Professional Documents

Culture Documents

Chapter 16

Uploaded by

Aarti JCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 16

Uploaded by

Aarti JCopyright:

Available Formats

Chapter 16

Hybrid and Derivative Securities

Solutions to Problems

P16-1. LG 2: Lease Cash Flows

Basic

Firm

A

B

C

D

E

Year

Lease Payment

(1)

Tax Benefit

(2)

14

114

18

125

110

$100,000

80,000

150,000

60,000

20,000

$40,000

32,000

60,000

24,000

8,000

P16-2. LG 2: Loan Interest

Intermediate

Loan

Year

Interest Amount

1

2

3

4

$1,400

1,098

767

402

1

2

$2,100

1,109

1

2

3

$312

220

117

1

2

3

4

5

$6,860

5,822

4,639

3,290

1,753

1

2

3

$4,240

3,768

3,220

After-tax Cash Outflow

[(1) (2)]

(3)

$60,000

48,000

90,000

36,000

12,000

394

Part 6 Special Topics in Managerial Finance

4

5

6

2,585

1,848

993

P16-3. LG 2: Loan Payments and Interest

Intermediate

Payment = $117,000 3.889 = $30,085 (Calculator solution: $30,087.43)

Year

1

2

3

4

5

6

Beginning

Balance

Interest

Principal

$117,000

103,295

87,671

69,860

49,555

26,408

$16,380

14,461

12,274

9,780

6,938

3,697

$13,705

15,624

17,811

20,305

23,147

26,388

$116,980

$26,408

$117,000

Note: Due to the PVIFA tables in the text presenting factors only to the third decimal place and

the rounding of interest and principal payments to the second decimal place, the summed principal

payments over the term of the loan will be slightly different from the loan amount. To compensate

in problems involving amortization schedules, the adjustment has been made in the last principal

payment. The actual amount is shown with the adjusted figure to its right.\P16-4. LG 2: Lease

versus Purchase

Chapter 16

Hybrid and Derivative Securities

395

Challenge

(a) Lease

After-tax cash outflow = $25,200 (l 0.40 ) = $15,120/year for 3years + $5,000 purchase

option in year 3 (total for year 3: $20,120)

Purchase

After-tax

Cash

Total

Tax

Deductions

Shields

Outflows

Loan

MainDepre- Interest

Payment tenance

ciation at 14% (2 + 3 + 4) [(0.40) (5)] [(1 + 2) (6)]

Year

(1)

(2)

(3)

(4)

(5)

(6)

(7)

1

2

3

$25,844

25,844

25,844

$1,800

1,800

1,800

$19,800

27,000

9,000

$8,400

5,958

3,174

$30,000

34,758

13,974

$12,000

13,903

5,590

$15,644

13,741

22,054

(b)

End

of Year

After-tax

Cash Outflows

PVIF8%,n

$15,120

15,120

20,120

0.926

0.857

0.794

PV of Outflows

Calculator

Solution

Lease

1

2

3

$14,001

12,958

15,975

$42,934

$42,934.87

$14,486

11,776

17,511

$43,773

$43,773.06

Purchase

1

2

3

$15,644

13,741

22,054

0.926

0.857

0.794

(c) Since the PV of leasing is less than the PV of purchasing the equipment, the firm should lease

the equipment and save $962 in present value terms.

396

Part 6 Special Topics in Managerial Finance

P16-5. LG 2: Lease versus Purchase

Challenge

(a) Lease

After-tax cash outflows = $19,800 (1 0.40) = $11,880/year for 5 years plus $24,000

purchase option in year 5 (total $35,880).

Purchase

Year

Loan

Payment

(1)

Maintenance

(2)

Depreciation

(3)

1

2

3

4

5

$23,302

23,302

23,302

23,302

23,302

$2,000

2,000

2,000

2,000

2,000

$16,000

25,600

15,200

9,600

9,600

Total

Tax

After-tax

Cash Outflows

Interest Deductions Shields

at 14% (2 + 3 + 4) [(0.40) (5)] [(1 + 2) (6)]

(5)

(6)

(7)

(4)

$11,200

9,506

7,574

5,372

2,862

$29,200

37,106

24,774

16,972

14,462

$11,680

14,842

9,910

6,789

5,785

$13,622

10,460

15,392

18,513

19,517

(b)

End

of Year

After-tax

Cash Outflows

PVIF9%,n

PV of Outflows

Calculator

Solution

Lease

1

2

3

4

5

$11,880

11,880

11,880

11,880

35,880

0.917

0.842

0.772

0.708

0.650

$10,894

10,003

9,171

8,411

23,322

$61,801

$61,807.41

$12,491

8,807

11,883

13,107

12,686

$58,974

$58,986.46

Purchase

1

2

3

4

5

(c)

$13,622

10,460

15,392

18,513

19,517

0.917

0.842

0.772

0.708

0.650

The present value of the cash outflows is less with the purchasing plan, so the firm should

purchase the machine. By doing so, it saves $2,827 in present value terms.

P16-6. LG 2: Capitalized Lease Values

Intermediate

Lease

A

B

C

D

E

Table Values

$40,000

120,000

9,000

16,000

47,000

6.814 =

4.968 =

6.467 =

2.531 =

7.963 =

$272,560

596,160

58,203

40,496

374,261

Calculator Solution

$272,547.67

596,116.77

58,206.78

40,500.72

374,276.42

Chapter 16

Hybrid and Derivative Securities

P16-7. LG 3: Conversion Price

Basic

(a) $1,000 20 shares = $50 per share

(b) $500 25 shares = $20 per share

(c) $1,000 50 shares = $20 per share

P16-8. LG 3: Conversion Ratio

Basic

(a)

(b)

(c)

$1,000 $43.75 = 22.86 shares

$1,000 $25.00 = 40 shares

$600 $30.00 = 20 shares

P16-9. LG 3: Conversion (or Stock) Value

Basic

(a) Bond value = 25 shares $50

= $1,250

(b) Bond value = 12.5 shares $42

= $525

(c) Bond value = 100 shares $10.50 = $1,050

P16-10. LG 3: Conversion (or Stock) Value

Basic

Bond

A

B

C

D

Conversion Value

25 $42.25

16 $50.00

20 $44.00

5 $19.50

=

=

=

=

$1,056.25

$800.00

$880.00

$97.50

P16-11. LG 4: Straight Bond Values

Intermediate

Bond

Years

Payments

Factors

PV

Calculator

Solution

120

20

$100

1,000

6.623

0.073

$662.30

73.00

$735.30

$735.07

$549.50

112.80

$662.30

$662.61

$803.01

12.00

$815.01

$814.68

$807.24

20.00

$827.24

$827.01

114

14

130

30

125

25

$96

800

$130

1,000

$140

1,000

5.724

0.141

6.177

0.012

5.766

0.020

397

398

Part 6 Special Topics in Managerial Finance

P16-12. LG 4: Determining ValuesConvertible Bond

Challenge

(a)

Years

Payments

Factor, 12%

PV

Calculator Solution

120

20

$100

1,000

7.469

0.104

$746.90

104.00

$850.90

$850.61

(b) Conversion value = 50 shares market price

50 $15 = $750

50 $20 = 1,000

50 $23 = 1,150

50 $30 = 1,500

50 $45 = 2,250

(c)

Share Price

Bond Value

$15

20

23

30

45

$850.90

1,000.00

1,150.00

1,500.00

2,250.00

As the share price increases the bond will start trading at a premium to the pure bond value

due to the increased probability of a profitable conversion. At higher prices the bond will

trade at its conversion value.

(d) The minimum bond value is $850.90. The bond will not sell for less than the straight bond

value, but could sell for more.

P16-13. LG 4: Determining ValuesConvertible Bond

Challenge

(b) Straight Bond Value

Years

115

15

Payments

$130

1,000

(b) Conversion value

$9.00 80 = $720

12.00 80 = 960

13.00 80 = 1,040

15.00 80 = 1,200

20.00 80 = 1,600

Factor, 12%

5.575

0.108

PV

Calculator Solution

$724.75

108.00

$832.75

$832.74

Chapter 16

Hybrid and Derivative Securities

399

(c)

Share Price

Bond Value

$9.00

$832.75

12.00

960.00

13.00

1,040.00

15.00

1,200.00

20.00

1,600.00

(Bond will not sell below straight bond value)

As the share price increases the bond will start trading at a premium to the pure bond value

due to the increased probability of a profitable conversion. At higher prices the bond will

trade at its conversion value.

(d)

Value of a Convertible Bond

1800

Conversion

Value

1600

1400

Value of

Convertible

Bond

1200

1000

800

Straight Bond

Value

600

400

200

0

0

10

15

20

25

Price per Share of Common Stock

Up to Point X, the Straight Bond Value is the minimum market value. For stock prices above

Point X, the Conversion Value Line is the market price of the bond.

400

Part 6 Special Topics in Managerial Finance

P16-14. LG 5: Implied Price of Attached Warrants

Intermediate

Implied price of all warrants = Price of bond with warrants Straight bond value

Price per warrant =

Implied Price of all warrants

Number of warrants

Straight Bond Value:

Bond

Years

Payments

115

15

$120

1,000

110

10

120

20

7.963 (11%)

0.124

$110

1,000

Price Per Warrant:

Price with

Bond

Warrants

$1,000

1,100

500

1,000

5.650 (12%)

0.322

$50

500

120

20

A

B

C

D

6.462 (13%)

0.160

$95

1,000

7.469 (12%)

0.104

Straight

Bond Value =

PV

Solution

Calculator

$775.44

160.00

$935.44

$935.38

$536.75

322.00

$858.75

$858.75

$398.15

62.00

$460.15

$460.18

$821.59

104.00

$925.59

$925.31

Factors

$935.44

858.75

460.15

925.59

=

=

=

=

Implied

Price

$64.56

241.25

39.85

74.41

Number

of Warrants =

10

30

5

20

=

=

=

=

P16-15. LG 5: Evaluation of the Implied Price of an Attached Warrant

Challenge

(a) Straight Bond Value

Years

Payments

PVIF (13%)

PV

Calculator

Solution

130

30

$115

1,000

7.496

0.026

$862.04

26.00

$888.04

$ 887.57

(b) Implied price of all warrants = (Price with warrants Straight Bond Value)

Implied price of warrant

= $1,000 $888.04

Implied price of warrant

= $111.96

Price per

Warrant

$6.46

8.04

7.97

3.72

Chapter 16

Hybrid and Derivative Securities

401

(c) Price per warrant = Implied price of all warrants number of warrants

Price per warrant = $111.96 10

Price per warrant = $11.20

(d) The implied price of $11.20 is below the theoretical value of $12.50, which makes the bond

an attractive investment.

P16-16. LG 5: Warrant Values

Challenge

(a)

TVW

TVW

TVW

TVW

TVW

TVW

TVW

TVW

=

=

=

=

=

=

=

=

(P0 E) N

($42 $50) 3

($46 $50) 3

($48 $50) 3

($54 $50) 3

($58 $50) 3

($62 $50) 3

($66 $50) 3

=

=

=

=

=

=

=

$24

$12

$6

$12

$24

$36

$48

(b)

Common Stock Price versus Warrant Price

60

50

40

Market

Value

30

Value of

Warrant ($)

20

Theoretical

Value

10

0

40

45

50

55

60

65

70

-10

-20

-30

Price per Share of Common Stock

(c) It tends to support the graph since the market value of the warrant for the $50 share price

appears to fall on the market value function presented in the table and graphed in part (b).

The table shows that $50 is one-third of the way between the $48 and the $54 common

stock value; adding one-third of the difference in warrant values corresponding to those

stock values (i.e., ($18 $9) 3) to the $9 warrant value would result in a $12 expected

warrant value for the $50 common stock value.

(d) The warrant premium results from a combination of investor expectations and the ability

of the investor to obtain much larger potential returns by trading in warrants rather than

stock. The warrant premium is reflected in the graph by the area between the theoretical

value and the market value of the warrant.

402

Part 6 Special Topics in Managerial Finance

(e) Yes, the premium will decline to zero as the warrant expiration date approaches. This occurs

due to the fact that as time diminishes, the possibilities for speculative gains likewise decline.

P16-17. LG 5: Common Stock versus Warrant Investment

Challenge

(a)

$8,000 $50 per share = 160 shares

$8,000 $20 per warrant = 400 warrants

(b) 160 shares ($60 $50) = $1,600 profit

(c)

400 shares ($45 $20) = $10,000 profit

$1,600 $8,000 = 20%

$10,000 $8,000 = 125%

(d) Ms. Michaels would have increased profitability due to the high leverage effect of the

warrant, but the potential for gain is accompanied with a higher level of risk.

P16-18. LG 5: Common Stock versus Warrant Investment

Challenge

(a) $6,300 $30 per share = 210 shares purchased

210 shares ($32 $30) = $420 profit

$420 $6,300 = 6.67%

(b) $6,300 $7 per warrant

= 900 warrants purchased

Profit on original investment = [($4 per share 2) $7 price of warrant] = $1

$1 gain 900 warrants

= $900 profit

$1 $7 = 14.29% total gain

(c) Stock

(1) $6,300 investment $6,300 proceeds from sale = $0

(2) 210 shares ($28 $30) = $420 (6.67%)

Warrants (1) [($2 gain per share 2 shares) $7 price of warrant] 900 warrants

= $3 900 = $2,700 = 42.85%

(2) Since the warrant exercise price and the stock price are the same, there is no

reason to exercise the warrant. The full investment in the warrant is lost:

$7 900 warrants = $6,300

$7 $7 = 100%

(d) Warrants increase the possibility for gain and loss. The leverage associated with warrants

results in higher risk as well as higher expected returns.

P16-19. LG 6: Option Profits and Losses

Intermediate

Option

A 100 shares $5/share = $500

$500 $200

= $300

100 shares $3/share = $300

$300 $350

= $50

The option would be exercised, as the loss is less than the cost of the option.

100 shares $10/share = $1,000

$1,000 $500

= $500

D

E

$300; the option would not be exercised.

$450; the option would not be exercised.

Chapter 16

Hybrid and Derivative Securities

403

P16-20. LG 6: Call Option

Intermediate

(a)

Stock transaction:

$70/share $62/share = $8/share profit

$8/share 100 shares = $800

(b) Option transaction:

($70/share 100 shares) = $7,000

($60/per share 100 shares) = 6,000

$600 cost of option = 600

profit = $400

(c) $600 100 shares = $6/share

The stock price must rise to $66/share to break even.

(d) If Carol actually purchases the stock, she will need to invest $6,200 ($62/share 100 shares)

and can potentially lose this full amount. In comparison to the option purchase, Carol only

risks the purchase price of the option, $600. If the price of the stock falls below $56/share,

the option purchase is favored. (Below $56/share, the loss in stock value of $600 [($62

$56) 100 shares], would exceed the cost of the option). Due to less risk exposure with the

option purchase, the profitability is correspondingly lower.

P16-21. LG 5: Put Option

Intermediate

(a)

($45 $46) 100 shares = $100

The option would not be exercised above the striking price; therefore, the loss would be the

price of the option, $380.

($45 $44) 100 shares = $100

$100 $380

= $280

The option would be exercised, as the amount of the loss is less than the option price.

($45 $40) 100 shares = $500

$500 $380

= $120

($45 $35) 100 shares = $1,000

$1,000 $380

= $620

(b) The option would not be exercised above the striking price.

(c) If the price of the stock rises above the striking price, the risk is limited to the price of the put

option.

P16-22. Ethics Problem

Challenge

When a company issues a stock and sells it at market price and keeps the proceeds then it

increases the number of shares outstanding and dilution of earnings takes place. However, when

the company issues stock to acquire assets, or pays a part of operating costs, these costs become

expenses. Similarly, when the company issues stock in exchange for options to be exercised by

employees below the market price, this is equivalent to issuing the stock at the market price and

paying the difference to the employees in cash, which is clearly an expense.

You might also like

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- Chapter 13 Solutions MKDocument26 pagesChapter 13 Solutions MKCindy Kirana17% (6)

- Chapter 16Document13 pagesChapter 16Andi Luo100% (1)

- Chapter 11Document45 pagesChapter 11LBL_Lowkee100% (3)

- Chapter-6 GITMAN SOLMANDocument24 pagesChapter-6 GITMAN SOLMANJudy Ann Margate Victoria67% (6)

- Chapter 15Document6 pagesChapter 15Rayhan Atunu100% (1)

- Chapter 6 SolutionsDocument7 pagesChapter 6 Solutionshassan.murad83% (12)

- Chapter 5 SolutionsDocument16 pagesChapter 5 Solutionshassan.murad60% (5)

- Principles of Managerial Finance Chapter 10Document13 pagesPrinciples of Managerial Finance Chapter 10vireu100% (3)

- Chapter - 14-Working Capital and Current Assets ManagementDocument8 pagesChapter - 14-Working Capital and Current Assets ManagementShota TsakashviliNo ratings yet

- Chapter 10 SolutionsDocument21 pagesChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Chapter 12Document34 pagesChapter 12LBL_Lowkee100% (1)

- Gitman CH 14 15 QnsDocument3 pagesGitman CH 14 15 QnsFrancisCop100% (1)

- M19 Gitm4380 13e Im C19 PDFDocument12 pagesM19 Gitm4380 13e Im C19 PDFGolamSarwar100% (2)

- Chapter 10 SM Principles of Managerial FinanceDocument42 pagesChapter 10 SM Principles of Managerial FinanceMajd Ayman83% (6)

- Chapter 4 SolutionsDocument14 pagesChapter 4 Solutionshassan.murad82% (11)

- Chapter 10Document42 pagesChapter 10LBL_LowkeeNo ratings yet

- Chapter 11Document29 pagesChapter 11Fathan Mubina92% (12)

- Chapter 8Document37 pagesChapter 8AparnaPriomNo ratings yet

- Chapter 5 Time Value of MoneyDocument5 pagesChapter 5 Time Value of MoneyMariya ErinahNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- Questions On LeasingDocument5 pagesQuestions On Leasingriteshsoni100% (2)

- Chapter 7 SolutionsDocument4 pagesChapter 7 Solutionshassan.murad33% (3)

- Chapter 13 SolutionsDocument26 pagesChapter 13 SolutionsMathew Idanan0% (1)

- Chapter 6 Solutions Interest Rates and Bond ValuationDocument7 pagesChapter 6 Solutions Interest Rates and Bond ValuationTuvden Ts100% (1)

- Ch09 Resource Allocation CrashcostDocument25 pagesCh09 Resource Allocation Crashcostndc6105058No ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- Chapter 1 ProblemsDocument3 pagesChapter 1 Problemsahmedknight100% (2)

- Chapter 12 SolutionsDocument13 pagesChapter 12 SolutionsCindy Lee75% (4)

- Preffered Stock ValuationDocument1 pagePreffered Stock ValuationJeanne Sherlyn Tello100% (1)

- Plan Your Cash Flow and Finances with These ToolsDocument4 pagesPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- Chapter 22 Problem #1Document6 pagesChapter 22 Problem #1Lê Đặng Minh Thảo100% (1)

- Chapter 9 SolutionsDocument16 pagesChapter 9 SolutionsIsah Ma. Zenaida Felisilda50% (2)

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- Principles of Managerial Finance: Chapter 11Document54 pagesPrinciples of Managerial Finance: Chapter 11Crystal Nedd100% (3)

- The Cost of Capital: ResourcesDocument20 pagesThe Cost of Capital: ResourcesAbegail Song BaliloNo ratings yet

- Tugas GSLC Corp Finance Session 17 & 18Document8 pagesTugas GSLC Corp Finance Session 17 & 18Javier Noel Claudio100% (1)

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeeNo ratings yet

- M12 Gitm4380 13e Im C12 PDFDocument23 pagesM12 Gitm4380 13e Im C12 PDFGolamSarwar0% (1)

- Comparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuityDocument3 pagesComparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuitydzazeenNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- Chapter 6: (Interest Rates) and Bond ValuationDocument8 pagesChapter 6: (Interest Rates) and Bond ValuationcydlingsNo ratings yet

- Financial Management Chapter 11 AnswerDocument14 pagesFinancial Management Chapter 11 Answerandrik_2091% (11)

- F.M Rev 2019Document17 pagesF.M Rev 2019AA BB MMNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- IM Ch10Document16 pagesIM Ch10Lim BoonShenNo ratings yet

- Final Exam Corporate Finance CFVG 2016-2017Document8 pagesFinal Exam Corporate Finance CFVG 2016-2017Hạt TiêuNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- ACF 103 Revision Qns Solns 20141Document11 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Problem Set 3 (Duration II) With AnswersDocument5 pagesProblem Set 3 (Duration II) With Answerskenny013No ratings yet

- SD17 Hybrid F9 Answers Clean ProofDocument10 pagesSD17 Hybrid F9 Answers Clean ProofVinny Lu VLNo ratings yet

- Ch. 13 Leverage and Capital Structure AnswersDocument23 pagesCh. 13 Leverage and Capital Structure Answersbetl89% (27)

- AC550 Week Four AssigmentDocument8 pagesAC550 Week Four Assigmentsweetpr22No ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Efficient market insider dealing regulationsDocument9 pagesEfficient market insider dealing regulationsBadihah Mat SaudNo ratings yet

- MTP Soln 1Document14 pagesMTP Soln 1Anonymous 8wg4eowIdzNo ratings yet

- Practice Problems Ch12Document57 pagesPractice Problems Ch12Kevin Baconga100% (2)

- Dde 321 - Solutions Exercise 5Document3 pagesDde 321 - Solutions Exercise 5Foititika.netNo ratings yet

- CostingDocument3 pagesCostingAarti JNo ratings yet

- Accounting Homework Help IliskimeDocument1 pageAccounting Homework Help IliskimeAarti JNo ratings yet

- American Finance Association, Wiley The Journal of FinanceDocument8 pagesAmerican Finance Association, Wiley The Journal of FinanceAarti JNo ratings yet

- CR 1845Document90 pagesCR 1845Aarti JNo ratings yet

- Saudi Vision2030Document85 pagesSaudi Vision2030ryx11No ratings yet

- NCK - Annual Report 2017 PDFDocument56 pagesNCK - Annual Report 2017 PDFAarti JNo ratings yet

- Hi5019 Individual Assignment t1 2019 Qyuykqw5Document5 pagesHi5019 Individual Assignment t1 2019 Qyuykqw5Aarti J50% (2)

- 1 - Sis40215 CPT Case Studies 3Document61 pages1 - Sis40215 CPT Case Studies 3Aarti J0% (2)

- Chapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Document32 pagesChapter 7 Inventory Problem Solutions Assessing Your Recall 7.1Judith DelRosario De RoxasNo ratings yet

- CH 07 SMDocument11 pagesCH 07 SMAarti JNo ratings yet

- Deegan Chapter 10Document18 pagesDeegan Chapter 10Aarti JNo ratings yet

- 6 Capital Market Intermediaries and Their RegulationDocument8 pages6 Capital Market Intermediaries and Their RegulationTushar PatilNo ratings yet

- Mgt201 Solved Subjective Questions Vuzs TeamDocument12 pagesMgt201 Solved Subjective Questions Vuzs TeamAarti JNo ratings yet

- Caltex Australia CTX 2017 Annual ReportDocument127 pagesCaltex Australia CTX 2017 Annual ReportAarti JNo ratings yet

- TFTH C 636639530213947535 31700 2Document55 pagesTFTH C 636639530213947535 31700 2Aarti JNo ratings yet

- Ch03 Prob3-6ADocument9 pagesCh03 Prob3-6AAarti J100% (1)

- Relevant Cost Examples EMBA-garrison Ch.13Document13 pagesRelevant Cost Examples EMBA-garrison Ch.13Aarti JNo ratings yet

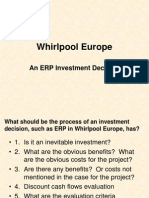

- Whirlpool EuropeDocument19 pagesWhirlpool Europejoelgzm0% (1)

- Mergers Don't Always Lead To Culture Clashes.Document3 pagesMergers Don't Always Lead To Culture Clashes.Lahiyru100% (3)

- Investment Decision MethodDocument44 pagesInvestment Decision MethodashwathNo ratings yet

- MCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Document139 pagesMCK (McKesson Corporation) Annual Report With A Comprehensive Overview of The Company (10-K) 2013-05-07Aarti J100% (1)

- Case Study Ch03Document3 pagesCase Study Ch03Munya Chawana0% (1)

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Document2 pagesPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JNo ratings yet

- 2 Case - 2Document10 pages2 Case - 2Aarti JNo ratings yet

- Organizational CultureDocument21 pagesOrganizational CultureAarti JNo ratings yet

- Coles Year in Review 2017Document28 pagesColes Year in Review 2017Aarti JNo ratings yet

- 2010 06 13 - 091545 - Case13 30Document6 pages2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINo ratings yet

- ACCG315Document4 pagesACCG315Joannah Blue0% (1)

- Accounting Changes and Errors: HapterDocument46 pagesAccounting Changes and Errors: HapterAarti JNo ratings yet

- The Whirlpool Europe Case: Investment On ERPDocument8 pagesThe Whirlpool Europe Case: Investment On ERPAarti JNo ratings yet

- Communicative Approach - ChomskyDocument4 pagesCommunicative Approach - ChomskyMiss AbrilNo ratings yet

- Motion For Reconsideration (Bolado & Aranilla)Document4 pagesMotion For Reconsideration (Bolado & Aranilla)edrynejethNo ratings yet

- The Relationship Between Dissociation and Voices: A Systematic Literature Review and Meta-AnalysisDocument52 pagesThe Relationship Between Dissociation and Voices: A Systematic Literature Review and Meta-Analysiseduardobar2000100% (1)

- Pulp Fiction DeconstructionDocument3 pagesPulp Fiction Deconstructiondomatthews09No ratings yet

- Sid The Science Kid - The Ruler of Thumb Cd1.avi Sid The Science Kid - The Ruler of Thumb Cd2.aviDocument27 pagesSid The Science Kid - The Ruler of Thumb Cd1.avi Sid The Science Kid - The Ruler of Thumb Cd2.avisheena2saNo ratings yet

- Vida 7Document32 pagesVida 7Silvia Rodriguez100% (1)

- Speakout E3 B1+ U2 - Teachers BookDocument20 pagesSpeakout E3 B1+ U2 - Teachers BookCarolinaNo ratings yet

- Human Resource Strategy: Atar Thaung HtetDocument16 pagesHuman Resource Strategy: Atar Thaung HtetaungnainglattNo ratings yet

- Elliot WaveDocument8 pagesElliot WaveGateshNdegwahNo ratings yet

- Numerology Speaking PDFDocument7 pagesNumerology Speaking PDFValeria NoginaNo ratings yet

- Case 3:09 CV 01494 MODocument13 pagesCase 3:09 CV 01494 MOAnonymous HiNeTxLMNo ratings yet

- Preventing Stroke PointsDocument2 pagesPreventing Stroke PointsGermán Mariano Torrez GNo ratings yet

- Literary Analysis Essay - Student PacketDocument11 pagesLiterary Analysis Essay - Student Packetapi-2614523120% (1)

- DR Raudhah Ahmadi KNS1633 Engineering Mechanics Civil Engineering, UNIMASDocument32 pagesDR Raudhah Ahmadi KNS1633 Engineering Mechanics Civil Engineering, UNIMASAriff JasniNo ratings yet

- Letters and Treaties by Mohammad PBUH-3 PDFDocument19 pagesLetters and Treaties by Mohammad PBUH-3 PDFAbdulaziz Khattak Abu FatimaNo ratings yet

- Chapter 1: Functions and Relations: Precalculus, 1st EdDocument49 pagesChapter 1: Functions and Relations: Precalculus, 1st EdjakyNo ratings yet

- English Language (1122)Document26 pagesEnglish Language (1122)TD X Mzinda100% (1)

- 2C 2I 1R Pedagogical ApproachesDocument9 pages2C 2I 1R Pedagogical ApproachesMenchelyn MarasiganNo ratings yet

- MWSS v. CADocument15 pagesMWSS v. CAAlexander AbonadoNo ratings yet

- Scitech 101 Course Pack Final Revision Edited 8-11-2021Document111 pagesScitech 101 Course Pack Final Revision Edited 8-11-2021Zendee Jade MaderaNo ratings yet

- Michigan History-Lesson 3Document4 pagesMichigan History-Lesson 3api-270156002No ratings yet

- Figures of Speech AND 21 Literary GenresDocument33 pagesFigures of Speech AND 21 Literary GenresMike AsuncionNo ratings yet

- Case 6 Solved by Iqra's GroupDocument11 pagesCase 6 Solved by Iqra's GroupIqra -Abdul ShakoorNo ratings yet

- Maternal and Perinatal Outcome in Jaundice Complicating PregnancyDocument10 pagesMaternal and Perinatal Outcome in Jaundice Complicating PregnancymanognaaaaNo ratings yet

- Determinants of Cash HoldingsDocument26 pagesDeterminants of Cash Holdingspoushal100% (1)

- 5 Reasons To Exercise PDFReadingDocument2 pages5 Reasons To Exercise PDFReadingMỹ HàNo ratings yet

- Dentsply Sirona Q2 Earnings Presentation - FINALDocument18 pagesDentsply Sirona Q2 Earnings Presentation - FINALmedtechyNo ratings yet

- 1 Gaona BrianDocument218 pages1 Gaona BrianElias Nicol100% (1)

- National Competency Based Teachers StandardDocument34 pagesNational Competency Based Teachers Standarddanebantilan100% (3)

- Past Simple - Present PerfectDocument5 pagesPast Simple - Present PerfectAnonymous MCobwixNo ratings yet