Professional Documents

Culture Documents

Illustration Plan

Uploaded by

sohailCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration Plan

Uploaded by

sohailCopyright:

Available Formats

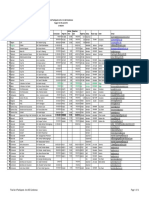

EFU Life Assurance Ltd.

Illustration Of Benefits for 'Prosperity For Life'

Prepared for: Mr. MUHAMMAD FAISAL

Basic Details:

01/05/1981

Date of Birth of: Mr. MUHAMMAD FAISAL

Age: 34

Expected Commencement Date: 01/03/2015

Reference No:

1095 - ( 2.0.0.0 )

Coverage Details:

Currency: Rupees

Mode: Annual

Type: Indexed Premium Compound

Death Benefit: Option 2

Sum Assured

Premium

Term

900,000

Whole of Life

45,000

Accidental Death and Disability Benefit Plus

900,000

20

1,575

Life Care Plus

500,000

20

3,580

Prosperity for Life [Protection Multiple =20]

Waiver of Premium

1,003

20

Rs.51,158

Total Annual Premium

Table 1:Illustrative Values

All benefits are at the end of policy year

7% p.a Rate of Return

Policy

Year

Cumulative Main

Plan Premium Paid

Main Plan Death

Benefit

11% p.a Rate of Return

9% p.a Rate of Return

Cash Value

Main Plan Death

Benefit

Cash Value

Main Plan Death

Benefit

Cash Value

45,000

910,922

10,922 *

911,129

11,129 *

911,336

11,336 *

92,250

946,664

46,664

947,771

47,771

948,886

48,886

141,863

991,083

91,083

993,999

93,999

996,970

96,970

193,956

1,045,230

145,230

1,051,119

151,119

1,057,183

157,183

248,653

1,104,776

204,776

1,114,988

214,988

1,125,628

225,628

306,086

1,171,854

271,854

1,187,986

287,986

1,204,995

304,995

366,390

1,245,395

345,395

1,269,285

369,285

1,294,780

394,780

429,710

1,325,857

425,857

1,359,611

459,611

1,396,079

496,079

496,195

1,413,748

513,748

1,459,773

559,773

1,510,120

610,120

10

566,005

1,509,613

609,613

1,570,647

670,647

1,638,253

738,253

15

971,035

2,138,082

1,238,082

2,330,024

1,430,024

2,556,630

1,656,630

20

1,487,968

3,069,446

2,169,446

3,536,692

2,636,692

4,125,698

3,225,698

25

2,147,719

3,570,606

3,570,606

4,562,636

4,562,636

5,899,564

5,899,564

30

2,989,748

5,645,774

5,645,774

7,586,682

7,586,682

10,383,997

10,383,997

35

4,064,414

8,629,283

8,629,283

12,215,316

12,215,316

17,747,488

17,747,488

36

4,312,635

9,364,099

9,364,099

13,396,603

13,396,603

19,703,570

19,703,570

Notes:

> This is a Whole of Life contract hence a fixed maturity age is not applicable. However, an age of 70 years is used above for illustration purposes.

> The following year-wise percentages of the basic premium would be allocated for purchasing the units:

Year 1:30% - Year 2:80% - Year 3:90%- Year 4 to 5:100% -Year 6 to 10:103%- Year 11 onwards:105%

> The Illustrative Values do not take into account any partial surrenders.

> Following expenses would be charged every year for Prosperity for Life:

Fund Management Charge

Bid-Offer Spread

Administration Charge

= 0.125% of the Regular Premium Cash value and FAP cash value per month.

= 5% of the net Regular Basic Premium and Fund Acceleration Premium.

= Rs. 480 per annum (this charge only applies to the basic regular premium)

> For determining the illustrative values mentioned above, the Administration Charge is increased every year by 2% which is the average rate at which

the Company has increased its Administrative Charge in the last five years.

> Death Benefit is the sum of the Cash Value and Sum Assured, till 55 years age next birthday. From age 56 onwards the Death Benefit is greater of

Sum Assured or Cash Value.

> *The policy cannot be surrendered until two full year's premiums have been paid.

> There is an option of applying the cash value to provide an annuity. The amount of expected annual pension will depend on the investment climate

prevailing at the time when the pension is purchased.

Client:

Name:

Sales Representative:

Name:

Signature:

Date:

Signature:

Date:

EFU Life Assurance Ltd. is registered and supervised by the Securities and Exchange Commission of Pakistan.

11/03/2015

Page 1 of 3

7:24:46AM

ISO 9001:2008 Certified Company

Rated AA by JCR-VIS Credit Rating

Reference No:

1095 - ( 2.0.0.0 )

EFU Life Assurance Ltd.

Illustration Of Benefits for 'Prosperity For Life'

Prepared for: Mr. MUHAMMAD FAISAL

Notes:

> Under the Inflation Protection Benefit,the Basic Regular Premium will increase every year by 5% of the prior year's premium.

> The policyholder has the option to pay Fund Acceleration Premiums from first year onwards. 100% of the Fund Acceleration Premiums are allocated to

purchase units.

> An age based mortality charge applies for the life insurance risk each year and is dependent on the sum at risk. From age 56 onwards, no mortality

charge applies in years where the cash value exceeds the sum assured.

> The 'Rate of Return' assumptions of 7%, 9% and 11% mentioned in the table(s) above are before deduction of 'Fund Management Charge'. This

charge has been deducted from the 'Rate of Return' assumption prior to determining the illustrative values in the table(s).

> The Fund Values are based on assumptions; the actual values can be higher or lower than the ones illustrated above depending upon the performance

of the underlying investments in the EFU Managed Growth Fund. The values illustrated are net of all charges.

> Under Accidental Death and Disability Benefit Plus, an additional amount of Rs .900,000 is payable, if the Life Assured becomes permanently disabled

or dies by means of accident.

> Lifecare Benefit Plus covers Heart Attack, Coronary, Artery surgery, Cancer, Paralysis, Kidney Failure, Stroke, Blindness, Major Organ Transplant,

Multiple Sclerosis, Deafness, Benign Brain Tumour, Coma, Major Head Trauma, Loss of Limbs and Loss of Speech.

> Under Waiver of Premium(WOP), if the life assured becomes permanently disabled thus incapable of performing any occupation, the premium is

waived off and the policy continues in the same way as prior to disablement.

> All charges mentioned in the above notes are reviewable at the discretion of the Company.

> A description of how the contract works is given in the Policy Provisions and Conditions.

> This is the approved illustration format of the Company. Any other illustration, verbal, written or electronic, which contradicts with this illustration should

not be given any consideration and should be reported to the Company.

> The selected fund is EFU Managed Growth Fund and the investable part of basic premium will be invested in this fund. This is a balanced asset

allocation fund. Please note that Unit Linked life insurance plans are subject to investment risk factors, Investment risk in the investment fund selected by

policyholder is borne by himself, and unit prices may go up or down reflecting the market value of the underlying assets.

Declaration by Client:

I have studied the above illustration and the notes carefully and understood them fully. I also confirm that no other illustration, verbal written or electronic,

in contradiction to this illustration has been given to me.

Signature:

Name & CNIC :

Date:

Mr. MUHAMMAD FAISAL & 00000-0000000-0

Address: Not Available

Declaration by Sales Representative:

I confirm that I have not made any verbal, written or electronic presentation which is in contradiction to this illustration. I also confirm that I have not

misled or deceived the prospective client in any way.

In case of any misconduct on my part, the Company and I shall be responsible for any loss to the prospective client. In such circumstances, SECP shall

have the authority to take any action in light of the Insurance Ordinance 2000.

Date:

Signature:

Sales Consultant Code:

Name & Designation :

&

EFU Life Assurance Ltd. is registered and supervised by the Securities and Exchange Commission of Pakistan.

11/03/2015

Page 2 of 3

7:24:46AM

ISO 9001:2008 Certified Company

Rated AA by JCR-VIS Credit Rating

Reference No:

EFU Life Assurance Ltd.

Application for Fund Selection

(For New Business Only)

1095 - ( 2.0.0.0 )

Full Name of Proposed Life Assured :

CNIC No.:

00000-0000000-0

Name of Plan:

Prosperity for Life

Mr. MUHAMMAD FAISAL

(Option 2 )

1. I hereby agree to select the following Fund in connection with my Proposal & Declaration for Life Assurance:

(Please tick one)

Fund

EFU Managed Growth Fund

EFU Guaranteed Growth Fund

EFU Aitemad Growth Fund

2. I understand, agree acknowledge that 'Unit Allocation' of current and future 'Regular Premium' and any 'Fund Acceleration Premium' will be done in

accordance with all relevant Clauses of the Standard Policy Provisions & Conditions governing the Plan I have selected . I further understand and

agree that 'Unit Allocation' would be made in the Fund selected in para 1 above.

3. I understand, agree and acknowledge that the criteria set out by the company shall determine the acceptability of my request and that the Company

shall have the right at its discretion to disallow my request if this application fails to meet the criteria prescribed by the Company from time to time.

4. I understand, agree and acknowledge that this Application would take effect only after my Proposal & Declaration for Life Assurance has been

accepted by the Company and communicated to me in writing; first premium has been received and realized at the Company's Main Office; and the

Policy Document has been issued.

5. I understand, agree and acknowledge that this Application can not be back -dated and will only take effect after issuance of the Policy by the

Company as detailed in Para 4 above.

6. I understand, agree and acknowledge that Investment Funds are subject to investment risks and the unit prices may go up or down reflecting the

market value of the underlying assets.

7. I fully agree to pay any Fees and Charges applicable to Fund Selection as determined by the Company from time to time.

8. I hereby declare that I have fully understood the above and have selected the fund mentioned in Para 1 of this Application on my own free will.

9. I understand, agree and acknowledge that this Application, once approved, shall from part of the Standard Policy Provisions and Conditions

governing the Policy with which it is attached.

Signed at

on the

day of

in the year

Signature of Proposed Life Assured

Important Notice: This Application, together with 'Proposal & Declaration for Life Assurance', shall form part of the Contract between the Proposed

Life Assured and EFU Life Assurance Ltd and will be the basis on which the policy will be issued.

EFU Life Assurance Ltd. is registered and supervised by the Securities and Exchange Commission of Pakistan.

11/03/2015

Page 3 of 3

7:24:46AM

ISO 9001:2008 Certified Company

Rated AA by JCR-VIS Credit Rating

You might also like

- IQ Industry Qualifications DIPLOMA LEVEL I & II HAIRDRESSING GENERAL PAPERDocument2 pagesIQ Industry Qualifications DIPLOMA LEVEL I & II HAIRDRESSING GENERAL PAPERSharon AmondiNo ratings yet

- China Scholarships 2019 Updated PDFDocument8 pagesChina Scholarships 2019 Updated PDFVibrant OverseasNo ratings yet

- Create An HR Plan For Blue Line SubsidiaryDocument9 pagesCreate An HR Plan For Blue Line Subsidiarysamreen waseem100% (1)

- SOP Vaasa Uni FinlandDocument2 pagesSOP Vaasa Uni FinlandRlf ReraNo ratings yet

- How To Write A Scholarship ProposalDocument5 pagesHow To Write A Scholarship ProposalhedayatullahNo ratings yet

- Axis ASAP - KYC Offer Terms and Conditions (Clayton - Travel Bag)Document6 pagesAxis ASAP - KYC Offer Terms and Conditions (Clayton - Travel Bag)Ragul0042No ratings yet

- Prime Bank 2003Document19 pagesPrime Bank 2003Ziaul Ahsan ChowdhuryNo ratings yet

- Fully Funded Scholarships in Italy 2021Document5 pagesFully Funded Scholarships in Italy 2021PDRINo ratings yet

- SOP - AutomotiveDocument2 pagesSOP - AutomotiveHARIKRISHNAN SR100% (1)

- Scholarship Table Final PDFDocument2 pagesScholarship Table Final PDFMohammad Raza Mohammad RazaNo ratings yet

- Sop AsiyaDocument2 pagesSop AsiyaAbdulfatai Abdulrasheed100% (1)

- Statement of Purpose / Cover LetterDocument11 pagesStatement of Purpose / Cover LetterJacobo Posada HoyosNo ratings yet

- Beauty NotesDocument3 pagesBeauty NotesEshaan JindalNo ratings yet

- MottoDocument2 pagesMottoArsalan RaisaniNo ratings yet

- Bangalore UniversityDocument2 pagesBangalore UniversityAtul KashyapNo ratings yet

- CasDocument2 pagesCasJamesalbert KingNo ratings yet

- Student Reg ProcessDocument4 pagesStudent Reg ProcessChetan JadhavNo ratings yet

- MSC Finance and Investment BankingDocument2 pagesMSC Finance and Investment BankingStephen0% (1)

- How To Migrate To Australia in 6 Easy StepsDocument11 pagesHow To Migrate To Australia in 6 Easy StepsAngel Camille DonozoNo ratings yet

- 2023-2024 学年浙江省政府奖学金申请表 Application Form For Zhejiang Government ScholarshipDocument1 page2023-2024 学年浙江省政府奖学金申请表 Application Form For Zhejiang Government Scholarshiptoongpang.phusanisaNo ratings yet

- 2019 N 06667 PDFDocument6 pages2019 N 06667 PDFBilal KhanNo ratings yet

- 2016 Public Procurement ActDocument36 pages2016 Public Procurement ActkNo ratings yet

- Fms Sample SopsDocument13 pagesFms Sample SopsUmang MittalNo ratings yet

- Study Plan For MS Electrical Engineering PDFDocument4 pagesStudy Plan For MS Electrical Engineering PDFAli KazmiNo ratings yet

- New Abi Student Enroll AgreementDocument3 pagesNew Abi Student Enroll Agreementapi-324720319100% (1)

- Canada Email Format ExampleDocument11 pagesCanada Email Format ExampleShihab SultanNo ratings yet

- Emory Acceptance LetterDocument1 pageEmory Acceptance Letterapi-549350243No ratings yet

- Ike's Georgetown Acceptance LetterDocument4 pagesIke's Georgetown Acceptance LettertipapornNo ratings yet

- IIM Summer Internship Statement of PurposeDocument2 pagesIIM Summer Internship Statement of PurposeSoumyadeepNo ratings yet

- Motivation Letter Master's Economics Entrepreneurship Italy UniversityDocument1 pageMotivation Letter Master's Economics Entrepreneurship Italy UniversityHOly Holy50% (2)

- Essay Fo Brunei ScholarshipDocument2 pagesEssay Fo Brunei ScholarshipAhtishamNo ratings yet

- Sample CV FormDocument1 pageSample CV FormaronanubhavNo ratings yet

- Motivation LetterDocument1 pageMotivation LetterYazanAlomariNo ratings yet

- MBA Applicant's Statement of PurposeDocument3 pagesMBA Applicant's Statement of PurposeAdnan Ahmad100% (1)

- Motivation LetterDocument2 pagesMotivation LetterDukuzimana Theo DtNo ratings yet

- Motivation Letter (THM)Document1 pageMotivation Letter (THM)Danish BhuttaNo ratings yet

- Samwel Karanja C.VDocument3 pagesSamwel Karanja C.VSamwel M. KaranjaNo ratings yet

- CBU Acceptance Letter for International StudentDocument4 pagesCBU Acceptance Letter for International StudentDukuzimana Theo DtNo ratings yet

- Coursera Financial AidDocument2 pagesCoursera Financial AidChaima BejaouiNo ratings yet

- SAMPLE MBA Personal StatementDocument1 pageSAMPLE MBA Personal StatementMansoor_GombeNo ratings yet

- Ximb PGCBMDocument4 pagesXimb PGCBMnarai3No ratings yet

- Evidence To Be A JournalistDocument5 pagesEvidence To Be A JournalistWendyNo ratings yet

- Internship Report On Verification of Alternative Cash Assistance FilesDocument46 pagesInternship Report On Verification of Alternative Cash Assistance FilesLayes AhmedNo ratings yet

- Allotment Letters (SAVIOUR Green Isle)Document12 pagesAllotment Letters (SAVIOUR Green Isle)Sonakshi ChauhanNo ratings yet

- Global Hotel Management Statement of PurposeDocument3 pagesGlobal Hotel Management Statement of PurposeromanNo ratings yet

- Statement of Purpose Dinesh IndusDocument2 pagesStatement of Purpose Dinesh IndusHarish TalluriNo ratings yet

- Summers Master Resume Format: Name: Date of Birth: AGE: 21 Cat Percentile: 98.44 Category: Educational QualificationsDocument5 pagesSummers Master Resume Format: Name: Date of Birth: AGE: 21 Cat Percentile: 98.44 Category: Educational QualificationsJayaSiva KatneniNo ratings yet

- Chartered Qualification in Human Resource Management: Group PresentationDocument20 pagesChartered Qualification in Human Resource Management: Group PresentationYazhini ManoharanNo ratings yet

- MCF Edinburgh PG How To Apply 2020Document3 pagesMCF Edinburgh PG How To Apply 2020Leila CheropNo ratings yet

- Statement of Purpose China PDFDocument2 pagesStatement of Purpose China PDFShannon RutanNo ratings yet

- Statement of PurposeDocument2 pagesStatement of Purposeapi-438667529No ratings yet

- Final Report Askari BankDocument117 pagesFinal Report Askari BankAsha JadunNo ratings yet

- SOPDocument1 pageSOPAbhistChauhanNo ratings yet

- A Project On Multi Banking Account SystemDocument4 pagesA Project On Multi Banking Account SystemHimanshu RaiNo ratings yet

- Carleton Statement of IntentDocument2 pagesCarleton Statement of IntentAkash DeepNo ratings yet

- Ttt-Proposal Writing WorkshopDocument92 pagesTtt-Proposal Writing WorkshopIbrahim Abubakar AlhajiNo ratings yet

- SopDocument2 pagesSopPeeyushiRaghavNo ratings yet

- Motivation LetterDocument2 pagesMotivation LetterBabar MehmoodNo ratings yet

- CV Sisgp 2023 - 2024Document4 pagesCV Sisgp 2023 - 2024LydiaNo ratings yet

- QAISERDocument3 pagesQAISERsohailNo ratings yet

- PMS Past Papaer 2016 Business Administratio Paper IDocument1 pagePMS Past Papaer 2016 Business Administratio Paper IMehvishNo ratings yet

- Monthly Global Point Current Affairs January 2019 PDFDocument171 pagesMonthly Global Point Current Affairs January 2019 PDFsohailNo ratings yet

- Current AffairsDocument171 pagesCurrent AffairssohailNo ratings yet

- Rules of Business Amended 03-03-2017Document85 pagesRules of Business Amended 03-03-2017sajidNo ratings yet

- Rules of Business Amended 03-03-2017Document85 pagesRules of Business Amended 03-03-2017sajidNo ratings yet

- QAISERDocument3 pagesQAISERsohailNo ratings yet

- Illustration PlanDocument3 pagesIllustration Plansohail0% (1)

- Hogan v. John Hancock Mut. Life Ins. Co, 195 F.2d 834, 3rd Cir. (1952)Document6 pagesHogan v. John Hancock Mut. Life Ins. Co, 195 F.2d 834, 3rd Cir. (1952)Scribd Government DocsNo ratings yet

- Recruitment of Life Advisors in Indian Life Insurance IndustryDocument92 pagesRecruitment of Life Advisors in Indian Life Insurance IndustryDeepak Sharma100% (1)

- What If My Business Has An Unneeded Life Insurance PolicyDocument2 pagesWhat If My Business Has An Unneeded Life Insurance PolicyDave SeemsNo ratings yet

- PNB Financial CenterDocument2 pagesPNB Financial CenterMariline Lee100% (4)

- Cs M.K. PandeyDocument40 pagesCs M.K. PandeySam DanielNo ratings yet

- Etihad Credit Export Insurance-02.01.20Document3 pagesEtihad Credit Export Insurance-02.01.20kidamanNo ratings yet

- AIO-publication-40-eng-Final List PDFDocument14 pagesAIO-publication-40-eng-Final List PDFKush GuptaNo ratings yet

- Bajaj Life InsuranceDocument71 pagesBajaj Life InsuranceHoney MinhasNo ratings yet

- TI Emulgade SE-PFDocument1 pageTI Emulgade SE-PFeggy mushadi100% (1)

- Solavei Bankruptcy14 14505 TWD 1Document249 pagesSolavei Bankruptcy14 14505 TWD 1John CookNo ratings yet

- CPA Review Center Income Tax TheoriesDocument4 pagesCPA Review Center Income Tax TheoriesJennifer Arcadio100% (1)

- Eastern Shipping Lines v. CA, 234 SCRA 781 (1994)Document9 pagesEastern Shipping Lines v. CA, 234 SCRA 781 (1994)Clive HendelsonNo ratings yet

- Weavers HealthDocument25 pagesWeavers HealthHuidrom SharatNo ratings yet

- Negotiating Expatriate PackagesDocument7 pagesNegotiating Expatriate PackagesMuhammad QadeerNo ratings yet

- Loro Parque Killer Whale Facility Service & Loan Agreement - Formerly ConfidentialDocument41 pagesLoro Parque Killer Whale Facility Service & Loan Agreement - Formerly ConfidentialJeffrey Ventre MD DC100% (1)

- Aia Smart Wealth BuilderDocument5 pagesAia Smart Wealth BuilderSaicharan SreedharaNo ratings yet

- India's Gold Rush Its Impact and SustainabilityDocument35 pagesIndia's Gold Rush Its Impact and SustainabilitySCRIBDEBMNo ratings yet

- Intro To Aviation Ins (Fahamkan Je Tau)Document4 pagesIntro To Aviation Ins (Fahamkan Je Tau)Anisah NiesNo ratings yet

- Oblicon Finals (Memory Aid)Document4 pagesOblicon Finals (Memory Aid)Mitch TuazonNo ratings yet

- 2016 The Institutes Full CatalogDocument40 pages2016 The Institutes Full CatalogJeremy JarvisNo ratings yet

- BCP 7th Edition Version 1Document255 pagesBCP 7th Edition Version 1Shi Hui100% (1)

- Takaful Course & OutlineDocument2 pagesTakaful Course & OutlineAnonymous HlEh2INo ratings yet

- Dan Peterson ResumeDocument3 pagesDan Peterson ResumeCrowdfundInsiderNo ratings yet

- Development Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Document4 pagesDevelopment Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Kimberly SendinNo ratings yet

- Test Bank Finance PDFDocument9 pagesTest Bank Finance PDFHasanQtietNo ratings yet

- FINA 420 - Insurance RisksDocument30 pagesFINA 420 - Insurance RisksZiyi YinNo ratings yet

- Fundamental Principles of Taxation in The Light of Modern DevelopmentsDocument222 pagesFundamental Principles of Taxation in The Light of Modern Developmentsaveros12No ratings yet

- Social Impact Assessment of Muthoot Fincorp's Muthoot Mahila Mitra ProgrammeDocument45 pagesSocial Impact Assessment of Muthoot Fincorp's Muthoot Mahila Mitra ProgrammeZachy Jimmy VellukunnelNo ratings yet

- BinderDocument3 pagesBinderBK AcharyaNo ratings yet

- Loc PDFDocument3 pagesLoc PDFEong Huat Corporation Sdn BhdNo ratings yet