Professional Documents

Culture Documents

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Uploaded by

Kamlesh PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961

Uploaded by

Kamlesh PatelCopyright:

Available Formats

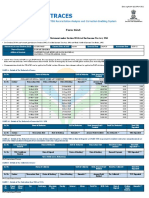

Data updated till 23-Jan-2015

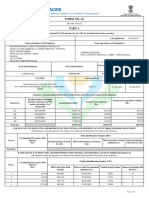

Form 26AS

Annual Tax Statement under Section 203AA of the Income Tax Act, 1961

See Section 203AA and second provision to Section 206C (5) of the Income Tax Act, 1961 and Rule 31AB of Income Tax Rules, 1962

Permanent Account Number (PAN)

AGRPM7794G

Current Status of PAN

Active

Financial Year

2013-14

Assessment Year

Name of Assessee

MANAN KIRITBHAI MANKAD

B-201 SUHAVAN APPARTMENTS, NEAR NEW HP PETROL PUMP, JUDGES BUNGALOWS ROAD, BODAKDEV,

Address of Assessee

AHMEDABAD, GUJARAT, 380015

2014-15

Above data / Status of PAN is as per PAN details. For any changes in data as mentioned above, you may submit request for corrections.

Refer www.tin-nsdl.com / www.utiitsl.com for more details. In case of discrepancy in status of PAN please contact your Assessing Officer

Communication details for TRACES can be updated in 'Profile' section. However, these changes will not be updated in PAN database as mentioned above

(All amount values are in INR)

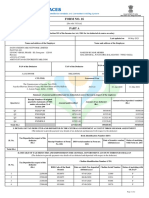

PART A - Details of Tax Deducted at Source

Sr. No.

Name of Deductor

TAN of Deductor

HDFC ASSET MANAGEMENT COMPANY LIMITED

MUMH04900A

Sr. No.

Section1

Transaction Date

Status of Booking*

Date of Booking

Remarks**

1

2

3

4

194C

194C

194C

194C

23-Jan-2014

14-Oct-2013

16-Jul-2013

25-Apr-2013

F

F

F

F

06-May-2014

18-Jan-2014

16-Oct-2013

26-Jul-2013

Sr. No.

2

Name of Deductor

KOTAK MAHINDRA OLD MUTUAL LIFE INSURANCE LIMITED

MUMO02128A

Section1

Transaction Date

Status of Booking*

Date of Booking

Remarks**

1

2

3

4

5

6

7

8

9

10

11

12

13

14

194D

194D

194D

194D

194D

194D

194D

194D

194D

194D

194D

194D

194D

194D

31-Mar-2014

21-Mar-2014

28-Feb-2014

19-Feb-2014

31-Jan-2014

31-Jan-2014

31-Dec-2013

15-Nov-2013

31-Oct-2013

30-Sep-2013

15-Sep-2013

31-Aug-2013

14-Aug-2013

31-Jul-2013

F

F

F

F

F

F

F

F

F

F

F

F

F

F

23-May-2014

23-May-2014

23-May-2014

23-May-2014

23-May-2014

23-May-2014

18-Jan-2014

18-Jan-2014

18-Jan-2014

19-Oct-2013

19-Oct-2013

19-Oct-2013

19-Oct-2013

19-Oct-2013

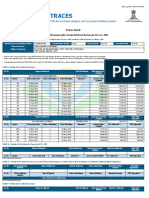

Name of Deductor

3

Sr. No.

Transaction Date

1

2

3

194C

194C

194C

07-Feb-2014

07-Aug-2013

18-Apr-2013

Status of

Booking*

F

F

F

MUMP16274G

Date of Booking

Remarks**

21-May-2014

16-Oct-2013

20-Jul-2013

Total TDS

Deposited

558.38

558.38

Tax Deducted##

TDS Deposited

22.56

12.80

31.45

46.77

55.26

72.23

33.26

21.57

71.59

11.24

44.84

31.45

25.73

77.63

22.56

12.80

31.45

46.77

55.26

72.23

33.26

21.57

71.59

11.24

44.84

31.45

25.73

77.63

Total TDS

Deposited

Total Tax Deducted#

24615.00

Amount Paid / Credited

60.00

60.00

60.00

60.00

Total Tax Deducted#

225.60

128.00

314.50

467.70

552.60

722.30

332.60

215.70

715.90

112.40

448.40

314.50

257.30

776.30

Total Amount Paid /

Credited

240.00

TDS Deposited

60.00

60.00

60.00

60.00

5583.80

Amount Paid / Credited

TAN of Deductor

ICICI PRUDENTIAL MUTUAL FUND

Section1

240.00

Tax Deducted##

6000.00

6000.00

6000.00

6000.00

Total Amount Paid /

Credited

Total TDS

Deposited

Total Tax Deducted#

24000.00

Amount Paid / Credited

TAN of Deductor

Sr. No.

Sr. No.

Total Amount Paid /

Credited

246.00

Tax

246.00

Deducted##

5000.00

16585.00

3030.00

TDS Deposited

50.00

166.00

30.00

50.00

166.00

30.00

PART A1 - Details of Tax Deducted at Source for 15G / 15H

Sr. No.

Sr. No.

Name of Deductor

Section1

Transaction Date

Date of Booking

TAN of Deductor

Total Amount Paid /

Credited

Total Tax Deducted#

Total TDS

Deposited

Remarks**

Amount Paid / Credited

Tax Deducted##

TDS Deposited

No Transactions Present

PART A2 Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Seller of Property)

TDS Certificate

Name of Deductor

Number

No Transactions Present

Sr. No.

PAN of

Deductor

Acknowledgement

Number

Total Transaction

Amount

Transaction

Date

TDS

Deposited

Date of

Deposit

Status of

Booking*

Date of

Booking

PART B - Details of Tax Collected at Source

Sr. No.

Sr. No.

Name of Collector

Section1

No Transactions Present

Transaction Date

Status of Booking*

Date of Booking

TAN of Collector

Total Amount Paid /

Debited

Total Tax Collected+

Total TCS

Deposited

Remarks**

Amount Paid / Debited

Tax Collected++

TCS Deposited

Assessee PAN: AGRPM7794G

Assessee Name: MANAN KIRITBHAI MANKAD

Assessment Year:

2014-15

PART C Details of Tax Paid (other than TDS or TCS)

Sr. No. Major Head3 Minor Head2

Tax

Surcharge

Education Cess

Others

Total Tax

BSR Code Date of Deposit

Challan Serial

Number

Remarks**

No Transactions Present

PART D Details of Paid Refund

Sr. No.

Assessment Year

Mode

Amount of Refund

Interest

Date of Payment

Remarks

No Transactions Present

PART E Details of AIR Transaction

Sr. No.

1

Type of

Transaction4

003 - Purchase of

Mutual Fund units

>= Rs. 2,00,000

003 - Purchase of

Mutual Fund units

>= Rs. 2,00,000

Name of AIR Filer

HDFC MUTUAL FUND , HUL Hous e, H.T. Parekh Marg

166, Backbay Reclamation, Churchgate Mumbai 190186 19

400020

HDFC MUTUAL FUND , HUL Hous e, H.T. Parekh Marg

166, Backbay Reclamation, Churchgate Mumbai 190186 19

400020

Transaction

Single / Joint

Number of

Date

Party Transaction Parties

Amount

Mode

Remarks**

02-Dec-2013

Single

560544.00

Others

29-Aug-2013

Single

425000.00

Others

Notes for AIR :

1. Due date for filing Annual Information return by specified entities (Filers) is 31st August, immediately following the FY in which transaction is registered / recorded. This

section will be updated after filing AIR.

2. Transaction amount is total amount reported by AIR filer. It does not reflect respective share of each individual in joint party transaction.

PART F Details of Tax Deducted at Source on Sale of Immovable Property u/s 194IA(For Buyer of Property)

TDS Certificate

Name of Deductee

Number

No Transactions Present

Sr. No.

PAN of

Deductee

Acknowledgement Total Transaction

Number

Amount

Transaction

Date

TDS

Deposited

Date of Deposit

Status of

Date of Booking

Booking*

(All amount values are in INR)

PART G -TDS Defaults* (Processing of Statements)

Sr. No.

Financial Year

Short Payment Short Deduction

Interest on TDS

Payments default

Interest on TDS

Deduction Default

Late Filing Fee u/s

234E

Interest u/s 220(2)

Total Default

Sr. No.

TANs

Short Payment Short Deduction

Interest on TDS

Payments default

Interest on TDS

Deduction Default

Late Filing Fee u/s

234E

Interest u/s 220(2)

Total Default

No Transactions Present

*Notes:

1. Defaults relate to processing of statements and donot include demand raised by the respective Assessing Officers.

2. For more details please log on to TRACES as taxpayer.

Contact Information

Part of Form 26AS

A

A1

A2

B

C

D

E

F

G

Contact in case of any clarification

Deductor

Deductor

Deductor

Collector

Assessing Officer / Bank

Assessing Officer / ITR-CPC

Concerned AIR Filer

NSDL / Concerned Bank Branch

Deductor

Legends used in Form 26AS

* Status of Booking

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only

when payment details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to

Final (F) on verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductors have matched with the

payment details mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS

/ TCS booked in Government account have been verified with payment details submitted by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement

but the amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in

the statement or makes additional payment for excess amount claimed in the statement

** Remarks

Legend

'A'

'B'

Description

Rectification of error in challan uploaded by bank

Rectification of error in statement uploaded by deductor

Assessee PAN: AGRPM7794G

'C'

'D'

'E'

'F'

'T'

Assessee Name: MANAN KIRITBHAI MANKAD

Assessment Year:

2014-15

Rectification of error in AIR filed by filer

Rectification of error in Form 24G filed by Accounts Officer

Rectification of error in Challan by Assessing Officer

Lower/ No deduction certificate u/s 197

Transporter

# Total Tax Deducted includes TDS, Surcharge and Education Cess

## Tax Deducted includes TDS, Surcharge and Education Cess

+ Total Tax Collected includes TCS, Surcharge and Education Cess

++ Tax Collected includes TCS, Surcharge and Education Cess

Notes for Form 26AS

a. Figures in brackets represent reversal (negative) entries

b. In Part C, details of tax paid are displayed excluding TDS or TCS, payments related to Securities Transaction Tax and Banking Cash Transaction Tax

c. Tax Credits appearing in Part A, A1, A2 and B of the Annual Tax Statement are on the basis of details given by deductor in the TDS / TCS statement filed by them. The

same should be verified before claiming tax credit and only the amount which pertains to you should be claimed

d. This statement is issued on behalf of the Income Tax Department. See Section 203AA and second provision to Section 206C(5) of the Income Tax Act, 1961 and Rule

31AB of Income Tax Rules, 1962

e. This statement does not include payments pertaining to Assessment Year (AY) other than the AY mentioned above and payments against penalties

f. Date is displayed in dd-MMM-yyyy format

g. Details of Tax Deducted at Source in Form 26AS, for Form 15G/15H includes transactions for which declaration under section 197A has been Quoted

1. Sections

Section

192

193

194

194A

194B

194BB

194C

194D

194DA

194E

194EE

Description

Salary

Interest on Securities

Dividends

Interest other than 'Interest on securities'

Winning from lottery or crossword puzzle

Winning from horse race

Payments to contractors and sub-contractors

Insurance commission

Payment in respect of life insurance policy

Payments to non-resident sportsmen or sports associations

Payments in respect of deposits under National Savings Scheme

194F

Payments on account of repurchase of units by Mutual Fund or

Unit Trust of India

194G

194H

194I

194IA

194J

Commission, price, etc. on sale of lottery tickets

Commission or brokerage

Rent

TDS on Sale of immovable property

Fees for professional or technical services

194K

Income payable to a resident assessee in respect of units of a

specified mutual fund or of the units of the Unit Trust of India

194LA

194LB

194LBA

Payment of compensation on acquisition of certain immovable

Income by way of Interest from Infrastructure Debt fund

Certain income from units of a business trust

2. Minor Head

Code

100

102

106

107

300

400

800

Description

Advance Tax

Surtax

Tax on distributed profit of domestic companies

Tax on distributed income to unit holder

Self Assessment tax

Tax on regular assessment

TDS on sale of immovable property

Section

Description

194LC

Income by way of interest from specified company payable to a

non-resident

194LD

195

196A

196B

196C

196D

206CA

206CB

TDS on interest on bonds / government securities

Other sums payable to a non-resident

Income in respect of units of non-residents

Payments in respect of units to an offshore fund

Income from foreign currency bonds or shares of Indian

Income of foreign institutional investors from securities

Collection at source from alcoholic liquor for human

Collection at source from timber obtained under forest lease

206CC

Collection at source from timber obtained by any mode other

than a forest lease

206CD

Collection at source from any other forest produce (not being

tendu leaves)

206CE

Collection at source from any scrap

206CF

Collection at source from contractors or licensee or lease

relating to parking lots

206CG

Collection at source from contractors or licensee or lease

relating to toll plaza

206CH

Collection at source from contractors or licensee or lease

relating to mine or quarry

206CI

206CJ

206CK

Collection at source from tendu Leaves

Collection at source from on sale of certain Minerals

Collection at source on cash case of Bullion and Jewellery

3. Major Head

Code

0020

0021

0023

0024

0026

0028

0031

0032

0033

Description

Corporation Tax

Income Tax (other than companies)

Hotel Receipt Tax

Interest Tax

Fringe Benefit Tax

Expenditure Tax / Other Taxes

Estate Duty

Wealth Tax

Gift Tax

4. Type of Transaction

Code

Description

003

Receipt from any person of an amount of two lakh rupees or more for purchase of units of a Mutual Fund.

004

Receipt from any person of an amount of five lakh rupees or more for acquiring bonds or debentures issued by a company or institution.

005

Receipt from any person of an amount of one lakh rupees or more for acquiring shares issued by a company.

008

Receipt from any person of an amount of five lakh rupees or more in a year for investment in bonds issued by Reserve Bank of India

Assessee PAN: AGRPM7794G

Assessee Name: MANAN KIRITBHAI MANKAD

Assessment Year:

Glossary

Abbreviation

AIR

AY

EC

Description

Annual Information Return

Assessment Year

Education Cess

Abbreviation

TDS

TCS

Description

Tax Deducted at Source

Tax Collected at Source

2014-15

You might also like

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rupalNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Lavanya MittaNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

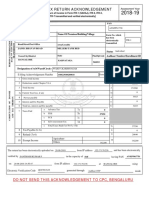

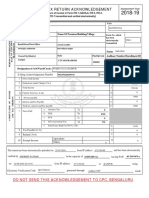

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Indian Income Tax Return Acknowledgement SummaryDocument1 pageIndian Income Tax Return Acknowledgement SummaryPradeep NegiNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ayush ThakkarNo ratings yet

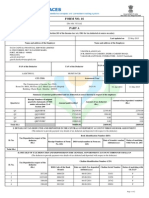

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AFuture ArtistNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ITO TECHNICALNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajen sahaNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Apqpa0045n 2018Document4 pagesApqpa0045n 2018samaadhuNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Form No. 16: Part ADocument9 pagesForm No. 16: Part ArakehsNo ratings yet

- Annual Tax Statement DataDocument4 pagesAnnual Tax Statement DataPalani KumarNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniNo ratings yet

- Acppk4010m 2018Document4 pagesAcppk4010m 2018Rohit GuptaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Annual Tax Statement Form 26ASDocument4 pagesAnnual Tax Statement Form 26ASMadhukar GuptaNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- TDS Certificate Form 16Document9 pagesTDS Certificate Form 16Aman AgrawalNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Daman SharmaNo ratings yet

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Maryam ZahraNo ratings yet

- Form 16 TDS Certificate SummaryDocument2 pagesForm 16 TDS Certificate SummaryPravin HireNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAmit SharmaNo ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahesh JadhavNo ratings yet

- Indian ITR Acknowledgement for AY 2020-21Document1 pageIndian ITR Acknowledgement for AY 2020-21AJAY KUMAR JAISWALNo ratings yet

- 24/7 Customer Private Limited PayslipDocument1 page24/7 Customer Private Limited PayslipMehraj PashaNo ratings yet

- TaxyDocument4 pagesTaxyNeevinternational NeevNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAryan KulhariNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- TDS certificateDocument2 pagesTDS certificateMohammed MohieNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Tax Audit Checklist GuideDocument3 pagesTax Audit Checklist Guidehemanth0% (1)

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- TDS Deduction GuideDocument35 pagesTDS Deduction GuideBj Thivagar0% (2)

- FORM 16 TITLEDocument5 pagesFORM 16 TITLEPunitBeriNo ratings yet

- Form 16 and Salary DetailsDocument22 pagesForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Guidelines For Investment Proof SubmissionDocument6 pagesGuidelines For Investment Proof Submissionzaheer KaziNo ratings yet

- Gen Principle - Income Tax DigestDocument50 pagesGen Principle - Income Tax DigestJanelle TabuzoNo ratings yet

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- 5) Tuason v. LingadDocument2 pages5) Tuason v. LingadjoyceNo ratings yet

- Course Outline in 2 Semester, AY 2018-2019: Taxation 1Document15 pagesCourse Outline in 2 Semester, AY 2018-2019: Taxation 1Johayrah Campong50% (2)

- Estate tax calculation and deductions for Damon SalvatoreDocument5 pagesEstate tax calculation and deductions for Damon SalvatoreJheng Jingco89% (9)

- Summary & Career Objective:: Curriculum VitaeDocument3 pagesSummary & Career Objective:: Curriculum VitaeJnanamNo ratings yet

- Service TaxDocument4 pagesService TaxFrankie WolfeNo ratings yet

- Important Questions For CBSE Class 12 Macro Economics Chapter 5Document8 pagesImportant Questions For CBSE Class 12 Macro Economics Chapter 5Ayush JainNo ratings yet

- Government GrantDocument14 pagesGovernment GrantnatiNo ratings yet

- S. No Miti Particulars Bill No. Gross Total Taxable VatDocument1 pageS. No Miti Particulars Bill No. Gross Total Taxable VatRam Krishna PandeyNo ratings yet

- 13.cir V Benguet CorpDocument5 pages13.cir V Benguet CorpQuengilyn QuintosNo ratings yet

- Profits and Gains From Business and ProfessionDocument4 pagesProfits and Gains From Business and ProfessionAyaan AhmedNo ratings yet

- Customer 2022-10-29 160743296Document2 pagesCustomer 2022-10-29 160743296Mukund DagaNo ratings yet

- Payment 4 PDFDocument3 pagesPayment 4 PDFgataduNo ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- 117237-2007-Systra Philippines Inc. v. Commissioner ofDocument8 pages117237-2007-Systra Philippines Inc. v. Commissioner ofEmary GutierrezNo ratings yet

- Income Tax Calculator - TaxScoutsDocument1 pageIncome Tax Calculator - TaxScoutsnadine.massabkiNo ratings yet

- 1 TAXF372-TaxinActionCASESTUDYandREQUIREDDocument3 pages1 TAXF372-TaxinActionCASESTUDYandREQUIREDrenette1010No ratings yet

- Chapter 4 - Tax Schemes, Periods, Methods and ReportingDocument2 pagesChapter 4 - Tax Schemes, Periods, Methods and ReportingRoshel RombaoaNo ratings yet

- Vat Polish ActDocument2 pagesVat Polish Actcris_ileana_39763320No ratings yet

- 17) Smi-Ed Philippines Technology, Inc., Petitioner, vs. Commissioner of Internal Revenue, Respondent, G.R. No. 175410Document9 pages17) Smi-Ed Philippines Technology, Inc., Petitioner, vs. Commissioner of Internal Revenue, Respondent, G.R. No. 175410ZackNo ratings yet

- 2019 Tax Rev Finals Digests PDFDocument178 pages2019 Tax Rev Finals Digests PDFDooNo ratings yet

- Capital Gains TaxDocument25 pagesCapital Gains TaxZander100% (1)

- OfferDocument1 pageOfferАнастасия МалявкоNo ratings yet

- CorporationsDocument68 pagesCorporationsPaoNo ratings yet

- The lack of effectiveness of tax exemption policies in achieving development on the Algerian economyDocument27 pagesThe lack of effectiveness of tax exemption policies in achieving development on the Algerian economyHamid HathatiNo ratings yet

- 3504-Article Text-20329-1-10-20230501Document11 pages3504-Article Text-20329-1-10-20230501agrewNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number: Date of FilingDocument1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number: Date of Filingcredit cardNo ratings yet

- ACC 203 Taxation in NepalDocument9 pagesACC 203 Taxation in NepalSophiya PrabinNo ratings yet