Professional Documents

Culture Documents

Nahmias Solutions Chapter 2

Uploaded by

RafiaZamanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nahmias Solutions Chapter 2

Uploaded by

RafiaZamanCopyright:

Available Formats

SOLUTIONS TO SELECTED PROBLEMS FROM NAHMIAS BOOK

CHAPTER 2

FORECASTING

2.13

Fcst1Fcst2DemandErr1Err2Er1^2Er2^2|Err1|

22321025633461089211633

2893203405120260140051

4303903755515302522555

134112110242576424

19015022535751225562535

5504905252535625122525

1523.51599.16637.16666

(MSE1(MSE2)(MAD1)

Err2 e1/D *100 e2/D 100

4612.8906217.96875

2015.0000

5.88253

1514.666674.00000

221.818181.81818

7515.5555633.33333

354.7619056.66667

32.1666614.1154911.61155

(MAD2)(MAPE1)(MAPE2)

2.14

It means that E(ei) 0. This will show up by considering

n e

i

i 1

A bias is indicated when this sum deviates too far from zero.

2.16

MA(3)forecast:258.33

MA(6)forecast:249.33

MA(12)forecast:205.33

2.17, 2.18, and 2.19.

OnestepaheadTwostepahead

e

e

MonthForecastForecastDemand

1

2

July205.50149.7522317.5073.25

August225.25205.5028660.7580.50

September241.50225.2521229.5013.25

October250.25241.5027524.7533.50

November249.00250.2518861.0062.25

December240.25249.0031271.7563.00

MAD=44.254.3

The one step ahead forecasts gave better results (and should have according to the theory).

2.20

Month Demand

MA(3) MA(6)

July223226.00161.33

August286226.67183.67

September212263.00221.83

October275240.33233.17

November188257.67242.17

December312225.00244.00

MA (6) Forecasts exhibit less variation from period to period.

2.21

An MA(1) forecast means that the forecast for next period is simply the current period's

demand.

Month

Demand

MA(4)

MA(1)

Error

MonthDemandMA(4)MA(1)

Error

July223205.5028057

August286225.2522363

September212241.5028674

October275250.2521263

November188249.0027587

December312240.25188124

MAD=78.0

(Much worse than MA(4))

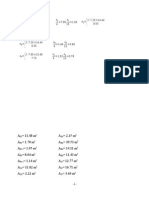

2.35

a)

V1 = (16 + 32 + 71 + 62)/4 = 45.25

V2 = (14 + 45 + 84 + 47)/4 = 47.5

1. G0 = (V2 - V1)/N = 0.5625

2. S0 = V2 + G0 (N-1/2) = 47.5 + (0.5625)(3/2) = 48.34

3. ct =

Dt

Vi N 1/ 2 j G0

-2N+1 = t 0

c-7 =

16

= 0.36

45.25 5/ 2 1..56

c-6 =

32

= 0.71

45.25 5/ 2 2.56

c-5 =

71

= 1.56

43.25 5/ 2 3.56

c-4 =

62

= 1.35

45.25 5/ 2 4.56

c-3 =

14

= 0.30

47.5 5/ 2 1.56

c-2 =

45

= 0.95

47.5 5/ 2 2.56

c-1 =

84

= 1.76

47.5 5/ 2 3.56

c0 =

47

= 0.97

47.5 5/ 2 4.56

(c7 + c3)/2 = .33

(c6 + c2)/2 = .83

(c5 + c1)/2 = 1.66

(c4 + c0)/2 = 1.16

Sum =

3.98

Norming factor = 4/3.9 = 1.01

Hence the initial seasonal factors are:

b)

c-3 = .33

c-1 = 1.67

c-2 = .83

c-0 = 1.17

= 0.2, = 0.15, = 0.1, D1 = 18

S1 = (D1/c-3) + (1-)(S0 + G0) = 0.2(18/0.33)

+ 0.8(48.34 + 0.56) = 50.03

G1 = (S1 - S0) + (1 - ) = G0 = 0.1(50.03 - 48.34)

+ 0.9(0.56) = 0.70

c1 = (D1/S1) + (1-)c3 = 0.15(18/50.03) + 0.85(0.33)

= .3345

c)

Forecasts for 2nd, 3rd and 4th quarters of 1993

F1,2 = [S1 + G1]c2 = (50 + .70)0.83 = 42.08

F1,3 = [S1 + 2G1]c3 = (50 + 2(.70))1.67 = 85.84

F1,4 = [S1 + 3G1]c4 = (50 + 3(.70))1.17 = 60.96

2.36

Period

1

2

3

4

51

86

66

Forecast

Forecast

from

from

30(d) e

31(c) e

t

t

35.8

82.4

56.5

15.2

3.6

9.5

42.08

85.84

60.96

8.92

0.16

5.04

MAD = 9.43 MAD = 4.71

MSE = 111.42 MSE = 35.00

Hence we conclude that Winter's method is more accurate.

2.37

S1 = 50.03

G1 = 0.67

= 0.2

= 0.15

= 0.1

D1 = 18

D2 = 51

D3 = 85

D4 = 66

S2 = 0.2(51/0.83) + 0.8(50.03 + 0.70) = 52.87

G2 = 0.1(52.87 - 50.03) + 0.9(0.70) = 0.914

S3 = 0.2(86/1.67) + 0.8(52.87 + 0.914) = 53.33

G3 = 0.1(53.33 - 52.85) + 0.9(0.885) = 0.8445

S4 = 0.2(66/1.17) + 0.8(53.33 + 0.8445) = 54.62

G4 = 0.1(54.62 - 53.33) + 0.9(0.8445) = 0.8891

c1 = (.15)[18/50] + (0.85)(.33) = .3345 .34

c2 = (.15)[51/52.85] + 0.85(0.83) = .8502 .85

c3 = (.15)(86/53.29) + 0.85(1.67) = 1.6616 1.66

c4 = (.15)(66/54.59) + 0.85(1.17) = 1.1758 1.18

The sum of the factors is 4.02. Norming each of the factors by multiplying by

4/4.02 = .995 gives the final factors as:

c1 = .34

c2 = .84

c3 = 1.65

c4 = 1.17

The forecasts for all of 1995 made at the end of 1993 are:

F4,9 = [S4 + 5G4]c1 = [54.62 + 5(0.89)]0.34 = 20.08

F4,10 = [S4 + 6G4]c2 = [54.62 + 6(0.89)]0.84 = 50.37

F4,11 = [S4 + 7G4]c3 = [54.62 + 7(0.89)]1.65 = 100.40

F4,12 = [S4 + 8G4]c4 = [54.62 + 8(0.89)]1.17 = 72.24

You might also like

- Solutions Manual Production Operations Analysis 6th Edition Steven NahmiasDocument28 pagesSolutions Manual Production Operations Analysis 6th Edition Steven NahmiasAli Veli46% (13)

- Solutions On Stoch Inventory CH 5. (Nahmias)Document9 pagesSolutions On Stoch Inventory CH 5. (Nahmias)Jarid Medina100% (4)

- Solution Chapter8Document8 pagesSolution Chapter8Bunga Safhira Wirata50% (2)

- Solutions To Selected Problems From Nahmias' Book EOQDocument6 pagesSolutions To Selected Problems From Nahmias' Book EOQDaniela Paz Retamal Cifuentes50% (2)

- Nahmias Chapter 3 SolutionsDocument9 pagesNahmias Chapter 3 SolutionsDiego Andres Vasquez100% (1)

- PPP - Homework 5Document17 pagesPPP - Homework 5Wiratha Nungrat67% (9)

- PPP - Homework 2Document7 pagesPPP - Homework 2Wiratha Nungrat100% (2)

- Lean Application at LantechDocument2 pagesLean Application at Lantechehadjulaeha100% (1)

- Excercises Section 3,4Document12 pagesExcercises Section 3,4Eber Mancipe100% (1)

- HW 5 SolDocument5 pagesHW 5 SolSrikar VaradarajNo ratings yet

- 1Document2 pages1KaeNo ratings yet

- Production Solution ManualDocument1 pageProduction Solution ManualMerve BilgiçNo ratings yet

- Production and Operation AnalysisDocument3 pagesProduction and Operation Analysisadam_xu50% (4)

- Production & Operations Management - UploadDocument42 pagesProduction & Operations Management - UploadAlison Browne-Ellis100% (2)

- DocxDocument5 pagesDocxSelinnur GöklerNo ratings yet

- IE3120 Manufacturing Logistics: Tutorial 2Document27 pagesIE3120 Manufacturing Logistics: Tutorial 2Joli SmithNo ratings yet

- Homework SolDocument5 pagesHomework SolAbdurraouf Aghila100% (3)

- InventoryDocument6 pagesInventorysaaz77No ratings yet

- Design Calculation Anchor Flange ASME VIII Div 1Document4 pagesDesign Calculation Anchor Flange ASME VIII Div 1Dhia SlamaNo ratings yet

- 60Document5 pages60RafiaZamanNo ratings yet

- Solution Chapter5Document8 pagesSolution Chapter5Aykut Yıldız0% (1)

- Assignment 1Document3 pagesAssignment 1Horace Cheung100% (1)

- Chap 10 WEDocument5 pagesChap 10 WENPNo ratings yet

- PPP - Homework 4Document7 pagesPPP - Homework 4Wiratha Nungrat67% (3)

- Assign. 2 F-07Document3 pagesAssign. 2 F-07api-263151280% (1)

- Solution Chapter6Document4 pagesSolution Chapter6Bunga Safhira WirataNo ratings yet

- Chapter 03 SolvedDocument24 pagesChapter 03 SolvedMN NabiNo ratings yet

- Aggregate Plan and MRP - ExcerciseDocument8 pagesAggregate Plan and MRP - ExcerciseAlessandro NájeraaNo ratings yet

- 574716238Document9 pages574716238aaltivegreenNo ratings yet

- Chapter4 Ans NahmiasDocument10 pagesChapter4 Ans NahmiasCansu KapanşahinNo ratings yet

- PPP - Homework 3Document5 pagesPPP - Homework 3Wiratha NungratNo ratings yet

- Phy315 Manual 2Document78 pagesPhy315 Manual 2Waheed MohammedNo ratings yet

- This Study Resource Was: F (Q) Co Cu+CoDocument8 pagesThis Study Resource Was: F (Q) Co Cu+Comarvin mayaNo ratings yet

- Testbank SolutionsDocument58 pagesTestbank SolutionsHaider KamranNo ratings yet

- Decision TreeDocument8 pagesDecision TreePham TinNo ratings yet

- Distributed DatabasesDocument58 pagesDistributed Databasesapi-26355935No ratings yet

- Ise216 Mid-Term 2011 Answer2Document4 pagesIse216 Mid-Term 2011 Answer2David García Barrios100% (1)

- MSC in Operational Research Operational Techniques 1 Operational ResearchDocument10 pagesMSC in Operational Research Operational Techniques 1 Operational ResearchGangaa ShelviNo ratings yet

- Aggregate Planning: Translating Demand Forecasts Production Capacity LevelsDocument27 pagesAggregate Planning: Translating Demand Forecasts Production Capacity LevelsDotecho Jzo EyNo ratings yet

- Excel AldepDocument41 pagesExcel AldepsalehNo ratings yet

- Practice Problem 2Document3 pagesPractice Problem 2rajatchikuNo ratings yet

- CH 06Document55 pagesCH 06Swapnil BondeNo ratings yet

- HW1Document12 pagesHW1roberto tumbacoNo ratings yet

- Chapter 4 Single Item Probabilistic DemandDocument92 pagesChapter 4 Single Item Probabilistic DemandQuỳnh NguyễnNo ratings yet

- Circular Base PlateDocument4 pagesCircular Base PlateErnesto Feliciano Basurto Galvez100% (1)

- Taller 3 - Sistemas NumericosDocument15 pagesTaller 3 - Sistemas NumericosJulian CamargoNo ratings yet

- Smath No Pongas Lo de T 360 Eso No Va Tabla 4.1 HDocument3 pagesSmath No Pongas Lo de T 360 Eso No Va Tabla 4.1 HEilithNo ratings yet

- Smath No Pongas Lo de T 360 Eso No Va Tabla 4.1 HDocument4 pagesSmath No Pongas Lo de T 360 Eso No Va Tabla 4.1 HEilithNo ratings yet

- Smath No Pongas Lo de T 360 Eso No Va Tabla 4.1 HDocument4 pagesSmath No Pongas Lo de T 360 Eso No Va Tabla 4.1 HEilithNo ratings yet

- Ebook Elementary Statistics 2Nd Edition Navidi Solutions Manual Full Chapter PDFDocument43 pagesEbook Elementary Statistics 2Nd Edition Navidi Solutions Manual Full Chapter PDFDouglasRileycnji100% (12)

- Elementary Statistics 2nd Edition Navidi Solutions ManualDocument22 pagesElementary Statistics 2nd Edition Navidi Solutions Manualberthakha3lw100% (31)

- Analytical AccelerationDocument3 pagesAnalytical AccelerationKhairul IzuwanNo ratings yet

- Numerical TestDocument2 pagesNumerical TestChakkaravarthy KannanNo ratings yet

- Cálculos TopograficosDocument2 pagesCálculos TopograficosMaría Mónica DurangoNo ratings yet

- Cálculos #1Document2 pagesCálculos #1María Mónica DurangoNo ratings yet

- Lampiran KOPI & TEHDocument11 pagesLampiran KOPI & TEHSulistyaniNo ratings yet

- Ejercicios Álgebra LinealDocument30 pagesEjercicios Álgebra Linealaigs050122hmctrra1No ratings yet

- E 7.95 15.96 e e e 7.20 14.44Document16 pagesE 7.95 15.96 e e e 7.20 14.44Rares NedeleaNo ratings yet

- Skema Add Math P2 Trial SPM ZON A 2012Document13 pagesSkema Add Math P2 Trial SPM ZON A 2012benderatcNo ratings yet

- Exam Exercise Answer Dec 17Document2 pagesExam Exercise Answer Dec 17ayeshaNo ratings yet

- Sequences and Series PracticeDocument10 pagesSequences and Series PracticeyoavNo ratings yet

- SC968 Lecture 5 WorksheetDocument8 pagesSC968 Lecture 5 WorksheetRafiaZamanNo ratings yet

- Unit Plant Other Names Sponsor Capacity (MW) Status Region Country Subnational UnitDocument22 pagesUnit Plant Other Names Sponsor Capacity (MW) Status Region Country Subnational UnitRafiaZamanNo ratings yet

- Table 1: Yearly Number of Mfis Per Thana (2001-2018)Document1 pageTable 1: Yearly Number of Mfis Per Thana (2001-2018)RafiaZamanNo ratings yet

- Research Title: Coal-Based Power Generation in Bangladesh: Problems and ProspectsDocument18 pagesResearch Title: Coal-Based Power Generation in Bangladesh: Problems and ProspectsRafiaZamanNo ratings yet

- HTTP 8Document7 pagesHTTP 8RafiaZamanNo ratings yet

- Source: Based On Data From Hewlett-Packard Co. Annual ReportsDocument6 pagesSource: Based On Data From Hewlett-Packard Co. Annual ReportsRafiaZamanNo ratings yet

- The National Highway Traffic Safety Administration The Department of LaborDocument5 pagesThe National Highway Traffic Safety Administration The Department of LaborRafiaZamanNo ratings yet

- Tea Production, Export and Consumption Comparison: Amount (Million) (KG)Document3 pagesTea Production, Export and Consumption Comparison: Amount (Million) (KG)RafiaZamanNo ratings yet

- Scenario 1: Mixed Strategy in Which Certain Levels of Workers Are Used To Produce The Demand Along With Hiring and Firing OptionsDocument12 pagesScenario 1: Mixed Strategy in Which Certain Levels of Workers Are Used To Produce The Demand Along With Hiring and Firing OptionsRafiaZamanNo ratings yet

- Bangladesh Local Supplies Market Contacts Details and Additional InformationDocument11 pagesBangladesh Local Supplies Market Contacts Details and Additional InformationRafiaZamanNo ratings yet

- Books Express:: House - 98, 1st Floor, Road 11, Block C, Banani, Dhaka 1213Document1 pageBooks Express:: House - 98, 1st Floor, Road 11, Block C, Banani, Dhaka 1213RafiaZamanNo ratings yet

- Southwest Airlines - How Herb Kelleher Led The WayDocument6 pagesSouthwest Airlines - How Herb Kelleher Led The WayRafiaZamanNo ratings yet