Professional Documents

Culture Documents

MBL Infrastructure poised for growth on improving order inflows and BOT tolling

Uploaded by

HitechSoft HitsoftOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBL Infrastructure poised for growth on improving order inflows and BOT tolling

Uploaded by

HitechSoft HitsoftCopyright:

Available Formats

Initiating coverage | Infrastructure

January 23, 2015

MBL Infrastructures

BUY

Gearing-up for next level of growth

CMP

Target Price

Strong Order inflows to lead to better execution: MBL Infrastructures (MBL), a

specialist EPC player is expected to benefit from NHAIs ~2,000km of EPC award

activity in the next 12 months. With economic revival, infra award activity across

verticals should catch-up. MBL has participated in projects worth `10,000cr.

Going by its past track record, of ~25% strike rate, MBL should report ~`2,500cr

worth of new project wins in the next 12 months. We expect MBLs order inflow to

report ~13% CAGR over FY2014-17E, which is likely to be followed-up by

stronger execution. Accordingly, we expect MBLs standalone entity to report a

strong ~18% top-line CAGR during FY2014-17E.

Investment Period

~16% PAT CAGR during FY2014-17E: Stronger execution, benefits of backward

integration and better absorption of fixed costs, should help the standalone entity

report a ~22% EBITDA CAGR during FY2014-17E (EBITDA margin to expand

107bp during the same period). Despite a strong EBITDA growth, higher interest

and depreciation expenses would restrict standalone PAT at ~16% CAGR during

the same period, as per our estimation.

BOT projects nearing completion: MBL has a portfolio of 5 BOT Road projects, of

which 4 are won on Toll+Grant or Toll+Annuity model. This, when coupled

with the fact that 4 of these projects are in the mineral belt region and are interconnected with no alternate roads, indicates that these projects could generate

impressive equity IRRs. With commencement of 4 BOT projects in FY2016-17, we

can expect a possible easing in the balance sheet stress.

`442

`561

12 Months

Stock Info

Infrastructure

Sector

Market Cap (` cr)

916

Net debt (` cr)

704

Beta

1.3

52 Week High / Low

464/100

Avg. Daily Volume

14,819

Face Value (`)

10

BSE Sensex

29,279

Nifty

8,836

Reuters Code

MBLI.BO

Bloomberg Code

MBL@IN

Shareholding Pattern (%)

Promoters

46.7

Comfortable Balance Sheet: MBL is one of the Road developers with moderate

consol. D/E ratio of 1.8x. With 3 BOT projects nearing completion (to commence

tolling in FY2016E) and 4th to commence operations in FY2017E, we expect

consol. D/E ratio to increase to 2.7x by FY2017E. With Management clarifying

that it does not intend to add any new BOT projects to companys portfolio till

FY2017E, we are confident that MBLs D/E ratio would peak at 2.7x, which is

comforting.

MF / Banks / Indian Fls

29.6

Valuation: At CMP of `442/share, MBL is trading at FY2016E and FY2017E

EV/EBITDA multiple of 9.1x and 7.0x, respectively. Improved order inflow outlook

(with current bid pipeline of ~`10,000cr), strong profitability growth, and a

comfortable Balance Sheet strengthen our view that MBL is poised for re-rating

from here-on. We value BOT projects using PV of Free Cash Flows to Equity

shareholders to arrive at a value of `105/share (for all 5 of the BOT projects). We

have assigned 8.0x target P/E multiple to the standalone business to arrive at a

value of `456/share. On adding-up value of standalone entity and BOT projects,

we arrive at FY2017E sum-of-the-parts (SoTP) based price target of `561/share.

Given the 27% upside from the current levels, we initiate coverage on MBL

Infrastructures with a BUY rating.

Sensex

FII / NRIs / OCBs

5.7

Indian Public / Others

Abs. (%)

MBL

18.1

3m

1yr

3yr

9.4

38.5

72.3

37.6 272.5 198.7

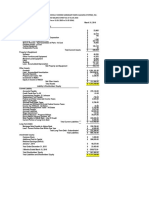

Key Financials (Standalone)

Y/E March (` cr)

Net Sales

% chg

Net Profit

% chg

EBITDA (%)

EPS (`)

P/E (x)

P/BV (x)

RoE (%)

RoCE (%)

EV/Sales (x)

EV/EBITDA (x)

FY2013

1,343

55

9.8

32

14.0

2.0

15.1

16.6

0.9

9.2

FY2014

1,754

30.6

75

35.8

10.0

43

10.3

1.7

17.6

19.3

0.7

7.0

FY2015E

2,019

15.1

85

12.9

10.5

41

10.8

1.4

15.2

17.5

0.8

7.5

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

FY2016E

2,453

21.5

100

18.4

10.9

48

9.1

1.2

14.4

16.5

0.7

6.8

FY2017E

2,857

16.5

118

17.6

11.1

57

7.8

1.1

14.8

16.5

0.7

6.0

Yellapu Santosh

022 3935 7800 Ext: 6828

santosh.yellapu@angelbroking.com

Initiating coverage | MBL Infrastructure

Investment Argument

Order Inflow outlook improves, gives better revenue

visibility

In a poor award activity environment during FY2010-14, captive orders from BOT

projects helped MBL clock a 36% CAGR in its order inflows. Taking into account

the new governments thrust on the Infra sector, and with economic indicators

showing signs of revival; we expect revival across Infra award environment to

catch-up from here on.

Post amendments to the Land Acquisition Law, NHAI is gearing up to have a

strong award activity in 4QFY2015E-FY2016E. We expect NHAI to award

~4,000km of road projects in the next 12 months. Of these, ~2,000km would be

through the EPC route. With MBLs Management clarifying that the company would

not be bidding for BOT projects, it can be estimated on this basis that MBL would

only bid for ~2,000km of EPC road projects.

The Management also highlighted that the company has bid for projects worth

~`10,000cr, which are currently at different bidding stages. If we look at the last

5 years historical win rate of 20-40%, coupled with slightly lower bidding intensity,

we are comforted that MBL is likely to report ~`2,500cr (indicating 25% strike rate

assumption) worth of project wins in the next 12 months.

Our order inflow growth assumption captures (1) resumption in award activity from

State PWDs/ NHAI Road projects, (2) award activity from DFC (Dedicated Freight

Corridor) space, and (3) uptick in award activity from Metro, Industrial

Construction as well as Building & Housing Construction space. Accordingly, we

expect ~13% CAGR in MBLs order inflows during FY2014-17E.

Exhibit 2: Execution to pick-up

1.6x

1.4x

2,500

2,800

2,500

1,700

(14)

0

-50

FY10

FY11

FY12

FY13

OI (` cr)

Source: Company, Angel Research

FY14

FY15E FY16E

y/y change (%)

1,500

1,000

12

1,967

2,681

1,453

577

7

(32)

50

47

1,000

FY17E

0.9x

500

0.8x

0.6x

0.6x

0.5x

1.0x

1.0x

0.9x

0.6x

2,876

1,835

84

1,500

1.2x

1.2x

2,000

1,070

100

609

2,000

500

3,000

2,933

150

2,886

152

1.8x

1.6x

3,205

2,500

3,500

2,992

200

3,000

2,500

Exhibit 1: Order Inflow to catch-up

0.4x

0.2x

0.0x

FY10

FY11

FY12

FY13

OB (` cr)

FY14 FY15E FY16E

Execution Rate (x)

FY17E

Source: Company, Angel Research

MBLs unexecuted order book (as of 2QFY2015-end) stands at `2,354cr, thereby

giving revenue visibility for another 4-5 quarters. As against the Managements

guidance of an order book of over `3,500cr by 4QFY2015-end, we expect MBL to

end with an order book of `2,886cr. Our lower OB assumption for FY2015 is

owing to expectation of just `1,700cr of OI for FY2015 (to-date, publicly reported

OI of `860cr). However, with order inflow momentum likely to catch-up from

here-on, we expect MBL to also experience strong uptick in execution (execution

rate would pick-up from 0.6x in FY2014 to 1.0x by FY2017E).

January 23, 2015

Initiating coverage | MBL Infrastructure

BOT projects to start paying-off

Currently, only 1 of the 5 BOT Road projects owned by MBL is operational. The

remaining 4 projects are likely to commence operations in FY2016-17E. 3 of the

4 ongoing projects are nearing completion (entire land acquisition is complete,

and majority of equity infusion is done), indicating minimal execution risks from

here-on. These 3 BOT projects are likely to attain Commercial Operations Date

(CoD) over the next 2-4 quarters.

Exhibit 3: BOT Projects Net Total Income (in ` cr)

FY14

FY15E

FY16E

FY17E

17

19

21

23

Waraseoni-Lalbarra BOT project

12

Garra-Waraseoni BOT project

14

23

Seoni-Katangi BOT project

11

22

Seoni-Balaghat-Rajegaon BOT project

Suratgarh-Bikaner BOT project

50

BOT Projects - Net Total Income

17

19

54

130

Source: Company, Angel Research

Given that the ongoing EPC work at Suratgarh-Bikaner BOT project is slow and

behind schedule (~20% of total EPC work is done), we expect this project to attain

CoD in 2HFY2017E.

AAP Infrastructures Ltd (Seoni-Balaghat-Gondia stretch), the companys only

operational BOT project, has been profitable since FY2010 (incurred losses during

FY2008-09). Notably, 2 of the 4 BOT projects have been bagged under

Toll+ Annuity model and another 2 have been bagged on a grant model. We are

impressed with Managements business acumen, as MBL is likely to generate

Future Cash flows of 0.4x-2.5x for the equity invested. MBLs cautious strategy

impresses us as in our view, we expect MBL to generate impressive Equity IRRs in

the range of 15-18% (for 3 of the upcoming BOT projects). Whereas,

Garra-Waraseoni project in our view is likely to generate just 6% equity IRR.

We expect MBLs Net Total Income from BOT projects to increase from `17cr in

FY2014 to `130cr in FY2017E (95% CAGR during FY2014-17E). Also, with the

commencement of tolling across 4 BOT projects, we expect the debt repayment

cycle of these SPVs to commence, thereby easing consol. balance sheet stress.

~18% & ~16% Revenue & PAT CAGR, respectively, during FY14-17E

On the back of a strong ~13% CAGR in Order Inflows during FY2014-17E, we

expect execution also to pick. Accordingly, we expect the standalone business to

report ~18% revenue CAGR during FY2014-17E to `2,857cr.

Revenue growth should help MBL absorb fixed costs, leading to EBITDA growth.

Our 22% EBITDA CAGR estimate during FY2014-17E is on the back of following

levers, (1) benefits from their in-house Ready-To-Mix concrete (RMCs), (2) access to

6 quarrying facilities, (3) higher utilization of in-house Construction Equipment

(current Plant & Machinery [P&M] Gross block stands at `200cr), and (4) better

absorption of fixed costs. Despite commencement of interest rate down-cycle, we

do not expect entire benefits of EBITDA growth to flow-down to the PAT level. We

expect interest and depreciation expenses to restrict PAT CAGR during FY2014-17E

to ~16%.

January 23, 2015

Initiating coverage | MBL Infrastructure

Comfortable Gearing ratio

MBL has been prudent in managing its capital requirements. Considering

standalone entitys D/E ratio (of ~1.0x) and standalone entitys potential to

generate over `100cr of Cash Flow from Operations during FY2014-17E, we are

not much concerned about the gearing ratio at standalone entity level.

MBLs selective strategy to bid for and win new BOT projects at the right time has

helped the company in managing its capital efficiently. This could be gauged from

their consol. D/E ratio, which at 2QFY2015-end stood at 1.8x.

As a prudent move, in anticipation of improvement in business cycle, MBL recently

pursued a Qualified Institutional Placement (QIP) issue (issued 3.2mn additional

shares @`365/share, thereby raising ~`110cr). 4 of the ongoing BOT projects

require equity investments of ~`87cr. With MBLs Management clarifying that it

would not bid for BOT Road projects till FY2017E, idly lying cash and internal

accruals should be enough to fund the equity requirements of these 4 BOT

projects. Also, by raising equity, MBL has built-up its war chest for the next phase

of growth. On the whole, we expect consol. gearing ratio to increase to 2.7x by

FY2017E, which is in a comfortable zone.

Exhibit 4: Standalone D/E ratio

Exhibit 5: Consolidated D/E ratio

1,200

2.0x

1,000

1.6x

800

1.1x

1.0x

1.1x

1.2x

400

2.0x

1.6x

1.6x

1.5x

1,000

1.0x

FY16E

FY17E

0.0x

Std. Debt (` cr)

Source: Company, Angel Research

D/E ratio (x)

2,183

1,080

FY15E

0.2x

1,955

955

FY14

500

1,391

695

FY13

0.4x

772

463

0.6x

446

200

2.1x

1,500

1.0x

0.8x

2.5x

2,000

1.4x

1.3x

1.3x

3.0x

2.7x

2.6x

644

600

2,500

1.8x

FY13

FY14

FY15E

FY16E

FY17E

0.5x

0.0x

Consol. Debt (` cr)

D/E ratio (x)

Source: Company, Angel Research

Selective bidding, best approach to grow Order Book

MBL, over the years, has shown immense maturity in bidding for the right kind of

projects and working for clients who are quality conscious. It bids for projects,

which are funded either by government agencies or international bodies such as

World Bank and ADB. This strategy mitigates payment default risk and helps

maintain WC levels prudently.

When the entire industry was witnessing heated competition and experiencing

higher D/E ratios (on account of higher exposure to BOT road projects), MBL

stayed away from the BOT space. It was only after competition started easing-off

that MBL entered the BOT Road space. This strategy helped them bid for projects

in a lesser competitive environment and sign the projects with attractive terms.

Given that 2 of MBLs projects are on Toll+ Annuity and another 2 on Toll+ Grant

model, we are optimistic of the company experiencing impressive equity IRR across

these projects. This strategy has also helped MBL in building its order book in a

down-cycle, when the award activity witnessed severe slowdown. It is this business

January 23, 2015

Initiating coverage | MBL Infrastructure

prudence, which helped MBL cover its fixed costs base in a down-cycle and

maintain ~10% standalone EBITDA levels.

Notably, all projects of MBL have a price pass-on clause in-built, thereby insulating

the company from any sharp fall in EBITDA margins.

All the above-mentioned initiatives and well timed strategic moves have helped

MBL maintain ~10% EBITDA margins during FY2010-14 and generate Cash flow

from Operations to the tune of ~`176cr during FY2012-14.

Backward integration to aid in quicker margin expansion

MBL over the years has invested in (1) Ready-to-Mix Concrete (RMC) plants,

(2) 6 quarrying facilities strategically located across North & Eastern India and

(3) wide array of Construction Equipments. This strategy to invest in resources

would help the company in ensuring quick and timely supply of stone aggregates

at the project location, thus translating into cost savings. In an up-cycle, where

award activity is likely to see a sharp bounce back, we expect having large

inventory of construction equipments would help MBL in lowering execution costs;

reduce mobilization time, thereby translating to higher operating margins. All

these backward integration initiatives should help the standalone entity in reporting

a 107bp EBITDA margin expansion during FY2014-17E to 11.1%.

January 23, 2015

Initiating coverage | MBL Infrastructure

Update on BOT Projects

MBL has a portfolio of 5 BOT Road projects, of which only 1 is operational

(Seoni-Balaghat-Gondia). MBLs Management has guided that all 4 BOT road

projects would be operational in FY2016E (vs. our assumption of only 3 being

operational in FY2016E). By 2QFY2015-end, MBL had already invested `201cr of

the total required `288cr, implying that `87cr further needs to be invested towards

these 4 BOT projects. ~`110cr raised from the QIP issue and internal accruals

should help MBL meet the remaining equity requirement of `87cr.

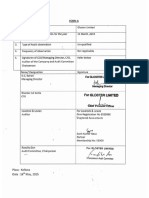

Exhibit 6: Details of BOT Projects

Particulars

AAPIL

MHDCL

MPTRCL

MPRNCL

BOT- Toll

WaraseoniLalbarra Road

BOT- Toll+Annuity

GarraWaraseoni

BOT- Toll+Annuity

SBTRCL

Project Type

Seoni-BalaghatGondia

BOT- Toll

State

Madhya Pradesh

Maharashtra

Madhya Pradesh

Madhya Pradesh

Rajasthan

114

76

18

47

172

Operational

Under Construction

Under Construction

Under Construction

Under Construction

15 years

30 years

15 years

15 years

16 years

100%

100%

100%

100%

65%

Mar-05

Sep-11

Dec-11

Mar-13

Dec-11

TPC (` in cr)

108

212

57

137

620

EPC (` in cr)

91

177

47

110

510

Debt (` in cr)

61

101

42

97

450

Equity (` in cr)

12

51

15

40

170

Grant (` in cr)

35

60

5%

5%

5%

5%

Stretch

Length (kms)

Status

Concession Period

MBL's stake

Concession Agreement Date

Seoni-Katangi

Bikaner-Suratgarh

BOT- Toll

Traffic Growth Assumption:

1-5 years

6-16 years

3%

3%

3%

3%

16 years and there-after

5%

0%

NA

NA

NA

Equity IRR (%)

15%

16%

6%

18%

Source: Company, Angel Research; Note: NA- Not Applicable

MBLs Management maintained that they have strategically bid for road projects in

mineral rich regions, which also happen to be important hubs and presently do not

have any other alternative connecting roads. Notably, 4 of the 5 BOT road

projects are inter-connected namely, Seoni- Balaghat-Gondia, Seoni-Katangi to

Maharashtra Border, Waraseoni-Lalbarra and Garra-Waraseoni stretches.

Accordingly, MBLs Management claims to have 2 stretches of BOT projects. One

of the stretches is on NH-15 across Suratgarh-Bikaner (connecting north India to

Samakhiali, Gujarat) and other one is a stretch across NH-6/7 in Madhya

Pradesh.

January 23, 2015

Initiating coverage | MBL Infrastructure

Consolidated Financials

MBL reported an impressive 29% top-line CAGR during FY2010-14 to `1,766cr.

This top-line growth reflects (1) ~51% order book CAGR during the same period,

and (2) ~21% Toll Income CAGR during same period (for their only operational

BOT- Seoni-Balaghat-Rajegaon stretch). At 2QFY2015E-end, MBLs unexecuted

order book stood at `2,354cr, thereby giving revenue visibility for another

4-5 quarters. For 1HFY2015E, MBL reported a 14.0% yoy top-line growth (to

`864cr). With uptick in order book and commencement of 4 BOT road projects,

we expect MBL to report a 19% top-line CAGR during FY2014-17E.

Exhibit 7: Consol. Revenue split

FY14

FY15E

FY16E

FY17E

Consolidated Revenues

1,766

2,038

2,507

2,986

FY14-17E

CAGR (%)

19

Standalone Revenues

Particulars (` cr)

1,749

2,019

2,453

2,857

18

Revenues from BOT Projects

17

19

54

130

95

Seoni-Balaghat-Rajegaon BOT project

17

19

21

23

10

Waraseoni-Lalbarra BOT project

12

n/a

Garra-Waraseoni BOT project

14

23

n/a

Seoni-Katangi BOT project

11

22

n/a

Suratgarh-Bikaner BOT project

50

n/a

Source: Company, Angel Research; Note: n/a- Not Applicable

Despite a challenging macro environment, EPC business dependency on captive

BOT projects helped the company maintain its EBITDA margins at over 10% levels.

During FY2010-14, MBL reported an impressive 19.6% EBITDA CAGR (to `188cr).

With 4 of the BOT projects (have higher EBITDA margins vs. EPC business) likely to

commence operations in FY2016-17, coupled with (1) efficiencies from their

backward integration initiatives, and (2) new project wins on low bidding intensity,

we can expect MBL to report sharp EBITDA growth during FY2014-17E (we have

modeled ~32% CAGR over FY2014-17E). In other words, we expect EBITDA

margins to expand by 372bp during FY2014-17E to 14.4%.

Exhibit 8: Consol. EBITDA split

FY14

FY15E

FY16E

FY17E

FY14-17E

CAGR (%)

Consolidated EBITDA

188

229

311

429

32

Standalone EBITDA

176

212

267

317

22

12

17

44

112

111

Particulars (` cr)

BOT Projects EBITDA

Source: Company, Angel Research

During FY2010-14, MBL reported a restricted PAT CAGR of ~9%, reflecting the

impact of higher interest and depreciation expenses (partly owing to their

Seoni-Balaghat-Rajegaon BOT project). 4 of the BOT projects are expected to

commence operations in FY2016-17E. We do not expect the entire benefits of

EBITDA growth to flow down to the PAT level, as interest and depreciation

expenses would also increase. Accordingly, we expect MBL to report ~9% PAT

CAGR during FY2014-17E. In other words, PAT margins would decline from 4.4%

in FY2014 to 3.3% by FY2017E.

January 23, 2015

Initiating coverage | MBL Infrastructure

Exhibit 9: Consol. PAT split

FY14A

FY15E

Consolidated PAT

77

90

88

99

FY14-17E

CAGR (%)

9

Standalone PAT

75

85

100

118

16

(12)

(19)

NA

Particulars (` cr)

BOT Projects PAT

FY16E

FY17E

Source: Company, Angel Research; Note: NA - Not applicable

Capital deployment towards BOT projects, which report losses in first 1-2 years,

should be a drag on overall return ratios of the company. Accordingly, we expect

consol. Return on Capital Employed (RoCE) and Return on Equity (RoE) ratios to

decline from ~16%/18% in FY2014 to ~13%/13% in FY2017E.

Exhibit 10: Consolidated RoCE (%)

Exhibit 11: Consolidated RoE (%)

18

20

16

18

14

16

14

12

12

10

10

16

13

13

18

FY15E

15

FY14

13

13

FY13

12

16

4

15

FY13

FY14

FY15E

FY16E

FY17E

Source: Company, Angel Research

January 23, 2015

FY16E

FY17E

Source: Company, Angel Research

Initiating coverage | MBL Infrastructure

Valuation

We have valued MBL using Sum-Of-The-Parts method. MBLs EPC business (under

standalone entity) has been valued using FY2017E P/E multiple, whereas BOT

projects are valued using the Free Cash flow to Equity holders method.

Value of Core EPC business

The standalone EPC business is trading at FY2016E and FY2017E P/E multiple of

9.1x and 7.8x, respectively. Standalone entity EPC is trading at ~25% discount to

its peers average (include- Simplex Infra, Ahluwalia Contracts, KNR Construction

and J Kumar Infra). This discount could be attributable to (1) MBLs lower RoE of

14.8% for FY2017E vs. peers average of 16.3% in FY2017E), and (2) higher

dependency on only one vertical, i.e. the Roads Vertical (a/cs for ~73% of

unexecuted order book).

Exhibit 12: Peer Group comparison (Standalone numbers)

Particulars

Revenues (` cr)

EBITDA Margins (%)

PAT Margins (%)

Rev. CAGR

FY17E FY2014-17E(%)

PAT CAGR

FY2014-17E(%)

FY14

FY15

FY16

FY17

FY15E

FY16E

FY17E

FY15E

FY16E

MBL Infra

1,754

2,019

2,453

2,857

10.5

10.9

11.1

4.2

4.1

4.1

17.7

16.3

Simplex Infra

5,499

5,696

6,472

7,670

10.7

10.8

10.4

1.2

1.8

2.6

11.7

49.4

837

886

1,059

1,336

15.4

15.5

14.7

7.1

7.3

7.3

16.9

17.2

957

1,155

1,408

1,692

10.3

11.0

11.9

5.7

6.2

7.0

20.9

76.0

1,169

1,456

1,774

2,191

17.5

17.3

16.8

6.9

7.4

7.6

23.3

25.9

13.5

13.7

13.5

5.2

5.7

6.2

18.2

42.1

KNR Construction

Ahluwalia Contracts

J Kumar Infra

Average

Source: Bloomberg estimates, Company, Angel Research

Exhibit 13: Peer Group comparison (Standalone numbers)

RoE (%)

EPS (`)

Adj. P/E (x)

CMP

M-Cap

(` cr)

FY14

FY15

FY16

FY17

FY15E

FY16E

FY17E

FY15E

FY16E

FY17E

MBL Infra

442

916

17.6

15.2

14.4

14.8

40.9

48.5

57.0

10.7

9.0

7.7

Simplex Infra

366

1,812

4.5

4.9

7.8

12.1

13.9

24.1

41.7

26.3

15.2

8.8

KNR Construction

378

1,055

4.5

4.9

7.8

12.1

22.3

27.5

34.9

16.8

13.6

10.8

Ahluwalia Contracts

243

1,626

10.1

23.1

23.2

24.4

10.1

13.4

17.9

24.1

18.1

13.5

J Kumar Infra

476

1,535

15.6

14.9

16.0

16.8

31.9

41.6

52.0

14.9

11.4

9.2

8.7

12.0

13.7

16.3

20.5

14.6

10.6

Average

Source: Bloomberg estimates, Company, Angel Research

We have valued MBLs core EPC business (standalone entity) based on P/E multiple

and assigned 8.0x for FY2017E EPS of `57, resulting in value of `456 per share.

Value of BOT projects

BOT projects have been valued using the Free Cash flow to Equity holders

method. Our value for all the 5 BOT projects comes to `105/share, which is 19%

January 23, 2015

Initiating coverage | MBL Infrastructure

of the overall SOTP value for the company. Ongoing projects contribute 3% and

under-development projects contribute 16% to the overall value.

On combining the value of EPC business BOT projects, we arrive at a combined

business value of `561/share, reflecting 27% upside in the stock price from the

current levels. In order words, the stocks current market price reflects the business

value of just the standalone entity. We sense that as and when announcements of

the remaining 4 BOT projects are made, the stock price would catch-up

accordingly. We initiate coverage on MBL with a target price of `561/ share.

Exhibit 14: Sum-of-the-Parts based Valuation Table

Particulars

MBL's EPC business

Segment

FY17E Std. PAT

(` cr)

Target Multiple

Target Value

(` cr)

Value/ share

(`)

% of SoTP

Construction

118

8.0

945

456

81

945

456

81

Total

Basis

P/E of 8.0x

Discounted FCFE

(` cr)

Project Stake

Adj. FCFE Value

(` cr)

Value/ share

(`)

% of SoTP

Road BOT projects

Seoni-Balaghat-Rajegaon

Toll

BOT Project

Waraseoni-Lalbarra BOT Project Toll + Annuity

31

100%

31

15

Ke of 17%

22

100%

22

11

Ke of 17%

Garra-Waraseoni BOT Project

Particulars

Proj. Type

Basis

Toll + Annuity

17

100%

17

Ke of 17%

Seoni-Katangi BOT Project

Toll

74

100%

74

36

Ke of 17%

Suratgarh-Bikaner BOT Project

Toll

114

65%

74

35

Ke of 17%

218

105

19

1,162

561

100

Total

258

Grand Total

Upside

27%

CMP

442

Source: Company, Angel Research

Key risks

January 23, 2015

Promoters have pledged ~5% of their equity stake (Promoters hold 46% stake

in MBL Infra). Any further increase in the pledge by the promoters could lead

to volatility in the stock price.

Suratgarh-Bikaner BOT project currently accounts for ~20% of unexecuted

order book. Any further delays in getting clearances could impact our nearterm execution assumptions, as well as equity IRRs.

Lower than expected order inflows due to slowdown in new project award

activity

Slower growth vs. our traffic growth expectations is potential risk to toll

revenues from BOT projects.

10

Initiating coverage | MBL Infrastructure

Exhibits

Exhibit 15: Order Book split- Vertical-wise

Exhibit 16: Order Book split- State-wise

5.8%

11.7%

6.0%

18.3%

7.2%

3.9%

24.9%

54.8%

17.5%

10.7%

11.1%

5.5%

Roads & Highway Cons.

Other Infra

Railway Infra

Roads & Highway O&M

Building & Housing

22.6%

Haryana

Assam

West Bengal

Rajasthan

New Delhi

Uttarakhan

Madhya Pradesh

Others

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 17: Order Book split- Client-wise

Exhibit 18: Consol. Revenue (` cr)

20.8%

35

3,500

10.7%

30

3,000

30

9.5%

2,500

6.1%

25

23

2,000

5.8%

20

19

15

1,500

15

22.6%

10

WBHDCL

PWD Rajasthan

NHAI

MPRDC

FY13

Source: Company, Angel Research

Exhibit 19: Consol. EBITDA (` cr)

Exhibit 20: Consol. PAT (` cr)

350

31

30

300

22

250

25

20

200

15

150

10

429

311

229

188

50

143

100

0

5

0

FY13

FY14

FY15E

EBITDA (` cr)

Source: Company, Angel Research

January 23, 2015

FY16E

FY17E

y/y change (%)

2,986

35

100

99

35

36

80

90

400

40

120

60

40

30

25

20

77

40

39

FY16E

FY17E

y/y change (%)

17

13

57

45

42

450

2,507

2,038

FY14

FY15E

Revenues (` cr)

Source: Company, Angel Research

500

5

0

PWD Haryana

88

PWD Uttarakhand

Others

1,766

500

24.6%

1,355

1,000

15

10

5

20

(2)

0

FY13

FY14

FY15E

PAT (` cr)

(5)

FY16E

FY17E

y/y change (%)

Source: Company, Angel Research

11

Initiating coverage | MBL Infrastructure

17

16

16

FY13

FY14

FY15E

FY16E

FY17E

17

17

17

18

18

18

10

15

19

12

14

19

14

15

20

16

18

18

15

20

19

Exhibit 22: Standalone Return on Capital Employed (%)

20

17

Exhibit 21: Standalone Return on Equity (%)

FY13

FY14

FY15E

FY16E

FY17E

15

Source: Company, Angel Research

January 23, 2015

Source: Company, Angel Research

12

Initiating coverage | MBL Infrastructure

Exhibit 23: List of Ongoing projects

Project details

Contract Value

(` in cr)

Unexecuted Value

(` in cr)

Development & Operation on BOT basis of Bikaner-Suratgarh of NH-15

510

411

Widening to 4-lane of Dankuni-Chandanagar section of SH-13

318

275

Improve & strengthening of roads under Package no. C-4 in Almora dist.

217

217

Construction of Seoni-Katangi BOT Road project

177

21

RCD Contract, ADB funded project for improvement/ upgradation of roads & bridges of SH-68

(Shivganj-Rafiganj- Uphara-Devkund-Baidrabad)

169

37

NHAI contract to widen-strengthen NH-37 stretch of Sonapur-Guwahati (51% JV with TCIL)

158

40

Improve & strengthen roads under Package no. C-2 in Udham singh Nagar dist.

143

143

Construction of Garra-WaraSeoni BOT Road project

110

59

Construct buildings at National Law University, Rajiv Gandhi Education City, Sonepat Dist.

92

91

Construct depot-cum-workshop at Kalindi-kunj (Line-8 for Delhi MRTS Phase III)

84

56

Construct 222 flats, Keelandev Towers at Shivaji Nagar, Bhopal, MP

63

48

Construct Bus Terminus at GT Road, Serampore Municipality, Hooghly, WB

55

39

Re-development of Police Colony, Delhi Cantt.

50

47

Construction of Residential Buildings for NHAI staff at Dwarka, N-Delhi

49

19

Construction of WaraSeoni-Lalbarra BOT Road project

47

Construct Assam Judicial Academy & National Law School at Amingaon, Assam

44

32

Construct 4-lane RoB at Delhi Ambala line in Sonepat, Haryana

43

20

Construct Police Residence Quarters at Kindli Check Post, Delhi

41

19

Construct 96 flats at Tulsi Nagar, Bhopal

40

32

Construct 2-lane RoB at Delhi Ambala Railway line of Sonepat-Purkhas Road, Sonepat, Haryana

36

27

Construct Group Housing Residential Apartments for NBCC on Delhi Saharanpur Highway, Baghpat, UP

35

Construct 92 flats at Mahadev Parisar, & Construct Commercial Building at Shivaji Nagar, Bhopal

24

Construct 2-lane RoB at Delhi Ambala Railway line of Delhi-Ambala, Sonepat, Haryana

23

Construct Panchayat & Rural Development Dept. Building at Sector-19 in Naya Raipur

19

17

Construct Police Station & Residences at Hari Nagar, New Delhi

19

10

Construct Residential Accommodation for Senior Officers of SPA, Bhopal

13

11

O&M of Garra-Waraseoni Road project

38

38

O&M of Waraseoni-Lalbarra Road project

15

15

O&M of Seoni-Katangi Road project

263

263

O&M of Suratgarh-Bikaner Road project

251

251

O&M of Seoni-Balaghat Gondia Road, MP

51

49

Residential Complex for Judicial staff at Sec-19, Dwarka, Delhi

46

46

Other Contracts

85

3,327

2,354

Total Gross Order Book

Source: Company, Angel Research

January 23, 2015

13

Initiating coverage | MBL Infrastructure

Income Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

1,343

1,754

2,019

2,453

2,857

30.6

15.1

21.5

16.5

1,211

1,578

1,807

2,186

2,539

Cost of Materials Consumed

954

1,376

1,587

1,921

2,237

Direct Labour, Sub-Contracts

180

118

125

150

173

23

27

30

39

44

Net Sales

% Chg

Total Expenditure

Employee benefits Expense

Other Expenses

EBITDA

55

57

65

76

86

131

176

212

267

317

34.0

20.3

26.1

18.7

9.8

10.0

10.5

10.9

11.1

10

15

19

21

% Chg

EBIDTA %

Depreciation

EBIT

166

197

249

296

33.9

18.3

26.4

19.0

51

70

84

115

139

PBT

74

101

115

136

160

Tax

19

26

30

35

42

25.4

25.4

26.0

26.0

26.0

55

75

85

100

118

% Chg

Interest and Financial

Charges

Other Income

% of PBT

PAT before Exceptional item

Exceptional item

PAT

124

55

% Chg

85

100

118

12.9

18.4

17.6

PAT %

4.1

4.3

4.2

4.1

4.1

Diluted EPS

32

43

41

48

57

35.8

(4.6)

18.4

17.6

% Chg

January 23, 2015

75

35.8

14

Initiating coverage | MBL Infrastructure

Balance Sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

Sources of Funds

Equity Capital

18

18

21

21

21

Reserves Total

374

443

633

725

833

Networth

391

460

654

746

854

Total Debt

446

463

695

955

1,080

Other Long-term Liabilities

108

153

199

199

199

Deferred Tax Liability

Total Liabilities

30

34

35

35

35

974

1,111

1,582

1,934

2,167

175

214

279

324

364

38

48

63

81

102

137

166

216

243

261

Application of Funds

Gross Block

Accumulated Depreciation

Net Block

Capital WIP

Investments

98

166

220

308

308

Inventories

491

559

729

872

984

Sundry Debtors

302

374

544

640

730

Cash and Bank Balance

18

13

18

51

98

Loans, Advances & Deposits

71

97

90

89

95

Current Assets

Other Current Asset

January 23, 2015

39

46

48

Current Liabilities

285

324

365

405

447

Net Current Assets

601

725

1,056

1,294

1,508

Other Assets

139

53

90

90

90

Total Assets

974

1,111

1,582

1,934

2,167

15

Initiating coverage | MBL Infrastructure

Cash Flow Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

Profit before tax

74

101

115

136

160

Depreciation

10

15

19

21

Change in Working Capital

(80)

(3)

(308)

(205)

(168)

Interest & Financial Charges

51

70

84

115

139

Direct taxes paid

(47)

(14)

(30)

(35)

(42)

163

(125)

30

111

(Inc)/ Dec in Fixed Assets

(33)

(39)

(65)

(45)

(40)

(Inc)/ Dec in Investments

(26)

(68)

(54)

(88)

Cash Flow from Investing

(59)

(107)

(119)

(133)

(40)

117

109

18

232

260

125

Cash Flow from Operations

Issue/ (Buy Back) of Equity

Inc./ (Dec.) in Loans

Dividend Paid (Incl. Tax)

(3)

(6)

(9)

(9)

(10)

(51)

(70)

(84)

(115)

(139)

55

(58)

256

136

(24)

Inc./(Dec.) in Cash

(3)

13

33

46

Opening Cash balances

18

51

Closing Cash balances

18

51

98

Interest Expenses

Cash Flow from Financing

January 23, 2015

16

Initiating coverage | MBL Infrastructure

Key Ratio (Standalone)

Y/E March

FY13

FY14

FY15E

FY16E

FY17E

P/E (on FDEPS)

14.0

10.3

10.8

9.1

7.8

P/CEPS

12.4

9.1

9.2

7.7

6.6

Dividend yield (%)

0.7

0.7

0.8

0.8

0.9

EV/Sales

0.9

0.7

0.8

0.7

0.7

EV/EBITDA

9.2

7.0

7.5

6.8

6.0

EV / Total Assets

1.2

1.1

1.0

0.9

0.9

EPS (fully diluted)

31.6

42.9

40.9

48.5

57.0

Cash EPS

Valuation Ratio (x)

Per Share Data (`)

35.7

48.5

48.3

57.5

67.3

DPS

3.0

3.0

3.7

3.5

4.2

Book Value

224

263

315

360

412

RoCE (Pre-tax)

16.6

19.3

17.5

16.5

16.5

Angel RoIC (Pre-tax)

15.0

18.4

14.7

14.8

15.5

RoE

15.1

17.6

15.2

14.4

14.8

Asset Turnover (Gross Block) (X)

0.8

0.9

0.9

0.9

0.9

Inventory / Sales (days)

134

109

116

119

119

Receivables (days)

82

70

83

88

88

Payables (days)

28

27

25

22

20

D/E ratio (x)

1.1

1.0

1.1

1.3

1.3

Interest Coverage Ratio (x)

2.4

2.4

2.4

2.2

2.1

Returns (%)

Turnover ratios (x)

Leverage Ratios (x)

January 23, 2015

17

Initiating coverage | MBL Infrastructure

Income Statement (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

1,355

1,766

2,038

2,507

2,986

30.3

15.4

23.0

19.1

1,212

1,578

1,809

2,196

2,557

Cost of Materials Consumed

954

1,376

1,587

1,921

2,237

Direct Labour, Sub-Contracts

180

118

125

150

173

23

27

30

39

44

Net Sales

% Chg

Total Expenditure

Employee benefits Expense

Other Expenses

EBITDA

55

57

67

87

103

143

188

229

311

429

31.2

21.6

35.8

38.1

10.6

10.7

11.2

12.4

14.4

11

14

21

34

57

% Chg

EBIDTA %

Depreciation

EBIT

132

% Chg

Interest and Financial Charges

Other Income

PBT

Tax

% of PBT

PAT before Exceptional item

Exceptional item

PAT before Minority Interest

Minority Interest

PAT after Minority Interest

58

208

277

372

19.4

33.3

34.3

75

89

155

246

76

103

121

125

129

20

26

31

36

44

25.7

25.2

25.3

29.2

33.9

57

77

90

88

85

57

77

90

88

85

(14)

57

77

90

88

99

35.9

17.1

(1.9)

12.2

% Chg

PAT %

4.2

4.4

4.4

3.5

3.3

Diluted EPS

32

44

43

43

41

36.0

(1.1)

(1.9)

(3.8)

% Chg

January 23, 2015

174

31.6

18

Initiating coverage | MBL Infrastructure

Balance Sheet (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

Sources of Funds

Equity Capital

18

18

21

21

21

Reserves Total

380

451

642

722

797

Networth

398

469

663

742

817

Total Debt

644

772

1,391

1,955

2,183

44

40

73

73

73

Other Long-term Liabilities

Minority Interest

32

32

32

18

30

34

35

35

35

1,116

1,347

2,193

2,837

3,126

248

287

352

841

1,583

59

73

91

121

183

Net Block

189

214

261

720

1,400

Capital WIP

209

376

715

620

Investments

20

20

24

24

24

Inventories

491

559

729

872

984

Sundry Debtors

Deferred Tax Liability

Total Liabilities

Application of Funds

Gross Block

Accumulated Depreciation

Current Assets

253

318

594

731

829

Cash and Bank Balance

77

68

15

50

102

Loans, Advances & Deposits

72

98

90

89

95

39

46

48

Current Liabilities

208

330

365

405

447

Net Current Assets

692

721

1,103

1,382

1,612

16

90

90

90

1,116

1,347

2,193

2,837

3,126

Other Current Asset

Other Assets

Total Assets

January 23, 2015

19

Initiating coverage | MBL Infrastructure

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

Profit before tax

76

103

121

125

129

Depreciation

11

14

21

34

57

Change in Working Capital

(35)

(56)

(472)

(248)

(172)

Interest & Financial Charges

58

75

89

155

246

Direct taxes paid

(48)

(14)

(31)

(36)

(44)

62

122

(272)

28

216

(Inc)/ Dec in Fixed Assets

(172)

(206)

(404)

(394)

(121)

(Inc)/ Dec in Investments

(20)

(4)

Cash Flow from Investing

(191)

(206)

(409)

(394)

(121)

117

202

128

619

564

228

Cash Flow from Operations

Issue/ (Buy Back) of Equity

Inc./ (Dec.) in Loans

Dividend Paid (Incl. Tax)

Interest Expenses

Minority Interest

Cash Flow from Financing

January 23, 2015

(3)

(6)

(9)

(9)

(10)

(58)

(75)

(89)

(155)

(246)

32

(14)

142

78

638

401

(42)

Inc./(Dec.) in Cash

13

(6)

(42)

35

53

Opening Cash balances

50

63

57

15

50

Closing Cash balances

63

57

15

50

102

20

Initiating coverage | MBL Infrastructure

Key Ratio (Consolidated)

Y/E March

FY13

FY14

FY15E

FY16E

FY17E

P/E (on FDEPS)

13.7

10.1

10.2

10.4

10.8

P/CEPS

11.5

8.5

8.3

7.5

5.9

Dividend yield (%)

0.7

0.7

0.8

0.8

0.9

EV/Sales

1.0

0.8

1.1

1.1

1.0

EV/EBITDA

9.4

7.9

10.0

9.1

7.0

EV / Total Assets

1.2

1.1

1.0

1.0

1.0

EPS (fully diluted)

32.3

44.0

43.5

42.7

41.0

Cash EPS

38.7

52.0

53.6

58.9

75.3

3.0

3.0

3.7

3.5

4.2

227.1

267.6

319.7

358.2

394.4

RoCE (Pre-tax)

14.6

15.6

12.7

11.8

13.2

Angel RoIC (Pre-tax)

12.9

14.4

10.2

10.4

12.5

RoE

15.2

17.8

15.9

12.6

12.7

Asset Turnover (Gross Block) (X)

0.6

0.7

0.7

0.5

0.4

Inventory / Sales (days)

127

108

115

117

113

Receivables (days)

57

59

82

97

95

Payables (days)

18

25

24

21

19

D/E ratio (x)

1.6

1.6

2.1

2.6

2.7

Interest Coverage Ratio (x)

2.3

2.4

2.4

1.8

1.5

Valuation Ratio (x)

Per Share Data (`)

DPS

Book Value

Returns (%)

Turnover ratios (x)

Leverage Ratios (x)

January 23, 2015

21

Initiating coverage | MBL Infrastructure

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

MBL Infrastructure

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

January 23, 2015

Buy (> 15%)

Reduce (-5% to -15%)

Accumulate (5% to 15%)

Sell (< -15%)

Neutral (-5 to 5%)

22

Initiating coverage | MBL Infrastructure

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

sarabjit@angelbroking.com

Vaibhav Agrawal

VP-Research (Banking)

vaibhav.agrawal@angelbroking.com

Amarjeet Maurya

Analyst (FMCG, Media, Mid-Cap)

amarjeet.maurya@angelbroking.com

Bharat Gianani

Analyst (Automobile)

bharat.gianani@angelbroking.com

Rahul Dholam

Analyst (Metal, Oil & Gas)

rahul.dholam@angelbroking.com

Santosh Yellapu

Analyst (Infrastructure)

santosh.yellapu@angelbroking.com

Shrenik Gujrathi

Analyst (Cap Goods, Cement)

shrenik.gujrathi@angelbroking.com

Umesh Matkar

Analyst (Banking)

umesh.matkar@angelbroking.com

Twinkle Gosar

Analyst (Mid-Cap)

gosar.twinkle@angelbroking.com

Tejas Vahalia

Research Editor

tejas.vahalia@angelbroking.com

Siddarth Bhamre

Head Technical & Derivatives

siddarth.bhamre@angelbroking.com

Sameet Chavan

Technical Analyst

sameet.chavan@angelbroking.com

Sneha Seth

Associate (Derivatives)

sneha.seth@angelbroking.com

Mayuresh Joshi

VP - Institutional Sales

mayuresh.joshi@angelbroking.com

Meenakshi Chavan

Dealer

meenakshis.chavan@angelbroking.com

Gaurang Tisani

Assistant Manager

gaurangp.tisani@angelbroking.com

Production Incharge

dilipm.patel@angelbroking.com

Technicals and Derivatives:

Institutional Sales Team:

Production Team:

Dilip Patel

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 /

NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

January 23, 2015

23

You might also like

- Bus5601 SG 070510 PDFDocument120 pagesBus5601 SG 070510 PDFDellendo FarquharsonNo ratings yet

- Lecture - ACC117Document4 pagesLecture - ACC117Andrea Pamela OngNo ratings yet

- Test Bank For Essentials of Corporate Finance 9th Edition by RossDocument24 pagesTest Bank For Essentials of Corporate Finance 9th Edition by Rosspauljohnstonapgsoemyjk98% (45)

- NBCC LTD (NBCC) : Orderbook Solid Strong Inflows AnticipatedDocument17 pagesNBCC LTD (NBCC) : Orderbook Solid Strong Inflows Anticipatedarun_algoNo ratings yet

- BHEL - Initiating CoverageDocument23 pagesBHEL - Initiating CoveragePranjayNo ratings yet

- IEA Report 19th JanuaryDocument28 pagesIEA Report 19th JanuarynarnoliaNo ratings yet

- Capital Goods: 1QFY17E Results PreviewDocument9 pagesCapital Goods: 1QFY17E Results PreviewAnonymous y3hYf50mTNo ratings yet

- IEA Report 20th MarchDocument23 pagesIEA Report 20th MarchnarnoliaNo ratings yet

- IEA Report 20th FebruaryDocument29 pagesIEA Report 20th FebruarynarnoliaNo ratings yet

- HDFC Sec Value Picks Sept15Document13 pagesHDFC Sec Value Picks Sept15sanjay901No ratings yet

- SHAW Equity Research ReportDocument13 pagesSHAW Equity Research ReportAnonymous 7CxwuBUJz3No ratings yet

- Allahabad Bank Equity Research Report - CorrectedDocument20 pagesAllahabad Bank Equity Research Report - CorrectedkushagraNo ratings yet

- Union Budget (2016-17) : FM Finally Gets It Right!Document12 pagesUnion Budget (2016-17) : FM Finally Gets It Right!Muralidharan KrishnamoorthyNo ratings yet

- Tata Consultancy Services: Rs1,139 NeutralDocument8 pagesTata Consultancy Services: Rs1,139 NeutralSumit AggarwalNo ratings yet

- BSCPL Infrastructure Limited: Analysts Contact RatingsDocument9 pagesBSCPL Infrastructure Limited: Analysts Contact RatingsArthy ShamaNo ratings yet

- Initiating Coverage Cherat Cement Company LTD 2Document10 pagesInitiating Coverage Cherat Cement Company LTD 2faiqsattar1637No ratings yet

- NCC Kedar ReportDocument4 pagesNCC Kedar ReportKedarNo ratings yet

- Infra Emkay 151014Document113 pagesInfra Emkay 151014SUKHSAGAR1969No ratings yet

- HSBC May22 q2Document28 pagesHSBC May22 q2Meishizuo ZuoshimeiNo ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Earnings Call Transcript - Q1FY24Document17 pagesEarnings Call Transcript - Q1FY24untu778899No ratings yet

- Infrastructure-Driven Growth Powers Access Engineering Coverage InitiationDocument8 pagesInfrastructure-Driven Growth Powers Access Engineering Coverage InitiationhaffaNo ratings yet

- Revenue and FinancialsDocument8 pagesRevenue and Financialsvaibhavrs22.pumbaNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- When The Gap Between Perception and Reality Is The Maximum, Price Is The Best''Document20 pagesWhen The Gap Between Perception and Reality Is The Maximum, Price Is The Best''sukujeNo ratings yet

- Stocksview Report On JiyaDocument3 pagesStocksview Report On JiyaMuralidhar RayapeddiNo ratings yet

- Nagarjuna Construction (NAGCON) : Rising Debt Level To Restrict Earnings GrowthDocument6 pagesNagarjuna Construction (NAGCON) : Rising Debt Level To Restrict Earnings GrowthEquity DynamicsNo ratings yet

- IEA Report 17th JanuaryDocument28 pagesIEA Report 17th JanuarynarnoliaNo ratings yet

- Construction Sector Update BCA SecuritiesDocument33 pagesConstruction Sector Update BCA Securitiesotong_lennonNo ratings yet

- IEA Report 13th DecemberDocument23 pagesIEA Report 13th DecembernarnoliaNo ratings yet

- Kolte-Patil Developers LTDDocument35 pagesKolte-Patil Developers LTDArghya DasNo ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- IEA Report 18th JanuaryDocument25 pagesIEA Report 18th JanuarynarnoliaNo ratings yet

- Can Fin Homes: Investment ArgumentDocument5 pagesCan Fin Homes: Investment ArgumentmilandeepNo ratings yet

- IEA Report 28th FebruaryDocument34 pagesIEA Report 28th FebruarynarnoliaNo ratings yet

- Group01 - Construction IndustryDocument18 pagesGroup01 - Construction IndustrySAHIL JAISWALNo ratings yet

- CCME Top Pick of 2011 Northland SecuritiesDocument8 pagesCCME Top Pick of 2011 Northland SecuritieswctbillsNo ratings yet

- Indian Infrastructure Industry - The Road Ahead: IntroductionDocument7 pagesIndian Infrastructure Industry - The Road Ahead: IntroductionAkhil KapoorNo ratings yet

- IEA Report 10th May 2017Document28 pagesIEA Report 10th May 2017narnoliaNo ratings yet

- HSIE Results Daily - 12 Nov 22-202211120745240401459Document18 pagesHSIE Results Daily - 12 Nov 22-202211120745240401459N KhanNo ratings yet

- RBBL's cash conversion cycle and working capital management analysisDocument1 pageRBBL's cash conversion cycle and working capital management analysisAshraful Islam ShowrovNo ratings yet

- B.G. Shirke Construction Technology PVT LTDDocument8 pagesB.G. Shirke Construction Technology PVT LTDvikasaggarwal01No ratings yet

- Ashoka Buildcon Limited: Healthy Business Outlook StaysDocument6 pagesAshoka Buildcon Limited: Healthy Business Outlook StaysdarshanmadeNo ratings yet

- An Assignment On "The Impact of Merger Between CBOP and HDFC BANK"Document12 pagesAn Assignment On "The Impact of Merger Between CBOP and HDFC BANK"Hardeep Singh BhatiaNo ratings yet

- SharekhanTopPicks 030811Document7 pagesSharekhanTopPicks 030811ghachangfhuNo ratings yet

- Sharekhan top picks outperform in FY2010Document6 pagesSharekhan top picks outperform in FY2010Kripansh GroverNo ratings yet

- Allahabad Bank Equity Research ReportDocument18 pagesAllahabad Bank Equity Research ReportkushagraNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- HSIE Results Daily - 16 Nov 22-202211160644133905041Document22 pagesHSIE Results Daily - 16 Nov 22-202211160644133905041Devarsh VakilNo ratings yet

- IDirect MuhuratPicks 2014Document8 pagesIDirect MuhuratPicks 2014Rahul SakareyNo ratings yet

- RHB Equity 360°: (Parkson, KLK, AirAsia, Tan Chong, APM, Carlsberg, Hunza Technical: KLK, AFG) - 19/08/2010Document5 pagesRHB Equity 360°: (Parkson, KLK, AirAsia, Tan Chong, APM, Carlsberg, Hunza Technical: KLK, AFG) - 19/08/2010Rhb InvestNo ratings yet

- IL&FS Transportation Earnings Call SummaryDocument40 pagesIL&FS Transportation Earnings Call SummarycontactdpsNo ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- RHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Document4 pagesRHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Rhb InvestNo ratings yet

- KPIT OutlookDocument3 pagesKPIT OutlookgirishrajsNo ratings yet

- Escorts Mar 17 2020 SparkDocument62 pagesEscorts Mar 17 2020 SparkVaibhav ShahNo ratings yet

- HDFC CenturionDocument4 pagesHDFC CenturionurmishusNo ratings yet

- Idirect Bel Q4fy16Document13 pagesIdirect Bel Q4fy16khaniyalalNo ratings yet

- Bangalore Real Estate Sector to See 30-40% Price FallDocument53 pagesBangalore Real Estate Sector to See 30-40% Price FallArvind KaliaNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- Building Inspection Service Revenues World Summary: Market Values & Financials by CountryFrom EverandBuilding Inspection Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- MediaRelease ExtendedWorkOrder MIPDocument3 pagesMediaRelease ExtendedWorkOrder MIPHitechSoft HitsoftNo ratings yet

- CholaFin AR 20182019Document234 pagesCholaFin AR 20182019HitechSoft HitsoftNo ratings yet

- Company Analysis and Financial Due Diligence: August 2013Document50 pagesCompany Analysis and Financial Due Diligence: August 2013HitechSoft HitsoftNo ratings yet

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftNo ratings yet

- Jnac 31mar16Document4 pagesJnac 31mar16HitechSoft HitsoftNo ratings yet

- Gloster 5385950315Document121 pagesGloster 5385950315HitechSoft HitsoftNo ratings yet

- HPCotton 5028730316Document72 pagesHPCotton 5028730316HitechSoft HitsoftNo ratings yet

- JindalWorldwide 5315430316Document101 pagesJindalWorldwide 5315430316HitechSoft HitsoftNo ratings yet

- Gloster 5385950316Document130 pagesGloster 5385950316HitechSoft HitsoftNo ratings yet

- Sree Rayalseema Alkalies 16 5077530316Document75 pagesSree Rayalseema Alkalies 16 5077530316HitechSoft HitsoftNo ratings yet

- Gloster 5385950314Document105 pagesGloster 5385950314HitechSoft HitsoftNo ratings yet

- Bajaj Auto 3Q FY2016Document12 pagesBajaj Auto 3Q FY2016HitechSoft HitsoftNo ratings yet

- Sankhya 5329720316Document77 pagesSankhya 5329720316HitechSoft HitsoftNo ratings yet

- Intense 5323260316Document118 pagesIntense 5323260316HitechSoft HitsoftNo ratings yet

- IndTraDeco Annual Report 1516Document49 pagesIndTraDeco Annual Report 1516HitechSoft HitsoftNo ratings yet

- State Bank of India 3Q FY2016 Review IndiaDocument10 pagesState Bank of India 3Q FY2016 Review IndiaHitechSoft HitsoftNo ratings yet

- IndoAMines Annual Reort 2015-2016 India CorporateDocument120 pagesIndoAMines Annual Reort 2015-2016 India CorporateHitechSoft HitsoftNo ratings yet

- Cadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016Document11 pagesCadila Healthcare Posts Robust Net Profit Growth of 40% in 3QFY2016HitechSoft HitsoftNo ratings yet

- GlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesDocument13 pagesGlaxoSmithKline Pharma reports 12.8% rise in Q3 sales, misses profit estimatesHitechSoft HitsoftNo ratings yet

- Lupin: Performance HighlightsDocument12 pagesLupin: Performance HighlightsHitechSoft HitsoftNo ratings yet

- Panamapanama Petroleum 2011 Annual Report India CorporateDocument49 pagesPanamapanama Petroleum 2011 Annual Report India CorporateHitechSoft HitsoftNo ratings yet

- BulletProofInvesting TakeawaysDocument3 pagesBulletProofInvesting TakeawaysHitechSoft HitsoftNo ratings yet

- AngelBrokingResearch Cipla 3QFY2016RU 240216Document11 pagesAngelBrokingResearch Cipla 3QFY2016RU 240216HitechSoft HitsoftNo ratings yet

- AngelBrokingResearch NTPC OFSNote 230216Document11 pagesAngelBrokingResearch NTPC OFSNote 230216HitechSoft HitsoftNo ratings yet

- Redmi1s Flash Screens 1s Brick CellDocument1 pageRedmi1s Flash Screens 1s Brick CellHitechSoft HitsoftNo ratings yet

- Panama Petro Ar 2010Document40 pagesPanama Petro Ar 2010Inder KalraNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Panama Petroleum India Corporate Annual Report 2013Document71 pagesPanama Petroleum India Corporate Annual Report 2013HitechSoft HitsoftNo ratings yet

- Panama Petroleum 2012 Annual Report India CorporateDocument45 pagesPanama Petroleum 2012 Annual Report India CorporateHitechSoft HitsoftNo ratings yet

- CUET SQP Accountancy PaperDocument12 pagesCUET SQP Accountancy PaperShreyas BansalNo ratings yet

- Cash Flow Statement: by B.K.VashishthaDocument20 pagesCash Flow Statement: by B.K.VashishthaNadya Shamini100% (1)

- Chapter 2 Financial AnalysisDocument26 pagesChapter 2 Financial AnalysisCarl JovianNo ratings yet

- OF Financial Statement: Dr. Quang NguyenDocument56 pagesOF Financial Statement: Dr. Quang NguyenQuang NguyễnNo ratings yet

- Revised But Not Yet CompletedDocument51 pagesRevised But Not Yet CompletedBrex Malaluan GaladoNo ratings yet

- Cash Flow and Ratio AnalysisDocument7 pagesCash Flow and Ratio AnalysisShalal Bin YousufNo ratings yet

- Funds Flow StatementDocument2 pagesFunds Flow StatementDimpy SoniNo ratings yet

- Statement of Cash Flow Analysis: Kathmandu University School of Management (KUSOM)Document61 pagesStatement of Cash Flow Analysis: Kathmandu University School of Management (KUSOM)ginish12No ratings yet

- Accounting Equation - Problems & SolutionsDocument48 pagesAccounting Equation - Problems & Solutionsgokul babu tallamNo ratings yet

- Class 12 Solution AccountDocument45 pagesClass 12 Solution AccountChandan ChaudharyNo ratings yet

- Bonus Ch15Document45 pagesBonus Ch15agctdna5017No ratings yet

- Discussion Problems With SolutionsDocument9 pagesDiscussion Problems With SolutionsRaveeda AnwarNo ratings yet

- Cash Flow AnalysisDocument15 pagesCash Flow AnalysisElvie Abulencia-BagsicNo ratings yet

- Cashflow Project+SandhyaDocument71 pagesCashflow Project+Sandhyaabdulkhaderjeelani1480% (5)

- Management Reporter and Cash FlowsDocument9 pagesManagement Reporter and Cash Flowspjanssen2306No ratings yet

- Test Bank Principles of Managerial Finance 11th Edition Lawrence GitmanDocument56 pagesTest Bank Principles of Managerial Finance 11th Edition Lawrence GitmanCzetherea Vince100% (2)

- Obinna FMTDocument33 pagesObinna FMTocmainNo ratings yet

- Financial Statement (Types)Document23 pagesFinancial Statement (Types)Prabir Kumer RoyNo ratings yet

- Booklet 4Document20 pagesBooklet 4JohnNo ratings yet

- Presentation Slides of Credit AnalysisDocument117 pagesPresentation Slides of Credit AnalysisDamotNo ratings yet

- This Project Is Done by Karthik SP Based On Cash Flow Analysis For Union Bank of IndiaDocument105 pagesThis Project Is Done by Karthik SP Based On Cash Flow Analysis For Union Bank of IndiaKarthik Sp100% (1)

- Mapping Financial Risks with Qualitative AnalysisDocument4 pagesMapping Financial Risks with Qualitative AnalysisSyed Basit HaiderNo ratings yet

- DAIRY FARM Business PlanDocument14 pagesDAIRY FARM Business PlanOnnatan DinkaNo ratings yet

- Literature Review On Common Size StatementDocument5 pagesLiterature Review On Common Size Statementafdtukasg100% (1)

- FAR 05 Task PerformanceDocument2 pagesFAR 05 Task PerformanceCla JoyceNo ratings yet

- ASNPO at a Glance OverviewDocument21 pagesASNPO at a Glance OverviewRemi AboNo ratings yet

- Fas95 PDFDocument66 pagesFas95 PDFNaamir Wahiyd BeyNo ratings yet