Professional Documents

Culture Documents

Ais

Uploaded by

JulietMaryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ais

Uploaded by

JulietMaryCopyright:

Available Formats

This housing finance scheme brings to you an excellent opportunity to have your own

house or flat. The scheme has been carefully tailored to suit your requirements. The

reasonable rate of interest that you pay will be calculated on reducing balance, i.e. you

do not have to pay interest on the loan installments actually repaid from the date of

such repayment.

Eligibility

Individual (including NRI and PIO) having minimum 21 years of age and maximum 70

years of age (all class of borrower) inclusive of repayment period.

Purpose

Purchase and construction of independent house/ready built flat for residential

purpose.

Extension/Repair/Renovation of existing house/flat not more than 50 years old.

Takeover of home loans availed from other banks/FIs.

Loan is also available for furnishing of house property.

Purchase of old house/flat not more than 30 years old.

Quantum of loan

The area-specific maximum limits for construction/purchase are as under :

Location/Centre

For Construction/ Purchase/

For Repair/

Takeover A/Cs

Extension/ Renovation

Metro/Urban/Semiurban

No upper limit

Rs.25 lac

Rural

No upper limit

Rs.7.5 lac

Loan Entitlement

Least of the Following:

i.

75% or 80% (as the case may be) of the project cost, stamp duty registration and

other documentation charges not to be included in the cost of housing property.

ii.

On

the

basis

of

monthly

income-

The total deductions existing plus the EMI of the proposed loan would be linked to

Gross Monthly Income (GMI) of the borrower as under

o

GMI upto Rs.50,000/- - 60% of GMI

GMI above Rs.50,000/- and upto Rs.1,00,000/- - 70% of GMI (subject to

minimum monthly take home pay of Rs.20,000/-)

GMI above Rs.1,00,000/- -75% of GMI (subject to minimum monthly take

home pay of Rs.30,000/-)

Processing Fee

0.5% of the loan amount, minimum Rs.1500/- & maximum Rs. 15000/Click here for rate of Interest :

Repayment

The maximum period of repayment is 30 years/360 EMI but should not be beyond 70

years in case of all class of borrower.

Security & Guarantee

EMTD of property financed.

No third party guarantee

Prepayment charge

NIL

Tax Benefits

Tax relief on principal and interest components of this loan would be available as per

provisions prevailing under Income Tax Act.

Insurance

Insurance cover on House Property under UCO Griha Raksha Yojana Scheme

to cover the risk of damage to home by natural calamities

Critical illness cover for Home Loan borrowers UCO Griha Raksha Plus to

cover the outstanding loan in case of (a) death/permanent total disability arising out

of an accident and (b) being diagnosed for contracting any of the listed critical

illness

UCO Griha Jeevan Suraksha to cover the outstanding loan in case of

accidental or natural death of borrower

For more details, please contact your nearest UCO Bank branch.

- Click here for FAQ

- List of approved Projects/Builders tie-ups

You might also like

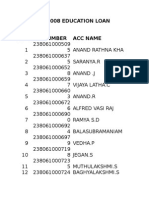

- 2008 Education Loan SN O Acc Number Acc NameDocument2 pages2008 Education Loan SN O Acc Number Acc NameJulietMaryNo ratings yet

- B.K. School of Business Management Gujarat UniversityDocument77 pagesB.K. School of Business Management Gujarat UniversityMAHESHNo ratings yet

- To Whomsoever It May Concern: Tel. No. (044) 2239 4053 (S.M.) (044) 2239 4885 E-Mail:selaiy@ucobank - Co.inDocument1 pageTo Whomsoever It May Concern: Tel. No. (044) 2239 4053 (S.M.) (044) 2239 4885 E-Mail:selaiy@ucobank - Co.inJulietMaryNo ratings yet

- What Are The Six Key Differences Between Multinational & Domestic Financial Management?Document4 pagesWhat Are The Six Key Differences Between Multinational & Domestic Financial Management?JulietMaryNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RMC No. 134-2020Document1 pageRMC No. 134-2020nathalie velasquezNo ratings yet

- OD329415113671088100Document1 pageOD329415113671088100maniksarkarmaniksarkar67No ratings yet

- House No L - 1311, Sector 5-B/3, North KARACHI, Karachi Central North Karachi Town Arsalan AkkilDocument6 pagesHouse No L - 1311, Sector 5-B/3, North KARACHI, Karachi Central North Karachi Town Arsalan AkkilMuhammad AhsanNo ratings yet

- Use The Data For The Next Four QuestionsDocument8 pagesUse The Data For The Next Four QuestionsNo FaceNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Preetesh DevNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3 - Copy BIR WebsiteDocument9 pages2551Q Jan 2018 ENCS Final Rev 3 - Copy BIR Websitedindi genilNo ratings yet

- Countrywise Withholding Tax Rates Chart As Per DTAADocument8 pagesCountrywise Withholding Tax Rates Chart As Per DTAAajithaNo ratings yet

- Cardekho: Salary Slip For The Month of November - 2021Document2 pagesCardekho: Salary Slip For The Month of November - 2021Røcky DêêpåkNo ratings yet

- Economic Impact StudyDocument3 pagesEconomic Impact StudyBASK DigitalNo ratings yet

- Tax Invoice Sulemaan Sayyedshaikh: Pay BillDocument3 pagesTax Invoice Sulemaan Sayyedshaikh: Pay Billsia hairnbeautyNo ratings yet

- T CODES 2Document13 pagesT CODES 2aashima_soodNo ratings yet

- RPR Whatsapp PDFDocument1 pageRPR Whatsapp PDFHarpinder ਮਾਨNo ratings yet

- Bir Form Percentage TaxDocument3 pagesBir Form Percentage TaxEc MendozaNo ratings yet

- (42,907 Unread) - Peteracejohn - Ingel@yahoo - Com - Yahoo MailDocument2 pages(42,907 Unread) - Peteracejohn - Ingel@yahoo - Com - Yahoo MailPeter Ace John IngelNo ratings yet

- Tugas Personal Pertama AKDocument7 pagesTugas Personal Pertama AKerni75% (4)

- My Bank StatementDocument1 pageMy Bank StatementDEMO HảiNo ratings yet

- Inclusion in Gross IncomeDocument3 pagesInclusion in Gross IncomeHi HelloNo ratings yet

- Jose Alvarado-1Document2 pagesJose Alvarado-1Yeison EscalanteNo ratings yet

- Wasssim Zhani Income Taxation of Corporations SMDocument293 pagesWasssim Zhani Income Taxation of Corporations SMwassim zhaniNo ratings yet

- Chapter-1: Principles of Income-Tax Law Self Assessment QuestionsDocument46 pagesChapter-1: Principles of Income-Tax Law Self Assessment QuestionsJasmeet SinghNo ratings yet

- Kerala State Electricity Board Limited: Demand Cum Disconnection NoticeDocument2 pagesKerala State Electricity Board Limited: Demand Cum Disconnection NoticeAskar AsaruNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Excel FileDocument3 pagesExcel FilePawan YadavNo ratings yet

- Hello!: I Am Jean Clarence MarceloDocument18 pagesHello!: I Am Jean Clarence MarceloJean MarceloNo ratings yet

- Swift MT700Document4 pagesSwift MT700FTU.CS2 Lê Phương ThảoNo ratings yet

- GeM SERVICE PROPOSALDocument2 pagesGeM SERVICE PROPOSALKartik RajputNo ratings yet

- Cta 3D CV 08259 D 2015may27 RefDocument50 pagesCta 3D CV 08259 D 2015may27 Refanorith88No ratings yet

- ITAD Ruling 7-2016Document11 pagesITAD Ruling 7-2016Haydn JoyceNo ratings yet

- Get Release ConfirmationDocument1 pageGet Release ConfirmationJobin JamesNo ratings yet

- 1.reviewer CparDocument31 pages1.reviewer CparMinie KimNo ratings yet