Professional Documents

Culture Documents

Pei 300 - Top 50 Pe Funds

Uploaded by

DonZ1063Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pei 300 - Top 50 Pe Funds

Uploaded by

DonZ1063Copyright:

Available Formats

TPG The Blackstone Group Kohlberg Kravis Roberts Goldman Sachs

Principal Investment Area The Carlyle Group CVC Capital Partners Apax

Partners Apollo Global Management Bain Capital Oaktree Capita

Management Hellman & Friedman General Atlantic Providence

Equity Partners Cerberus Capital Management Warburg Pincus

Advent International First Reserve Corporation Silver Lake Lone Sta

Funds Riverstone Holdings Leonard Green & Partners Thomas H. Lee

Partners Golden Gate Capital BC Partners JC Flowers & Co. Terra

Firma Capital Partners American Capital Teachers Private Capital NGP

Energy Capital Management Fortress Investment Group Clayton

Dubilier & Rice CPP Investment Board Bridgepoint PAI Partners AXA

Private Equity Mount Kellett Capital EQT Partners Marfin Investmen

Group EnCap Investments Abraaj Capital Citi Capital Advisors Onex

International Petroleum Investment Company Stone Point Capita

TA Associates Hony Capital Nordic Capital ArcLight Capital Partners

Equistone Partners Europe CDH Investments HitecVision AS JP

Morgan Asset Management Charterhouse Capital Partners American

Securities Capital Partners Mubadala Development Company

Summit Partners Tiger Global Management Avista Capital Partners

AlpInvest Partners Dubai International Capital MatlinPatterson Globa

Advisers GI Partners New Mountain Capital Kelso & Co. Denham

Capital Management Sun Capital Partners Ares Managemen

Lion Capital Investcorp Bank BSC Lindsay Goldberg Pamplona

Capital Management H.I.G. Capital Doughty Hanson Accel Partners

Berkshire Partners Vista Equity Partners WL Ross & Co. Welsh Carson

Anderson & Stowe Centerbridge Capital Partners Energy Capita

Partners Intermediate Capital Group Cinven Oak Hill Capital Partners

may 2012

private equity international

page 37

page 40

private equity international

may 2 012

pei 300

TPG still top of the class

Its a second consecutive year at the top

for TPG, whose remarkable fundraising

machine accumulated a cool $49.9 billion in the period covered by this years

PEI 300 ranking, down from $50.6 billion in 2001.

Diversification has been key to TPGs

success. Buyouts remain its strength but

if investors want growth capital, or venture, or even special situations,TPG led

by managing partner James Coulter has

a fund for them. Its also a genuinely global

operation: in addition to its traditional

strongholds of North America andWestern

Europe, it has been a trailblazer in emerging markets like Brazil, Russia and China.

Indeed, exploiting Asias growth opportunity might be a hot topic for most

managers these days, for TPG its old

Coulter: leading the worlds largest firm

news the firm has been raising funds

there successfully since the 1990s. And it

shows no sign of slowing down: this year

it held a first close on its first two RMB

funds, and even bought a minority stake

in Indonesian manager Northstar Pacific

(as it looks to get a foot in the door of

another high-potential emerging market).

Its also reportedly nearing a $1.5 billion

first close on a new Asian buyout fund that

could ultimately garner up to $4 billion.

Its a story that investors clearly like.

The firm continues to attract huge commitments from big LPs, including the US

pension funds, and has also been selected

as an official partner by the state-owned

Russian Direct Investment Fund and China

Development Bank, as the two countries

respective governments look to boost foreign investment.

Impeccably well-connected and incredibly well-resourced no wonder investors

keep giving TPG their money in such vast

quantities...

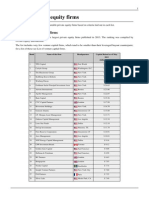

pei 300 the top 50

Rank

Fund manager

Headquarters

PEI 300 Five-Year

Fundraising Total ($m)

vw

TPG

Fort Worth (Texas)

$49,897.00

The Blackstone Group

New York

$49,638.30

Kohlberg Kravis Roberts

New York

$47,689.87

Goldman Sachs Principal Investment Area

New York

$43,469.25

The Carlyle Group

Washington, DC

$30,741.39

CVC Capital Partners

London

$25,068.77

Apax Partners

London

$22,823.88

Apollo Global Management

New York

$21,035.00

Bain Capital

Boston

$21,033.49

10 p

Oaktree Capital Management

Los Angeles

$17,632.31

11 q

Hellman & Friedman

San Francisco

$17,200.00

12 vw

General Atlantic

Greenwich (Connecticut)

$16,800.00

13 p

Providence Equity Partners

Providence (Rhode Island)

$16,300.00

14 vw

Cerberus Capital Management

New York

$15,900.00

pHigher rank than 2011

qLower rank than 2011 vwSame rank as 2011 PEI 50 debut

may 2012

private equity international

page 41

pei 300

Rank

Fund manager

Headquarters

PEI 300 Five-Year

Fundraising Total ($m)

15 q

Warburg Pincus

New York

$15,000.00

16 q

Advent International

Boston

$13,895.43

17 q

First Reserve Corporation

Greenwich (Connecticut)

$13,521.70

18 p

Silver Lake

Menlo Park

$12,258.31

19 p

Lone Star Funds

Dallas

$12,207.60

20 p

Riverstone Holdings

New York

$10,920.00

21 p

Leonard Green & Partners

Los Angeles

$10,300.00

22 p

Thomas H. Lee Partners

Boston

$10,100.00

23 p

Golden Gate Capital

San Francisco

$9,614.00

24 p

BC Partners

London

$9,418.71

25 p

JC Flowers & Co.

New York

$9,300.00

26 q

Terra Firma Capital Partners

London

$9,266.78

27 p

American Capital

Bethesda (Maryland)

$9,192.00

28 q

Teachers' Private Capital

Toronto

$9,045.43

29 p

NGP Energy Capital Management

Dallas

$8,994.00

30 p

Fortress Investment Group

New York

$8,650.00

31 q

Clayton Dubilier & Rice

New York

$8,250.00

32 p

CPP Investment Board

Toronto

$8,050.90

33 p

Bridgepoint

London

$7,996.04

34 p

PAI Partners

Paris

$7,993.44

35 q

AXA Private Equity

Paris

$7,646.80

36 p

Mount Kellett Capital

New York

$7,522.00

37 p

EQT Partners

Stockholm

$7,449.61

38 p

Marfin Investment Group

Athens

$7,310.17

39 q

EnCap Investments

Houston

$6,948.00

40 p

Abraaj Capital

Dubai

$6,723.87

41 q

Citi Capital Advisors

New York

$6,577.46

42 q

Onex

Toronto

$6,364.70

International Petroleum Investment Company

Abu Dhabi

$6,344.49

44 p

Stone Point Capital

Greenwich (Connecticut)

$6,330.58

45 q

TA Associates

Boston

$6,270.00

46 p

Hony Capital

Beijing

$6,083.37

47 q

Nordic Capital

Stockholm

$6,056.59

48 p

ArcLight Capital Partners

Boston

$5,951.00

49 p

Equistone Partners Europe

London

$5,852.32

50 p

CDH Investments

Hong Kong

$5,794.22

43

pHigher rank than 2011

qLower rank than 2011 vwSame rank as 2011 PEI 50 debut

You might also like

- List of Private Equity FirmsDocument10 pagesList of Private Equity FirmsJimmy Carlos Riojas MarquezNo ratings yet

- Mark Yusko's Presentation at iCIO: Year of The AlligatorDocument123 pagesMark Yusko's Presentation at iCIO: Year of The AlligatorValueWalkNo ratings yet

- BookassetmgtnewDocument545 pagesBookassetmgtnewTeddy BearNo ratings yet

- Level 1:: Advanced Financial Modeler (Afm)Document23 pagesLevel 1:: Advanced Financial Modeler (Afm)munaftNo ratings yet

- Pei 135 - Pei300Document13 pagesPei 135 - Pei300Anonymous Rwa38rT8GVNo ratings yet

- OQ Methodolgy For Hedge FundsDocument23 pagesOQ Methodolgy For Hedge FundsSteve KravitzNo ratings yet

- Topic03 ValuationVCDocument29 pagesTopic03 ValuationVCGaukhar RyskulovaNo ratings yet

- PDF Advanced Valuation Erasmus CompressDocument7 pagesPDF Advanced Valuation Erasmus CompressannaNo ratings yet

- Wealth Creation 2008 - 13Document52 pagesWealth Creation 2008 - 13Pratik JoshteNo ratings yet

- Top 300 PEIDocument8 pagesTop 300 PEIJerome OngNo ratings yet

- Indian Banks - CLSADocument4 pagesIndian Banks - CLSAPranjayNo ratings yet

- The Rise of The Leveraged LoanDocument7 pagesThe Rise of The Leveraged LoanTanit PaochindaNo ratings yet

- Indian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Document188 pagesIndian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Debjit AdakNo ratings yet

- Ey Private Credit in India v1Document18 pagesEy Private Credit in India v1Naman JainNo ratings yet

- Types of Banks in The PhilippinesDocument13 pagesTypes of Banks in The PhilippinesHarka MeeNo ratings yet

- Lecture 8 Professional Venture Capital PDFDocument91 pagesLecture 8 Professional Venture Capital PDFGladz ReyNo ratings yet

- Global Infrastructure and Project FinancDocument44 pagesGlobal Infrastructure and Project FinancZulmy Ikhsan WNo ratings yet

- TPG Specialty Lending ResearchDocument25 pagesTPG Specialty Lending ResearchaaquibnasirNo ratings yet

- ICICI Securities SFB Sector ThematicDocument149 pagesICICI Securities SFB Sector ThematicYerrolla MadhuravaniNo ratings yet

- 1 - Nvidia Pitch ReportDocument4 pages1 - Nvidia Pitch Reportapi-475759227No ratings yet

- Lazard Secondary Market Report 2022Document23 pagesLazard Secondary Market Report 2022Marcel LimNo ratings yet

- Quality Earnings ChecklistDocument7 pagesQuality Earnings ChecklistKevin SmithNo ratings yet

- Goldman Exhibits - Hearing On Wall Street and Financial CrisisDocument901 pagesGoldman Exhibits - Hearing On Wall Street and Financial CrisisFOXBusiness.com100% (1)

- M and A Jargon Demystified PDFDocument80 pagesM and A Jargon Demystified PDFMohamed YounisNo ratings yet

- 2016 Preqin Global Private Equity and Venture Capital Report Sample Pages PERACS PersistenceDocument2 pages2016 Preqin Global Private Equity and Venture Capital Report Sample Pages PERACS PersistenceTDGoddardNo ratings yet

- Handbook: 2022 EDITIONDocument247 pagesHandbook: 2022 EDITIONFarhana Lukman DSNo ratings yet

- Infrastructure Investor - Brazil Intelligence ReportDocument40 pagesInfrastructure Investor - Brazil Intelligence ReportjleungcmNo ratings yet

- Submarine Workforce PDFDocument160 pagesSubmarine Workforce PDFfaithnicNo ratings yet

- 2010 0701 AIG Goldman Supporting DocsDocument518 pages2010 0701 AIG Goldman Supporting Docsenglishbob618No ratings yet

- Clsa RussiaDocument97 pagesClsa RussiaAnonymous pKw7NB4jNo ratings yet

- Approved List of Valuers 2016 17 PDFDocument216 pagesApproved List of Valuers 2016 17 PDFKarthick SalemNo ratings yet

- An Explorative Event Study of Listed Private Equity VehiclesDocument105 pagesAn Explorative Event Study of Listed Private Equity VehiclesSiddh MehtaNo ratings yet

- Tts Turbo Macros HandoutDocument9 pagesTts Turbo Macros HandoutCopper KiddNo ratings yet

- Cfo GM & Manager ClientDocument33 pagesCfo GM & Manager ClientkinananthaNo ratings yet

- BBrief Six Degrees of Tiger Management 01 03 12Document11 pagesBBrief Six Degrees of Tiger Management 01 03 12Sarah RamirezNo ratings yet

- 2011 Pei 300Document23 pages2011 Pei 300mtrizzle06No ratings yet

- PEI FundSupp JPMorganDocument5 pagesPEI FundSupp JPMorganShawnDurraniNo ratings yet

- A Debt-Fuelled Spree That Led To $5.4B PharmEasy's Catch-22 - The KenDocument1 pageA Debt-Fuelled Spree That Led To $5.4B PharmEasy's Catch-22 - The KenKrish PatelNo ratings yet

- Fitch C Do RatingDocument29 pagesFitch C Do RatingMakarand LonkarNo ratings yet

- Ambit Embassy Office Parks REIT Initiation The PDFDocument45 pagesAmbit Embassy Office Parks REIT Initiation The PDFanil1820No ratings yet

- FAST MorningstarDocument9 pagesFAST MorningstarmichaelkitloNo ratings yet

- Structuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)Document3 pagesStructuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)wclonnNo ratings yet

- Pitchbook Private Equity Breakdown 4Q 2009Document6 pagesPitchbook Private Equity Breakdown 4Q 2009Zerohedge100% (1)

- Sohn Contest IAC InteractiveDocument10 pagesSohn Contest IAC Interactivemarketfolly.comNo ratings yet

- Quiz1 PDFDocument45 pagesQuiz1 PDFShami Khan Shami KhanNo ratings yet

- Seed Marketing in IndiaDocument12 pagesSeed Marketing in Indiaaki16288No ratings yet

- Private Equity Secondaries China - PEI Magazine WhitepaperDocument2 pagesPrivate Equity Secondaries China - PEI Magazine WhitepaperpfuhrmanNo ratings yet

- JPMorgan WorldCAPMDocument3 pagesJPMorgan WorldCAPManto nellaNo ratings yet

- Case29trx 130826040031 Phpapp02Document14 pagesCase29trx 130826040031 Phpapp02Vikash GoelNo ratings yet

- The 2011 HEC-DowJones PE Performance Ranking ReportDocument6 pagesThe 2011 HEC-DowJones PE Performance Ranking ReportDan PrimackNo ratings yet

- WhiteMonk HEG Equity Research ReportDocument15 pagesWhiteMonk HEG Equity Research ReportgirishamrNo ratings yet

- Cub Energy Reverse TakeoverDocument331 pagesCub Energy Reverse TakeoverAlex VedenNo ratings yet

- Eco ProjectDocument29 pagesEco ProjectAditya SharmaNo ratings yet

- 09 JAZZ Equity Research ReportDocument9 pages09 JAZZ Equity Research ReportAfiq KhidhirNo ratings yet

- The 2016 HEC-DowJones PE Performance Ranking ReportDocument6 pagesThe 2016 HEC-DowJones PE Performance Ranking ReportTDGoddardNo ratings yet

- Empowerment, Vision, and Positive Leadership: An Interview With Alan Mulally, Former CEO, Boeing Commercial-Current CEO, Ford Motor CompanyDocument6 pagesEmpowerment, Vision, and Positive Leadership: An Interview With Alan Mulally, Former CEO, Boeing Commercial-Current CEO, Ford Motor CompanyhasanmougharbelNo ratings yet

- Damodaran On Valuation 1Document58 pagesDamodaran On Valuation 1gioro_mi100% (1)

- Financial EconomicsDocument18 pagesFinancial EconomicsvivianaNo ratings yet

- What Makes A MoatDocument5 pagesWhat Makes A MoatMohammed ShakilNo ratings yet

- Bloomberg Top Hedge Funds 2010Document14 pagesBloomberg Top Hedge Funds 2010jackefeller100% (1)

- Pe Insider 012611Document8 pagesPe Insider 012611rsh765No ratings yet

- Bloomberg - Richest Hedge Funds 02 2011Document6 pagesBloomberg - Richest Hedge Funds 02 2011Adam PedharNo ratings yet

- ICAEW Approved EmployerDocument5 pagesICAEW Approved Employerali_sattar15100% (1)

- Employment Report HHL MSC Program Full Time PDFDocument3 pagesEmployment Report HHL MSC Program Full Time PDFSaathvik RangamaniNo ratings yet

- Re Its 16052021Document21 pagesRe Its 16052021Ricardo LimaNo ratings yet

- Monthly Billing ReportDocument2,293 pagesMonthly Billing ReportBalaNo ratings yet

- Section Team Rankings (Nonresearch)Document1 pageSection Team Rankings (Nonresearch)Tiso Blackstar GroupNo ratings yet

- Adresses ExchangesDocument4 pagesAdresses ExchangesJulien CryptoAddictNo ratings yet

- List of Banks With IFSC and Short Name PDFDocument1 pageList of Banks With IFSC and Short Name PDFRaj YadavNo ratings yet

- Assignment of Internship Shriram Life Insurance CorporationDocument2 pagesAssignment of Internship Shriram Life Insurance CorporationRavi Kant sfs 1No ratings yet

- Annexure - 1 Table 2.3 (A) Long-Term Rating Grades Mapping: SBP Rating Grade Fitch Moody's S&PDocument1 pageAnnexure - 1 Table 2.3 (A) Long-Term Rating Grades Mapping: SBP Rating Grade Fitch Moody's S&PSidrah ShaikhNo ratings yet

- Al TamimiDocument30 pagesAl TamimiRAFIK SAYAHNo ratings yet

- Estadísitica 14-15 - PrácticasDocument60 pagesEstadísitica 14-15 - PrácticasPedro LopezNo ratings yet

- PlacementDocument9 pagesPlacementlokottamNo ratings yet

- Political Contributions DinkelackerDocument5 pagesPolitical Contributions DinkelackerFriends of Juvenile JusticeNo ratings yet

- 2 Marks BsDocument38 pages2 Marks BsShankar ReddyNo ratings yet

- Top 100 Companies in PolandDocument3 pagesTop 100 Companies in PolandBaktygul KosimovaNo ratings yet

- 123456Document54 pages123456sripriyaNo ratings yet

- Nama Perusahaaan ProposalDocument14 pagesNama Perusahaaan ProposalTitaniaveronica SijabatNo ratings yet

- Komunikado CIBC FirstCaribbean Ta Duna Un Man Na Skolnan Ku Mucha Speshal (Pap)Document2 pagesKomunikado CIBC FirstCaribbean Ta Duna Un Man Na Skolnan Ku Mucha Speshal (Pap)Knipselkrant CuracaoNo ratings yet

- List of Accredited Collection Agency As of October 2021Document3 pagesList of Accredited Collection Agency As of October 2021DODJIE DIMACULANGANNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument26 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureRaghav SharmaNo ratings yet

- Global Financial Advisory Mergers & Acquisitions Rankings 2013Document40 pagesGlobal Financial Advisory Mergers & Acquisitions Rankings 2013Ajay SamuelNo ratings yet

- Micr CodesDocument537 pagesMicr CodeskvvbgayathriNo ratings yet

- LimitDocument2 pagesLimitYoginder KumarNo ratings yet

- Placement Season 2020-21: Sector Company Company DesignationDocument2 pagesPlacement Season 2020-21: Sector Company Company DesignationSunny SahNo ratings yet

- NullDocument1 pageNullapi-25890370No ratings yet

- Chenn 111Document6 pagesChenn 111Nityanad Choudhary100% (1)

- Divya SelectionDocument21 pagesDivya Selectionnaveen.jain28495No ratings yet