Professional Documents

Culture Documents

Statutory Claim Faxed To IRS Ogden

Uploaded by

:Aaron :Eil®©™100%(8)100% found this document useful (8 votes)

3K views26 pagesInternational Publication and Notice: Statutory Claim faxed to IRS in Odgen

UCC 1-308; 1-103

All Indigenous Rights Reserved

without prejudice

un charter articles 55 & 56

undrip / undhr

executive order 13107

presidential proclamation 7500

hjr-194

hjr-3

Original Title

Statutory Claim Faxed to IRS Ogden

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInternational Publication and Notice: Statutory Claim faxed to IRS in Odgen

UCC 1-308; 1-103

All Indigenous Rights Reserved

without prejudice

un charter articles 55 & 56

undrip / undhr

executive order 13107

presidential proclamation 7500

hjr-194

hjr-3

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

100%(8)100% found this document useful (8 votes)

3K views26 pagesStatutory Claim Faxed To IRS Ogden

Uploaded by

:Aaron :Eil®©™International Publication and Notice: Statutory Claim faxed to IRS in Odgen

UCC 1-308; 1-103

All Indigenous Rights Reserved

without prejudice

un charter articles 55 & 56

undrip / undhr

executive order 13107

presidential proclamation 7500

hjr-194

hjr-3

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

TOAT TOR PERORT

Ee "

BAX COVER MI

FAX NUMBER 1-85¢

) INTERNAL REVENUE SERVICE Ogden (.4MC)

N. Rulon White Bivd

MS 6737, Ogden, UT 81404

Fax: (955) 244-7522

From: :Aarop-HakinsEil: ROTM — Latp: cory dpwi2$0o

\ RA6H0-/41 Lads

38° $2° 37" N, Lat vwhiatas. Turtlerkstand/ Ata ¥

e910 APPLEWOOD S

MD [26743]) emaail. tunvier

Re. IRS MANUAL 21,7,13,3.2.2(2) ~ Statutory Claim of Agron Halie

fo Whom this decs concem, I require these decutienia: Sete

Gregorian calendar] published at:

wou this (March (72015 Gregorian ca'end). with he so

file. (Individual Mesier File ‘ Business Vasier

BY FAX ON MARCH 17, 2018]

Tora pages enciosed. pages rac hie

1 you have any questions of concems, ¢)

Ce: Accomp: Management Center

Cer RS General Counsel, DHS

(Ce: Public Accounts Conmittes

CC: IMF, BIS. WBG (World Ba

Department of Hemetan.

UK, Co

as

. we vurrent

ATUPGRY CLAIM SENT

FAX COVER SHEET

FAX NUMBER 1-855-214-7522

To: INTERNAL REVENUE SERVICE Ogden (OAMC)

1973 N. Rulon White Blvd,

MIS 6737, Ogden, UT 84404

[March 19, 2015]

690-74 |

38° 52°37" N. Lat; 32" 28.7" W. Long, :Powhatan, Turtle-Island/Adlan/Amexem;

[Care of 910 APPLEWOOD ST.. Capitol Heights, MD [20743]] email: «urnherear@email.com

Re: IRS MANUAL 21.7.13.

})~ Statutory Claim of Aaron Hakim Eil

To Whom this does concern, I require these documents: Statutory Claim of [March 17, 2015

Gregorian calendar] published at:

‘on this [March 17 2015 Gregorian calendar], with the noted changes made to update your current

file. (Individual Master File / Business Master File) [REPLACE STATUTORY CLAIM SENT

BY FAX ON MARCH 17, 2015]

Total pages enclosed: 2 pages sac lus, fox coven Mother flee meee lO He

Ifyou have any questions of coneems, do not hesitate to contact me. WUE Tabi Ryle

Ce: Account Management Center AE pee 54 Teg

Ce: IRS General Counsel, DHS ~Department of Homeland Security, "SCha7 saps

Ce: Public Accounts Committee (U.K.), Committee of 300 ae

CC: IMF, BIS, WBG (World Banking Group) eae.

Co: Witnesses: Elizabeth Alexandra Mary Windsor-Mountbatten Battenburg,

MISNOMER: Queen Elizabeth II(sic)

United Nations Convention on the Elimination of Racial Discrimination (UNCERD)

INTERNATIONAL MONETARY FUND (IMF)

Secretary General Ban Ki-moon, UNITED NATIONS — Geneva Switzerland,

Office of the High Commission on Human Rights (OHCHR) — Geneva, Switzerland

United Nations

United Nations Special Rapportuer on Indigenous Issues, Internal Revenue

Secretary of the Treasury of Puerto Rico - Melba Acosta Febo.

INTERNAL REVENUE SERVICE (IRS),

United States Treasury-U.S. Office of the Comptroller of the Currency:

International Criminal Court — Office of the Prosecutor, Information and Evidence Unit

THE VATICAN / HOLY SEE ~ Pope Frances

‘THE JESUIT CURIA IN ROME - Adolfo Nicholas, Superior General

/

TLinternatmaal Pubkectos + Notce

FAX COVER SHEET

FAX NUMBER 1-855-214-7522

‘To: INTERNAL REVENUE SERVICE Ogden (OAMC)

1973 N. Rulon White Blvd.

M/S 6737, Ogden, UT 84404

Fax: (855) 214-7522

[March 17, 2015]

From: :Aaron-Hakim:Eil: ®OTM — hitp://\www,seribd,con/doe/256954712/Statutory=

Declaration-RA-690-741-177-US.

38° 52° 37° N, Lat; -76° 52° 28. ig, :Powhatan, Turtle-Island/Atlan/Amexem;

[Care of 910 APPLEWOOD ST., Capitol Heights, MD [20743] email: turnierear@omail.com

Re: IRS MANUAL 21.7.13.3.2.2(2) ~ Statutory Claim of Aaron Hakim Bil, +2015

To Whom this does concern, I require these documents: Statutory Claim of [March 17, 20. 15

Gregorian calendar] published at: Whos :// woo. 37d com fee 12546 521 Shatory Cleime Fad)

on this [March 17 2015 Gregorian calendar], with the noted changes made to update your current

file, (Individual Master File / Business Master File) “ nee

den

Total pages enclosed: | 3 pages

Ifyou have any questions of concems, do not hesitate to contact me,

Ce: Account Management Center

‘Ce: IRS General Counsel, DHS -Department of Homeland Security,

Ce: Public Accounts Committee (U.K.), Committee of 300

CC: IMP, BIS, WBG (World Banking Group)

Ce: Witnesses: Elizabeth Alexandra Mary Windsor-Mountbatten Battenburg,

MISNOMER: Queen Elizabeth II(si¢)

United Nations Convention on the Elimination of Racial Diseris

INTERNATIONAL MONETARY FUND (IMF)

Secretary General Ban Ki-moon, UNITED NATIONS — Geneva Switzerland,

Office of the High Commission on Human Rights (OHCHR) ~ Geneva, Switzerland

United Nations

United Nations Special Rapportuer on Indigenous Issues, Intemal Revenue

Secretary of the Treasury of Puerto Rico - Melba Acosta Febo

INTERNAL REVENUE SERVICE (IRS),

United States Treasury-U.S, Office of the Comptroller of the Currency;

International Criminal Court — Office of the Prosecutor, Information and Evidence Unit

THE VATICAN / HOLY SEE — Pope Frances

THE JESUIT CURIA IN ROME - Adolfo Nicholas, Superior General

ition (UNCERD)

Hekin

[mech 17, 205]

‘i

Huces

Wy a

Statutory Claim of :Aaron-Hakim:Eil:R©™ in Accord with IRS MANUAL 21.7.13.3.2.2(2/

1707 Cestui Que Vie Trust Act

|, Aaron Clark Roberts now known as: Aaron Hakim Eil, Indigenous, Autochthonous Flesh and Blood Man

(AmarwXi/Ani-Vil wiva, Tsa-la-gi (Cherokee) Moor ), Claim my Life Estate in Accord with: the United Nations

Declaration on the Rights of Indigenous Peoples htip://1ww.un.org/esa/socdev/unpfiidocuments/DRIPS. en,pdt

Presidential Proclamation 7500; HJR-194 - hitp:/www.upa,sov/fisy/pky/BILLS- | L0hres!94ch/pdf/BUL

L1Ohres!9eh,pdr'; 8. Con, Res. 26 -hitp://www.gpo.gov/tdsys/pkoBILLS-I LL s/pdf/BILLS-

ML Ges.pdl's HIR-3 - htipsi//www congress. gov/ 1 1O/bills/hjpes/BILLS-1 sls Title 8 USC §876, IRS

n Statement itp//w\v.irs.20V/pubirs-news/ir-98-59 pal, that Lam nota decedent (IRS MANUAL.

21.7.13.3.2.2(2), Lam alive and | am not dead (1540 Cestui Que Vie Act, 1666 Cestui Que Vie Act, 1707 Cestui Que Vie

Act http://w. legislation gov lapel Ann/6/72/contents ). [ want the record held in your computer database which may

list me as deceased to be changed to alive. According to IRS MANUAL 21,7.13.3.2.2(2): Am infant is the decedent of:

gslate or grantor, owner or trustor ofa trust, guardianship, receivership or custodianship. that has yet to receive an SSN:

Inipies /part2./inn,_21-007-0L3e.hinil = Declaration of assumptive death is a fiction: G.R. No.160258 Republic

of The Philippines v. Gloria Bermudez-Lorino:

Intpzea judiciary.gov.phvindex.phpaction=mnuactual_contents&ap=|70100ep=y . | have a SSN Number, so by the IRS

MANUAL: 21.7.13.3.2.2(2), | am not a decedent: (Black's Law Dictionary 8" Ed,, p. 435 ~ decedent n. A dead person,

esp. one who has died recently). Iam no longer liable for: a) Maritime Liens being enforced against me, b) securities

being taken out of the estate. All maritime Liens currently being enforced against me I hereby claim invalid, null & void,

ab initio ~ nune pro tune, See: Libfer code ~ Art. 3, 31, 33, 38: htip:/avalon,layyale edu/19%h_century/licber.asp and At

48, 46, & 95 of the Hague Convention IV Oct. 18, 1907 hiip://vww.icre.orwihl.nst/FU

Lam the infant who does have an SSN number which makes me the beneficiary of this trust. The SSN and the Name vests

within me: an Indigenous Autochthonous Living Man. Being that the IRS works in Admiralty, the IRS according to its

‘own code, can no longer enforce any maritime Liens against myself, as | have now claimed my Life Estate: [am not lost

at sea, nor am 1a decedent / vessel in commerce (18 USC §9) (1707 Cestui Que Vie Act, U.K).

Jurat

United Nations Declaration on the Rights of Indigenous Peoples -

(hup:/vww.un.orw/esa/socdev/unpfidocumentyDRIPS_en.pdf

UN Declaration on the Rights of Indigenous Peoples, UN Convention on Economic, Social &

Cultural Rights, United Nations Charter; Articles 55 & 56; Presidential Proclamation 7500,

HLLR. 194, $.Con, Res 26, 8. 1200, HIR-3

Aflirmed to and subscribed before me this,

if” aay of_Marc | +2015,

oon,

All Ledegenis Eght® heseoved Ss

Yitmese Rew oee

we SSC (-FS UNDO UNO

Berk foe Gil

Afiant

Personally Known Produced Identification _ ~~

Type and of ID_ A» 0027

ti nf, 3016

My Commision Expires

() A

Statutory Claim of :Aaron-Hakim:Eil_in Accord with IRS MANUAL 21,7.133.2.20y

1707 Cestui Que Vie Trust Act

|, Aaron Clark Roberts now known as: Aaron Hakim Eil, Indigenous, Autochthonous Flesh and Blood Man

(AmarwXi/Ani-Yu iva, Tsa-la-gi (Cherokee) Moor ), Claim my Life Estate in Accord with: the United Nations

Declaration on the Rights of Indigenous Peoples hip/vwunorw/esa/soedev/unpfi/documents/DRIPS. en nd

Presidential Proclamation 7500; HIR-194 « hnip://www.ep0,c0v/(dsvs/pke/BILL SI [Ohres 94chipdi/BILL

LhresLO4eh pdf's 8. Con, Res. 26 - htipyAvww.sp0.eov/fdsys/pke/BILLS- 1 Isconres26es/dl/BILLS-

{1 lscomes26es.pdl; HUR-3 - hups:/www conaress.gov/| 1O/ils/htes3/BILLS-11Ohjressih.pdty Title B USC §876, IRS

Mission Statement hiipz/vww.irs.2ov/pubjirs-news/ir-98-59.pdt, that [ am net a decedent (IRS MANUAL

31,7 13.32.2@), lam alive and I am not dead (1540 Cestui Que Vie Act, 1666 Cestui Que Vie Act, 1707 Cestui Que Vie

Act hupi/Avww. legislation gov.uk/apnb/Ann/6/72/contents ) I want the record held in your computer database which may

i 7 7.13.3. An infant is the decedent of an

‘slate or grantor owner or trustor ofa rus, guardianship, receivership or eustodianship, that has yet ta receive an SSN:

ST ames inn 2 -007-03rhm| ~ Deelration of assumptive death isa fiction: G.t. No-160288 Republic

of The Philippines v. Gloria Bermudez-Lorino:

‘hupitica judiciary gov.phvindex.php2action=mnusctusl_contenis.cap~i701004¢p=y . {have a SSN Number, so by the IRS

MANUAL: 21.7-13.32.2@), | am not a decedent: (Black's Law Dietionary 8* Ed, p. 435 — decedent n. A dend person,

f3p. one who has died recently), 1am no longer liable for: a) Maritime Liens being enforced against me, securties

being taken out ofthe estate. All maritime Liens eurvently being enforced against me | hereby claim invalid, null & v

ab initio ~ nune pro tune. See: Libfer code ~ Art. 3, 31, 33, 38: htip:/avalon lawvalo.edu/l 9th centuryMicher asp and Art

45, 46, & 55 ofthe Hague Convention IV Oct. 18, 1907 ip: /ivw\jere.onw/ihlans/FULL/0S

{1am the infant who does have an SSN number which makes me the beneficiary of ths trust. The SSN and the Name vests

within me: an Indigenous Autochthonous Living Man. Being thatthe IRS works in Admiralty, the IRS aecording to te

own code, can to longer enforee any maritime Liens against myself, as I have now claimed my Life Estate: 1am not lest

at sea, nor am Ta decedent / vessel in commerce (18 USC §9) (1707 Cestui Que Vie Act, U.K.).

durat

United Nations Declaration on the Rights of Indigenous Peoples -

Chttp://www.un.ore/esa/socdev/unpfii/documents/DRIPS_en.pdf

UN Declaration on the Rights of Indigenous Peoples, UN Convention on Economie, Social &

Cultural Rights, United Nations Charter; Articles 53 & 56; Congressional Record P. A320 may

11 1955, Motu Proprio July 2013, Pope Francis Apology to the Indigenous Peoples & World

Day of Peace Letter, IDFPAD, Presidential Proclamation 7500, H.J.R. 194, HIR-3

Affirmed to and subseribed before me this 19#*day of __ Maceh 2015.

by:

GES CONS

INTERNAL REVENUE SERVICE PUBLICATION 4205

TAX EXEMPT & GOVERNMENT ENTITIES

Modernized e-File (MEF) Test Package for Exempt

Organization Filings

Form 990 - Return of Organization Exempt From Income Tax

Form 990-EZ - Return of Organization Exempt From Income Tax

Form 990-N - Electronic Notice (e-Postcard) for Tax Exempt

Organizations not Required to File Form 990 or 990-EZ

Form 990-PF — Return of Private Foundation or Section 4947(A)(1)

Trust Treated as a Private Foundation

Form 1120-POL - U.S. Income Tax Return for Certain Political

Organizations

FORM 8868 - Application for Extension of Time to File an Exempt

Organization Return

TAX YEAR 2012

@IRS

Publication 4206 (Rev, 11-2012) Catalog Number 369618

Department ofthe Treasury Internal Revenue Service wis cov

INTERNAL REVENUE SERVICE PUBLICATION 4205

TAX EXEMPT & GOVERNMENT ENTITIES REVISION 1 (11/2012)

INTERNAL REVENUE SERVICE

MISSION STATEMENT

PROVIDE AMERICA’S TAXPAYERS TOP QUALITY

SERVICE BY HELPING THEM UNDERSTAND AND

MEET THEIR TAX RESPONSIBILITIES, AND BY

APPLYING THE TAX LAW WITH INTEGRITY AND

FAIRNESS TO ALL

NEW IRS MISSION STATEMENT EMPHASIZES TAXPAYER SERVICE

WASHINGTON — The Internal Revenue Service on Thursday unveiled an

overhauled mission statement to reflect the agency's new emphasis on serving

taxpayers.

The new statement is simple and direct. The IRS mission is to "provide America’s

taxpayers top quality service by helping them understand and meet their tax

responsibilities and by applying the tax law with integrity and fairness to all.”

The new language represents the new direction for the IRS, which is working to

transform itself into a customer-oriented organization. The mission also reinforces the

agency's duty to administer the tax laws fairly for everyone.

“This mission statement reflects the new attitude at the IRS," said Charles O.

Rossotti, Commissioner of Internal Revenue. "Our top priority is putting the interests of

the taxpayers first, and this is spelled out simply and clearly in the mission statement.”

The pledge will serve as a daily reminder to people both inside and outside the

IRS about the agency's mission. The 27-word statement will be prominently featured on

1998 tax publications, at IRS offices around the country and on the agency's website.

(more)

“Words alone aren't going to change the IRS, but this serves an important

purpose,” Rossotti said. “The mission statement will be a reminder that we must be

dedicated on a day-in, day-out basis to serving taxpayers. This is just one of the steps

that we need to take.”

The new mission statement was mandated by the IRS Restructuring and Reform

Act approved by Congress and signed July 22 by President Clinton. The legislation

required the IRS "to review and restate its mission to place a greater emphasis on

serving the public and meeting taxpayers’ needs."

The IRS circulated drafts of a new mission statement in July and August. The

document was finalized after receiving comments from a variety of sources, ranging

from public feedback on the agency's Internet site to suggestions from tax

professionals and IRS employees.

The final mission statement underscores the agency's efforts to help individuals

While ensuring that all taxpayers are served the by agency's commitment to apply the

law fairly to all.

XXX

[Note to editors: The new mission statement replaces an older version dating to the

1980s. The previous statement said, "The purpose of the Internal Revenue Service is

to collect the proper amount of tax revenue at the least cost; serve the public by

continually improving the quality of our products and services; and perform in a manner

warranting the highest degree of public confidence in our integrity, efficiency and

fairness."]

a

Seaton ramen nt sadn dh rsd ar he

$e

STATUTORY INSTRUMENTS.

ae eer eee

1997 No. 1778

SOCIAL SECURITY

The Social Security (United States of America) Order 1997

Made = = 22nd July 1997

Coming into force = = Ist September 1997

Whereas at London on the 13th February 1984 an Agreement on social security between the

Government ofthe United Kingdom of Great Britain and Northern Ireland and the Government of

the United States of America (hereinafter referred to as “the Agreement”) and an Administrative

‘Agreement for the implementation ofthe Agreement (hereinafter referred to as “the Administrative

‘Aareement”)(1) were signed on behalfof those Governments and effect was given to the Agreement

by the Social Security (United States of America) Order 1984 (hereinafter referred to a5 “the

Principal Order")(2)

‘And Whereas at London on 6th June 1996 a Supplementary Agseement between the Government

of the United Kingdom of Great Britain and Norther Ireland and the Government of the United

States of America (which Supplementary Agreement is set out in Schedule | to this Order

and is hereinafler refereed to as “the Supplementary Agreement”) amending the Agreement

and a Supplementary Administrative Agreement amending the Administrative Agreement (which

Supplementary Administrative Agreement is set out in Schedule 2 to this Order and is hereinafter

referred to as “the Supplementary Administrative Agreement")(3) were signed on behalf of those

Governments

‘And Whereas by Adicle 3 of the Supplementary Agroement itis provided thatthe Supplementary

‘Agreement shall enter into force on the first day of the third month following the mont in which

fetch Government has received from the other Government written notification that all statutory

‘and constitutional requirements have been complied with for entry into force of the Supplementary

Agreement

‘And Whereas by Article 2 of the Supplementary Administrative Agreement itis provided thatthe

Supplementary Administrative Agreement shall enter into force onthe date of entry into force of |

the Supplementary Agreement

‘And Whereas written notification in accordance with Article 3 of the Supplementary Agreement was

received by each Govemiment on 20th June 1997 and accordingly the Supplementary Agrecment

sand the Supplementary Administrative Agreement enter into force on the Ist September 1997

‘And Whereas by section 179(1)(a) and (2) of the Social Security Administration Act 1992(4) itis

Provided that Her Majesty may by Order in Council make provision for modifying or adapting that

& Stout,

{Ci 334, pulses tn the Supplementary Ageement ond the Sepementay Adniiave Agree

DexsmetGensr: 201340

“SM Td TOR TR AT aT TT

SuntryIeanent a ser ti ed et

SCHEDULE | ‘ile?

SUPPLEMENTARY AGREEMENT AMENDING THE AGREEMENT

‘ON SOCIAL SECURITY BETWEEN THE GOVERNMENT OF THE

UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND.

AND THE GOVERNMENT OF THE UNITED STATES OF AMERICA,

‘The Government ofthe United Kingdom of Great Britain and Northern Ireland and the Government

of the United States of Ameries;

Having considered the Agreement on Social Security which was signed on their behalf at London

on 13th February 1984 (hereinafter refered to as “the Agreement”);

Having recognised the need to revise certain provisions of the Agreement:

Have agreed as follows:

Article 1

1. Article 1 ofthe Agreement shal be revised as follows:

(a) Paragraph 1 shall be revised to read as follows:

‘Teritory” means,

a5 regards the United States, the States, the District of Columbia, the

‘Commonwealth of Puerto Rico, the United States Virgin Islands, Guam,

American Samoa and the Commonwealth of the Northern Mariana Islands, and

as regards the United Kingdom, England, Scotland, Wales, Norther Ireland, and

also the Isle of Man, the Island of Jersey, and the Islands of Guernsey, Alderney,

Herm and Jethou; and references to the “United Kingdom” oto “territory” in

‘elation to the United Kingdom shall include the Isle of Man, the Island of Jersey,

and the Islands of Guernsey, Alderney, Herm and Jethou where appropriate:

(b) Paragraph 3 shall be revised to read as follows:

“3. “Competent Authority” means,

as regards the United States, the Commissioner of Social Seeutity, and

as regards the United Kingdom, the Department of Social Security for Great

Britui, the Department of Health and Social Services for Northern Ireland, the

Department of Health and Social Security ofthe Isle of Man, the Employment and

Social Security Committee of the States of the Island of Jersey or the Guernsey

Social Security Authority asthe ease may requires

(© Paragraph 7 shall be revised to read as follows:

7, As regards the United Kingdom:

(2) “insurance period” means,

4 contribution period or an equivalent period:

(6) “contribution period

4 period in respect of which contributions appropriate to the benefit in

‘question are payable, have been paid or treated as paid:

(©) “equivalent period” means,

1 period for which contributions appropriate to the ben¢

been credited;

in question have

(€) “survivor’s benefit” means,

i RS

Snare cara hr ed fr

Article 3

‘This Supplementary Agreement shall enter into force on the frst day ofthe third month following

the month in which both Governments shall have informed each other by a formal exchange of notes

that che steps necessary under their national statutes to enable the Supplementary Agreement to take

cffect have been taken,

IN WITNESS WHEREOF, the undersigned, being duly authorised thereto by their respective

Governments, have signed this Supplementary Agreement

DONE in duplicate at London on 6th June 1996.

FOR THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND

NORTHERN IRELAND;

Willian Marsden,

(Americas Director, FCO)

FOR THE GOVERNMENT OF THE UNITED STATES OF AMERICA:

Timouhy E. Dec

(Minister, Embassy of the United States of America)

SCHEDULE 2 aele2

‘SUPPLEMENTARY ADMINISTRATIVE AGREEMENT AMENDING THE

ADMINISTRATIVE AGREEMENT FOR THE IMPLEMENTATION OF THE

‘AGREEMENT ON SOCIAL SECURITY BETWEEN THE GOVERNMENT.

(OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN

IRELAND AND THE GOVERNMENT OF THE UNITED STATES OF AMERICA,

The Government ofthe United Kinadom of Great Britain and Northern Ireland and the Government

(of the United States of America:

in accordance with Article 15(a) of the Aurzement on Social Security between the Government of

the United Kingdom of Great Britain and Northern Ireland and the Government of the United States

‘of America signed on their behalf at London on 13th February 1984 (hereinafter referred to as “the

Agreement”) as amended by the Supplementary Agreement ofthis dates

Have agreed to amend the Administrative Agreement for the implementation of the Agreement as

follows —

Article 1

1. Article 2 paragraph | of the Administrative Agreement shall be revised to read as follows:

“L. The liaison agencies referred to in Article 15 of the Agreement shall be:

(a) for the United Stats,

the Social Security Administration,

(b) for the United Kingda,

(in Groat Britain,

Forall contingencies except Articles 4 10 6 of the Agreement and the

provision of United Kingdom insurance records for Disability Benet,

* Sin TT ig TOR FN a OT ET TE

Stn vrai at aru nh i fa

Department of Social Sccurity Pensions and Overseas Benefits

Directorate, Tyneview Park, Whitley Road, Benton Neweastle upon

‘Tyne, England NE9S IBA;

For Anicles 4to 6 of the Agreement and to provide United Kingdom

insurance records for Disability Benefit,

Contributions Agency Intemational Services, Longbenton, Newcastle

‘upon Tyne, England NE9S 1YX

iin Northem Ireland, Social Security Ageney Overseas Branch,

Commonwealth House, Castle Steet, Beliast, Northern Ireland BT IDX

(ii) in the Isle of Man, Department of Health and Sosial Security, Markwell

House, Market Street, Douglas, Isle of Man IMI 2RZ

(iv) in Jersey, Employment and Social Security Department, Philip Le Feuvre

House, La Motte Street, St Helier, Jersey, Channel Islands JES SPE

(0 in Guernsey, Guernsey Social Security Authority, Edward T Wheadon

House, Le Truchot, St Peter Port, Guernsey, Channel Islands GY 3WH.",

2. Amticle 9 paragraph | of the Administrative Agreement shall be revised by adding the following

sentence atthe end thereof:

“However, the Ageneies ofthe avo Parties may agree on a different alloc

‘medical examinations arranged under this paragraph”.

of expenses for

Article 2

‘This Supplementary Administrative Agreement shall enter into force on the date of entry into force

of the Supplementary Agreement of this date amending the Agreement

EXPLANATORY NOTE

(This note is not part of the Order)

‘This Order makes provision forthe modification ofthe Social Security Administration

‘Act 1992 and the Social Security Contributions and Benefits Act 1992 50 as to give

effect tothe Supplementary Agreement on social security (which is set out in Schedule |

to this Order) made between the Government ofthe United Kingdom of Great Britain

and Northern treland and the Government of the United States of America. The

Supplementary Agreement amends the Agreement on social security set out in Schedule 1

to the Social Security (United States of Ameriea) Order 1984 t0 take into account

changes in United Kingdom legislation, in particular as relates to incapacity benefit.

‘There are also set out in Schedile 2to this Order the provisions of a Supplementary

Administrative Agreement amending the Administrative Agrecment set out

in Schedule 2 to the Social Security (United States of America) Order 1984,

This Order does not impose any costs on business,

3.3 Rights Suspension and Corruption

Article 100 - Cestui Que Vie Trust

Canon 2036

‘A,Cestu Ove Vie Trust. also known by several ather pseudonyms such as *Term of Life or Years" or

“Par Autre Ve" or ‘Fide Commissary Trust” or “Foreign Situs ust of “Secret Must iss pasate form

cet trust fast formed inthe léth Certury under Henry Vil of England on ove or more presumptions

'ncladng (but not limites to) one or more Persons presumed wards, infants, dots, st or coarioned,

at "sea" ard therefore assumed orasumed “dead” after seven (7h years, Adtional presummptoee by

hich such a Trust may be legally” formed were added in later statutes to hehe bankruptey,

Incapacky, mortgages and private compares

‘Canon 2037

Interns of the evidential istry ofthe formation of Cestui Que Ve Tusts

(i. The fist Cestu Que Vie Trusts formed were through an Act of Herry Vil af England in 2540

(G2iton.o ci) and later wholly corrupted whereby the poor people of England, efter hevng all

theirhomes, goods and wean elzed in 1535 (27 Hen.2 €-20) under the “quits” of small

‘elgious estotes under £200, were granted the welfare or “commonwealt? benef ef a Cestut

‘Que Use or simply an “estate with whichto lve, fo work and to bequeath va # wrtten ml and

(i) 1666 westrrster and the nding classes pessed the infamous “Proof of tte Act” also

{alld the Costu Que Ve Act (13Car 2 c.6) whereby the poor and disenironchised that Nad tot

“prover” to Westminster and the Courts thay were alve, were henceforth to be decaree "dead

{n law” and therefore lost. abandoned and the property to he managed intheir absence, This

supremely orally repugnant act, which remains in force today ste oith of Mu ad the

Infamous occut rtuats of the British Courts nthe wearing of Black Tobes ove ates

Paraphernalia in honoring te "dead and

(i) 21707 Westminster under Queen Ame (Ann ¢.18) extended the provisions of “Proof of

Life" and Cestul Gu Vie, extending the Use of such structures ukimately for eorperate sna sther

franchise purposes. mis wicked, profane ond completcly sacriegious act n grect defarce (9 al

forms of Chrstian morals and Rule of Law has remained a cornerstone of global banking nd

Finanelal control tothe 2st Century: ana

{iv 1796, King George W (36 Geo.3.< 52520) duty was applied to Estates Pu Autre Vie for the

fst timer an

(2 92037 (2 Viet. €.26) an the amendments tothe nature of Wil, tat if person under an

Estate Pur tre vie (Cesiut Que vie dis nat make = proper wil, theh such property would be

SFanted to the executors and aominstrators

Canon 2038

Interns of tne evidential history af the operation and any format relet or remedy associated with

Gestul Que Vie Trusts, taking into accourt al Statutes reterening Gestul Gus Wie'prerte 1540 9°69

delberate aud an proot othe iteatimacy of Westminster statutes

{0) The “frat” Act outing Cestui Que (Vie| Trusts is dellberately hidden under the claimed

Statues ofthe reign of King Richard tin 1403 [1Rlch-3 1) whereby the act (sti nforee)

States thet all conveyances and Wansfers and we of property gues, even though a purchaser

may be unaware itis effectively under “cestu que use" (subject to 8 Cestul Que Ve Trust), The

{act also gives 2 vague and challenge path of rele! tht fone is of complete rind. rot an Fare

tnd rot under fnencio Guress then any property under Costu Que Vie sts rightly theta

orune: ond

(i) The “secon Act outlniog Cestul Que (Vie) Trusts i deliberately hidden under the retgn of

Henry 70hin 2488 (aon.7'©.17) permitted lords to render any attempt by people Closoed os

“wards to demonstrate thei eecom useless and that auch lotus May use wits another,

vices to “Torce” such people back to belng complont “wards” (poor slaves). The ony remedy

oder this act was if word demonstrated the waste ofthe ltd as to the property (and erergy)

Seized fromthe poor lignorant write slaves) ord

{it The “third" Act ouining the operation of Cestui que Vie only hidden this time as Estate Pur

‘Autre Vie was in 1741 under 14 Ge0.2 ¢.20) whereby one who was krauledgeable ofthe Gest

Que Ve slavery system could between the ages of 16 to 20, seek to recov! such propery

Under Cestul Que Ve and cease tobe a slave. However, the same act made lew tat aker 20

‘years the remedy for such recovery was no longer avaliable, despite te fact tet the exsience

9f Cestul Que Ve Trusts denied and Westminster ard Barks are sworn tole obstruct hide at

allcost the exstence of the foundations of global barking slavery,

Canon 2039

Intenms of essertial elements concerning Cestui Que Vie Thsts:

WA Cestu Que (Ve) Trust may only exist for severty (70) years being the tradionsl accepted

“ite expoctancy ofthe estatez and

lil A Beneticiory under Estate may be ether a eneficiary or a Cestu Que (Ve) Thst. When a

Benericiery loses drect benef of ay Property ofthe hgher Estate placea mn Cests Que (Ve)

‘Trust on ther behsit. they do not “own” the Cestu Que (Vie) Trust and are ony the benetlary of

whet the Trustees ofthe Cestul Ove (Ve) Thst choose fo provide them ane

(a) The original purnose end function of @ Cestul Que (Vie) Trust was to form a temporery Estate

{or the Benefit of another because some everk, state of stais of eondtion revere them ram

claiming ther status as ing, competert and presert before 9 Competent auhorhy Therefore,

any clairs, history, statutes or arguments that deviate in terms ofthe srainand fonction ef

Costu Que (Vie) Must 86 pronouread by these conons i false ard automoticelly hal ard void

‘canon 2040

‘The Trust Corpus created by a Cestui Que (Vie) is also known as the Estate from two Latin words

etstatuo iteraly meaning “by vitue of decree, statite or judgment However as the Estate Is held

ing Temporary net permanent Trust, to (Corporate) Person 9s Beneficiary cnisled only te

equitable title and the use of the Property, rater thon legal tie and therefore ownership ofthe

Property Ory the Corporation, also known as Body Corporate, Estate and Trust Carpus of 9 Cestul

‘Qve (Ve) Trst possesses vald legal personaly.

Canon 2041

‘The Property of any Estate created through 9 Temporary (Testamentary) Trust may be regarded as

Under "Cestul Que Use" by the Corporate Person, even ft anather name or desciten is used to

tine the type of trust or use. Therefore “Cestul Que Use f not 9 Person but 9 Might ard therefore a

form or "property

Canon 2042

In 1534, prior to the st Cestul Que Vie Act (2540), Henry Vl decloed the first Gest Que Ve type

estate with the Act of Supremecy which created the Crown Estat, In 1604, seventy (70) Years ter,

James !f England modlied the estate as the Crown Union (Union of crowns). By the 28th Century,

the Crown was viewed as a comoany. However by the start ofthe 1sth Cent, around 1818 ommrds

Upon the barkeuptey of the company (2814/5), becarve te fly private Cromn Corporation

Crttalled by European private Barer tami’,

Canon 2043

Since 1501 there has been a second series of Cestul Que Vie Estates concerning the property of

"persons" and rights whch migrated tothe Urted States for aumniatration neha

{in 2652 the Act forte Settlement of ieland 2651-52 which intraguced the concept of

“settlemerts", enemies of the state and restrictions of movement instates of "emergency" and

{i In 2861 the Emergency Powers Act 1863; ane

(i) 2932 the Emergency Rell and Construction Act 1932-32 nd

(iv) fe 2002 the Patriot Act 2001.

Canon 2044

‘Since 1591, there has been a third series of Cestul Que Vie Estates concerning the property of soul"

‘and ecclesiastical rights which migrated fo the Unted States for administration ncuding

(0) 92661 the Act of Settlement 1661-62; and

{in 3871 the District of Columbia Act 1873; and

(im 1964 the Land Lease Act 1942,

Canon 2045

‘By 2815 and the bankruptey ofthe Crown and Bank of England by the Rothschilds, forthe 2st time, the

Cestui Que Vie Trusts ofthe Unted Kingdom became azcets placed in private berks cflectiely,

becoming private trusts" or ‘ice Commissary Trusts” administered by commssionats (guar clans)

From 1835 and the Wits Act, these pvave tuts have hewn aise corsvicred “secret Tats” rose

‘eustence does not need tobe diag.

Canon 2046

From 1917/18 with the enactment of tre Sedition Act andthe Trading withthe Enemy Act inthe United

States and through the Untea Kingdom, the chizens af the Commormeakh and the Unies Stniee

became effectively "enemies ofthe state" and “allens" hichintum corveriea the "Fide Coransory”

private secret trusts to ‘Foreign Sus (Private Iternatanal] Toate,

Canon 2047

'r 1931, the Roman Cult. alo Known as the Vatican created the Sank for International Settlements for

{he controt of claimed property of associated private central vans aroud the worl, Upon te

delberate bankruptcy of mast countries, prvate central barks were hstelled as admingtretor ond

the global Cesta! Que Ve/Foreign Situs Trust system was inplemested fom 1933 onwards.

Canon 2048

Since 1933, when a child is borne in State(Estae) under Inferior Roman low, three (3) Cestui Que

{Mie} Truss are created upon certain presumptions, spechcaty designe a deny ths cll trcer

any rights of Real Property. ary nights 32 a Free Person and any Rights fo be krown ae mas ove

‘woman rather than a tresture or animal by claiming and possessing thet Soul or sete

Canon 2049

Since 1933, upon a new chi being bore, the Execitors or Administrators ofthe higher Estate

Zilliraly and knowingly convey the benetkib|erttements of the chic as Beneteary Ino the 1k

{esti Que(Vie) Trust nthe form of 2 Registry Nurber by egistering the Nome, thereby oso

‘raating the Corporate Person ard derying the eld any rights as ah owner of Real rope

Canon 2050

Since 1933, when a chi s borne the Executos or Administrators ofthe higher Estate knowingly ond

lial claim the baby ae chattel to the Estate, The slave bby contrect es un eregtes by aon

the anciere radtion of ether having the nk inpression ofthe feet of te baby onte the lee Gees

Fecord, ora drop of ts Blood a8 wel as tricking the parerts to sigring the baby anay tough te

‘decenful egal meanings onthe ive birth record. Ths Wve bith resordas a promesory mie Ey

onverted into a slave bond sold tothe private reserve bank ofthe estate and thin coreened into a

2nd and separate Cestu' Que (Ve) Trust per chil owned by the bane, Upon the promisrony ate

Feaching maturity ard the bank being unable to “selze* the slave eid, 9 aritme len lawl

issued to "salvage" the lost property and tself monetized 8s currency issued inseres against tre

CCestut Oue Ive) Trust

Canon 2051,

Each Cestui Que Ve Tust created since 1933 represents one ofthe 3 Crowns representing the 3

‘aims of property ofthe Roman Cut, being Real Property, Personal Property and Scclesiosiea

Pronerty and the denial of any nghis to men ana women other than those < owen as loyal members

ofthe society ord as Executors and Admnstrtors

Canon 2052

The Three (3) Cestul Que Vie Trusts are the specifc denial of rights of Real Property, Personal

Property and Ecclesiastical Property for mest men ard women, cortespands eracly othe tree

forms of Bw availabe tothe Goll ofthe Bor Aesociation Cours The teat formaflaw ie conpee

commercial isn effective because ofthe 1st Costu Que Vie Wust-the Second formot oe 6

‘maritime and trust law fs effective because ofthe 2nd Cestu Que Ve Test The 3d formot lew Is

Talmudic and Roman Cul law is efectve because ofthe 3d Cestu Que Vie Trst of Booker

Canon 2053

‘he Birth Cerificate Issued under Romon Law repeesents the modern equvalent tothe Settlement

Gerticates of the 17th century and signtes the Polder as n pauper and etfeciwey » Roman Save.

{he Birth Certicote has no direct relationship tothe private secret trusts controled by the private

anking network, nor can it be used to force the administration of state or nation sige the

existence of these secret trusts

Canon 2054

4s the Costes Que Vie Trusts are created as private secret trusts on mutple presumptions including

{he ongoing berkruptcy of certain natlanel estates, they remam the claimed private propery of te

Roman Cut banks and therefore cannot be direct claimed or Used.

Canon 2055

ile the private secret trusts of the private central barks cernat be diectly addressed, they are

sill formed on certain presumptions of law inchuaingclnimed ownership ofthe name, the Booy, the

‘mind ond sou of ivants, men and wornen. Each and every mand women ha tne absalne FaR to

rebuke end reject such false presumptions 83 9 member af Orc Heaven and volder at tre own the

Canon 2056

‘Given the private secret trusts ofthe private central barks are created on false presurptions, when

4 man or women makes clear thelr Live Borne Record and claim over thew Own Tame, boGy rand ed

Soul, any such trust based on such alse presumptions ceases to have ay property.

Canon 2057

‘ay Administrator or Executor that refuses to immeciatelyaizsolve a Cestui Que (Vie) Trust, upon @

Person estabishing thei status and competency. i QuIy af raud and fundamental Breach of thet

‘Aducary diales requiring thei immeciate rerrovel ard parish

Jesus was born years earlier than thought, claims Pope - Telegraph hitp:/*vww.telegraph.co.uk/news/worldnews'the-pope!9693S76Llesus,

Lof2

Jesus was born years earlier than thought, claims Pope

The entire Christian calendar is based on a miscalculation, the Pope has declared, as he claims ina

new book that Jesus was born several years earlier than commonly believed.

The Pope also weighs in on the debate over Chris's birthplace Photo: Filippo Monteforte (AFP

By Nick Squires, Rome

4:02PM GMT 21 Nov 2012

The ‘mistake’ was made by a sixth century monk known as Dionysius E3

jguus or in English Dennis the Small,

the 85-year-old pontiff claims in the book ‘Jesus of Nazareth: The Infancy Narratives’, published on

Wednesday.

"The calculation of the beginning of our calendar — based on the birth of Jesus ~ was made by Dionysius

Exiguus, who made a mistake in his calculations by several years." the Pope writes in the book, which went on

sale around the world with an initial print run of a million copies.

“The actual date of Jesus's birth was several years before.”

‘The assertion that the Christian calendar is based on a false premise is not new — many historians belie

Christ was born sometime between 7BC and 2BC.

e that

But the fact that doubts over one of the keystones of Christian tradition have been raised by the leader of the

world’s one billion Catholics is striking.

Dennis the Small, who was born in Eastern Europe, is credited with being the “inventor” of the modern

3/17/2015 10:54. AM,

‘Jesus was born years earlier than thought, claims Pope - Telegraph hitp://www.telegraph.co,.uk/news'/ worldnewsithe-pope96933T76/Jesus.

dora

calendar and the concept of the Anno Domini era.

He drew up the new system in part to distance it trom the calendar in use at the time, which was based on the

ign of the Roman emperor Diocletian,

‘The emperor had persecuted Chri

ians, so there was good reason to expunge

in favour of one inspired by the birth of Christ

from the new dating system

The monk's calendar became widely accepted in Europe afier it was adopted by the Venerable Bede, the

historian-monk, to date the events that he recounted in his Ecclesiastical History of the English People, which

he completed in AD 731.

But exactly how Dennis calculated the year of Christ's birth is not clear and the Pope's claim that he made a

mistake is a view shared by many scholars,

The Bible does not specify

calculations on vague references to Jesus's age at the start of his ministry and the fact that he was baptised in

the reign of the emperor Tiberius,

a date for the birth of Christ. The monk instead appears to have based his

Christ's birth date is not the only controversy raised by the Pope in his new book — he also said that contrary

to the traditional Nativity scene, there were no oxen, donkeys or other animals at Jesus's birth,

He also weighs in on the debate over Christ's

born in Nazareth rather than Bethlehem,

hplace. rejecting arguments by some scholars that he was

John Barton, Professor of the Interpretation of the Holy Scripture at Oriel College, Oxford University, said most

‘academies agreed with the Pope that the Christian calendar was wrong and that Jesus was born several years

earlier than commonly thought, probably between 6BC and 4BC.

"There is no reference to when he was born in the Bible - all we know is that he was born in the reign of

Herod the Great, who died before 1 AD," he told The Daily Telegraph. "It's been surmised for a very long time

that Jesus was born before 1AD - no one knows for sure.”

‘The idea that Christ was born on Dec 25 also has no basis in historical fact, "We don't even know which season

he was born in. The whole idea of celebrating his birth during the darkest part of the year is probably linked to

pagan traditions and the winter solstice.

How we moderate

(© Copyright of Telegraph Media Group Linted 2015,

3/17/2015 10:54 AM

United Nations Avresissi201

Ss General Assembly Tt March 2011

Sinty-ffth sess

‘Agenda item 67

Resolution adopted by the General Assembly on 21 December 2010

lon the report of the Third Committee (A/65/455)]

65/201. Universal realization of the right of peoples

to self-determination

The General Assembly,

Reaffirming the importance, for the effective guarantee and observance of

human rights, of the universal realization of the right of peoples. to

self-determination enshrined in the Charter of the United Nations and embodied in

the International Covenants on Human Rights," as well as in the Declaration on the

Granting of Independence to Colonial Countries and Peoples contained in General

Assembly resolution 1514 (XV) of 4 December 1960,

Welcoming the progressive exercise of the right to self-determination by

peoples under colonial, foreign or alien occupation and theit emergence into

sovereign statehood and independen.

Deeply concerned at the continuation of acts or threats of foreign military

intervention and occupation that are threatening to suppress, or have already

suppressed the right to sel determination of peoples and nations.

Expressing grave concern that, as a consequence of the persistence of such

actions, millions of people have been and are being uprooted from their homes as

refligees and displaced persons, and emphasizing the urgent need for concerted

international action to alleviate their condition,

Recalling the relevant resolutions regarding the violation of the right of

Peoples to self-determination and other human rights as a result of foreign military

intervention, aggression and occupation, adopted by the Commission on Human

Rights at its sixty-first” and previous sessions,

Reaffirming its previous resolutions on the universal realization of the right of

peoples to self-determination, including resolution 64/149 of 18 December 2009,

" Reslacon 2200 (XD) ane,

* See Offical Reconds of the Economic amd Social Cowell 2008, Supplement No.3 and corigenda

(€£2008723 and Core] and 2) chap Tl est A

0.52460 =

{AON A

ARESI6S/201

Reaffirming also its resolution $5/2 of 8 September 2000, containing the

United Nations Millennium Declaration, and recalling its resolution 60/1 of

16 September 2005. containing the 2005 World Summit Outcome, which, inter alia,

upheld the right to self-determination of peoples under colonial domination and

foreign occupation,

Taking note of the report of the Seeretary-General on the right of peoples to

self-determination,’

1. Reaffirms that the universal realization of the right of all peoples,

including those under colonial, foreign and alien domination, to selt-determination

is a fundamental condition for the effective guarantee and observance of human

rights and for the preservation and promotion of such tights;

Declares its firm opposition to acts of foreign military intervention,

aggression and occupation, since these have resulted in the suppression of the right

of peoples to self-determination and other human rights in certain parts of the

world:

3. Calls pon those States responsible to cease immediately their military

intervention in and occupation of foreign countries and territories and all acts of

repression, discrimination, exploitation and maltreatment, in particular the brutal

and inhuman methods reportedly employed for the execution of those acts against

the peoples concerned:

4. Deplores the plight of millions of refugees and displaced persons who

have been uprooted as a result of the aforementioned acts, and reaffirms their vight

to return to their homes voluntarily in safety and with honour:

5. Requests the Human Rights Council to continue to give special attention

{0 Violations of human rights, especially the right to self-determination, resulting,

from foreign military intervention, aggression or occupation;

6. Requests the Secretary-General to report on the question to the General

Assembly at its sixty-sixth session under the item entitled “Right of peoples to

self-determination”,

7Ist plenary meeting

21 December 2010

H. Res, 194

In the House of Representatives, U. Ss,

4,

1, 2008,

duly

Whereas millions of Africans and their descendants were

enslaved in the United States and the 13 American colo-

nies from 1619 through 1865;

Whereas slavery in America resembled no other form of invol-

untary servitude known in histe

is Africans were cap

tured and sold at auction like inanimate objects or ani-

mals;

Wh

reas Africans foreed into slavery were brutalized, humili-

ated, dehumanized, and sul

jected to the indignity of

being stripped of their names and heritage;

Whereas enslaved families were torn apart after having: been

sold separately from one another;

Whereas the system of slavery and the visceral ra

mt against

persons of African descent upon which it depended be-

came entrenched in the Nation’s social fabr

Whi

As slavery was not officially abolished until the passage

of the 13th Amendment to the United States Constitu-

tion in 1865 after the end of the Civil War;

1 246 yeu

Whereas after emancipation tre rs of slavery, Afvi-

can-Ame

“is Soon

aw the fleeting political, social, and

cconomie ygtins they made during Reconstruction ¢

rulent

cerated by v acism, lynchings, disenfranchisement,

10

1 CONGRESS

ues H J RES. 3

0 Ue Oo

‘To acknowledge a long history of official depredations and i

hy the Cited States Government regarding Tndian tribes and offer

Jan apology to all Native Peoples on behalf of the United States.

IN THE HOUSE OF REPRESENTATIVES

slaxvary 4, 2007

Abs, Jo ANN D.N1s of Virginia introduced the following joint resolution:

whieh was refered to the Committe on Natural Resonrees

JOINT RESOLUTION

To acknowledge a long history of official depredations and

illet “l policies hy the United States Government

g Indian tribe:

regan and offer ain apology to all Native

United States,

Peoples on behalf of i

Whereas the ancestors of today's Native Peoples inhabited

the land of the present

uy Thnited States

memorial and for thousands of ye

ce time ime

before the arrival of

peoples of European descent;

Whereas the Nati

tected, and stew

Peoples have for millennia honored, pro-

arded this land we cherish;

Whereas the Native Peoples are spiritual peoples with a deep

and abiding belief in the Creator, and for millennia their

peoples have maintained a powerful: spir

mal connection

U.S. Office of Personnel Management ETHNICITY AND RACE IDENTIFICATION

GigeloPuncred Oia Starts’ | (ease te ey NO RACE IDENTIFICATION

a nee Se liane ah ve)

RoBeERTS Adon C S/1978

fay is

Privacy Act Statement

Ethnicity and race information is requested under the authority of 42 U.S.C. Section 2000e-16 and in compliance with

the Office of Management and Budget's 1997 Revisions to the Standards for the Classification of Federal Data on Race

‘and Ethnicity. Providing this information is voluntary and has no impact on your employment status, but in the instance

‘of missing information, your employing agency will attempt to identify your race and ethnicity by visual observation,

This information is used as necessary to plan for equal employment opportunity throughout the Federal government. It

is also used by the U. 8. Office of Personne! Management or employing agency maintaining the records to locate

individuals for personnel research or survey response and in the production of summary descriptive statistics and

analytical studies in support of the function for which the records are collected and maintained, or for related workforce

studies.

Social Security Number (SSN) is requested under the authority of Executive Order 9397, which requires SSN be used

{or the purpose of uniform, orderly administration of personnel records. Providing this information is voluntary and failure

10 do so will have no effect on your employment status. If SSN is not provided, however, other agency sources may be

Used to obtain it,

‘Specific Instructions: The two questions below are designed to Ideniy your ethniiy and race. Regardless of your answer to

| question 1, goto question 2.

{Question 1. “Are You Hispanic or Latino? (A person of Cuban, Mexican, Puerto Rican, South or Genial American, or ther

Spanish culture or origin, regardless of race.)

ves Sef No

Question 2. Please select the racial category or categories with which you mest closely identi by placing an Xin the appropriate

box Check as many as apply

RACIAL CATEGORY

(CAGE CATEORT DEFINITION OF CATEGORY

[Sl roto nar or asea neve 7 paraon having oie nary ol th olga peoples of Nonh and Sou AnoaGe

(riding "Conta Amerea),”ont who ainaine wba elabon cramer

chant

Asien ‘A poron naving ogns in any ofthe cignal peoples of tho Far East, Southeast

fsa, or th Indian Suboonont Incuing, or exemple, Canboda. China, has,

Jopan, Koes, Malaysia, Pakistan, te Piping lands, Thole, aed Vietnam,

Black or Aean Amercan ‘person having oighsin any of the blak rai groups Ati,

G) Native Hawaiian or Otner Pacific stander | A person having origins in any ofthe original peoples of Hawai, Guam, Samoa, or

other Pacific Islands,

Pr wnte ‘A person having origins in any ofthe orginal peoples of Europe, the Midtle East, or

oP i emacro

CIAL AR sir chervece pyaar

1 dory ase a

“88s. Secon 2000-18

NSN 7ea0-01-099.0448,

Ma

i SES COONS

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Weiss Concise Trustee Handbook PDFDocument0 pagesWeiss Concise Trustee Handbook PDFMichael Haskins100% (7)

- Business Trust ManualDocument98 pagesBusiness Trust Manualspcbanking67% (3)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Pope Francis Apologizes To Indigenous Peoples For Grave Sins' of Colonialism - Indian Country Media NetworkDocument2 pagesPope Francis Apologizes To Indigenous Peoples For Grave Sins' of Colonialism - Indian Country Media Network:Aaron :Eil®©™83% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Ucc 1-201 DefintionsDocument44 pagesUcc 1-201 Defintions:Aaron :Eil®©™No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Notice of Default (Official)Document7 pagesNotice of Default (Official):Aaron :Eil®©™100% (1)

- UCC-3 Termination Statement of Lien Against PG County - The Lien No Longer Exists FYIDocument3 pagesUCC-3 Termination Statement of Lien Against PG County - The Lien No Longer Exists FYI:Aaron :Eil®©™100% (1)

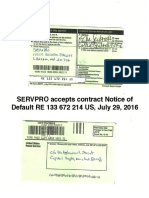

- SERVPRO Accepts Offer To Contract-Registered Mail Return Receipt RE133672205USDocument3 pagesSERVPRO Accepts Offer To Contract-Registered Mail Return Receipt RE133672205US:Aaron :Eil®©™No ratings yet

- Certificate of Commercial Dishonor (PG County)Document19 pagesCertificate of Commercial Dishonor (PG County):Aaron :Eil®©™100% (1)

- Indigenous Press Release Signed & SealedDocument6 pagesIndigenous Press Release Signed & Sealed:Aaron :Eil®©™100% (1)

- 2013 Provider DirectoryDocument124 pages2013 Provider Directory:Aaron :Eil®©™No ratings yet

- USPS Returns Complaint As Insufficient AddressDocument1 pageUSPS Returns Complaint As Insufficient Address:Aaron :Eil®©™No ratings yet

- SERVPRO Accepts Registered Mail RE133672214US DefaultDocument1 pageSERVPRO Accepts Registered Mail RE133672214US Default:Aaron :Eil®©™No ratings yet

- BETTER BUSINESS BUREAU (BBB) and Kenneth Perryman Acknowledges Indigenous Standing and Claim Against SERVPRODocument3 pagesBETTER BUSINESS BUREAU (BBB) and Kenneth Perryman Acknowledges Indigenous Standing and Claim Against SERVPRO:Aaron :Eil®©™No ratings yet

- SERVPRO Accepts Registered Mail RE133672214US DefaultDocument1 pageSERVPRO Accepts Registered Mail RE133672214US Default:Aaron :Eil®©™No ratings yet

- Dishonor by Non Acceptance by Rushern L. BakerDocument1 pageDishonor by Non Acceptance by Rushern L. Baker:Aaron :Eil®©™100% (1)

- UCC-3 Addendum Against PG Dep't of The EnvironmentDocument22 pagesUCC-3 Addendum Against PG Dep't of The Environment:Aaron :Eil®©™100% (1)

- Statement of Claim (Department of The Environment)Document37 pagesStatement of Claim (Department of The Environment):Aaron :Eil®©™No ratings yet

- Affidavit of Statement of Facts-Counter Claim (Official)Document95 pagesAffidavit of Statement of Facts-Counter Claim (Official):Aaron :Eil®©™100% (3)

- Official International Fax of SF-181 (Office of International Operations)Document33 pagesOfficial International Fax of SF-181 (Office of International Operations):Aaron :Eil®©™100% (1)

- At-Sik-Hata :nation Complaints Sent To UNOHCHR SecretariatDocument15 pagesAt-Sik-Hata :nation Complaints Sent To UNOHCHR Secretariat:Aaron :Eil®©™No ratings yet

- Notice of Default Against PG CountyDocument104 pagesNotice of Default Against PG County:Aaron :Eil®©™No ratings yet

- Office of Inspector General Response To Complaint: Hotline Form Submission (ID: 15164)Document2 pagesOffice of Inspector General Response To Complaint: Hotline Form Submission (ID: 15164):Aaron :Eil®©™No ratings yet

- Affidavit of Material Facts-Notice of Adverse Claim # RA139134451USDocument41 pagesAffidavit of Material Facts-Notice of Adverse Claim # RA139134451US:Aaron :Eil®©™100% (2)

- UCC-1 Filing Certified Lien Against RV Bey Publications For $36,720,000,000.00 DollarsDocument25 pagesUCC-1 Filing Certified Lien Against RV Bey Publications For $36,720,000,000.00 Dollars:Aaron :Eil®©™86% (7)

- Facebook Acknowledges My Indigenous StandingDocument1 pageFacebook Acknowledges My Indigenous Standing:Aaron :Eil®©™No ratings yet

- USPS Blocks Delivery To HeruDocument5 pagesUSPS Blocks Delivery To Heru:Aaron :Eil®©™No ratings yet

- AACRAO Member Chart Demographics 2015Document13 pagesAACRAO Member Chart Demographics 2015:Aaron :Eil®©™No ratings yet

- Certificate of Commercial Dishonor AmendmentDocument14 pagesCertificate of Commercial Dishonor Amendment:Aaron :Eil®©™100% (4)