Professional Documents

Culture Documents

Carter's LBO Model

Uploaded by

NoahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carter's LBO Model

Uploaded by

NoahCopyright:

Available Formats

Confidential

03/09/2015 22:22:55

NOTE: You can't rely on the formulas in this sample spreadsheet, because it has some circular references and pulls values from other worksheets which are not included.

If you want to adapt it for use with the case, you will have to review the logic and formulas to be sure they are valid.

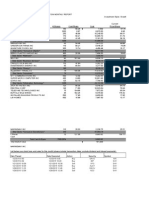

Sample Leveraged Buyout Analysis

Purchase Price

($ in millions)

$771.9

EBITDA

58.0

Implied EBITDA multiple

13.3x

Sources and Uses Summary

Uses of Funds

Purchase Price of Equity

Plus: Debt Refinanced

Less: Cash

Enterprise Value

Senior Debt Financing Fees

Subordinated Debt Financing Fees

Advisory Fees

Total Uses of Funds

Cash-for-Stock Purchase - Goodwill Not Deductible For Tax Purposes

Return Calculation

$538.5

0.0

0.0

538.5

0.0

0.0

20.0

$558.5

Sources of Funds

Revolver

Term Loan B

Senior subordinated notes

Equity

Other [Mgmt. Equity or Options]

Total Sources of Funds

%

3.1%

22.4%

31.3%

43.1%

0.0%

100.0%

$17.5

125.0

175.0

241.0

0.0

$558.5

Int. Rate

7.3%

8.1%

10.9%

0.0%

0.0%

Equity %

2.5%

97.5%

0.0%

100.0%

Subordinated Debt IRR

Equity IRR

Purchase Price Multiple Analysis

2000

Net Sales

EBIT

EBITDA

Cash Flow Analysis

Net Sales

EBITDA

Depreciation & Amortization

EBITA

Amortization of Intangibles Assets and Fin. Fees

EBIT

Less: Interest Expense

Revolver

Term Loan B

Senior subordinated notes

Total Interest Expense

Pre-Tax Profit

Cash Income Taxes @

Net Income

30.0%

+Depreciation and Amortization

-Capital Expenditures, Incl. Acq. Earn-Out

-Working Capital Requirements

Cash Flow Available for Debt Repayment

Cash Flow Available after Debt Repayment

Pro Forma

2000

$471.4

58.0

17.5

40.5

0.0

40.5

0.0

2001

$536.4

75.5

19.8

55.6

0.0

55.6

Fiscal Years Ending December 31,

2002

2003

2004

$618.0

$710.7

$816.5

89.1

109.1

134.3

22.9

26.3

30.2

66.2

82.8

104.1

0.0

0.0

0.0

66.2

82.8

104.1

2005

$938.2

162.1

34.7

127.4

0.0

127.4

2006

$985.1

$170.2

36.4

133.8

0.0

133.8

19.0

29.1

0.0

10.1

19.0

28.0

0.0

9.0

19.0

26.8

0.0

7.8

19.0

25.4

0.0

6.4

19.0

24.0

0.0

5.0

19.0

22.5

11.4

3.2

8.2

27.6

8.1

19.5

39.4

11.6

27.8

57.4

17.0

40.4

80.1

23.8

56.3

104.9

31.3

73.6

113.0

33.7

79.3

17.5

15.2

24.6

($14.0)

19.8

18.5

4.3

$16.6

$0.0

22.9

18.5

(1.0)

$33.2

$18.3

26.3

18.5

(0.3)

$48.5

$33.4

34.7

18.5

(0.6)

$90.5

$72.8

36.4

18.5

(0.6)

$97.9

$140.8

30.2 #

18.5###

(0.6) #

$68.6

$52.3

Pro Forma

2000

1.4x

2.0x

N/A

N/A

$58.0

2.5x

5.5x

56.9%

2001

2.0x

2.7x

5.2%

0.0%

$75.5

1.7x

4.0x

53.6%

At

Closing

$17.5

125.0

175.0

241.0

$558.5

$0.0

2001

$0.9

125.0

175.0

260.5

$561.4

$0.0

IRR

Fiscal Years Ending December 31,

2002

2003

2004

2.5x

3.3x

4.3x

3.3x

4.3x

5.6x

9.9%

14.7%

19.8%

11.2%

23.3%

36.3%

$89.1

$109.1

$134.3

1.2x

0.9x

0.6x

3.2x

2.5x

1.9x

49.8%

45.2%

39.8%

2005

5.7x

7.2x

25.4%

50.4%

$162.1

0.4x

1.5x

34.1%

2006

6.4x

8.2x

31.4%

65.7%

$170.2

0.3x

1.3x

28.8%

Revolver

Term Loan B

Senior Subordinated Debt

Equity

Total Capitalization

Cash Balance

Fiscal Years Ending December 31,

2003

2004

$0.0

$0.0

95.9

79.6

175.0

175.0

328.7

385.0

$599.7

$639.6

$51.7

$104.0

2005

$0.0

62.0

175.0

458.6

$695.6

$176.8

2006

$0.0

42.9

175.0

537.9

$755.8

$140.8

EBITDA

Times: Assumed Exit Multiple

Equals: Implied Enterprise Value

Less: Total Debt Outstanding

Plus: Cash Balance

Equals: Implied Enterprise Value

$75.5

5.5

$415.0

(179.2)

$0.6

$236.4

$162.1

5.5

$891.5

(89.40)

$0.6

$802.7

$170.2

6.5

$1,106.3

(89.40)

$1.6

$1,018.5

$0.0

111.03

175.0

288.3

$574.4

$18.3

$89.1###

5.5 #

$490.1###

(159.70)

$0.6###

$331.0###

$109.1###

5.5 #

$600.1###

(138.40)

$0.6###

$462.3###

$134.3###

5.5 #

$738.8###

(114.70)

$0.6###

$624.7###

2002

1.0 x

9.7 x

7.1 x

0.9 x

8.1 x

6.0 x

27.21% (uses RATE function)

Acquisition Fees

% Advisory Fees (Buyer's Inv. Banking, Legal, etc.)

$ Advisory Fee

Senior Term Debt Fee %

Deferred Senior Debt Fee $

Amortization Period

Annual Amortization

Capitalization

2002

2001

1.1 x

13.3 x

9.3 x

0.0

3.5

19.0

20.8 ###

Coverages & Debt Amortization

EBITA Interest Coverage

EBITDA Interest Coverage

Cumulative Total Debt Repaid

Cumulative Senior Term Debt Repaid

EBITDA

Senior Debt / EBITDA

Total Debt / EBITDA

Total Debt / Total Capitalization

2005 EBITDA Exit Multiple

5.5x

6.0x

#VALUE!

#VALUE!

27.5%

29.9%

Subordinated Debt Cash Flows

0.0%

$0.0

5

$0.0

1.0%

$5.4

Subordinated Debt Fee %

Deferred Sub. Debt Fee $

Amortization Period

Annual Amortization

2.0%

$3.5

5

$0.7

You might also like

- Carter's LBO CaseDocument3 pagesCarter's LBO CaseNoah57% (7)

- Carter LBODocument1 pageCarter LBOEddie KruleNo ratings yet

- Cornell - Case Study LBODocument25 pagesCornell - Case Study LBOCommodity100% (2)

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsDocument11 pagesInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsPrashantK100% (1)

- BerkshireDocument30 pagesBerkshireNimra Masood100% (3)

- Berkshire Partners Bidding For Carter'S - Group 6Document21 pagesBerkshire Partners Bidding For Carter'S - Group 6Versha100% (1)

- Seagate LBO AnalysisDocument58 pagesSeagate LBO Analysisthetesterofthings100% (2)

- Berkshire - IntroDocument2 pagesBerkshire - IntroRohith ThatchanNo ratings yet

- Investment Banking LBO ModelDocument4 pagesInvestment Banking LBO Modelkirihara95100% (1)

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- LBO In-Depth AnalysisDocument12 pagesLBO In-Depth Analysisricoman19890% (1)

- Apple LBO ModelDocument34 pagesApple LBO ModelShawn PantophletNo ratings yet

- Case Study LBODocument4 pagesCase Study LBOadarshraj100% (3)

- IB Merger ModelDocument12 pagesIB Merger Modelkirihara95100% (1)

- Berkshire PartnersDocument2 pagesBerkshire PartnersAlex TovNo ratings yet

- NYSF Leveraged Buyout Model TemplateDocument20 pagesNYSF Leveraged Buyout Model TemplateBenNo ratings yet

- Merger ModelDocument8 pagesMerger ModelStuti BansalNo ratings yet

- LBO Model - CompletedDocument12 pagesLBO Model - CompletedJennifer HsuNo ratings yet

- Precedent TransactionsDocument14 pagesPrecedent Transactionslondoner4545100% (3)

- LBO Model - TemplateDocument9 pagesLBO Model - TemplateByron FanNo ratings yet

- LBO Model Template - PE Course (Spring 08)Document18 pagesLBO Model Template - PE Course (Spring 08)chasperbrown100% (11)

- LBO Analysis TemplateDocument11 pagesLBO Analysis TemplateBobby Watkins75% (4)

- LBO Modeling Test Example - Street of WallsDocument20 pagesLBO Modeling Test Example - Street of WallsvinaymathewNo ratings yet

- LBO DELL Presentation Case StudyDocument20 pagesLBO DELL Presentation Case StudyJoseph TanNo ratings yet

- DCF Analysis JBDocument10 pagesDCF Analysis JBNoah100% (3)

- Full Merger Model Kraft-Kellogg - ShellDocument9 pagesFull Merger Model Kraft-Kellogg - ShellGeorgi VankovNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisTheicon420No ratings yet

- $ in Millions, Except Per Share DataDocument59 pages$ in Millions, Except Per Share DataTom HoughNo ratings yet

- LBO Model TemplateDocument67 pagesLBO Model TemplateAlex TovNo ratings yet

- Comparable Companies CompletedDocument8 pagesComparable Companies Completeduclabruin220No ratings yet

- Complete Private Equity ModelDocument16 pagesComplete Private Equity ModelMichel MaryanovichNo ratings yet

- Airthread Excel SolutionDocument18 pagesAirthread Excel SolutionRiya ShahNo ratings yet

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Seagate CaseDocument1 pageSeagate Casepexao87No ratings yet

- Flash Memory IncDocument9 pagesFlash Memory Incxcmalsk100% (1)

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- Core Lbo ModelDocument25 pagesCore Lbo Modelsalman_schonNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsDocument22 pagesInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitionsaleaf92100% (1)

- LBO TrainingDocument18 pagesLBO TrainingCharles Levent100% (3)

- Acquisition Leveraged Finance (한성원)Document18 pagesAcquisition Leveraged Finance (한성원)Claire Jingyi Li100% (5)

- LBO Test - 75Document84 pagesLBO Test - 75conc880% (1)

- Simple LBO ModelDocument14 pagesSimple LBO ModelProfessorAsim Kumar MishraNo ratings yet

- Excel Spreadsheet For Mergers and Acquisitions ValuationDocument6 pagesExcel Spreadsheet For Mergers and Acquisitions Valuationisomiddinov100% (2)

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Private Equity Buy Side Financial Model and ValuationDocument19 pagesPrivate Equity Buy Side Financial Model and ValuationBhaskar Shanmugam100% (3)

- FlashMemory Beta NPVDocument7 pagesFlashMemory Beta NPVShubham Bhatia50% (2)

- DELL LBO Model Part 2 Completed (Excel)Document9 pagesDELL LBO Model Part 2 Completed (Excel)Mohd IzwanNo ratings yet

- 1 PE and LBO A MUST Read ChicagoLBO-SyllabusAADocument16 pages1 PE and LBO A MUST Read ChicagoLBO-SyllabusAAGeorge Triantis100% (1)

- LBO Sensitivity Tables BeforeDocument37 pagesLBO Sensitivity Tables BeforeMamadouB100% (2)

- Leveraged Buyouts: A Practical Introductory Guide to LBOsFrom EverandLeveraged Buyouts: A Practical Introductory Guide to LBOsRating: 5 out of 5 stars5/5 (1)

- Leveraged Buyouts: A Practical Guide to Investment Banking and Private EquityFrom EverandLeveraged Buyouts: A Practical Guide to Investment Banking and Private EquityRating: 4 out of 5 stars4/5 (2)

- The Art of M&A Structuring: Techniques for Mitigating Financial, Tax and Legal RiskFrom EverandThe Art of M&A Structuring: Techniques for Mitigating Financial, Tax and Legal RiskRating: 2 out of 5 stars2/5 (1)

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsFrom EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNo ratings yet

- Advanced Accounting Jeter 5th Edition Solutions ManualDocument37 pagesAdvanced Accounting Jeter 5th Edition Solutions Manualgordonswansonepe0q100% (10)

- Jetblue CompsDocument3 pagesJetblue CompsNoahNo ratings yet

- DCF Analysis JBDocument10 pagesDCF Analysis JBNoah100% (3)

- M&A Case StudyDocument2 pagesM&A Case StudyNoahNo ratings yet

- Yield SummaryDocument5 pagesYield SummaryNoahNo ratings yet

- Driehaus January Monthly Report - DMNW Equity PartnersDocument4 pagesDriehaus January Monthly Report - DMNW Equity PartnersNoahNo ratings yet

- Sell Candidates Gains/Loss Summary: Estimates OnlyDocument4 pagesSell Candidates Gains/Loss Summary: Estimates OnlyNoahNo ratings yet

- Noah Diaz - Unofficial TranscriptDocument3 pagesNoah Diaz - Unofficial TranscriptNoahNo ratings yet

- Noah Diaz - ResumeDocument1 pageNoah Diaz - ResumeNoahNo ratings yet

- Noah Diaz - Resume 2Document1 pageNoah Diaz - Resume 2NoahNo ratings yet

- 30-Second CommercialDocument1 page30-Second CommercialNoahNo ratings yet

- ASBADocument2 pagesASBAAryan MahawarNo ratings yet

- Tutorial 2 - Financial EnvironmentDocument5 pagesTutorial 2 - Financial EnvironmentShi ManNo ratings yet

- Case Nike Cost of Capital - FinalDocument7 pagesCase Nike Cost of Capital - FinalNick ChongsanguanNo ratings yet

- Deutsche Bank ResearchDocument6 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- Agreement Umair Fauziah Abdi - Farheen - Nadeem Briquette Coal 1mar23 Final PDFDocument2 pagesAgreement Umair Fauziah Abdi - Farheen - Nadeem Briquette Coal 1mar23 Final PDFgiri yudhaNo ratings yet

- Pakistan Data Sheet - Ecomm 2020Document5 pagesPakistan Data Sheet - Ecomm 2020Meekal ANo ratings yet

- Ist Semester BASU Course HandbookDocument39 pagesIst Semester BASU Course HandbookYashraj SinghNo ratings yet

- Customer Welcome ChecklistDocument4 pagesCustomer Welcome Checklistjupiter stationeryNo ratings yet

- JPM Bond CDS Basis Handb 2009-02-05 263815Document92 pagesJPM Bond CDS Basis Handb 2009-02-05 263815ccohen6410100% (1)

- Speccom - NCBA GBL ReviewerDocument10 pagesSpeccom - NCBA GBL ReviewerSarah CadioganNo ratings yet

- Allied Banking Vs Lim Sio WanDocument7 pagesAllied Banking Vs Lim Sio WanshambiruarNo ratings yet

- Fin 201 PPT Deal MakerDocument18 pagesFin 201 PPT Deal MakerF.T. BhuiyanNo ratings yet

- ch17 180206123815 PDFDocument75 pagesch17 180206123815 PDFYeni Amelia100% (1)

- Atanasov and Nenovsky Money-And-Prices-In-The-18th-19th-Centuries-Bulgarian-Historiography Bulgarian Historical Review 2019Document33 pagesAtanasov and Nenovsky Money-And-Prices-In-The-18th-19th-Centuries-Bulgarian-Historiography Bulgarian Historical Review 2019Hristiyan AtanasovNo ratings yet

- Chapter - 33: Derivatives For Managing Financial RiskDocument21 pagesChapter - 33: Derivatives For Managing Financial RiskAkash saxenaNo ratings yet

- Lobj18 0005498Document48 pagesLobj18 0005498Nadil NinduwaraNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAman VermaNo ratings yet

- International Business Law 6th Edition August Test BankDocument21 pagesInternational Business Law 6th Edition August Test Bankchristabeldienj30da100% (33)

- Grade: Igcse-2 Subject: Business StudiesDocument3 pagesGrade: Igcse-2 Subject: Business StudiesAnish KanthetiNo ratings yet

- CE 22 Lecture 3-1 Simple and Compound Interest, Single Cash FlowsDocument30 pagesCE 22 Lecture 3-1 Simple and Compound Interest, Single Cash FlowsOscar Sheen VillaverdeNo ratings yet

- Case Study On Meezan Bank by Urooj KhursheedDocument40 pagesCase Study On Meezan Bank by Urooj KhursheedUrooj SheikhNo ratings yet

- Mutual Fund: Rishu AnandDocument11 pagesMutual Fund: Rishu AnandRishu Anand MridulaNo ratings yet

- Revision Question Mid Semester Exam (Lecturer Copy)Document14 pagesRevision Question Mid Semester Exam (Lecturer Copy)ntyn1904No ratings yet

- How To Buy CryptocurrenciesDocument2 pagesHow To Buy CryptocurrenciesObinna ObiefuleNo ratings yet

- Cash Flow Statement Presentation)Document12 pagesCash Flow Statement Presentation)Arun GuleriaNo ratings yet

- AuditingDocument9 pagesAuditingRenNo ratings yet

- Petty CashDocument8 pagesPetty Cashevy sabacajanNo ratings yet

- @csupdates Chapter 21 CIRP, Liquidation Wining Up SBECDocument29 pages@csupdates Chapter 21 CIRP, Liquidation Wining Up SBECthevinayakshuklaaNo ratings yet

- Central Banking (Notes)Document8 pagesCentral Banking (Notes)Trish BustamanteNo ratings yet

- Chapter 9 Investment PropertyDocument4 pagesChapter 9 Investment PropertyAngelica Joy ManaoisNo ratings yet