Professional Documents

Culture Documents

Remittance Activity of Janata Bank

Uploaded by

Jajabor ShuhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Remittance Activity of Janata Bank

Uploaded by

Jajabor ShuhanCopyright:

Available Formats

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Table of Contents

Contents

Chapter

Chapter-1

Introduction

Page

No.

Letter of Transmittal

Student Declaration

Acknowledgement

Executive Summary

Acronyms

i

ii

iii

iv

5

1.1

1.2

1.3

1.4

1.5

1.6

1.7

1.8

1.9

07

08

08

08

09

09

10

10

11

Introduction

Origin of the Report

Objectives of the report

Scope of the report

Limitations of the Study:

Analysis techniques

Required data

Methodology of the Study

Flow Chart of the Study

2.1 History of Banking

Chapter-2

History

of 2.2 History of Private Banks in Bangladesh

Banking

in 2.3 Current Structure of Banks in Bangladesh

2.4 Bangladesh Economy 2010-11

Bangladesh

13

14

15

17

3.1 History of the Bank

3.2 Vision, Values, Mission & Objective of JBL

Chapter-3

3.3 Core operations:

The Bank at a 3.4 Recent performance of JBL

3.5 Management Hierarchy of the Bank

Glance;

3.6 Corporate Social Responsibilities (CSR)

Janata Bank 3.7 Information of Branches

3.8 Products of JBL

Ltd.

3.9 Function of Janata Bank Limited as a

Commercial bank

3.10 Financial Highlights of JBL at a Glance

Performance Analysis

19

19

20

21

22

23

24

25

26

Chapter-04

4.1 Introduction of the Issue

4.2 Justification of the Report

4.3 Bank Remittance

4.4 Janata Bank Ltd.s Remittance Activities

4.5 Local or Inland Remittance Activities of JBL

Ahsanullah University of Science & Technology

27

32

32

32

33

34

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Remittance

Activities:

Study on

Janata Bank

Ltd.

4.6 Demand Draft (D.D.)

4.7 Payment Order (P.O.)

4.8 Mail Transfer (M.T.)

4.9 Telegraphic Transfer (T.T.)

4.10 Financial Data Regarding Local Remittance of

JBL. (RGSM Br.) Dhaka

4.11 Clearing House

4.12 Transfer Delivery

4.13Foreign Remittances Activates in JBL

4.14 Inward Foreign Remittance:

4.15 FDD [Foreign Demand Draft]

4.16 SRC [Speedy Remittance cell]

4.17Financial Data Regarding Inward Foreign

Remittance of JBL (RGSM Br.)Dhaka

4.18 Outward Foreign Remittance.

Chapter-05

5.1 SWOT Analysis of JBL

Finding &

5.2 Findings

Recommendation 5.3 Recommendations

Chapter -06

Conclusion

Reference/Bibliography

Appendix

36

45

48

50

53

55

57

59

61

67

68

73

75

77

80

81

83

84

85

List of Figure

Contents

Serial No.

Figure 1.1

Figure 3.1

Figure 3.2

Figure 3.3

Figure 3.4

Figure 4.1

Figure 4.2

Figure 4.3

Figure 4.4

Figure 4.5

Figure 4.6

Figure 4.7

Figure 4.8

Flow Chart of the Study

Organizational Structure of Janata bank limited

CSR activities of Janata Bank Limited of 2010

Product of Janata Bank Ltd.

Function of Janata Bank Limited

How a bank perform its remittance activities

Local or Inland Remittance Activities of JBL

Sample of Demand Draft

Sample of Demand Draft advice Book.

The process of issuance of D.D.

Sample of Payment Order

Example Receipt (MT/TT)

This is the simple of FDD.

Ahsanullah University of Science & Technology

Page No.

11

23

23

25

26

34

35

36

39

40

45

49

67

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

List of Graph

Serial No.

Graph 3.1

Graph 3.2

Graph 3.3

Graph 3.4

Graph 3.5

Graph 4.1

Graph 4.2

Graph 4.3

Graph 4.4

Graph 4.5

Graph 4.6

Graph 4.7

Graph 4.8

Graph 4.9

Graph 4.10

Graph 4.11

Graph 4.12

Graph 4.13

Graph 4.14

Graph 4.15

Contents

Page No.

Compare between Operating Profit and Net Profit of JBL

Compare between Non- Interest Income and Interest

Income of JBL

Comparing Net Profit After Tax (NPAT) with four

Nationalized Commercial Bank of Bangladesh

Comparing Return on Investment (ROI) and Return on

Assets (ROA) with four Nationalized Commercial Bank of

Bangladesh

Comparing Earning per Share (EPS) with four

Nationalized Commercial Bank of Bangladesh

D.D. paid without advice both local and foreign from 2009

to 2010

Total D.D. Cancelled at JBL in 2009 and 2010

Total Payment Order Issued at JBL in 2009 and 2010

Total M.T. payable at JBL in 2009 and 2010

Total T.T. payable at JBL in 2009 and 2010

JBL RGSM Branch Dhaka Inward Local Remittance

earning in 2011

JBL Rajanigandha Super Market Branch Dhaka in Inward

Local Remittance earning from 2008 to 2011

Contribution of JBL in Foreign Remittance earning from

2004 to 2011

National Inward Remittance of Janata Bank Limited

National Inward Foreign Remittance of Janata Bank

Limited

National Inward Foreign Remittance of Janata Bank

Limited (Last 3 months of 2011)

National Inward Foreign Remittance of Janata Bank

Limited (Last 3 months of 2011)

Total F.D.D. payable at JBL in 2009 and 2010

JBL Rajanigandha Super Market Branch Dhaka in Inward

Foreign Remittance earning from 2008 to 2011

JBL Rajanigandha Super Market Branch Dhaka in Inward

Local Remittance earning in 2011.

27

28

Ahsanullah University of Science & Technology

28

29

30

42

44

47

49

51

53

54

62

63

63

64

65

67

73

74

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

List of Table

Contents

Serial No.

Table 3.1

Table 3.2

Table 4.1

Table 4.2

Table 4.3

Table 4.4

Table- 4.5

Table-4.6

Table-4.7

Table-4.8

Number of Branches

Table 3.2: List of Branches (Grade/Category wise)

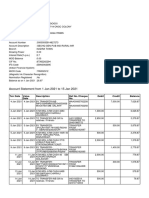

JBL RGSM Branch Dhaka Inward Local Remittance

earning in 2011

JBL Rajanigandha Super Market Branch Dhaka in

Inward Local Remittance earning from 2008 to 2011

Web-based Foreign Remittance Instant/Spot Cash

Payment System (EFT).

Country wise Foreign Remittance of JBL from 2004 to

2010

National Inward Remittance of Janata Bank Limited

National Inward Foreign Remittance of JBL (Last 3

months of 2011)

JBL RSMB Dhaka in Inward Foreign Remittance earning

from 2008 to 2011

JBL Rajanigandha Super Market Branch Dhaka in

Inward Foreign Remittance earning in 2011

Ahsanullah University of Science & Technology

Page

No.

24

24

53

54

60

61

62

64

73

74

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Acronyms

JBL

CEO

MD

CSR

A/C

DMCBL

NPAT

ROI

ROA

EPS

HO or H/O

Janata Bank Limited

Chief Executive Officer

Managing Director

Corporate Social Responsibilities

Account

The Dhaka Mercantile Co-operative Bank Limited

Net Profit after Tax

Return on Investment

Return on Assets

Earning per Share

Head Office

PO

DD

TT

MT

CIBTA

IBCA

IBDA

TIN

IBC

OBC

CAD

GD

IDT

ESS

F.D.D

F.T.T.

SRC

Pay Order

Demand Draft

Telegraphic Transfer

Mail Transfer

Computer Inter Branch Transaction Account

Inter Bank Credit Advice

Inter Branch Debit Advice

TAX Identification Number

Inward Bills for Collection

Outward Bills for Collection

Cash Against Documents

General Diary

Inter Data Transfer

Education Savings Scheme

Foreign Demand Draft

Foreign Telegraphic Transfer

Speedy Remittance cell

Ahsanullah University of Science & Technology

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Chapter-01

Introduction

Ahsanullah University of Science & Technology

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

1.1

Introduction

This report has a certain purpose to focus on the operations of Remittance of Janata Bank

Limited. Without any doubt Remittance catches the flash as it has great importance in the

balance of trade in economy. Banks plays a vital role in this discipline.

In the age of globalization, the importance of banking sector is beyond description. Banking

sector is going ahead with the improvement and invention of new services and offerings to

gather and retain more customers. Besides other banking activities Remittance has become

an essential part of a Banks daily activity to perform. In our daily life we usually use the tools

like DD, TT, MT etc. in order to sent money from one place to another. Again, we know that

foreign remittance has a great impact on our national economy. Internship in Janata Bank Ltd

(Rajanigandha Super Market Branch Dhaka) has brought me the opportunity to know

details about various tools of remittance. At the vary beginning of the internee period, I was

too much interested about Loan sanctioning and recovery system of a bank like Janata Bank

Ltd but in a few days I recognized that my branch deals with remittance more then any

other banking activities including loans. Working with remittance system in daily Banking

day turns my attention from loans to remittance which creates the background of the study.

Ahsanullah University of Science & Technology

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

1.2

Origin of the Report

Although total B.B.A. program combines an excellent blend of theoretical and classroom

knowledge but aside this internship program facilitates a student to bring light on their

theoretical knowledge to apply this in practical ground.

This report is based on an internship program at Janata Bank Limited to gather practical

knowledge about banking activities. This is followed by practical experiences in the

Rajanigandha Super Market Branch Dhakaof Janata Bank Limited. Each intern must carry

out a specific project, in order to report on specific activity of the organization. Consequently

a report based on the projects is to be submitted to both the authority of Janata Bank Ltd and

the University. My topic for this internship report is Remittance Activities:Study on

Janata Bank Ltd. Janata Bank Ltd deals with almost every activities of Banking but

Rajanigandha Super Market Branch Dhaka has a special involvement with remittance. So it is

the main reason behind choosing this topic.

1.3

Objectives of the report

1.3.1 Broad Objective:

The broad objective of this report is to prepare a detailed report on Janata Bank Remittance

Activities and understand the techniques, problems and possible solutions associated with the

issue.

1.3.2 Specific Objective:

The specific objectives of the study are as follows:

To describe different activities in the Remittance section of Janata Bank,

Rajanigandha Super Market Branch Dhaka.

To find out the problems in those activities

To suggest some recommendations to the problems

1.4

Scope of the report

This study would focus on the following areas of Janata Bank Limited.

Actual Remittance activities of Janata Bank Limited.

Overview the current procedure of remittance management.

Overview the current procedure of inward and outward foreign remittance

management.

Organizational structures and responsibilities of management.

Ahsanullah University of Science & Technology

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Each of the above areas would be critically analyzed to determine the proper efficiency of

Janata Banks Remittance Management system.

1.5

Limitations of the Study:

There were some problems while conducting the study. A whole hearted effort was applied to

conduct the study and to bring a reliable and fruitful result. In spite of this, there exist some

limitations, which acted as a barrier to conduct the study. The limitations were:

Time limitation: It was one of the main constraints that affected covering all aspects of the

study.Very short time frame- the report had to be conducted in a short duration (3 months).

Lack of Secondary Information: The Remittance data of Janata Bank Ltd. is not much

available over the net. Secondary source of information was not sufficient for the completion

of the report.

Limitation of the Scope: Much confidential information was not disclosed by respective

personnel of the department

In many case the relevant authorities are not helpful to provide information.

The organization maintains strict confidentiality about their financial and other

information. They are afraid of any type of information leakage to their

competitors. So there was always difficulty to have appropriate information from

them.

The main difficulty of the study was insufficiency of current information relevant

to the study.

Consolidated data related to the study were not given due to time shortage.

All required information was not available in any specific branch of the bank and

there was also limited opportunity to visit more than one branch.

Duration of the study was too short to find out the exact calculation from the

employee.

Scope of my study is so wide that analytical and comprehensive study is not

possible.

Lack of sufficient books, papers and journals etc.

Web site of the Organization isnt up to date to gather valuable information.

1.6

Analysis techniques

Both qualitative and quantitative methods were applied for preparing this report. The data

were analyzed and presented by Microsoft excel and shows percentage, graphical

presentation and different types of charts. Best effort was given to analyze the numerical

findings.

Ahsanullah University of Science & Technology

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

1.7

Required data

I have mainly focused on numerical data in preparing the report. Also I have used theoretical

portion as the demand of the report. Analyzing Remittance management of a bank, both

theoretical and technical knowledge are necessary for execution. Then everything with

accuracy, I have analyzed and made conclusion.

1.8

Methodology of the Study

While conducting the study, sources were explored for primary information and data. But

hardly any updated data could be found. In the absence of updated information or data

dependence on secondary data has been inevitable. However, whenever possible primary data

has been used. Data were also collected by interviewing the responsible officers and from

some documents & statements printed by the Janata Bank Ltd. Janata Bank Ltd. also helped

me in collecting data providing books and Banks annual report.

1.8.1 Study Design

This study is descriptive in nature and so was conducted using assessment of different

historical data along with other sources.

1.8.2 Sources of data

Primary:

a) Personal interview-Face to-face conversation and in depth interview with the respective

officer of the bank.

b) Practical work exposures on different aspects of this field.

Secondary:

A. Annual report of JBL.

B. Relevant documents related to the study as provided by the officers.

C. Periodicals published by Bangladesh Bank.

D. Different publications and relevant circulars.

E. Official website of JBL

F. Manuals of JBL

Ahsanullah University of Science & Technology

10

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

1.9

Flow Chart of the Study

PLANNING

DESIGNING THE LAYOUT

THE APPROACH

The Literature Review

Theoretical Consideration

METHODOLOGY

SUBMISSION OF THE

REPORT

PRIMARY SOURCES

a) Face to face conversation with

Bankers

SECONDARY SOURCES

a) Annual report

b) Working papers

c) Office files

d) Selected Books

COLLECTING INFORMATION

ANALYZING

PREPARING THE REPORT

SUBMISSION OF THE

REPORT

Figure -1.1: Flow Chart of the Study

Ahsanullah University of Science & Technology

11

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Chapter-2

History of Banking in Bangladesh

Ahsanullah University of Science & Technology

12

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

2.1 History of Banking

The first banks were the merchants of the ancient world that made loans to farmers and

traders that carried goods between cities. The first record of such activity dates back to

around 2000 BC in Assyria and Babylonia. Later, in ancient Greece and during the Roman

Empire, lenders who were based in temples made loans but also added two important

innovations: accepting deposits and changing money. During this period, there is similar

evidence of the independent development of lending of money in ancient China and

separately in ancient India.

The origin of banking, in the modem sense, is traced to Italy. The word Bank also seems to

have originated from Italy. The word Bank is supposed to have been derived from the

German word Banck, meaning a mound or heap (like a small hill), from which Italians

adopted Banco. Others believe that the word bank has been derived from Bancus or banc

or Banque which means a bench at which the money changers or mediaeval bankers used to

charge one kind of money into another and transact their banking business. The early banking

was, however, closely associates with the business of money-changing.

Bangladesh inherited its banking structure from the British regime and had 49 banks and

other financial institutions before the Partition of India in 1947. Bengal Bank, the first

British-Patronized modern bank established in India in 1784, had opened its two branches in

1873 in Sirajganj and Chittagong of Bangladesh region. Thereafter, another branch of Bengal

Bank was opened in Chandpur in 1900. A number of other branches of Bengal Bank were

opened in this region and some branches had been closed in Course of time. There were six

other branches of Bengal Bank in operation in the territory of Bangladesh until the Partition

of British-India in 1947 and these branches were at Chittagong (1906), Mymensing (1922),

Rangpur (1923), Chandpur (1924), and Narayanganj (1926).

Following the emergence of Pakistan in 1947, Stat Bank of Pakistan, the Central Bank of the

country, came into being in July 1948. Later, the National bank of Pakistan, a strong

commercial bank was set up in 1949. In all, 36 scheduled commercial banks were in

operation in the whole Pakistan until 1971. Pakistanis owned most of these banks and only

three of them namely, National Bank of Pakistan, Habib Bank Ltd. and the Australasia Bank

Ltd, had one branch of each in East Pakistan in 1949.During 1950-58, there other Pakistaniowned banks, Premier Bank Ltd., Bank of Bhowalpur Ltd. and Muslim Commercial Bank,

had Opened their branch in East Pakistan. Four Pakistan-owned banks, the United Bank Ltd.,

Union Bank Ltd.(Note: the United Bank Limited and Union Bank Limited were renamed as

Janata Bank.), Standard Bank Ltd. and the commerce Bank Ltd. Conducted banking business

in the Province during 1959-1965.But all of them Had their headquarters in west Pakistan.

East Pakistan had only two banks Owned by local business groups white headquarters in

Dhaka. These were the Eastern Mercantile Bank Ltd. (Presently Pubali Bank Ltd.) and

Eastern Banking Corporation Ltd. (Presently Uttara Bank Ltd.) established in 1959 and 1965

respectively.

In the beginning of 1971, there were 1130 branches of 12 banks in operation in East Pakistan.

The foundation of independent banking system in Bangladesh was laid through the

establishment of the Bangladesh Bank in 1972 by the Presidential Order No. 127of 1972

(which took effect on 16th December, 1971). Through the Order, the eastern branch of the

Ahsanullah University of Science & Technology

13

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

former State Bank of Pakistan at Dhaka was renamed as the Bangladesh Bank as a fullfledged office of the central bank of Bangladesh and the entire undertaking of the State Bank

of Pakistan in, and in relation to Bangladesh has been delivered to the Bank.

Bangladesh Bank has been entrusted whit all of the traditional central banking functions

including the sole responsibilities of issuing currency, Keeping the reserves, formulating and

managing the monetary and credit policy, regulating the banking system, stabilizing domestic

and external monetary value, preserving the par value of Bangladesh Taka, fostering

economic growth and development and the development of the countrys market.

Janata Bank Limited is the 2nd largest state owned commercial bank in Bangladesh.

Immediately after the liberation of Bangladesh in 1971, the erstwhile United Bank Limited

and Union Bank Limited were renamed as Janata Bank.

The rate of growth and development of banking sector in the country was extremely slow

until 1983 when the government allowed to establish private banks and started

denationalization process: initially, the Uttara Bank in the same year and thereafter, the

Pubali Bank, and the Rupali Bank in 1986.

Modern banking system plays a vital role for a nations economic development. Over the last

few years the banking world has been undergoing a lot of changes due to deregulation,

technological innovations, globalization etc. These changes in the banking system also

brought revolutionary changes in a countrys economy. Present world is changing rapidly to

face the challenge of competitive free market economy. It is well recognized that there is an

urgent need for better, qualified management and better-trained staff in the dynamic global

financial market. Bangladesh is no exceptions of this trend. Banking Sector in Bangladesh is

facing challenges from different angles though its prospect is bright in the future.

2.2 History of Private Banks in Bangladesh

There were no domestic private commercial banks in Bangladesh until 1982; When the ArabBangladesh Bank Ltd. commenced private commercial banking in the country. Five more

commercial banks came up in 1983 and initiated a moderate growth in banking financial

institutions. Despite slow growth in number of individual banks, there had been a relatively

higher growth of branches of nationalized commercial banks (NCBs) during 1973-83. There

number had increased from 1512 in 1973-74 to4603 in 1982-83.

Financial sector reforms to strengthen the regulatory and supervisory framework for banks

made headway in 2006 although at a slower than expected pace. Overall health of the

banking system showed improvement since 2002 as the gross Non-performing Loans (NPL)

declined from 28 percent to 14 percent while net NPL (less Provision) reduced to 8 percent

from 21 percent. This led significant improvement in the profitability ratios. Although the

Private Commercial Banks (PCB) NPL ratio registered a record low of 6 percent, the four

Nationalized Commercial Banks (NCB) position are still weak and showed very high NPL at

Ahsanullah University of Science & Technology

14

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

25 percent. The NCBs have large capital shortfalls with a risk-weighted capital asset ratio of

just 0.5 percent (June 2006) as against the required 9 percent. For the PCBs risk-weighted

capital asset ratio stood at 10 percent. Bangladesh Bank issued a good number of prudential

guidelines during the year 2006 and the first quarter of 2007 which among others relate to:

Rationalization of prudential norms for loan classification and provisioning,

Policy for rescheduling of loans,

Designing and enforcing an "integrated credit risk grading manual",

Credit rating of the banks, and

Revisions to the make-up of Tier-2 capital.

2.3 Current Structure of Banks in Bangladesh

The commercial banking system dominates Bangladesh's financial sector. Bangladesh Bank

is the Central Bank of Bangladesh and the chief regulatory authority in the sector. The

banking system is composed of four state-owned commercial banks, five specialized

development banks, thirty private commercial Banks and nine foreign commercial banks. The

Nobel-prize winning Grameen Bank is a specialized micro-finance institution, which

revolutionized the concept of micro-credit and contributed greatly towards poverty reduction

and the empowerment of women in Bangladesh.

2.3.1 Central Bank

Bangladesh Bank

Pursuant to Bangladesh Bank Order, 1972 the Government of Bangladesh reorganized the

Dhaka branch of the State Bank of Pakistan as the central bank of the country, and named it

Bangladesh Bank with retrospective effect from 16 December 1971.

2.3.2 State-owned Commercial Banks

The banking system of Bangladesh is dominated by the 4 Nationalized Commercial Banks In

which 3 are totally controlled by government and 1 (Rupali Bank) bank is controlled by both

government and private sector. , which together controlled more than 54% of deposits and

operated 3388 branches (54% of the total) as of December 31, 2004.[1] The nationalized

commercial banks are:

Nationalized Commercial Bank of Bangladesh:

1. Sonali Bank

2. Agrani Bank

3. Rupali Bank

4. Janata Bank

Ahsanullah University of Science & Technology

15

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

2.3.3 Private Commercial Banks

Private Banks are the highest growth sector due to the dismal performances of government

banks (above). They tend to offer better service and products.

1. United Commercial Bank Limited

2. Mutual Trust Bank Limited

3. BRAC Bank Limited

4. Eastern Bank Limited

5. Dutch Bangla Bank Limited

6. Dhaka Bank Limited

7. Islami Bank Bangladesh Ltd

8. Uttara Bank Limited

9. Pubali Bank Limited

10. IFIC Bank Limited

11. National Bank Limited

12. The City Bank Limited

13. NCC Bank Limited

14. Prime Bank Limited

15. Southeast Bank Limited

16. Al-ArafahIslami Bank Limited

17. Social Islami Bank Limited

18. Standard Bank Limited

19. One Bank Limited

20. Exim Bank Limited

21. Bangladesh Commerce Bank Limited

22. First Security Islami Bank Limited

23. The Premier Bank Limited

24. Bank Asia Limited

25. Trust Bank Limited

26. ShahjalalIslami Bank Limited

27. Jamuna Bank Limited

28. ICB Islami Bank

29. AB Bank

30. Marcantile Bank Limited

2.3.4 Specialized Development Banks

Out of the specialized banks, two (Bangladesh Krishi Bank and RajshahiKrishiUnnayan

Bank) were created to meet the credit needs of the agricultural sector while the other two (

Bangladesh Shilpa Bank (BSB) & Bangladesh ShilpaRinSangtha (BSRS) are for extending

term loans to the industrial sector.The Specialized banks are:

1. Bangladesh Krishi Bank

2. KARMASANGSTHAN Bank

3. RajshahiKrishiUnnayan Bank

4. Progoti Co-operative Landmortgage Bank Limited (ProgotiBanK)

Ahsanullah University of Science & Technology

16

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

5. Grameen Bank

6. The Dhaka Mercantile Co-operative Bank Limited (DMCBL)

7. Bangladesh Development Bank Ltd

8. Bangladesh Someday Bank Limited(Cooperative Bank)

9. Ansar VDP Unnyan Bank

10. BASIC Bank Limited (Bangladesh Small Industries and Commerce Bank Limited)

2.3.5 Foreign Commercial Banks

1. Citibank

2. HSBC

3. Standard Chartered Bank

4. Commercial Bank of Ceylon

5. State Bank of India

6. Habib Bank Limited

7. National Bank of Pakistan

8. Woori Bank

9. Bank Alfalah

[Source: www.bangladesh-bank.org -Financial System >Banks , Bangladesh Bank

&http://en.wikipedia.org/wiki/List_of_banks_in_Bangladesh]

2.4 Bangladesh Economy 2010-11

Bangladesh is an advantageous position in relation to world average growth and the growth

of emerging and developing economies. Bangladesh maintained a steady growth in 2010

despite global financial turmoil, but given the increasing demand, the growing power and

energy shortages and poor infrastructure remained major impediments to the countrys

industrial growth. Economic growth in Bangladesh has so far been only insensibly affected

by the ongoing global slowdown, attaining 6.7 percent teal GDP growth in FY 11 following

6.0 percent growth of FY 10. (Appendix- )

Foreign exchange reserve in more than USD 10.14 billion even after ACU adjustment

Agriculture sector achieved a strong growth of 4.7 percent in FY 10 Growth rate of industry

sector slowed down from 6.5 percent in FY 09 to 6.0 percent in FY 10, Service sector

consistently experienced a moderately high performance, contributing to its increasing share

in GDP. During the year 2009-10 contribution of service sector in GDP is 49.9 percent. Gross

investment as percentage of GDP increase, recording 25.0% of GDP in FY 10 compared to

24.37% of GDP in FY 09.

Total foreign remittance during FY 10 stood at USD 10.99 billion, registering a growth of

13.4% over FY 09. Remittance from Saudi Arabia constituted the major share (30.87%) of

the total inward remittance.

Janata Bank has contributed much to attain the achievement in all above sectors and boost the

economy of the country during the year under report.

Ahsanullah University of Science & Technology

17

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Chapter-3

Profile of Janata Bank Ltd. at a Glance

Ahsanullah University of Science & Technology

18

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.1 History of the Bank

Janata Bank Limited is the 2nd largest state owned commercial bank in Bangladesh.

Immediately after the liberation of Bangladesh in 1971, the erstwhile United Bank Limited

and Union Bank Limited were renamed as Janata Bank. The established of Janata Bank was

happened under the Bangladesh Bank order 1972. It was incorporated as a public Limited

Company on 21, May 07 vide certificate of incorporation No-C66933 (4425)07 in the early

era of privatization. The Bank has taken over the business of Janata Bank at a purchase

consideration of Tk. 2593.90 million as a going concern through a vendor agreement signed

between the Ministry of Finance of the Peoples Republic of Bangladesh and the Board of

Directors on behalf of Janata Bank Limited on 15th November 2007. The operation of Janata

Bank Limited works through 851 branches and including 4 overseas branches at United Arab

Emirates and a subsidiary company named Janata Exchange Company Srl in Italy. It is linked

1202 foreign correspondents all over the world.

3.2 Vision, Values, Mission & Objective of JBL

3.2.1 Vision

Become the effective largest commercial bank in Bangladesh to support socio- economic

development of the country and to be a leading bank in south Asia.

3.2.2 Values

Professionalism

Diversity

Growth

Values

Integrity

Dignity

Accountability

Ahsanullah University of Science & Technology

19

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.2.3 Mission

Janata Bank Limited will be an effective commercial bank by maintaining a stable growth

strategy, delivering high quality financial products, providing excellent customer service

through an experienced management team and ensure good corporate governance in every

step of banking network.

3.2.3 Objective

The bank plays a vital role in socio-economic development of Bangladesh

A) Agro credit.

B) Micro credit

C) SME Credit

D) Project loan (Industrial credit)

E) General Loan

Maximize profit through customer satisfaction and contributing in national economy.

Doing foreign exchange and trade to uphold the national interest and balance of trade

in favor of Bangladesh.

Blocking all kinds of illegal monitory activities with emphasis on money laundering

as per Govt. instructions and Bangladesh Bank Circulars.

Brining new technology based high quality customer service and products through IT

such as ATM. ONE STOP SERVICE, ONLINE BANKING. CREDIT AND DEBIT

CARD, AUTOMATED CLEARING HOUSE FACILITY.

Giving quality merchant bank service to the customer and maintaining healthy

portfolio.

3.3 Core operations:

Janata Bank Limited, the second largest commercial bank in Bangladesh, has an authorized

capital of Tk. 20000 Million, paid up capital of Tk5000 Million and reserve fund of Tk.10240

Million in 2010.

The Bank has a total asset of Tk. 345234 Million as on 31st December 2010. Immediately

after the emergence of Bangladesh in 1971, the erstwhile United Bank Limited and Union

Bank Limited were nationalized and renamed as Janata Bank Limited.

Janata Bank Limited operates through 872 (up to 2011) branches including 4 overseas

branches at United Arab Emirates. It is linked with 1198 foreign correspondents all over the

world.

The Bank employs more than 13(Thirteen) thousand persons.

Ahsanullah University of Science & Technology

20

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

The mission of the bank is to actively participate in the socio- economic development of the

nation by operating a commercially sound banking organization, providing credit to viable

borrowers, efficiently delivered and competitively priced, simultaneously protecting

depositors funds and providing a satisfactory return on equity to the owners.

The Board of Directors is composed of 15 (fifteen) members headed by a Chairman. The

Directors are representatives from both public and private sectors.

The Bank is headed by the Managing Director (Chief Executive), who is a reputed banker.

The corporate head office is located at Dhaka with 35 (thirty five) Divisions.

3.4 Recent performance of JBL

Major Achievement in 2010

Shareholder equity increased to Tk.20390 million in 2010 from Tk.14925 million in

2009.

Classified loan reduced to Tk.-11827 million in 2010 from Tk.14037 million in 2009.

Capital adequacy increased to Tk.23454 million in 2010 from Tk.14765 million in

2009.

Interest margin increased to Tk.7067 million in 2010 from Tk.4490 million in 2009.

Return on asset increased to 1.42 percent in 2010 from 0.95 percent in 2009.

Earning per share (EPS) increased to Tk.98.16 in 2010 from Tk.73.37 in 2009.

Foreign trade increased to Tk.302259 million in 2010 from Tk.206715 million in

2009.

Deposit increased to Tk.286567 million in 2010 from Tk.246175 million in 2009.

Loan and advance increased to Tk.225732 million in 2010 from Tk.166359 million in

2009.

Operating profit increased to Tk.12036 million in 2010 from Tk.8578 million in 2009.

Pre-tax profit increased to Tk.7820 million in 2010 from Tk.5656 million in 2009.

After-tax profit increased to Tk.4908 million in 2010 from Tk.2804 million in 2009.

Janata Bank Limited awarded by ICIC Bank Hong Kongfor batter performance of US

Dollar clearing.

Janata Bank Limited contributed to the National exchange Tk.1557 million in 2010 as

against Tk.830 million in 2009.

Janata Bank Limited distributed Tk.61.29 million for Corporate Social

Responsibilities (CSR) activities in2010 as against Tk.17 million in 2009.

Ahsanullah University of Science & Technology

21

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Recently The Bank has been recognized internationally and domestically for

its good performance.

International Award-The Bank of the year-2011 in Bangladesh

Janata Bank Limited has been awarded The Bank of the Year-2011 in Bangladesh

by the London based Financial Magazine The Banker of the Financial Times Group.

This is for the sixth time the bank has been awarded The Bank of the Year. Janata

Bank Limited achieved remarkable progress in the year 2010.

ICMAB Best Corporate Award-2011

Janata Bank Limited has been awarded 'ICMAB Best Corporate Award - 2011' by the

Institute of Cost and Management Accountants of Bangladesh. This Bank secured the

first position among the state owned Commercial Banks in Bangladesh.

International Award -"World's Best Bank Award-2009 in Bangladesh

Janata Bank Limited was awarded Best Bank-Bangladesh in the Global Finance,

World's Best Bank Awards, 2009 by New York based Financial Magazine "Global

Finance". "Global Finance" has identified winning banks based on number of criteria

including growth in Assets, Profitability, Strategic relationships, Customer Service,

Competitive pricing and innovative products.

International Award -"World's Best Bank Award-2008 in Bangladesh

International Award -"World's Best Bank Award-2007 in Bangladesh

International Award -The Bank of the Year-2004 in Bangladesh

Janata Bank Limited receives "Asian Banking Awards 2004" on Financing

Program for Women Entrepreneurship:

Janata Bank Limited gets The Banker Award-2003

International Award-The Bank of the Year-2002

International Award-The Bank of the Year-2001

It may be noted here that Janata Bank Limited has been working hard in improving the

customer services in recent times by introducing a number of IT-based reform measures

3.5 Management Hierarchy of the Bank

3.5.1 Board of Directors

The Board of Directors is composed of thirteen members headed by a Chairman and the

directors comprised of representatives from both public and private sectors and shareholders.

The Bank is headed by the Managing Director (Chief executive) who is a reputed

professional Banker

Ahsanullah University of Science & Technology

22

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.5.2 Organizational Structure of Janata bank limited

Chairman

Managing Director

Deputy Managing Director

General Manager

Assitant General Manager

Manager

Senior Executive Officer

Executive Officer

Assistant Executive Officer

Support Stuff

Figure-3.1 Organizational Structure of Janata bank limited

3.6 Corporate Social Responsibilities (CSR)

As a state-owned bank, its goal is not only make profit, but also to serve people through our

Corporate Social Responsibilities (CSR) .The Bank has adequate scope to provide financial

assistance to the distressed and deprived people individually and through various

organization towards human development. The Bank pursuing CSR activities with funds

generated from profit. The Bank disbursed Tk.61.29 million in 2010 as against allocated 70

million. CSR aims at maximizing realization of human potentials and minimizing human

deprivation.

CSR activities of Janata Bank Limited of 2010 are given below:-

Corporate Social Responsibilities

7%

7%

25%

Poverty reduction and

rehabilitation

Health

16%

Knowledge building

20%

25%

Disaster mitigation

Figure3.2:- CSR activities of Janata Bank Limited of 2010

Ahsanullah University of Science & Technology

23

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.7 Information of Branches

Janata Bank Ltd. operates through 868 branches. It is linked to its foreign correspondents all

over the world. Janata Bank Ltd. Also have four overseas branches.

Number of Branches

Branches in Bangladesh

868

Rural Branches

486

Urban Branches

Overseas Branches

Total Branches

382

4

872

Table 3.1 Number of Branches

List of Branches (Grade/Category wise)

SL

01

02

03

04

05

06

07

08

Total

Name

Local Office

Corporate -1 Branches

Corporate -2 Branches

Overseas Branches

Grade - 1 Branches

Grade - 2 Branches

Grade - 3 Branches

Grade - 4 Branches

No

1

12

41

4

204

209

294

107

872

Table 3.2: List of Branches (Grade/Category wise)

Ahsanullah University of Science & Technology

24

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.8 Products of JBL

JBL offers both corporate and retail banking services with a strong focus on socio economic

development of the country. The bank typically provides short term working capital loan and

limited long term exposure. Moreover, JBL offers micro enterprise and special credit as well

as rural banking. Under corporate banking service JBL provides trade finance, project

finance, syndication etc. On the other hand, consumer loan, deposit scheme, remittance

facilities are served through retail banking. In 2010, JBL launched its merchant banking

operation to diversify its product portfolio.

Deposit

Products

Products

of JBL

Credit

Products

E-Services

ATM

Operation

Current deposit Account , Short

term Deposit, Savings Bank

Deposit Account, Fixed Deposit,

Foreign Currency Deposit,

Monthly Saving Schene, Monthly

Profit Based Saving Csheme,

Janata Bank Savings pension

Scheme (JBSPS), Janata Bank

Deposit Scheme (JBDS), Education

Deposit Scheme (EDS), Medical

Deposit Scheme (MDS), Janata

Bank Monthly Savings Scheme

(JBMSS), Janata Bank Special

Deposit Scheme (JBSDS), Janata

Bank School Banking Savings

Karjakram

Term Loan, Trade Finance,

Import Finance, Export Finance,

SME Financing, Micro Credit,

Agricultural & Rural Credit,

Consumer Credit, Home Loan,

Loan for Merchant Banking

Speedy Remittance Western Union

Money Transfer,

Automated Clearing, Internet

Banking, ATM Banking

Debit Card Operation

Salary Card

Figure 3.3: Product of Janata Bank Ltd.

Ahsanullah University of Science & Technology

25

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.9 Function of Janata Bank Limited as a Commercial bank

Function of

Janata Bank

Limited

General function

Collecting deposit , Lending

loan , Honouring cheque ,

Creation of medium of

exchange, Discounting bills,

Money transfer etc.

Development

function

Creation of savings and

formation of capital, helps

export and import business,

Investment in development

sector, HR development etc.

Representative

function

Receive and payment as the

representative of clients, selling

of share and securities,

Service function

Transaction of foreign

currencies, information sharing,

Consulting and others service

functions.

Figure 3.4: Function of Janata Bank Limited

3.9.1 Other Services of Janata Bank Limited.

Beside regular banking operation, Janata Bank Limited offers specialized services to different

walks of clients/agencies throughout the country. Under the network of utility services,

customers of different govt. organizations, corporate bodies, local bodies, educational

institutions, students, etc are getting essential benefits from the Bank continuously.

The utility services of Janata Bank Limited's are:

Bills Collection

Payment Made on Behalf of Government

Services Areas

3.9.1.1 Bills Collection

Collecting the gas bills of Titas, Bakhrabad and Jalalabad Gas Transmission and

Distribution Companies.

Regular collection of electricity bills of Dhaka Electricity Supply Authority, Dhaka

Electricity Company, Bangladesh Power Development Board and Rural

Electrification Board.

Ahsanullah University of Science & Technology

26

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Regularly collects the telephone bills of Telegraph and Telephone Board.

Collects Water/Sewerage bills of Water and Sewerage Authority.

Municipal holding tax of City Corporation/ Municipalities is collected by JBL.

3.9.1.2 Payment Made on Behalf of Government

Payment of non- Govt. teachers salaries

Providing girl Students scholarship/stipend & Primary Student Stipend.

Provides army pension

Payment of widows, divorcees and destitute women allowances

Old-age Allowances

Food procurement Bills

3.10 Financial Highlights of JBL at a Glance

Performance Analysis

3.10.1 Compare between Operating Profit and Net Profit of JBL from 2008

to 2010

Taka in Million

Operating Profit and Net Profit of JBL

14000

12000

10000

8000

6000

4000

2000

0

Operating Profit

Net Profit

2006

2007

2008

2009

2010

4213

4963

7003

8578

12037

1681

3145

2982

4907

Year

Source: Janata Bank Annual Report -2010

Graph3.1: Compare between Operating Profit and Net Profit of JBL

The Graph-3.1 shows that, The Net Profit of JBL. up to December 2010 is Tk.4907

Million which is higher than Tk. 2982 Million in 2009. Where, in 2006 the net profit of

JBL is zero.

So we can say that, the growth of Net Profit as compared to Operating Profit is

respectable.

Ahsanullah University of Science & Technology

27

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

3.9.2 Compare between Non- Interest Income and Interest Income of JBL

from 2009 to 2010

Taka in Million

20000

15000

10000

5000

0

2009

2010

4722

7283

15401.7

17684.9

Non Interest Income

Interest Income

Year

Source: Janata Bank Annual Report -2010

Graph 3.2: Compare between Non- Interest Income and Interest Income of JBL

The Graph 3.2 shows that, The Non Interest Income of JBL. up to December 2010 is

Tk.7283 Million which is higher than Tk. 4722 Million in 2009. So we can say that, the

growth of Non Interest Income as compared to Interest Income is respectable.

Taka in Million

3.9.3Janata Bank Ltd compare with Nationalized Commercial Bank of

Bangladesh

5000

4000

3000

2000

1000

0

Net Profit Afret tax

Janata

Bank Ltd.

4907

Rupali

Bank Ltd.

600.6

Agrani

Bank Ltd.

3516.8

Sonali

Bank Ltd.

2737.6

Name Of Nationalized Commercial Bank

Source: Annual Report- 2010 of the above Banks

Graph3.3: Comparing Net Profit After Tax (NPAT) with four Nationalized Commercial Bank of

Bangladesh

The Graph3.3 shows that, the Net Profit after Tax (NPAT) of JBL up to December 2010

is Tk.4907 Million which is higher than NPAT of Rupali Bank Ltd. (Tk. 600.6 Million),

Agrani Bank Ltd. (Tk. 351608 Million) and Sonali Bank Ltd. (Tk. 2737.6 Million).

Ahsanullah University of Science & Technology

28

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Percentage

After analyzing the chart we can say that the financial position of Janata Bank Ltd. is

batter than other Nationalized Commercial Bank of Bangladesh.

16.00%

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

Return on Investment (ROI)

Retern on Assets (ROA)

Janata

Bank Ltd.

4.89%

Rupali

Bank Ltd.

11.22%

Agrani

Bank Ltd

14.75%

Sonali

Bank Ltd.

9.39%

1.45%

1.15%

1.33%

0.03%

Name of Bank

Source: Annual Report- 2010 of the above Banks

Graph 3.4: Comparing Return on Investment (ROI) and Return on Assets (ROA) with four

Nationalized Commercial Bank of Bangladesh

The Graph 3.4 shows that, the Return on Investment (ROI) of JBL up to December 2010

is 4.89% which is lower than the Return on Investment (ROI) of Rupali Bank Ltd.

(ROI-11.22%), Agrani Bank Ltd. (ROI-14.75%) and Sonali Bank Ltd. (ROI-9.39%).

Where, the Return on Assets (ROA) of JBL up to December 2010 is 1.45% which is

higher than the Return on Assets (ROA) of Rupali Bank Ltd. (ROA-1.15%), Agrani

Bank Ltd. (ROA-1.33%) and Sonali Bank Ltd. (ROA-0.03%).

After analyzing the chart we can say that the financial position of Janata Bank Ltd. is

batter than other Nationalized Commercial Bank of Bangladesh though ROI is lower.

Ahsanullah University of Science & Technology

29

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Taka

Earning Per Share

100

90

80

70

60

50

40

30

20

10

0

Earning Per Share

Janata Bank

Ltd.

98.16

Rupali Bank

Ltd.

48.02

Agroni Bank

Ltd.

64.35

Sonali Bank

Ltd.

30.42

Name of Bank

Source: Annual Report- 2010 of the above Banks

Graph 3.5:- Comparing Earning per Share (EPS) with four Nationalized Commercial

Bank of Bangladesh

The Graph- 3.5 shows that, Earning per Share (EPS) of JBL up to December 2010 is

Tk.98.16 which is higher than EPS of Rupali Bank Ltd. (Tk48.02), Agrani Bank Ltd.

(Tk. 64.35) and Sonali Bank Ltd. (Tk. 30.42).

After analyzing the chart we can say that the financial position of Janata Bank Ltd. is

batter than other Nationalized Commercial Bank of Bangladesh.

Ahsanullah University of Science & Technology

30

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Chapter-04

Remittance Activities:

Study on Janata Bank Ltd.

Ahsanullah University of Science & Technology

31

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

4.1 Introduction of the Issue

Now a day a modern banker must have to perform a number of ancillary services, besides

performing the two essential functions of accepting deposits and investing its funds.

Remittance of funds can be considered as one of the most important ancillary service

provided by a Bank. With a network of the branches spread over the entire country banks are

eminently suitable institutions for the remittance of funds from one place to another. Bank

remittance is safe, swift, inexpensive, and simple. Bank takes the risk of theft or loss of

customers money in exchange of a very little commission. Again, the reserve of foreign

remittance plays a great role in national economy. With various types of accounts

maintaining in international branches and coordinating international banks these foreign

currencies are being carried sending by non-resident Bangladeshis.

4.2 Justification of the Report

Due to market economy a huge competition exists among the nationalized, foreign and

private commercial banks and therefore the expectation of the customers growing rapidly

concerning the banking operation & how customer service can be more attractive. Bank

Remittance- the way of sending customers money from one place to another, has becomes the

most important part of customer service in recent years. On the other hand, these ancillary

services are generating a great income to the Banks. Under the above circumstances, it has

become necessary for Janata Bank Ltd. to focus its' attention towards the improvement of

various customer services and increase the efficiency to attract and also retain the customers.

That is why it is quite justified to make an in-depth study about its operation and evaluate

service provided by this bank and scope for its improvement. Since marketing is the area of

my study, Bank Remittance seems preferred to me rather then any other banking activities to

study. Thus I think, this study will vehemently help me to go forward and improve my career

path.

4.3 Bank Remittance

One of the most important aspects of the Commercial Banks is rending services to its

customers. Among different services render by a Commercial Banks to its customer

remittance facilities are very well known and popular to the customers. The word

"Remittance" means sending of money from one place to another branch within the country.

There are two types of Remittance: Inward & Outward. The Commercial Banks Remittance

facilities enable its customers to avoid risk arising out of theft or loss in carrying cash money

from one place to another or making payment to some one in another place. Banks take the

risk and ensure payment to the beneficiary in exchange of a little bit benefit known as

Exchange or Commission.

Ahsanullah University of Science & Technology

32

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Different parties in money transfer process:

Normally four types of parties are related to money transfer process:1. Customer [who send money]

2. Issuing Branch [This branch take money from customer and order to pay money to

other bank.]

3. Paying Branch [This branch pay money to the beneficiary]

4. Payee or Beneficiary [Who get money]

Major works of this department:

The following works are done in this department Issuing & Payment of Demand Draft, Payment Order

All related correspondence with other Branches & Banks.

Compliance of Audit & Inspection.

Balance of D.D.& P.O. payable & D.D.& P.O. Paid with advice.

Payment of Incoming TT.

Issuing, encashment of Pay Order and maintenance of record and proof sheet.

Issuance of Local Drafts

Issuing and encashment of BCD.

All related correspondences.

Issuing of Outgoing TT.

Issuance of T.T.ICA, IBCA & IBDA.

Inward foreign remittance collection.

Outward foreign remittance activities.

4.4 Janata Bank Ltd.s Remittance Activities

JBL has its branches in the major cities of the country and therefore, it serves as one of the

best mediums for remittance of funds from one place to another. This service is available to

both customers and non-customers of the bank.

JBL perform both Inward and Outward remittance activities. We can divide remittance

activities of Janata Bank Ltd. By the following wayRemittence

activites at

JBL

Local

\Inland

Remittence

Inward

Remittence

Outward

Remittence

Ahsanullah University of Science & Technology

Foreign

Remittance

Inward

Remittence

Outward

Remittence

33

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

4.5 Local or Inland Remittance Activities of JBL

Local or inland remittance department of JBL performs an important role to send money from

one place to another branch within the country.

We can easily understand the remittance activities in a Bank by the following

Place-2

Place-1

4.

Beneficiary

(Money Receiver)

1.

Customer

(Money Sender)

Go to

Remittance

department

2.

Issuing Branch

(Taking money with

bank commissions)

Pay

Money

Order Send

3.

Paying Branch

(Getting order from

issuing Branch)

Figure4.1: How a bank perform its remittance activities

By this way money is sent from one branch to another branch within the country. Here in

place-1; any customer pays money with bank commission at the Issuing Branch and

Beneficiary collect money from Paying Branch at Place-2.

In this case, the Issuing Branch only sent a written document to the Paying Branch in order to

pay the money to the Beneficiary.

Money is sent from one branch to another branch within the country by following wayBank remittance may be categorized as Demand Draft (DD)

Mail Transfer (MT)

Telegraphic Transfer (TT)

Payment Order (PO)

Traveller Cheques.

Ahsanullah University of Science & Technology

34

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Telegraphic

Transfer (TT)

Demand

Draft (DD)

Inward

Remittance

Payment

Order (PO)

Mail Transfer

(MT)

Traveler

Cheques.

Local or

Inland

Remittance

Activities of

JBL

Telegraphic

Transfer (TT)

Demand

Draft (DD)

Out ward

Remittance

Payment

Order (PO)

Mail Transfer

(MT)

Traveler

Cheques.

Figure- 4.2 : Local or Inland Remittance Activities of JBL

The following register books are to be maintained for remittance concern: DD. MT. TT Advice Register

DD Payment registers Day Book

TT Payment Register Book

Ex-Advice Payment Register Book

Above all this service is performed by the Remittance department efficiently.

Here, I am now explaining in brief the process and activities of local remittance in JBL and

JBL Rajanigondha Super Market Branch, Dhaka as well.

Ahsanullah University of Science & Technology

35

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

4.6 Demand Draft (D.D.)

Demand Draft is an instruction payable on demand. It is negotiable instrument issued by the

branch Bank containing an order to another branch of the same Bank to pay a certain sum of

money to a certain person or order on demand. This instrument can be purchased by a

customer from a particular Bank branch for himself or for beneficiary and can handed over to

the purchaser for delivery to the beneficiary. The payee or beneficiary will claim the proceeds

of the instrument by producing the same to the concerned paying branch. Demand Draft may

be paid in cash to the payee on proper identification or the proceeds may be credited to his

account. Banks issue drafts for a nominal commission. The commission depends upon the

amount to be transmitted. The purchaser of the draft needs not to be a customer or account

holder of the Bank. Draft can be crossed also.

Sample of Demand Draft

No. D.D. 012345

Janata Bank Ltd.

.Branch

Data //

On demand pay to .. Or

Order the sum of . Taka(..)

for value received.

Janata Bank Ltd.

..

Officer

For Janata Bank Ltd.

Manager

Figure4.3- Sample of Demand Draft

After analyzing this sample Demand Draft we identify the following feature1. Serial Number (No. D.D. 012345)

2. Branch Name

3. Amount of money (Numerical)

4. Date of Time

5. Name of Beneficiary

6. Amount of money (in ward)

7. Two Officer signature (with P.A. number)

Conformity and inconformity between Cheque and Demand Draft.

Explanation

1. Meaning

2. Facility

Cheque

A cheque is an unconditional

order directing the banker to

pay a certain sum of money

only to or to the order of a

certain person.

The current account and

saving account holders get a

Ahsanullah University of Science & Technology

Demand Draft

A draft is an order to pay money

drawn by one office of a bank

upon another office of the same

bank for a sum of money payable

to order on demand.

Draft is issued to anyone even to

non-account holders.

36

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

cheque facility.

3. Purpose

Cheques are used to make

payments

or

to

settle

transactions. There is no

certainty of payment in the

case of cheques as they can be

dishonored or payment can be

stopped.

4. Drawer

In case of cheque, the drawer

is the customer of the bank.

5. Bank charges The bank may not charge for

issuing the cheque book.

6. Dishonour

Cheques can be dishonored

for various reasons.

7. Stopping of In case of cheque, the drawer

payment

can ask the bank to stop

payment of the cheque even if

it is delivered to the payee.

8. Popularity

Cheques are very common

and

popular

mode

of

payment.

9. Clearance

In case of cheque, there is a

need for clearance.

10. Parties

Three parties are involved in

involved

cheque transaction viz., (a)

Drawer, (b) Drawee, and (c)

Payee.

The main purpose of a draft is to

transfer money from one place to

another or to guarantee the

certainty of payment to the payee.

In case of draft, the drawer is the

bank itself.

The bank charges a nominal fee or

commission to issue a draft.

There is no question of

dishonoring of draft.

In case od draft, the purchaser of

the draft can ask the bank to stop

payment before the draft is

delivered to the payee.

Drafts do not enjoy much

popularity as compared to

cheques.

In case of draft, there is no need

for clearance.

Two parties are involved in draft

transaction viz., (a) Drawer, and

(b) Payee.

4.6.1 Issuance of Demand Draft

While issuing demand Draft, an official must be confirmed about the existence of the Bran

where the DD is to be issued or drawn as asked for by the applicant. Application on Banks

prescribed form (Remittance-226) for DD be obtained from the applicant duly filled and

signed by then. Thereafter, Applicant will be asked to deposit the amount or DD and

exchange Commission commuted correctly at the prescribed rate. On receipt of cash voucher

will be passed and scrolled by the officers. DD will be issued and recorder to the DD issues

register filling the appropriate columns. Test number (if required) is affixed on both DD and

Advice as per instruction. It is mentionable here that DD application is treated as Credit

Voucher or SBG A/C (IBT A/C) and reported to HO, Recon, Division showing credit entry

against contra Branch (paying Branch). The minimum exchange of demand drafts or Bank

Ahsanullah University of Science & Technology

37

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Drafts is Tk. 20/- (including VAT Tk. 3/-) for the amount of Tk. 1 to Tk. 20000.After that

that exchange is charged Tk. 1/-for each Tk. 1000/-, and VAT is 15% of the commission.

The voucher will be passed by the following way- [Issuing Branch]

Cash Transfer

Cheque Transfer

Transfer

order

Mail/Letter

Dr.

Dr. : Partys A/C , Cheque

Dr. : Partys A/C [FormA/C- No.]

: Cash A/c

Cr. : Income A/c ;

Commission on

Remittance

Cr. : Like as Cash

by

Cr. : Like as cash

[Partys app. To be

attached with vouchers]

For any amount of DD issued, a relative DD Advice and sent to paying branch where the

Advice converted into Voucher.

In an advice we find following items:

1. Name of Issuing Branch of JBL and code number.

2. Name of Drawee or Paying Branch of JBL and code number.

3. Date

4. Advice No.

5. D.D. No.

6. Beneficiary name

7. Amount of money both numeric and word.

8. Authorized signature.

This advice is done four copies. First two copies is send to the Drawee/Paying branch, third

copy is send to the Head Office (HO) with daily extracts and the fourth copy is adjoining in

Draft advice Books as an office copy.

Draft advice Book normally printed by special ink and it have a serial number.

Ahsanullah University of Science & Technology

38

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

Janata Bank Ltd.

(In Quadruplicate)

Computerized Inter Branch Transaction Credit Advice

(For Demand Draft Only)

Name of Inter Branch Transaction A/C Sub Head

From

Originating Br.

To

Responding Br.

D.D. No

Advice No.

Code No. of the Sub Head of

Inter Br. Transaction A/C.

Name of the Region of

Originating Br.

Originating Br.

Originating Date

Name of the Region of

Responding Br.

Responding Br.

Code

Transaction Code

Particulars

Amount

Total Taka (in wards)

Prepared By

.

Officer (PA No.)

Officer (PA No.)

PORTION ABOVE THIS MUST BE FILLED IN BY THE ORIGINATING BRANCH

Responding Br. Seal

DATE

DEBIT

----------------- RESPONDING

INTER BRANCH TRANSACTION RESPONDING

A/C. SUB HEAD AMOUNT AND

BR. CODE

PARTICULARS AS ABOVE.

Prepared By

Officer (PA No.)

Officer (PA No.)

Quadruplicate copy to be retained by originating Branch as Office Copy. Accts. : 76 (504)

B.M. 5-80.

Figure-4.4: Sample of Demand Draft advice Book

Ahsanullah University of Science & Technology

39

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

The client will fill up the Demand Draft Application form.

Teller will receive the cash against the Demand Draft including the Charges & Vat as per

schedule of charges in case the party pays in cash. Teller will put the received stamp on the DD

application & prepare IDT for the entire amount. DD application and IDT to be submitted to the

Remittance Department for issuance of the DD.

For Issuance of DD against cheque or partys instruction, respective account will be debited after

verification of customers signature by the Cash Department.

The Demand Draft shall be prepared Branch wise controlling number will be given on the draft

besides the printed numbers putting an oblique (/) in between. The amount of draft will be

protecting graphed. The description of the DD will be recorded in the DD issuing Register.

The draft number should be written on the voucher & DD Application form.

Draft should be signed jointly by the GB Head & another authorized signatory with P.A. number.

Test is required for money transfer value of Tk.50,000.00 or over. The tested message will be

sent to the paying branch through Fax or E-Mail. Test no. should be written on the CIBTA and on

the face of the Demand Draft in Red Ink.

The CIBTA should be prepared in triplicate. Original to be sent to the drawee branch. Second

copy for the branch accounts department and the third copy should be retained by the Remittance

Department (in the CIBTA book) for ready reference.

Concern Officer must ensure that acknowledgement is obtained from the client or his authorized

representative on the counter folio and issuing register.

Figure4.5: The process of issuance of D.D.

4.6.2 Demand Drafts received for Collect

a) All the Inward Demand Drafts will be received by the Managers or Accountant and

examine by him to ensure that there is no unreasonable gap between the dates of purchased

Ahsanullah University of Science & Technology

40

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

receipt at branch. Cases of delay will be reported to the Head Office & a copy to the Regional

Office of the purchase office. These will be numbered with D.D.R numbers, promptly

acknowledge, entered individually in the Demand Draft received for realization register,

without passing any entries.

b) Clearing cheque and cheque on the branches will be paid or returned unpaid the same day.

Other Demand Drafts entered in the register will be presented or payment to the drawee

through the cash department.

c) On realization the proceeds together with the overdue interest, if any Demand Draft will be

credited to the purchasing offices in the Janata Bank General Account sending Transfer

Responding, Advises (TRA) and reported to Head Office on schedule. Unpaid DDR's will be

returned to the purchasing offices along with the objection Memo.

4.6.3 Why D.D. Advice is used in Drawee/ Paying Branch.

When Drawee Branch gets a D.D. advice then this branch will take it as a voucher and the

paying banker will verify the genuineness of that advice by way of verifying the number and

signature. They will also record this information in their D.D. payable register. Then they

passed following voucherDr. : CIBT A/C (Drawee branch zone)

Cr. : Bills Payable A/C : D.D. Payable

4.6.4 Procedure of Payment

Proceeds of Demand Draft is received by the paying bank as and when it responds the

relative advise on the receipt of DD Advises from different branches, the paying banker will

verity the genuineness of the Advice by way of verifying the number and signature. Beside

this, Drafts payable can be made without the Advice of issuing Bank and on that time the

payment is called Acceptance Payment. Before making payment of the DD, the branch will

ascertain the genuine of its issuance as well as the genuine of the payee. Open Drafts may be

paid on proper identification of the payee and crossed Drafts can never be paid in cash over

the counter.

Ahsanullah University of Science & Technology

41

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

The process of entry D.D. PaymentIf the payment is to be made If the payment is to be made

after receipt of the Advice

before receipt of the Advice

If the amount of Dr. : Bills Payable A/C , D.D. Dr. : Sundry Assets A/C. D.D.

Paid W/A

draft is pain in cash Payable

Cr. : Cash A/C

Cr. : Cash A/C

If the amount of Dr. : Bills Payable A/C, D.D. Dr. : Sundry Assets A/C , D.D.

paid W/A

draft is pain by Payable

clearing House

Cr. : CIBT A/C Local Office Cr. : CIBT A/C Local Office

If the amount of Dr. : Bills Payable A/C, D.D. Dr. : Sundry Assets A/C , D.D.

paid W/A

draft is pain by Payable

transfer

(from

Cr. : Partys A/C or CIBT A/C

Cr. : Partys A/C or CIBT A/C

Account)

Here, we find that, sometime Drawee Branch is obliged to pay money (Taka) before receive

draft advice. In this case this money is provided from Sundry Assets A/C, D.D. paid W/A.

When that type of advice will get then following voucher will be passed-

Taka In Million

Dr. : CIBT A/C , (Issuing Zone)

Cr. : Sundry Assists A/C , D.D. Paid W/A

2000

1500

1000

500

0

D.D. paid without advice (Local)

D.D. Paid without

advice(Foreign)

2009

1399.48

2010

1580.965

1567.6

616.95

Year

*Source: Janata Bank Ltd. ; Annual Report 2010; Sundry assets; page-147

Graph 4.1: D.D. paid without advice both local and foreign from 2009 to 2010

After analyzing the Graph-4.1we find that in 2010 JBL paid 1580.965 million (Taka)

before receiving D.D. advices which is higher than 1399.48 million in 2009.

Ahsanullah University of Science & Technology

42

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

4.6.5. Duplicate DD

In some cases, it may be happened that the DD is lost and reported to the concerned

Branches. In this case, issuing Branch will communicate with the paying Branch and will

obtain confirmation regarding non-payment of the DD & Payment Branch will exercise

cautions against payment of DD including caution marking on the respective DD advice with

the words "Care Reported Lost" issuing Branch will then issue a duplicate DD on obtaining

of indemnity bond from the Applicant signed by two persons known to the Bank s sureties. In

such case, duplicate DD be marked with the words: "DUPLICATE IN LIEU OF ORIGINAL

NO ......."

Issuance of Duplicate Payment Order

Duplicate pay order may be issued on receipt of written request of the purchaser along

with GD at local police station. Signature of the purchaser should be verified from the

original application.

Issuing branch should obtain an indemnity bond on a non judicial stamp paper or

adhesive stamp for the adequate value in presence of at least two witnesses. The

Branch will thereafter write to Head Office for their approval to issue duplicate

payment order.

The Head office on receipt of the request from the issuing branch will immediately

issue caution circular from Cash Against Documents (CAD) to all the branches

regarding loss of the pay order asking them to record stop payment. The Head Office

will thereafter issue clearance to the issuing branch for issuing a duplicate draft in lieu

of original reported lost.

On receipt of clearance from the Head Office, the issuing branch will issue a pay

order

clearly

the

words

DUPLICTAE

ISSUED

INLIEU

OF

ORIGINALPAYMENT ORDER-. DATED------ in bold letters on the top of the

front page of the payment order. The charges for issuance of duplicate pay order

should be realized from the client.

A note to this effect is made on the original application on form and on the Pay Order

Issued Register.

Insurance of duplicate DD be noted against the entry of original one.

Ahsanullah University of Science & Technology

43

Janata Bank Limited

Remittance Activities; A Study on Janata Bank Ltd

4.6.6 Cancellation of Demand Draft

In some cases, the purchaser of the bank draft may ask the issuing branch to return the

amount of DD stating its non requirement. In these cases, the issuing Branch will obtain

written application from the purchaser whose signature must be tallied with the signature

obtained earlier. An amount Tk. 25/- be recovered from the purchaser as cancellation charges

and will be Credited to the Commission A/C the purchaser will acknowledge receipt of the

proceeds writing the words received payment by cancellation and will sign. One revenue

stamp to be affixed on the revenue of the Draft. In this case, payment is made by Debit to

PBG A/C and a relative cancellation advice is sent to the Issuing Branch.

1400000

1200000

Taka

1000000

800000

600000

400000

200000

0

D.D. Cancellation

2009

456725

2010

1361711

Year