Professional Documents

Culture Documents

TD Asset Management: Year End Market Report - 2009

Uploaded by

Daniel BothaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TD Asset Management: Year End Market Report - 2009

Uploaded by

Daniel BothaCopyright:

Available Formats

Year-End Market Report

2009

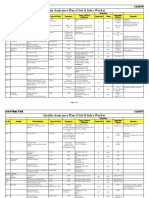

EQUITY MARKETS – Local Currency Returns

• In the early part of the year, investors continued to grapple with negative news indicating the worldwide recession could be deeper and longer than previously

thought. World equity markets hit multi-year lows in early March. Policy makers took emergency measures to stabilize the financial system and stimulate economic

activity and towards the middle of the year optimism began to mount that the worst of the global recession was over and a recovery was taking shape. Investors

became less risk-averse and increasingly turned from relatively safe government bonds to potentially higher-yielding assets like equities. By year-end, the

markets had rebounded to post positive returns for the 12 months.

End Level 2009 2009 C$

S&P/TSX 11746 30.7% 30.7% • Best annual gain since 1979; beat S&P 500 for 6th year in row – Total Return 35%.

DOW JONES 10428 18.8% 2.7% • American Express, Microsoft, IBM, Cisco Systems led the advance – TR 5.4% C$.

S&P 500 1115 23.5% 6.7% • Tech, materials, consumer discretionary led all 10 sectors higher – TR 8.6% C$.

NASDAQ 2269 43.9% 24.3% • 6 of 7 sectors rose, led by computers, telecom; banks fell – TR 24.9% C$.

RUSSELL 2000 625 25.2% 8.2% • Consumer discretionary, tech led 8 of 9 sectors higher; financials fell – TR 9.3% C$.

NIKKEI 225 10546 19.0% 0.2% • One of the smallest returns among world stock markets – TR 2.4% C$.

EAFE 1581 27.7% 10.4% • European stks up 60% since Mar; best yearly gain in 10 years – TR 13.6% C$.

MSCI WORLD 1168 27.0% 9.7% • Biggest advance since 2003 – TR 12.2% C$.

TSX SECTORS • In complete reverse of 2008, all 10 sectors advanced in 2009.

End Level 2009 End Level 2009

Information Technology 261 44.3% Industrials 1134 23.7%

Financials 1568 38.3% Utilities 1702 12.7%

Energy 2855 35.0% Consumer Discretionary 899 11.1%

Materials 3020 33.4% Consumer Staples 1546 6.1%

Health Care 325 28.6% Telecommunication Services 726 0.7%

Oil: West Texas Intermediate US$/b $79.36 $34.76 Gold: Spot US$/oz $1,096.95 $214.90

FIXED INCOME MARKETS YEAR-END RATES %

3-mo T-bill 10-yr Bond 30-yr Bond

Canada 0.34 3.61 4.08 • Over the year, Canadian 3-month T-bill yields fell about 54 basis points, while the

U.S. 0.06 3.84 4.64 yield on 10-year federal government bonds rose 92 bps and the yield on 30-year

Spread 0.28 -0.23 -0.56 federal bonds climbed 63 bps. U.S. Treasury yields were up across the board, as

well.

End Level 2009

DEX Universe Bond 737.1 5.4% • Overall, Canadian bonds posted positive returns on the year. Corporate bonds were

DEX Real Return Bond 399.1 14.5% strong, outperforming government issues, as credit spreads tightened from

Mer Lynch US High Yield Master II 685.0 57.5% historically wide margins and are now back to where they were before the failure of

Lehman Brothers in September 2008.

Last Meeting Current Rate Next Meeting

Bank of Canada Dec 8 0.25% Jan 19 • Overnight rate was cut from 1.50% to 0.25% in the early part of 2009.

U.S. Federal Reserve Dec 16 zero to 0.25% Jan 27 • Federal funds rate held to a target range of zero to 0.25% in 2009.

CURRENCIES

End Level 2009

Canadian dollar: CAD per USD 1.0532 15.7% • The C$ bounced back from a sharp drop versus the US$ in 2008, as optimism the

Japanese yen: JPY per USD 93.0200 -2.6% global economy is recovering spurred a rally in commodity prices and reduced the

Euro: USD per EURO 1.4321 2.5% US$'s appeal as a safe haven. The C$ finished the year at 95.54 cents US, after

British pound: USD per GBP 1.6170 10.8% hitting a low of 76.85 in March and a high of 97.65 in October.

Relative to the Canadian dollar (2009): euro (-11.9%); British pound (-5.0%); yen (-16.4%).

OUTLOOK

Although headwinds remain, the worst is probably behind us and policy makers are now considering the need to remove monetary stimulus in light of the

prospects for improving economic activity and rising inflation expectations. However, they will likely take a cautious approach in timing and scope.

The Bank of Canada (BoC) held the overnight rate at 0.25% at its meeting of 2009 in December, and reiterated that it intends to leave it unchanged until mid-

2010, conditional on the outlook for inflation. The BoC said that although areas of weakness remain, the global economy is showing further signs of improvement

and the global outlook is slightly better than it projected in its quarterly Monetary Policy Report in October. As for Canada, the BoC continues to expect steady

improvement in the economy, led by domestic demand. It still projects that inflation is unlikely to return to its 2.0% target before the second half of 2011.

The US Federal Reserve (Fed) also remained on hold in December and reaffirmed its commitment to keep the federal funds rate exceptionally low for an

extended period. The Fed noted that the economy is strengthening, and that household spending appears to be expanding, though it remains constrained by

ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. It still expects inflation to remain subdued for some time. At the same time, the

European Central Bank kept its key lending rate at a record-low 1.00% in December, noting the low borrowing rate was appropriate, as the region recovers

gradually from recession and inflation remains tame.

Overall, the current backdrop remains positive as 2010 gets underway. Accommodative monetary and fiscal policy should help fuel moderate economic growth,

which would support earnings without stirring inflationary pressures. And policy makers have generally indicated that they are committed to maintaining stimulus

measures for some time yet to provide substantial liquidity.

*This report has been prepared for information purposes only. The information has been drawn from sources believed to be reliable, but the accuracy or completeness is not guaranteed,

nor in providing it does The Toronto-Dominion Bank, its affiliates, subsidiaries or related entities or TD Asset Management Inc. assume any responsibility or liability for any errors or

omissions in the information or for any loss or damage suffered. Particular investment strategies should be evaluated relative to each individual's objectives.

TD Asset Management Inc. is a wholly-owned subsidiary of The Toronto-Dominion Bank

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Quality Assurance Plan - CivilDocument11 pagesQuality Assurance Plan - CivilDeviPrasadNathNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Using Ms-Dos 6.22Document1,053 pagesUsing Ms-Dos 6.22lorimer78100% (3)

- ICON Finals Casebook 2021-22Document149 pagesICON Finals Casebook 2021-22Ishan ShuklaNo ratings yet

- An Analysis of The Cloud Computing Security ProblemDocument6 pagesAn Analysis of The Cloud Computing Security Problemrmsaqib1No ratings yet

- Trading Rules To Successful ProfitsDocument89 pagesTrading Rules To Successful ProfitsOuattaraNo ratings yet

- Integrated Management System 2016Document16 pagesIntegrated Management System 2016Mohamed HamedNo ratings yet

- Kpolovie and Obilor PDFDocument26 pagesKpolovie and Obilor PDFMandalikaNo ratings yet

- The Financial Planning Pyramid: Securing Your Financial FutureDocument6 pagesThe Financial Planning Pyramid: Securing Your Financial FutureDaniel BothaNo ratings yet

- Individual Pension Plan (IPP) : An OverviewDocument4 pagesIndividual Pension Plan (IPP) : An OverviewDaniel BothaNo ratings yet

- Harbour Advisors: Market Report & Performance Overview From Gerry ColemanDocument2 pagesHarbour Advisors: Market Report & Performance Overview From Gerry ColemanDaniel BothaNo ratings yet

- Financial Risk Management: What Is Discretionary Capital?Document3 pagesFinancial Risk Management: What Is Discretionary Capital?Daniel BothaNo ratings yet

- Investment Diversification Alive and WellDocument2 pagesInvestment Diversification Alive and WellDaniel BothaNo ratings yet

- Malaybalay CityDocument28 pagesMalaybalay CityCalvin Wong, Jr.No ratings yet

- Catalog de Aparatura Si Instrumentar Veterinar Eikemeyer-GermaniaDocument336 pagesCatalog de Aparatura Si Instrumentar Veterinar Eikemeyer-GermaniaDr. Dragos CobzariuNo ratings yet

- Flange CheckDocument6 pagesFlange CheckMohd. Fadhil JamirinNo ratings yet

- Ingres in ReproductionDocument20 pagesIngres in ReproductionKarlNo ratings yet

- Technology in Society: SciencedirectDocument10 pagesTechnology in Society: SciencedirectVARGAS MEDINA ALEJANDRANo ratings yet

- ARHAM FINTRADE LLP - Company, Directors and Contact Details Zauba CorpDocument1 pageARHAM FINTRADE LLP - Company, Directors and Contact Details Zauba CorpArun SonejiNo ratings yet

- Actara (5 24 01) PDFDocument12 pagesActara (5 24 01) PDFBand Dvesto Plus CrepajaNo ratings yet

- 4.1.1.6 Packet Tracer - Explore The Smart Home - ILM - 51800835Document4 pages4.1.1.6 Packet Tracer - Explore The Smart Home - ILM - 51800835Viet Quoc100% (1)

- Quality Assurance Plan-75FDocument3 pagesQuality Assurance Plan-75Fmohamad chaudhariNo ratings yet

- Self-Efficacy and Academic Stressors in University StudentsDocument9 pagesSelf-Efficacy and Academic Stressors in University StudentskskkakleirNo ratings yet

- Alan Freeman - Ernest - Mandels - Contribution - To - Economic PDFDocument34 pagesAlan Freeman - Ernest - Mandels - Contribution - To - Economic PDFhajimenozakiNo ratings yet

- LNWH Alcohol GUIDELINE SUMMARY 2018Document1 pageLNWH Alcohol GUIDELINE SUMMARY 2018Ai Hwa LimNo ratings yet

- Promoting The Conservation and Use of Under Utilized and Neglected Crops. 12 - TefDocument52 pagesPromoting The Conservation and Use of Under Utilized and Neglected Crops. 12 - TefEduardo Antonio Molinari NovoaNo ratings yet

- Matrix CPP CombineDocument14 pagesMatrix CPP CombineAbhinav PipalNo ratings yet

- James KlotzDocument2 pagesJames KlotzMargaret ElwellNo ratings yet

- High Intermediate 2 Workbook AnswerDocument23 pagesHigh Intermediate 2 Workbook AnswernikwNo ratings yet

- New Regular and Irregular Verb List and Adjectives 1-Ix-2021Document11 pagesNew Regular and Irregular Verb List and Adjectives 1-Ix-2021MEDALITH ANEL HUACRE SICHANo ratings yet

- Data Mining For Business Analyst AssignmentDocument9 pagesData Mining For Business Analyst AssignmentNageshwar SinghNo ratings yet

- 1.12 Properties of The Ism - FlexibilityDocument4 pages1.12 Properties of The Ism - FlexibilityyomnahelmyNo ratings yet

- Characteristics: Our in Vitro IdentityDocument4 pagesCharacteristics: Our in Vitro IdentityMohammed ArifNo ratings yet

- New KitDocument195 pagesNew KitRamu BhandariNo ratings yet

- Facts About The TudorsDocument3 pagesFacts About The TudorsRaluca MuresanNo ratings yet

- Mythology GreekDocument8 pagesMythology GreekJeff RamosNo ratings yet