Professional Documents

Culture Documents

E 14 - Aafr

Uploaded by

askermanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E 14 - Aafr

Uploaded by

askermanCopyright:

Available Formats

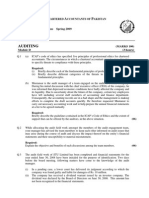

The Institute of Chartered Accountants of Pakistan

Advanced Accounting and Financial Reporting

Final Examination

Winter 2012

Module E

Q.1

4 December 2012

100 marks - 3 hours

Additional reading time - 15 minutes

Following are the extracts from the draft financial statements of three companies for the year

ended 30 June 2012:

Revenue

Cost of sales

Gross profit

Operating expenses

Profit from operations

Investment income

Profit before taxation

Income tax expense

Profit for the year

INCOME STATEMENTS

Tiger Limited

Panther Limited

Leopard Limited

(TL)

(PL)

(LL)

-------------------Rs. in million------------------6,760

568

426

(4,370)

(416)

(218)

2,390

152

208

(1,270)

(54)

(132)

1,120

98

76

730

10

1,850

98

86

(400)

(20)

(17)

1,450

78

69

STATEMENTS OF CHANGES IN EQUITY

Ordinary share capital

Retained earnings

of Rs. 10 each

TL

PL

LL

TL

PL

LL

---------------------------Rs. in million-------------------------As on 1 July 2011

10,000

800

600

2,380

270

70

Final dividend for the year

ended 30 June 2011

(1,000)

(60)

Profit for the year

1,450

78

69

As on 30 June 2012

10,000

800

600

2,830

348

79

The following information is also available:

(i)

Several years ago, TL acquired 64 million shares in PL for Rs. 1,000 million when PLs

retained earnings were Rs. 55 million. Up to 30 June 2011, cumulative impairment

losses of Rs. 50 million had been recognized in the consolidated financial statements, in

respect of goodwill.

On 31 December 2011, TL disposed off its entire holding in PL for Rs. 1,300 million.

(ii)

(iii)

(iv)

(v)

On 1 July 2011, 42 million shares of LL were acquired by TL for Rs. 550 million. An

impairment review at 30 June 2012 indicated that goodwill recognized on acquisition

has been impaired by Rs. 7 million.

During the year, LL sold goods costing Rs. 50 million to TL at a mark-up of 20% on

cost. 40% of these goods remained unsold on 30 June 2012.

Investment income appearing in TLs separate income statement includes profit on sale

of PLs shares and dividend received from LL.

TL values the non-controlling interest at its proportionate share of the fair value of the

subsidiarys identifiable net assets.

It may be assumed that profits of all companies had accrued evenly during the year.

Required:

Prepare TLs consolidated income statement and consolidated statement of changes in equity

for the year ended 30 June 2012 in accordance with the requirements of International

Financial Reporting Standards. (Ignore deferred tax implications)

(23)

AdvancedAccountingandFinancialReporting

Q.2

Page2 of5

The following information pertains to Crow Textile Mills Limited (CTML) for the year ended

30 June 2012:

(a)

Stocks include 4,000 maunds of cotton which was purchased on 1 April 2012 at a cost of Rs.

6,200 per maund. In order to protect against the impact of adverse fluctuations in the price of

cotton, on the price of its products, CTML entered into a six months futures contract on the

same day to deliver 4,000 maunds of cotton at a price of Rs. 6,300 per maund.

At year end i.e. 30 June 2012, the market price of cotton (spot) was Rs. 5,500 per maund and

the futures price for September delivery was Rs. 5,550 per maund.

All necessary conditions for hedge accounting have been complied with.

(b)

(05)

On 1 July 2011, 2 million convertible debentures of Rs. 100 each were issued. Each debenture

is convertible into 25 ordinary shares of Rs. 10 each on 30 June 2014. Interest is payable

annually in arrears @ 8% per annum. On the date of issue, market interest rate for similar

debt without conversion option was 11% per annum. However, on account of expenditure of

Rs. 4 million, incurred on issuance of shares, the effective interest rate increased to 11.81%.

(08)

Required:

Prepare Journal entries for the year ended 30 June 2012 to record the above transactions.

(Show all necessary calculations)

Q.3

In order to pursue expansion of its business, Parrot Limited (PL) has made the following

investments during the year ended 30 June 2012:

(a)

On 1 July 2011, PL acquired 20% shares of Goose Limited (GL), a listed company, when

GLs retained earnings stood at Rs. 250 million and the fair value of its net assets was

Rs. 350 million. The purchase consideration was two million ordinary shares of PL whose

market value on the date of purchase was Rs. 33 per share. PL is in a position to exercise

significant influence in finalizing the financial and operational policies of GL.

The summarized statement of financial position of GL at 30 June 2012 was as follows:

Share capital (Rs. 10 each)

Retained earnings

Net assets

Rs. in million

100

280

380

380

Recoverable amount of GLs net assets at 30 June 2012 was Rs. 370 million.

(b)

(06)

Costs incurred for development and promotion of a brand are enumerated below:

(i)

(ii)

(iii)

(iv)

(v)

(vi)

(vii)

Research on size of potential market

Products designing

Labour costs in refinement of products

Development work undertaken to finalize the product design

Cost of upgrading the machine

Staff training costs

Advertisement costs

Rupees

800,000

1,500,000

950,000

11,000,000

18,000,000

600,000

3,400,000

Required:

Discuss how the above investments/costs would be accounted for in the consolidated financial

statement for the year ended 30 June 2012.

(06)

AdvancedAccountingandFinancialReporting

Q.4

Page3 of5

Primate Mart Limited (PML) operates a network of several retail stores throughout the

country. In order to retain its market share and achieve growth in revenue, PML has extended

substantial credit facilities to its major customers. Consequently, PMLs bank borrowings

have increased substantially over the past few years. PML has recently requested its bank for

further increase in its borrowing facilities.

The bank is concerned about the increase in the quantum of loans extended to PML and has

appointed you to analyse the financial performance of PML for the last three years. The

information available in respect of the company is as follows:

(i)

Statement of financial position

Property, plant and equipment

Stock-in-trade

Trade debts

Cash

Share capital

Retained earnings

Long term loans from bank

Short term running finance

Trade creditors

Tax payable

(ii)

2012

2011

2010

-------------- Rs. in million -------------322

290

278

620

540

440

443

385

344

15

12

12

1,400

1,227

1,074

90

282

372

420

320

280

8

1,400

90

288

378

355

200

284

10

1,227

90

291

381

212

200

277

4

1,074

Income statement

Sales

Cash

Credit

Total sales

Cost of sales

Gross profit

Other operating costs

Profit from operations

Financial charges

Profit before taxation

Taxation

Profit for the year

Depreciation for the year

Proposed dividend

2012

2011

2010

-------------- Rs. in million -------------1,050

940

790

450

380

320

1,500

1,320

1,110

(996)

(864)

(723)

504

456

387

(384)

(341)

(288)

120

115

99

(102)

(79)

(57)

18

36

42

(6)

(12)

(14)

12

24

28

33

10%

36

20%

42

20%

(iii) The present borrowing limit sanctioned to PML is Rs. 750 million.

Required:

Prepare a report for the bank containing an analysis of the financial performance of the

company for the period covered by the financial statements. Your report should focus on the

particular concern of the bank regarding the rapidly increasing level of lending exposure to

PML and suggest matters which the bank may discuss with the PMLs management.

(Assume your name is Bashir Ahmed)

(15)

AdvancedAccountingandFinancialReporting

Q.5

Page4 of5

Lion Engineering Limited (LEL) operates an approved pension scheme (defined benefit plan) for

all its permanent employees who have completed one years service. The details for the year ended

30 June 2012 relating to the pension scheme are as follows:

Present value of pension scheme obligation at 30 June 2011

Fair value of schemes assets at 30 June 2011

Unrecognized actuarial loss at 30 June 2011

Current service cost

Contribution made during the year

Benefits paid during the year

Present value of pension scheme obligation at 30 June 2012

Fair value of schemes assets at 30 June 2012

Rs. in million

100

70

20

29

30

45

110

80

Additional information:

(i) With effect from 1 July 2011, LEL had amended the scheme whereby the employees

pension entitlement had been increased. The benefits would become vested after three years.

According to actuarial valuation the present value of the cost of additional benefits at

1 July 2011 was Rs. 15 million.

(ii) The discount rate and expected rate of return on the plan assets on 30 June 2012 were as

follows:

Discount rate

13%

Expected rate of return on plan assets

10%

(iii) LEL was required to pay Rs. 40 million to the scheme, during the year ended 30 June 2012.

Because of cash flow constraints, LEL was able to contribute Rs. 30 million only.

(iv) Average remaining working lives of employees is 10 years.

(v) LEL uses the corridor approach to recognize actuarial gains and losses.

(vi) Last actuarial valuation was made on 30 June 2012 using the Projected Unit Credit Method.

Required:

Prepare the relevant extracts from the statement of financial position and the related notes to the

financial statements for the year ended 30 June 2012. Show all necessary workings.

(Accounting policy note is not required. Deferred tax may be ignored)

(18)

Q.6

Eagle Bank Limited (EBL) is listed on all the stock exchanges in Pakistan. At the year end, the total

borrowings of the bank amounted to Rs. 29,761 million, which included borrowings outside

Pakistan amounting to Rs. 11,712 million. Details of borrowings at the year-end were as follows:

(i)

(ii)

All local borrowings are in Pak Rupees.

Inter-bank call money borrowings amounted to Rs. 3,600 million. These borrowings were

unsecured and carried mark-up ranging between 8.7% and 12.1% per annum.

(iii) EBL operates in several countries where it maintains nostro accounts. The overdrawn nostro

accounts amounted to Rs. 456 million. Mark-up on overdrawn nostro accounts was charged

by the foreign banks at the rates prevailing in the respective countries.

(iv) Outstanding loans from the State Bank of Pakistan (SBP) under the Export Refinance

Scheme amounted to Rs. 14,182 million. These loans carried mark-up ranging between

9.7% and 11% per annum and were secured by EBLs cash and other securities held by SBP.

(v) The borrowings under repurchase agreements amounted to Rs. 11,523 million and carried

mark-up ranging between 6.3% and 12.5% per annum. These borrowings are secured against

government securities amounting to Rs. 24,802 million and are repayable latest by

April 2013.

Required:

Prepare note on Borrowings for inclusion in the Financial Statements of Eagle Bank Limited with

appropriate disclosures in accordance with the State Bank of Pakistan guidelines.

(10)

AdvancedAccountingandFinancialReporting

Q.7

Page5 of5

Quail Pakistan Limited (QPL), a listed company, is reviewing the following transactions which

have not yet been accounted for in the financial statements for the year ended 30 June 2012:

(a)

On 1 July 2011, QPL announced a bonus of Rs. 30 million to its employees if they achieved

the annual budgeted targets by 30 June 2012. The bonus would be paid in the following

manner:

25% of the bonus would be paid in cash on 31 December 2012 to all employees

irrespective of whether they are still working for QPL or not.

The balance 75% will be given in share options, to those employees who are in QPLs

employment on 31 December 2012. The exercise date and number of options will be fixed

by the management on the same day.

The budgeted targets were achieved. The management expects that 5% employees would

leave between 30 June 2012 and 31 December 2012.

(04)

(b)

On 30 June 2012, a plant having a list price of Rs. 50 million was purchased. QPL has

allowed the following options to the supplier, in respect of payment thereagainst:

To receive cash equivalent to price of 1.5 million shares of the company after 3 months; or

To receive 1.7 million shares of the company after 6 months.

QPL estimates that price of its shares would be Rs. 35 per share after three months and

Rs. 40 per share after six months.

(05)

Required:

Discuss how the above share-based transactions should be accounted for in QPLs financial

statements for the year ended 30 June 2012. Show necessary calculations.

(Journal entries are not required)

(THE END)

You might also like

- E13Document2 pagesE13askermanNo ratings yet

- CLWDocument2 pagesCLWapi-3838998No ratings yet

- E13 ItmacDocument3 pagesE13 ItmacaskermanNo ratings yet

- E-13 ItmacDocument3 pagesE-13 ItmacaskermanNo ratings yet

- D10 CaDocument4 pagesD10 CaaskermanNo ratings yet

- D12 CacDocument6 pagesD12 CacaskermanNo ratings yet

- E 13 - ItmacDocument3 pagesE 13 - ItmacaskermanNo ratings yet

- E 16 - BMGDocument3 pagesE 16 - BMGaskermanNo ratings yet

- E 15 - CLSDocument3 pagesE 15 - CLSaskermanNo ratings yet

- Information Technology: T I C A PDocument2 pagesInformation Technology: T I C A PaskermanNo ratings yet

- Information Technology: T I C A PDocument2 pagesInformation Technology: T I C A PaskermanNo ratings yet

- D10 CaDocument4 pagesD10 CaaskermanNo ratings yet

- Information Technology: T I C A PDocument3 pagesInformation Technology: T I C A Papi-3838998No ratings yet

- Information Technology: Continued On Next Page...Document2 pagesInformation Technology: Continued On Next Page...askermanNo ratings yet

- D11 AudDocument2 pagesD11 AudaskermanNo ratings yet

- D11 AudDocument3 pagesD11 AudaskermanNo ratings yet

- Company LawDocument2 pagesCompany LawaskermanNo ratings yet

- D9 CLWDocument2 pagesD9 CLWaskermanNo ratings yet

- Corporate Laws2008Document3 pagesCorporate Laws2008askermanNo ratings yet

- Company LawDocument3 pagesCompany LawaskermanNo ratings yet

- D10 CacDocument4 pagesD10 CacaskermanNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument2 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanaskermanNo ratings yet

- ClsDocument3 pagesClsaskermanNo ratings yet

- Caf-9 AudDocument3 pagesCaf-9 AudaskermanNo ratings yet

- Caf-8 CmaDocument4 pagesCaf-8 CmaaskermanNo ratings yet

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanNo ratings yet

- Caf-4 BMBDocument2 pagesCaf-4 BMBaskermanNo ratings yet

- Caf-5 Far1Document5 pagesCaf-5 Far1askermanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ACT AprilDocument64 pagesACT AprildingdongbellsNo ratings yet

- DP SNCR 1511,1512Document6 pagesDP SNCR 1511,1512AmeerHamzaWarraichNo ratings yet

- MGT555 CH 6 Regression AnalysisDocument19 pagesMGT555 CH 6 Regression AnalysisSITI MADHIHAH OTHMANNo ratings yet

- IAS 19 Employee Benefits OverviewDocument8 pagesIAS 19 Employee Benefits OverviewAANo ratings yet

- Life Insurance MathematicsDocument6 pagesLife Insurance MathematicsdurgasainathNo ratings yet

- 2014, APPLIED ECONOMETRICS, Question PaperDocument22 pages2014, APPLIED ECONOMETRICS, Question PapernikhiljoshisrccNo ratings yet

- Oversikt ECN402Document40 pagesOversikt ECN402Mathias VindalNo ratings yet

- Solution To Mid-Term Exam ADM4348M Winter 2011Document17 pagesSolution To Mid-Term Exam ADM4348M Winter 2011SKNo ratings yet

- Sample Registration System SRSDocument2 pagesSample Registration System SRSଖପର ପଦା ଜନତାNo ratings yet

- Modelling The Health Care ILO 8018 PDFDocument398 pagesModelling The Health Care ILO 8018 PDFJuvenal Espirito SantoNo ratings yet

- MultivariableRegression 4Document98 pagesMultivariableRegression 4Alada manaNo ratings yet

- Quant Studies Chapter 7Document14 pagesQuant Studies Chapter 7latrattoriamoliseNo ratings yet

- Actuarial SocietyDocument35 pagesActuarial Societysachdev_researchNo ratings yet

- Mathematics PDFDocument218 pagesMathematics PDFhppynnluNo ratings yet

- Econometrics QuestionsDocument3 pagesEconometrics QuestionstabetsingyannfNo ratings yet

- Managerial Accounting 14th Edition Garrison Test BankDocument35 pagesManagerial Accounting 14th Edition Garrison Test Bankreneestanleyf375h100% (23)

- ACO Ant Colony Optimization for the Quadratic Assignment ProblemDocument13 pagesACO Ant Colony Optimization for the Quadratic Assignment Problemjaved765No ratings yet

- Time Value Money Compounding DiscountingDocument78 pagesTime Value Money Compounding DiscountingKamran ArifNo ratings yet

- Chapter 14Document23 pagesChapter 14YolandaNo ratings yet

- Analyse Econometrique Avec Stata 12 2Document414 pagesAnalyse Econometrique Avec Stata 12 2Miguel RobitailleNo ratings yet

- Exercise Sem 2 20162017 - Past YearDocument5 pagesExercise Sem 2 20162017 - Past Yearsyakirah-mustaphaNo ratings yet

- Global DemogrphyDocument6 pagesGlobal DemogrphyPring MayNo ratings yet

- Solution Manual For A Second Course in Statistics Regression Analysis 8th Edition William Mendenhall Terry T SincichDocument34 pagesSolution Manual For A Second Course in Statistics Regression Analysis 8th Edition William Mendenhall Terry T SincichEricOrtegaizna100% (39)

- EBE Ch2Document10 pagesEBE Ch2Syed Muhammad Haris HayatNo ratings yet

- Insurance Risk Suite IFRS17 Group Calculations LibraryDocument2 pagesInsurance Risk Suite IFRS17 Group Calculations LibrarypalmkodokNo ratings yet

- Practical Risk Theory For ActuariesDocument1 pagePractical Risk Theory For ActuariesCesar JvNo ratings yet

- VDA, - 4 GeneralDocument62 pagesVDA, - 4 Generalaperezpi26606No ratings yet

- All IPPDocument17 pagesAll IPPNitish BawejaNo ratings yet

- IFRS 17 Expenses: Explanatory ReportDocument35 pagesIFRS 17 Expenses: Explanatory ReportWubneh AlemuNo ratings yet

- PERS LawsuitDocument120 pagesPERS LawsuitStatesman JournalNo ratings yet