Professional Documents

Culture Documents

MAS - First Pre-Board 2014-15 With Solutions

Uploaded by

Aj de Castro0 ratings0% found this document useful (0 votes)

451 views6 pagesmas

Original Title

MAS - First Pre-board 2014-15 With Solutions

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmas

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

451 views6 pagesMAS - First Pre-Board 2014-15 With Solutions

Uploaded by

Aj de Castromas

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 6

BALIUAG UNIVERSITY

CPA REVIEW 2013-14

MANAGEMENT ADVISORY MANAGEMENT FIRST PRE-BOARD

JACF

EXAM

__________________________________________________________________________________________________

1.

Answer: C

Oct.

Nov.

Dec.

Sales

200,000

210,000

220,500

Beginning inventory

(150,000)

(168,000)

(176,400)

Ending inventory: (210,000 x 80%)

168,000

(220,500 x 80%)

176,400

(220,500 x 1.05 x 80%)

______

______

185,220

Required production

218,000

218,400

229,320 =

665,700

2.

Amswer: C Nyclyn: 24 / 0.80 x 15

=

450

Salex: 19.2 / 0.80 x 21 =

504

Protet: 10 x 28

=

280

1,234

3.

Answer: D Spending: (AT x AVR) (AT x SVR)

[53,500 x (P315,000 / 53,500)] [(53,500 x (P3,600,000 / 600,000)]

P315,000 P321,000 = 6,000 F

Efficiency: (AT x SVR) (ST x SVR)

P321,000 [(26,000 units x 2 DLH) x P6] = 9,000 U

4.

Answer: C

Fixed Spending: (AFxOH BFxOH)

P260,000 (P3,000,000 / 12) = 10,000 U

Fixed Volume: [BFxOH (ST x SFxOH)]

P250,000 (26,000 x 2 x P5) = 10,000 F

5.

Answer: B

Budgeted Fixed Overhead

=

P108,000

Less: Std. Time x Std. Fixed Overhead: [24,000 x (108,000 / 27,000)

=

96,000

Unfavorable volume variance

P

12,000

6.

Answer: D

Variable production cost: Total variable cost variable selling expense

(50,000 30,000) = 20,000

Unit VC: (20,000 / 20,000) + (30,000 / 12,000) = 3.5

Variable income = 12,000 (12 -3.5) 100,000 = 2,000

7.

Answer: D

Variable costing: 7,000 [(22,500 / 7,500) + (30,000 / 7,500) + 2] = P63,000

Absorption costing: 7,000 [(22,500 / 7,500) + (30,000 / 7,500) + 2 + (40,000 /

8,000)] + 2,500* = P100,500

*Capacity (volume) variance: (NP AP) FFOH / u = (8,000 7,500) 5 = 2,500 U

8.

Answer: A

Absorption Costing: (25 16) 16,000 64,000 = 80,000 + 8,000 F** - 12,000 UF

= P76,000

** Favorable: Actual production > Normal Production

9.

BALIUAG UNIVERSITY

CPA REVIEW 2013-14

MANAGEMENT ADVISORY MANAGEMENT FIRST PRE-BOARD

JACF

EXAM

__________________________________________________________________________________________________

Answer: B

Relevant Cost to Make

Relevant Cost to Buy

Purchase price

P60

DM

P 6

DL

30

VOH

12

Relevant FOH

9

P57

P60

X no. of units

20,000

20,000

1,140,000

1,200,000 =

60,000

+ Savings

25,000

Relevant cost that would be saved

85,000

10.

Answer: A

PM

PR

SP/u

P50

P75

VC/u:

DM

26

38

DL

10

18

FOH

8

11

CM/u

P 6

P 8

Multiply by units produced / hr.

3

2

CM/hr.

P18

P16

Multiply by no. of hrs. available

2,000

Max. CM

36,000

11.

Answer: C (16 - 8) 4,000 = (18 8) X

x = 3,200 units

12.

Answer:

Sales (P4,000,000 x 162.5%)

P6,500,000

Less: Costs and Expenses:

Materials and labor

P4,000,000

Operating costs

1,500,000

5,500,000

Net income before tax

P1,000,000

Less: Income tax 35%

350,000

Net income

P 650,000

P650,000 / P6,500,000 = 10%

13.

Answer: Rate of return on average total assets is net income divided by average total assets

P650,000 / P2,600,000 = 25%

14.

Answer: P6,500,000 / P2,600,000 = 2.5 times

15.

Answer: Average total assets

P2,600,000

Less: Loan payable

520,000

Stockholders equity

P2,080,000

P650,000 / P2,080,000 = 31.25%

16.

Answer: D

17.

[(34,000 4,000) 21,000] / (50,000 20,000) = .30

Chk: Y = (15,000 +4,000) + .30(30,000)

BALIUAG UNIVERSITY

CPA REVIEW 2013-14

MANAGEMENT ADVISORY MANAGEMENT FIRST PRE-BOARD

JACF

EXAM

__________________________________________________________________________________________________

Answer: C

y = a + bx or

a = y bx

(230,000 50,000b) 1.25 = 280,000

60,000b

287,500 62,500b = 280,000 60,000b

=

b=3

18.

Answer: A

CMR = FxC / BES

CMR = FxC BES = 78,750 (975,000 750,000) = 35%

BES: FxC CMR

FxC = BES x CMR = 975,000 (35%) = 341,250

19.

Answer: B

CMR x MSR = NPR 20% x 33.33% = 6.67%

S= 5,000 6.67% = 75,000

CM = 15,000

FC = 10,000 BES =

50,000

20.

a

21.

b

22.

Answer: D

(4,000 3,525 75) / (625 + 1,775) = 16.67%

23.

C

24.

Answer: C

2,000,000 = (30M COST) 15% (1.8M + 17.2M) = P25.15M

25.

A

26.

Answer: B

Costs (cash outflows): 50,000 + 2,000

= P52,000

Savings (cash inflows): 11,000 + 0.35 (15,000 11,000) + 2,000 (1-0.35) =

(13,700)

P38,300

27.

Answer: C

28.

B

29.

Answer: D

Required: The cost estimation method that should be used to generate a function expressed

as Y=a+bX

Discussion: Regression analysis can be used to find an equation for the linear relationship

among variables. However, multiple regression is not used to generate an equation of the

type Y=a+bX because multiple regression has more than one independent variable. In other

words, a multiple regression equation would take the form:Y=a+bX1+cX2+dX3n . . .

30.

Answer: B

Required : The actual finished goods ending inventory using absorption costing.

Discussion : Under the absorption method unit cost is P30 (P12 direct materials+P9 direct

labor+ P4 variable overhead + P5 fixed overhead). Given beginning inventory of 35, 000

units, the ending inventory equals 40,000 units (35,000 BI + 130, 000 produced 125, 000

sold. Hence, ending inventory was P1, 200, 000 (P30x40, 0000 units).

31.

Answer : C

Required: The actual finished goods ending investment using variable costing.

Discussion : Using variable costing, the unit cost of ending inventory is P25 (P12 direct

materials + P9 direct labor + P4 variable overhead). Given beginning inventory 35, 000 units,

the ending inventory equals 40, 000 units (35, 000 PI + 130, 000 produced 125, 000 sold).

Thus, ending inventory was P1, 000, 000 (P25x 40, 000)

32.

Answer : A

Required: The true statement comparing absorption costing and variable costing income.

Discussion: Absorption costing results in a higher income figure than variable costing

capitalizes some fixed factory overhead as part of inventory. These cost are expensed during

the period incurred under variable costing. Consequently, variable costing recognizes greater

BALIUAG UNIVERSITY

CPA REVIEW 2013-14

MANAGEMENT ADVISORY MANAGEMENT FIRST PRE-BOARD

JACF

EXAM

__________________________________________________________________________________________________

expenses and lower income because some fixed costs of previous periods absorbed by the

beginning inventory are expensed in the current period is never burdened with fixed costs of

previous periods

33.

A

34.

D

35.

A

36.

B

Required: The difference between absorption costing and variable costing income

Discussion : The difference is caused by the capitalization of some of the fixed manufacturing

overhead. When inventories increase during the periods, the absorption method capitalizes

that overhead and transfer it to future periods. The variable costing method expenses it in the

current period. Inventories increased by 5, 000 units during the period, and each of those

units would have included P5 of fixed manufacturing overhead under absorption costing.

Accordingly, P25, 000 of fixed manufacturing overhead would have been capitalized.

Recognizing P25, 000 of fixed cost in the balance sheet instead of the income statement

results in a P25, 000 difference in income between the two costing methods.

37.

B

Discussion: The production control supervisor has the most control over the material usage

variance. The material usage variance measures the excess amount of materials used over

the amount specified in the standards. The materials usage (or material quantity) variance,

when unfavorable, is often attributable to waste, shrinkage, or theft in the production areas.

The excess usage occurs under the supervision of the production department.

38.

D

39.

C

40.

Answer B

41.

C

42.

D

43.

Answer: D

44.

D

45.

B

46.

B

47.

A

48.

A

49.

D

50.

A

51.

D

52.

The primary objective of management accounting is C

53.

Which of the following is true of managerial accounting rather than financial accounting?

D

54.

B

55.

In a broad sense, cost accounting can be defined within the accounting system as C

56.

Traditional managerial accounting systems are often criticized for A

57.

Strategic cost management has emerged from a blending of D

58.

Answer: D

Processing hours per unit: XY 7:

0.75 / 1 = 0.75 or 45 minutes

BD 4: 0.20 / 1 = 0.20 or 12 minutes

Additional contribution margin using 100,000 hours: XY 7:

100,000 / 0.75 x P1 =

P133,333

BD 4: 100,000 / 0.20 x P0.50 = P250,000

59.

Answer: B

BALIUAG UNIVERSITY

CPA REVIEW 2013-14

MANAGEMENT ADVISORY MANAGEMENT FIRST PRE-BOARD

JACF

EXAM

__________________________________________________________________________________________________

Units sold to earn P1M = (1,000,000 + 1,000,000) / 5.25 = 380,952

The use of P1M fixed costs will require 380,952 units which are within the first range.

60.

Answer: C

Std. unit cost: Variable (7,000,000 x 0.60) / 140,000

P30

Fixed OH (11,200,000 x 0.50) / 160,000

35

Std. unit cost

P65

61.

Answer: B

Budgeted fixed overhead (30,000 x 2)

60,000

Applied FOH (25,000 x 2)

50,000

Unfavorable volume variance

10,000

62.

The best characterization of an opportunity costs is that it is A

63.

Answer: C

Direct material

2.00

Direct labor

2.40

Variable overhead

1.60

Avoidable marketing cost (0.7 x 2.50) 1.75

Relevant cost to make

7.75

The maximum purchase price, if ever the company has to decide buying the product, is P6.75.

Any amount higher than P6.75 will necessarily increase the unit cost of the product.

64.

Answer: D

Direct materials

4.50

Direct labor

10.00

Variable overhead

3.00

Variable selling expense

1.00

Additional profit (40,000 / 5,000)

8.00

Required selling price

26.50

65.

Which of the following statement is true? A

66.

Answer: C

Before-tax cash flow

100,000

Less annual depreciation (500,000 / 8)

62,500

Book income before tax

37,500

Less income tax (37,500 x 0.3)

11,250

Net book income

26,250

Add back depreciation

62,500

Annual after-tax cash inflow

88,750

Alternative computation for ATCF: (100,000 x .70) + (62,500 x .30) = P88,750

Computation of net present value:

PV of ATCF: 88,750 x 5.747

510,046

PV of after-tax salvage value: 20,000 x 0.70 x 0.54

7,560

Total

517,606

Investment

500,000

Net present value

17,606

The problem assumed that the salvage value is ignored in the computation of annual

depreciation so that the annual cash inflows will be greater. The problem did not include

among the choices the assumption that salvage value will be deducted from the cost in

computing the amount of annual depreciation.

67.

BALIUAG UNIVERSITY

CPA REVIEW 2013-14

MANAGEMENT ADVISORY MANAGEMENT FIRST PRE-BOARD

JACF

EXAM

__________________________________________________________________________________________________

Answer: D

The amount of investment: the PV of annuity at IRR = 4.355 x 6,000 =

26,130

68.

Answer: A

Annual sales 360 days x 100,000

36.0M

Inventory turnover 36M / 5M

7.2x

Inventory conversion period 360 / 7.2 = 50.0 days

69.

70.

Answer: B Since the expected value is positive, the company should expect to make a profit if

the product is introduced. Given the relationship between stock age and stock quality, the

number regarding the age of the inventory for specific qualities are irrelevant. Accordingly, one

would expect that the proportion of low- quality items among those aged 6 12 months would be

the same as the proportion for the entire sample (30 / 130 = 23%). The expected number of lowquality items aged 6 12 months is 10.4 (45 x 23%).

END

1

2

3

4

5

6

7

8

9

1

0

Theor

y of

Accou

nts Set B

(Mock

Board)

1

A

1

1

A

2

1

A

3

1

B

4

1

C

5

1

A

6

1

B

7

1

B

8

1

A

9

2

B

0

C

A

D

A

C

B

D

A

A

C

2

1

2

2

2

3

2

4

2

5

2

6

2

7

2

8

2

9

3

0

A

A

C

A

B

D

D

C

B

D

3

1

3

2

3

3

3

4

3

5

3

6

3

7

3

8

3

9

4

0

4

D 1

4

B 2

4

D 3

4

B 4

4

D 5

4

B 6

4

B 7

4

B 8

4

A 9

5

D 0

D

D

A

D

D

D

C

D

C

D

5

1

5

2

5

3

5

4

5

5

5

6

5

7

5

8

5

9

6

0

D

C

C

B

C

D

D

D

A

C

6

1

6

2

6

3

6

4

6

5

6

6

6

7

6

8

6

9

7

0

C

B

C

B

D

A

B

D

C

D

7

1

7

2

7

3

7

4

7

5

7

6

7

7

7

8

7

9

8

0

B

C

D

B

C

A

B

C

D

B

8

1

8

2

8

3

8

4

8

5

8

6

8

7

8

8

8

9

9

0

91

92

93

94

95

96

97

98

99

10

0

You might also like

- Ccabeg Case Studies Accountants Public PracticeDocument20 pagesCcabeg Case Studies Accountants Public PracticeAj de CastroNo ratings yet

- Case of Unidentified IndustriesDocument5 pagesCase of Unidentified IndustriesRNo ratings yet

- Solution - Handout - Cash and Cash Equivalents - Inclusions and ExclusionsDocument5 pagesSolution - Handout - Cash and Cash Equivalents - Inclusions and ExclusionsMaricon BerjaNo ratings yet

- Part 4C Quantitative Methods For Decision Analysis 354Document102 pagesPart 4C Quantitative Methods For Decision Analysis 354AshNor RandyNo ratings yet

- Far Eastern University Department of Accountancy & Internal Auditing Intermediate Accounting 1 Midterm Grading PeriodDocument8 pagesFar Eastern University Department of Accountancy & Internal Auditing Intermediate Accounting 1 Midterm Grading PeriodJOSCEL SYJONGTIANNo ratings yet

- Persons Who Give Contribution To SociologyDocument4 pagesPersons Who Give Contribution To SociologyAj de Castro100% (1)

- VAT Computation Part 2 GuideDocument2 pagesVAT Computation Part 2 GuideNe BzNo ratings yet

- Managerial Accounting Exercises Chapter 12Document6 pagesManagerial Accounting Exercises Chapter 12Angelica Lorenz100% (1)

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- 04sol-Investments WB 1stDocument21 pages04sol-Investments WB 1stNJ SyNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Forms of Receivable FinancingDocument3 pagesForms of Receivable FinancingVillaruz Shereen MaeNo ratings yet

- RMYC Cup 2 - RevDocument9 pagesRMYC Cup 2 - RevJasper Andrew AdjaraniNo ratings yet

- Accounting for investmentsDocument3 pagesAccounting for investmentsCrissette RoslynNo ratings yet

- Article 1599Document9 pagesArticle 1599Yvonne Kristine EstacioNo ratings yet

- Auditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DDocument14 pagesAuditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DKim Cristian MaañoNo ratings yet

- Assessment Current LiabilitiesDocument6 pagesAssessment Current LiabilitiesEdward Glenn BaguiNo ratings yet

- AIS Chapter 7Document2 pagesAIS Chapter 7Rosana CabuslayNo ratings yet

- Aud ProbDocument9 pagesAud ProbKulet AkoNo ratings yet

- Mahusay Acc3112 Major Output 2Document2 pagesMahusay Acc3112 Major Output 2Jeth Mahusay100% (1)

- Practical Accounting 1Document13 pagesPractical Accounting 1Sherrizah Ferrer MaribbayNo ratings yet

- The Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. AuditorDocument2 pagesThe Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. Auditoraccounts 3 lifeNo ratings yet

- INVENTORY COSTSDocument271 pagesINVENTORY COSTSshiwoshiwoNo ratings yet

- Accounting for Property, Plant and Equipment (ProblemsDocument4 pagesAccounting for Property, Plant and Equipment (ProblemsMina ChouNo ratings yet

- Assignment 1 Caro Coleen Sec27Document2 pagesAssignment 1 Caro Coleen Sec27Alyssa TordesillasNo ratings yet

- Quiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresDocument8 pagesQuiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresCassandra MarieNo ratings yet

- UCP: CVP Analysis and ExercisesDocument10 pagesUCP: CVP Analysis and ExercisesDin Rose GonzalesNo ratings yet

- 3 - Discussion - Joint Products and ByproductsDocument2 pages3 - Discussion - Joint Products and ByproductsCharles TuazonNo ratings yet

- Bl2: The Law On Private Corporation Final Examination General InstructionsDocument4 pagesBl2: The Law On Private Corporation Final Examination General InstructionsShaika HaceenaNo ratings yet

- Capstone Theory & ProblemDocument10 pagesCapstone Theory & ProblemAia SmithNo ratings yet

- Banking Assignment No. 4Document3 pagesBanking Assignment No. 4Rossette AnasarioNo ratings yet

- Auditing Theory ReviewerDocument3 pagesAuditing Theory ReviewerZtrick 1234No ratings yet

- Gross Profit Method Estimates InventoryDocument18 pagesGross Profit Method Estimates InventoryRigine Pobe MorgadezNo ratings yet

- ACC117-CON09 Module 3 ExamDocument16 pagesACC117-CON09 Module 3 ExamMarlon LadesmaNo ratings yet

- Answered - BCD Company Offer Its Investors Option - BartlebyDocument1 pageAnswered - BCD Company Offer Its Investors Option - BartlebyTrisha AgraamNo ratings yet

- Financial Management - Part 1 For PrintingDocument13 pagesFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasNo ratings yet

- Far - QuizDocument3 pagesFar - QuizRitchel CasileNo ratings yet

- Cost Accounting for Scrap, Spoilage, Defective, and ReworkDocument2 pagesCost Accounting for Scrap, Spoilage, Defective, and ReworkMartin Quing100% (1)

- Cup 3 Questions Answer KeyDocument34 pagesCup 3 Questions Answer KeyDenmarc John AragosNo ratings yet

- Chapter 4Document65 pagesChapter 4NCTNo ratings yet

- Accounting for Business Combinations Midterm Exam ReviewDocument4 pagesAccounting for Business Combinations Midterm Exam ReviewMica Ella San DiegoNo ratings yet

- Consumer Product Quality and SafetyDocument30 pagesConsumer Product Quality and SafetykrstnkyslNo ratings yet

- The Following Questions Might Be Addressed When An Auditor Is Completing An Internal Control QuestionDocument1 pageThe Following Questions Might Be Addressed When An Auditor Is Completing An Internal Control QuestionSomething ChicNo ratings yet

- 04 CVP AnswerDocument36 pages04 CVP AnswerjoyjoyjoyNo ratings yet

- Gilbert Manufacturing Company Budgets for 2019 and 2020Document69 pagesGilbert Manufacturing Company Budgets for 2019 and 2020lov3m3100% (2)

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsJohn kyle Abbago100% (2)

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- Fedillaga Case13Document19 pagesFedillaga Case13Luke Ysmael FedillagaNo ratings yet

- Departmentalized Factory OverheadDocument10 pagesDepartmentalized Factory Overheadhae1234No ratings yet

- Understanding Inventory Valuation and ReportingDocument57 pagesUnderstanding Inventory Valuation and ReportingA. MagnoNo ratings yet

- Peacock Co Trial Balance Fire Loss ProblemDocument2 pagesPeacock Co Trial Balance Fire Loss ProblemmhikeedelantarNo ratings yet

- Seatwork For BA202.SaturdayDocument2 pagesSeatwork For BA202.SaturdayMelcanie Tiala YatNo ratings yet

- MAS - 1416 Profit Planning - CVP AnalysisDocument24 pagesMAS - 1416 Profit Planning - CVP AnalysisAzureBlazeNo ratings yet

- Intermediate Accounting 1 WeekDocument32 pagesIntermediate Accounting 1 Weekimsana minatozakiNo ratings yet

- Seatwork CH3&4Document2 pagesSeatwork CH3&4Jemely Bagang100% (1)

- Test 3Document2 pagesTest 3Kim LimosneroNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- F2 Mock2 AnsDocument8 pagesF2 Mock2 AnsHajra Zahra0% (1)

- EXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsDocument37 pagesEXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsAnonymous Lih1laaxNo ratings yet

- MAS Answer Key SolutionDocument6 pagesMAS Answer Key SolutionJonalyn JavierNo ratings yet

- UntitledDocument11 pagesUntitledBipin Kumar JhaNo ratings yet

- Learning Guide No. 3 - AnswersDocument10 pagesLearning Guide No. 3 - AnswersXaivri Ylaina VrieseNo ratings yet

- ToaDocument14 pagesToaAj de CastroNo ratings yet

- NFJPIA Christmas Photo Contest RulesDocument7 pagesNFJPIA Christmas Photo Contest RulesAj de CastroNo ratings yet

- Seize A Partner .And Never Be .: RightDocument1 pageSeize A Partner .And Never Be .: RightAj de CastroNo ratings yet

- QuestionnaireDocument1 pageQuestionnaireAj de CastroNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and Errors AND OTHER INCOME Cash Flows and Sme'SDocument1 pageAccounting Policies, Changes in Accounting Estimates and Errors AND OTHER INCOME Cash Flows and Sme'SAj de CastroNo ratings yet

- Direct and Absorption Costing 2014Document15 pagesDirect and Absorption Costing 2014Aj de CastroNo ratings yet

- Financial Instruments NaDocument6 pagesFinancial Instruments NaAj de CastroNo ratings yet

- Baliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillDocument7 pagesBaliuag University: It Is Not Enough That We Do Our Best Sometimes We Must Do What Is Required. - Winston ChurchillAj de CastroNo ratings yet

- BALIUAG UNIVERSITY CPA REVIEW 2014-15 STANDARD COST AND VARIANCE ANALYSISDocument10 pagesBALIUAG UNIVERSITY CPA REVIEW 2014-15 STANDARD COST AND VARIANCE ANALYSISAj de CastroNo ratings yet

- Auditing Problems, Theory of Accounts & Practical Accounting 1 Auditing Problems Theory of Accounts Practical Accounting 1 Audit of CashDocument5 pagesAuditing Problems, Theory of Accounts & Practical Accounting 1 Auditing Problems Theory of Accounts Practical Accounting 1 Audit of CashAj de CastroNo ratings yet

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument34 pagesChapter I - Definitions SEC. 22. Definitions - When Used in This TitleAj de CastroNo ratings yet

- Day 0 and Day 1 schedule for JPIA conferenceDocument4 pagesDay 0 and Day 1 schedule for JPIA conferenceAj de CastroNo ratings yet

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroNo ratings yet

- Finish PreDocument2 pagesFinish PreAj de CastroNo ratings yet

- Safeguards in An Accounting EnvironmentDocument2 pagesSafeguards in An Accounting EnvironmentAj de CastroNo ratings yet

- Brief Guidelines and ProceduresDocument5 pagesBrief Guidelines and ProceduresAj de CastroNo ratings yet

- Rizal NotesDocument2 pagesRizal NotesAj de CastroNo ratings yet

- Task Delegation MycDocument2 pagesTask Delegation MycAj de CastroNo ratings yet

- Multicolore PDFDocument1 pageMulticolore PDFAj de CastroNo ratings yet

- NFJPIA Region 3 Council Election RulesDocument10 pagesNFJPIA Region 3 Council Election RulesAj de CastroNo ratings yet

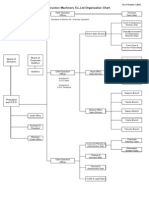

- Itochu Construction Machinery Co.,Ltd Organization Chart: Board of Directors Board of Corporate AuditorsDocument1 pageItochu Construction Machinery Co.,Ltd Organization Chart: Board of Directors Board of Corporate AuditorsAj de CastroNo ratings yet

- Business Ethics and Social ResponsibilityDocument17 pagesBusiness Ethics and Social ResponsibilityAj de CastroNo ratings yet

- Environmental Accounting Reaction PaperDocument3 pagesEnvironmental Accounting Reaction PaperAj de CastroNo ratings yet

- Hybrid Varieties PDFDocument1 pageHybrid Varieties PDFAj de CastroNo ratings yet

- VB CodeDocument7 pagesVB CodeAj de CastroNo ratings yet

- Estimator PDFDocument4 pagesEstimator PDFAj de CastroNo ratings yet

- Masinag Protocol For Palay PDFDocument1 pageMasinag Protocol For Palay PDFAj de CastroNo ratings yet

- Line 2020Document11 pagesLine 2020Mai NguyenNo ratings yet

- PPT10 - Creating Competitive Advantage - The Global Marketplace - and Sustainable MarketingDocument52 pagesPPT10 - Creating Competitive Advantage - The Global Marketplace - and Sustainable Marketingzahra mutiara sakaNo ratings yet

- Grain Distribution Risk MitigationDocument27 pagesGrain Distribution Risk MitigationWendy SugandaNo ratings yet

- Managerial Accounting 3rd Edition Whitecotton Solutions ManualDocument42 pagesManagerial Accounting 3rd Edition Whitecotton Solutions Manualsestetto.vitoe.d4rcv4100% (19)

- JP Morgan - Global Fixed Income Markets Weekly - March 9 2012Document56 pagesJP Morgan - Global Fixed Income Markets Weekly - March 9 2012john.gromalaNo ratings yet

- The Four Types of Market Structures: Perfect CompetitionDocument26 pagesThe Four Types of Market Structures: Perfect CompetitionAnnNo ratings yet

- Applied Eco Q4 Lesson 3Document11 pagesApplied Eco Q4 Lesson 3Alfred Jornalero CartaNo ratings yet

- The Use of Information System (Is) In: DelhiveryDocument3 pagesThe Use of Information System (Is) In: DelhiveryEsha GuptaNo ratings yet

- Business Oxford Unit 1Document36 pagesBusiness Oxford Unit 1remaselshazly76No ratings yet

- AVE ReportDocument32 pagesAVE ReportManoNo ratings yet

- Chap 11 Tanner - Setting Goals & Managing The Sales Force Performance 01 Feb 2017Document30 pagesChap 11 Tanner - Setting Goals & Managing The Sales Force Performance 01 Feb 2017NISAR AHMEDNo ratings yet

- Designing Services and Products for OperationsDocument206 pagesDesigning Services and Products for OperationsTIZITAW MASRESHANo ratings yet

- RiskCalc 3.1 WhitepaperDocument36 pagesRiskCalc 3.1 WhitepaperOri ZeNo ratings yet

- Marketing Strategy Internship ReportDocument37 pagesMarketing Strategy Internship ReportA H LabuNo ratings yet

- Craig Hallum Research Report - TEARDocument6 pagesCraig Hallum Research Report - TEARuser 80405No ratings yet

- MM Lectures CompleteDocument518 pagesMM Lectures CompleteVarunNo ratings yet

- Di PrelimsDocument3 pagesDi PrelimsBrock LesnerNo ratings yet

- Tuturial Three Without AnswersDocument3 pagesTuturial Three Without AnswersGhada SabryNo ratings yet

- HP-Compaq Deal Design QuestionsDocument4 pagesHP-Compaq Deal Design QuestionsAkshay JoshiNo ratings yet

- I-Great Damai - Product Info - 10012014Document9 pagesI-Great Damai - Product Info - 10012014MOHD AFIFI HASHIMNo ratings yet

- ch1 Acc WsDocument4 pagesch1 Acc WspranjalNo ratings yet

- 51 Checklist Buy BackDocument3 pages51 Checklist Buy BackvrkesavanNo ratings yet

- BM Faculties & CoursesDocument3 pagesBM Faculties & CoursesleylianNo ratings yet

- TechniumDocument14 pagesTechniumPeter ParkerNo ratings yet

- Maruti Suzuki Capital Budgeting Performance 2012-2022Document8 pagesMaruti Suzuki Capital Budgeting Performance 2012-2022Vaibhavi PatelNo ratings yet

- ISBPlacements Report 2023Document24 pagesISBPlacements Report 2023Gaurav RawatNo ratings yet

- Ent300 Assignment 3 Business Plan General Guidelines 2021Document18 pagesEnt300 Assignment 3 Business Plan General Guidelines 2021anisNo ratings yet

- Selam TenkoluDocument27 pagesSelam Tenkolutame kibruNo ratings yet

- LECTURE 4 PROBLEMS BOND AND STOCK VALUATIONDocument4 pagesLECTURE 4 PROBLEMS BOND AND STOCK VALUATIONDahniar AmalinaNo ratings yet