Professional Documents

Culture Documents

2014-07 Deutsche Bank - India Newsletter

Uploaded by

deipakguptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014-07 Deutsche Bank - India Newsletter

Uploaded by

deipakguptaCopyright:

Available Formats

Deutsche Bank

Global Network Banking

India Newsletter

July 2014

On Indias economy, the financial sector & the corporate world

The economic situation

Cyclical recovery underway: High frequency

growth indicators related to India have

improved somewhat in the last couple of

months, thereby supporting our view that

the Indian economy has likely bottomed in

this cycle. Industrial sector growth has

surprised to the upside in Apr2014

(+3.4%yoy) and May2014 (+4.7%yoy),

helping the 3-month moving average to rise

to +2.5% in May2014, from -0.5% in

Mar2014. Within industrial production, we

note that the rebound in capital goods

production has been particularly striking in

Apr2014 and May2014. The improvement

in the capital goods production has been

accompanied by a sharp pickup in capital

goods momentum (improved to 18.5% in

May2014, from -8.6% in Mar2014) and

acceleration in non-oil-non-gold imports

growth. The recent PMI trend has also been

encouraging. Led by a sharp rebound in the

services sector, the composite PMI has

managed to rise above the threshold level

of 50 in Apr-Jun2014 for the first time after

three quarters. Overall, the recent data

trend indicates that the Indian economy has

embarked on the path of a cyclical

recovery; a robust structural recovery,

supported by growth-critical reforms, is

however several quarters away, in our view.

(Deutsche Bank Global Markets Research)

Monsoon update: Monsoon rains have

been deficient so far, with the overall

precipitation level registering 35% below

normal between 1st Jun2014 and 17th

Jul2014. Rainfall deficiency has reduced

somewhat from Jun2014 levels (43% below

normal), but the situation remains

worrisome. North-western and central

regions have been the worst affected so far.

The growth impact of a poor monsoon is

unlikely to be significant, given i) reduced

dependence on Kharif (summer crop), with

a commensurate increase in Rabi (winter

crop) production; ii) decreasing dependency

on monsoon, given increased use of

irrigation facilities; and iii) relatively small

share of agriculture sector (13.7%) to

influence overall economic growth. The

biggest risk of a poor monsoon is

undoubtedly inflation. A poor harvest can

potentially exacerbate pressure on food

prices. (Deutsche Bank Global Markets Research)

Purchasing

Managers

Index

(PMI):

Manufacturing PMI increased to 53.0 in

Jul2014, from 51.5 in Jun2014, thereby

pushing the 3-month moving average to a

15-month high (52.0 in Jul2014 vs. 51.4 in

Jun2014). In contrast to the manufacturing

PMI, services PMI surprised sharply to the

downside, with the Jul2014 number coming

in at 52.2, down from 54.4 in Jun2014.

Overall, the composite PMI weakened to

53.0, from 53.8 in Jun2014. We refrain from

reading too much into the monthly

fluctuation of PMI data; the 3-month moving

average clearly indicates that the economy

has bottomed in 1Q of 2014 and a cyclical

recovery is underway at present, albeit from

a depressed base. Our concern is more

regarding the inflation indicators, which

seem to be suggesting renewed pressure

on input prices, which carries the risk of

spilling over to output prices with a lag.

Inflation: CPI inflation rose to +8.0% in

Jul2014 (+0.9%mom), undoing the mild

improvement in trend seen in the previous

couple of months. The outturn was led by a

sharp spike in food prices (+2.8%mom),

especially

vegetable

prices

(up

16.9%mom). The resurgence in price

pressure was however not restricted to

food; even core CPI prices were up

0.8%mom (+7.4%yoy in Jul2014), the

highest increase since Sept2013. WPI

inflation eased to +5.2% in Jul2014 (from

5.4% in Jun2014), broadly in line with

consensus estimate of +5.1%, driven by

food prices as in the case of WPI. A

favourable base effect will help push WPI

inflation below +5% in the coming months,

assuming some softening of food prices

post Aug2014. But beyond Nov2014 when

the base effect turns negative, we see the

inflation trajectory rising once again, with

WPI heading to +6% to +6.5% by midJun2015. (Deutsche Bank Global Markets Research)

Industrial production (IP): Jun2014 IP

surprised to the downside, rising by

+3.4%yoy (vs. +5.0% in May2014), against

our and market expectation of +5.5%yoy

growth. Despite the lower than anticipated

outturn, IP growth during Apr-Jun2014

quarter has improved appreciably (to a

3-year high of +3.9% from the previous

quarter average of -0.5%. This implies a

robust pickup in industrial sector GDP

growth for Apr-Jun2014 as well (given the

strong correlation between the two indices),

which is likely to push headline GDP growth

higher by about 100bps than the previous

quarters outturn (+4.6%yoy), in our view.

Issue 33

India Newsletter

Page 1 of 5

(Deutsche Bank Global Markets Research)

(Deutsche Bank Global Markets Research)

Core infrastructure production (Jun2014)

recorded a robust growth, with the yoy rate

rising to +7.3%, from +2.3%yoy in

May2014. Besides a favorable base effect,

biggest support to growth came from subsectors such as electricity, cement, coal

and steel. (Deutsche Bank Global Markets Research)

India Newsletter

Page 2 of 5

Indias

trade

deficit

increased

to

USD11.8bn in Jun2014, from USD11.2bn in

May2014. Exports growth remained robust

(+10.2%yoy), but moderated from May2014

outturn (+12.4%yoy). Imports recorded a

positive growth (+8.3%yoy) after a gap of 1

year, led by pick up in both oil (+10.9%yoy)

and non-oil imports (+7.0%yoy) growth,

primarily driven by gold imports. Jun2014

trade data is broadly in line to meet our

FY15 annual trade deficit and current

account deficit estimate of USD 168bn

(8.0% of GDP) and USD 43bn (2.1% of

GDP) respectively. (Deutsche Bank Global

Despite a pickup in projects completed

and easing of stalled projects, we note that

incremental investments growth (i.e. the

yoy rate of incremental change in

investments between the current and the

previous quarter) decelerated further in the

quarter. This indicates that the underlying

domestic demand momentum in the

economy remains anemic and any likely

uptick in yoy growth rate of the investment

component in national accounts will be

more on account of a favorable base effect.

Markets Research)

Financial sector

India Blocks WTO Agreement to Ease

Trade Rules: India effectively blocked an

international agreement on easing trade

regulations in Jul-Aug2014, saying the

effort to promote global trade should be

linked to food security, allowing developing

countries more freedom to subsidize and

stockpile food. India's actions prompted

criticism from WTO members, some of

whom said that India's brinkmanship could

undermine the international trading system

as the country has basically hijacked the

trade talks to force a change on one issue.

India's problem relates to WTO rules on

food stockpiling and subsidizing. WTO has

a formula that defines how much money a

country can spend creating a food stockpile

for security and support for farmers. India

wants the rules changed to allow it to go

beyond the limits. (online.wsj.com)

Capex update: Latest quarterly data (AprJun2014) from Centre for Monitoring Indian

Economys CapEx database, which helps

track the trend of firm level investment in

India, breaks down investment between the

public and private sectors, in ongoing and

postponed projects, as well as the value

and number of investments. The database

presently collects information on around

45,000 projects by 9,000 firms. The

outstanding value of projects captured by

the database is about 80% of GDP. There

are three key takeaways:

We note that project completion rate

(measured in real INR terms) jumped by

+42%yoy during the quarter, entirely due to

higher rate of completion of private sector

projects compared with last years, while

public sector project completion rate has

failed

to

show

any

meaningful

improvement;

Projects stalled, both in terms of cost and

absolute units, eased in the quarter. This,

along with the pick-up in project completion

rate, led to a slight moderation in the

stalled/completed ratio of projects

(Deutsche Bank Global Markets Research)

Monetary policy review (Aug2014): RBI

stressed that near term inflation risks were

balanced while the medium term risks were

to the upside, but in both cases

considerable uncertainty prevailed. While

there is no inclination to keep policy tight for

a prolonged period, and clearly RBI is not

impervious to the political economy that

would demand policy easing in the coming

months, we think that the policy statement

provides a roadmap under which RBI will

try to thread the balance between fighting

inflation and supporting growth. We think

RBI will be comfortable continuing to ease

liquidity on the margin while keeping the

key policy rates unchanged. Looking at the

projected path of inflation from now till the

end of 2015, it appears to us that the room

to cut rates in a sustainable and credible

manner wont arrive for another year. We

had earlier expected a couple of rate cuts in

late 2014, only to be countered by rate

hikes in mid-2015. We now expect neither

to take place. An unchanged policy stance

with respect to rates will leave the real

policy rate to around +1% on average,

which in our view would be consistent with

the 6% inflation target (to be achieved by

Jan2016, as per RBI glide path). (Deutsche

Bank Global Markets Research)

Domestic Systemically Important Banks (DSIBs) guidelines: Released by RBI, the

guidelines focuses on D-SIBs need to hold

higher core capital, which is likely to be

about 0.6-0.8% above the minimum 8%

Common Equity Tier (CET) 1 ratio required

by banks over time. This will lead to higher

equity dilution by public sector banks

(PSBs) over time. Private banks may also

need to put aside this capital, but they look

reasonably well placed on capital. Under

the framework the indicators to be used for

assessment are: size, interconnectedness,

substitutability and complexity with weights

assigned. Based on their systemic

importance, banks will be plotted into 4

different buckets and will be required to

have additional CET 1 requirement ranging

from 0.2% to 0.8% of Risk Weighted

Assets, depending upon the bucket. D-SIBs

will also be subjected to differentiated

supervisory requirements and higher

intensity of supervision. Names of banks

classified as D-SIBs will be disclosed in

August every year starting from 2015.

(Deutsche Bank Global Markets Research)

Trade Receivables Discounting System

(TReDS): RBI moved closer in setting up

TReDS - an exchange driven receivables

/invoice trading mechanism that could end

the agony of Small and Medium Enterprises

(MSMEs) which face endless delays in

receiving payments for their supplies to

bigger companies. TReDS will provide the

platform to bring participants together for

facilitating

uploading,

accepting,

discounting, trading and settlement of the

invoices / bills of MSMEs. Proposed model

is akin to Mexican development bank

Nafinsa's creation of an electronic platform.

Stocks exchanges, depositaries, clearing

corporations could be ideal candidates

which could bid to set up TReDS which

helps shorten working capital cycle of

MSMEs. MSME sellers, corporate buyers

and financiers - both banks and non-bank

can participate in this platform, which may

be launched by NSE, BSE or the Clearing

Corporation of India. TReDS would facilitate

the discounting of both invoices as well as

bills of exchange - two forms of fund-based

instruments. (Business Standard)

Foreign Portfolio Investment (FPI) into India

may hit a record in 2014; surpassing the

USD 24bn recorded in 2012, market

strategists based in the US and Asia-Pacific

say. Even as the indices are hovering

around record levels, holdings of FIIs are at

an all-time high and there is a premium of

416 basis points to the MSCI Emerging

Market Index. Indian equity markets have

been the biggest recipient of FII flows

among emerging markets in 2014. As a

result, India's weightage among the

regional funds such as BRIC's fund, AsiaPacific Fund and Emerging Market fund has

reached a significantly higher level than its

historical average. Indian markets have

succeeded in staving off the risk of

diversion of fund flows on two counts. First,

FIIs believe that the new government will

bring

massive

transformational

and

structural changes in the policy and reform

process in order to pep up the sluggish

economy. Second, trajectory of crude oil

prices, the biggest risk for the government's

balance sheet, is easing. (The Economic Times)

Fund raising via preferential allotment

dropped 58%yoy in Apr-Jun2014 quarter to

Disclaimer

The information and opinions in this report were prepared by Deutsche Bank AG or one of its

affiliates (collectively "Deutsche Bank"). The information herein is believed by Deutsche Bank to be

reliable and has been obtained from public sources believed to be reliable. Deutsche Bank makes no

representation as to the accuracy or completeness of such information.

Opinions, estimates and projections in this report constitute the current judgement of the cited

sources and/or the author as of the date of this report. They do not necessarily reflect the opinions of

Deutsche Bank or any of its subsidiaries and affiliates and are subject to change without notice.

Deutsche Bank nor its subsidiaries/affiliates has no obligation to update, modify or amend this report

or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion,

projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This report is provided for informational purposes only. It is not to be construed as an offer to buy or

sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any

particular trading strategy in any jurisdiction. The information contained in this report does not

constitute the provision of investment advice. Neither Deutsche Bank AG nor its subsidiaries/affiliates

accept any responsibility for liabilities arising from the use of this document or its contents.

India Newsletter

Page 3 of 5

INR 115.73bn. During the entire 2013/14

fiscal, companies had mopped up more

than INR 460bn through this route.

However, the number of preferential issues

grew to 171 in Apr-Jun2014 quarter, from

126 in the preceding 3 months. Market

participants attribute the slowdown to

companies preference for Qualified

Institutional Placement (QIP) issues for

fund raising. (Hindu Business Line)

Multiple price bids for bond auctions: RBI

will revert to the multiple price method for

bond auctions, after a year when the

present practice of a uniform price method

was adopted. Under uniform price method,

all successful bidders are required to pay

for the allotted quantity of securities at the

same rate while under multiple price

method; bidders are required to pay at

respective price or yield, at which bids were

placed. Market participants say aggressive

pricing, typically seen under uniform pricing

method, could be one reason for the

change. (Business Standard)

Financial Inclusion Mission: Government

will set up a credit guarantee fund to

support its over INR 400bn new Financial

Inclusion Mission, which envisages to give

INR 5,000 overdraft facility to around 80mn

new account holders. The scheme could

also be extended to present account

holders which according to estimates may

exceed over 150mn accounts, thus putting

a burden of over INR 750bn on the banking

system. (The Economic Times)

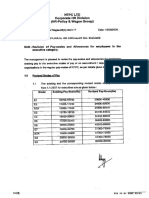

Market Indicators (July 29, 2014)

India Stock Indices

(Source: Bloomberg)

1 Month

Change

1 Year

Change

Sens ex (25991.23)

3.55%

32.65%

Ni fty (7748.7)

3.19%

32.87%

BSE Sma ll Cap (9966.64)

-0.56%

82.24%

BSE Mi d Cap (9139.22)

-0.72%

60.23%

Major Comm. Indices

(Source: Bloomberg)

1 Month

Change

1 Year

Change

Crude (MCX) (6110)

-4.05%

-0.94%

Gol d (MCX) (27890)

-0.70%

-0.80%

Agri Index (MCX) (3028.48)

0.58%

2.97%

Meta l Index (MCX) (4824.35)

1.02%

6.78%

1 Month

Change

1 Year

Change

Major Exchange Rates

(Source: Bloomberg)

USD/INR (60.1375)

0.09%

1.21%

EUR/INR (80.8082)

-1.26%

2.43%

EUR/USD (1.3409)

-1.76%

1.11%

USD/JPY (102.12)

0.69%

4.25%

Inflation numbers

(Source: Bloomberg)

1 Month

1 Year

Change (bps) Change (bps)

WPI (5.43%)

-75.00

27.00

CPI (7.46%)

-82.00

-241.00

Major Yields & Rates

(Source: Bloomberg)

1 Month

1 Year

Change (bps) Change (bps)

Repo (8%)

0.00

75.00

Govt 1yr (8.319)

0.06

-0.25

Govt 10yr (8.432)

-0.31

0.31

Comme rcia l Pa per (9.3875)

3.75

-142.50

Corporate Bond (9.3889)

19.86

-35.36

Industry / corporate sector

Rural consumption growth remain bullish:

Consumer goods makers stand to profit

from a sharper focus on India's rural areas,

where ownership of products such as cars,

motorcycles and white goods more than

doubled between 2004/05 and 2011/12

according to latest statistics. The much

lower penetration than urban markets also

shows that there is a correspondingly

higher potential for growth. About 50% of

the rural households owned a television in

2011/12 compared with 25% in 2004/05, as

per national statistical agencys report titled

'Household Consumption of Various Goods

and Services in India'. Similarly, 9.4%

households in villages possessed a

refrigerator in 2011/12 against 4.4% in

2004/05. Spending on products such as

mobiles and laptops also rose very fast in

rural areas. Significantly, increase in rural

spending happened even as the dismal

power supply improved only marginally

during the period. (The Economic Times)

Indias luxury market: India's luxury market

is set to exceed USD 10bn mark by 2014,

boosted by a new class of wealthy termed

'closet customers', who have have joined

the traditionally rich contributing to higher

luxe sales. From about USD 3.66bn in

2007, the luxury market has more than

doubled to USD 7.58bn in 2012. Growth is

seen at nearly 17% in 2014. According to

the World Wealth Report released by

Capgemini and RBC Wealth Management

in Jan2014, India is ranked 16th in the list

of countries with the highest number of high

net worth individuals (at about 156,000) in

2013. With spending by India's rich

continuing to grow unhindered by any

slowdown, aligning with fashion events,

shows and designers has become the latest

trend among investors, brands and

marketers alike. That explains why BMW

signed a sponsorship deal with the

upcoming India Bridal Fashion Week, which

is the company's first association with

fashion anywhere in the world. It's also why

private equity firm Everstone Capital

invested INR 1bn in designer Ritu Kumar's

company. Also, L Capital, an investment

arm of luxury giant LVMH Group, picked up

stakes in homegrown garment retailer

Fabindia and luxury retailer Genesis

Luxury, and still has an appetite for more

such deals. (The Economic Times)

Branded-hotel occupancy remain subdued:

India's branded-hotel occupancy rate

remained below 60% in Apr-Jun2014,

marginally better than last year's level in the

same quarter. All-India average room rates

during the quarter declined 3%, hovering at

INR 5,500/night. Tariffs have dropped 40%

in last 4 years. Experts attributed the poor

industry performance to the growing supply

of rooms and the general economic

slowdown. Branded-hotel room inventory

has risen close to 40%, or 96,000 rooms, in

the last 4 years while demand has grown

lower at 15%. According to hotel

consultancy firm HVS, India is expected to

add another 54,000 branded rooms in the

coming 3 to 4 years. (The Economic Times)

Domestic construction equipment industry:

Driven by growth in investment in the

infrastructure sector, domestic construction

equipment industry is likely to grow at 12%

CAGR to USD 4bn by 2017, increasing

India's global share to 10% by 2017, says a

survey. The growth will be driven by

infrastructure investment of USD 1tn during

12th Five Year Plan. According to a report

by Roland Berger Strategy Consultants,

India's construction equipment market,

though small by global standards, is

extremely competitive and has players

operating under different strategies. Post

2014 general elections; there is an

expected economic resurgence which will

boost urbanisation of India. Government

has granted new infrastructure projects and

is

allowing

huge

investments

in

infrastructure

industry.

Residential

construction industry is expected to grow

from a CAGR of 10.8% during 2006/11 to

15.3% by 2017. (The Economic Times)

SEZ abroad for chemicals: Government of

India is mulling setting up chemical and

petrochemical complex in countries having

easy access to feedstock to ensure

availability of primary chemical raw

materials exclusively for Indian companies.

Government has identified Iran and

Myanmar for this purpose and is planning to

start the dialogue on these complexes. This

will be a win-win deal for all these countries.

While India can gain access to critical

hydrocarbon feedstocks, Iran and Myanmar

will witness investment in refinery by Indian

companies. (Business Standard)

Disclaimer

The information and opinions in this report were prepared by Deutsche Bank AG or one of its

affiliates (collectively "Deutsche Bank"). The information herein is believed by Deutsche Bank to be

reliable and has been obtained from public sources believed to be reliable. Deutsche Bank makes no

representation as to the accuracy or completeness of such information.

Opinions, estimates and projections in this report constitute the current judgement of the cited

sources and/or the author as of the date of this report. They do not necessarily reflect the opinions of

Deutsche Bank or any of its subsidiaries and affiliates and are subject to change without notice.

Deutsche Bank nor its subsidiaries/affiliates has no obligation to update, modify or amend this report

or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion,

projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This report is provided for informational purposes only. It is not to be construed as an offer to buy or

sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any

particular trading strategy in any jurisdiction. The information contained in this report does not

constitute the provision of investment advice. Neither Deutsche Bank AG nor its subsidiaries/affiliates

accept any responsibility for liabilities arising from the use of this document or its contents.

India Newsletter

Regulatory environment

Telecom

regulator

(TRAI)

releases

guidelines for spectrum sharing: TRAI has

issued detailed recommendation for

spectrum sharing, which we believe are

likely to be accepted by the Dept of

Telecom (the licensor) and promulgated

into rules. The new recommendations allow

sharing of spectrum only if the two

operators have spectrum in the same band

in the same market i.e. circle. The current

recommendations on these aspects are

positive compared to the previous rules.

The increase in usage charge is only 0.5%

of revenues compared to the pre-sharing

baseline being paid by the operator. The

previous rule would almost double the

usage charge. The M&A guidelines limit the

spectrum held by a single operator to 25%

of total assigned in a market or 50% of

spectrum in a band. (Deutsche Bank Global

Markets Research)

Guidelines for reserves exempt bonds for

infra and mortgage financing have been

issued by RBI. Banks can raise these

bonds with a minimum maturity of 7 years.

We believe that funding costs on these

bonds could be 70-80 bps lower and priority

sector benefits could result in a 100 bps

positive impact. Larger banks will benefit

the most, as they are better placed to raise

long-term funds. The size of the bond

market will be a constraining factor. While

the bigger challenges for infrastructure

relate to government policy decisions,

higher interest rates and maturity

mismatches which banks run also restrict

the flow of funds to the sector. Even a 1%

interest rate reduction for a 10-15 year

asset could result in substantial savings for

the infrastructure project, and better liquidity

will also help the asset quality somewhat.

(Deutsche Bank Global Markets Research)

SEBI issued draft rules for infrastructure

trusts, which would allow companies to

monetize their infrastructure projects.

Among the guidelines, SEBI proposes to

allow infrastructure trusts to raise money

either through a public issue or a private

placement, with a minimum issue size of

INR 2.5bn (USD 41.54mn). Tax incentives

for infrastructure investment trusts have

already been declared. (Reuters)

RBI unveiled draft guidelines for setting up

small banks. The move aim at providing

savings instruments to the un-served and

under-served sections of population and

give loans to small farmers, micro and small

enterprises, and other un-organised sector

businesses. Although capital adequacy of

Page 4 of 5

15% will be mandatory, they will be

computed on relatively simpler Basel-1

standards since such banks will not deal

with sophisticated products. Small banks

will be subject to all regulations of RBI as

applicable to existing commercial banks,

including the maintenance of Cash Reserve

Ratio and Statutory Liquidity Ratio.

Promoters initial contribution should be at

least 40% of the banks total paid-up

capital. In case it is more, the promoter will

be required to bring down the holding to

26% within 12 years from the date of

commencement of business of the bank.

(Hindu Business Line)

SEBI is set to issue fresh guidelines on the

settlement guarantee fund (SGF), which

could see the introduction of a core fund

and limit the liability of non-defaulting

members. Members will not be able to take

any exposure against core fund, aimed at

providing extra cushion in trade settlement.

All

intermediaries,

including

stock

exchanges, clearing corporations (CC) and

brokers, will have to contribute towards the

core fund. (Business Standard)

Separate governance standards for "big

and complex business groups" is being

mooted by SEBI that includes those

pertaining to related party transactions and

independent directors. Proposals also

include integration of disclosures made by

entities under different regulations to

reduce the number of times the same

disclosure is to be made by an individual.

(Business Standard)

Company News

Amazon, worlds largest online retailer, said

it was pumping in fresh investments of USD

2bn in its Indian arm, Amazon.in, a day

after Indias biggest e-commerce company,

FlipKart announced that it had raised USD

1bn in funding from private equity investors.

Amazon launched its Indian marketplace in

Jun2013. (Hindu Business Line)

David Lloyd, British health and fitness

group, is buying around 20% stake in

Talwalkars Better Value Fitness, Mumbaibased chain of health centres, for INR 1bn.

David Lloyd Leisure Group operates 81

clubs in the UK and a further 10 clubs

across Europe. (Business Standard)

EDF Energies Nouvelles, French green

energy company, and Luxembourg-based

EREN have acquired 25% stake each in

ACME Solar Energy Ltd, the solar energy

arm of India-based ACME Cleantech

Solutions for INR 5.5bn. (Business Standard)

Piramal Enterprises Ltd, an India based

conglomerate, has tied up with Dutch

pension fund APG Asset Management to

invest USD 1bn in Indian infrastructure

companies over 3 years. Piramal and APG

have each initially committed USD 375mn

for investments under the alliance. (Reuters)

Trafigura, the Swiss commodities giant, has

launched an online store in India to sell

primary metals, seeking a slice of USD 8bn

market and becoming the first big

commodities trader to cater to hordes of

small manufacturers dotting the country.

India's primary metals market is forecast to

grow at up to 8% a year. (Reuters)

Tide Water Oil Co (India), a lubricant

manufacturer, has signed an agreement

with Japan's JX Nippon Oil & Energy Corp

to form a joint venture company in India JX Nippon TWO Lubricants India. Both

companies will have equal stake in the new

entity. (The Economic Times)

Swatch, the Swiss watchmaker, which has

recently sought permission to set up shop

in India, has proposed to procure small or

melee diamonds from India to meet 30%

local sourcing requirement for foreign

companies in single-brand retail. Swatch

proposes to invest USD 10mn over 5 years

to set up 30-35 retail stores. (The Economic

Times)

Miscellaneous

Indian whiskies tighten grip over global

growth

charts:

Data

from

Drinks

International shows that 7 among the top 10

fastest growing whisky brands in the world

are Indian. Radico Khaitan's Crown clocked

in the highest global growth of 75% in 2013,

followed by Pernod Ricard's Imperial Blue

(40%), Allied Blenders & Distillers' Officer's

Choice (31%) and United Spirits Ltd's

Haywards Fine (30%). Pernod's The

Glenlivet single malt was the only global

brand to feature in the top 5 with a growth

of 25%. Officer's Choice is presently the

largest selling whisky brand globally with

23.8mn cases (of 9 litre each) ousting

McDowell's No. 1 to the top spot. The

famed Johnnie Walker, which was market

leader only 3 years ago, is now the 3rd

largest selling whisky brand in the world

with 20.1mn cases. Terming Indian whisky

as a 'powerhouse', Drinks International said

that of the 17 'millionaire' whisky brands in

India, 11 reported robust growth in 2013. In

India's 310mn cases strong spirits market,

Whisky sales overwhelmingly dominate with

175mn cases, accounting for 57% of the

market. (The Economic Times)

Disclaimer

The information and opinions in this report were prepared by Deutsche Bank AG or one of its

affiliates (collectively "Deutsche Bank"). The information herein is believed by Deutsche Bank to be

reliable and has been obtained from public sources believed to be reliable. Deutsche Bank makes no

representation as to the accuracy or completeness of such information.

Opinions, estimates and projections in this report constitute the current judgement of the cited

sources and/or the author as of the date of this report. They do not necessarily reflect the opinions of

Deutsche Bank or any of its subsidiaries and affiliates and are subject to change without notice.

Deutsche Bank nor its subsidiaries/affiliates has no obligation to update, modify or amend this report

or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion,

projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This report is provided for informational purposes only. It is not to be construed as an offer to buy or

sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any

particular trading strategy in any jurisdiction. The information contained in this report does not

constitute the provision of investment advice. Neither Deutsche Bank AG nor its subsidiaries/affiliates

accept any responsibility for liabilities arising from the use of this document or its contents.

India Newsletter

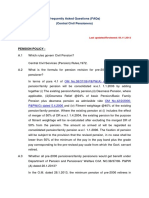

Economic & Financial Indicators

Ratings:

Fitch: BBB- (Stable)

S&P: BBB- (Negative)

Moodys: Baa2 (Stable)

2012 (12/13)

2013 (F) (13/14)

2014 (F) (14/15)

2015 (F) (15/16)

USD bn

1838

1882

1986

2254

USD

1509

1522

1583

1770

Real GDP Growth

FY, % yoy

4.5

4.7

5.5

6.5

Real GDP Growth

CY, % yoy

4.9

4.4

5.6

6.0

Priv. consumption

% yoy

5.7

4.0

5.6

6.0

Govt consumption

% yoy

7.6

4.4

2.9

5.0

FY, % yoy (avg)

9.7

10.1

7.4

7.4

Merchandise exports

FY, USD bn

301.9

319.7

329.6

354.3

Merchandise Imports

FY, USD bn

503.5

466.2

484.5

544.2

Trade Balance

FY, USD bn

-201.7

-146.5

-154.9

-189.8

% of GDP

-11.0

-7.8

-7.6

-8.4

Current Account

FY, USD bn

-91.5

-49.2

-32.4

-57.3

-2.5

Nominal GDP

GDP per Capita

CPI

% of GDP

-5.0

-2.6

-1.6

Fiscal accounts (consolidated deficit)

% of GDP

-7.2

-7.0

-7.0

-6.7

Govt debt

% of GDP

68.5

66.6

64.6

62.9

>Domestic

% of GDP

64.9

63.3

61.5

60.0

>External

% of GDP

3.6

3.3

3.1

2.9

% of GDP

21.4

22.7

23.6

23.3

FX reserves

USD bn

295.6

293.9

334.2

373.9

FDI (net)

USD bn

15.4

26.3

25.0

30.0

FX Rate

INR/USD (eop)

54.8

61.8

61.0

63.0

Total external debt

Source: Deutsche Bank Global Markets Research as of 18 July 2014. Please note that these figures may not match with those mentioned before due to different sources.

Abbreviation index:

1H= First half, 2Q= Second quarter, 3mma= 3-month moving average, AD= Authorized dealer, ADB= Asian Development Bank, AMFI= Association of Mutual Funds in India,

Avg= Average, BMI= Business Monitor International, bn= Billion, BoP= Balance of payments, Bps= Basis points, BSE= Bombay Stock Exchange, CAGR= Compounded annual

growth rate, Capex= Capital expenditures, CCD= Compulsorily convertible debentures, CCI= Competition Commission of India, CCPS= Compulsorily convertible preference

shares, CD= Certificates of deposits, CERC= Central Electricity Regulatory Commission, CIC-ND-SI= Systemically Important Core Investment Company, CPI= Consumer price

7

index, crore= Unit in the Indian number system equal to 10m (10,000,000; 10 ) or 100 lakhs, CRR= Cash reserve ratio, DB= Deutsche Bank, Dept= Department, DIPP=

Department of Industrial Policy & Promotion (Government of India, Ministry of Commerce & Industry), ECB= External commercial borrowing, EEFC= Exchange Earner's Foreign

Currency, EM= Emerging Market, FCNR= Foreign currency Non-Resident, FCY= Foreign currency, FDI= Foreign direct investment, FICCI= Federation of Indian Chambers of

Commerce and Industry, FII= Foreign institutional investors, FIPB = Foreign Investment Promotion Board, FPI= Foreign Portfolio Investor, FTA= Free trade agreement, FX=

Foreign exchange, FY= Financial year, GDP= Gross domestic product, GIC= Global in-house centres, IATA= International Air Transport Association, IFC= International Finance

Corporation, IGCC= Indo-German Chamber of Commerce, IIP= Index of Industrial Production, IMF= International Monetary Fund, INR= Indian Rupee, IP= Industrial production,

IRDA= Insurance Regulatory and Development Authority, JV= Joint venture, kg= Kilogram, LatAm= Latin America, mn= Million, M&A= Mergers & acquisitions, MNC=

Multination corporations, m-o-m= Month-on-month, MoU= Memorandum of understanding, mt= Metric tons, MW= Megawatts, NBFC= Non-Banking Financial Company, NEFT=

National Electronic Funds Transfer, Nifty= National Stock Exchanges Fifty, NPA= Non-Performing Assets, NRI= Non-resident Indian, NSE= National Stock Exchange of India,

NSSO= National Sample Survey Organisation, OECD= Organization for Economic Cooperation & Development, OEM= Original equipment manufacturers, PE= Private equity,

PMI= Purchasing Managers Index, PPP= Public-private partnership, QFI=Qualified foreign investors, qoq= Quarter-on-quarter, R&D= research and development, RBI= Reserve

Bank of India, sa= Seasonally adjusted, SEBI= Securities and Exchange Board of India, SGD= Singapore Dollar, Sensex= Benchmark index of the Bombay Stock Exchange,

SEZ= Special Economic Zone, SIAM= Society of Indian Automobile Manufacturers, SLR= Statutory Liquidity Ratio, SME= Small-medium-sized enterprises, tn= Trillion, TRAI=

Telecom Regulatory Authority of India, UK= The United Kingdom, UAE= United Arab Emirates, UNCTAD= United Nations Conference on Trade and Development, WPI=

Wholesale price index, yoy= Year-on-year, ytd= Year to date. Months may have been abbreviated by their first 3 or 4 letters (eg Jan for January).

Disclaimer

The information and opinions in this report were prepared by Deutsche Bank AG or one of its

affiliates (collectively "Deutsche Bank"). The information herein is believed by Deutsche Bank to be

reliable and has been obtained from public sources believed to be reliable. Deutsche Bank makes no

representation as to the accuracy or completeness of such information.

Opinions, estimates and projections in this report constitute the current judgement of the cited

sources and/or the author as of the date of this report. They do not necessarily reflect the opinions of

Deutsche Bank or any of its subsidiaries and affiliates and are subject to change without notice.

Deutsche Bank nor its subsidiaries/affiliates has no obligation to update, modify or amend this report

or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion,

projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

This report is provided for informational purposes only. It is not to be construed as an offer to buy or

sell or a solicitation of an offer to buy or sell any financial instruments or to participate in any

particular trading strategy in any jurisdiction. The information contained in this report does not

constitute the provision of investment advice. Neither Deutsche Bank AG nor its subsidiaries/affiliates

accept any responsibility for liabilities arising from the use of this document or its contents.

You might also like

- Invesco Factsheet June 2022Document56 pagesInvesco Factsheet June 2022ADARSH GUPTANo ratings yet

- Scanner Hardware Stopped Scan - Replace Collimator CAM (A - B) Motor and Coupling AssemblyDocument5 pagesScanner Hardware Stopped Scan - Replace Collimator CAM (A - B) Motor and Coupling AssemblyLuis BattaNo ratings yet

- Oracle Database Performance Tuning Advanced Features and Best Practices For DbasDocument303 pagesOracle Database Performance Tuning Advanced Features and Best Practices For Dbassss pppNo ratings yet

- Appeal For Exclusion COA For An Act Committed in Good FaithDocument13 pagesAppeal For Exclusion COA For An Act Committed in Good FaithPj Tigniman100% (6)

- Take Home Assignment 2Document2 pagesTake Home Assignment 2Kriti DaftariNo ratings yet

- Classical Vs KeynisianDocument8 pagesClassical Vs KeynisianRinky BhattacharyaNo ratings yet

- A Guide To Diagnostic Insulation Testing Above 1 KV: Toll Free Customer Service NumberDocument40 pagesA Guide To Diagnostic Insulation Testing Above 1 KV: Toll Free Customer Service NumberdeipakguptaNo ratings yet

- Equity Valuation of MaricoDocument18 pagesEquity Valuation of MaricoPriyanka919100% (1)

- CrimLaw2 Reviewer (2007 BarOps) PDFDocument158 pagesCrimLaw2 Reviewer (2007 BarOps) PDFKarla EspinosaNo ratings yet

- Hands On With Google Data Studio: A Data Citizen's Survival Guide - Lee HurstDocument5 pagesHands On With Google Data Studio: A Data Citizen's Survival Guide - Lee HurstdowycyfoNo ratings yet

- Introductory Lesson MburghDocument2 pagesIntroductory Lesson Mburghapi-315866938No ratings yet

- Invesco Factsheet July 2023Document56 pagesInvesco Factsheet July 2023Akhilesh ksNo ratings yet

- India ForecastDocument10 pagesIndia Forecastmalikrocks3436No ratings yet

- First Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoDocument5 pagesFirst Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoUttam AuddyNo ratings yet

- Market Outlook, 15th February 2013Document19 pagesMarket Outlook, 15th February 2013Angel BrokingNo ratings yet

- H1 2014 - Market InsightsDocument50 pagesH1 2014 - Market Insightsshaj VarmaNo ratings yet

- Budget AnalysisDocument9 pagesBudget AnalysisRishi BiggheNo ratings yet

- Governor's Statement - August 6, 2020: TH TH TH THDocument13 pagesGovernor's Statement - August 6, 2020: TH TH TH THThe QuintNo ratings yet

- Economic Data India 2009Document4 pagesEconomic Data India 2009akashNo ratings yet

- Governor's StatementDocument11 pagesGovernor's Statementvipulpandey005No ratings yet

- Report On Macroeconomics and Banking: April 3, 2010Document17 pagesReport On Macroeconomics and Banking: April 3, 2010pratiknkNo ratings yet

- Global Economy HeadwindsDocument10 pagesGlobal Economy HeadwindsKhushboo NagpalNo ratings yet

- Economic Analysis: Real GDP Growth (% Change)Document13 pagesEconomic Analysis: Real GDP Growth (% Change)Shantnu SoodNo ratings yet

- Asia Insights: Indonesia: Q2 GDP Growth Picked Up FurtherDocument6 pagesAsia Insights: Indonesia: Q2 GDP Growth Picked Up FurtherDyah MaharaniNo ratings yet

- Fundamental AnalysisDocument15 pagesFundamental AnalysissuppishikhaNo ratings yet

- Economic and Financial DevelopmentsDocument25 pagesEconomic and Financial DevelopmentsConnorLokmanNo ratings yet

- Task 4 - Abin Som - 21FMCGB5Document8 pagesTask 4 - Abin Som - 21FMCGB5Abin Som 2028121No ratings yet

- Economic Environment of Business: Group 1Document4 pagesEconomic Environment of Business: Group 1Darshan SankheNo ratings yet

- India Monthly Investment Outlook and Strategy: January 2013Document13 pagesIndia Monthly Investment Outlook and Strategy: January 2013saikumarmohinderNo ratings yet

- India Development Update - World Bank November 2022Document44 pagesIndia Development Update - World Bank November 2022Kislay KanthNo ratings yet

- India GDP Overview: Chart TitleDocument3 pagesIndia GDP Overview: Chart TitleShreyans PokharnaNo ratings yet

- Subsidiaries of ICICI Bank Annual Report FY2014Document356 pagesSubsidiaries of ICICI Bank Annual Report FY2014karan_w3No ratings yet

- IndiaEconomicsOverheating090207 MFDocument4 pagesIndiaEconomicsOverheating090207 MFsdNo ratings yet

- CPI InflationDocument3 pagesCPI InflationKabilanNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument15 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Credit Policy September 2011Document6 pagesCredit Policy September 2011Gaurav WamanacharyaNo ratings yet

- Economic Survey2013-14Document254 pagesEconomic Survey2013-14kunal1104No ratings yet

- India Monthly Outlook by UBSDocument7 pagesIndia Monthly Outlook by UBSSumanth GururajNo ratings yet

- India Has Become TheDocument19 pagesIndia Has Become TheInderdeep DhillonNo ratings yet

- Monetary Policy of PakistanDocument16 pagesMonetary Policy of PakistanTaYmoorAltafNo ratings yet

- GDP Fy14 Adv Est - 7 Feb 2014Document4 pagesGDP Fy14 Adv Est - 7 Feb 2014mkmanish1No ratings yet

- Ey Economy Watch December 2023Document33 pagesEy Economy Watch December 2023navamietnNo ratings yet

- Asia-Pacific 2014: Risks Narrow As Growth Grinds Higher: Economic ResearchDocument11 pagesAsia-Pacific 2014: Risks Narrow As Growth Grinds Higher: Economic Researchapi-239404108No ratings yet

- LinkDocument24 pagesLinkDhileepan KumarasamyNo ratings yet

- Monetary Policy Review Sept 2014Document7 pagesMonetary Policy Review Sept 2014tirthanpNo ratings yet

- Chapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofDocument21 pagesChapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofnavneetNo ratings yet

- Ram Mohan T T (ET) (03!03!2011) Pranab Deserves 9 On 10Document2 pagesRam Mohan T T (ET) (03!03!2011) Pranab Deserves 9 On 10AshutoshNo ratings yet

- CHP 1Document13 pagesCHP 1Gulfishan MirzaNo ratings yet

- Economic Survey 2012 India Is Not Shining May 2012Document6 pagesEconomic Survey 2012 India Is Not Shining May 2012jayant-212002No ratings yet

- IE 2 - Unit 1 - Macroeconomic Scenario and Policy Options - Manoj PandaDocument35 pagesIE 2 - Unit 1 - Macroeconomic Scenario and Policy Options - Manoj PandaApoorva SharmaNo ratings yet

- RBI S Annual Monetary Policy: RBI Revised Repo Rate and CRR. Policy Expected To Be Aggresive Amid High InflationDocument27 pagesRBI S Annual Monetary Policy: RBI Revised Repo Rate and CRR. Policy Expected To Be Aggresive Amid High Inflationsheetal_sab19929665No ratings yet

- Economic Survey 2013-14Document373 pagesEconomic Survey 2013-14piyushNo ratings yet

- DirectorDocument49 pagesDirectorrohitkoliNo ratings yet

- We Expect Liquidity To Be Tight Till December, at Least. - J P MorganDocument5 pagesWe Expect Liquidity To Be Tight Till December, at Least. - J P MorganAlpesh PatelNo ratings yet

- First Cut - GDP - Nov'15 (12017101)Document6 pagesFirst Cut - GDP - Nov'15 (12017101)Abhijit ThakarNo ratings yet

- TATA AIA Annual Report March 2020Document22 pagesTATA AIA Annual Report March 2020SantoshNo ratings yet

- Overheating: Niranjan Rajadhyaksha's Previous ColumnsDocument5 pagesOverheating: Niranjan Rajadhyaksha's Previous ColumnsVaibhav KarthikNo ratings yet

- Vinidhan Annual Report FY15 PDFDocument8 pagesVinidhan Annual Report FY15 PDFNitin GavishterNo ratings yet

- D&B Economy Forecast Press Release For June 2014Document1 pageD&B Economy Forecast Press Release For June 2014Ravi Krishna MettaNo ratings yet

- CRISIL First Cut - CPI - IIP PDFDocument7 pagesCRISIL First Cut - CPI - IIP PDFAnirudh KumarNo ratings yet

- Premia Insights Feb2020 PDFDocument6 pagesPremia Insights Feb2020 PDFMuskan mahajanNo ratings yet

- KPMG Union Budget 2014Document32 pagesKPMG Union Budget 2014Ashish KediaNo ratings yet

- Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Economic Survey 2023Document3 pagesEconomic Survey 2023GRAMMAR SKILLNo ratings yet

- FICCI Economic Outlook Survey Jan 2011Document18 pagesFICCI Economic Outlook Survey Jan 2011Ashish KumarNo ratings yet

- Gross Domestic ProductDocument6 pagesGross Domestic ProductnanabirjuNo ratings yet

- Indian EconomyDocument37 pagesIndian EconomyDvitesh123No ratings yet

- Inflation, IIP & PMIDocument6 pagesInflation, IIP & PMIAJAY ARNo ratings yet

- SBI Credit Card Terms and ConditionsDocument2 pagesSBI Credit Card Terms and ConditionsdeipakguptaNo ratings yet

- Certificate of OriginalityDocument1 pageCertificate of OriginalityAbhishek KukrejaNo ratings yet

- Indira Gandhi National Open University: School of Management Studies Maidan Garhi, New Delhi - 110 068Document1 pageIndira Gandhi National Open University: School of Management Studies Maidan Garhi, New Delhi - 110 068Abhishek KukrejaNo ratings yet

- Management Programme 2018Document249 pagesManagement Programme 2018Bisuraj SharmaNo ratings yet

- Paytm Wallet TnCsDocument2 pagesPaytm Wallet TnCsdeipakguptaNo ratings yet

- Pay RevisionDocument27 pagesPay RevisiondeipakguptaNo ratings yet

- SBI Credit Card Terms and ConditionsDocument2 pagesSBI Credit Card Terms and ConditionsdeipakguptaNo ratings yet

- Management Programme Term-End Examination June, 2012 Ms-612: Retail ManagementDocument5 pagesManagement Programme Term-End Examination June, 2012 Ms-612: Retail ManagementdeipakguptaNo ratings yet

- Fin 1 PDFDocument26 pagesFin 1 PDFsurabhi jainNo ratings yet

- Fly Ash UtilizationDocument9 pagesFly Ash UtilizationdeipakguptaNo ratings yet

- Public Finance - Basic Concepts, Ties and Aspects: Aim of This ChapterDocument75 pagesPublic Finance - Basic Concepts, Ties and Aspects: Aim of This Chapterdiy with OshinixNo ratings yet

- FAQ PensionDocument31 pagesFAQ PensionSudhir ParasharNo ratings yet

- NTPC News-14 May 2018-01Document10 pagesNTPC News-14 May 2018-01deipakguptaNo ratings yet

- EEIMDocument8 pagesEEIMdeipakguptaNo ratings yet

- 8 Management Programme Term-End Examination June, 2012 I-0 Ms-10: Organisational Design, Development and ChangeDocument8 pages8 Management Programme Term-End Examination June, 2012 I-0 Ms-10: Organisational Design, Development and ChangedeipakguptaNo ratings yet

- NTPC Innovation SchemeDocument10 pagesNTPC Innovation SchemedeipakguptaNo ratings yet

- MS 495Document8 pagesMS 495deipakguptaNo ratings yet

- Management Programme Term-End Examination June, 2012: MS-11 No. of Printed Pages: 7Document7 pagesManagement Programme Term-End Examination June, 2012: MS-11 No. of Printed Pages: 7deipakguptaNo ratings yet

- MS 3 PDFDocument6 pagesMS 3 PDFdeipakguptaNo ratings yet

- MS 611Document4 pagesMS 611deipakguptaNo ratings yet

- Management Programme Term-End Examination June, 2012: MS-11 No. of Printed Pages: 7Document7 pagesManagement Programme Term-End Examination June, 2012: MS-11 No. of Printed Pages: 7deipakguptaNo ratings yet

- Course ListDocument10 pagesCourse ListdeipakguptaNo ratings yet

- Emobility FullDocument17 pagesEmobility FulldeipakguptaNo ratings yet

- E-Mobility: Introduction: Prague, April 27, 2010Document11 pagesE-Mobility: Introduction: Prague, April 27, 2010deipakguptaNo ratings yet

- Regulatory Framework of Power Sector BrouchureDocument3 pagesRegulatory Framework of Power Sector BrouchuredeipakguptaNo ratings yet

- MS 2Document4 pagesMS 2deipakguptaNo ratings yet

- Regulatory Framework of Power Sector BrouchureDocument3 pagesRegulatory Framework of Power Sector BrouchuredeipakguptaNo ratings yet

- PG Diploma (Direct Entry) PDFDocument180 pagesPG Diploma (Direct Entry) PDFAbhishek KumarNo ratings yet

- E-Mobility Y: Opportunities & Challenges GDocument12 pagesE-Mobility Y: Opportunities & Challenges GdeipakguptaNo ratings yet

- NCH 101 Course Plan - 2021Document4 pagesNCH 101 Course Plan - 2021RamishaNo ratings yet

- Kerala University PHD Course Work Exam SyllabusDocument4 pagesKerala University PHD Course Work Exam Syllabuslozuzimobow3100% (2)

- 8035-Article Text-59635-1-10-20190329Document4 pages8035-Article Text-59635-1-10-20190329Hesti RahmadatiNo ratings yet

- Training Needs in Facilities Management Zaharah Manaf 2005Document11 pagesTraining Needs in Facilities Management Zaharah Manaf 2005Anonymous dmYc1M4uNo ratings yet

- Mock Test 3Document15 pagesMock Test 3MadhuNo ratings yet

- Applied Optimization For Wireless, Machine Learning, Big DataDocument1 pageApplied Optimization For Wireless, Machine Learning, Big DataSumaNo ratings yet

- Module1 Lesson 1Document22 pagesModule1 Lesson 1ARLENE NORICONo ratings yet

- MarketingplanmiltonDocument4 pagesMarketingplanmiltonapi-385455349No ratings yet

- Use of English 01Document2 pagesUse of English 01Doylce TrầnNo ratings yet

- RizalDocument6 pagesRizalKin BarklyNo ratings yet

- State MottosDocument3 pagesState MottosFrancisco MedinaNo ratings yet

- Boast 1 - Fragility Hip Fractures PDFDocument1 pageBoast 1 - Fragility Hip Fractures PDFSam BarnesNo ratings yet

- Lec 2 Ideology of PakDocument49 pagesLec 2 Ideology of PakIshfa Umar0% (1)

- PhysicsssssDocument1 pagePhysicsssssSali IqraNo ratings yet

- Additional Mathematics Project Work Kelantan 2/2012Document29 pagesAdditional Mathematics Project Work Kelantan 2/2012Muhammad Afif44% (9)

- SanamahismDocument7 pagesSanamahismReachingScholarsNo ratings yet

- A Beginner Guide To Website Speed OptimazationDocument56 pagesA Beginner Guide To Website Speed OptimazationVijay KumarNo ratings yet

- People Vs AbellaDocument32 pagesPeople Vs AbellaKanraMendozaNo ratings yet

- Project SelectingDocument29 pagesProject SelectingayyazmNo ratings yet

- BM AssignmentDocument7 pagesBM AssignmentAntony LawrenceNo ratings yet

- 330A 2018docDocument20 pages330A 2018docDavid MendozaNo ratings yet

- Frankenstein Final EssayDocument3 pagesFrankenstein Final Essayapi-605318216No ratings yet