Professional Documents

Culture Documents

Social Protection & Microinsurance - 0

Uploaded by

sagarsbhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Social Protection & Microinsurance - 0

Uploaded by

sagarsbhCopyright:

Available Formats

EA CONSULTANTS | SOCIAL PROTECTION AND MICROINSURANCE

Social

Protection &

Microinsurance

June 2013

EA CONSULTANTS | Access to Finance, Markets and Social Protection

MICROINSURANCE CENTRE: OCTOBER 2010

DECEMBER 2013

EA Consultants was contracted by the

MicroInsurance Centre to collaborate on

a major donors USD 2 million, threeyear project to provide clarity around

two key questions in the microinsurance

field Is there value for low income

people? and Is there a business case?.

The Microinsurance Learning and

Knowledge (MILK) project will study a

variety of microinsurance models and

products through quantitative and

qualitative research. It will seek to fill

some of the gaps in the current

understanding of client value and the

business case, while helping to bring

together the various parties involved in

microinsurance research.

CHALLENGES AND PRACTICES IN CONSUMER

PROTECTION. MICROINSURANCE NETWORK:

DECEMBER 2012 MARCH 2013

EA Consultants was contracted by the

Microinsurance Network to develop a

framework for understanding the main

challenges and practices in consumer

protection in microinsurance, with a

focus on identifying the key themes in

consumer protection in microinsurance.

The study was supported by two case

studies of consumer protection in

Colombia and the Philippines, as well as

examples of specific issues and

approaches drawn from outside these

two countries. The field-work included

extensive interviews with stakeholders

and client focus group interview to gain

insight into what are the effective

approaches to consumer protection. The

primary objective of this study was to

underline key lessons from the specific

practices in this relatively mature

microinsurance market.

ASEGURADORA RURAL: JANUARY 2012

DECEMBER 2012

EA Consultants has been contracted to

provide strategic guidance and coaching

to

Aseguradora

Rural

in

the

development of a basic low-cost health

EA Consultants, Tel:212-734-6461, e-mail: contactus@eac-global.com

Visit us at www.eac-global.com

Our Approach

Low- and middle-income countries often lack

the resources to provide their citizens with

sufficient safety nets and social services to

protect them from the devastating effects of

external shocks. In the absence of these public

programs, microinsurance can help the poor

mitigate risk. Yet, microinsurance is not just

about small policies. It involves tailoring

products and processes to a new, low-income

target while taking into account the demands of

the market.

The private sector can play a role in facilitating

this access. However, EA Consultants

recognizes that innovation in this field does not

only emanate to the private sector. Whether

through social security, microinsurance or other

programs, governments, donors and other

stakeholders can play an important role in

helping to mitigate the risk of vulnerable

populations. EA Consultants provides advisory

and research services to these stakeholders to

develop sustainable markets for microinsurance

products.

www.eac-global.com

EA CONSULTANTS | SOCIAL PROTECTION AND MICROINSURANCE

insurance product for low income

Guatemalans with a focus on microentrepreneurs and their families. The

project included a market study, product

design as well as marketing and sales

strategies with links to other banking

products.

MICROINSURANCE CENTRE: LANDSCAPE OF

MICROINSURANCE IN LATIN AMERICA.

FEBRUARY 2012 NOVEMBER 2012

EA Consultants mobilized a team of

local analysts to collect data of twentyone Latin American countries about the

availability of microinsurance products

in each country. The information

included an analysis of obstacles to

developing these markets as well as

current opportunities for the market. It

was part of an initiative with the

IADB/FMI to build their understanding of

the

opportunities

to

promote

microinsurance in the region.

MICROSERFIN: PANAMA. FEBRUARY 2012

OCTOBER 2012

EA

Consultants

worked

with

Microserfin, one of the largest

microfinance institutions in Panama and

part of the BBVA Development Group,

on developing a microinsurance strategy

and pilot project. The project included a

study of the market focused on the

evaluation of existing microfinance

opportunities and mechanisms for

overcoming the challenges low-income

clients of Microserfin may face. Such

challenges were determined through

background interviews with potential

clients. Furthermore, EA Consultants

reviewed the recent regulatory changes

in microinsurance to ensure that all

elements of the pilot project would be

feasible given the new restrictions and

regulations. Finally, our product design

integrated a branding strategy and the

commercialization of these products

across the existing agency infrastructure

through capacity building materials to

help and support

microinsurance.

2

the

sale

of

INISER NICARAGUA & INTERNATIONAL

LABOUR

ORGANIZATION

(ILO):

NICARAGUA. OCTOBER 2009 MARCH

2012

EA Consultants has been supporting

Nicaraguas largest insurance company

in conjunction with the ILO to develop

the first microinsurance program in

Nicaragua. The project involved an initial

feasibility study and the design of a

strategic program for microinsurance for

INISER. EA Consultants worked with

INISER to identify appropriate agent and

delivery channels, design an innovative

new product and assess the operational

and information systems needs of the

insurer and its potential agents. Our

team supported the roll out of the

product including the development of

marketing materials, training of loan

officers, operational backstopping and

the development of an IT interface. The

first insurance product in INISERs

portfolio included a strong gender

component, recognizing that women are

an important part of the microfinance

client portfolio, yet they are often most

vulnerable to adverse shocks.

CENTRAL

AMERICAN

MICROFINANCE

NETWORK (REDCAMIF): OCTOBER 2008

JULY 2011

EA Consultants partnered with the

Central American Microfinance Network

to design a microinsurance program for

the

networks

99

microfinance

institutions in the six countries where it

operates (Guatemala, El Salvador,

Honduras, Nicaragua, Costa Rica and

Panam). The initial activity involved a

diagnostic

mapping

of

existing

microinsurance programs in Central

America,

the

organization

and

leadership in a workshop for a

representative group of microfinance

institutions in the region and the

EA Consultants, Tel:212-734-6461, e-mail: contactus@eac-global.com

conceptual development and design of a

program.

EA

Consultants

also

supported REDCAMIF in its early stages

of seeking funding for the program as

well as in an effort to promote

awareness of microinsurance in the

region through network meetings and a

first annual Microinsurance Forum for

Central America.

FONDO DE SOLIDARIDAD E INVERSIN

SOCIAL (FOSIS) AND INTERNATIONAL

LABOUR ORGANIZATION/MICROINSURANCE

INNOVATION FACILITY (ILO/MIF): CHILE.

JUNE 2010 APRIL 2011

EA Consultants collaborated with

FOSIS with the support of the ILO/MIF in

the design of a support program for

microinsurance for micro and small

businesses in Chile. The project included

an analysis of current demand in the

country,

businesses

offering

microinsurance and a financial analysis.

Additionally, they conducted a study of

demand, consisting of analysis of

different segments of the target

population through mining data on the

current and potential microinsurance

clients, interviews with banking and

microfinance institutions, conducting

focus groups with micro and small

enterprises and surveys. The project

culminated in a product design and the

potential intervention of FOSIS in

helping assure the diffusion and

commercialization of this product.

INTERNATIONAL LABOUR ORGANIZATION,

MICROINSURANCE INNOVATION FACILITY

(ILO/MIIF): FOSIS, CHILE. JUNE 2010

MARCH 2011

EA Consultants led an ILO team project

to support FOSIS, a development

agency in Chile and the Ministry of

Planning of the Government of Chile to

develop a microinsurance program. The

project includes extensive market

analysis of urban low income and

unemployed workers in Chile to develop

www.eac-global.com

EA CONSULTANTS | SOCIAL PROTECTION AND MICROINSURANCE

a series of appropriate micro insurance

products for these segments. The

products were linked to cash transfers,

savings and small microcredit loans to

facilitate delivery as well as the trust of

the potential customers. The work

included a supply side analysis of

existing mass market insurance products

and micro insurance products for the low

income segment, an analysis of

potential delivery channels and a

demand side analysis of customer

preferences and needs.

ASEGURADORA RURAL, GUATEMALA:

DECEMBER 2010 JANUARY 2011

EA Consultants was contracted to

provide strategic guidance and coaching

to

Aseguradora

Rural

in

the

development of a basic low cost health

insurance product for low income

Guatemalans with a focus on low

income and women and homemakers

through the holding companys large

distribution network, Banrural. The

strategic support activities included a

market study, product design, liaising on

cost and regulatory issues, supporting

marketing and strategy development.

Additionally, sales staff was trained with

ongoing coaching. The result was the

development of a womens cancer

prevention and coverage insurance; Vivo

Segura.

MICROINSURANCE INNOVATION FACILITY

(ILO/MIIF): GLOBAL. MAY 2010

SEPTEMBER 2010

EA Consultants worked with the ILOs

Microinsurance Innovation Facility to

undertake a comprehensive mapping of

existing migrant linked microinsurance

products worldwide. The purpose of the

study was to inform the ILO/MIIF and

the microinsurance community on

existing models aimed at broadening

access to microinsurance services by

offering these to migrants as well as to

offer recommendations for expanding

this access.

INTER-AMERICAN

DEVELOPMENT

BANK/MULTILATERAL INVESTMENT FUND

(IADB/MIF): MARCH 2010 SEPTEMBER

2010

EA Consultants worked with the

IADB/MIF on a two-part assessment of

the feasibility of a cross border

microinsurance product between Mexico

and the US. The project involved an

assessment of the supply of existing

products, including worldwide models

that can be replicated; the demand for

such products, through a market study

with Mexican migrants in the New York

City area; and an assessment of the legal

and regulatory barriers to these

products. The study looked to gain a

greater understanding of the health

claims characteristics of the informal

sector in Nicaragua as well as the health

outcomes on children covered by health

insurance and the role of quantity in the

utilization and retention in health

insurance.

MICROINSURANCE

CENTRE:

GLOBAL.

JANUARY 2010 MAY 2010

EA Consultants was contracted by the

MicroInsurance Centre to collaborate on

an evaluation team for a major donors

US$70 million grants in microinsurance

in India, Pakistan, the Philippines,

Tanzania, and Uganda among other

countries. The work resulted in a set of

strategic recommendations for future

contributions of this donor in the field. In

particular, EA Consultants focused on

the lessons that have been generated

from the grants and to what extent

these have been effective in bringing

interest and further investment in

microinsurance.

EA Consultants, Tel:212-734-6461, e-mail: contactus@eac-global.com

3

GLOBAL

DEVELOPMENT

NETWORK:

JANUARY 2007 MARCH 2009

EA Consultants implemented an

experimental randomized evaluation of

a pilot program in Nicaragua that

extends social security health insurance

to the informal sector. Through this pilot

program, Nicaraguas Social Security

Institute (INSS) contracted three

microfinance institutions: ACODEP,

Banco Procredit, and Findesa to market

its health insurance to their clients

affiliate new subscribers and to collect

payment through MFI branch networks.

CENTRAL

AMERICAN

MICROFINANCE

NETWORK (REDCAMIF): 2008 2009

EA Consultants provided advisory

services to train the Central American

Microfinance Network and its members

to better understand the microinsurance

business model. The advisory services

also supported the implementation of a

series of workshops and one large

conference. Furthermore, we helped

build up and train a commission of

REDCAMIF member representatives

from the six countries in which it

operates (Guatemala, El Salvador,

Honduras, Nicaragua, Costa Rica and

Panama). As part of the advisory

services we rendered, we performed

diagnostic

mapping

of

existing

microinsurance programs in Central

America.

FINCA INTERNATIONAL (FINCA MXICO):

APRIL 2007 JULY 2008

EA Consultants developed a proposal

for FINCA Mxico to pilot a program to

offer non-financial services to clients.

The preparatory work included an

analysis of client demand through focus

group interviews in two states: Hidalgo

and Puebla. The review also included an

assessment of the current credit

methodology and its compatibility with

providing non-financial services through

interviews with loan officers, branch

www.eac-global.com

EA CONSULTANTS | SOCIAL PROTECTION AND MICROINSURANCE

managers

and

FINCA

Mxico

management. It also included a review

of the public, private and NGO health

service infrastructure in two states that

drove the design of the pilot program

focused on demand generating activities

such as training in family health care. To

ensure the cost-effective delivery of

health training, EA Consultants

identified a specialized training institute,

IMIFAP and facilitated a strategic

partnership between them and FINCA

Mxico. The program was designed to

be self-sustaining over time, and will be

a part of the ongoing development of

financial products and services in health.

The pilot program will tie into FINCA

Mxicos ongoing efforts to develop new

client-focus products. EA Consultants is

assisting FINCA Mxico and FINCA

International in fundraising activities

related to the project.

FINCA UGANDA: APRIL 2007 JULY 2008

EA Consultants collaborated in the

design of an innovative financially

sustainable proposal to encourage a

strategic partnership between FINCA

Uganda and Microcare, a national health

insurance company in Uganda. This

provided micro-entrepreneurs at FINCA

Uganda with increased access to

healthcare.

NEW

YORK

UNIVERSITY-FORD

FOUNDATION: FEBRUARY 2007 MAY 2007

EA Consultants performed a rigorous

comprehensive strategic analysis of Pro

Mujer Nicaragua (PMN), a networked

microfinance institution that offers

financial and non-financial services to its

clients. The analysis focused on PMNs

provision of non-financial services.

EA Consultants, Tel:212-734-6461, e-mail: contactus@eac-global.com

www.eac-global.com

You might also like

- Major Economic Indicators: Monthly Update: Volume 11/2020 November 2020Document28 pagesMajor Economic Indicators: Monthly Update: Volume 11/2020 November 2020sagarsbhNo ratings yet

- MA Course InformationDocument17 pagesMA Course InformationTahmid RaajNo ratings yet

- Financial Performance Analysis of Selected Banks in Bangladesh: A Study On Islamic and Conventional BanksDocument16 pagesFinancial Performance Analysis of Selected Banks in Bangladesh: A Study On Islamic and Conventional BankssagarsbhNo ratings yet

- Agricultural Credit in Bangladesh 2Document14 pagesAgricultural Credit in Bangladesh 2sagarsbhNo ratings yet

- Agriculture and CMSME Finance: Chapter-9Document18 pagesAgriculture and CMSME Finance: Chapter-9sagarsbhNo ratings yet

- A Comparative Study of Liquidity Management of AnDocument20 pagesA Comparative Study of Liquidity Management of AnAngeLa Vajza RiaNo ratings yet

- Agricultural Credit in Bangladesh: Present Trend, Problems and RecommendationsDocument13 pagesAgricultural Credit in Bangladesh: Present Trend, Problems and RecommendationsTanzinaNo ratings yet

- An Overview of Overall Banking Sector. - An Overview of Agent BankingDocument1 pageAn Overview of Overall Banking Sector. - An Overview of Agent BankingsagarsbhNo ratings yet

- Dokumen - Tips - Academic Calendar Committee 2017 Bibmorgbd MD Ceo Agrani Bank Limited MD PDFDocument142 pagesDokumen - Tips - Academic Calendar Committee 2017 Bibmorgbd MD Ceo Agrani Bank Limited MD PDFsagarsbhNo ratings yet

- Academic Calendar Fall 2020-21Document2 pagesAcademic Calendar Fall 2020-21sagarsbhNo ratings yet

- Role of Banking-Sector To Inclusive GrowthDocument15 pagesRole of Banking-Sector To Inclusive GrowthsagarsbhNo ratings yet

- Academic Calendar Summer 2021 ModifiedDocument1 pageAcademic Calendar Summer 2021 ModifiedsagarsbhNo ratings yet

- BA in English Degree - Revised On 2018 - Linguisitcs Checklist 2015-2016Document1 pageBA in English Degree - Revised On 2018 - Linguisitcs Checklist 2015-2016sagarsbhNo ratings yet

- Bangladesh University of Business & Technology (Bubt) Program: BBA Semester: Spring, 2021 Course Code: Course Title: Course Instructor: OfficeDocument1 pageBangladesh University of Business & Technology (Bubt) Program: BBA Semester: Spring, 2021 Course Code: Course Title: Course Instructor: OfficesagarsbhNo ratings yet

- Cap 1Document74 pagesCap 1Mej Beit Chabab100% (1)

- MPRA Paper 33590 PDFDocument26 pagesMPRA Paper 33590 PDFsagarsbhNo ratings yet

- Significance of Credit Risk Management in Banking PDFDocument4 pagesSignificance of Credit Risk Management in Banking PDFsagarsbhNo ratings yet

- 61307754Document14 pages61307754sagarsbhNo ratings yet

- 8th Batch Brochure PDFDocument24 pages8th Batch Brochure PDFsagarsbhNo ratings yet

- PDFDocument24 pagesPDFsagarsbhNo ratings yet

- 15 BibliographyDocument5 pages15 BibliographysagarsbhNo ratings yet

- Academic CalenderDocument174 pagesAcademic Calendermaasum61No ratings yet

- DSBM PDFDocument22 pagesDSBM PDFsagarsbhNo ratings yet

- PDFDocument20 pagesPDFsagarsbhNo ratings yet

- DSBM PDFDocument22 pagesDSBM PDFsagarsbhNo ratings yet

- EMBM2019Document24 pagesEMBM2019sagarsbhNo ratings yet

- Embm Intake 2015 PDFDocument24 pagesEmbm Intake 2015 PDFsagarsbhNo ratings yet

- PDFDocument24 pagesPDFsagarsbhNo ratings yet

- 4ed6 PDFDocument1 page4ed6 PDFsagarsbhNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case ColorscopeDocument7 pagesCase ColorscopeRatin MathurNo ratings yet

- Art Integrated ProjectDocument14 pagesArt Integrated ProjectSreeti GangulyNo ratings yet

- Ethical Hacking IdDocument24 pagesEthical Hacking IdSilvester Dian Handy PermanaNo ratings yet

- Aircraft Wiring Degradation StudyDocument275 pagesAircraft Wiring Degradation Study320338No ratings yet

- OB and Attendance PolicyDocument2 pagesOB and Attendance PolicyAshna MeiNo ratings yet

- Previews 1633186 PreDocument11 pagesPreviews 1633186 PreDavid MorenoNo ratings yet

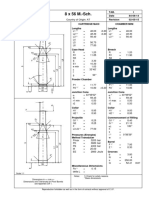

- 8 X 56 M.-SCH.: Country of Origin: ATDocument1 page8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimNo ratings yet

- Payment of Wages 1936Document4 pagesPayment of Wages 1936Anand ReddyNo ratings yet

- Department of Education: Raiseplus Weekly Plan For Blended LearningDocument3 pagesDepartment of Education: Raiseplus Weekly Plan For Blended LearningMARILYN CONSIGNANo ratings yet

- Law of AttractionDocument2 pagesLaw of AttractionKate SummersNo ratings yet

- Kallatam of Kallatar (In Tamil Script Tscii Format)Document78 pagesKallatam of Kallatar (In Tamil Script Tscii Format)rprabhuNo ratings yet

- Agenda - 2 - Presentation - MS - IUT - Thesis Proposal PPT Muhaiminul 171051001Document13 pagesAgenda - 2 - Presentation - MS - IUT - Thesis Proposal PPT Muhaiminul 171051001Tanvir AhmadNo ratings yet

- SHS G11 Reading and Writing Q3 Week 1 2 V1Document15 pagesSHS G11 Reading and Writing Q3 Week 1 2 V1Romeo Espinosa Carmona JrNo ratings yet

- Module 7 NSTP 1Document55 pagesModule 7 NSTP 1PanJan BalNo ratings yet

- DG Oil SpecificationDocument10 pagesDG Oil SpecificationafsalmohmdNo ratings yet

- Writ Petition 21992 of 2019 FinalDocument22 pagesWrit Petition 21992 of 2019 FinalNANDANI kumariNo ratings yet

- Libya AIP Part1Document145 pagesLibya AIP Part1Hitham Ghwiel100% (1)

- Philippine Education Deteriorating - EditedDocument3 pagesPhilippine Education Deteriorating - EditedRukimi Yamato100% (1)

- Investigation Data FormDocument1 pageInvestigation Data Formnildin danaNo ratings yet

- EP07 Measuring Coefficient of Viscosity of Castor OilDocument2 pagesEP07 Measuring Coefficient of Viscosity of Castor OilKw ChanNo ratings yet

- Fin Accounting IFRS 2e Ch13Document62 pagesFin Accounting IFRS 2e Ch13Nguyễn Vinh QuangNo ratings yet

- Pogon Lifta MRL PDFDocument128 pagesPogon Lifta MRL PDFMašinsko ProjektovanjeNo ratings yet

- Eje Delantero Fxl14 (1) .6Document2 pagesEje Delantero Fxl14 (1) .6Lenny VirgoNo ratings yet

- Bharti Airtel Strategy FinalDocument39 pagesBharti Airtel Strategy FinalniksforloveuNo ratings yet

- Ubicomp PracticalDocument27 pagesUbicomp Practicalvikrant sharmaNo ratings yet

- Learning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)Document6 pagesLearning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)NurulNo ratings yet

- Corelink Mmu600ae TRM 101412 0100 00 enDocument194 pagesCorelink Mmu600ae TRM 101412 0100 00 enLv DanielNo ratings yet

- New Presentation-Group AuditingDocument23 pagesNew Presentation-Group Auditingrajes wariNo ratings yet

- BV DoshiDocument6 pagesBV DoshiNimNo ratings yet

- Level of Organisation of Protein StructureDocument18 pagesLevel of Organisation of Protein Structureyinghui94No ratings yet