Professional Documents

Culture Documents

Private Equity Exchange Forum: Discount

Uploaded by

pankajdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Private Equity Exchange Forum: Discount

Uploaded by

pankajdCopyright:

Available Formats

2013

Private Equity Exchange Forum

11th & 12th April, 2013 | Hotel Four Seasons, Mumbai

Investing With Vigilance: Adapting And Thriving In

A Vibrant Environment

2nd Annual

2nd Annual

ERA

ERA

LEGAL

LEGAL

PRIVA E PRIVA E

EQUI Y FORUM

EQUI Y FORUM

WHERE

THE DIALOGUE MATTERS

WHERE THE DIALOGUE

MATTERS

11th & 12th April, 2013|Mumbai

11th & 12th April,

2013|Mumbai

The 2nd Annual LegalEra Private Equity Forum 2013 the premium congregation for and of lea

Equity

Investors,

CEOs,

CFOs,

Managing

Directors,

Legal Heads,

GP

The 2nd Annual LegalEra Private

Equity

Forum

2013

the

premium

congregation

for LP,

and

ofetcleading Private

Equity Investors, CEOs, CFOs, Managing Directors, Legal Heads, LP, GP etc

Theme for this year forum is Investing with Vigilance: Adapting and Thriving in a Vibrant Environ

Forum will ensure that the meeting becomes a catalyst for economic growth, successful investme

Theme for this year forum is Investing

with Vigilance:

Adapting

collaboration

and cooperation

in 2013 and Thriving in a Vibrant Environment. The

Forum will ensure that the meeting becomes a catalyst for economic growth, successful investment strategies,

collaboration and cooperation in 2013

Conference Highlights

Conference Highlights

LP- Meets

GP

Which sectors are the most promising in

LP- Meets

the current market?

Network

Bounding

with the Business

Network

E-commerce, infrastructure, real GP

estate &

Which sectors are the most promising ingreentech Analysis & Understanding

the current market?

2013 Prospects.

Renowned

early bird

speakers

structuring exist

What do general partners and limited

Compliance, Risk & Governance

partners are looking for?

early

bird

Exit Strategies: Practical aspects aboutTaxing and regulatory environment

for

structuring exist

Growth or Governance

Mitigating Factors for growth

DISCOUNT

Compliance, Risk & GovernanceVenture capital opportunities and

challenges

Mitigating Factors for growth

Renowned

speakers

In-House

Counsel

E-commerce, infrastructure, real estate &What do general partners and limited

greentech Analysis & Understandingpartners are looking for?

In-House

Exit Strategies: Practical aspects about

2013 Prospects.

Counsel

DISCOUNT

Conference Stand

Network

1-2 DELEGATES

3-5 DELEGATES

Conference

Fees*

INR

25000 +Standared

Tax

6+

DELEGATES

before 25th March, 2013

1-2 DELEGATES

tax will be applicab

INR*service

30000

*per

ticket rate

3-5 DELEGATES

INR 25000

6+ DELEGATES

INR 22000

Register online at www.leprivateequity.com

INR 25000 + Tax

before 25th March, 2013

Taxing and regulatory environment forForeign Private Equity Firms

*service tax will be applicable on the above rates

Looking Ahead: Indias PE industry in

*per ticket rate

For Sponsorship

For Delegate

Growth or Governance

2015

Venture capital opportunities and

challenges

Knowledge

Partner

Foreign

Private Equity Firms

Reg

Vishal Sharma Anita Rodrigues

Ravi Sharma Yusuf P

Tel : +91 9766 910575 Tel : +91 9819 002345

Tel : 022 4206 4211 Tel : 02

Email: vishal@legalera.in Email: anita@legalera.in Email: ravi@legalera.in Email: y

Register online at www.leprivateequity.com

Where The Dialogue Matters

Associate Partner

Looking Ahead: Indias PE industry in

2015

wit

Media Partner

For

Sponsorship

Knowledge

Partner:

Supporting Partner

For Delegate

Registration

Media Partner:

Vishal Sharma Anita Rodrigues

Ravi Sharma Yusuf Petiwala

Tel : +91 9766 910575 Tel : +91 9819 002345

Tel : 022 4206 4211 Tel : 022 4206 4213

Email: vishal@legalera.in Email: anita@legalera.in Email: ravi@legalera.in Email: yusuf@legalera.in

Online Media Partner:

Talent Partner

Knowledge Partner:

Organised & C

Media Partner:

Supporting Partner

Online Media Partner:

Organised & Conceived by:

Day 1 : 11th April, 2013

08:30-09:30

Tea & Registration

09:30-09:45

Welcome Remarks

09:45-10:45

Keynote speech on:

Global economic outlook, overview for next 12 months;

Impact of Indian policies, political and regulatory conditions on

Private Equity investments in India and the way forward.

10.45-11.45

Past, Present and Future of the Private Equity Industry

Lessons from the past

Private Equity industrys commitment and contribution towards Indias growth

story in years to come

Industry changes and challenges likely to be faced in near future

What GPs should do in the interest of the long-term sustainability and viability

of Private Equity industry?

11:45-12:15

Investments Perspective in 2013 Regulations & Outlook

Indian Regulatory changes 2012 and the way ahead

Impact of the changes in the tax laws proposed by the Finance Minister in Budget 2013

Deciphering the General Anti-Avoidance Rule (GAAR) provisions and its impact on

the PE industry

How concerning are the proposed GAAR tax provisions from an LP perspective?

Moderated by:

Punit Shah, Partner and Co-Head of Tax

Practice, KPMG, India

Panel Members:

Maninder Cheema, Deputy General

Manager, SEBI

TBC

Bhavin Shah, Partner, Financial Services and

Private Equity Tax practice, KPMG, India

Rupa Vora, Group Director & CFO, IDFC

Alternatives

H. Jayesh, Founder Partner, Juris Corp

Tej K.Gujadhur, Partner, GFin Corporate

Services Ltd.

Networking Luncheon

14:30-15:30

Sourcing and Securing Deals in the Competitive Space

Regional / global franchise for competitive advantage for deal sourcing

Capital growth opportunities in India key drivers and risks involved

Are there enough attractive deals? How does Private Equity access the best deals?

Developing relationships with promoters and intermediaries to source most

attractive deal flows

Deal flow - where are deals to be found in the competitive space

15:30-16:00

Moderated by:

Gopal Srinivasan, Managing Partner, TVS

Capital

Panel Members:

Bala Deshpande, Sr. Managing Director, NEA

Mukul Nag, Managing Director, Standard

Chartered Private Equity Advisory (I) Pvt

Ltd.

Sandeep Aneja, Managing Partner, Kaizen PE

Fund

Padmanabh Sinha, Managing Partner, Tata

Opportunities Fund

Coffees / Tea Break

12:15-13:15

13.15-14:30

Keynote Speakers:

Siva Subramanian Ramann, Executive

Director, SEBI

Ashish Kumar Chauhan, Managing Director

& Chief Executive, Bombay Stock Exchange

(BSE)

Moderated by:

Pankaj Dutt, Managing Partner, Alexander

Hughess

Panel Members:

Rakesh Sony, Director, Motilal Oswal

Private Equity Advisors Pvt Ltd.

Mrinal Chandran, Vice President, Clearwater

Capital Partners

Rajesh Dalal, Venture Partner, OrbiMed

Advisors

Sunish Sharma, Managing Partner, Kedaara

Capital Advisors LLP

Coffees / Tea Break

16:00-16:45

How GP can enhance the portfolio of a Company?

The growing importance and role of Branding in improving Valuation

Importance of brand recognition and learning from the Indian Corporate houses

Moderated by:

TBC

Panel Members:

Abhishek Shah, Managing Director,

Unilazor

Strategies for creating brand and improvising valuation?

Challenges to find ways to add value to portfolio companies

16:45-17:00

Closing Remarks and Networking lounge opens with Tea/Coffee

Day 2 : 12th April, 2013

09:00-10:00

Tea & Registration

10:00-11:00

Anti Corruption, Compliance, Fraud and Risk Management

Involved while Investing

Fraud and Risk management Involved while Investing

How can Government and Industry work more closely together to tackle corruption?

Panel discussion on the anti corruption legislation in India, the effect of high profile

penalties, government initiatives and organizations and implementation of an effective

compliance program

11:00-12:00

Best Practices from the Fund Raising Perspective?

Strategies to be employed in competitive fundraising market

Recent trends in negotiations of terms and conditions of the LPA

Regulatory sensitivities and marketing the fund

Valuations current scenario and its impact on fundraising

12:00-12:30

Moderated by:

Sandip Bhagat, Partner, S&R Associates

Panel Members:

Ajay Vaidya, Chief Legal Officer, Kotak

Mahindra

Akhil Prasad, Head Legal & Company

Secretary , Fidelity

M. V. Phadke, CFO, IDBI Bank

Dinesh Anand, Head Forensic services,

KPMG, India

Moderated by:

Shivani Bhasin, CEO & Managing Director

India Alternatives Fund

Panel Members:

Sunil Rohokale, Managing Director and CEO,

ASK Group

Prakash Nene, Partner, Multiples Alternate

Asset Management

Subir Nag, Head - Mezzanine Fund, FRIR&

Strategy at ICICI Venture

Santosh K. Gujadhur, Partner, GFin Corporate

Services Ltd

Coffees / Tea Break

12:30-13:30

Finding the right exit strategy

India is now looked upon as being a tough market to exit. Whats causing exit

deficit in India?

What exit opportunities exist in the short, medium and the long term?

How appealing are trade sales and buy-outs as exit vehicles?

What role do market regulations play in formulating exit strategies, and SEBIs

general perception towards this end?

Tax laws and impact on exit landscape

Moderated by:

TBC

Panel Members:

Abhinav Sinha, Director, Fidelity Growth

Partners India

Sameer Mehta, Director, Atlas Venturez

Alok Gupta, Managing Director & CEO,

Gerken Capital Associates

Amit Agarwal, Partner, SNG & Partners

Darius Pandole, Partner, New Silk Route

Advisors Pvt. Ltd.

Networking Luncheon

13.30-15:00

15:00-15:40

Exclusive Interview Session on Investment in 2012 and

future outlook

Q & A Session

15.45-16:00

15:30-16:00

Closing Remarks

Closing Remarks

16:00-17:00

Closing coffee/ Tea Networking

Moderated by:

TBC

Panel Members:

TBC

For Sponsorship Vishal Sharma - +91 9967 255 222 | Anita Rodrigues - +91 9819 002 345

For Delegate Registration Yusuf Petiwala - 022 4206 4213 | Ravi Sharma - 022 4206 4211

You might also like

- Top 50 Real Estate PE FirmsDocument15 pagesTop 50 Real Estate PE Firmsbzit11100% (1)

- The Gift Ofe 11 Even Moves To Make Me WealthyDocument234 pagesThe Gift Ofe 11 Even Moves To Make Me WealthyMarco1998No ratings yet

- India M&ADocument135 pagesIndia M&Aaditya pariharNo ratings yet

- Vault Guide PEDocument155 pagesVault Guide PENéné Oumou BARRYNo ratings yet

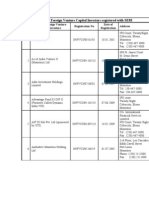

- A-List of Foreign Venture Capital Investors Registered With SEBIDocument24 pagesA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNo ratings yet

- Venture Capital Mena ReportDocument50 pagesVenture Capital Mena ReportBala SubramanianNo ratings yet

- The 401(K) Owner’S Manual: Preparing Participants, Protecting FiduciariesFrom EverandThe 401(K) Owner’S Manual: Preparing Participants, Protecting FiduciariesNo ratings yet

- Plma 2013 - Preliminary Buyers ListDocument147 pagesPlma 2013 - Preliminary Buyers Listpankajd67% (3)

- Pei 300 - Top 50 Pe FundsDocument3 pagesPei 300 - Top 50 Pe FundsDonZ1063No ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- New York Placement ListDocument4 pagesNew York Placement ListDan Primack100% (1)

- LBO OverviewDocument21 pagesLBO Overviewjason0No ratings yet

- Placement AgentsDocument4 pagesPlacement AgentssunsetstarzNo ratings yet

- Karvy Stock Broking LTD.: Summer Training Report ONDocument47 pagesKarvy Stock Broking LTD.: Summer Training Report ONAkshay SinghalNo ratings yet

- Antler Demo Day BookletDocument14 pagesAntler Demo Day BookletKanta NandanaNo ratings yet

- Aibi Summit 2016Document48 pagesAibi Summit 2016Anonymous KRErbYM7No ratings yet

- Final Synopsis AbhijeetDocument9 pagesFinal Synopsis AbhijeetAbhijeet Redij100% (1)

- Aditya Birla Mutual FundDocument66 pagesAditya Birla Mutual Fundpratim shindeNo ratings yet

- A Study On HDFC Mutual FundDocument88 pagesA Study On HDFC Mutual FundSagar Paul'gNo ratings yet

- Private Equity Exchange Forum: DiscountDocument3 pagesPrivate Equity Exchange Forum: DiscountpankajdNo ratings yet

- Business Advisor - Post Budget 2013 Special - PreviewDocument8 pagesBusiness Advisor - Post Budget 2013 Special - PreviewD. MuraliNo ratings yet

- Indian Family Wealth Forum 2015 - AgendaDocument24 pagesIndian Family Wealth Forum 2015 - AgendaPremkumarJittaNo ratings yet

- Final JMF Annual Report 12-13 - WebDocument134 pagesFinal JMF Annual Report 12-13 - WebRichard JonesNo ratings yet

- F4309Document105 pagesF4309Shahab KhanNo ratings yet

- Annual Report 2012Document118 pagesAnnual Report 2012M Umar FarooqNo ratings yet

- Analysis of Consumer Behavior Towards Share Trading and Sales Promotion of Anand Rathi Securities LTD - Ambala"Document48 pagesAnalysis of Consumer Behavior Towards Share Trading and Sales Promotion of Anand Rathi Securities LTD - Ambala"amar12345678No ratings yet

- 2 NDDocument12 pages2 NDpravi''sNo ratings yet

- ANAND-RATHI Tanuj Kumar ProjectDocument90 pagesANAND-RATHI Tanuj Kumar ProjectTanuj Kumar50% (2)

- Customer Perception Towards Mutual Fund FinalDocument74 pagesCustomer Perception Towards Mutual Fund FinalujranchamanNo ratings yet

- BCSPL PresentationDocument15 pagesBCSPL PresentationSummi GuptaNo ratings yet

- Summer Training Project ReportDocument40 pagesSummer Training Project ReportJaved MasihNo ratings yet

- Equity Investment and Economic Growth of India & Market Stratrgies of ReligareDocument63 pagesEquity Investment and Economic Growth of India & Market Stratrgies of ReligareChandan ParsadNo ratings yet

- India2011 Brochure 18Document6 pagesIndia2011 Brochure 18Deepali JetleyNo ratings yet

- Module 1Document42 pagesModule 1Sneha MulchandaniNo ratings yet

- TRAINING REPORT FINAL FinaDocument52 pagesTRAINING REPORT FINAL FinaNeuherbs InternNo ratings yet

- EventUpdate-May4 - 2012Document16 pagesEventUpdate-May4 - 2012saurabhjain8414No ratings yet

- Project Report Nishant SharmaDocument59 pagesProject Report Nishant SharmaSubham PandeyNo ratings yet

- 360 Degree Financial Planning (Bajaj Capital LTD)Document47 pages360 Degree Financial Planning (Bajaj Capital LTD)Asin Ganguly100% (1)

- Comapany Profile Anandrathi GroupDocument25 pagesComapany Profile Anandrathi GroupNikhil BoggarapuNo ratings yet

- Pnjdent: Prudent Advisory Services LTDDocument20 pagesPnjdent: Prudent Advisory Services LTDDasari PrabodhNo ratings yet

- Final Year Bba STR of AllDocument63 pagesFinal Year Bba STR of Allharshchhikara983No ratings yet

- College ProjectDocument55 pagesCollege ProjectMasood RazaNo ratings yet

- A Report O2Document51 pagesA Report O2gurjit20100% (1)

- ProjectDocument27 pagesProjectRavi Prakash TiwariNo ratings yet

- Summer Training Report ON A Study On Commodities Future Trading AT Religare Commodities LTDDocument65 pagesSummer Training Report ON A Study On Commodities Future Trading AT Religare Commodities LTDkjrajdasNo ratings yet

- Annual Report 2012-13Document45 pagesAnnual Report 2012-13Hardik RupareliaNo ratings yet

- Kiran Sharma - CV PDFDocument3 pagesKiran Sharma - CV PDFKiran SharmaNo ratings yet

- Finance Project Report On Commodity MarketDocument67 pagesFinance Project Report On Commodity MarketSaket VermaNo ratings yet

- Annual Report 2014Document103 pagesAnnual Report 2014asimsquareNo ratings yet

- Rajat Dhar LinkedinProfileDocument4 pagesRajat Dhar LinkedinProfileFinogent AdvisoryNo ratings yet

- Shriram Transport Finance Company Limited Is IndiaDocument9 pagesShriram Transport Finance Company Limited Is IndianithinzeNo ratings yet

- Financial Services Provided by Anand RathiDocument35 pagesFinancial Services Provided by Anand RathisokajiNo ratings yet

- Corp Prestn OIADocument65 pagesCorp Prestn OIARohan MalandkarNo ratings yet

- Investment Decision and Portfolio ManagementDocument35 pagesInvestment Decision and Portfolio ManagementradhikaNo ratings yet

- FM - MarvadiDocument83 pagesFM - Marvadijagrutisolanki01No ratings yet

- Brochure - Indian Accounting Standard (6th September 2019)Document5 pagesBrochure - Indian Accounting Standard (6th September 2019)Mehar BhagatNo ratings yet

- Research Report For The Month of Feb23-1Document20 pagesResearch Report For The Month of Feb23-1Ranjan SharmaNo ratings yet

- Internship ReportDocument54 pagesInternship ReportKeerat KhoranaNo ratings yet

- Brochure16September2022Document5 pagesBrochure16September2022madhav agarwalNo ratings yet

- Sapm 2 Total 90 PagesDocument91 pagesSapm 2 Total 90 PagesPochender VajrojNo ratings yet

- Marketing of Mutual Funds and Its InsightsDocument48 pagesMarketing of Mutual Funds and Its InsightsKeshav GuptaNo ratings yet

- Employee Retention - Challenges & StratagiesDocument84 pagesEmployee Retention - Challenges & StratagiesArvind MahandhwalNo ratings yet

- Rohit Mudnal A - 53 (Black Book)Document65 pagesRohit Mudnal A - 53 (Black Book)AtharvaNo ratings yet

- 02 NBFC - Tata CapitalDocument354 pages02 NBFC - Tata CapitalNaeem FastNo ratings yet

- NAME: SME Business Synergies India (P) LTD.: Envc Alliance UniveristyDocument7 pagesNAME: SME Business Synergies India (P) LTD.: Envc Alliance UniveristyJatin SahnanNo ratings yet

- FinalDocument17 pagesFinalShan MohammedNo ratings yet

- Company ProflieDocument4 pagesCompany ProflieKALERU.SINDHU 21111322No ratings yet

- Nitin Mahinder & Associates: Chartered AccountantsDocument14 pagesNitin Mahinder & Associates: Chartered AccountantsNMA NMANo ratings yet

- Sviet Deepak SharekhanDocument84 pagesSviet Deepak Sharekhanindian0018No ratings yet

- Birla Sun Life Mutual FundDocument75 pagesBirla Sun Life Mutual FundManjunath@116No ratings yet

- Green Bond Market Survey for Thailand: Insights on the Perspectives of Institutional Investors and UnderwritersFrom EverandGreen Bond Market Survey for Thailand: Insights on the Perspectives of Institutional Investors and UnderwritersNo ratings yet

- Area's Largest Executive Search Firms Area's Largest Executive Search FirmsDocument1 pageArea's Largest Executive Search Firms Area's Largest Executive Search FirmspankajdNo ratings yet

- I Cai Official DirectoryDocument278 pagesI Cai Official DirectorypankajdNo ratings yet

- Alexander HughesDocument24 pagesAlexander HughespankajdNo ratings yet

- A Blue Print For An Information Technology Park in MoldovaDocument23 pagesA Blue Print For An Information Technology Park in MoldovaruwanegoNo ratings yet

- A Literature Review On Investors Perception TowarDocument227 pagesA Literature Review On Investors Perception Towartilak kumar vadapalliNo ratings yet

- Market Awareness of Brand Aditya Birla Money LTD'Document61 pagesMarket Awareness of Brand Aditya Birla Money LTD'ALI0911No ratings yet

- Asset Management OverviewDocument23 pagesAsset Management OverviewfaiyazadamNo ratings yet

- L7 Private EquityDocument35 pagesL7 Private EquityDeepak Kumar SubudhiNo ratings yet

- Ambit Insight 2013Document32 pagesAmbit Insight 2013Ishpal SinghNo ratings yet

- HSBC STG IB League 2022 Case StudyDocument13 pagesHSBC STG IB League 2022 Case StudyGrimoire HeartsNo ratings yet

- Diamond Business BuilderDocument2 pagesDiamond Business BuilderLouis du ToitNo ratings yet

- Brochure - Columbia - Private - Equity - 25 - August - 2020 - V10 2Document11 pagesBrochure - Columbia - Private - Equity - 25 - August - 2020 - V10 2sam_schwartz_7No ratings yet

- Entrep Learning Module 5 and 6Document13 pagesEntrep Learning Module 5 and 6ChristyNo ratings yet

- Finance Zutter CH 1 4 REVIEWDocument112 pagesFinance Zutter CH 1 4 REVIEWMarjorie PalmaNo ratings yet

- Board 3.0 Gilson:GordonDocument15 pagesBoard 3.0 Gilson:GordonMary LandNo ratings yet

- Resurgent India Limited Weekly Newsletter Aug 13 2010Document5 pagesResurgent India Limited Weekly Newsletter Aug 13 2010Udrrek Vikram DharnidharkaNo ratings yet

- Taylor Root - Hong Kong Private Practice 2022Document9 pagesTaylor Root - Hong Kong Private Practice 2022Edmund ThamNo ratings yet

- Capital Iq MaterialDocument38 pagesCapital Iq MaterialMadan MohanNo ratings yet

- IIMB Alumni Magzin Final - 16!05!2011Document48 pagesIIMB Alumni Magzin Final - 16!05!2011Sridhar DPNo ratings yet

- PHD Thesis On Venture Capital in IndiaDocument8 pagesPHD Thesis On Venture Capital in Indiachristinavaladeznewyork67% (3)

- Nomura BrochureDocument2 pagesNomura BrochureSteven VandewieleNo ratings yet

- Credit Suisse Single Family Index 2022Document24 pagesCredit Suisse Single Family Index 2022Scarlett TaiNo ratings yet