Professional Documents

Culture Documents

Financial Ratio Summary Sheet

Uploaded by

Keith Tomasson100%(1)100% found this document useful (1 vote)

64 views1 pageThis document defines and describes various financial ratios used to evaluate a company's performance. It includes liquidity ratios like the current ratio and cash ratio that measure a company's ability to meet short-term obligations, as well as leverage and debt coverage ratios like the debt-to-total assets ratio and times-interest-earned ratio that evaluate financial risk. Additionally, it outlines profitability ratios such as gross profit margin and return on equity that assess how efficiently a company generates profits relative to sales and investments. Finally, the document defines shareholder return ratios such as dividend yield and price-to-earnings ratio that measure returns received by shareholders.

Original Description:

Some common ratios used in Financial Statement Analysis.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines and describes various financial ratios used to evaluate a company's performance. It includes liquidity ratios like the current ratio and cash ratio that measure a company's ability to meet short-term obligations, as well as leverage and debt coverage ratios like the debt-to-total assets ratio and times-interest-earned ratio that evaluate financial risk. Additionally, it outlines profitability ratios such as gross profit margin and return on equity that assess how efficiently a company generates profits relative to sales and investments. Finally, the document defines shareholder return ratios such as dividend yield and price-to-earnings ratio that measure returns received by shareholders.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

64 views1 pageFinancial Ratio Summary Sheet

Uploaded by

Keith TomassonThis document defines and describes various financial ratios used to evaluate a company's performance. It includes liquidity ratios like the current ratio and cash ratio that measure a company's ability to meet short-term obligations, as well as leverage and debt coverage ratios like the debt-to-total assets ratio and times-interest-earned ratio that evaluate financial risk. Additionally, it outlines profitability ratios such as gross profit margin and return on equity that assess how efficiently a company generates profits relative to sales and investments. Finally, the document defines shareholder return ratios such as dividend yield and price-to-earnings ratio that measure returns received by shareholders.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Financial Ratios

Method of Calculation

Description

= Current Assets - Current Liabilities

Measures the relationship of Current Assets to

Current Liability in absolute terms. Represents a

cushion in meeting current liabilities

=Current Assets/Current Liabilities

To give a general indication of the ability of a

business (borrower) to meet its current obligations.

= Cash/Current Liabilities

To supplement the current ratio in measuring

liquidity, this ratio places more emphasis on cash.

=(Current Assets-Inventory)/Current Liabilities

To supplement the current ratio in measuring

liquidity, this ratio places more emphasis on liquid

assets which can be quickly converted into cash.

=Total Liabilities/Total Assets

Measures the proportion of all debts provided by

lenders to finance all assets.

Liquidity Ratios

Net working capital ($000)

Current ratio (times)

Cash ratio (times)

Quick ratio (times)

Leverage and Debt Coverage Ratios

Debt-to-total assets ratio (percent)

Debt-to-equity ratio (times)

Times-interest-earned ratio (times)

=(Profit before Tax + Finance Costs)/Finance Costs

Measures the proportion of all debts in relation to

the total equity

Shows the debt-paying ability of a business or its

capacity to service the finance costs.

Measures ability to meet debt and Dividend payments

=Total Debt/Total Equity

Debt Service Coverage Ratio

(times)

=Net Profit + Extraordinary Items + Depreciation + Finance Costs

Principal & Interest commitments + Dividends

Interest Coverage Ratio

(times)

=Net Profit before Interest & Taxes/Interest Payable

=Long Term Debt/Shareholder Equity + Long Term Debt

Measures ability to cover interest payments

Measures ability to pay Debt and Interest. The higher

the degree of operating leverage, the higher the risk

of not repaying debt and interest.

=(Profit before Tax + Finance Costs + Lease Pymts)

(Finance Costs + Lease Payments)

Shows the ability of a business to service the

finance costs and any other contractual payments.

=Trade Receivables

(Revenues/365)

Measures the number of days it takes to collect trade

receivables

Inventory Turnover (times)

=Cost of Sales/ Inventory

Shows how long it takes for inventories to turn

around or how fast it moves.

Average Payment Period (days)

=Trade Payables

(Cost of Goods Sold/365)

Measures the number of days it takes to make

payments to trade creditors

Operating Leverage or Gearing Ratio (times)

Fixed-charges-coverage ratio (times)

Asset-Management & Activity Ratios

Accounts receivable performance measures

Average collection period (days)

Inventory performance measures

Asset ratios

Capital assets turnover ratio (times)

Total assets turnover ratio (times)

=Revenue/Non-Current Assets

=Revenue/Total Assets

Measures how intensively a firms non-current assets

such as property, plant, and equipment are working.

Measures the intensity by which all assets, that is,

current and non-current assets are used to generate

revenue

Profitability Ratios

Gross Profit Margin

(percent)

Operating Margin (percent)

Return on revenue ratio (percent)

Return on total assets ratio (percent)

Return on equity ratio (percent)

Return on Shareholder Investment (ROI) (percent)

Operating Expenses to Revenues (percent)

=Gross Profit/Revenue

=Operating Profit before interest & Tax/Revenue

Shows the efficiency of managing cost of goods sold

Shows the efficiency of a business, and ability to pay

fixed costs

=Net Profit/Revenue

Shows the overall profitability after interest and tax

= Net Profit/Total Assets

Measures the return on funds invested in the business

by both the owners and the lenders

=Profit/Total Equity

Shows how profitable a business is to its owners

= Net Profit after Tax/Shareholder Investment

=Operating Expenses/Revenues

= $Sales in Y2 - $Sales in Y1

$Sales in Y1

Measures the efficiency of an investment

Measures the efficiency of management of operating

expenses.

=Operating Profit before Interest & Taxes

Shareholder's Equity & LTD

Measures the growth rate in Sales Revenues

Measures a companys efficiency at allocating the

funds pro-vided by shareholders and long-term

financing to profitable investments. Gives a sense of

how well a company is using its money to generate

Dividends per Share

= Total Dividends/#Shares Outstanding

Dividend per share gives an indication of how much

money a shareholder will receive for each share held.

Dividend payout Ratio

=Total Dividends Paid/Net Profit after Tax

Measures how much of profits after tax are paid back

to shareholders in the form of dividends.

= Total Dividends Paid/Market Value per Share

Measures the return on funds invested in the business

by shareholders

=Net Profit after Tax/Total # Shares Outstanding

Calculates the part of the net profits that is attributed

to each share

=Market Value per Share/Earnings per Share

A popular measure of measuring the relationship of

share price to the Earnings ability of the company per

share

Growth in Sales

Return on Capital Employed (ROCE)

Shareholder Return Ratios

(percent)

(percent)

Dividend Yield

Earnings per Share (EPS)

Price/Earnings (P/E) Ratio

You might also like

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsvijayNo ratings yet

- Form 4506-T (Rev. 11-2021)Document1 pageForm 4506-T (Rev. 11-2021)keyNo ratings yet

- Financial Assets, Money, Financial Transactions, CH2Document51 pagesFinancial Assets, Money, Financial Transactions, CH2jaelou09100% (1)

- Maricris G. Alagar BA-101 Finance IIDocument5 pagesMaricris G. Alagar BA-101 Finance IIMharykhriz AlagarNo ratings yet

- Export Credit Insurance Policy PDFDocument2 pagesExport Credit Insurance Policy PDFBrianNo ratings yet

- #BWNLLSV #000000Q4T6WXX2A6#000AMP90F Champeil D Lewis 18026 Valley BLVD Apt 96 BLOOMINGTON CA 92316-2083Document4 pages#BWNLLSV #000000Q4T6WXX2A6#000AMP90F Champeil D Lewis 18026 Valley BLVD Apt 96 BLOOMINGTON CA 92316-2083Popo Lewis67% (3)

- Cash Flows AccountingDocument9 pagesCash Flows AccountingRosa Villaluz BanairaNo ratings yet

- ACCA F9 Lecture 2Document37 pagesACCA F9 Lecture 2Fathimath Azmath AliNo ratings yet

- A Guide To Mutual Fund Investing: Helping You Reach Your Financial GoalsDocument8 pagesA Guide To Mutual Fund Investing: Helping You Reach Your Financial GoalsSAURABHNo ratings yet

- Day Count ConventionDocument7 pagesDay Count ConventionDiego GonzálesNo ratings yet

- Stock Market TerminologiesDocument19 pagesStock Market TerminologiesAfshan GulNo ratings yet

- Comprehensive Case Applying Financial Statement AnalysisDocument4 pagesComprehensive Case Applying Financial Statement AnalysisFerial FerniawanNo ratings yet

- CFA Level 1 (Book-B)Document170 pagesCFA Level 1 (Book-B)butabutt100% (1)

- Ratio Analysis: Theory and ProblemsDocument51 pagesRatio Analysis: Theory and ProblemsAnit Jacob Philip100% (1)

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Securities and MarketsDocument51 pagesSecurities and MarketsBilal JavedNo ratings yet

- Sample BaziDocument7 pagesSample Bazirendao100% (1)

- Chapter# 5 of Investments Principles & Concepts International Student Version 11th EditionDocument5 pagesChapter# 5 of Investments Principles & Concepts International Student Version 11th Editionmavimalik89% (9)

- Financial RatiosDocument15 pagesFinancial RatiosHojol100% (1)

- Profitability Ratios: and Allowances) Minus Cost of SalesDocument2 pagesProfitability Ratios: and Allowances) Minus Cost of Salesrachel anne belangelNo ratings yet

- Financial Statement Analysis PPT 3427Document25 pagesFinancial Statement Analysis PPT 3427imroz_alamNo ratings yet

- Time Value of Money: All Rights ReservedDocument94 pagesTime Value of Money: All Rights Reservedjcgaide3No ratings yet

- Corporate Finance: Laurence Booth - W. Sean ClearyDocument136 pagesCorporate Finance: Laurence Booth - W. Sean Clearyatif41No ratings yet

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Working CapitalDocument39 pagesWorking CapitalHema LathaNo ratings yet

- ACCA F8 Chapter 14 ReceivableDocument18 pagesACCA F8 Chapter 14 ReceivableOmer UddinNo ratings yet

- Chapter-9, Capital StructureDocument21 pagesChapter-9, Capital StructurePooja SheoranNo ratings yet

- Accounting For Leases NotesDocument6 pagesAccounting For Leases NotesDominickdadNo ratings yet

- Chapter 04 Working Capital 1ce Lecture 050930Document71 pagesChapter 04 Working Capital 1ce Lecture 050930rthillai72No ratings yet

- C.A IPCC Ratio AnalysisDocument6 pagesC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- Chapter 15 Company AnalysisDocument51 pagesChapter 15 Company Analysissharktale282850% (2)

- Operating Cycle of Business and Financing Working - CapitalDocument23 pagesOperating Cycle of Business and Financing Working - CapitalKarthik SuryanarayananNo ratings yet

- Cost of Capital Lecture Slides in PDF FormatDocument18 pagesCost of Capital Lecture Slides in PDF FormatLucy UnNo ratings yet

- Cpa Questions Part XDocument10 pagesCpa Questions Part XAngelo MendezNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementVaibhavNo ratings yet

- Accounting For ManagersDocument35 pagesAccounting For Managerssuresh84123No ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Cecchetti-5e-Ch02 - Money and The Payment SystemDocument46 pagesCecchetti-5e-Ch02 - Money and The Payment SystemammendNo ratings yet

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreDocument6 pagesStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniNo ratings yet

- Source Document of AccountancyDocument7 pagesSource Document of AccountancyVinod GandhiNo ratings yet

- Warren Larsen Chp1 (Principles of Accounting)Document147 pagesWarren Larsen Chp1 (Principles of Accounting)annie100% (1)

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- Advanced Auditing Final Exam-Group QuestionsDocument12 pagesAdvanced Auditing Final Exam-Group QuestionsAnna FlemingNo ratings yet

- Ch.10 - The Statement of Cash Flows - MHDocument59 pagesCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- Managerial Accounting 06Document58 pagesManagerial Accounting 06Dheeraj SunthaNo ratings yet

- Aicpa 040212far SimDocument118 pagesAicpa 040212far SimHanabusa Kawaii IdouNo ratings yet

- Pledging Accounts Receivable The Pledging Process SecondDocument5 pagesPledging Accounts Receivable The Pledging Process SecondmomindkhanNo ratings yet

- CH 05Document4 pagesCH 05vivienNo ratings yet

- Unit 2 Capital Budgeting Technique ProblemsDocument39 pagesUnit 2 Capital Budgeting Technique ProblemsAshok KumarNo ratings yet

- What's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetDocument30 pagesWhat's A Bond?: What's A Bond? Types of Bonds Bond Valuation Techniques The Bangladeshi Bond Market Problem SetpakhijuliNo ratings yet

- Chapter 4 SolutionsDocument85 pagesChapter 4 SolutionssevtenNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter Questions PDFDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter Questions PDFNbua AhmadNo ratings yet

- Cash Flow Statement-2015Document43 pagesCash Flow Statement-2015Sudipta Chatterjee100% (1)

- CMA Exam Review - Part 2 - Section A - Financial Statement AnalysisDocument7 pagesCMA Exam Review - Part 2 - Section A - Financial Statement Analysisaiza eroyNo ratings yet

- Marginal CostingDocument30 pagesMarginal Costinganon_3722476140% (1)

- Total Common Dividend Numbers of Shares (Common) Dividend Per Share Market ValueDocument4 pagesTotal Common Dividend Numbers of Shares (Common) Dividend Per Share Market ValueKeziah AliwanagNo ratings yet

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- Corporate Finance Chapter6Document20 pagesCorporate Finance Chapter6Dan688No ratings yet

- Accounting Sample 1Document6 pagesAccounting Sample 1AmnaNo ratings yet

- Capital and Revenue ExpendituereDocument30 pagesCapital and Revenue ExpendituereDheeraj Seth0% (1)

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocument5 pagesBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANo ratings yet

- Chapter 16Document23 pagesChapter 16JJNo ratings yet

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- The Capital Adequacy Ratio in Pension FundsDocument7 pagesThe Capital Adequacy Ratio in Pension FundsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ASM 2 Nguyen Gia Phong 5060Document51 pagesASM 2 Nguyen Gia Phong 5060duyhhagbs210636No ratings yet

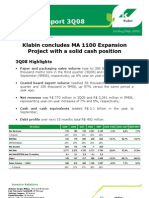

- Quarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionDocument15 pagesQuarterly Report 3Q08: Klabin Concludes MA 1100 Expansion Project With A Solid Cash PositionKlabin_RINo ratings yet

- Types of TaxesDocument58 pagesTypes of TaxesJuniorJayBNo ratings yet

- KIeso Chapter 18 Part 1Document8 pagesKIeso Chapter 18 Part 1Pelangi DiamondNo ratings yet

- Order in The Matter of Capacious Farming Private LimitedDocument20 pagesOrder in The Matter of Capacious Farming Private LimitedShyam SunderNo ratings yet

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsArsh AgarwalNo ratings yet

- Pas 32 Financial Instruments PresentationDocument1 pagePas 32 Financial Instruments PresentationArjay ParaleNo ratings yet

- Partnership Agreement: Jessa Jane Mariano Jannelle SapiandanteDocument2 pagesPartnership Agreement: Jessa Jane Mariano Jannelle SapiandanteHocPoLab TechNo ratings yet

- Factors For Using Derivatives: Evidence From Malaysian Non-Financial CompaniesDocument10 pagesFactors For Using Derivatives: Evidence From Malaysian Non-Financial CompaniesAlex CiNo ratings yet

- NCR NegoSale Batch 15148 011623-1 PDFDocument38 pagesNCR NegoSale Batch 15148 011623-1 PDFSlow DownNo ratings yet

- Transmittal Letter CoaDocument1 pageTransmittal Letter CoaJanine PigaoNo ratings yet

- 2015 IOMA Derivatives Market SurveyDocument41 pages2015 IOMA Derivatives Market SurveyAlexandra IoanaNo ratings yet

- Not For Profit IonDocument23 pagesNot For Profit Ioncarahul89No ratings yet

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- Act121 - 1S 2Q - Set ADocument4 pagesAct121 - 1S 2Q - Set AElena Salvatierra ButiuNo ratings yet

- KDocument1 pageKSamaNo ratings yet

- Manufacturers Life Insurance Vs MeerDocument4 pagesManufacturers Life Insurance Vs MeerAna AdolfoNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- f7 Mapit-Workbook-Q-A PDFDocument248 pagesf7 Mapit-Workbook-Q-A PDFKevin Ch LiNo ratings yet

- Assignment On Credit Card: Name: Md. Anik Hasan ID: 19020096Document2 pagesAssignment On Credit Card: Name: Md. Anik Hasan ID: 19020096Md Anik HasanNo ratings yet

- Ucla PGP Pro BrochureDocument28 pagesUcla PGP Pro BrochureTarapada MishraNo ratings yet

- Mutual FundDocument2 pagesMutual Fundkum_praNo ratings yet