KeelatDocument1 pageLaser Level-Kll0001 - KeelatfakhrulNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Man Up Cage SSWDocument2 pagesMan Up Cage SSWrossiwidnes78No ratings yet

- How To Hack WPA-WPA2 WiFi Using Kali LinuxDocument6 pagesHow To Hack WPA-WPA2 WiFi Using Kali LinuxJoel PérezNo ratings yet

- Project Execution Plan: Document NoDocument26 pagesProject Execution Plan: Document NoLeon PeterNo ratings yet

- Ipoque Product Brochure Net-Reporter WebDocument4 pagesIpoque Product Brochure Net-Reporter WebmickysouravNo ratings yet

- Service Letter: Hartzell Propeller IncDocument3 pagesService Letter: Hartzell Propeller IncAbdeslamBahidNo ratings yet

- Using Python and Sockets: System Power Supply ProgrammingDocument6 pagesUsing Python and Sockets: System Power Supply Programmingtakaca40No ratings yet

- Low-Cost Attitude Determination and Control System of The Student-Built 3U+ Cubesat SourceDocument15 pagesLow-Cost Attitude Determination and Control System of The Student-Built 3U+ Cubesat SourceBlack HunterNo ratings yet

- Arista Openstack Deployment GuideDocument40 pagesArista Openstack Deployment GuideegondragonNo ratings yet

- Betriebsanleitung Operating Instructions: Busmodul Profibus-Dp V1Document20 pagesBetriebsanleitung Operating Instructions: Busmodul Profibus-Dp V1OSAMANo ratings yet

- sc1088 PDFDocument7 pagessc1088 PDFMariuszChreptakNo ratings yet

- Toyota Hybrid SystemDocument32 pagesToyota Hybrid SystemSherman KillerNo ratings yet

- Automotive Quality High-Power: Stanley Electric's Latest High-Power IR LEDDocument1 pageAutomotive Quality High-Power: Stanley Electric's Latest High-Power IR LEDbobbbNo ratings yet

- Implementing Cisco Application Centric Infrastructure (DCACI) v1.0Document4 pagesImplementing Cisco Application Centric Infrastructure (DCACI) v1.0mohammedsuhel2020No ratings yet

- IP Fragmentation With ExamplesDocument6 pagesIP Fragmentation With ExamplesNio Zi FengNo ratings yet

- Samsung E1210S UM IND Eng Rev.1.0 090203Document2 pagesSamsung E1210S UM IND Eng Rev.1.0 090203Ahsan BurhanyNo ratings yet

- M300 Pro GNSS Receiver: FeaturesDocument2 pagesM300 Pro GNSS Receiver: FeaturesingerulcrissNo ratings yet

- ArevaDocument10 pagesArevamkbpgcilNo ratings yet

- Guidelines For ICT-RTMDocument45 pagesGuidelines For ICT-RTMDesi MundaNo ratings yet

- Acura CD Changer PinoutDocument10 pagesAcura CD Changer PinoutcenjibaNo ratings yet

- Electrical Thumb Rules (Part-2) PDFDocument2 pagesElectrical Thumb Rules (Part-2) PDFElectrical RadicalNo ratings yet

- Bollinger Bands %B (%B) - TradingView DocumentationDocument5 pagesBollinger Bands %B (%B) - TradingView DocumentationFinTNo ratings yet

- Practical Industrial Cybersecurity: ICS, Industry 4.0, and IIoTFrom EverandPractical Industrial Cybersecurity: ICS, Industry 4.0, and IIoTNo ratings yet

- Dark Data: Why What You Don’t Know MattersFrom EverandDark Data: Why What You Don’t Know MattersRating: 4.5 out of 5 stars4.5/5 (3)

- Defensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityFrom EverandDefensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityRating: 5 out of 5 stars5/5 (1)

- The Internet Con: How to Seize the Means of ComputationFrom EverandThe Internet Con: How to Seize the Means of ComputationRating: 5 out of 5 stars5/5 (6)

- Blockchain Basics: A Non-Technical Introduction in 25 StepsFrom EverandBlockchain Basics: A Non-Technical Introduction in 25 StepsRating: 4.5 out of 5 stars4.5/5 (24)

- Grokking Algorithms: An illustrated guide for programmers and other curious peopleFrom EverandGrokking Algorithms: An illustrated guide for programmers and other curious peopleRating: 4 out of 5 stars4/5 (16)

- THE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE: "THE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE"From EverandTHE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE: "THE STEP BY STEP GUIDE FOR SUCCESSFUL IMPLEMENTATION OF DATA LAKE-LAKEHOUSE-DATA WAREHOUSE"Rating: 3 out of 5 stars3/5 (1)