Professional Documents

Culture Documents

Chapter 3 Lecture Hand-Outs - Problem Solving

Uploaded by

Luzz LandichoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3 Lecture Hand-Outs - Problem Solving

Uploaded by

Luzz LandichoCopyright:

Available Formats

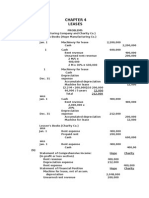

Fin Man 1, Chapter 3 Lecture Hand-outs

Free Cash Flow Business Analysis

A group of investors is considering buying the Wheelwright Corporation, but does not want to

contribute to the companys financial support after the purchase. Wheelwrights management

has offered the following financial statements covering last year ($M omitted):

Income Statement

Balance Sheets

Beginning

Ending

ASSETS

Sales

100

Cash

COGS*

34

Depreciation

6

Gross Margin

60

Expenses

25

EBIT

35

Interest

7

EBT

28

Tax

8

Net Income

20

*Cost of Goods Sold

6

Accts Receivable

Inventory

9

13

12

Current Assets

Fixed Assets

Gross

Accum Deprec

Net Fixed Assets

Total Assets

20

7

31

100

(12)

88

115

(18)

97

119

133

36

LIABILITIES & EQUITY

Accts Payable

Accruals

Current Liabilities

Debt

Equity

Total Liabilities

& Equity

17

21

6

23

71

25

8

29

59

45

119

133

Wheelwright paid no dividends and sold no new stock during the year. The firms tax rate is

30%.

REQUIRED: a. Develop Wheelwrights free cash flow and make a recommendation as to

whether it seems to be an appropriate acquisition for the investors.

b. Assume that the investors will purchase the company subject to its existing

debt ($59M). Does that change your recommendation?

SOLUTION:

a. First calculate Wheelwrights net operating profit and operating cash flow

NOPAT = EBIT(1-T) = $35 (1-.3) = $24.5

and

Operating Cash Flow = NOPAT + Depreciation = $24.5 + $6 = $30.5

Then subtract increases in gross fixed assets and current accounts for free cash flow,

Prepared by: Luzz B. Landicho, CPA, MBA

Faculty, College of Accountancy & Economics, PLM

Page 1 of 5

Fin Man 1, Chapter 3 Lecture Hand-outs

FCF = Operating Cash Flow Increase in Fixed Assets - Increase in Current

Accounts

= $30.5 - $15 - $1 = $14.5

Since free cash flow is substantially positive and the potential buyers are not interested in

further investment, it seems that Wheelwright is an appropriate acquisition candidate.

b. Consideration of servicing Wheelwrights debt leads to a concept known as free cash

flow to equity (FCFE). This is what remains for stockholders after the firm uses cash to pay

interest and make any payments required to reduce principal. Since interest is deductible, we

can consider its cash flow implications after tax by multiplying by (1-T).

Interest after tax = Interest (1-T) = $7 (1-.3) = $4.9

Subtracting that from free cash flow implies that Wheelwright generates almost $10M per

year thats available to pay off debt and/or distribute to shareholders. Unless the debt

requires unusually large principal payments in the short run, the firm still appears to meet the

investors requirements

Common Size Statements

Linden Corp. has a 10% market share in its industry. Below are income statements ($M) for Linden and for the

industry.

Linden

Industry

Sales

$6,000

$64,000

Cost of Goods Sold

3,200

33,650

Gross Margin

2,800

30,350

Expenses:

Sales and Marketing

430

3,850

Engineering

225

2,650

Finance and Administration

650

4,560

Total Expenses

1,305

11,060

EBIT

Interest Expense

EBT

Tax

Net Income

1,495

230

1,265

500

765

19,290

4,500

14,790

5,620

9,170

REQUIRED:

Develop common sized income statements for Linden and the industry as a whole.

SOLUTION:

Sales

Cost of Goods Sold

Gross Margin

Expenses:

Sales and Marketing

Engineering

Finance and Administration

Total Expenses

Linden

$6,000

3,200

2,800

%

100.0

53.3

47.7

Industry

$64,000

33,650

30,350

%

100.0

52.6

47.4

430

225

650

1,305

7.2

3.8

10.8

21.8

3,850

2,650

4,560

11,060

6.0

4.1

7.1

17.2

Prepared by: Luzz B. Landicho, CPA, MBA

Faculty, College of Accountancy & Economics, PLM

Page 2 of 5

Fin Man 1, Chapter 3 Lecture Hand-outs

EBIT

Interest Expense

EBT

Tax

Net Income

1,495

230

1,265

500

765

24.9

3.8

21.1

8.3

12.8

19,290

4,500

14,790

5,620

9,170

30.1

7.0

23.1

8.8

14.3

RATIO ANALYSIS

Axtel Company has the following financial statements:

In addition, Axtel retired stock for $1,000,000 and paid a dividend of $1,727,000. Depreciation for the

year was $1,166,000. Construct a Statement of Cash Flows for Axtel for 2001. (Hint: Retiring stock means buying it

back from shareholders. Assume the purchase was made at book value, and treat it like a negative sale of stock.)

REQUIRED:

Calculate all of the ratios discussed in the chapter for the Axtel Company of problem 5. Assume Axtel had leasing

costs of $7,267 in 20X1, and had 1,268,000 shares of stock outstanding that were valued at $28.75 per share at year

end.

SOLUTION:

Prepared by: Luzz B. Landicho, CPA, MBA

Faculty, College of Accountancy & Economics, PLM

Page 3 of 5

Fin Man 1, Chapter 3 Lecture Hand-outs

Current Ratio

Current Assets / Current Liabilities

= $11,678 / $2,110 = 5.5

Quick Ratio

[Current Assets Inventory] / Current Liabilities= ($11,678 $3,220) / $2,110

= 4.0

Average Collection Period (ACP)

[Accts Rec / Sales] 360

= [($5,583 / $36,227) 360]

= 55.5 days

Inventory Turnover

COGS / Inventory

= $19,925 / $3,220 = 6.2

OR

Sales / Inventory

= $36,227 / $3,220 = 11.3

Fixed Asset Turnover

Sales / Fixed Assets

= $36,227 / $11,047 = 3.3

Total Asset Turnover

Sales / Total Assets = $36,227 / $22,725 = 1.6

Debt Ratio

[Long Term Debt + Current Liabilities] / Total Assets

= ($6,002 + $2,110) / $22,725

= 35.7%

Debt to Equity Ratio

Long Term Debt: Equity

= $6,002 : $14,613

= .41:1

Times Interest Earned (TIE)

EBIT / Interest = $5,434 / $713 = 7.6

Cash Coverage

[EBIT + Depreciation] / Interest = ($5,434 + $1,166) / $713 = 9.3

Fixed Charge Coverage

[EBIT + Lease Payments] / [Interest + Lease Payments] = ($5,434 + $7,267) / ($713 + $7,267)

= 1.6

Return on Sales

Prepared by: Luzz B. Landicho, CPA, MBA

Faculty, College of Accountancy & Economics, PLM

Page 4 of 5

Fin Man 1, Chapter 3 Lecture Hand-outs

Net Income / Sales = $3,116 / $36,227 = 8.6%

Return on Assets

Net Income / Total Assets = $3,116 / $22,725 = 13.7%

Return on Equity

Net Income / Equity = $3,116 / $14,613 = 21.3%

Price Earnings Ratio (P/E)

First calculate the Earnings per Share (EPS)

EPS

= Net Income / # shares outstanding

= $3,116 / 1.268 million

= $2.46

Then

P/E

= Stock Price / EPS = $28.75 / $2.46 = 11.7

Market to Book Value Ratio

First calculate the Book Value per Share

BV per Share = Equity / # shares outstanding

= $14,613 / 1.268 million

= $11.52

Then

Market to Book Value

= Stock Price / BV per share

= $28.75 / $11.52

= 2.5

Prepared by: Luzz B. Landicho, CPA, MBA

Faculty, College of Accountancy & Economics, PLM

Page 5 of 5

You might also like

- Exercise - Financial Statement AnalysisDocument3 pagesExercise - Financial Statement Analysisfarahhr100% (1)

- PAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceDocument2 pagesPAS 28 Does Not Require The Equity Method To Be Applied To Which of The Following InstanceAngeline RamirezNo ratings yet

- Problem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostDocument4 pagesProblem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostJune Maylyn MarzoNo ratings yet

- IAS 33 QuestionsDocument2 pagesIAS 33 QuestionsRamakrishnan VenkatesanNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- Practice Questions - Financial Statement AnalysisDocument6 pagesPractice Questions - Financial Statement Analysisluliga.loulouNo ratings yet

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- Instructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterDocument9 pagesInstructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterMIKASANo ratings yet

- Parte 2 Segundo ParcialDocument23 pagesParte 2 Segundo ParcialJose Luis Rasilla GonzalezNo ratings yet

- TVM Activity 4 SolutionsDocument2 pagesTVM Activity 4 SolutionsAstrid BuenacosaNo ratings yet

- Modern Advanced Accounting Group AssignmentDocument1 pageModern Advanced Accounting Group Assignmentmohamed dahir Abdirahmaan100% (1)

- Soal AkmDocument5 pagesSoal AkmCarvin HarisNo ratings yet

- Simplified SFM Ques Bank by Finance Acharya Jatin Nagpal CA, FRMDocument378 pagesSimplified SFM Ques Bank by Finance Acharya Jatin Nagpal CA, FRMKushagra SoniNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Baltzan6e Chapter03 TB AnswerKeyDocument166 pagesBaltzan6e Chapter03 TB AnswerKeyShaker ShubairNo ratings yet

- 2012 EE enDocument76 pages2012 EE enDiane MoutranNo ratings yet

- New LeveragesDocument16 pagesNew Leveragesmackm87No ratings yet

- 2011-02-09 035108 Finance 14Document4 pages2011-02-09 035108 Finance 14SamNo ratings yet

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- Unit Four: Measuring Mix and Yield VariancesDocument6 pagesUnit Four: Measuring Mix and Yield VariancesTammy 27100% (1)

- Finance Chapter 17Document30 pagesFinance Chapter 17courtdubs75% (4)

- Module A2Document0 pagesModule A2Somesh PalNo ratings yet

- ACTG311 Long Quiz PDFDocument3 pagesACTG311 Long Quiz PDFKRIS ANNE SAMUDIONo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Term Exam 2edited Answer KeyDocument10 pagesTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDONo ratings yet

- CHAPTER 9 Without AnswerDocument6 pagesCHAPTER 9 Without AnswerlenakaNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- 677261-Foundations of Financial Management Ch04Document28 pages677261-Foundations of Financial Management Ch04pcman92No ratings yet

- Chapter 1 Managerial Accounting, The Business Organization, and Professional EthicsDocument36 pagesChapter 1 Managerial Accounting, The Business Organization, and Professional EthicssamahNo ratings yet

- Lease Accounting ProblemsDocument27 pagesLease Accounting ProblemsElijah Lou ViloriaNo ratings yet

- Tutorial FIN221 Chapter 2 (Q&A) - Part TwoDocument11 pagesTutorial FIN221 Chapter 2 (Q&A) - Part TwojojojoNo ratings yet

- Assignment 1 - Chapter 2Document6 pagesAssignment 1 - Chapter 2Ho Thi Phuong ThaoNo ratings yet

- Assignment 2 PromDocument15 pagesAssignment 2 PromRussel Renz de MesaNo ratings yet

- Soal Tugas Problem Product CostingDocument2 pagesSoal Tugas Problem Product CostingMaria DiajengNo ratings yet

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Chapter Three CVP AnalysisDocument65 pagesChapter Three CVP AnalysisBettyNo ratings yet

- 1.3.2.1 Elaborate Problem Solving AssignmentDocument17 pages1.3.2.1 Elaborate Problem Solving AssignmentYess poooNo ratings yet

- Consolidated Financial Statements DefinitionDocument17 pagesConsolidated Financial Statements DefinitionBelay MekonenNo ratings yet

- Test Bank Applied Statistics in Business and Economics 5th Edition DoaneDocument66 pagesTest Bank Applied Statistics in Business and Economics 5th Edition DoaneKhải Hưng NguyễnNo ratings yet

- Chapter 1Document45 pagesChapter 1Zedie Leigh VioletaNo ratings yet

- 7Document28 pages7Alex liao0% (1)

- Conta FinancieraDocument21 pagesConta FinancieraAdrian TajmaniNo ratings yet

- Hillyard Master BudgetDocument4 pagesHillyard Master Budgetyuikokhj75% (4)

- Understanding Intangible AssetsDocument8 pagesUnderstanding Intangible AssetsMya B. Walker100% (1)

- Ratio Analysis and Financial Ratios from Chanakya Business SchoolDocument15 pagesRatio Analysis and Financial Ratios from Chanakya Business Schoolsajith santy0% (1)

- Calculate Expected Returns and Standard Deviation of Investment PortfoliosDocument4 pagesCalculate Expected Returns and Standard Deviation of Investment PortfoliosKashifNo ratings yet

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- CoMa Quiz 2Document21 pagesCoMa Quiz 2Antriksh JohriNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument3 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- Ch-2 Financial Analysis &planningDocument27 pagesCh-2 Financial Analysis &planningMulatu LombamoNo ratings yet

- Problem Set 3 Financial Statements BS SE S18Document8 pagesProblem Set 3 Financial Statements BS SE S18Nust Razi100% (1)

- Fair ValueDocument8 pagesFair Valueiceman2167No ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Audit of Local Bodies PDFDocument4 pagesAudit of Local Bodies PDFSriram BastolaNo ratings yet

- Week 13 SolutionsDocument7 pagesWeek 13 SolutionsStanley RobertNo ratings yet

- Incremental AnalysisDocument18 pagesIncremental AnalysisMary Joy BalangcadNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- Trabajo Zarate FinishDocument17 pagesTrabajo Zarate FinishDavidFloresNo ratings yet

- TechNotes 2018 For PostingDocument161 pagesTechNotes 2018 For PostingLuzz LandichoNo ratings yet

- Manage Uniform Allowance Rules for Government EmployeesDocument5 pagesManage Uniform Allowance Rules for Government EmployeesLuzz LandichoNo ratings yet

- Budget Circular No. 2017-4Document4 pagesBudget Circular No. 2017-4NonoyTaclino100% (2)

- Solutions To Chapter 7Document8 pagesSolutions To Chapter 7Luzz Landicho50% (6)

- Tax Updates 2013 PandA (Lea Roque)Document221 pagesTax Updates 2013 PandA (Lea Roque)Luzz LandichoNo ratings yet

- CL-No2018-4 Modified Guidelines For The Payment of Retirement Gratuity and Terminal Leave RG TL BenefitsDocument2 pagesCL-No2018-4 Modified Guidelines For The Payment of Retirement Gratuity and Terminal Leave RG TL BenefitsLuzz LandichoNo ratings yet

- 2019 Philippines Budget Priorities FrameworkDocument2 pages2019 Philippines Budget Priorities FrameworkLuzz LandichoNo ratings yet

- Solutions To Chapter 6 Vera CruzDocument9 pagesSolutions To Chapter 6 Vera CruzLuzz Landicho100% (1)

- Solutions To Chapter 3 Selected ProblemsDocument8 pagesSolutions To Chapter 3 Selected ProblemsLuzz Landicho100% (1)

- Solutions To Chapter 10Document2 pagesSolutions To Chapter 10Luzz LandichoNo ratings yet

- PFRS Updates 2013 PandA (Rodel Marqueses)Document120 pagesPFRS Updates 2013 PandA (Rodel Marqueses)Luzz LandichoNo ratings yet

- Solutions To Chapter 9Document10 pagesSolutions To Chapter 9Luzz Landicho100% (1)

- The Philippine Institute of Certified Public AccountantsDocument1 pageThe Philippine Institute of Certified Public AccountantsLuzz LandichoNo ratings yet

- Mngment Acctg Revised 2013-SyllabusDocument3 pagesMngment Acctg Revised 2013-SyllabusLuzz Landicho100% (1)

- Basic BEP Problems and SolutionsDocument3 pagesBasic BEP Problems and SolutionsLuzz LandichoNo ratings yet

- SSS Form E 1Document2 pagesSSS Form E 1Eleaquim M. Gilbuela75% (12)

- Solutions To Chapter 12Document8 pagesSolutions To Chapter 12Luzz LandichoNo ratings yet

- Estate Tax TableDocument8 pagesEstate Tax TableLuzz LandichoNo ratings yet

- Various Exercises PP 65 To 66Document2 pagesVarious Exercises PP 65 To 66Luzz Landicho50% (2)

- Electra-Quick Case StudyDocument4 pagesElectra-Quick Case StudyKKKNo ratings yet

- Psa 210 PDFDocument22 pagesPsa 210 PDFLuzz LandichoNo ratings yet

- Lecture 1a - Managerial Accounting, The Business Organization, and Professional EthicsDocument13 pagesLecture 1a - Managerial Accounting, The Business Organization, and Professional EthicsLuzz LandichoNo ratings yet

- Blank Working Papers PDFDocument48 pagesBlank Working Papers PDFLuzz LandichoNo ratings yet

- Study Notes AjeDocument14 pagesStudy Notes AjeLuzz LandichoNo ratings yet

- Classification of Accounts PDFDocument3 pagesClassification of Accounts PDFLuzz Landicho100% (1)

- Lecture Notes - Accounting BasicsDocument4 pagesLecture Notes - Accounting BasicsLuzz LandichoNo ratings yet

- Arce Repair p43Document1 pageArce Repair p43Luzz LandichoNo ratings yet

- Value Added TaxDocument6 pagesValue Added Taxarjohnyabut80% (10)

- Study Notes - Excel Data Analysis ToolsDocument3 pagesStudy Notes - Excel Data Analysis ToolsLuzz LandichoNo ratings yet

- Suitability Assessment Form PDFDocument5 pagesSuitability Assessment Form PDFHershey GabiNo ratings yet

- Financial Risk Management 2Document9 pagesFinancial Risk Management 2Manoj SharmaNo ratings yet

- How Corporations Raise Venture Capital and Issue SecuritiesDocument24 pagesHow Corporations Raise Venture Capital and Issue SecuritiesJamroz KhanNo ratings yet

- Esn 120301Document63 pagesEsn 120301mvk911No ratings yet

- By - Laws OF: Article I Subscription, Issuance and Transfer of SharesDocument9 pagesBy - Laws OF: Article I Subscription, Issuance and Transfer of SharesattyvillaNo ratings yet

- Fin 651 Web ProjectDocument8 pagesFin 651 Web Projectfathazam1No ratings yet

- Rate of Return MeasurementsDocument106 pagesRate of Return MeasurementsRimpy SondhNo ratings yet

- Chapters 7 – 13 Essay QuestionsDocument26 pagesChapters 7 – 13 Essay QuestionsKayla SheltonNo ratings yet

- Income Tax ReviewerDocument99 pagesIncome Tax ReviewerAbby EsculturaNo ratings yet

- Module 2 Relationship of Financial Objectives To Organizational Study and ObjectivesDocument4 pagesModule 2 Relationship of Financial Objectives To Organizational Study and ObjectivesSofia YuNo ratings yet

- Chapter 04: Goals and Governance of The Firm: D. I, Ii and IiiDocument13 pagesChapter 04: Goals and Governance of The Firm: D. I, Ii and IiiTrinh VũNo ratings yet

- Free e-book on primary & secondary marketsDocument12 pagesFree e-book on primary & secondary marketsnehaNo ratings yet

- Lecture Notes: Introduction To Financial Derivatives: Jaeyoung SungDocument9 pagesLecture Notes: Introduction To Financial Derivatives: Jaeyoung SungRizki MaulanaNo ratings yet

- Case 5 - Proton Full AssignmentDocument42 pagesCase 5 - Proton Full AssignmentShaa Didi100% (1)

- Ong Yong Vs TiuDocument29 pagesOng Yong Vs TiuCookies CreamNo ratings yet

- Bahan UTS Pak Totok PDFDocument32 pagesBahan UTS Pak Totok PDFsilviana isyantoNo ratings yet

- The Grandmother With Faith in Indian StocksDocument3 pagesThe Grandmother With Faith in Indian Stockssac_divakarNo ratings yet

- Assignment DigestedCasesDocument2 pagesAssignment DigestedCasesLito0% (1)

- Chap 18Document41 pagesChap 18JackNo ratings yet

- San Juan vs. CA Case DigestDocument14 pagesSan Juan vs. CA Case DigestFaye Cience BoholNo ratings yet

- 2022 CFA Level 1 Curriculum Changes Summary (300hours)Document1 page2022 CFA Level 1 Curriculum Changes Summary (300hours)jkklnklnNo ratings yet

- Employee Stock Ownership and MlpsDocument20 pagesEmployee Stock Ownership and MlpssukeshNo ratings yet

- Real Estate-: Allows Diversification of Asset - Real Estate Has Almost No Direct Correlation With Other PopularDocument12 pagesReal Estate-: Allows Diversification of Asset - Real Estate Has Almost No Direct Correlation With Other PopularsanskritiNo ratings yet

- Adobe Reports Record Revenue: Digital Experience Subscription Revenue Grows 25 Percent Year-Over-Year in Q3Document7 pagesAdobe Reports Record Revenue: Digital Experience Subscription Revenue Grows 25 Percent Year-Over-Year in Q3Dhruba laskarNo ratings yet

- Investment AvenuesDocument103 pagesInvestment AvenuesSuresh Gupta50% (2)

- MC FinalDocument14 pagesMC Finalahmed arfanNo ratings yet

- Cost of Capital 2020Document29 pagesCost of Capital 2020Sai Swaroop MandalNo ratings yet

- Ifci 2Document10 pagesIfci 2Sudhir Kumar YadavNo ratings yet

- Revised Corpotation Code1Document30 pagesRevised Corpotation Code1Entor EntorNo ratings yet

- FMCHAPTER ONE - PPT Power PT Slides - PPT 2Document55 pagesFMCHAPTER ONE - PPT Power PT Slides - PPT 2Alayou TeferaNo ratings yet