Professional Documents

Culture Documents

Donor Cases Doctrines Cont

Uploaded by

Kim Barrios0 ratings0% found this document useful (0 votes)

12 views3 pageshuhh;

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthuhh;

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesDonor Cases Doctrines Cont

Uploaded by

Kim Barrioshuhh;

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

ZAPANTA VS.

POSADAS

-

lNTERNAL REVENUE; INHERITANCE TAX

UPON

DONATIONS.The

principal

characteristics of a donation mortis causa, which

distinguish it essentially from a donation inter

vivos, are that in the former it is the donor's

death that determines the acquisition of, or the

right to, the property, and that it is revocable at

the will of the donor. In the donations in

question, their effect, that is, the acquisition of,

or the right to, the property, was produced while

the donor was still alive, for, according to their

expressed terms they were to have this effect

upon acceptance, and this took place during the

donor's lifetime.

2.ID.; ID.Neither can these donations be

considered as an advance on inheritance or

legacy, according to the terms of section 1536 of

the Administrative Code, because they are

neither an inheritance nor a legacy. And it cannot

be said that the plaintiffs received such advance

on inheritance or legacy, since they were not

heirs or legatees of their predecessor in interest

upon his death (sec. 1540 of the Administrative

Code). Neither can it be said that they obtained

this inheritance or legacy by virtue of a

document which does not contain the requisites

of a will (sec. 618 of the Code of Civil

Procedure).

BONSATO VS. CA

-

VDA DE ROCES VS. POSADAS

-

INHERITANCE TAX; GlFTS 'INTER VlVOS";

SECTION 1540, ADMINISTRATIVE CODE.

The gifts referred to in section 1540 of the

Revised Administrative Code are, obviously,

those donations inter vivos that take effect

immediately or during the lifetime of the donor,

but are made in consideration of his death. Gifts

inter vivos, the transmission of which is not

made in consideration of the donor's death,

should not be understood as included within the

said legal provision for the reason that it would

be equivalent to levying a direct tax on property

and not on the transmission thereof, which act is

not within the scope of the provisions contained

in Article XI of Chapter 40 of the Administrative

Code referring expressly

to tax on inheritances, legacies and other

acquisitions mortis causa.

INTERPRETATION.Such interpretation of

the law is not in conflict with the rule laid down

in the case of Tuason and Tuason vs. Posadas

(54 Phil., 289), wherein it was said that the

expression "all gifts" refers to gifts inter vivos,

because the law considers them as advances in

anticipation of inheritance in the sense that they

are gifts inter vivos made in consideration of

death. In that case, it was not held that that kind

of gifts consisted in those made completely

independent of death or without regard to it.

REQUISITES OF A DISPOSITION "MORTIS

CAUSA".A disposition post mortem should

reveal the following characteristics: (1) the

transferor retains the ownership (full or naked)

and control the property while alive; (2) the

transfer is revocable, before his death, by the

transferor at will, ad nutum; and (3) the transfer

should be void if the transferor should survive

the transferee.

3.ID.; DONATIONS "INTER Vivos".If the

donor conveys the ownership and only reserves

for himself during his lifetime the owner's share

of the fruits or procedure, and the deed expressly

declares the act to be "irrevocable", it is not a

donation mortis causa, but a conveyance inter

vivos.

DONATIONS "MORTIS CAUSA"; CASES

THEREON.In the cases held by the Supreme

Court to be transfers mortis causa and declared

invalid for not having been executed with the

formalities of testaments, the circumstances

clearly indicated the transferor's intention to

defer the passing of title until after his death.

5.DONATIONS "INTER Vivos"; REQUISITES.

The solemnities required for a donation inter

vivos are those prescribed by article 633 of the

Civil Code of 1889

PUIG VS. PENAFLORIDA

-

Donations; Inter vivos and mortis causa;

Distinguished.The Spanish Civil Code of

1889 (Art. 620) as well as the Civil Code of the

Philippines (Art. 728), admit only gratuitous

transfers of title or real rights to property either

by way of donation inter vivos or else by way of

last will and testament, executed with the

requisite legal formalities. In the first case, the

act is immediately operative, even if the actual

execution may be deferred until the death of the

donor; in the second, nothing is conveyed to the

grantee and nothing is acquired by the latter,

until the death of the grantor-testator, the

disposition being until then ambulatory and not

Same; Same; Conveyance or alienation

revocable at the discretion of donor.In

dispositions mortis causa conveyance or

alienation is revocable ad nutum, i.e., at the

discretion of the grantor or so-called "donor"

simply because the latter has changed his mind

Same; Same; Specification of whereby be

revoked.The specification in the deed of

donation of the causes whereby the act may be

revoked by the donor indicates that the donation

is inter vivos, rather than a disposition mortis

causa

Same; Same; Designation of the donation as

mortis causa not controlling criterion.The

designation of the donation as mortis causa, or a

provision in the deed to the effect that the

donation is "to take effect at the death of the

donor" are not controlling; such statements are

to be construed together with the rest of the

instrument, in order to give effect to the real

intent of the transferor (Concepcion vs.

Concepcion, supra; Bonsato vs. Court of

Appeals, supra).

Same; Same; Rules governing conveyance for

enerous consideration.A conveyance for

onerous consideration is governed by the rules

of contracts and not by those of donation or

testament

Same; Same; Nature of donation in case of

doubt.In case of doubt, the conveyance should

be deemed donation inter vivos rather than

mortis causa, in order to avoid uncertainty as to

the ownership of the property subject of the

deed.

Same; Same; Compliance or binding effect of

donation cannot be left to the sole will of

grantor.Defendant-appellant's argument that

the stipulated power of the grantor to encumber

or alienate the property to persons, other than

the donee, at any time before the grantor dies,

should be viewed as a mere resolutory condition

that does not contradict but confirms the

immediate effectivity of the donation is not

legally tenable, since it ignores the circumstance

that the co-called "resolutory condition" is one

purely dependent upon the exclusive will of the

grantor, and is proof that the deed, as executed,

is not obligatory at all (Civ. Code of 1889, Art.

1115; Civil Code of the Philippines, Art. 1182).

Confirming the rule, both the old and the new

Civil Codes prescribe that the effectivity,

compliance, or binding effect of contracts cannot

be left to the sole will of one of the parties (Art.

1256, Civ. Code of 1889; Art. 1308, Civil Code

of the Philippines).

BALAQUI VS. DANGSON

-

DONATIONS; DONATIONS "INTER VlVOS"

AND DONATIONS "MORTIS CAUSA;"

DISTINCTION BETWEEN."A donation

mortis causa differs from a donation inter vivos

in that it is made, as its name implies, in

consideration of death or mortal peril, without

the donor's intention to lose the thing or its free

disposal in case of survival, as in testamentary

dispositions, and that such is the definition

contained in the laws of the Instituta and the

Digesto, and in law 11, title 4, Partida 5, cited in

the first assignment of error, as well as in article

620 of the Civil Code, in providing that the gifts

to be governed by the rules of testamentary

succession are those taking effect upon the

donor's death; and that donations inter vivos are

those made without such consideration, but out

of the donor's pure generosity and the recipient's

deserts, although the subject matter is not

delivered at once, or the delivery is to be made

post mortem, which is a simple matter of form

and does not change the nature of the act, and

such gifts are irrevocable, especially if without a

price and onerous in character." (Decision of the

Supreme Court of Spain of January 28, 1898.)

ID. ; ID. ; ID.As the donor guaranteed the

right which she conferred on the donee by virtue

of the deed of gift, wherein, by way of

recompense for the latter's good services, she

donates to her the two parcels of land with their

improvements, said gift is inter vivos and

irrevocable,

and

not

mortis

causa,

notwithstanding the fact that the donor stated in

said deed that she did not transfer the ownership

of the two parcels of land donated, save upon

her death, for such a statement can mean nothing

else than that she only reserved to herself the

possession and usufruct of said property, and

because the donor could not very well guaranty

the aforesaid right after her death. [Balaqui vs.

Dongso, 53 Phil. 673(1929)]

mandatory.Section 119, paragraph (b)(1) and

(c) of the Tax Code does not confer on the

Commissioner of Internal Revenue or on the

courts any power and discretion not to impose

the 1% interest monthly and the 5% surcharge

for delay in payment of the gift tax already

assessed.

PIROVANO VS. CIR

-

Taxation; Gift tax; Donation out of gratitude for

past services taxable.A donation made by a

corporation to the heirs of a deceased officer out

of gratitude for his past services is subject to the

donees gift tax.

Same; Same; Same; No deduction for value of

past services.A donation made out of gratitude

for past services is not subject to deduction for

the value of said services which do not

constitute a recoverable debt.

Same; Same; Same; Gratitude not consideration

under tax code.Gratitude has no economic

value and is not consideration in the sense that

the word is used under Section 311 of the Tax

Code.

Same; Same; Collection of interest and

surcharge for delay in payment of tax

TANG HO VS. BOARD OF TAX APPEALS

-

DONATIONS; DONATION OF CONJUGAL

PROPERTY BY THE HUSBAND; RULE

UNDER CIVIL CODE OF 1889.Under the

Civil Code of 1889, a donation by the husband,

alone does not become in law a donation by both

spouses merely because it involves property of

the conjugal partnership.

4.ID. ; ID. ; ID. ; DONATION TAXABLE

AGAINST HUSBAND EXCLUSIVELY.A

donation of property belonging to the conjugal

partnership, made during its existence by the

husband alone in favor of the common children,

is taxable to him exclusively as sole donor.

You might also like

- Supreme CourtDocument2 pagesSupreme CourtKim BarriosNo ratings yet

- Zebulun TribeDocument2 pagesZebulun TribeKim BarriosNo ratings yet

- SandiganbayanDocument3 pagesSandiganbayanKim BarriosNo ratings yet

- Special Complex CrimeDocument2 pagesSpecial Complex CrimeKim BarriosNo ratings yet

- Special Complex CrimeDocument2 pagesSpecial Complex CrimeKim BarriosNo ratings yet

- Orquiola vs. CADocument13 pagesOrquiola vs. CAKim BarriosNo ratings yet

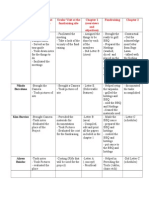

- TableDocument21 pagesTableKim Barrios100% (1)

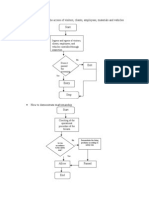

- How To Control The Access of Visitors, Clients, Employees, Materials and Vehicles StartDocument4 pagesHow To Control The Access of Visitors, Clients, Employees, Materials and Vehicles StartKim BarriosNo ratings yet

- Dendrimers For Theranostic ApplicationsDocument17 pagesDendrimers For Theranostic ApplicationsKim BarriosNo ratings yet

- LegitimesDocument3 pagesLegitimesnarockavNo ratings yet

- Fringe BenefitDocument9 pagesFringe BenefitKim BarriosNo ratings yet

- Format 1990 2000 Countries GDP Per Capita Ppopulation GDP Per Capita Population XXX XXX XXX XXX XXXDocument1 pageFormat 1990 2000 Countries GDP Per Capita Ppopulation GDP Per Capita Population XXX XXX XXX XXX XXXKim BarriosNo ratings yet

- Ocular Visit at Brgy. Lawa Ocular Visit at The Fundraising Site (Overviews and Objectives) FundraisingDocument3 pagesOcular Visit at Brgy. Lawa Ocular Visit at The Fundraising Site (Overviews and Objectives) FundraisingKim BarriosNo ratings yet

- Karl Marx's Life and WorkDocument5 pagesKarl Marx's Life and WorkKim BarriosNo ratings yet

- The Principal Commerce in Every Civilized Society Is That Between The Towns People and The Country Folk. The Raw MaterialsDocument2 pagesThe Principal Commerce in Every Civilized Society Is That Between The Towns People and The Country Folk. The Raw MaterialsKim BarriosNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Finals EconDocument8 pagesFinals Econchewykookie ahNo ratings yet

- Alonso V Cebu Country ClubDocument4 pagesAlonso V Cebu Country Clubadonis.orillaNo ratings yet

- Sababan Magic Notes - Taxation LawDocument87 pagesSababan Magic Notes - Taxation LawJoey DealinoNo ratings yet

- Tax Lecture Estate Tax Part 2Document7 pagesTax Lecture Estate Tax Part 2Kathreen Aya ExcondeNo ratings yet

- Spec Pro Digests 3rd CompilationDocument12 pagesSpec Pro Digests 3rd CompilationKia FavorNo ratings yet

- Estate Tax CasesDocument17 pagesEstate Tax CasesWarly PabloNo ratings yet

- Agtarap Vs AgtarapDocument3 pagesAgtarap Vs Agtarapcrisanto perezNo ratings yet

- Estate Tax and Some Exempt TransfersDocument3 pagesEstate Tax and Some Exempt TransfersfcnrrsNo ratings yet

- G.R. No. L-43082 June 18, 1937 PABLO LORENZO, As Trustee of The Estate of Thomas Hanley, Deceased, PlaintiffDocument25 pagesG.R. No. L-43082 June 18, 1937 PABLO LORENZO, As Trustee of The Estate of Thomas Hanley, Deceased, PlaintiffAndrea TiuNo ratings yet

- Bermuda Segregated Accounts Companies-BDADocument15 pagesBermuda Segregated Accounts Companies-BDADecimusBlueNo ratings yet

- Scotty's LandingDocument16 pagesScotty's Landingal_crespo_2No ratings yet

- 8 - Vda. de Gil Sr. v. Cancio - LAYNODocument3 pages8 - Vda. de Gil Sr. v. Cancio - LAYNORaymond ChengNo ratings yet

- Taxation Reviewer PDFDocument32 pagesTaxation Reviewer PDFIsobel CoNo ratings yet

- Marcos II v. CA DigestsDocument2 pagesMarcos II v. CA Digestspinkblush717No ratings yet

- Laco Reginald DLSLTax Rev Midterm Exam GO2 or GO3Document19 pagesLaco Reginald DLSLTax Rev Midterm Exam GO2 or GO3Greggy Law100% (1)

- COLLECTOR Vs FISHERDocument2 pagesCOLLECTOR Vs FISHERFrancise Mae Montilla MordenoNo ratings yet

- Tax Case DigestDocument2 pagesTax Case DigestPrincessNo ratings yet

- 065 - MIAA V CADocument4 pages065 - MIAA V CAKarina GarciaNo ratings yet

- Calculate Taxes, Fees and ChargesDocument81 pagesCalculate Taxes, Fees and ChargesrameNo ratings yet

- MOA SampleDocument3 pagesMOA SampleMarjorie MayordoNo ratings yet

- Taxation LawDocument127 pagesTaxation LawMark SorianoNo ratings yet

- 23 G.R. No. 120880 - Marcos II v. Court of AppealsDocument18 pages23 G.R. No. 120880 - Marcos II v. Court of AppealsCamille CruzNo ratings yet

- Case Digest - Doctrines in TaxationDocument3 pagesCase Digest - Doctrines in TaxationBryne Angelo BrillantesNo ratings yet

- 4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - BalucanagDocument1 page4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - BalucanagVikki AmorioNo ratings yet

- Incidence of TaxationDocument12 pagesIncidence of TaxationRajesh ShahiNo ratings yet

- Gross EstateDocument69 pagesGross EstateRedgiemarkNo ratings yet

- D Mercer - Private Client Case Study-V1Document5 pagesD Mercer - Private Client Case Study-V1kapoor_mukesh4uNo ratings yet

- MCIAA Vs LAPU LAPU CITYDocument5 pagesMCIAA Vs LAPU LAPU CITYJep Echon TilosNo ratings yet

- Tax Reviewer FinalDocument50 pagesTax Reviewer FinalMiroNo ratings yet

- Inheritance Tax - Part 2: Relevant To Acca Qualification Paper F6 (Uk)Document13 pagesInheritance Tax - Part 2: Relevant To Acca Qualification Paper F6 (Uk)Shuja Muhammad LaghariNo ratings yet