Professional Documents

Culture Documents

TTCL Initiation Report: Leading Thai Contractor With Regional Presence and Bright Prospects

Uploaded by

mukesh516Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TTCL Initiation Report: Leading Thai Contractor With Regional Presence and Bright Prospects

Uploaded by

mukesh516Copyright:

Available Formats

THAILAND EQUITY

Investment Research

Daily

Initiation Report

Thailand Research Team

+66 (2) 862 9999 ext. 2030

Toyo-Thai Corporation (TTCL)

Leading Contractor With Regional Presence

BUY

Fair Value

THB15.90

Price

THB14.00

CONSTRUCTION

Toyo-Thai Corporation PCL builds petroleum

factories and also constructs chemical,

power, and biodiesel plants. It has

subsidiaries in Vietnam, Malaysia, Myanmar,

US, Abu Dhabi and the Philippines.

Stock Statistics

Bloomberg Ticker

Share Capital (m)

Market Cap (US$m)

52 week HL Price (RM)

3mth Avg Vol (000)

YTD Returns

Beta (x)

TTCL TB

480.00

224

15.50

8.00

1,689.78

18.64

1.05

Major Shareholders (%)

Toyo Engineering Corp.

Thai NVDR

Chiyoda Corp.

26.0

10.5

7.0

Share Performance (%)

Month

Absolute

1m

-0.7

3m

-2.1

6m

7.9

12m

68.4

Relative

-4.5

-10.3

-6.2

46.5

Share Price Performance

We initiate our coverage on TTCL with a BUY rating and TP of THB15.93, based on a

FY12 PER of 13.5x. The prospects of TTCL, which has maintained a strong track

record since its IPO, look brighter than ever. The companys competitive advantage

lies in its solid engineering team that has completed construction projects worldwide

at relatively low cost. Its strong alliances with construction giants from Japan and

South Korea should greatly enhance its overseas operations going forward.

Bright prospects ahead. Toyo-Thai Corporation PCL (TTCL) is currently the only one in

Thailand that is able to independently provide integrated engineering, procurement,

construction (integrated EPC) services for petroleum and petrochemical projects worth

USD300m-USD500m. Unlike most Thai contractors, TTCL has a lot of room to grow in the

foreign markets since making its name regionally, especially in Vietnam and Malaysia. In

1Q12, the company earned THB2.2bn (+21.9% y-o-y) in revenue and a net profit of

THB111.5m (+5.5% y-o-y). At the end of the first quarter, its backlog was at a record high of

THB17.5bn, 55%-60% of which should be realized this year. Thus our FY12 projected

revenue of THB11.9bn is largely secured.

Quality engineers and cost management leaders. TTCLs engineers have lived up to

global standards. One of the companys most outstanding milestones was building the

worlds largest hydrogen peroxide (HP) plant for a joint venture between Dow Chemical

Company (USA) and Solvay (Belgium), both of which are among the worlds largest

international chemical firms. The projects EPC was implemented by TTCL under Solvays

supervision. The plant successfully kicked off production on 21 Aug 2011. TTCLs track

record in the EPC business is strong evidence that the company is entering the global stage,

where most competitors are from developed countries. This gives the company some

competitive advantage in terms of cost leadership since Thai engineers and staff command

lower salaries than their counterparts in developed countries.

Recommend BUY with TP of THB15.90 (+13.6% upside). We initiate coverage on TTCL

with a BUY recommendation and TP of THB15.90, which is based on an EPS of 1.18

(+41.8% y-o-y) and FY12 PER of 13.5x, which is close to its average trailing PER since

2009. As one of the countrys leading EPC contractors with strong alliances in Japan and

South Korea, the firm should be able to grow its construction business in both the domestic

and foreign markets, and stabilize its revenue by building and investing more in power plant

projects with its partners.

16.00

14.00

12.00

10.00

8.00

6.00

4.00

2.00

0.00

Feb-10

Aug-10

Feb-11

Aug-11

Feb-12

FYE Dec (THBm)

Revenue

Net Profit

% chg y-o-y

Consensus

EPS (THB)

DPS (THB)

Dividend yield (%)

ROAE (%)

ROAA (%)

PER (x)

BV/share (THB)

P/BV (x)

EV/ EBITDA (x)

FY09

FY10

FY11

FY12f

FY13f

10330.5

325.5

4.2%

0.68

0.42

3.0

31.7

5.7

20.6

2.9

4.9

16.68

5318.1

337.1

3.6%

0.70

0.34

2.5

23.2

8.1

19.9

3.2

4.4

16.43

8995.1

399.7

18.6%

0.83

0.40

2.9

25.0

7.6

16.8

3.5

4.0

16.23

11846.8

566.7

41.8%

567.0

1.18

0.59

4.2

31.1

7.9

11.9

4.1

3.4

13.39

17497.8

734.0

29.5%

755.7

1.53

0.76

5.5

34.0

8.6

9.2

4.9

2.9

12.79

OSK Research See important disclosures at the end of this report

OSK Research

COMPANY BACKGROUND

Only EPC contractor in Thailand with regional presence. Toyo-Thai Corp (TTCL), Thailands first allround engineering company, was incorporated in 1985 as a joint venture between Italian-Thai

Development Public Company Ltd, one of the largest contractors in Thailand, and Toyo Engineering Corp

(TEC), a leading international engineering company in Japan. TTCL is an integrated contractor that

provides engineering design, procurement of machines and equipment, and construction (integrated EPC)

for turnkey projects mainly in the petroleum, petrochemical, chemical and energy industries. In 27 years,

TTCL has undertaken over 190 projects building process plants and facilities in both domestic and foreign

markets. It expanded its international business in 1997, and has built plants in the United States, China,

Bangladesh, Vietnam and Malaysia. In 2009, the company was listed on the Stock Exchange of Thailand

with a registered capital of THB480m. Today, TEC holds about 26% of TTCL shares while the Ital-Thai

group owns a stake of about 8.85%.

Growing profit through peaks and troughs. As an integrated EPC contractor, TTCL focuses on

medium-sized projects valued from USD300m to USD500m. In FY11, revenue from petrochemical and

chemical projects accounted for 66.6% of total revenue while the remainder came from energy projects.

The company saw a substantial drop in revenue in FY10 (see Figure 1) as it was then heavily reliant on

clients that wanted to have their plants built in Map Ta Phut Industrial Estate (see Figure 6). Toward the

end of 4Q09, the Central Administrative Court ordered government agencies to suspend operation and

construction of 76 projects in Map Ta Phut, 59 of which are in petrochemical, oil, gas, refinery and metals.

Ongoing construction was put on hold, with no new orders until September 2010 when the court allowed

most of the 76 industrial projects to resume. As a result, TTCLs FY10 revenue plunged 48.6% y-o-y,

although its net profit grew at a 30.3% CAGR from FY08 to FY11 (see Figure 1). To reduce the volatility in

its revenue, the company diversified its EPC business to foreign markets and started investing in power

plant projects, all of which TTCL has to be the main EPC contractor (see Figure 5: Evolution of TTCLs

Revenue). Apart from investing in power plants, the company also aims to add more power plant owners

to its list of clients, as evidenced by the composition of the potential projects, of which the value of six

power projects account for 44% (see Figure 8).

Figure 1: Revenue, gross profit and net profit

Figure 2: Profitability

Source : OSK, TTCL

Source : OSK, TTCL

Figure 3: Revenue breakdown 2011

Figure 4: EBIT breakdown 2011

Source : Bloomberg

Source : Bloomberg

We estimate FY12 gross

margin at 10.8% and

FY12 net margin at

4.8%.

OSK Research See important disclosures at the end of this report

OSK Research

Figure 5: Evolution of TTCLs revenue

Investments will be

power projects, all

which TTCL has to

the EPC contractor

well.

in

of

be

as

Source: Bloomberg, TTCL

Figure 6: Sample of projects done in the past

Heavy

reliance

on

projects in Map Ta Phut

is expected to become

the thing of the past.

Note; Number of clients are in red, locations are in light purple, and project descriptions are in black.

Source: OSK, TTCL

INVESTMENT HIGHLIGHTS

Bright prospects ahead. For petroleum and petrochemical projects worth USD300m-USD500m, TTCL is

unique in that it can provide integrated EPC services to clients without relying on other companies to work

jointly with. Unlike other Thai contractors, TTCL has a lot more room to grow in the foreign markets since

becoming well-known in the region. The firms backlog of THB17.5bn as of 31 March, 2012 is a record

high, with THB10.8bn (61.4%) from foreign markets, mostly from Vietnam and Malaysia. We expect about

THB9.6bn (55%) of the total backlog to be realized this year, bringing the FY12 revenue to THB11.9bn

(+31.7% y-o-y). Currently, the company has new proposed project worth THB80.6bn collectively. As such,

it should see strong growth in EPC services demand for the next two years as its backlog keeps growing

and the company begins bidding for bigger projects next year.

Stabilizing income via investment in power plant projects. The company has also started investing in

power plants, such as Navanakorn Electrics 110MW power plant and Siam Solar Powers 8MW

photovoltaic electrical plant for which it carried out the EPC. As of 31 March 2012, the company had

invested some THB750m in Navanakorns preferred shares. The eventual investment will be about

THB1.09bn by 1Q13 when it becomes operational, while the dividend to be paid (10.5% fixed rate) to

TTCL should come in by the middle of FY13. Siam Solars plant, 25%-owned by TTCL, should start

production by 4Q12. The company is currently in talks with investing partners to invest an additional

THB1bn to THB2bn in four power projects. This type of investment is aimed at bringing in a stable income

stream in the long term.

OSK Research See important disclosures at the end of this report

OSK Research

Figure 7: Backlog as of 31 March 2012

Figure 8: Potential project proposals

Source : TTCL

Source : TTCL

For potential proposals,

there are 6 power, 12

petrochemical and 1

utilities projects.

Strong EPC track record. TTCLs truly live up to global standards. One of the companys major

milestones was building the worlds largest hydrogen peroxide (HP) plant for a joint venture between Dow

Chemical Company (USA) and Solvay (Belgium), which are among the worlds largest international

chemical firms. The projects EPC was performed by TTCL under supervision by Solvay. The plant began

production on 21 Aug 2011. The EPC services for Phase 2 of this plant are also being conducted by

TTCL. Last year, the company was awarded EPC contracts by Lynas Malaysia SB in Malaysia and a

Vietnam National Chemical Groups subsidiary in Vietnam.

Competitive advantage = cost leadership. TTCLs EPC business track record is strong evidence that it

is entering the global stage dominated by competitors from the more developed countries. This gives it a

strong competitive advantage in terms of cost leadership since Thai engineers and employees command

much lower salaries than their counterparts in developed countries. According to the companys head of

finance, South Koreas wages in this industry are about one-half of the Japans, while Thai wages are only

one-third of South Koreas (over the last five years, TTCLs salaries, wages and other employee benefits

have, on average, accounted for 16.40% of total cost). Although wages around the globe are converging,

it will likely take quite a while (i.e. at least 10 years) before Thai wages rise to levels comparable to those

in Japan and South Korea. Having realized this, several companies in South Korea and Japan are looking

towards partnerships and alliances with TTCL, knowing that such a relationship will enable them to offer

more competitive rates when they bid for projects. For example, Chiyoda Corp - the second largest EPC

contractor in Japan - acquired 7% of TTCLs issued shares in FY10 with the aim of working with the latter

to bid for projects of global scale.

Figure 9: TTCLs founders and alliances

TTCL is equipped with

high quality and cost

leadership

causing

Japanese and Korean

firms to seek partnership

with the company.

OSK Research See important disclosures at the end of this report

OSK Research

Flush with liquidity. The companys enormous cash reserves and short-term investments, making up

58.4% of total assets as of 31 March, reflect its highly liquid position. However, most of the cash cannot

be deemed excess cash a proportion of it was from deferred revenue and customer advances for

construction contracts, implying that much of it will need to be utilized to cover operating working liabilities.

In calculating excess cash, we found a negative difference between operating working assets and

liabilities, with the former coming up THB3.5bn short. If TTCL uses cash to cover the shortfall, it would still

be left with THB934.2m in cash and short-term investments of THB1.95 per share (which is 13.9% of its

share price). In addition, it currently has no interest-bearing debt to pay off.

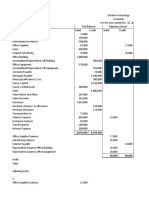

Figure 10: Excess cash at the end of 1Q12

The

excess

cash

accounts for 13.8% of

the current share price.

Backlog leads revenue upwards. We are optimistic on TTCLs outlook this year and the next. As of 31

March 2012, the company had a record high backlog of THB17.5bn, 55% of which we expect the

company to realize this year (as opposed to the 60% estimated by TTCL), boosting our projected FY12

revenue to THB11.9bn (+31.7% y-o-y) and FY12 earnings to THB567m (+41.8% y-o-y).

Figure 11: Backlog and revenue

After the Map Ta Phut

incident during 4Q094Q10 is over, TTCLs

backlog

has

risen

substantially.

Source: OSK, Bloomberg

OSK Research See important disclosures at the end of this report

OSK Research

Global slowdown to have limited impact on FY13 performance. We believe the impact of global

economic uncertainties, including the European debt crisis and Chinas slowdown, on TTCLs FY13

performance is likely to be limited. This is because the EPC projects on average take two-and-a-half years

to complete. Project owners, while planning their investments, consider economic conditions two to three

years forward when their plants become operational rather than on the prevailing economic situations.

However, a few project owners, especially those in the petrochemical industries, might postpone their

investment until the global economy is on more solid ground, and commodities prices start to pick up.

This leads us to the scenario analysis below.

Figure 12: FY13f revenue from construction and services

under different scenarios

Number of projects in

this table represents

those that would actually

go through auctions

during 2H12 or 1Q13.

Source: OSK

Base-case scenario: FY13f sales of THB17.435bn. Our worst-case scenario suggests FY13f sales of

THB15.13bn, and the best-case scenario suggests sales of THB18.62bn (see Figure 12 above). There

are two main assumptions: first, that the auctioning of all six power plants worth about THB36.6bn will go

ahead as planned since decisions to build power plants are not affected by current economic conditions,

as such facilities take at least two years to build. Second, we assume that TTCL will be able to garner

about a third of the projects it plans to bid for, based on the five-year average rate. Nevertheless, our

base-case scenario is that THB71.7bn worth of projects (out of THB80.6bn) will actually go through

auctions during this year and 1Q13, in which case the company will have FY13f sales of THB17.435, up

by 32.5% from FY12f.

Recommend BUY, TP THB15.90 (+13.6% upside). We initiate coverage on TTCL with a BUY

recommendation and TP of THB15.90, based on a FY12 PER of 13.5x and FY12 EPS of 1.18 (+41.8% yo-y). The estimated FY12f PER is almost identical to the companys average trailing PER since 2010

(13.4x) and close to the average of forward FY12f PER of comparable companies (13.3x), including those

of Samsung Engineering, Chiyoda, JGC, CTCI and PEC. All of these companies are integrated EPCs

which build projects similar to TTCL. With its global standards and cost advantage, the company is

prepared to grow as it has set up subsidiaries in a number of countries including Vietnam, Malaysia,

Myanmar, US, Abu Dhabi and Philippines. As Thailands only EPC contractor with a regional presence

and strong alliances in Japan and South Korea, the firm should be able to grow its construction business

in both domestic and foreign markets, as well as stabilize its revenue by building and increasing its

investment in power plant projects with its partners.

OSK Research See important disclosures at the end of this report

OSK Research

Figure 13: Regional EPC* contractors (as of 11 July, 2012)

Samsung Engineering,

Chiyoda, JGC, CTCI

and

PEC

are

comparable companies

as they build similar

types of projects as

TTCL does.

Note: Forward PER (2012) for regional contractors are supplied by Bloomberg and based on consensus of FY12 EPS.

Source: OSK, Bloomberg

*E= Engineering design, P = Procurement, C = Construction

Figure 14: Valuation (as of 11 July 2012)

Source: OSK, Bloomberg

Figure 15: Historical trailing PER (as of 11 July 2012)

Source: Bloomberg

Figure 16: Subsidiaries and new business development

The Philippines office

was just set up in May,

2012.

Source:TTCL

OSK Research See important disclosures at the end of this report

OSK Research

EARNINGS FORECAST

FYE Dec (THBm)

Turnover

EBITDA

PBT

Net Profit

EPS (THB)

DPS (THB)

Margin

EBITDA (%)

PBT (%)

Net Profit (%)

ROAE (%)

ROAA (%)

Balance Sheet

Fixed Assets

Current Assets

Total Assets

Current Liabilities

Net Current Assets

LT Liabilities

Shareholders Funds

Net Gearing (%)

Cash Flow

PBT

Other Operating Cash

Chg in Working Capital

Operating Cashflow

CAPEX

FCF

FY09

FY10

FY11

FY12f

FY13f

10330.5

497.0

475.7

325.5

0.68

0.42

5318.1

488.5

467.7

337.1

0.70

0.34

8995.1

585.3

563.8

399.7

0.83

0.40

11846.8

770.0

741.3

566.7

1.18

0.59

17497.8

957.3

924.1

734.0

1.53

0.76

4.8

4.6

3.2

9.2

8.8

6.3

6.5

6.3

4.4

6.5

6.3

4.8

5.5

5.3

4.2

31.7

5.7

23.2

8.1

25.0

7.6

31.1

7.9

34.0

8.6

59.3

4472.7

4607.5

3227.8

1245.0

0.16

1,379.5

Net Cash

98.3

3378.1

3675.0

2125.5

1252.6

13.59

1,535.9

Net Cash

127.1

6097.4

6903.6

5009.4

1088.0

212.05

1,682.2

Net Cash

187.2

5965.2

7440.5

5225.3

739.9

224.90

1,990.4

Net Cash

235.1

7214.3

9615.7

7024.8

189.4

228.93

2,361.9

Net Cash

475.7

1673.0

1200.8

57.7

-1382.4

467.7

833.5

-532.2

171.3

-646.2

563.8

-1774.0

2238.3

510.7

1688.5

741.3

235.9

340.8

695.6

-332.0

924.1

-419.1

1141.4

960.0

231.6

OSK Research See important disclosures at the end of this report

OSK Research

OSK Research See important disclosures at the end of this report

You might also like

- Project Management Consultants - Directory - EPC EngineerDocument11 pagesProject Management Consultants - Directory - EPC Engineereng.tash5526No ratings yet

- Oil and Gas in MyanmarDocument3 pagesOil and Gas in MyanmarKunwadi ChantaraparnNo ratings yet

- The 10 Largest Downstream and Petrochemical ProjectsDocument5 pagesThe 10 Largest Downstream and Petrochemical ProjectsbiomenggNo ratings yet

- © Oecd/Iea - Oecd/Nea 2015Document21 pages© Oecd/Iea - Oecd/Nea 2015Febrian AdiputraNo ratings yet

- Companies Catalogue 2013Document32 pagesCompanies Catalogue 2013Mbamali ChukwunenyeNo ratings yet

- INDONESIA INDUSTRIAL ESTATES DIRECTORY 2018-2019 (Westpoint) PDFDocument1 pageINDONESIA INDUSTRIAL ESTATES DIRECTORY 2018-2019 (Westpoint) PDFGinnyNo ratings yet

- ANCG Construction Group Organisational StructureDocument31 pagesANCG Construction Group Organisational StructureSuhail KhanNo ratings yet

- Privatisation Mundra PortDocument11 pagesPrivatisation Mundra PortmailsarathNo ratings yet

- ABB EPC - General Presentation - March 15 EPC Plants For The Oil&Gas IndustryDocument45 pagesABB EPC - General Presentation - March 15 EPC Plants For The Oil&Gas IndustryAnonymous Vbv8SHv0bNo ratings yet

- Germany Lead Market For Energy Storage Fuel Cell SystemsDocument56 pagesGermany Lead Market For Energy Storage Fuel Cell Systemsashoho1No ratings yet

- Overall Pre-Contract Report 2007-11-30Document8 pagesOverall Pre-Contract Report 2007-11-30Daniel EvansNo ratings yet

- EPC and ERGP - The NexusDocument37 pagesEPC and ERGP - The NexusOyinleye AdebowaleNo ratings yet

- Internship CompanyDocument19 pagesInternship CompanySourNo ratings yet

- Consultancy Companies - Directory - EPC EngineerDocument31 pagesConsultancy Companies - Directory - EPC EngineernewprojectaceNo ratings yet

- Public-Private Partnerships Improve InfrastructureDocument15 pagesPublic-Private Partnerships Improve Infrastructureindiangal1984No ratings yet

- Chevron Thailand FactsheetDocument5 pagesChevron Thailand FactsheetVishan SharmaNo ratings yet

- APOilGas Newsletter HighlightsDocument12 pagesAPOilGas Newsletter HighlightsSueKrishnanNo ratings yet

- INTEGRATED SOLUTIONS PROVIDERDocument15 pagesINTEGRATED SOLUTIONS PROVIDERPetrochem Designs OfficialNo ratings yet

- HydrogenPro Integrated Report 2022Document162 pagesHydrogenPro Integrated Report 2022Aya ElbouhaliNo ratings yet

- Hyosung Corporation Catalog English 2010Document106 pagesHyosung Corporation Catalog English 2010balasubramanium_rNo ratings yet

- Saipem Sustainability 2018Document72 pagesSaipem Sustainability 2018dandiar1No ratings yet

- Asean LNG Power Market Update Opportunities 2019Document26 pagesAsean LNG Power Market Update Opportunities 2019Gaurav DuttaNo ratings yet

- China Construction ContractorsDocument3 pagesChina Construction ContractorsAbdul WahabNo ratings yet

- The Essential Guide To Feasibility Planning and Construction Procurement For Junior Mining Companies Part 2 Detailed Engineering and Construction 56739Document38 pagesThe Essential Guide To Feasibility Planning and Construction Procurement For Junior Mining Companies Part 2 Detailed Engineering and Construction 56739Tina CoNo ratings yet

- L & T DetailsDocument18 pagesL & T DetailsathulkannanNo ratings yet

- QuantumScape Analyst Presentation Oct2020Document37 pagesQuantumScape Analyst Presentation Oct2020sanjeev thadaniNo ratings yet

- Intl. Projects - ExpandingHorizonsDocument8 pagesIntl. Projects - ExpandingHorizonsJnanamNo ratings yet

- Rail Sector Overview v1Document6 pagesRail Sector Overview v1Adam DanielNo ratings yet

- 5all Buyer Presentations - 148Document64 pages5all Buyer Presentations - 148Jigisha VasaNo ratings yet

- Middle East Top EPC ContractorsDocument16 pagesMiddle East Top EPC Contractorsm_sath2009100% (1)

- CogenDocument138 pagesCogenzubair1951100% (2)

- Developing LNG Bunkering in IndiaDocument17 pagesDeveloping LNG Bunkering in IndiaMaria NirmalNo ratings yet

- Automotive Clustering in Europe-Data PDFDocument116 pagesAutomotive Clustering in Europe-Data PDFManojlovic VasoNo ratings yet

- Sabah - Sarawak Gas Pipeliene Project BackgroundDocument4 pagesSabah - Sarawak Gas Pipeliene Project BackgroundAnkit Kumar0% (1)

- Nioec Vendor List PDFDocument545 pagesNioec Vendor List PDFkomail0% (1)

- Bhel Contractors List Eastern RegionDocument28 pagesBhel Contractors List Eastern RegionRafath AlamNo ratings yet

- PPP in Ports: The Indian PerspectiveDocument12 pagesPPP in Ports: The Indian PerspectiveAbhishek RawatNo ratings yet

- Tata, TipperDocument95 pagesTata, Tippermonika_richaNo ratings yet

- RAS UK StrategyDocument23 pagesRAS UK StrategyCezar-Victor NăstaseNo ratings yet

- Singapore - Oil & Gas Financial JournalDocument11 pagesSingapore - Oil & Gas Financial JournalTimothae ZacharyyNo ratings yet

- Hydrogen Economist MENA2022Document15 pagesHydrogen Economist MENA2022DanihNo ratings yet

- DP World's Journey from Local to Global Port OperatorDocument20 pagesDP World's Journey from Local to Global Port OperatorlucasNo ratings yet

- EMIS Insights - India Infrastructure Sector Report 2020 - 2024 PDFDocument74 pagesEMIS Insights - India Infrastructure Sector Report 2020 - 2024 PDFNikhilAgarwalNo ratings yet

- Implementing SAP SMS at UTPDocument28 pagesImplementing SAP SMS at UTPbladeforeverNo ratings yet

- LNG Project ProfileDocument5 pagesLNG Project ProfiledjoefriNo ratings yet

- 2013 List of China's LNG PlantsDocument2 pages2013 List of China's LNG PlantsarapublicationNo ratings yet

- Construction & Equipments Industry in India: June 2010Document12 pagesConstruction & Equipments Industry in India: June 2010Vishal Rastogi100% (1)

- Malaysia PetroDocument75 pagesMalaysia PetroEldrazi100% (1)

- 3d Hitech Systems Limited Profile ConsolidatedDocument148 pages3d Hitech Systems Limited Profile Consolidatedapi-365094488No ratings yet

- Engineering Procurement Construction EPC PDFDocument2 pagesEngineering Procurement Construction EPC PDFfotopredicNo ratings yet

- Asset Management Work Sample - IntroductionDocument6 pagesAsset Management Work Sample - IntroductionThe Grisham TiwariNo ratings yet

- Task Force Report 2019 PDFDocument52 pagesTask Force Report 2019 PDFhsingla25No ratings yet

- QGPR Apr2014Document76 pagesQGPR Apr2014Anonymous hAiENTeytNo ratings yet

- GCC Power Market Outlook and Renewable Energy SnapshotDocument23 pagesGCC Power Market Outlook and Renewable Energy Snapshotjinalshah1012713No ratings yet

- LPG Manufacturer List PDFDocument16 pagesLPG Manufacturer List PDFHindustan ScaleNo ratings yet

- 2 SMART Tunnel in MalaysiaDocument52 pages2 SMART Tunnel in MalaysiaSusman HadiNo ratings yet

- Indonesia Freight Transport & Shipping Report 2021Document37 pagesIndonesia Freight Transport & Shipping Report 2021Sooraj K100% (1)

- Energy and Power Overview - LNGDocument28 pagesEnergy and Power Overview - LNGRhys JamesNo ratings yet

- Investor Presentation (Company Update)Document32 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Poised To Catch Asean’s Growth WaveDocument9 pagesPoised To Catch Asean’s Growth WavebodaiNo ratings yet

- Net Metering and Solar Rooftop Whitepaper EfficientCarbonDocument7 pagesNet Metering and Solar Rooftop Whitepaper EfficientCarbonmukesh516No ratings yet

- Neil McDonald - Modern Chess Miniatures - Cadogan (1995)Document154 pagesNeil McDonald - Modern Chess Miniatures - Cadogan (1995)mukesh516100% (1)

- 2012 Talent Shortage Survey Results US Final FinalDocument36 pages2012 Talent Shortage Survey Results US Final FinalEuler DiasNo ratings yet

- Chess Teaching ManualDocument303 pagesChess Teaching Manuallavallee2883No ratings yet

- Sorghum and Millet - West AfricaDocument3 pagesSorghum and Millet - West Africamukesh516No ratings yet

- On Raw MaterialDocument5 pagesOn Raw Materialmukesh516No ratings yet

- Mining Constn EquipmentDocument55 pagesMining Constn EquipmentPiyush KatakwarNo ratings yet

- Neil McDonald - Mastering Checkmates - Batsford (2003) PDFDocument162 pagesNeil McDonald - Mastering Checkmates - Batsford (2003) PDFmukesh51688% (8)

- SPA Research ReportDocument52 pagesSPA Research Reportashu9026No ratings yet

- China Machine Tools 200402Document38 pagesChina Machine Tools 200402mukesh516No ratings yet

- Chernev, Irving - Chessboard MagicDocument89 pagesChernev, Irving - Chessboard MagicRomain PtrNo ratings yet

- Mass DistributionDocument137 pagesMass Distributionmukesh516No ratings yet

- Living With GypsumDocument36 pagesLiving With Gypsummukesh516No ratings yet

- Gypsum MiningDocument31 pagesGypsum Miningmukesh516No ratings yet

- DTT DR Talentcrisis070307Document24 pagesDTT DR Talentcrisis070307Nikita RawatNo ratings yet

- Manufacturing SkillsDocument10 pagesManufacturing Skillsmukesh516No ratings yet

- The System of Education in IndiaDocument71 pagesThe System of Education in IndiaAman SharmaNo ratings yet

- Acid Slurry (ALKYL Benzene Sulphonate) : Ntroduction Arket OtentialDocument5 pagesAcid Slurry (ALKYL Benzene Sulphonate) : Ntroduction Arket OtentialRajul GargNo ratings yet

- 2012 Talent Shortage Survey Results US Final FinalDocument36 pages2012 Talent Shortage Survey Results US Final FinalEuler DiasNo ratings yet

- Material Handling India PDFDocument7 pagesMaterial Handling India PDFsangeeth_7No ratings yet

- Top 30 EPC Company in MENADocument12 pagesTop 30 EPC Company in MENAyour_marjolaine100% (1)

- Construction Equipment 10708Document22 pagesConstruction Equipment 10708mukesh516No ratings yet

- Availability and UtilizationDocument6 pagesAvailability and Utilizationmukesh516No ratings yet

- Sorghum and Millet - West AfricaDocument3 pagesSorghum and Millet - West Africamukesh516No ratings yet

- Sorghum and Millet - West AfricaDocument3 pagesSorghum and Millet - West Africamukesh516No ratings yet

- Pipeline 0 PDFDocument8 pagesPipeline 0 PDFmukesh516100% (1)

- Frameowrk For Testing ServiceDocument2 pagesFrameowrk For Testing Servicemukesh516No ratings yet

- Sorghum Consumption - IndiaDocument24 pagesSorghum Consumption - Indiamukesh516No ratings yet

- Indian Life SciencesDocument3 pagesIndian Life Sciencesmukesh516No ratings yet

- Research ProposalDocument19 pagesResearch Proposalዝምታ ተሻለNo ratings yet

- Frsa Module III Problems SolutionsDocument34 pagesFrsa Module III Problems Solutionsaijaz ahmed nagthan01No ratings yet

- Financial Accounting - All QsDocument21 pagesFinancial Accounting - All QsJulioNo ratings yet

- Forecasting Financial StatementsDocument58 pagesForecasting Financial StatementsEman KhalilNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- Accounting For Amalgamation - ProblemsDocument8 pagesAccounting For Amalgamation - ProblemsBrowse Purpose100% (1)

- Business PlanDocument27 pagesBusiness PlanMARIA KEAROMA TAGOTANo ratings yet

- Narcolarm, Inc. (A) : The Crimson Press Curriculum Center The Crimson Group, IncDocument2 pagesNarcolarm, Inc. (A) : The Crimson Press Curriculum Center The Crimson Group, IncNitin GautamNo ratings yet

- SGX Investor's Guide To Reading Annual ReportsDocument12 pagesSGX Investor's Guide To Reading Annual Reportsjilbo604No ratings yet

- Nidec Philippines Corporation Company ProfileDocument35 pagesNidec Philippines Corporation Company ProfileVergel MartinezNo ratings yet

- Kohls Balance Sheet 2015Document2 pagesKohls Balance Sheet 2015Mathew VisarraNo ratings yet

- Ashish Bhattad: Contact: +91 7066105779Document2 pagesAshish Bhattad: Contact: +91 7066105779parth sarthyNo ratings yet

- Test Bank ACC101-300cauDocument91 pagesTest Bank ACC101-300cauNguyễn Thanh HươngNo ratings yet

- A Levels Accounting Notes PDFDocument207 pagesA Levels Accounting Notes PDFLeanne Teh100% (4)

- MGT101 Super File SOLVED 100% PDFDocument90 pagesMGT101 Super File SOLVED 100% PDFMuaviya Ghani100% (1)

- Course: Advanced Accounting: Chapter 2: Partnership Liquidation and IncorporationDocument4 pagesCourse: Advanced Accounting: Chapter 2: Partnership Liquidation and Incorporationmohamed dahir AbdirahmaanNo ratings yet

- ALKA - Annual Report 2019Document173 pagesALKA - Annual Report 2019Sri Zahara Dewi SNo ratings yet

- FABM2 - 12 - Q1 - Mod5 - Analysis-of-Financial-Statements - V5 FSDocument34 pagesFABM2 - 12 - Q1 - Mod5 - Analysis-of-Financial-Statements - V5 FSEllah Ollicetnom100% (1)

- The Gazette: of IndiaDocument4 pagesThe Gazette: of Indiaravi_bhateja_2No ratings yet

- 2nd Long Quiz StudentDocument8 pages2nd Long Quiz StudentDumb MushNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- Wiley P2 Sec-A FlashcardDocument29 pagesWiley P2 Sec-A FlashcardnaxahejNo ratings yet

- As On 31 Dec 2019 IPs PDFDocument30 pagesAs On 31 Dec 2019 IPs PDFVbs ReddyNo ratings yet

- Community Center Business Plan ExampleDocument31 pagesCommunity Center Business Plan ExampleJoseph QuillNo ratings yet

- Chap 007Document16 pagesChap 007dbjn100% (1)

- Christine Sousa BagsDocument6 pagesChristine Sousa BagsChristian GapasNo ratings yet

- VCSCDHC 20230216 BuyDocument11 pagesVCSCDHC 20230216 BuylinhatranNo ratings yet

- Notes Receivable Journal EntriesDocument6 pagesNotes Receivable Journal EntriesKhai Supleo PabelicoNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- Son of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesFrom EverandSon of Hamas: A Gripping Account of Terror, Betrayal, Political Intrigue, and Unthinkable ChoicesRating: 4.5 out of 5 stars4.5/5 (488)

- Age of Revolutions: Progress and Backlash from 1600 to the PresentFrom EverandAge of Revolutions: Progress and Backlash from 1600 to the PresentRating: 4.5 out of 5 stars4.5/5 (6)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Reagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarFrom EverandReagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarRating: 4 out of 5 stars4/5 (4)

- The Great Game: The Struggle for Empire in Central AsiaFrom EverandThe Great Game: The Struggle for Empire in Central AsiaRating: 4.5 out of 5 stars4.5/5 (406)

- How States Think: The Rationality of Foreign PolicyFrom EverandHow States Think: The Rationality of Foreign PolicyRating: 5 out of 5 stars5/5 (7)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldFrom EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldRating: 4.5 out of 5 stars4.5/5 (1143)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- The Tragic Mind: Fear, Fate, and the Burden of PowerFrom EverandThe Tragic Mind: Fear, Fate, and the Burden of PowerRating: 4 out of 5 stars4/5 (14)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4.5 out of 5 stars4.5/5 (4)

- A People's History of the World: From the Stone Age to the New MillenniumFrom EverandA People's History of the World: From the Stone Age to the New MillenniumRating: 4 out of 5 stars4/5 (91)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Three Cups of Tea: One Man's Mission to Promote Peace . . . One School at a TimeFrom EverandThree Cups of Tea: One Man's Mission to Promote Peace . . . One School at a TimeRating: 3.5 out of 5 stars3.5/5 (3422)

- Catch-67: The Left, the Right, and the Legacy of the Six-Day WarFrom EverandCatch-67: The Left, the Right, and the Legacy of the Six-Day WarRating: 4.5 out of 5 stars4.5/5 (26)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Why Nations Fail: The Origins of Power, Prosperity, and Poverty | SummaryFrom EverandWhy Nations Fail: The Origins of Power, Prosperity, and Poverty | SummaryRating: 3.5 out of 5 stars3.5/5 (10)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- The Secret War With Iran: The 30-Year Clandestine Struggle Against the World's Most Dangerous Terrorist PowerFrom EverandThe Secret War With Iran: The 30-Year Clandestine Struggle Against the World's Most Dangerous Terrorist PowerRating: 4 out of 5 stars4/5 (25)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Chip War: The Fight for the World's Most Critical TechnologyFrom EverandChip War: The Fight for the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (82)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- How Everything Became War and the Military Became Everything: Tales from the PentagonFrom EverandHow Everything Became War and the Military Became Everything: Tales from the PentagonRating: 4 out of 5 stars4/5 (18)