Professional Documents

Culture Documents

Week 3 - 1

Uploaded by

JeanetteMcduffieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 3 - 1

Uploaded by

JeanetteMcduffieCopyright:

Available Formats

2/1/2015

IEBWireframe

AdjustingEntries

Thereismoretothemeasurementofbusinessincomethanmerelyrecordingsimplerevenueandexpense

transactionsthataffectonlyasingleaccountingperiod.Certaintransactionsaffecttherevenueor

expensesoftwoormoreaccountingperiods.Thepurposeofadjustingentriesistoassigntoeach

accountingperiodappropriateamountsofrevenueandexpense.Forexample,OvernightAutoService

purchasedshopsuppliesthatwillbeusedforseveralmonths.Thus,anadjustingentryisrequiredto

recordtheexpenseassociatedwiththeshopsuppliesthatOvernightuseseachmonth.

LO41

LO41

LEARNINGOBJECTIVE

Explainthepurposeofadjustingentries.

THENEEDFORADJUSTINGENTRIES

Forpurposesofmeasuringincomeandpreparingfinancialstatements,thelifeofabusinessisdivided

intoaseriesofaccountingperiods.Thispracticeenablesdecisionmakerstocomparethefinancial

statementsofsuccessiveperiodsandtoidentifysignificanttrends.

Butmeasuringnetincomeforarelativelyshortaccountingperiodsuchasamonthorevenayear

posesaproblembecause,asmentionedabove,somebusinessactivitiesaffecttherevenueandexpenses

ofmultipleaccountingperiods.Therefore,adjustingentriesareneededattheendofeachaccounting

periodtomakecertainthatappropriateamountsofrevenueandexpensearereportedinthecompany's

incomestatement.

Forexample,magazinepublishersoftenselltwoorthreeyearsubscriptionstotheirpublications.Atthe

endofeachaccountingperiod,thesepublishersmakeadjustingentriesrecognizingtheportionoftheir

advancereceiptsthathavebeenearnedduringthecurrentperiod.Mostcompaniesalsopurchase

insurancepoliciesthatbenefitmorethanoneperiod.Therefore,anadjustingentryisneededtomake

certainthatanappropriateportionofeachpolicy'stotalcostisreportedintheincomestatementas

insuranceexpensefortheperiod.Inshort,adjustingentriesareneededwhenevertransactionsaffectthe

revenueorexpensesofmorethanoneaccountingperiod.Theseentriesassignrevenuestotheperiodin

whichtheyareearned,andexpensestotheperiodsinwhichrelatedgoodsorservicesareused.

Intheory,abusinesscouldmakeadjustingentriesonadailybasis.Butasapracticalmatter,theseentries

aremadeonlyattheendofeachaccountingperiod.Formostcompanies,adjustingentriesaremadeona

monthlybasis.

TYPESOFADJUSTINGENTRIES

LO42

LO42

LEARNINGOBJECTIVE

Describeandpreparethefourbasictypesofadjustingentries.

Thenumberofadjustmentsneededattheendofeachaccountingperioddependsentirelyuponthenature

ofthecompany'sbusinessactivities.However,mostadjustingentriesfallintooneoffourgeneral

categories:1

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

1/25

2/1/2015

IEBWireframe

1. Convertingassetstoexpenses.Acashexpenditure(orcost)thatwillbenefitmorethanone

accountingperiodusuallyisrecordedbydebitinganassetaccount(forexample,Supplies,

UnexpiredInsurance,andsoon)andbycreditingCash.Theassetaccountcreatedactually

representsthedeferral(orthepostponement)ofanexpense.Ineachfutureperiodthatbenefits

fromtheuseofthisasset,anadjustingentryismadetoallocateaportionoftheasset'scostfrom

thebalancesheettotheincomestatementasanexpense.Thisadjustingentryisrecordedby

debitingtheappropriateexpenseaccount(forexample,SuppliesExpenseorInsuranceExpense)

andcreditingtherelatedassetaccount(forexample,SuppliesorUnexpiredInsurance).

Page143

2. Convertingliabilitiestorevenue.Abusinessmaycollectcashinadvanceforservicestobe

renderedinfutureaccountingperiods.Transactionsofthisnatureareusuallyrecordedbydebiting

Cashandbycreditingaliabilityaccount(typicallycalledUnearnedRevenueorCustomer

Deposits).Here,theliabilityaccountcreatedrepresentsthedeferral(orthepostponement)ofa

revenue.Intheperiodthatservicesareactuallyrendered(orthatgoodsaresold),anadjusting

entryismadetoallocateaportionoftheliabilityfromthebalancesheettotheincomestatementto

recognizetherevenueearnedduringtheperiod.Theadjustingentryisrecordedbydebitingthe

liability(UnearnedRevenueorCustomerDeposits)andbycreditingRevenueEarned(orasimilar

account)forthevalueoftheservices.

3. Accruingunpaidexpenses.Anexpensemaybeincurredinthecurrentaccountingperiodeven

thoughnocashpaymentwilloccuruntilafutureperiod.Theseaccruedexpensesarerecordedby

anadjustingentrymadeattheendofeachaccountingperiod.Theadjustingentryisrecordedby

debitingtheappropriateexpenseaccount(forexample,InterestExpenseorSalaryExpense)andby

creditingtherelatedliability(forexample,InterestPayableorSalariesPayable).

4. Accruinguncollectedrevenue.Revenuemaybeearned(oraccrued)duringthecurrentperiod,

eventhoughthecollectionofcashwillnotoccuruntilafutureperiod.Unrecordedearnedrevenue,

forwhichnocashhasbeenreceived,requiresanadjustingentryattheendoftheaccounting

period.Theadjustingentryisrecordedbydebitingtheappropriateasset(forexample,Accounts

ReceivableorInterestReceivable)andbycreditingtheappropriaterevenueaccount(forexample,

ServiceRevenueEarnedorInterestEarned).

ADJUSTINGENTRIESANDTIMINGDIFFERENCES

Inanaccrualaccountingsystem,thereareoftentimingdifferencesbetweencashflowsandthe

recognitionofexpensesorrevenue.Acompanycanpaycashinadvanceofincurringcertainexpensesor

receivecashbeforerevenuehasbeenearned.Likewise,itcanincurcertainexpensesbeforepayingany

cashoritcanearnrevenuebeforeanycashisreceived.Thesetimingdifferences,andtheadjusting

entriesthatresultfromthem,aresummarizedbelow.

Adjustingentriestoconvertassetstoexpensesresultfromcashbeingpaidpriortoanexpense

beingincurred.

Adjustingentriestoconvertliabilitiestorevenueresultfromcashbeingreceivedpriortorevenue

beingearned.

Adjustingentriestoaccrueunpaidexpensesresultfromexpensesbeingincurredbeforecashis

paid.

Adjustingentriestoaccrueuncollectedrevenueresultfromrevenuebeingearnedbeforecashis

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

2/25

2/1/2015

IEBWireframe

received.

AsillustratedinExhibit41,adjustingentriesprovideimportantlinkagesbetweenaccountingperiods

relatedtothesetimingdifferences.Specifically,theylink:(1)priorperiodcashoutflowstocurrent

periodexpenses,(2)priorperiodcashinflowstocurrentperiodrevenue,(3)currentperiodexpensesto

futurecashoutflows,and(4)currentperiodrevenuetofutureperiodcashinflows.

EXHIBIT41

AdjustingEntriesProvideLinksBetweenAccountingPeriods

EXHIBIT41

AdjustingEntriesProvideLinksBetweenAccountingPeriods

CHARACTERISTICSOFADJUSTINGENTRIES

Keepinmindtwoimportantcharacteristicsofalladjustingentries:First,everyadjustingentryinvolves

therecognitionofeitherrevenueorexpenses.Revenueandexpensesrepresentchangesinowners'

equity.However,owners'equitycannotchangebyitselftherealsomustbeacorrespondingchangein

eitherassetsorliabilities.Thuseveryadjustingentryaffectsbothanincomestatementaccount(revenue

orexpense)andabalancesheetaccount(assetorliability).Rarelydoadjustingentriesincludeanentryto

Cash.Itisimportanttorecognizethatnoneoftheadjustmentsdiscussedinthischapterrequireadebitor

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

3/25

2/1/2015

IEBWireframe

acredittoCash.

Page144

Second,adjustingentriesarebasedontheconceptsofaccrualaccounting,notuponmonthlybillsor

monthendtransactions.NoonesendsOvernightAutoServiceabillsaying,ShopSupplyExpensefor

themonthis$500.YetOvernightmustbeawareoftheneedtorecordtheestimatedcostofshop

suppliesconsumedifitistomeasureincomeproperlyfortheperiod.Makingadjustingentriesrequiresa

greaterunderstandingofaccrualaccountingconceptsthandoestherecordingofroutinebusiness

transactions.Inmanybusinesses,theadjustingprocessisperformedbythecontrollerorbyaprofessional

accountant,ratherthanbytheregularaccountingstaff.

Page145

YEARENDATOVERNIGHTAUTOSERVICE

Toillustratethevarioustypesofadjustingentries,wewillagainuseourexampleinvolvingOvernight

AutoService.Chapter3concludedwithOvernight'strialbalancedatedFebruary28,2015(theendofthe

company'ssecondmonthofoperations).WewillnowskipaheadtoDecember31,2015theendof

Overnight'sfirstyearofoperations.Thiswillenableustoillustratethepreparationofannualfinancial

statements,ratherthanstatementsthatcoveronlyasinglemonth.

Mostcompaniesmakeadjustingentrieseverymonth.WewillassumethatOvernighthasbeenfollowing

thisapproachthroughout2015.Thecompany'sunadjustedtrialbalancedatedDecember31,2015,

appearsinExhibit42.ItisreferredtoasanunadjustedtrialbalancebecauseOvernightlastmade

adjustingentriesonNovember30therefore,itisstillnecessarytomakeadjustingentriesforthemonth

ofDecember.

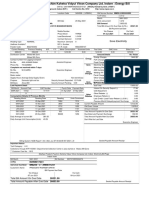

EXHIBIT42

UnadjustedTrialBalance

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

4/25

2/1/2015

IEBWireframe

d

OVERNIGHTAUTOSERVICE

TRIALBALANCE

DECEMBER31,2015

Cash............................................ $18,592

Accountsreceivable................................

6,500

Shopsupplies.....................................

1,800

Unexpiredinsurance................................

4,500

Toolsandequipment................................

12,000

Accumulateddepreciation:toolsandequipment..........

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

2,000

5/25

2/1/2015

IEBWireframe

Building..........................................

36,000

Accumulateddepreciation:building....................

Land.............................................

$1,500

52,000

Notespayable.....................................

4,000

Accountspayable..................................

2,690

Incometaxespayable...............................

1,560

Unearnedrentrevenue..............................

9,000

Capitalstock......................................

80,000

Retainedearnings..................................

Dividends.........................................

14,000

Repairservicerevenue..............................

171,250

Advertisingexpense................................

3,900

Wagesexpense....................................

56,800

Suppliesexpense..................................

6,900

Depreciationexpense:building........................

1,500

Depreciationexpense:toolsandequipment..............

2,000

Utilitiesexpense...................................

19,400

Insuranceexpense.................................

13,500

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

6/25

2/1/2015

IEBWireframe

Incometaxesexpense.............................. 22,608

$272,000 $272,000

EXHIBIT42

UnadjustedTrialBalance

Inthenextfewpagesweillustrateseveraltransactions,aswellastherelatedadjustingentries.Bothare

shownintheformatofgeneraljournalentries.Tohelpdistinguishbetweentransactionsandadjusting

entries,transactionsareprintedinblueandadjustingentriesinred.

CONVERTINGASSETSTOEXPENSES

LO43

LO43

LEARNINGOBJECTIVE

Prepareadjustingentriestoconvertassetstoexpenses.

Whenabusinessmakesanexpenditurethatwillbenefitmorethanoneaccountingperiod,theamount

usuallyisdebitedtoanassetaccount.Attheendofeachperiodbenefitingfromthisexpenditure,an

adjustingentryismadetotransferanappropriateportionofthecostfromtheassetaccounttoanexpense

account.Thisadjustingentryreflectsthefactthatpartoftheassethasbeenuseduporbecomean

expenseduringthecurrentaccountingperiod.

Page146

Anadjustingentrytoconvertanassettoanexpenseconsistsofadebittoanexpenseaccountandacredit

toanassetaccount(orcontraassetaccount).Examplesoftheseadjustmentsincludetheentriesto

apportionthecostsofprepaidexpensesandentriestorecorddepreciationexpense.

PrepaidExpenses

PrepaidExpensesPaymentsinadvanceoftenaremadeforsuchitemsasinsurance,rent,andoffice

supplies.Iftheadvancepayment(orprepayment)willbenefitmorethanjustthecurrentaccounting

period,thecostrepresentsanassetratherthananexpense.Thecostofthisassetwillbeallocatedto

expenseintheaccountingperiodsinwhichtheservicesorthesuppliesareused.Insummary,prepaid

expensesareassetstheybecomeexpensesonlyasthegoodsorservicesareusedup.

ShopSupplies

ShopSuppliesToillustrate,considerOvernight'saccountingpoliciesforshopsupplies.Assuppliesare

purchased,theircostisdebitedtotheassetaccountShopSupplies.Itisnotpracticaltomakejournal

entrieseveryfewminutesassuppliesareused.Instead,anestimateismadeofthesuppliesremainingon

handattheendofeachmonththesuppliesthataremissingareassumedtohavebeenused.

PriortomakingadjustingentriesatDecember31,thebalanceinOvernight'sShopSuppliesaccountis

$1,800.ThebalanceofthisassetaccountrepresentsshopsuppliesonhandonNovember30.The

SuppliesExpenseaccountshowsabalanceof$6,900,whichrepresentsthecostofsuppliesusedthrough

November30.Assumethatapproximately$1,200ofshopsuppliesremainonhandatDecember31.This

suggeststhatsuppliescostingabout$600havebeenusedinDecemberthus,thefollowingadjusting

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

7/25

2/1/2015

IEBWireframe

entryismade:

Theadjustingentryrequiredtoconvertthecostofsuppliesusedfromanassetaccounttoan

expense

d

Dec.31SuppliesExpense..................................... 600

ShopSupplies....................................

600

DecemberShopSuppliesadjustingentry.

Thisadjustingentryservestwopurposes:(1)Itchargestoexpensethecostofsuppliesusedin

December,and(2)itreducesthebalanceoftheShopSuppliesaccountto$1,200theamountof

suppliesestimatedtobeonhandatDecember31.

InsurancePolicies

InsurancePoliciesInsurancepoliciesalsoareaprepaidexpense.Thesepoliciesprovideabenefit,

insuranceprotection,overaspecificperiodoftime.Asthetimepasses,theinsurancepolicyexpires

thatis,itisusedupinbusinessoperations.

Toillustrate,assumethatonMarch1,Overnightpurchasedfor$18,000aoneyearinsurancepolicy

providingcomprehensiveliabilityinsuranceandinsuranceagainstfireanddamagetocustomers'vehicles

whileinOvernight'sfacilities.Thisexpenditure(atransaction)wasdebitedtoanassetaccount,as

follows(again,thisisatransaction,notanadjustingentry):

Purchase12monthsofinsurancecoverage

d

Mar.1UnexpiredInsurance.................................

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

18,000

8/25

2/1/2015

IEBWireframe

Cash..........................................

18,000

Purchasedaninsurancepolicyprovidingcoverageforthenext12months.

This$18,000expenditureprovidesinsurancecoverageforaperiodofonefullyear.Therefore,1/12of

thiscost,or$1,500,isrecognizedasinsuranceexpenseeverymonth.The$13,500insuranceexpense

reportedinOvernight'strialbalancerepresentstheportionoftheinsurancepolicythathasexpired

betweenMarch1andNovember30($1,500/mo.9months).The$4,500amountofunexpiredinsurance

showninthetrialbalanceistheremainingcostofthe12monthpolicystillineffectasofNovember30

($1,500/mo.3months).ByDecember31,anotherfullmonthofthepolicyhasexpired.Thus,the

insuranceexpenseforDecemberisrecordedbythefollowingadjustingentryatmonthend:

Page147

TheadjustingentryrequiredtorecordthecostofinsurancecoverageexpiringinDecember

d

Dec.31InsuranceExpense.................................... 1,500

UnexpiredInsurance...............................

1,500

DecemberInsuranceExpenseadjustingentry.

Noticethesimilaritiesbetweentheeffectsofthisadjustingentryandtheonethatwemadepreviouslyfor

shopsupplies.Inbothcases,theentriestransfertoexpensethatportionofanassetusedupduringthe

period.ThisflowofcostsfromthebalancesheettotheincomestatementisillustratedinExhibit43.

EXHIBIT43

AnExpiredAssetBecomesAnExpense

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

9/25

2/1/2015

IEBWireframe

EXHIBIT43

AnExpiredAssetBecomesAnExpense

YOURTURNYouasaCarOwner

Carownerstypicallypayinsurancepremiumssixmonthsinadvance.Assumethatyourecentlypaidyour

sixmonthpremiumof$600onFebruary1(forcoveragethroughJuly31).OnMarch31,youdecideto

switchinsurancecompanies.Youcallyourexistingagentandaskthatyourpolicybecanceled.Areyou

entitledtoarefund?Ifso,why,andhowmuchwillitbe?

(SeeourcommentsontheOnlineLearningCenterwebsite.)

RecordingPrepaymentsDirectlyintheExpenseAccounts

RecordingPrepaymentsDirectlyintheExpenseAccountsInourillustration,paymentsforshop

suppliesandforinsurancecoveringmorethanoneperiodweredebitedtoassetaccounts.However,some

companiesfollowanalternativepolicyofdebitingsuchprepaymentsdirectlytoanexpenseaccount,such

asSuppliesExpense.Attheendoftheperiod,theadjustingentrythenwouldbetodebitShopSupplies

andcreditSuppliesExpenseforthecostofsuppliesthathadnotbeenused.

ThisalternativemethodleadstothesameresultsasdoestheprocedureusedbyOvernight.Undereither

approach,thecostofsuppliesusedduringthecurrentperiodistreatedasanexpense,andthecostof

suppliesstillonhandiscarriedforwardinthebalancesheetasanasset.

Page148

Inthistext,wewillfollowOvernight'spracticeofrecordingprepaymentsinassetaccountsandthen

makingadjustmentstotransferthesecoststoexpenseaccountsastheassetsexpire.Thisapproach

correctlydescribestheconceptualflowofcoststhroughtheelementsoffinancialstatements.Thatis,a

prepaymentisanassetthatlaterbecomesanexpense.Thealternativeapproachisusedwidelyinpractice

onlybecauseitisanefficientshortcut,whichstandardizestherecordingoftransactionsandmay

reducethenumberofadjustingentriesneededattheendoftheperiod.Remember,ourgoalinthiscourse

istodevelopyourabilitytounderstandanduseaccountinginformation,nottotrainyouinalternative

bookkeepingprocedures.

Theideaofshopsuppliesandinsurancepoliciesbeingusedupoverseveralmonthsiseasyto

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

10/25

2/1/2015

IEBWireframe

understand.Butthesameconceptalsoappliestoassetssuchasbuildingsandequipment.Theseassetsare

convertedtoexpensesthroughtheprocessofdepreciation.

THECONCEPTOFDEPRECIATION

Depreciableassetsarephysicalobjectsthatretaintheirsizeandshapebutthateventuallywearoutor

becomeobsolete.Theyarenotphysicallyconsumed,asareassetssuchassupplies,butnonethelesstheir

economicusefulnessdiminishesovertime.Examplesofdepreciableassetsincludebuildingsandall

typesofequipment,fixtures,furnishingsandevenrailroadtracks.Land,however,isnotviewedasa

depreciableasset,asithasanunlimitedusefullife.

Eachperiod,aportionofadepreciableasset'susefulnessexpires.Therefore,acorrespondingportionof

itscostisrecognizedasdepreciationexpense.

WhatIsDepreciation?

WhatIsDepreciation?Inaccounting,thetermdepreciationmeansthesystematicallocationofthecost

ofadepreciableassettoexpenseovertheasset'susefullife.ThisprocessisillustratedinExhibit44.

NoticethesimilaritiesbetweenExhibit44andExhibit43.

EXHIBIT44

TheDepreciationProcess

EXHIBIT44

TheDepreciationProcess

Depreciationisnotanattempttorecordchangesintheasset'smarketvalue.Intheshortrun,themarket

valueofsomedepreciableassetsmayevenincrease,buttheprocessofdepreciationcontinuesanyway.

Therationalefordepreciationliesinthematchingprinciple.Ourgoalistooffsetareasonableportionof

theasset'scostagainstrevenueineachperiodoftheasset'susefullife.

Depreciationexpenseoccurscontinuouslyoverthelifeoftheasset,buttherearenodailydepreciation

transactions.Ineffect,depreciationexpenseispaidinadvancewhentheassetisoriginallypurchased.

Therefore,adjustingentriesareneededattheendofeachaccountingperiodtotransferanappropriate

amountoftheasset'scosttodepreciationexpense.

DepreciationIsOnlyanEstimate

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

11/25

2/1/2015

IEBWireframe

DepreciationIsOnlyanEstimateTheappropriateamountofdepreciationexpenseisonlyanestimate.

Afterall,wecannotlookatabuildingorapieceofequipmentanddeterminepreciselyhowmuchofits

economicusefulnesshasexpiredduringthecurrentperiod.

Page149

Themostwidelyusedmeansofestimatingperiodicdepreciationexpenseisthestraightlinemethodof

depreciation.Underthestraightlineapproach,anequalportionoftheasset'scostisallocatedto

depreciationexpenseineveryperiodoftheasset'sestimatedusefullife.Theformulaforcomputing

depreciationexpensebythestraightlinemethodis:2

Theuseofanestimatedusefullifeisthemajorreasonthatdepreciationexpenseisonlyanestimate.In

mostcases,managementdoesnotknowinadvanceexactlyhowlongtheassetwillremaininuse.

CASEINPOINT

DigitalVision/Alamy

DigitalVision/Alamy

Howlongdoesabuildinglast?Forpurposesofcomputingdepreciationexpense,mostcompanies

estimateabout30or40years.YettheEmpireStateBuildingwasbuiltin1931,andit'snotlikelytobe

torndownanytimesoon.Asyoumightguess,itoftenisdifficulttoestimateinadvancejusthowlong

depreciableassetsmayremaininuse.

DepreciationofOvernight'sBuilding

DepreciationofOvernight'sBuildingOvernightpurchaseditsbuildingfor$36,000onJanuary22.

Becausethebuildingwasold,itsestimatedremainingusefullifeisonly20years.Therefore,the

building'smonthlydepreciationexpenseis$150($36,000cost240months).Wewillassumethat

OvernightdidnotrecordanydepreciationexpenseinJanuarybecauseitoperatedforonlyasmallpartof

themonth.Thus,thebuilding's$1,500depreciationexpensereportedinOvernight'strialbalance

illustratedinExhibit42onpage145represents10fullmonthsofdepreciationrecordedin2015,from

February1throughNovember30($150/mo.10months).Anadditional$150ofdepreciationexpenseis

stillneededonthebuildingforDecember(bringingthetotaltobereportedintheincomestatementfor

theyearto$1,650).

TheadjustingentrytorecorddepreciationexpenseonOvernight'sbuildingforthemonthofDecember

is:

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

12/25

2/1/2015

IEBWireframe

d

Dec.31DepreciationExpense:Building............................. 150

AccumulatedDepreciation:Building......................

150

Decemberbuildingdepreciationadjustingentry($36,000240mo.).

Theadjustingentryrequiredtorecordmonthlydepreciationonthebuilding

TheDepreciationExpense:BuildingaccountwillappearinOvernight'sincomestatementalongwith

otherexpensesfortheyearendedDecember31,2015.ThebalanceintheAccumulatedDepreciation:

BuildingaccountwillbereportedintheDecember31balancesheetasadeductionfromtheBuilding

Account,asshownbelow.

Building.................................................. $36,000

Less:AccumulatedDepreciation:Building....................... (1,650)

BookValue............................................... $34,350

Page150

Howaccumulateddepreciationappearsinthebalancesheet

AccumulatedDepreciation:Buildingisanexampleofacontraassetaccountbecause(1)ithasacredit

balance,and(2)itisoffsetagainstanassetaccount(Building)toproducethebookvaluefortheasset.

Accountantsoftenusethetermbookvalue(orcarryingvalue)todescribethenetvaluationofanassetin

acompany'saccountingrecords.Fordepreciableassets,suchasbuildingsandequipment,bookvalueis

equaltothecostoftheasset,lesstherelatedamountofaccumulateddepreciation.Theendresultof

creditingtheAccumulatedDepreciation:Buildingaccountismuchthesameasifthecredithadbeen

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

13/25

2/1/2015

IEBWireframe

madedirectlytotheBuildingaccountthatis,thebookvaluereportedinthebalancesheetforthe

buildingisreducedfrom$36,000to$34,350.

Bookvalueisofsignificanceprimarilyforaccountingpurposes.Itrepresentscoststhatwillbeoffset

againsttherevenueoffutureperiods.Italsogivesusersoffinancialstatementsanindicationoftheageof

acompany'sdepreciableassets(olderassetstendtohavelargeramountsofaccumulateddepreciation

associatedwiththemthannewerassets).Itisimportanttorealizethatthecomputationofbookvalueis

baseduponanasset'shistoricalcost.Thus,bookvalueisnotintendedtorepresentanasset'scurrent

marketvalue.

DepreciationofToolsandEquipment

DepreciationofToolsandEquipmentOvernightdepreciatesitstoolsandequipmentoveraperiodof

fiveyears(60months)usingthestraightlinemethod.TheDecember31trialbalanceshowsthatthe

companyownstoolsandequipmentthatcost$12,000.Therefore,theadjustingentrytorecord

December'sdepreciationexpenseis:

Theadjustingentryrequiredtorecordthemonthlydepreciationontoolsandequipment

d

Dec.31DepreciationExpense:ToolsandEquipment................

AccumulatedDepreciation:ToolsandEquipment.........

200

200

Decembertoolsandequipmentadjustingentry($12,00060months=$200/mo.).

Again,weassumethatOvernightdidnotrecorddepreciationexpensefortoolsandequipmentinJanuary

becauseitoperatedforonlyasmallpartofthemonth.Thus,therelated$2,000depreciationexpense

reportedinOvernight'strialbalanceinExhibit42onpage145represents10fullmonthsofdepreciation,

fromFebruary1throughNovember30($200/mo.10months).Thetoolsandequipmentstillrequirean

additional$200ofdepreciationforDecember(bringingthetotaltobereportedintheincomestatement

fortheyearto$2,200).

WhatisthebookvalueofOvernight'stoolsandequipmentatDecember31,2015?Ifyousaid$9,800,

you'reright.3

DepreciationANoncashExpense

DepreciationANoncashExpenseDepreciationisanoncashexpense.Wehavemadethepointthatnet

incomedoesnotrepresentaninflowofcashoranyotherasset.Rather,itisacomputationoftheoverall

effectofcertainbusinesstransactionsonowners'equity.Therecognitionofdepreciationexpense

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

14/25

2/1/2015

IEBWireframe

illustratesthispoint.Asdepreciableassetsexpire,depreciationexpenseisrecorded,netincomeis

reduced,andowners'equitydeclines,butthereisnocorrespondingcashoutlayinthecurrentperiod.For

thisreason,depreciationiscalledanoncashexpense.Oftenitrepresentsthelargestdifferencebetween

netincomeandthecashflowfrombusinessoperations.

Page151

CONVERTINGLIABILITIESTOREVENUE

LO44

LO44

LEARNINGOBJECTIVE

Prepareadjustingentriestoconvertliabilitiestorevenue.

Insomeinstances,customersmaypayinadvanceforservicestoberenderedinlateraccountingperiods.

Forexample,afootballteamcollectsmuchofitsrevenueinadvancethroughthesaleofseasontickets.

Healthclubscollectinadvancebysellinglongtermmembershipcontracts.Airlinessellmanyoftheir

ticketswellinadvanceofscheduledflights.

Foraccountingpurposes,amountscollectedinadvancedonotrepresentrevenue,becausetheseamounts

havenotyetbeenearned.Amountscollectedfromcustomersinadvancearerecordedbydebitingthe

Cashaccountandcreditinganunearnedrevenueaccount.Unearnedrevenuesometimesisreferredtoas

deferredrevenue.

Whenacompanycollectsmoneyinadvancefromitscustomers,ithasanobligationtorenderservicesin

thefuture.Therefore,thebalanceofanunearnedrevenueaccountisconsideredtobealiabilityit

appearsintheliabilitysectionofthebalancesheet,notintheincomestatement.Unearnedrevenue

differsfromotherliabilitiesbecauseitusuallywillbesettledbyrenderingservices,ratherthanby

makingpaymentincash.Inshort,itwillbeworkedoffratherthanpaidoff.Ofcourse,ifthebusinessis

unabletorendertheservice,itmustdischargethisliabilitybyrefundingmoneytoitscustomers.

Whenacompanyrenderstheservicesforwhichcustomershavepaidinadvance,itisworkingoffits

liabilitytothesecustomersandisearningtherevenue.Attheendoftheaccountingperiod,anadjusting

entryismadetotransferanappropriateamountfromtheunearnedrevenueaccounttoarevenueaccount.

Thisadjustingentryconsistsofadebittoaliabilityaccount(unearnedrevenue)andacredittoarevenue

account.Forinstance,TheNewYorkTimesCompanyreportsa$67millioncurrentliabilityinits

balancesheetcalledUnexpiredSubscriptions.Thisaccountrepresentsunearnedrevenuefromselling

subscriptionsforfuturenewspaperdeliveries.TheliabilityisconvertedtoCirculationRevenueand

reportedinthecompany'sincomestatementastheactualdeliveriesoccur.

Toillustratetheseconcepts,assumethatonDecember1,HarborCabCo.agreedtorentspacein

Overnight'sbuildingtoprovideindoorstorageforsomeofitscabs.Theagreeduponrentis$3,000per

month,andHarborCabpaidforthefirstthreemonthsinadvance.Thejournalentrytorecordthis

transactiononDecember1was(again,thisisatransaction,notanadjustingentry):

d

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

15/25

2/1/2015

IEBWireframe

Dec.1Cash............................................

9,000

UnearnedRentRevenue.........................

9,000

CollectedinadvancefromHarborCabforrentalofstoragespaceforthreemonths.

Anadvanceit'snotrevenueit'saliability

RememberthatUnearnedRentRevenueisaliabilityaccount,notarevenueaccount.Overnightwillearn

rentalrevenuegraduallyoverathreemonthperiodasitprovidesstoragefacilitiesforHarborCab.Atthe

endofeachofthesethreemonths,Overnightwillmakeanadjustingentry,transferring$3,000fromthe

UnearnedRentRevenueaccounttoanearnedrevenueaccount,RentRevenueEarned,whichwillappear

inOvernight'sincomestatement.ThefirstinthisseriesofmonthlytransferswillbemadeatDecember

31withthefollowingadjustingentry:

d

Dec. UnearnedRentRevenue.............................

31

RentRevenueEarned...........................

3,000

3,000

DecemberadjustingentrytoconvertUnearnedRentRevenuetoRentRevenueEarned

($9,0003mo.).

AnadjustingentryshowingthatsomeunearnedrevenuewasearnedinDecember

Afterthisadjustingentryhasbeenposted,theUnearnedRentRevenueaccountwillhavea$6,000credit

balance.ThisbalancerepresentsOvernight'sobligationtorender$6,000worthofserviceoverthenext

twomonthsandwillappearintheliabilitysectionofthecompany'sbalancesheet.TheRentRevenue

EarnedaccountwillappearinOvernight'sincomestatement.

TheconversionofunearnedrevenuetorecognizeearnedrevenueisillustratedinExhibit45.

Page152

EXHIBIT45

UnearnedRevenueBecomesEarnedRevenue

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

16/25

2/1/2015

IEBWireframe

EXHIBIT45

UnearnedRevenueBecomesEarnedRevenue

RecordingAdvanceCollectionsDirectlyintheRevenueAccounts

RecordingAdvanceCollectionsDirectlyintheRevenueAccountsWehavestressedthatamounts

collectedfromcustomersinadvancerepresentliabilities,notrevenue.However,somecompaniesfollow

anaccountingpolicyofcreditingtheseadvancecollectionsdirectlytorevenueaccounts.Theadjusting

entrythenshouldconsistofadebittotherevenueaccountandacredittotheunearnedrevenueaccount

fortheportionoftheadvancepaymentsnotyetearned.Thisalternativeaccountingpracticeleadstothe

sameresultsasdoesthemethodusedinourillustration.

Inthistext,wewillfollowtheoriginallydescribedpracticeofcreditingadvancepaymentsfrom

customerstoanunearnedrevenueaccount.

ACCRUINGUNPAIDEXPENSES

LO45

LO45

LEARNINGOBJECTIVE

Prepareadjustingentriestoaccrueunpaidexpenses.

Thistypeofadjustingentryrecognizesexpensesthatwillbepaidinfuturetransactionstherefore,no

costhasyetbeenrecordedintheaccountingrecords.Salariesofemployeesandinterestonborrowed

moneyarecommonexamplesofexpensesthataccumulatefromdaytodaybutthatusuallyarenot

recordeduntiltheyarepaid.Theseexpensesaresaidtoaccrueovertime,thatis,togroworto

accumulate.Attheendoftheaccountingperiod,anadjustingentryshouldbemadetorecordany

expensesthathaveaccruedbutthathavenotyetbeenrecorded.Sincetheseexpenseswillbepaidata

futuredate,theadjustingentryconsistsofadebittoanexpenseaccountandacredittoaliability

account.WeshallnowusetheexampleofOvernightAutoServicetoillustratethistypeofadjusting

entry.

AccrualofWages(orSalaries)Expense

AccrualofWages(orSalaries)ExpenseOvernight,likemanybusinesses,paysitsemployeesevery

otherFriday.Thismonth,however,endsonaTuesdaythreedaysbeforethenextscheduledpayday.

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

17/25

2/1/2015

IEBWireframe

ThusOvernight'semployeeshaveworkedformorethanaweekinDecemberforwhichtheyhavenotyet

beenpaid.

Timecardsindicatethatsincethelastpayrolldate,Overnight'semployeeshaveworkedatotalof130

hours.Includingpayrolltaxes,Overnight'swageexpenseaveragesabout$15perhour.Therefore,at

December31,thecompanyowesitsemployeesapproximately$1,950forworkperformedinDecember.4

Thefollowingadjustingentryshouldbemadetorecordthisamountbothaswagesexpenseofthecurrent

periodandasaliability:

Adjustingentryrequiredtoaccruewagesowedattheendofthemonth

d

Dec.31WagesExpense......................................

WagesPayable...................................

1,950

1,950

AdjustingentrytoaccruewagesowedbutunpaidasofDecember31.

Page153

ThisadjustingentryincreasesOvernight'swagesexpensefor2015andalsocreatesaliabilitywages

payablethatwillappearintheDecember31balancesheet.

OnFriday,January3,2016,Overnightwillpayitsregularbiweeklypayroll.Letusassumethatthis

payrollamountsto$2,397.Inthiscase,thetransactiontorecordpaymentisasfollows(again,thisisa

transaction,notanadjustingentry):5

Paymentofwagesearnedintwoaccountingperiods

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

18/25

2/1/2015

IEBWireframe

2016

Jan.3WagesExpense(forJanuary)...........................

447

WagesPayable(accruedinDecember)...................

1,950

Cash...........................................

2,397

Biweeklypayroll,$1,950ofwhichhadbeenaccruedatDecember31,2015.

AccrualofInterestExpense

AccrualofInterestExpenseOnJanuary22,2015,Overnightpurchaseditsbuilding,anoldbusgarage,

fromtheMetropolitanTransitAuthorityfor$36,000.Overnightpaid$6,000cash,andissueda$30,000

90daynotepayableforthebalanceowed.Overnightpaidthe$30,000obligationinApril.Therewasno

interestexpensetoaccruebecausethisnotepayablewasnoninterestbearing.

OnNovember30,2015,Overnightborrowed$4,000fromAmericanNationalBankbyissuingan

interestbearingnotepayable.Thisloanistoberepaidinthreemonths(onFebruary28,2016),along

withinterestcomputedatanannualrateof9percent.TheentrymadeonNovember30torecordthis

borrowingtransactionis(again,thisisatransaction,notanadjustingentry):

d

Nov. Cash............................................

30

NotesPayable................................

4,000

4,000

BorrowedcashfromAmericanNationalBank,issuinga9%,$4,000notepayable,due

inthreemonths.

OnFebruary28,Overnightmustpaythebank$4,090.Thisrepresentsthe$4,000amountborrowed,plus

$90interest($4,000.093/12).The$90interestchargecoversaperiodofthreemonths.Althoughno

paymentismadeuntilFebruary28,2016,interestexpenseisincurred(oraccrued)atarateof$30per

month,asshowninExhibit46.

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

19/25

2/1/2015

IEBWireframe

EXHIBIT46

AccrualofInterest

EXHIBIT46

AccrualofInterest

ThefollowingadjustingentryismadeatDecember31toaccrueonemonth'sinterestexpenseandto

recordtheamountofunpaidinterestowedtothebankatDecember31,2015:

AdjustingentryrequiredtorecordinterestexpenseaccruedinDecember

d

Dec.31InterestExpense...........................................

InterestPayable.......................................

30

30

AdjustingentrytoaccrueDecemberInterestExpense($4,000.091/12).

Page154

The$30interestexpensethataccruedinDecemberwillappearinOvernight's2015incomestatement.

Boththe$30interestpayableandthe$4,000notepayabletoAmericanNationalBankwillappearas

liabilitiesintheDecember31,2015,balancesheet.

Overnightwillmakeasecondadjustingentryrecognizinganother$30ininterestexpenseonJanuary31,

2016.ThetransactiononFebruary28torecordtherepaymentofthisloan,including$90ininterest

charges,is(again,thisisatransaction,notanadjustingentry):

Paymentofinterestexpenseaccruedoverthreemonths

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

20/25

2/1/2015

IEBWireframe

d

2016

Feb.

28

NotesPayable.........................................

4,000

InterestPayable(fromDecemberandJanuary)...............

60

InterestExpense(Februaryonly)...........................

30

Cash.............................................

4,090

Repaid$4,000notepayabletoAmericanNationalBank,including$90ininterest

charges.

ACCRUINGUNCOLLECTEDREVENUE

LO46

LO46

LEARNINGOBJECTIVE

Prepareadjustingentriestoaccrueuncollectedrevenue.

Abusinessmayearnrevenueduringthecurrentaccountingperiodbutnotbillthecustomeruntilafuture

accountingperiod.Thissituationislikelytooccurifadditionalservicesarebeingperformedforthesame

customer,inwhichcasethebillmightnotbeprepareduntilallservicesarecompleted.Anyrevenuethat

hasbeenearnedbutnotrecordedduringthecurrentaccountingperiodshouldberecordedattheendof

theperiodbymeansofanadjustingentry.Thisadjustingentryconsistsofadebittoanaccount

receivableandacredittotheappropriaterevenueaccount.Thetermaccruedrevenueoftenisusedto

describerevenuethathasbeenearnedduringtheperiodbutthathasnotbeenrecordedpriortothe

closingdate.

Toillustratethistypeofadjustingentry,assumethatinDecember,Overnightenteredintoanagreement

toperformroutinemaintenanceonseveralvansownedbyAirportShuttleService.Overnightagreedto

maintainthesevansforaflatfeeof$1,500permonth,payableonthefifteenthofeachmonth.

Noentrywasmadetorecordthesigningofthisagreement,becausenoserviceshadyetbeenrendered.

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

21/25

2/1/2015

IEBWireframe

OvernightbeganrenderingservicesonDecember15,butthefirstmonthlypaymentwillnotbereceived

untilJanuary15.Therefore,OvernightshouldmakethefollowingadjustingentryatDecember31to

recordtherevenueearnedfromAirportShuttleduringthemonth:

Adjustingentryrequiredtoaccruerevenueearnedbutnotyetbilledorcollected

d

Dec.31AccountsReceivable...................................

RepairServiceRevenue.............................

750

750

AdjustingentrytorecordaccruedRepairServiceRevenueearnedinDecember.

ThecollectionofthefirstmonthlyfeefromAirportShuttlewilloccuronJanuary15,2016.Ofthis

$1,500cashreceipt,halfrepresentscollectionofthereceivablerecordedonDecember31theotherhalf

representsrevenueearnedinJanuary.Thus,thetransactiontorecordthereceiptof$1,500fromAirport

ShuttleonJanuary15willbe(again,thisisatransaction,notanadjustingentry):

Entrytorecordcollectionofaccruedrevenue

d

2016

Jan. Cash.............................................

15

AccountsReceivable.............................

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

1,500

750

22/25

2/1/2015

IEBWireframe

RepairServiceRevenue...........................

750

CashcollectedfromAirportShuttleforvanmaintenanceprovidedDecember15through

January15.

Page155

ThenetresultoftheDecember31adjustingentryhasbeentodividetherevenuefrommaintenanceof

AirportShuttle'svansbetweenDecemberandJanuaryinproportiontotheservicesrenderedduringeach

month.

ACCRUINGINCOMETAXESEXPENSE:THEFINALADJUSTINGENTRY

Asacorporationearnstaxableincome,itincursincometaxesexpense,andalsoaliabilityto

governmentaltaxauthorities.Thisliabilityispaidinfourinstallmentscalledestimatedquarterly

payments.ThefirstthreepaymentsnormallyaremadeonApril15,June15,andSeptember15.Thefinal

installmentactuallyisdueonDecember15butforpurposesofourillustrationandassignmentmaterials,

wewillassumethefinalpaymentisnotdueuntilJanuary15ofthefollowingyear.6

Initsunadjustedtrialbalance(Exhibit42onpage145),Overnightshowsincometaxesexpenseof

$22,608.ThisistheincometaxesexpenserecognizedfromJanuary20,2015,(thedateOvernightopened

forbusiness)throughNovember30,2015.IncometaxesaccruedthroughSeptember30havealready

beenpaid.Thus,the$1,560liabilityforincometaxespayablerepresentsonlytheincometaxesaccrued

inOctoberandNovember.

Theamountofincometaxesexpenseaccruedforanygivenmonthisonlyanestimate.Theactualamount

ofincometaxescannotbedetermineduntilthecompanypreparesitsannualincometaxreturn.Inour

illustrationsandassignmentmaterials,weestimateincometaxesexpenseat40percentoftaxable

income.Wealsoassumethattaxableincomeisequaltoincomebeforeincometaxes,asubtotaloften

showninanincomestatement.Thissubtotalistotalrevenuelessallexpensesotherthanincometaxes.

INTERNATIONALCASEINPOINT

Corporateincometaxratesvaryaroundtheworld.Arecentsurveyshowsthatratesrangefrom9percent

inMontenegroto55percentintheUnitedArabEmirates.Worldwide,theaveragetaxrateis24percent.

TheaveragerateintheUnitedStatesis40percent.*Inadditiontocorporateincometaxes,some

countriesalso(1)withholdtaxesondividends,interest,androyalties,(2)chargevalueaddedtaxesat

specifiedproductionanddistributionpoints,and(3)imposebordertaxessuchascustomsandimport

duties.Afewcountries,includingtheBahanashavenocorporatetaxes.

*KPMGCorporateTaxRateSurvey(2013).

In2015,Overnightearnedincomebeforeincometaxesof$66,570(seetheincomestatementinExhibit

52,page196,inChapter5).Therefore,incometaxesexpensefortheentireyearisestimatedat$26,628

($66,57040percent).GiventhatincometaxesexpenserecognizedthroughNovember30amountsto

$22,608(seetheunadjustedtrialbalanceinExhibit42),anadditional$4,020inincometaxesexpense

musthaveaccruedduringDecember($26,628$22,608).Theadjustingentrytorecordthisexpenseis:

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

23/25

2/1/2015

IEBWireframe

AdjustingentryrequiredtorecordincometaxesaccruedinDecember

d

Dec.31IncomeTaxesExpense............................... 4,020

IncomeTaxesPayable............................

4,020

AdjustingentrytorecordincometaxesaccruedinDecember.

Page156

ThisentryincreasesthebalanceintheIncomeTaxesExpenseaccounttothe$26,628amountrequired

fortheyearendedDecember31,2015.Italsoincreasestheliabilityforincometaxespayableto$5,580

($1,560+$4,020).ThetransactiontorecordthepaymentofthisliabilityonJanuary15,2016,willbe

(again,thisisatransaction,notanadjustingentry):

d

2016

Jan.15IncomeTaxesPayable...........................5,580

Cash.....................................

5,580

Paymentoftheremaining2015incometaxliability.

IncomeTaxesinUnprofitablePeriods

IncomeTaxesinUnprofitablePeriodsWhathappenstoincometaxesexpensewhenlossesareincurred?

Inthesesituations,thecompanyrecognizesanegativeamountofincometaxesexpense.Theadjusting

entrytorecordincometaxesattheendofanunprofitableaccountingperiodconsistsofadebittoIncome

TaxesPayableandacredittoIncomeTaxesExpense.

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

24/25

2/1/2015

IEBWireframe

Negativeincometaxesexpensemeansthatthecompanymaybeabletorecoverfromthegovernment

someoftheincometaxesrecognizedasexpenseinpriorperiods.7IftheIncomeTaxesPayableaccount

hasadebitbalanceatyearend,itisreclassifiedasanasset,calledIncomeTaxRefundReceivable.A

creditbalanceintheIncomeTaxesExpenseaccountisoffsetagainsttheamountofthebeforetaxloss,as

showninExhibit47.

EXHIBIT47

PartialIncomeStatement

d

PartialIncomeStatementforanUnprofitablePeriod

Income(loss)beforeincometaxes.................................... $(20,000)

Incometaxbenefit(recoveryofpreviouslyrecordedtaxes)................. 8,000

Netloss......................................................... $(12,000)

EXHIBIT47

PartialIncomeStatement

Incometaxbenefitcanreduceapretaxloss

Wehavealreadyseenthatincometaxesexpensereducestheamountofbeforetaxprofits.Noticenow

thatincometaxbenefitsintheformoftaxrefundscanreducetheamountofapretaxloss.Thus,

incometaxesreducethesizeofbothprofitsandlosses.Thedetailedreportingofprofitsandlossesinthe

incomestatementisillustratedinChapter5.

http://textflow.mheducation.com/parser.php?secload=4.1&fake&print

25/25

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- DD Manual FormDocument1 pageDD Manual FormestimeemilielauraNo ratings yet

- Save Electricity: N3968017241 MMZ50 - 3 - 3968017241Document1 pageSave Electricity: N3968017241 MMZ50 - 3 - 3968017241FREE BUSINESS INTELLIGENCENo ratings yet

- Collect CC 1Document1 pageCollect CC 1alan100% (1)

- Solutions To Chapter 13 Problems 1Document3 pagesSolutions To Chapter 13 Problems 1Hira ParachaNo ratings yet

- S Announcement 19717Document3 pagesS Announcement 19717Amy RillorazaNo ratings yet

- Vajra Bus Ticket PDFDocument2 pagesVajra Bus Ticket PDFSanath Kumar MalyalaNo ratings yet

- De LUNA Let's Analyze Activity 1Document4 pagesDe LUNA Let's Analyze Activity 1Jamille Ruth De LunaNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Chapter 3 - Investment IncomeDocument26 pagesChapter 3 - Investment IncomeRyan YangNo ratings yet

- The Taxes Involved in A Sale of Real Estate PropertyDocument7 pagesThe Taxes Involved in A Sale of Real Estate PropertyJessa CaberteNo ratings yet

- DPS Pune Fee Circular 202021 CLASSVIIIDocument1 pageDPS Pune Fee Circular 202021 CLASSVIIIshirinNo ratings yet

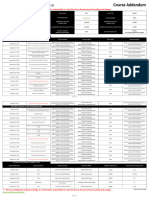

- Fall 2023 ACC400 NKK Course AddendumDocument2 pagesFall 2023 ACC400 NKK Course AddendumGKNo ratings yet

- ACCT 6011 Assignment #2 Template W21Document5 pagesACCT 6011 Assignment #2 Template W21patel avaniNo ratings yet

- UPI - Unified Payment InterfaceDocument9 pagesUPI - Unified Payment Interfacemohit0744No ratings yet

- Table of Contents - Federal Income Tax and Benefit GuideDocument32 pagesTable of Contents - Federal Income Tax and Benefit GuideJorge VichyNo ratings yet

- Chapter 8-1. ProblemsDocument10 pagesChapter 8-1. Problemsiamjan_101No ratings yet

- GSRTCDocument1 pageGSRTCPratik JayswalNo ratings yet

- How Safe Is My Money With Kapil Chit FundsDocument4 pagesHow Safe Is My Money With Kapil Chit FundskgsbppNo ratings yet

- T3 Ans.. (RA)Document8 pagesT3 Ans.. (RA)KY LawNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Raj DelhiNo ratings yet

- IPR ProjectDocument32 pagesIPR ProjectHemantPrajapatiNo ratings yet

- Cryptocurrencies in Public and Private Law David Fox Editor Full ChapterDocument67 pagesCryptocurrencies in Public and Private Law David Fox Editor Full Chapterlaurel.davis476100% (4)

- Case Digests Statcon - Judge Noli DiazDocument8 pagesCase Digests Statcon - Judge Noli DiazTim FloresNo ratings yet

- Probationary Officers Payment Challan 21052010Document1 pageProbationary Officers Payment Challan 21052010Sudhir ShanklaNo ratings yet

- ICAN NoticeDocument1 pageICAN NoticehawaNo ratings yet

- Business Income Tax (Schedule C)Document12 pagesBusiness Income Tax (Schedule C)Jichang HikNo ratings yet

- HR Generalist Online Training Basic v1.1 PDFDocument3 pagesHR Generalist Online Training Basic v1.1 PDFhariveerNo ratings yet

- Fee Notification of Under-Graduate BAMS, BHMS, BNYS, BUMS, BHA, BPO & B.SC Allied Health Sciences During September2017Document4 pagesFee Notification of Under-Graduate BAMS, BHMS, BNYS, BUMS, BHA, BPO & B.SC Allied Health Sciences During September2017passionNo ratings yet

- DHL Document - LOGODocument3 pagesDHL Document - LOGORavichanderNo ratings yet

- Savings Account - 18850100017771 Dharakeshwar Sa: AddressDocument1 pageSavings Account - 18850100017771 Dharakeshwar Sa: AddressLearn UrselfNo ratings yet