Professional Documents

Culture Documents

Depreciation

Uploaded by

Rituparna MajumdarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation

Uploaded by

Rituparna MajumdarCopyright:

Available Formats

Depreciation is a non-cash expense that reduces the value of an asset over time.

Assets depreciate for two reasons:

Wear and tear. For example, an auto will decrease in value because of the mileag

e, wear on tires, and other factors related to the use of the vehicle.

Obsolescence. Assets also decrease in value as they are replaced by newer models

. Last year's car model is less valuable because there is a newer model in the m

arketplace.

Depreciation is calculated as follows:

The original cost of the asset, including costs of acquiring the asset, transpor

ting it, and setting it up

Less the salvage value (the "scrap" value)

Divided over the years of useful life of the asset.

depreciation, in accounting, the allocation of the cost of an asset over its eco

nomic life. Depreciation covers deterioration from use, age, and exposure to the

elements. It also includes obsolescence i.e., loss of usefulness arising from the

availability of newer and more efficient types of goods serving the same purpos

e. It does not cover losses from sudden and unexpected destruction resulting fro

m fire, accident, or disaster.

Depreciation applies both to tangible property such as machinery and buildings a

nd to intangibles of limited life such as leaseholds and copyrights. It does not

apply to land. For convenience, depreciation accounts are usually kept for grou

ps of assets with similar characteristics and working life.

The general rule of charging off a depreciable asset during its life does not de

termine what the charge will be each year. Straight-line, fixed-percentage, and,

more rarely, annuity methods of depreciation (giving, respectively, constant, g

radually decreasing, and gradually increasing charges) are standard. Sometimes c

harges vary with use (e.g., with the number of miles per year a truck is driven)

. Special rules allow depletion of nonreproducible capital (such as a body of or

e being mined) for tax purposes to exceed original cost.

Basing depreciation on historical cost rather than on probable replacement cost

and on arbitrary rules rather than on actual use has been practiced to establish

definite tax liability and to standardize audits of accounts; in times of shift

ing price levels, however, such bases for measuring depreciation have proved esp

ecially imperfect.

SLM

Cost of fixed asset must be charged to the income statement in a manner that bes

t reflects the pattern of economic use of the asset. Most common methods of depr

eciation include Straight Line Method and Reducing Cost Method.

Straight Line Depreciation Method

Straight line method depreciates cost evenly through out the useful life of the

fixed asset. Straight line depreciation is calculated as follows:

Depreciation per annum = (Cost - Residual Value) / Useful Life

Where:

Cost includes the initial and any subsequent capital expenditure.

Residual Value is the estimated scrap value at the end of the useful life of the

asset. As the residual value is expected to be recovered at the end of an asset

's useful life, there is no need to charge the portion of cost equaling the resi

dual value.

Useful Life is the estimated time period an asset is expected to be used from th

e time it is available for use to the time of its disposal or termination of use

. Useful life is normally calculated in units of years but it may be calculated

based on an alternative basis. Useful life of an oil extraction company may for

example be the estimated oil reserves.

Test Your Understanding

Which of the following is true regarding Straight Line Depreciation?

It prevents bias in situations when the pattern of economic benefits from an ass

et is hard to estimate

Once straight line depreciation charge is determined, it is not revised subseque

ntly

Example

An asset has a useful life of 3 years.

Cost of the asset is $2,000.

Residual Value is $500.

Annual Depreciation cost will be $500 = (2000 - 500) / 3years

Straight line depreciation method is appropriate where economic benefits from th

e asset are expected to be realized evenly during its useful life. It is also co

nvenient where no reliable estimate can be made regarding the pattern of economi

c benefits over an asset's useful life.

WDV

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Side Hustle Workbook PDFDocument3 pagesSide Hustle Workbook PDFMihai si atat0% (1)

- Entrepreneurship and Service InnovationDocument6 pagesEntrepreneurship and Service InnovationRodrigo Vinícius SartoriNo ratings yet

- Capstone Project ReportDocument12 pagesCapstone Project ReportManisha VermaNo ratings yet

- How To Reach Staff Training CentreDocument4 pagesHow To Reach Staff Training CentreRituparna MajumdarNo ratings yet

- Computer Science & Engineering SyllabusDocument47 pagesComputer Science & Engineering Syllabusapumondal18No ratings yet

- Number Series (E)Document6 pagesNumber Series (E)Rituparna MajumdarNo ratings yet

- Parajumbles QuizDocument3 pagesParajumbles Quizhrocking1No ratings yet

- CSE Final Upto 3rd Year Syllabus 16.07.12Document47 pagesCSE Final Upto 3rd Year Syllabus 16.07.12pagalhaibeNo ratings yet

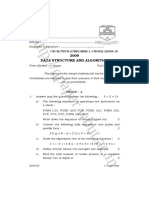

- MCS - 102Document4 pagesMCS - 102Rituparna MajumdarNo ratings yet

- Csem 103Document7 pagesCsem 103Rituparna MajumdarNo ratings yet

- Dos Commands PDFDocument11 pagesDos Commands PDFdevashish018No ratings yet

- CST 913Document4 pagesCST 913Rituparna MajumdarNo ratings yet

- M.tech CSE IT Unified 19.02.14 2Document48 pagesM.tech CSE IT Unified 19.02.14 2Rituparna MajumdarNo ratings yet

- Csem 107 (Old)Document7 pagesCsem 107 (Old)Rituparna MajumdarNo ratings yet

- MTech CSE&IT Mathematics 2015Document1 pageMTech CSE&IT Mathematics 2015Rituparna MajumdarNo ratings yet

- Csem 107 (Old)Document7 pagesCsem 107 (Old)Rituparna MajumdarNo ratings yet

- CS 902Document4 pagesCS 902Rituparna MajumdarNo ratings yet

- MTech CSE&IT Mathematics 2015Document1 pageMTech CSE&IT Mathematics 2015Rituparna MajumdarNo ratings yet

- M.tech CSE IT Unified 19.02.14 2Document48 pagesM.tech CSE IT Unified 19.02.14 2Rituparna MajumdarNo ratings yet

- AdverbDocument3 pagesAdverbRituparna Majumdar0% (1)

- 2012 CBSE XIIScience 4 2 SET2 SectionaDocument5 pages2012 CBSE XIIScience 4 2 SET2 SectionaRituparna MajumdarNo ratings yet

- Conjunction 1Document3 pagesConjunction 1Rituparna MajumdarNo ratings yet

- Adjective 1Document3 pagesAdjective 1Rituparna MajumdarNo ratings yet

- CSE Final Upto 4h Year Syllabus 14.03.14Document76 pagesCSE Final Upto 4h Year Syllabus 14.03.14Sushovan NathNo ratings yet

- Pronoun 1Document3 pagesPronoun 1Rituparna MajumdarNo ratings yet

- Test Bench andDocument2 pagesTest Bench andRituparna MajumdarNo ratings yet

- IEEE Paper FormatDocument9 pagesIEEE Paper FormatRituparna MajumdarNo ratings yet

- Recurrence AlgoDocument14 pagesRecurrence AlgoRituparna MajumdarNo ratings yet

- TopicsDocument2 pagesTopicsRituparna MajumdarNo ratings yet

- MatlabDocument2 pagesMatlabRituparna MajumdarNo ratings yet

- Music TherapyDocument11 pagesMusic TherapyRituparna MajumdarNo ratings yet

- chapter-02-HR-Planning-Trắc nghiệmDocument3 pageschapter-02-HR-Planning-Trắc nghiệmjimblesNo ratings yet

- E1 Enterprise Operations SyllabusDocument3 pagesE1 Enterprise Operations SyllabusKarrthikesu NadarajahNo ratings yet

- INTERNATIONAL MARKETINGDocument10 pagesINTERNATIONAL MARKETINGMaita Dabilbil Flores100% (2)

- Retail Management WalmartDocument17 pagesRetail Management WalmartSaytanya SonowalNo ratings yet

- Module 4 Management AccountingDocument14 pagesModule 4 Management AccountingRajimol KPNo ratings yet

- Module 1 - Introduction To Airline MarketingDocument30 pagesModule 1 - Introduction To Airline MarketingBhaskar SaileshNo ratings yet

- Gmail - Re - '414598210' NO OBJECTION CERTIFICATE ISSUANCE REQUESTDocument2 pagesGmail - Re - '414598210' NO OBJECTION CERTIFICATE ISSUANCE REQUESTajeetsinghrajput143No ratings yet

- TOPIC 6 Acquisitions, Corporate RestructuringDocument29 pagesTOPIC 6 Acquisitions, Corporate RestructuringLeon MushiNo ratings yet

- MBA 290 Strategic AnalysisDocument110 pagesMBA 290 Strategic AnalysisLynette TangNo ratings yet

- Royal Caribbean's Growth in Emerging Asian Cruise MarketDocument36 pagesRoyal Caribbean's Growth in Emerging Asian Cruise Marketمرزا احسن بیگNo ratings yet

- Strategic Marketing ManagementDocument23 pagesStrategic Marketing ManagementSadam IrshadNo ratings yet

- Accounting For Insurance Contracts - Ifrs 4: International Financial Reporting StandardsDocument32 pagesAccounting For Insurance Contracts - Ifrs 4: International Financial Reporting StandardsKylie TarnateNo ratings yet

- MJ, J, JL JH LKNDocument285 pagesMJ, J, JL JH LKNdvgfgfdhNo ratings yet

- Exercise 4Document45 pagesExercise 4Neal PeterosNo ratings yet

- REITsDocument16 pagesREITsDavidNo ratings yet

- Amul Ncol Press Ad 02 15062023Document1 pageAmul Ncol Press Ad 02 15062023Shikha ChaudharyNo ratings yet

- Swot Analysis LectureDocument19 pagesSwot Analysis LectureSaith UmairNo ratings yet

- HA3021 Week 9 Lecture 2Document52 pagesHA3021 Week 9 Lecture 2Sheshan Induwara MallawaarachchiNo ratings yet

- Yanbu Cement CoDocument2 pagesYanbu Cement ComoorthykemNo ratings yet

- FIA FA2 Final Assessment - Questions J13Document18 pagesFIA FA2 Final Assessment - Questions J13Valentina100% (4)

- Financial Accounting: Accounting For Merchandise OperationsDocument84 pagesFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoNo ratings yet

- Advertising-Social, Legal, Ethical & Economical AspectsDocument15 pagesAdvertising-Social, Legal, Ethical & Economical AspectsSwati Sharma100% (1)

- Sample Case StudyDocument6 pagesSample Case StudyDoc PhysioNo ratings yet

- Midterm Quiz No 1 Relevant Costing and Capital BudgetingDocument2 pagesMidterm Quiz No 1 Relevant Costing and Capital BudgetingLian GarlNo ratings yet

- Relevant Cost For Decision MakingDocument74 pagesRelevant Cost For Decision MakingDeepak SehrawatNo ratings yet

- Fourth Cut CPGDocument102 pagesFourth Cut CPGIsha SharmaNo ratings yet

- Marginal Costing Tutorial: Learn Key Concepts With ExamplesDocument5 pagesMarginal Costing Tutorial: Learn Key Concepts With ExamplesRajyaLakshmiNo ratings yet