Professional Documents

Culture Documents

Hanson Case

Uploaded by

Sanah BijlaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hanson Case

Uploaded by

Sanah BijlaniCopyright:

Available Formats

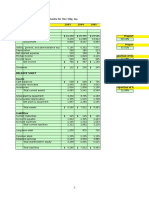

HANSSON PRIVATE LABEL

Operating Assumptions (Ex

Operating Assumptions

Based on Gates' Assumption

Use formulas to calculate the numbers in the cells highlighted green. You can check your answers with Exhibit 5 from the case.

Revenue Projection:

Total Capacity (000's)

Capacity Utilization

Unit Sales Volume (000's)

Selling Price Per Unit

Revenue (000's)

2009

80,000

60.0%

48,000

1.77

84,960

2010

80,000

65.0%

52,000

1.81

93,881

2011

80,000

70.0%

56,000

1.84

103,124

2012

80,000

75.0%

60,000

1.88

112,700

2013

80,000

80.0%

64,000

1.92

122,618

2014

80,000

85.0%

68,000

1.95

132,887

2015

80,000

85.0%

68,000

1.99

135,545

2016

80,000

85.0%

68,000

2.03

138,256

2017

80,000

85.0%

68,000

2.07

141,021

growing at

2.0%

growing at

growing at

growing at

1.0%

3.0%

3.0%

0.94

3,600

2,250

0.95

3,708

2,318

0.96

3,819

2,387

0.97

3,934

2,459

0.98

4,052

2,532

0.99

4,173

2,608

1.00

4,299

2,687

1.01

4,428

2,767

1.02

4,560

2,850

growing at

3.5%

4

160.0

640.0

4

165.6

662.4

6

171.4

1,028.4

6

177.4

1,064.4

8

183.6

1,468.8

8

190.0

1,520.2

8

196.7

1,573.4

8

203.6

1,628.5

8

210.7

1,685.5

growing at

3.5%

20.00

2,000

40,000

450

18,000.0

20.70

2,000

41,400

473

19,570.9

21.42

2,000

42,849

509

21,814.0

22.17

2,000

44,349

545

24,190.2

22.95

2,000

45,901

582

26,706.0

23.75

2,000

47,507

618

29,368.2

24.59

2,000

49,170

618

30,396.1

25.45

2,000

50,891

618

31,460.0

26.34

2,000

52,672

618

32,561.1

18,640.0

20,233.3

22,842.4

25,254.6

28,174.8

30,888.5

31,969.6

33,088.5

34,246.6

Selling, General & Administrative as a percentage of Revenu

7.8%

7.8%

7.8%

7.8%

7.8%

7.8%

7.8%

7.8%

7.8%

Working Capital Assumptions (1):

Days Sales Outstanding (DSO) (Acct Rec / Sales) x 365

Days Sales Inventory (DSI) (Inventory / COGS) x 365

Days Payable Outstanding (DPO) (Acct Pay / COGS) x 365

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

50.0x

44.0x

38.0x

Hourly Labor Cost divided by Unit Sales Volume

0.375

0.376

0.390

0.403

0.417

0.432

0.447

0.463

0.479

Units Sales Volume divided by Total Labor Hours

0.053

0.055

0.055

0.055

0.055

0.055

0.055

0.055

0.055

Production Costs:

Raw Materials Per Unit

Manufacturing Overhead (000's)

Maintenance Expense (000's)

Salaried Labor Cost:

Managers

Average Annual Cost (000's)

Total Salaried Labor Cost (000's)

Hourly Labor Cost:

Average Fully Loaded Hourly Cost

Hours Per Year

Cost Per Hourly Employee

Number of Hourly Workers

Total Hourly Labor Cost (000's)

Total Labor Cost (000's)

(1) Based on historical averages.

ng Assumptions (Exhibit 5)

ed on Gates' Assumptions

2018

80,000

85.0%

68,000

2.12

143,841

1.03

4,697

2,936

8

218.1

1,744.5

27.26

2,000

54,516

618

33,700.7

35,445.2

7.8%

50.0x

44.0x

38.0x

0.496

3.15%

0.055

0.34%

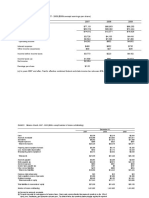

HANSSON PRIVATE LABEL

Cost Analysis

Based on Gates' Assumptions

Balance Sheet Data:

Accounts Receivable (DSO x Sales / 365)

Plus: Inventory (DSI x COGS / 365)

Less: Accounts Payable (DPO x COGS / 365)

Net Working Capital

Change in Working Capital

2009

11,645

8,393

7,245

12,792

12,792

2010

12,868

9,118

7,872

14,114

1,322

2011

14,135

9,976

8,613

15,499

1,384

2012

15,447

10,822

9,342

16,927

1,428

2013

16,807

11,739

10,134

18,411

1,485

2014

18,214

12,641

10,913

19,942

1,531

2015

18,578

12,877

11,117

20,339

397

2016

18,950

13,119

11,326

20,743

405

2017

19,329

13,368

11,540

21,156

413

2018

19,716

13,622

11,760

21,578

421

Property, Plant & Equipment

45,000

41,000

37,000

33,000

29,000

25,000

21,000

17,000

13,000

9,000

5,000

Total Invested Capital

45,000

53,792

51,114

48,499

45,927

43,411

40,942

37,339

33,743

30,156

26,578

4.9%

1.6x

7.8%

1.8x

9.9%

2.1x

12.8%

2.4x

16.1%

2.8x

19.9%

3.2x

22.5%

3.6x

25.7%

4.0x

29.7%

4.6x

34.6%

5.3x

84,960

69,610

50.0x

44.0x

38.0x

93,881

75,628

50.0x

44.0x

38.0x

103,124

82,747

50.0x

44.0x

38.0x

112,700

89,756

50.0x

44.0x

38.0x

122,618

97,362

50.0x

44.0x

38.0x

132,887

104,851

50.0x

44.0x

38.0x

135,545

106,807

50.0x

44.0x

38.0x

138,256

108,814

50.0x

44.0x

38.0x

141,021

110,873

50.0x

44.0x

38.0x

143,841

112,987

50.0x

44.0x

38.0x

Asset Efficiency:

RNOA (1)

ATO

Sales

COGS (Total Expenses less Selling, General & Admin)

Days Sales Outstanding (DSO) (Acct Rec / Sales) x 365

Days Sales Inventory (DSI) (Inventory / COGS) x 365

Days Payable Outstanding (DPO) (Acct Pay / COGS) x

(1) RNOA is return on net operating assets, and is defined as NOPAT divided by the ending invested capital account

HANSSON PRIVATE LABEL

Cash Flow Projections

Based on Gates' Assumptions

Use the assumptions from the 'Exhibit5' tab and your understanding of the REIT method to calculate the numbers in the green cells.

0

Operating Results:

2008

Revenue

Expenses

Less: Raw Material Costs

Less: Labor Expense

Less: Manufacturing Overhead

Less: Maintenance Expense

Less: Selling, General & Administrative Expense

Less Total Expenses

Investment

Less: Upfront Investment

45,000

Less: Change in Working Capital

Less: Return of Working Capital (1)

Less Total Investment

45,000

Less Taxes

Total After-Tax Cash Flows

45,000

Discount factor 1 / (1+r)^n

1.000

PV of cash flow (Total Cash flow x Discount f 56,714

NPV

11,714

Required return of project (cost of capital)

Effective corporate tax rate

Depreciation

1

2009

84,960

2

2010

93,881

3

2011

103,124

4

2012

112,700

5

2013

122,618

6

2014

132,887

7

2015

135,545

8

2016

138,256

9

2017

141,021

10

2018

143,841

45,120

18,640

3,600

2,250

6,627

76,237

49,369

20,233

3,708

2,318

7,323

82,950

53,698

22,842

3,819

2,387

8,044

90,790

58,109

25,255

3,934

2,459

8,791

98,547

62,603

28,175

4,052

2,532

9,564

106,926

67,181

30,888

4,173

2,608

10,365

115,216

67,852

31,970

4,299

2,687

10,573

117,380

68,531

33,089

4,428

2,767

10,784

119,598

69,216

34,247

4,560

2,850

11,000

121,873

69,908

35,445

4,697

2,936

11,220

124,206

12,792

1,322

1,384

1,428

1,485

1,531

397

405

413

12,792

1,889

(5,958)

0.914

(5,447)

1,322

2,772

6,836

0.836

5,714

1,384

3,334

7,616

0.764

5,820

1,428

4,061

8,664

0.699

6,053

1,485

4,677

9,530

0.639

6,087

1,531

5,468

10,672

0.584

6,232

397

5,666

12,103

0.534

6,461

405

5,863

12,390

0.488

6,047

413

6,059

12,676

0.446

5,656

421

(21,578)

(21,156)

6,254

34,537

0.408

14,090

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

4,000

Sum of WC

0

9.38%

40.00%

(1) The return of working capital occurs at the end of the forecasted cash flows. It is equal to accounts receivable less accounts payable less inventory. Note that the sum of all change in working capital is zero.

Note: Because the property, plant, and equipment is specialized and almost completely depreciated, it is assumed to be worthless.

HANSSON PRIVATE LABEL

Cash Flow Projections

Based on Gates' Assumptions

Use the assumptions from the 'Exhibit5' tab and your understanding of the Tax Shield method to calculate the numbers in the green cells.

0

Operating Results:

2008

Revenue

Expenses

Less: Raw Material Costs

Less: Labor Expense

Less: Manufacturing Overhead

Less: Maintenance Expense

Less: Selling, General & Administrative Expense

Less Total Expenses

Earnings before Interest, Tax, Depr & Ammort (EBITDA)

Less: Depreciation

Earnings before Interest and Tax (EBIT)

Less: Income tax

Net Operating Profit After Tax (NOPAT)

Add Depreciation

Operating Cash Flow

Investment

Less: Upfront Investment

Less: Change in Working Capital

Less: Return of Working Capital (1)

Less Total Investment

0

Total After-Tax Cash Flows

Discount factor 1 / (1+r)^n

PV of cash flow (Total Cash flow x Discount factor)

NPV

1

2009

2

2010

3

2011

4

2012

5

2013

6

2014

7

2015

8

2016

9

2017

10

2018

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

12,792

1,322

1,384

1,428

1,485

1,531

397

405

413

12,792

1,322

1,384

1,428

1,485

1,531

397

405

413

421

(21,578)

(21,156)

Sum of WC

0

Required return of project (cost of capital)

Effective corporate tax rate

(1) The return of working capital occurs at the end of the forecasted cash flows. It is equal to accounts receivable less accounts payable less inventory. Note that the sum of all change in working capital is zero.

Note: Because the property, plant, and equipment is specialized and almost completely depreciated, it is assumed to be worthless.

HANSSON PRIVATE LABEL

Internal Rate of Return

Based on Gates' Assumptions

Free Cash Flows:

Total Cash Flows

2008

(45,000)

IRR

13.06%

Modified IRR:

Un-Levered Free Cash Flows

2008

FV of Un-Levered FCF

Sum of FV FCF

Initial Investment

MIRR

Cost of Capital

139,012

45,000

11.94%

9.38%

2009

(5,958)

2010

6,836

2011

7,616

2012

8,664

2013

9,530

2014

10,672

2015

12,103

2016

12,390

2017

12,676

2018

34,537

2009

(5,958)

2010

6,836

2011

7,616

2012

8,664

2013

9,530

2014

10,672

2015

12,103

2016

12,390

2017

12,676

2018

34,537

(13,351)

14,005

14,265

14,836

14,920

15,274

15,837

14,823

13,865

34,537

HANSSON PRIVATE LABEL

Economic Value Added

Based on Gates' Assumptions

Invested Capital:

Beginning Balance

Plus: Change in Working Capital

Less: Depreciation

Ending Balance

2009

45,000

12,792

4,000

53,792

2010

53,792

1,322

4,000

51,114

2011

51,114

1,384

4,000

48,499

2012

48,499

1,428

4,000

45,927

2013

45,927

1,485

4,000

43,411

2014

43,411

1,531

4,000

40,942

2015

40,942

397

4,000

37,339

2016

37,339

405

4,000

33,743

2017

33,743

413

4,000

30,156

2018

30,156

421

4,000

26,578

EVA Analysis:

NOPAT

Less: Capital Charge

EVA

0

4,221

(4,221)

0

5,046

(5,046)

0

4,795

(4,795)

0

4,549

(4,549)

0

4,308

(4,308)

0

4,072

(4,072)

0

3,840

(3,840)

0

3,502

(3,502)

0

3,165

(3,165)

0

2,829

(2,829)

(3,859)

(4,217)

(3,664)

(3,178)

(2,752)

(2,378)

(2,050)

(1,709)

(1,412)

(1,154)

21,578

Cost of Capital

9.38%

PV of EVA

Plus: Return Working Capital (1)

Less: PV of 2018 Capital

Total EVA

(26,374)

8,803

10,843

(28,414)

(1) The return of working capital is equal to accounts receivable less accounts payable. Inventory is assumed to be worthless.

Note: Because the property, plant, and equipment is specialized and almost completely depreciated, it is assumed to be worthless.

You might also like

- Hansson PLDocument14 pagesHansson PLdenden007No ratings yet

- Heritage Doll CompanyDocument11 pagesHeritage Doll CompanyDeep Dey0% (1)

- Hansson Private Label - FinalDocument34 pagesHansson Private Label - Finalincognito12312333% (3)

- Hansson Private Label FinalDocument13 pagesHansson Private Label Finalrohan pankar67% (3)

- Hansson Private Label: Operating ResultsDocument28 pagesHansson Private Label: Operating ResultsShubham SharmaNo ratings yet

- HPL CaseDocument2 pagesHPL Caseprsnt100% (1)

- Case Hansson Private LabelDocument15 pagesCase Hansson Private Labelpaul57% (7)

- Assignment 8 - W8 Hand in (Final Project)Document3 pagesAssignment 8 - W8 Hand in (Final Project)Rodrigo Montechiari33% (6)

- HBR Hannson Final Case AnalysisDocument5 pagesHBR Hannson Final Case AnalysisTexasSWO75% (4)

- Hansson Case AnalysisDocument6 pagesHansson Case AnalysisKp Porter57% (7)

- Hansson Private LabelDocument4 pagesHansson Private Labelsd717No ratings yet

- Hannson Private Label VFDocument9 pagesHannson Private Label VFAugusto Peña ChavezNo ratings yet

- Hansson Private Label Case SolutionDocument3 pagesHansson Private Label Case SolutionTracy PhanNo ratings yet

- New Heritage ExhibitsDocument4 pagesNew Heritage ExhibitsBRobbins12100% (16)

- Harvard CaseDocument9 pagesHarvard CaseGemar Singian0% (2)

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Hansson ReportDocument2 pagesHansson ReportFatima NazNo ratings yet

- HBS Mercury CaseDocument4 pagesHBS Mercury CaseDavid Petru100% (1)

- Polar SportDocument4 pagesPolar SportKinnary Kinnu0% (2)

- NHDC Solution EditedDocument5 pagesNHDC Solution EditedShreesh ChandraNo ratings yet

- Heritage CaseDocument3 pagesHeritage CaseGregory ChengNo ratings yet

- Flash Memory, IncDocument16 pagesFlash Memory, Inckiller drama67% (3)

- Flash Memory IncDocument9 pagesFlash Memory Incxcmalsk100% (1)

- New Heritage Doll CompanDocument9 pagesNew Heritage Doll CompanArima ChatterjeeNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- Hanson CaseDocument7 pagesHanson CaseLe PhamNo ratings yet

- FlashMemory Beta NPVDocument7 pagesFlashMemory Beta NPVShubham Bhatia100% (1)

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaNo ratings yet

- Exhibits of Blaine Kitchenware, Inc - CaseDocument6 pagesExhibits of Blaine Kitchenware, Inc - CaseSadam Lashari100% (3)

- Case - Polar SportsDocument12 pagesCase - Polar SportsSagar SrivastavaNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Flash Memory CaseDocument6 pagesFlash Memory Casechitu199233% (3)

- FlashMemory SolnDocument8 pagesFlashMemory Solnchopra98harsh3311100% (4)

- AirThread G015Document6 pagesAirThread G015Kunal MaheshwariNo ratings yet

- Polar Sports Inc.Document4 pagesPolar Sports Inc.Talia100% (1)

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandNo ratings yet

- Polar Sports, Inc SpreadsheetDocument19 pagesPolar Sports, Inc Spreadsheetjordanstack100% (3)

- ACFINA2 Case Study HanssonDocument11 pagesACFINA2 Case Study HanssonGemar Singian50% (2)

- New Heritage Doll - SolutionDocument4 pagesNew Heritage Doll - Solutionrath347775% (4)

- New DollDocument2 pagesNew DollJuyt HertNo ratings yet

- Mercury Athletic SlidesDocument28 pagesMercury Athletic SlidesTaimoor Shahzad100% (3)

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- Question 1Document9 pagesQuestion 1Minh HàNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- Play Time Toy CompanyDocument4 pagesPlay Time Toy CompanychungdebyNo ratings yet

- Table A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)Document30 pagesTable A Consolidated Income Statement, 2009-2011 (In Thousands of Dollars)rooptejaNo ratings yet

- New Heritage Doll CoDocument3 pagesNew Heritage Doll Copalmis2100% (5)

- 326 Chapter 9 - Fundamentals of Capital BudgetingDocument20 pages326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifNo ratings yet

- Finance - WK 4 Assignment TemplateDocument31 pagesFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- Ans. Corporate Finance Part 2Document17 pagesAns. Corporate Finance Part 2HashimRazaNo ratings yet

- Managerial Accounting FiDocument32 pagesManagerial Accounting FiJo Segismundo-JiaoNo ratings yet

- Flash Inc Financial StatementsDocument14 pagesFlash Inc Financial Statementsdummy306075% (4)

- Excel Advanced Excel For Finance - EXERCISEDocument106 pagesExcel Advanced Excel For Finance - EXERCISEghodghod123100% (1)

- New Heritage SolutionDocument3 pagesNew Heritage SolutionJosé Luis DíazNo ratings yet

- Ch11 P11 Build A ModelDocument6 pagesCh11 P11 Build A ModelJDOLL1100% (2)

- Five Years Summarized Financial Projection Is Shown Below:: 8. Accounting PotentialsDocument5 pagesFive Years Summarized Financial Projection Is Shown Below:: 8. Accounting PotentialsRumiAhmedNo ratings yet

- New Heritage Doll Company Student SpreadsheetDocument4 pagesNew Heritage Doll Company Student SpreadsheetGourav Agarwal73% (11)

- Financial Planning and Forecasting PDFDocument29 pagesFinancial Planning and Forecasting PDFzyra liam styles100% (2)

- Operations ManagementDocument6 pagesOperations ManagementSanah BijlaniNo ratings yet

- Valuations SBR 1Document2 pagesValuations SBR 1Sanah BijlaniNo ratings yet

- ROMI - Case ROMI On Social MediaDocument2 pagesROMI - Case ROMI On Social MediaSanah BijlaniNo ratings yet

- Summary EcoDocument1 pageSummary EcoSanah BijlaniNo ratings yet

- Page Two McomDocument5 pagesPage Two McomSanah BijlaniNo ratings yet

- TCSDocument37 pagesTCSSanah BijlaniNo ratings yet

- NoticeDocument1 pageNoticeSanah BijlaniNo ratings yet

- Acknowledgement: Dr. Geeta - Nair For All Her Support and Guidance. I Would Also Like To Thank Her ForDocument3 pagesAcknowledgement: Dr. Geeta - Nair For All Her Support and Guidance. I Would Also Like To Thank Her ForSanah BijlaniNo ratings yet

- Godrej Consumer Products LTD Strategic ManagementDocument50 pagesGodrej Consumer Products LTD Strategic ManagementSanah Bijlani67% (3)

- Taxation - Business and ProfessionDocument45 pagesTaxation - Business and ProfessionSanah Bijlani67% (3)

- CostingDocument1 pageCostingSanah BijlaniNo ratings yet

- Answer of Integrative Case 1 (Track Software, LTD)Document2 pagesAnswer of Integrative Case 1 (Track Software, LTD)Mrito Manob67% (3)

- Session 1 SAMI 2 - Rex - MendozaDocument6 pagesSession 1 SAMI 2 - Rex - MendozaWoaineheartNo ratings yet

- Asisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Document5 pagesAsisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Kristine Vertucio0% (1)

- Channel DynamicsDocument5 pagesChannel DynamicsGhani Thapa20% (5)

- Chapter 5 Derivatives Markets - 2023Document35 pagesChapter 5 Derivatives Markets - 202305 Phạm Hồng Diệp12.11No ratings yet

- This Study Resource Was: Agenda Item 11 Half Year 4Document2 pagesThis Study Resource Was: Agenda Item 11 Half Year 4akiyama madokaNo ratings yet

- Take Home Midterms Mix 30Document6 pagesTake Home Midterms Mix 30rizzelNo ratings yet

- Rtgs Form Dena Bank PDFDocument1 pageRtgs Form Dena Bank PDFSuresh TatedNo ratings yet

- Living in PanamaDocument106 pagesLiving in PanamaMax PlanckNo ratings yet

- Partnership AccountingDocument8 pagesPartnership Accountingferdinand kan pennNo ratings yet

- The Effects of Business Ethics and Corporate Social Responsibility On Intellectual Capital Voluntary DisclosureDocument23 pagesThe Effects of Business Ethics and Corporate Social Responsibility On Intellectual Capital Voluntary DisclosureCase HandphoneNo ratings yet

- 2008 IOMA Derivatives Market Survey - For WCDocument83 pages2008 IOMA Derivatives Market Survey - For WCrush2arthiNo ratings yet

- Salary GUIDE 2021Document25 pagesSalary GUIDE 2021Mohammed Aljoaib100% (1)

- IDT MCQ's - June 21 & Dec 21 ExamsDocument99 pagesIDT MCQ's - June 21 & Dec 21 ExamsDinesh GadkariNo ratings yet

- 5.2. Tax-Aggressiveness-In-Private-Family-Firms - An - 2014 - Journal-of-Family-Busine PDFDocument11 pages5.2. Tax-Aggressiveness-In-Private-Family-Firms - An - 2014 - Journal-of-Family-Busine PDFLiLyzLolaSLaluNo ratings yet

- Macro and Micro Economics of MalaysiaDocument13 pagesMacro and Micro Economics of MalaysiaGreyGordonNo ratings yet

- Warehouse Management Systems and Logistics ManagementDocument1 pageWarehouse Management Systems and Logistics ManagementSanjay RamuNo ratings yet

- Lesson 4 - The Steps in The Accounting CycleDocument5 pagesLesson 4 - The Steps in The Accounting Cycleamora elyseNo ratings yet

- Chapter 02 Evans BermanDocument19 pagesChapter 02 Evans BermanthesimpleNo ratings yet

- Session 26 - Income TaxDocument23 pagesSession 26 - Income TaxUnnati RawatNo ratings yet

- Importance of Statistics in Different FieldsDocument3 pagesImportance of Statistics in Different FieldsTuppiyac NievaNo ratings yet

- Lean ManagementDocument28 pagesLean Managementmarbtec111550% (2)

- Presentation To Investor / Analyst (Company Update)Document51 pagesPresentation To Investor / Analyst (Company Update)Shyam SunderNo ratings yet

- Frequently Asked Questions Regarding The BPS FY23 Budget DeficitDocument1 pageFrequently Asked Questions Regarding The BPS FY23 Budget DeficitFox Boston StaffNo ratings yet

- Chapter 8: Admission of Partner: Rohit AgarwalDocument3 pagesChapter 8: Admission of Partner: Rohit AgarwalbcomNo ratings yet

- NEGOTIABLE INSTRUMENTonlyDocument97 pagesNEGOTIABLE INSTRUMENTonlyTomSeddyNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- A Quick Introduction To Hedge FundsDocument30 pagesA Quick Introduction To Hedge FundsA A MNo ratings yet

- Haier Case StudyDocument28 pagesHaier Case StudyMagesh Kaarthick S100% (2)

- Got Milk Case Study QuestionsDocument6 pagesGot Milk Case Study QuestionsSalman Naseer Ahmad Khan100% (1)