Professional Documents

Culture Documents

Advanced Business Writing: Worksheet 7: A Financial Report

Uploaded by

marhulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Business Writing: Worksheet 7: A Financial Report

Uploaded by

marhulCopyright:

Available Formats

Advanced Business Writing

Life

Worksheet 7: A financial report

1

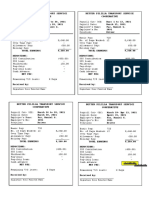

Read the two financial reports on the next page and answer these questions.

1

2

Match these section headings to the four parts of report A (labelled ad).

1

2

3

4

a rise / to rise: ________ , ________ , ________ , ________ , ________ , ________

a fall / to fall: ________ , ________

a change / to change: ________ , ________ , ________ , ________ , ________

Match these definitions with the underlined idiomatic expressions in the two texts.

1

2

3

4

5

6

7

is currently trading at a loss.

will continue to be a sound investment.

has been well-established in the market since...

should be treated with caution.

may well make a profit in the coming months.

ought to be avoided at all costs.

Categorise the words in bold in the report under the headings below.

1

2

3

Outlook (its future potential)

Context (what it does and its history)

Recommendation (what investors are advised to do)

Performance (how it is currently performing financially)

Look at these expressions from a financial report. In which section of a report

from Exercise 2 would you find each expression? Why? What tenses and forms do

we tend to use in each of the sections of a financial report?

1

2

3

4

5

6

What business sectors are being reported on?

Decide if each report is positive or negative.

endured a difficult period

it used to be a company you could invest in knowing that it wouldnt lose money

manages to stay clear of problems

badly affected by the lack of lending in this recession

a careful, patient, safe policy

be careful not to invest all or a lot of your money in this

does business in a lot of different sectors

Read the information about Swirling Guitars on the next page. Then write a

financial report. Include information about the companys context, its

performance and outlook, and provide recommendations for investors.

Life Advanced Business Writing

National Geographic Learning

Browning Industrial

a ___________________________

Browning Industrial has been a dominant player in the pharmaceutical industry for over 50 years, and has

recently diversified into cosmetic products such as sun-tan lotions and face creams.

b ___________________________

Once a safe bet, Browning is currently experiencing difficulties. Its recently published pre-tax profits were

down by 7% from the previous financial year. Hit by the credit crunch, as well as by an overhaul of

regulations which has allowed rivals to undercut its prices, Browning has had a rough ride in recent

months.

c ___________________________

The picture may well improve for Browning in the coming months, but dont bet your bottom dollar on it.

The prices of pharmaceutical products are set to rocket across Europe, but it isnt at all clear that this will

have a positive effect on Brownings profits as much of the money will be siphoned off in government

taxes. And Browning remains a bit player in the cosmetics industry, its position squeezed by larger

concerns. Basically, Browning will have to ride out the slump and hope that the economy gets the boost

were all hoping for soon.

d ___________________________

It would be wise to take a wait and see approach to Browning. Given its size and pedigree, it could well

prove to be a sound investment in the long run, but at the moment investors should be wary.

Danner Group

Danner Groups recent acquisition of Lanta Foods has turned the company into one of the largest concerns

in the food processing industry. As well as biscuits, cakes and jellies, Danner now make pet food and crisps.

Once a small, German food manufacturer, Danner has repositioned itself as a global player in the last

decade.

Overseas sales are growing rapidly, and the company is starting to steal market share from its competitors.

It controls over 30% of the international market with sales of about $50 billion per annum. As it trades in

essential foods, and has its finger in lots of pies, it doesnt seem to be affected by the downturn in the

economy. Led by a strong showing in the pet food sector, the company registered an 18% jump in net

income in the first three quarters of the last financial year before investment gains or losses.

Theres no reason to suspect that Danner Groups climb wont continue so long as it avoids the pitfalls

associated with transforming itself into an ever larger conglomerate. Its in the process of acquiring Simon

Foods, and will, no doubt, be looking to add further to its portfolio. However, as Danner Group is operating

in such a healthy sector, its in a win-win situation and its stock will continue to boom.

Weve been advising investors to take an interest in Danner for a number of years as its stock has been

such a consistent performer. Although its stock is no longer cheap, its growth prospects continue to be

attractive, with profits projected to increase 13% annually for the next few years.

Swirling Guitars

Established: 1960

Makers of high quality instruments

Market share: 20% in its home market; 4% worldwide

Sector performance: sales down by 15% in last decade;

affected by cheaper Asian imports

Current performance: sales steady for last four years

Outlook: about to launch new guitar; have increased staff

in the last year; Christmas approaching

Life Advanced Business Writing

I CAN

structure a financial report

use a range of tenses

use a range of verbs to talk about trends

use idiomatic expressions

National Geographic Learning

You might also like

- Procter and GambleDocument29 pagesProcter and GambleLinda PerezNo ratings yet

- BPC 10.0 Planning ScenariosDocument16 pagesBPC 10.0 Planning ScenariosDinakaran KailasamNo ratings yet

- HBS Case2 ToyRUs LBODocument22 pagesHBS Case2 ToyRUs LBOTam NguyenNo ratings yet

- Earn $1,100 Per Week Through Risk Free Arbitrage BettingDocument19 pagesEarn $1,100 Per Week Through Risk Free Arbitrage Bettingsnpatel171100% (1)

- A Complete Landscaping Company Business Plan: A Key Part Of How To Start A Landscaping BusinessFrom EverandA Complete Landscaping Company Business Plan: A Key Part Of How To Start A Landscaping BusinessRating: 5 out of 5 stars5/5 (1)

- FI504 Case Study 1 The Complete Accounting CycleDocument16 pagesFI504 Case Study 1 The Complete Accounting CycleElizabeth Hurtado-Rivera0% (1)

- All Template Chapter 6 As of September 10 2019Document32 pagesAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- Relative Clause TestDocument3 pagesRelative Clause TestmarhulNo ratings yet

- A Complete Mowing & Lawn Care Business Plan: A Key Part Of How To Start A Mowing BusinessFrom EverandA Complete Mowing & Lawn Care Business Plan: A Key Part Of How To Start A Mowing BusinessNo ratings yet

- Capstone Round 3Document43 pagesCapstone Round 3Vatsal Goel100% (1)

- Greenlight UnlockedDocument7 pagesGreenlight UnlockedZerohedgeNo ratings yet

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDocument8 pagesTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotNo ratings yet

- Lakewood Capital - 2020 Q2 Letter PDFDocument10 pagesLakewood Capital - 2020 Q2 Letter PDFcaleb wattsNo ratings yet

- Greenlight Letter Q4 2016Document6 pagesGreenlight Letter Q4 2016Zerohedge100% (3)

- Eric Khrom of Khrom Capital 2012 Q3 LetterDocument5 pagesEric Khrom of Khrom Capital 2012 Q3 LetterallaboutvalueNo ratings yet

- Practice Exercises # 2 - CH 14Document4 pagesPractice Exercises # 2 - CH 14Hamna AzeezNo ratings yet

- Sample Trust DeedDocument12 pagesSample Trust Deedfaizysyed100% (2)

- Conditionals explanations and exercisesDocument4 pagesConditionals explanations and exercisesmariutza1991No ratings yet

- Pinto Pm2 Ch03Document22 pagesPinto Pm2 Ch03Focus ArthamediaNo ratings yet

- Intermediate Progress Test Two: ReadingDocument7 pagesIntermediate Progress Test Two: Readingmodesto66No ratings yet

- Merchandising OperationsDocument39 pagesMerchandising OperationsRyan Jeffrey Padua Curbano50% (2)

- Advanced Business Writing: Worksheet 7: A Financial ReportDocument2 pagesAdvanced Business Writing: Worksheet 7: A Financial ReportsuerockNo ratings yet

- Recession Impact on Indian BusinessDocument12 pagesRecession Impact on Indian BusinessSauriya SinhaNo ratings yet

- Recession in The Present Economy and Its Impact On Business SectorDocument12 pagesRecession in The Present Economy and Its Impact On Business SectorPb 29 Speaker 1No ratings yet

- Thesis SummaryDocument4 pagesThesis Summaryapi-278033882No ratings yet

- Inala - Analyst ReportDocument2 pagesInala - Analyst ReportMaria LourdesNo ratings yet

- Valuation Thesis: Target Corp.: Corporate Finance IIDocument22 pagesValuation Thesis: Target Corp.: Corporate Finance IIagusNo ratings yet

- Business Analysis P&GDocument14 pagesBusiness Analysis P&GJonghoneydew ChoiNo ratings yet

- The Master Bean: Ethics or Bust?: (6 Marks)Document12 pagesThe Master Bean: Ethics or Bust?: (6 Marks)Sofia Martin IpiñaNo ratings yet

- Thesis Summary Week 10Document4 pagesThesis Summary Week 10api-278033882No ratings yet

- Clorox Annual Report 2009Document36 pagesClorox Annual Report 2009kirkhere100% (1)

- Chairman's Letter Highlights Strong Financial Performance and Growth OutlookDocument222 pagesChairman's Letter Highlights Strong Financial Performance and Growth OutlookGundeep Singh KapoorNo ratings yet

- International Marketing AssignmentDocument11 pagesInternational Marketing Assignmentdemstavros0% (1)

- q4 2013 ConfcallDocument6 pagesq4 2013 Confcalljcf129erNo ratings yet

- Poloz Remarks 190613Document6 pagesPoloz Remarks 190613ericaaliniNo ratings yet

- Week Four Learning Team Assignment: Larson Inc. ScenarioDocument8 pagesWeek Four Learning Team Assignment: Larson Inc. ScenarioMark RaoufNo ratings yet

- Stocks To Buy: NewslettersDocument17 pagesStocks To Buy: Newslettersfrank valenzuelaNo ratings yet

- Case Analysis of Home Depot Inc - in The New Millennium: View With Charts and ImagesDocument24 pagesCase Analysis of Home Depot Inc - in The New Millennium: View With Charts and ImagesAnkit AgarwalNo ratings yet

- ConagraDocument2 pagesConagracracking khalifNo ratings yet

- Pija Doc 1581907800Document8 pagesPija Doc 1581907800lamp vicNo ratings yet

- April Week 4 SumDocument3 pagesApril Week 4 Sumapi-278033882No ratings yet

- Pidilite Industries AnalysisDocument0 pagesPidilite Industries AnalysisAnitha Raja BNo ratings yet

- Big Lots Inc: Stock Report - July 23, 2016 - Nys Symbol: Big - Big Is in The S&P Midcap 400Document11 pagesBig Lots Inc: Stock Report - July 23, 2016 - Nys Symbol: Big - Big Is in The S&P Midcap 400Luis Fernando EscobarNo ratings yet

- 2Q22 Results Presentation TranscriptDocument11 pages2Q22 Results Presentation TranscriptDanniely AlcantaraNo ratings yet

- 2020年东南亚营销展望Document14 pages2020年东南亚营销展望Victor船长No ratings yet

- Groupon Inc Case AnalysisDocument8 pagesGroupon Inc Case Analysispatrick wafulaNo ratings yet

- Recession in IndiaDocument10 pagesRecession in Indiaabhagaur1No ratings yet

- Concept Questions w6Document31 pagesConcept Questions w6Sadia AdamNo ratings yet

- Turnaround Plan For Linens N ThingsDocument15 pagesTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- Top Distributors Sales Surge 23% to $8.37BDocument17 pagesTop Distributors Sales Surge 23% to $8.37BGlorianne Mylene LedesmaNo ratings yet

- Nyse PG 2023Document88 pagesNyse PG 2023listerlastrella00No ratings yet

- Fund Update Highlights Strong Returns and OpportunitiesDocument10 pagesFund Update Highlights Strong Returns and OpportunitiesAndreKlotzNo ratings yet

- Our Strategy To Drive GrowthDocument36 pagesOur Strategy To Drive GrowthjbsNo ratings yet

- Arrow Printing and PublishingDocument12 pagesArrow Printing and PublishingAshish AroraNo ratings yet

- Aig Best of Bernstein SlidesDocument50 pagesAig Best of Bernstein SlidesYA2301100% (1)

- Investor Report: JAN - APR 2018Document17 pagesInvestor Report: JAN - APR 2018ioannisramNo ratings yet

- 2017 Customers: Analysis of The 50 Companies AllottedDocument4 pages2017 Customers: Analysis of The 50 Companies Allottedharsh shahNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Premium Products, Small Brands and New Retail: China Shopper Report 2019, Vol. 1Document32 pagesPremium Products, Small Brands and New Retail: China Shopper Report 2019, Vol. 1Rupsayar DasNo ratings yet

- June 30, 2000Document4 pagesJune 30, 2000grrarrNo ratings yet

- Global Business OpportunitiesDocument14 pagesGlobal Business OpportunitiesAzmain KhanNo ratings yet

- Marketing StrategyDocument15 pagesMarketing Strategysankalp mohantyNo ratings yet

- Trade Report February 09Document7 pagesTrade Report February 09David DorrNo ratings yet

- AnalysisDocument3 pagesAnalysisXuân Đinh ThanhNo ratings yet

- Mac - 494 - 110508 - 224346 L&FDocument24 pagesMac - 494 - 110508 - 224346 L&FcaidahuihuiNo ratings yet

- KICTalking Points 080608Document6 pagesKICTalking Points 080608russ8609No ratings yet

- The Vilas Fund LP - Quarterly Letter Q4 2017 v1Document6 pagesThe Vilas Fund LP - Quarterly Letter Q4 2017 v1Michael BenzingerNo ratings yet

- Iconic Consumer Brands for More Defensive, Lower-risk Investing: Annual Review 2023From EverandIconic Consumer Brands for More Defensive, Lower-risk Investing: Annual Review 2023No ratings yet

- Offshore Riches, A Guide to Recession-proofing Your BusinessFrom EverandOffshore Riches, A Guide to Recession-proofing Your BusinessNo ratings yet

- Life Inter 2 LekciaDocument4 pagesLife Inter 2 Lekciamarhul100% (2)

- Difficult English words explained simplyDocument1 pageDifficult English words explained simplymarhulNo ratings yet

- Description of A PlaceDocument1 pageDescription of A PlacemarhulNo ratings yet

- Melts Becomes Will TravelDocument4 pagesMelts Becomes Will TravelMiguel FloresNo ratings yet

- Test Telekom StredaDocument2 pagesTest Telekom StredamarhulNo ratings yet

- PicturesDocument2 pagesPicturesmarhulNo ratings yet

- 2.B TestDocument2 pages2.B TestmarhulNo ratings yet

- Future Forms1Document7 pagesFuture Forms1marhulNo ratings yet

- Pulp FictionDocument1 pagePulp FictionmarhulNo ratings yet

- English Diagnostic TestDocument9 pagesEnglish Diagnostic TestNeeraj T. JoshiNo ratings yet

- English AwakeningsDocument1 pageEnglish AwakeningsmarhulNo ratings yet

- Conditional Exercises MixedDocument2 pagesConditional Exercises MixedmarhulNo ratings yet

- A First Time For EverybodyDocument1 pageA First Time For EverybodymarhulNo ratings yet

- Marcus Antonius: A Closer Look at the Life and Accomplishments of the Roman GeneralDocument1 pageMarcus Antonius: A Closer Look at the Life and Accomplishments of the Roman GeneralmarhulNo ratings yet

- JobsDocument2 pagesJobsmarhulNo ratings yet

- Persuasive Essay TopicsDocument5 pagesPersuasive Essay TopicsKatrina BaranNo ratings yet

- TestDocument2 pagesTestmarhulNo ratings yet

- Marcus Antonius: A Closer Look at the Life and Accomplishments of the Roman GeneralDocument1 pageMarcus Antonius: A Closer Look at the Life and Accomplishments of the Roman GeneralmarhulNo ratings yet

- Collection of GamesDocument31 pagesCollection of GamesmarhulNo ratings yet

- Upper Int U4 SummarisingResultsDocument2 pagesUpper Int U4 SummarisingResultsmarhul0% (1)

- Upper Intermediate Business Writing: Worksheet 1: Formal and Informal CorrespondenceDocument2 pagesUpper Intermediate Business Writing: Worksheet 1: Formal and Informal CorrespondencemarhulNo ratings yet

- Upper Int U11 ClarifyingAndCheckingUnderstandingDocument2 pagesUpper Int U11 ClarifyingAndCheckingUnderstandingmarhulNo ratings yet

- TestDocument2 pagesTestmarhulNo ratings yet

- Advanced Business Writing: Worksheet 12: A Formal Letter of AgreementDocument2 pagesAdvanced Business Writing: Worksheet 12: A Formal Letter of AgreementmarhulNo ratings yet

- Business WritingDocument2 pagesBusiness WritingmarhulNo ratings yet

- Upper Intermediate Business Writing: Worksheet 1: Formal and Informal CorrespondenceDocument2 pagesUpper Intermediate Business Writing: Worksheet 1: Formal and Informal CorrespondencemarhulNo ratings yet

- Int Unit2 ComparingOptionsAndRecommendingDocument2 pagesInt Unit2 ComparingOptionsAndRecommendingAndrew PerishNo ratings yet

- Advanced Business Writing: Worksheet 1: A CV or ResumeDocument2 pagesAdvanced Business Writing: Worksheet 1: A CV or ResumemarhulNo ratings yet

- Better Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeDocument1 pageBetter Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeHellen DeaNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Hillaire Belloc Bad Child Book of Beasts PDFDocument30 pagesHillaire Belloc Bad Child Book of Beasts PDFquinbusflestrinNo ratings yet

- Partnership Fundamentals 2Document6 pagesPartnership Fundamentals 2sainimanish170gmailcNo ratings yet

- HAF 216 Tax GuideDocument127 pagesHAF 216 Tax GuideMimi kupiNo ratings yet

- Petron F (1) .S 3Document74 pagesPetron F (1) .S 3cieloville06100% (1)

- Strategic Cost Management Coordinated Quiz 1Document7 pagesStrategic Cost Management Coordinated Quiz 1Kim TaehyungNo ratings yet

- Project Report On Adani PortDocument58 pagesProject Report On Adani PortVicky Lilani0% (2)

- Grizzly Community Hospital in Central Wyoming Provides Health Care ServicesDocument1 pageGrizzly Community Hospital in Central Wyoming Provides Health Care ServicesAmit PandeyNo ratings yet

- Netflix PresentationDocument19 pagesNetflix PresentationDiego EscalanteNo ratings yet

- PR CHP 5 - Ex 5-1 - Kelompok 1Document2 pagesPR CHP 5 - Ex 5-1 - Kelompok 1Lucky esteritaNo ratings yet

- Asian Paints Industry LeaderDocument9 pagesAsian Paints Industry LeaderMithilesh SinghNo ratings yet

- PRR PDFDocument6 pagesPRR PDFv siva kumarNo ratings yet

- General Questions: Pal SipDocument9 pagesGeneral Questions: Pal SipAura DewaNo ratings yet

- Chapter 3 Cost Accounting CycleDocument11 pagesChapter 3 Cost Accounting CycleSteffany RoqueNo ratings yet

- Answer KeyDocument2 pagesAnswer KeySHAZ NAY GULAYNo ratings yet

- Marketing Plan of Bkash - Group 2Document11 pagesMarketing Plan of Bkash - Group 2Sharmin A. Salma100% (1)

- Cost Accounting: Definition, Scope, Objectives and Significance of Cost AccountingDocument31 pagesCost Accounting: Definition, Scope, Objectives and Significance of Cost AccountingSachin SawhneyNo ratings yet

- Question Bank NvsDocument6 pagesQuestion Bank NvsDeepak DileepNo ratings yet

- Acr 4.2Document21 pagesAcr 4.2ASIKIN AJA0% (1)

- Letter To The Mayor (Sunshine City) FinalDocument2 pagesLetter To The Mayor (Sunshine City) Finalapi-288606068No ratings yet

- Salary Structure CreationDocument4 pagesSalary Structure CreationPriyankaNo ratings yet