Professional Documents

Culture Documents

Earnings Release - 4Q14

Uploaded by

MPXE_RIOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earnings Release - 4Q14

Uploaded by

MPXE_RICopyright:

Available Formats

4Q14 Earnings Release

4Q14 Earnings Release

ENEVA Announces Fourth Quarter 2014 Results

Accounting provisions and adjustments and other one-time events hit results major lines leading to a

negative EBITDA in the quarter that blurred plants operation stability and management efforts on

continuous cost optimization

Rio de Janeiro, March 26, 2015 - ENEVA S.A. (BM&FBOVESPA: ENEV3, GDR I: ENEVY) announces today results for

the fourth quarter ended December 31, 2015 (4Q14). The information below is presented on a consolidated basis in

accordance with the accounting practices adopted in Brazil, except where stated otherwise.

4Q14 Highlights

Energy sales: Decreased in 21.8% mainly due to Pecm II deconsolidation as of June 2014, despite the

increase of 132GW contributed by test and commissioning of Parnaba II;

Net Revenues: Excluding Pecm II deconsolidation and non-recurring events booked in 4Q13, totaling

R$179.7 million, revenues remained in line;

Operating Costs: 15.9% decrease mostly as a result of less fuel consumption by plants, despite booking

of unavailability costs provision due as of 2015;

Operating Expenses: Accounting provisions and adjustments and other one-time events impacted

Holding cost management program advance efforts;

Net Income: Reevaluation of Itaqui and Amapari asset values and accounting provision for the loss in the

sale of Pecm I contributed to post higher losses. Excluding these one-off events, net loss down to

R$380.0 million in the quarter and to R$535.2 million in 2014, a reduction of 43.2%.

MAIN INDICATORS

(R$ million)

4Q14

4Q13

2014

2013

Net Operating Revenue

368.2

530.3

-30.6%

1,798.1

1,438.8

25.0%

(397.4)

(472.3)

-15.9%

(1,579.3)

(1,507.0)

4.8%

Operating Expenses

(92.5)

(38.4)

140.5%

(173.0)

(167.3)

3.4%

EBITDA

(83.8)

76.3

N. A.

216.3

(88.9)

N. A.

(1,362.0)

(280.3)

386.0%

(1,517.2)

(942.5)

61.0%

5,006.4

5,932.9

-15.6%

5,006.4

5,932.9

-15.6%

1,821

2,330

-21.8%

7,885

6,430

22.6%

Operating Costs

Net Income

Net Debt

Total Generation Energy Sales (GWh)

4Q14 Earnings Release

4Q14 & Subsequent Events

Final agreement signing to maintain Parnaba II PPAs

On November 20, 2014, ENEVA signed the final agreement with Aneel Brazils National Electric Energy Agency

to adjust power supply obligations of the Parnaba II CCGT, which terms and conditions include:

Postponement of the PPAs Power Purchase Agreements, which will be effective from July 1, 2016 to April

30, 2036;

Generation replacement of Parnaba I OCGT by Parnaba II, until June 30, 2016, which procedure allows

power production with optimized use of natural gas resources;

Reduction of Parnaba II fixed revenue totaling R$334.1 million, to be paid for in installments as of January

2022, as tariff contribution. The reduction amounts to R$13.0 million per year between 2022 and 2025, and

to R$25.6 million per year between 2026 and 2036, adjusted by inflation (IPCA); and

Commitment to close the cycle of the four gas turbines of Parnaba I OCGT in up to five years from the

signing of the agreement. The energy of such project should be fully sold in the regulated market through an

appropriate auction. The regulator may postpone the indicated period of time whether the auction has not

been conducted.

In case of breach of any of the terms and conditions abovementioned, a 20% increase over the amount of the

reduction in Parnaba II fixed revenue will apply.

Resume of operation of Pecm I Generation Unit 1

On December 2, 2014, generation unit 1 of Pecm I TPP resumed operation after a shutdown due to the burnout

of the stator of its generator occurred on August 25, 2014. The generator was replaced with the objective of

reducing downtime and to enhance reliability of operations.

The investment to replace the generator will be covered by property damage liability insurance. The outage of

the unit during 87 days will impact the unavailability reimbursement calculation as of 2016 for a period of 60

months, which will be covered by business interruption insurance from the 61 st to the 87th day.

Sale of ENEVAs interest in Pecm I

On December 9, 2014, ENEVA has agreed to sell its interest in Pecm I TPP to EDP - Energias do Brasil S.A. for

R$300 million. This amount stands for the 50% of the share capital of Pecm I held by ENEVA and the future

capitalization of credits originally granted by ENEVA to Pecm I totaling R$409.9 million.

On March 10, 2015, CADE Brazils Antitrust Council approved without restrictions the transaction, despite the

conclusion of the transaction is subject to others conditions precedent, inter alia ENEVA creditors approval.

The proceeds with the sale of Pecm I will be used to strength the Companys cash position.

4Q14 Earnings Release

Judicial Recovery

On December 9, 2014, ENEVA and its subsidiary ENEVA Participaes filed for judicial recovery request, despite

several efforts made by the Management of the Company to implement its financial stabilization.

The request was as a result of (i) the non-revalidation of the agreement to suspend the amortization and

payment of interests of financial transactions entered into by the Company and certain subsidiaries with financial

creditors, due on November 21, 2014; and (ii) the failure to reach an agreement between the Company and

financial institutions to execute a financial stabilization plan of the Company aimed for the capital structure

strengthening and the debt re-profiling of the Company.

On December 16, 2014, the State Justice approved the judicial recovery request and appointed Deloitte Touch

Tohmatsu as the trustee.

On February 12, 2015, the judicial recovery plan was filed envisaging to push the financial debts reorganization

and to balance the capital structure of ENEVA. Such plan shall be implemented by means of:

(i)

the full payment of the amount of up to R$250,000 to each of the unsecured creditor, subject to the amount

of its respective credit;

(ii) the global reduction of 40% to 65% of the unsecured credits held by the creditors through the capitalization

of credits and/or the waiver of the unsecured credits and subsequent re-profiling of the remaining balance of

the debts owed to such creditors; and

(iii) the launch of a capital increase in the estimated amount of up to R$3 billion, at the issue price of R$0.15 per

share, to be composed of:

(a) capitalization of the credits held by the unsecured creditors;

(b) contribution of assets by shareholders, creditors and investors; and/or

(c) contribution in cash.

4Q14 Earnings Release

Economic and Financial Performance

In light of the partial sale of Pecm II, ENEVAs equity interest in the project was reduced to 50%. As a

consequence, following the accounting standards set forth by the IFRS 11, as of June 1, 2014, Pecm II is

recognized under the equity method.

As a consequence of the signing of Pecm I sale agreement, this asset will be accounted by the equity method

until December 2014.

1. Net Operating Revenues

In 4Q14, ENEVA recorded consolidated Net Operating Revenues of R$368.3 million vs R$530.3 million reported in

4Q13. The decrease in Net Revenues is mostly attributable to the deconsolidation of Pecm II as of June 2014.

Net Revenues in 4Q14 are comprised largely by the revenues from the Regulated Market Power Purchase

Agreements (PPA) of Itaqui and Parnaba I, which reached, respectively, R$132.7 million and R$233.4 million in

the period. In the quarter, Parnaba II revenue reflects costs reimbursement by Parnaba I for generating in

substitution of part of this last thermal plant, as provided for in the operational schematics of the Aneel

agreement to postpone Parnaba II startup date. Revenues from test and commissioning of Parnaba II (R$91.0

million) were booked as CAPEX, as provided for in accounting standards.

The breakdown of Operating Revenues for 4Q14 is as follows:

Operating Revenues

(R$ million)

Itaqui

Parnaba I

Parnaba II

Amapari

Write Off

Consolidated

Gross Revenues

147.7

259.8

11.6

5.3

(11.8)

412.6

Fixed Revenues

82.5

115.8

0.0

5.3

0.0

203.6

Variable Revenues

57.4

138.9

0.0

0.0

0.0

196.3

Adjustments from previous periods

0.0

0.0

0.0

0.0

0.0

0.0

Other Revenues

7.8

5.1

11.6

0.0

(11.8)

12.8

Deductions from Operating Revenues

(15.0)

(26.3)

(1.1)

(2.0)

0.0

(44.4)

Net Operating Revenues

132.7

233.4

10.5

3.4

(11.8)

368.3

4Q14 Earnings Release

2. Operating Costs

Operating Costs

(R$ million)

4Q14

4Q13

2014

2013

(19.5)

(15.1)

29.4%

(54.3)

(40.8)

33,2%

(138.7)

(219.3)

-36.7%

(698.7)

(624.0)

12,0%

Outsourced Services

(37.3)

(51.6)

-27.6%

(143.9)

(96.8)

48,6%

Leases and Rentals

(44.7)

(53.4)

-16.3%

(302.8)

(164.9)

83,6%

(7.9)

(39.3)

-79.8%

(69.1)

(274.4)

-74,8%

(112.2)

(38.0)

195.1%

(143.3)

(162.7)

-11,9%

Transmission Charges

(11.1)

(7.7)

44.4%

(42.3)

(38.7)

9,2%

Compensation for Downtime

(44.1)

(35.6)

23.7%

20.4

(149.7)

-113,7%

Other

(57.0)

5.3

-1177.0%

(121.5)

25.7

-572,9%

(360.4)

(416.8)

-13.5%

(1,412.0)

(1,363.6)

3.5%

(37.0)

(55.5)

-33.4%

(167.3)

(143.4)

16,6%

(397.4)

(472.3)

-15.9%

(1,579.3)

(1,507.0)

4.8%

Personnel and Management

Fuel

Energy Acquired for Resale

Other Costs

Total

Depreciation and Amortization

Total Operating Costs

Operating Costs totaled R$397.4 million in 4Q14, mainly impacted by a decrease of R$80.6 Million in fuel costs

relative to the same period of the preceding year, due mainly to the deconsolidation of Pecm II as of June 2014

and also the reduction of fuel consumption by Parnaba I and Amapari, attributed respectively to gas resources

optimization procedure and suspension of operations for PPA renegotiation. Fuel cost of R$138.7 million recorded

in the quarter is divided into R$61.4 million incurred by Itaqui, R$77.1 million incurred by Parnaba I and R$0.2

million by Amapari.

Deconsolidation of Pecm II also hit the Outsourced Services account, which reached R$37.3 million,

representing a reduction of R$14.3 million when compared to 4Q14. Excluding this effect, the referred cost

remained in line.

The Leases and Rentals account, which totaled R$55.7 million in the quarter, is comprised mainly by lease costs

incurred by Parnaba I, according to its gas supply agreement (R$44.0 million). Additionally, Parnaba I recorded

R$11.7 million in Leases and Rentals that were generation and operation costs of Parnaba II steam turbine and

related transmission charges transferred to Parnaba I, based on the operational schematics provided for in the

Aneel agreement to postpone Parnaba II startup date.

The Other Costs account, which totaled R$96.5 million in 4Q14, is mainly composed by transmission charges

(TUST) and compensation for downtime of the power plants (unavailability charges, also known as ADOMP).

Also, the Other Costs account was impacted by a write-down of credits held by Amapari which totaled R$37.1

million.

In 4Q14, Itaqui and Parnaba I had to reimburse DisCos for the energy not delivered calculated based on a 60month rolling average priced by the difference between their declared variable cost per MWh (CVU) and the

energy spot price (PLD). The energy exposure for 2014 of such plants represents -5.63 average MW/month and

+0.53 average MW/month, respectively. In August 2014, this parameter was recalculated for 2015 amounting to

-19.39 average MW/month for Itaqui and +0.84 average MW/month for Parnaba I. In the quarter, unavailability

costs totaled R$44.1 million for Itaqui (R$38.4 million was an accounting provision of unavailability due as of

5

4Q14 Earnings Release

2015) and R$0.0 for Parnaba I, which will be paid in 60 monthly instalments as of January 2015 and are subject

to annual reevaluation, as provided for in the 60-month rolling average calculation methodology.

Operational Highlights: During the period, Itaqui stopped for 18 days in October 2014 for inspection and

maintenance according to operation plan and thus lowering availability records. Net generation reached 522GWh.

Itaqui - Energy Availability

87%

75%

77%

1Q14

2Q14

72%

3Q14

4Q14

In 4Q14, Parnaba Is availability was compromised by occasional power reduction in order to allow Parnaba II

test and commissioning procedures. Net generation reached 844GWh.

Parnaba I - Energy Availability

99%

98%

94%

86%

1Q14

2Q14

3Q14

4Q14

3. Operating Expenses

In the quarter, Operating Expenses, excluding Depreciation & Amortization, amounted to R$91.6 million, a

145.7% increase when compared to 4Q13. In the same period, the Holding company posted Operating Expenses,

excluding Depreciation and Amortization, of R$84.1 million, compared to the R$35.6 million recorded in 4Q13.

During the period, the IPCA inflation index rose by 6.41%.

Operating Expenses

(R$ million)

Consolidated

4Q14

4Q13

2014

2013

Personnel

(54.3)

(18.5)

194.2%

(81.5)

(79.8)

2.1%

Outsourced Services

(24.0)

(15.5)

54.2%

(65.3)

(64.8)

0.7%

(2.1)

(1.2)

74.9%

(7.4)

(7.2)

2.7%

Leases and Rentals

Other Expenses

Total

Depreciation and Amortization

Total Operating Expenses

(11.3)

(2.1)

436.5%

(15.6)

(12.3)

26.6%

(91.6)

(37.3)

145.7%

(169.8)

(164.1)

3.5%

(0.8)

(1.1)

-27.8%

(3.2)

(3.1)

2.8%

(92.5)

(38.4)

140.5%

(173.0)

(167.3)

3.4%

4Q14 Earnings Release

Operating Expenses

(R$ million)

Personnel

Stock Options

Outsourced Services

Leases and Rentals

Other Expenses

Total

Depreciation and Amortization

Total Operating Expenses

Holding

4Q14

4Q13

2014

2013

(51.5)

3.4

(22.3)

131.1%

(74.3)

(67.6)

9.9%

(9.2)

-136.6%

0.2

-100.0%

(20.4)

(9.1)

123.8%

(49.4)

(40.4)

22.3%

(2.0)

(1.5)

33.9%

(6.9)

(5.5)

24.8%

(10.2)

(2.7)

273.6%

(12.8)

(7.9)

61.5%

(84.1)

(35.6)

136.1%

(143.3)

(121.4)

18.0%

(0.6)

(0.9)

-30.2%

(2.4)

(2.3)

3.3%

(84.8)

(36.6)

131.9%

(145.7)

(123.7)

17.8%

The main changes are as follows:

Personnel: Personnel expenses totaled R$54.3 million in 4Q14, compared to R$18.5 million reported in

the same period of the preceding year. The increase in personnel expenses is largely a result of:

Shared expenses from previous periods with subsidiaries provision amounting to R$27.8 million,

which will be transferred during the year of 2015 (+R$29.2 million);

Higher provision for employee bonus as compared to 4Q13 (+R$10.0 million);

Organizational redesign and streamlining and also reduction of labor costs associated with

dismissals (-R$5.7 million);

Accounting provision reduction for stock option-related expenses resulting from a decrease in

both the number of options outstanding and the share price since 4Q13 (-R$4.2 million);

Outsourced services: Expenses with outsourced services in 4Q14 totaled R$24.0 million, up R$8.4

million in relation to 4Q13. The highlights are:

Increase in IT expenses with infrastructure installation and contract termination with former IT

provider (+R$8.5 million);

Increase in expenses with technical, financial and legal consulting services in the Holding

company (+R$3.3 million);

Accounting provision in subsidiaries related to future shared expenses with holding due to IT

provider termination (-R$6.5 million).

Others: Increase mostly related to shared expenses from previous periods with subsidiaries amounting

to R$9.8 million, which will be transferred during the year of 2015 (+R$9.8 million).

4. EBITDA

In 4Q14, ENEVA reported a negative EBITDA of R$83.8 million, mainly comprised by:

Increase in Holdings Operating Expenses, mainly due to accounting provisions and adjustments;

Higher Operating Costs, reflecting accounting provision for unavailability costs of power plants due as of

2015 and write-down of credits by subsidiaries.

4Q14 Earnings Release

Adjusted EBITDA sums -R$1.9 million and is composed by excluding non-recurring events, such as

accounting provisions for unavailability costs of Itaqui for 2015 onwards, stock options, shared services

with subsidiaries and IT contract termination fee.

5. Net Financial Result

Financial Result

(R$ million)

4Q14

4Q13

2014

2013

Financial Income

22.1

36.1

-38.8%

131.7

88.5

48.8%

0.6

2.3

-75.9%

27.4

15.3

78.8%

Monetary variation

Revenues from financial investments

19.3

36.8

-47.4%

75.3

63.7

18.2%

0.8

(6.3)

-113.3%

17.0

1.2

1370.1%

Settlement of derivatives

1.6

-100.0%

Present value adjust. (debentures)

(0.1)

-100.0%

(0.0)

(0.5)

-100.0%

Marking-to-market of derivatives

Other

1.3

3.4

-60.5%

12.0

7.2

66.7%

(175.6)

(202.7)

-13.4%

(641.8)

(594.6)

7.9%

Monetary variation

(10.7)

(9.0)

18.9%

(40.9)

(33.7)

21.3%

Interest expenses

(114.5)

(133.1)

-14.0%

(516.5)

(364.8)

41.6%

Financial Expenses

Settlement of derivatives

117.7

-100.0%

Marking-to-market of derivatives

(1.8)

-100.0%

(4.1)

(121.1)

-96.6%

Costs and Interest on Debentures

(0.0)

(0.3)

-89.7%

(0.5)

(0.8)

-36.3%

(50.5)

(58.6)

-13.8%

(79.7)

(191.9)

-58.5%

(153.6)

(166.7)

-7.9%

(510.1)

(506.1)

0.8%

Other

Net Financial Result

In 4Q14, ENEVA recorded net financial expenses of R$153.6 million, compared to net expenses of R$166.7

million in 4Q13, impacted mainly by higher losses on monetary variation on derivatives, due to differential

exchange rates on hedging swaps. Despite Pecm II deconsolidation, higher interest expenses are related mostly

to the growth in holding indebtedness motivated by increased cash needs in the subsidiaries resulting mainly

from unavailability penalties. The net financial result was also impacted by the decrease in Other financial

expense, resulting from higher revenues by holding of intercompany loans.

Due to the Judicial Recovery process, as of December 9, 2014, all credit facilities interest payments contracted

by ENEVA, were suspended and since this date have not been accounted as financial expenses.

4Q14 Earnings Release

6. Equity Income

The company reported a negative equity income of R$620.1 million, mainly impacted by a provision recorded in

Pecm I of unavailability costs due as of 2015.

The following analyses consider 100% of the projects. On December 31, 2014, ENEVA held an interest of 50.0%

in Pecm I, Pecm II and ENEVA Participaes, 52.5% in both Parnaba III and Parnaba IV (30% as a direct

investment and 22.5% through ENEVA Participaes).

6.1.

Pecm I

INCOME STATEMENT - Pecm I

(R$ million)

4Q14

4Q13

2014

2013

Net Operating Revenues

303.7

332.7

-8.7%

1,153.7

984.4

17.2%

(609.7)

(305.7)

99.5%

(1,225.8)

(1,187.2)

3.3%

Operating Expenses

(7.0)

(5.8)

21.0%

(18.7)

(19.0)

-1.5%

Net Financial Result

(80.2)

(59.2)

35.5%

(281.4)

(206.0)

36.6%

(393.2)

(38.0)

934.3%

(372.2)

(427.8)

-13.0%

137.1

12.9

960.5%

135.9

145.4

-6.5%

NET INCOME

(256.1)

(25.1)

920.8%

(236.3)

(282.3)

-16.3%

EBITDA

(279.4)

61.7

-553%

46.0

(105.5)

-143.6%

Operating Costs

Earnings Before Taxes

Taxes Payable and Deferred

Net revenues for Pecm I in the quarter amounted to R$303.7 million, comprised of:

Fixed revenues amounting to R$157.8 million;

Variable revenues amounting to R$108.5 million;

Revenues referring to power trades resulting from the annual revision of the plants firm energy,

provided for in the PPA, totaling R$74.7 million;

Taxes on revenues amounting to R$37.2 million.

Operating Costs, excluding Depreciation and Amortization, totaled R$576.2 million, a 117.2% increase compared

to the same period of last year, mainly due to the effect of an accounting provision amounting to +R$278.2

million from unavailability costs due as of 2015 and higher fuel costs (+R$43.8 million) as a reflect of power

generation increase.

Fuel costs in the quarter reached R$114.6 million, split between coal (R$106.1 million) and diesel oil and other

(R$8.5 million) costs.

Operating Costs in 4Q14 were also inflated by costs associated with power trades resulting from the annual

revision of the plants firm energy, provided for in the PPAs, amounting to R$69.5 million. Every year, the ONS

resets the plants firm energy based on the performance of the past 60 months. If the average availability rate

falls below the value originally declared, the plants firm energy is reduced and the difference has to be covered

9

4Q14 Earnings Release

by a free market collateral contract. The plant can then sell in the spot market the energy associated with the

collateral contract, maintaining only the collateral component of the contract. In 4Q14, given high spot prices,

gross revenues resulting from this sale amounted to R$74.7 million.

Other costs totaled R$339.5 million in 4Q14. This account is composed mainly by transmission charges (R$15.2

million) and unavailability costs that totaled R$323.1MM, including R$278.2 million as an accounting provision of

unavailability due as of 2015. The energy exposure related to unavailability for 2014 represents -48.2 average

MW/month. In August 2014, this parameter was recalculated for 2015 and increased to -78.5 average

MW/month. Unavailability costs will be paid in 60 monthly instalments as of January 2015 and are subject to

annual reevaluation, as provided for in the 60-month rolling average calculation methodology.

In 4Q14, Pecm I recorded a negative EBITDA of R$279.4 million. Net financial expenses amounted to R$80.2

million, compared to R$59.2 million in 4Q13, impacted mainly higher losses on monetary variation, due to

differential exchange rates on hedging swaps.

Pecm I reported a net loss of R$256.1 million in 4Q14.

Operational Highlights: In 4Q14, Generation Unit 01 of the plant has being repaired and stopped for 50 days,

impacting total availability for the period. Despite this event, high availability standards were achieved during the

quarter. Net generation reached 1,034GWh.

Pecm I - Energy Availability

86%

83%

80%

77%

50%

2Q14

43%

3Q14

Pecm I

6.2.

71%

70%

71%

1Q14

97%

86%

83%

UG1

4Q14

UG2

Pecm II

INCOME STATEMENT - Pecm II

(R$ million)

4Q14

4Q13

2014

2013

Net Operating Revenues

153.2

146.6

4.5%

567.1

179.1

216.6%

(112.6)

(113.8)

4.5%

(440.2)

(164.1)

168.3%

Operating Expenses

(2.2)

1.2

-278.7%

(6.8)

(6.4)

6.7%

Net Financial Result

Operating Costs

(40.0)

(42.4)

-5.5%

(154.5)

(78.5)

96.7%

Other Revenues/Expenses

1.9

1.1

0.0

92790.8%

Earnings Before Taxes

0.3

(8.4)

-103.3%

(33.4)

(69.9)

-52.2%

2.7

-100.0%

0.4

23.5

-98.5%

0.3

(5.7)

-104.8%

(33.0)

(46.3)

-28.7%

54.9

55.4

-1.0%

180.4

30.2

497.6%

Taxes Payable and Deferred

NET INCOME

EBITDA

10

4Q14 Earnings Release

On October 18, 2013, Pecm II received authorization from Aneel to start commercial operations and to

supplying 365MW of energy under the terms of the PPA secured in the A-5 energy auction in 2008.

Net revenues for Pecm II in the quarter amounted to R$153.2 million, comprised of:

Fixed revenues amounting to R$74.3 million;

Variable revenues amounting to R$81.6 million;

Other revenues amounting to R$15.3 million;

Taxes on revenues amounting to R$18.1 million.

Operating Costs reached R$96.2 million in the quarter, excluding Depreciation and Amortization, comprised

mainly of:

Fuel costs totaled R$69.1 million, split between coal (R$67.1 million) and diesel oil and other costs

(R$2.0 million);

Transmission charges (R$6.0 million); and

Unavailability costs (-R$0.6MM), as a reflect of an accounting adjustment from previous periods. Pecm

II has no energy exposure related to unavailability neither for 2014 nor to 2015, due to its high

operational efficiency.

In 4Q14, Pecm II recorded a positive EBITDA of R$54.9 million.

Net financial expenses amounted to R$40.0 million, mainly impacted by interest expenses due to interest on

long-term financing no longer being capitalized with the start-up of operations of the plant.

Pecm II reported a net profit of R$0.3 million in 4Q14.

Operational Highlights: During the period, the plant recorded high availability figures, especially in November

2014 when hit 100%, thus consolidating itself as a true benchmark of the ENEVAs fleet. Net generation reached

736GWh.

Pecm II - Energy Availability

97%

96%

1Q14

2Q14

77%

3Q14

99%

4Q14

11

4Q14 Earnings Release

6.3.

ENEVA Participaes S.A

6.3.1. Holding Operating Expenses

Operating Expenses

Holding ENEVA Participaes S.A.

(R$ million)

4Q14

4Q13

2014

2013

Personnel

(4.9)

22.2

-122.0%

(17.9)

(27.2)

-34.1%

Outsourced Services

(5.2)

5.2

-199.2%

(10.2)

(6.3)

60.0%

Leases and Rentals

(1.1)

1.1

-202.5%

(2.0)

(3.2)

-39.2%

Other Expenses

(0.4)

10.0

-103.9%

(0.9)

(1.2)

-23.8%

(11.6)

38.5

-130.0%

(31.0)

(38.0)

-18.5%

(0.0)

(0.0)

46.8%

(0.1)

(0.0)

468.5%

(11.6)

38.5

-130.0%

(31.0)

(38.0)

-18.3%

Total

Depreciation and Amortization

Total Operating Expenses

In 4Q14, Operating Expenses, excluding Depreciation and Amortization, amounted to +R$27.0 million, a

decrease of R$37.4 million compared to 4Q13. The main changes are summarized as follows:

Higher provision for employee bonus as compared to 4Q13 (+R$8.0 million);

Booking of shared expenses from previous periods with holding and subsidiaries (-R$39.1 million);

Decrease in expenses of technical consultancy services, mainly the ones provided by E.ON (-R$3.5

million)

Accounting provision reduction for stock option-related expenses resulting from a decrease in both the

number of options outstanding and the share price since 4Q13 (-R$2.9 million).

6.3.2. Parnaba III

INCOME STATEMENT - Parnaba III

(R$ million)

Net Operating Revenues

4Q14

4Q13

2014

2013

55.9

89.4

-37.5%

244.9

198.3

23.5%

(44.2)

(58.5)

-24.5%

(239.4)

(221.9)

7.9%

Operating Expenses

(0.6)

(0.2)

280.5%

(2.0)

(0.5)

322.5%

Net Financial Result

(3.1)

(1.7)

82.6%

(10.7)

(4.8)

122.5%

Operating Costs

Other Revenues/Expenses

(17.7)

(8.0)

Earnings Before Taxes

(9.8)

29.0

-133.8%

(15.3)

(28.9)

-47.1%

3.2

(9.9)

-132.9%

5.1

9.8

-48.0%

NET INCOME

(6.5)

19.1

(1.3)

(10.2)

(19.1)

(0.5)

EBITDA

12.7

32.0

-60.3%

9.8

(22.8)

-143.0%

Taxes Payable and Deferred

On October 22, 2013, Parnaba III received authorization from Aneel to start the commercial operations of its

first generation unit, with 169MW of installed capacity. On February 17, 2014, the plant started the commercial

operations of its second generation unit, with 7MW of installed capacity, complying with the total capacity

contracted under the terms of the Regulated Market power purchase agreement secured in the 2008 A-5 energy

12

4Q14 Earnings Release

auction (176 MW).

Net revenues in the quarter amounted to R$55.9 million, comprised of:

Fixed revenues amounting to R$25.7 million;

Variable revenues amounting to R$35.4 million;

Taxes on revenues amounting to R$6.3 million.

Operating Costs reached R$44.6 million in the quarter, excluding Depreciation and Amortization, comprised

mainly of:

Fuel - natural gas (R$15.4 million);

Lease costs, according to the gas supply agreement (R$21.7 million)

Unavailability costs were not recorded in the period. Parnaba III has no energy exposure related to

unavailability neither for 2014 nor to 2015, due to its high operational efficiency.

In 4Q14, Parnaba III recorded a positive EBITDA of R$12.7 million.

Net financial expenses amounted to R$3.1 million, mainly impacted by interest expenses.

Parnaba III reported a net loss of R$6.5 million in 3Q14.

Operational Highlights: In 4Q14, Parnaba IIIs availability was compromised by occasional power reduction in

order to allow Parnaba II test and commissioning procedures and also by maintenance on gas facilities that

supply Parnaba Complex. Net generation reached 226GWh.

Parnaba III - Energy Availability

99%

1Q14

80%

82%

2Q14

3Q14

67%

4Q14

6.3.3. Parnaba IV

Parnaba IV (56MW) received authorization from Aneel to start commercial operations as a power self-producer

on December 12, 2013. The plant, a partnership between ENEVA, ENEVA Participaes and Petra Energia S.A.,

signed a contract in the free market with Kinross, for a five-year period, to supply 20 MWavg from December,

2013 until May, 2014 and 46MWavg from June, 2014 until December, 2018. The remaining power generation of

the plant is sold in the free market.

As of July, 2014, the structure to supply energy by Parnaba IV has been comprised by two entities, Parnaba IV

itself and Parnaba Comercializadora, in which different revenues and costs of the business are accounted.

13

4Q14 Earnings Release

INCOME STATEMENT - Parnaba IV

(R$ million)

Net Operating Revenues

4Q14

4Q13

2014

2013

7.2

5.8

23.7%

50.0

5.8

758.7%

Operating Costs

(2.2)

(3.2)

(32.5)

(3.2)

903.4%

Operating Expenses

(0.2)

(0.3)

-26.9%

(1.5)

(0.6)

142.3%

Net Financial Result

(5.7)

(1.1)

411.6%

(21.3)

3.4

-723.1%

Other Revenues/Expenses

Earnings Before Taxes

Taxes Payable and Deferred

NET INCOME

EBITDA

0.4

0.2

(0.5)

1.2

-140.4%

(5.1)

5.4

-195.4%

0.1

(0.4)

-137.7%

2.8

(1.8)

-254.6%

(0.3)

0.8

-141.8%

(2.3)

3.6

-165.5%

6.1

2.6

133.2%

21.0

2.3

814.3%

INCOME STATEMENT - Parnaba Comercializadora

(R$ million)

Net Operating Revenues

4Q14

4Q13

2014

2013

1.6

7.0

Operating Costs

(0.7)

(19.9)

Operating Expenses

(0.0)

(0.0)

Net Financial Result

(0.0)

(0.1)

Other Revenues/Expenses

0.2

0.2

Earnings Before Taxes

1.2

(12.8)

NET INCOME

1.2

(12.8)

EBITDA

1.0

(12.9)

Taxes Payable and Deferred

Net revenues in the quarter amounted to R$7.2 million in Parnaba IV, mainly comprised of the plant lease

contract to Parnaba Comercializadora amounting to R$7.9 million. In the same period of the year, Parnaba

Comercializadora revenues totaled R$1.6 million from the power sale in the market amounting to R$1.8 million.

Excluding Depreciation & Amortization, Operating Costs of Parnaba IV reached R$0.9 million in 4Q14, mainly

composed of Personnel and Insurance costs that sum R$0.6 million; Parnaba Comercializadora costs totaled

R$0.7 million, comprised mainly by:

Natural gas (R$6.2 million), booked in the entry Energy acquired for resale due to trading purpose of

the entity;

Plant lease contract (+R$7.2 million), reflecting the contribution of Kinross for the power supply of

46MWavg, according to contract signed with this party, amounting to +R$14.4 million;

Transmission charges (R$0.7 million).

Net financial expenses in Parnaba IV reached R$5.7 million, mainly impacted by interest expenses on

intercompany loans.

14

4Q14 Earnings Release

Operational Highlights: During the period, one of Parnaba IV engines stopped for inspection and maintenance

according to operation plan and thus lowering availability records. Net generation reached 108GWh.

Parnaba IV - Energy Availability

94%

91%

91%

3Q14

4Q14

63%

1Q14

2Q14

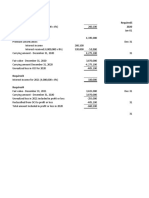

7. Net Income

In 4Q14, ENEVA reported a net loss of R$1,362.0 million, impacted mainly by the reevaluation of Itaqui and

Amapari asset values (R$358.8 million and R$62.5 million, respectively) and an accounting provision for the loss

in the sale of Pecm I (R$560.7 million). Excluding these one-off events, net loss in the quarter down to R$380.0

million.

INCOME STATEMENT

(R$ million)

4Q14

4Q13

2014

2013

Net Operating Revenues

368.2

530.3

-30.6%

1,798.1

1,438.8

25.0%

(397.4)

(472.3)

-15.9%

(1,579.3)

(1,507.0)

4.8%

Operating Expenses

(92.5)

(38.4)

140.5%

(173.0)

(167.3)

3.4%

Net Financial Result

(153.6)

(166.7)

-7.9%

(510.1)

(506.1)

0.8%

Equity Income

(140.6)

(1.7)

8392.0%

(170.7)

(153.0)

11.5%

Other Revenues/Expenses

(999.3)

(34.5)

2792.7%

(919.5)

(38.7)

2276.9%

(1,415.1)

(183.3)

672.2%

(1,544.4)

(933.3)

66.6%

Taxes Payable and Deferred

10.0

(97.9)

-110.2%

(2.5)

(11.2)

-77.3%

Minority Interest

43.0

0.9

4721.1%

39.8

2.0

1923.6%

(1,362.0)

(280.3)

386.0%

(1,517.2)

(942.5)

61.0%

(83.8)

76.3

-209.9%

216.3

(88.9)

-343.2%

Operating Costs

Earnings Before Taxes

NET INCOME

EBITDA

8. Debt

As of December 31, 2014, consolidated gross debt amounted to R$5,163.7 million, an increase of 2.3% in

relation to the amount recorded on September 30, 2014. When compared to December 31, 2013, consolidated

15

4Q14 Earnings Release

gross debt decrease 16.9% or R$ 1.046.8 million. The variation is mainly attributed to Pecm II deconsolidation

as of June 2014.

Consolidated Debt Profile (R$ million)

1.875

36%

2.382

46%

2.782

54%

Working Capital

Short Term

Project Finance

3.289

64%

Long Term

The balance of short-term debt at the end of December, 2014 was R$3,289.2 million, or R$136.6 million higher

than the amount recorded on September 31, 2014.

R$1,090.0 million out of the total balance of short-term debt are allocated in the projects (vs. R$1,062.7 million

on September 30, 2014), as follows:

R$243,6 million refer to the current portion of the short-term debts of Itaqui and Parnaba I;

R$846.4 million refer to bridge loans to Parnaba II.

The remaining balance of short-term debt, amounting to R$2,199.1 million, is allocated in the Holding company

(vs. R$2,089.9 million on September 30, 2014).

At the end of December, 2014, the average cost of debt was 10.94% p.a. and the average maturity at 3.3 years.

Debt Maturity Profile* (R$ million)

2.199,1

1.234,2

1.090,0

157,3

149,2

Cash & Cash

Equivalents

2015

2016

Project Finance

116,3

153,3

66,4

2017

155,0

2018

From 2019 on

Working Capital

*Values include principal + capitalized interest + charges

16

4Q14 Earnings Release

Debt, net of Cash position and Charges on debt, in 4Q14 amounted to R$5,006.4 million, 3.4% higher than the

value reported in 3Q14.

Consolidated Cash and Cash Equivalents (R$ million)

-452.7

474,5

-45.4

9,1

-64.7

207,3

29,1

157,3

Cash and Cash

Equivalents

(3Q14)

Revenues

Operating Costs

and Expenses

CAPEX

Intercompany

Loan

Debt Service

DSRA/Others

Cash and Cash

Equivalents

(4Q14)

*DSRA = Debt Service Reserve Account

Consolidated Cash and Cash Equivalents totaled R$156.5 million at the end of December, 2014, a decrease of

R$50.8 million as compared to the balance in September 30, 2014.

9. Capital Expenditures (Accounting view)

During 4Q14, ENEVAs consolidated Capital Expenditures totalized a negative R$453.0 million, mainly explained

by the review of Itaqui Fixes Asset value totaling R$358.8 million. Capitalized interest amounted to R$15.7

million and depreciation & amortization to R$35.3 million.

Consolidated Assets (R$ million)

4Q14

4Q13

Capex

Interest

Capitalized

Depreciation &

Amortization

Capex

Interest

Capitalized

Depreciation &

Amortization

Itaqui

-359.8

0.0

-19.6

40.4

0.0

-22.4

Parnaba I

-51.8

0.0

Parnaba II

-41.4

15.7

-11.9

0.0

-22.4

18.0

-3.9

-22.4

18.0

0.0

17

4Q14 Earnings Release

Equity Consolidated Assets Adjusted by ENEVAs interest (R$ million)

4Q14

4T13

Capex

Interest

Capitalized

Depreciation &

Amortization

Capex

Interest

Capitalized

Depreciation &

Amortization

Pecm I

58.8

0.0

-16.8

15.8

0.0

-20.2

Pecm II

11.2

0.0

-16.5

51.1

0.6

-21.4

10.Capital Markets

Stock Price Performance

ENEVAs capital on December 31, 2014 was constituted by 840,106,107 ordinary shares, of which 37.1% were

free float.

ENEVAs share price at the end of the fourth quarter of 2014 was R$0.40, compared to R$0.70 on September 30,

2014, representing a drop of 42.9% in the quarter. In the same period, the Bovespa Index (Ibovespa) decreased

7.6% and the Electrical Utilities Sector Index (IEE) fell 1.6%. In the last 12 months, ENEVAs shares fell 86.7%,

Ibovespa decrease 2.9% and IEE rose by3.52%. The Companys market capitalization at the end of the quarter

reached R$336.0 million. Average daily traded volume in 4Q14 was R$4.5 million.

Capital Markets Performance - 4Q14

09/30/2014 = 100

140

Capital Markets Performance - 12 mo

12/30/2013 = 100

140

120

120

-1.6%

-7.6%

100

80

3.5%

-2.9%

100

80

60

-42.9%

ENEV3

IEEX

IBOV

ENEV3

31/12/14

30/11/14

31/10/14

30/09/14

31/08/14

31/07/14

30/06/14

-86.7%

31/05/14

3.00

0.40

30/04/14

30/12/14

23/12/14

16/12/14

09/12/14

02/12/14

25/11/14

18/11/14

11/11/14

04/11/14

28/10/14

21/10/14

14/10/14

07/10/14

30/09/14

IBOV

R$/share

12/30/2013

12/30/2014

20

31/03/14

0.70

0.40

28/02/14

20

40

30/01/14

R$/shre

09/30/2014

12/30/2014

30/12/13

40

60

IEEX

18

4Q14 Earnings Release

Free Float Profile

(as of December 30, 2014)

4,4%

18.2%

95,6%

Brazil

International

81.8%

Individuals

Institutional

19

4Q14 Earnings Release

4Q14 Conference Call

Friday, March 27, 2015

11:00 am (Brasilia Time) / 10:00 am (US EST)

Access numbers Brazil

+55 11 3193-1001

+55 11 2820-4001

Access numbers US

+1 786 924-6977

Password: ENEVA

Webcast in English: www.ccall.com.br/eneva/4q14.htm

Webcast in Portuguese: www.ccall.com.br/eneva/4t14.htm

ENEVA Contacts

Investor Relations:

Rodrigo Vilela

Carlos Cotrim

+55 21 3721-3030

ri@ENEVA.com.br

ir.ENEVA.com.br

Press:

Marina Duarte

+55 21 3721-3373 / + 55 21 98132-0459

20

4Q14 Earnings Release

ANNEX

I.

Balance Sheet Assets (Holding and Consolidated)

Holding

(R$ million)

Current Assets

Consolidated

Dec-14

Dec-13

Dec-14

Dec-13

386.5

141.2

944.7

747.8

Cash and Cash Equivalents

72.5

110.2

157.3

277.6

Accounts Receivable

14.0

26.9

346.1

347.0

Gain on Derivatives

4.2

4.2

Subsidies CCC

30.8

300.0

300.0

99.2

78.4

Escrow Accounts

0.0

0.0

0.0

0.0

Prepaid Expenses

0.0

42.1

9.8

1,101.2

1,464.4

742.7

966.7

Accounts Receivable - Related Parties

831.3

1,256.9

406.8

542.6

AFAC

Assets Disposed to Sale

Inventories

Non-current Assets

Long-term Asset

248.0

206.7

26.3

0.2

Escrow Accounts

62.1

118.6

Deferred Taxes (IR/CSLL)

219.7

302.3

21.9

0.8

27.9

3.0

2,242.3

3,146.3

5,357.0

7,974.7

2,228.1

3,131.0

733.9

941.9

11.2

12.6

4,423.5

6,819.5

2.9

2.7

199.6

213.4

3,730.0

4,752.0

7,044.4

9,689.2

Prepaid Expenses - R&D

Fixed Assets

Equity Interest

Property, Plant and Equipment

Intangible Assets

TOTAL ASSETS

21

4Q14 Earnings Release

II.

Balance Sheet Liabilities (Holding and Consolidated)

Holding

Consolidated

(R$ million)

Dec-14

Dec-13

Dec-14

Dec-13

Current Liabilities

2,229.1

1,580.0

3,619.9

2,978.9

11.7

3.5

149.8

331.2

Accounts Payable

Personnel

Charges on Debts

Taxes Payable

Short Term Debt

Losses on Derivatives

Other

Non-current Liabilities

Long term Liabilities

Accounts Payable

6.7

8.4

14.9

16.8

214.4

15.7

266.7

85.3

1.6

0.7

27.1

45.9

1,984.7

1,546.5

3,022.5

2,322.8

9.8

5.2

138.9

176.8

357.9

703.2

2,206.8

4,136.5

9.8

(41.4)

(51.4)

Long-Term Debt

173.0

655.4

1,915.9

3,853.8

Intercompany Loan / Payable

171.6

34.5

320.9

307.7

3.5

8.1

0.4

11.6

5.2

11.0

14.8

82.5

123.6

Shareholder's Equity

1,153.0

2,468.7

1,145.3

2,450.2

Common Stock

4,707.1

4,532.3

4,707.1

4,532.3

Capital Reserve

Reserve Valuation Adjustments

(36.9)

(44.0)

(36.9)

(44.0)

Profit Reserve

350.8

350.5

350.8

350.5

Deferred Taxes (IR/CSLL)

Provision for Losses

Others

Minority Interests

Advance for Future Capital Increase - AFAC

0.0

(9.2)

0.0

(9.2)

Accumulated Profit or Losses

(2,360.8)

(1,418.3)

(2,368.6)

(1,436.8)

Net Earnings

(1,517.2)

(942.5)

(1,517.2)

(942.5)

3,730.0

4,752.0

7,044.4

9,689.2

Translation Adjustments

TOTAL LIABILITIES

22

4Q14 Earnings Release

III. Income Statement (Holding and Consolidated)

Holding

Consolidated

4Q14

4Q13

4Q14

4Q13

412.6

590.1

Energy Supply

412.6

590.1

Energy Commercialization

(0.0)

Deductions from Gross Revenue

(44.4)

(59.8)

Net Operating Revenues

368.2

530.3

Operating Costs

(397.4)

(472.3)

Personnel

(19.5)

(15.1)

Material

(9.6)

(8.9)

Fuel

(138.7)

(219.3)

Outsourced Services

(37.3)

(51.6)

Depreciation and Amortization

(37.0)

(55.5)

Leases and Rentals

(44.7)

(53.4)

CCC Subsidy

(0.8)

27.6

Energy Acquired for Resale

(7.9)

(39.3)

(R$ million)

Gross Operating Revenues

Other costs

(101.7)

(56.8)

(84.8)

(36.6)

(92.5)

(38.4)

(51.5)

(22.3)

(54.3)

(18.5)

(0.1)

(0.1)

(0.1)

(0.0)

(20.4)

(9.1)

(24.0)

(15.5)

Depreciation and Amortization

(0.6)

(0.9)

(0.8)

(1.1)

Leases and Rentals

(2.0)

(1.5)

(2.1)

(1.2)

(10.2)

(2.7)

(11.2)

(2.1)

EBITDA

(84.1)

(35.6)

(83.8)

76.3

Net Financial Income

(79.2)

(68.5)

(153.6)

(166.7)

(34.5)

Operating Expenses

Personnel

Material

Outsourced Services

Other Expenses

Other Revenues/ Expenses

(578.0)

(9.9)

(999.3)

Equity Income

(620.1)

(50.9)

(140.6)

(1.7)

(1,362.0)

(165.9)

(1,415.1)

(183.3)

Earnings Before Taxes

CSLL/IR

(2.2)

2.1

Deferred Taxes Provision (IR/CSLL)

(114.4)

12.2

(100.0)

Minority Interest

NET INCOME

43.0

0.9

(1,362.0)

(280.3)

(1,362.0)

(280.3)

23

4Q14 Earnings Release

IV.

Project Balance Sheet Assets (Consolidated Projects)

Itaqui

(R$ million)

Current Assets

Amapari

Parnaba I

Parnaba II

Dec-14

Dec-13

Dec-14

Dec-13

Dec-14

Dec-13

Dec-14

Dec-13

213.0

153.1

25.6

62.1

206.4

158.3

113.2

62.3

Cash and Cash Equivalents

29.1

27.3

16.7

9.8

38.1

32.0

0.9

57.7

Accounts Receivable

92.3

91.8

1.3

10.1

155.8

117.9

82.7

1.4

Gain on Derivatives

Subsidies CCC

30.8

Assets Disposed to Sale

Inventories

80.4

31.5

7.6

11.3

7.5

4.2

3.7

0.1

Escrow Accounts

Prepaid Expenses

11.1

2.5

0.1

0.1

5.0

4.1

25.8

3.1

238.3

261.9

0.4

1.9

40.7

50.7

27.9

24.1

4.5

4.4

0.0

2.7

2.4

12.3

14.9

37.4

64.8

0.1

24.6

34.0

192.1

192.1

1.8

12.0

14.0

15.6

8.7

Non-current Assets

Long-term Asset

Accounts Receivable - Related Parties

AFAC

Escrow Accounts

Deferred Taxes (IR/CSLL)

Prepaid Expenses - R&D

Fixed Assets

Equity Interest

Property, Plant and Equipment

Intangible Assets

TOTAL ASSETS

4.2

0.6

0.4

1.4

0.3

0.5

2,215.7

2,662.8

(0.0)

67.4

1,138.4

1,214.0

1,239.7

1,139.8

2,205.5

2,651.1

(0.1)

64.5

971.7

1,035.1

1,234.5

1,134.6

10.3

11.1

0.1

0.2

166.6

178.9

5.2

5.2

2,666.9

3,077.8

26.1

131.3

1,385.4

1,423.0

1,380.8

1,226.2

24

4Q14 Earnings Release

V.

Project Balance Sheet Liabilities (Consolidated Projects)

Itaqui

(R$ million)

Current Liabilities

Accounts Payable

Personnel

Charges on Debts

Amapari

Parnaba I

Parnaba II

Dec-14

Dec-13

Dec-14

Dec-13

Dec-14

Dec-13

Dec-14

Dec-13

256.7

285.5

28.2

31.6

199.3

265.8

906.6

594.8

46.8

126.2

24.7

29.5

30.0

85.8

36.6

57.9

3.4

3.0

0.5

0.5

2.3

1.7

2.0

2.3

8.9

9.2

4.7

12.1

38.7

0.4

Taxes Payable

13.0

14.4

1.1

0.1

6.6

9.4

4.8

6.7

Short Term Debt

92.3

90.5

137.7

137.6

807.7

480.0

92.3

42.3

1.9

1.5

18.0

19.2

16.8

47.4

1,541.1

1,724.7

1.2

0.1

715.4

769.0

11.9

303.3

Losses on Derivatives

Other

Non-current Liabilities

Long term Liabilities

Accounts Payable

Deferred Taxes (IR/CSLL)

(14.1)

(15.2)

(37.1)

(22.9)

(3.4)

1,127.8

1,213.5

615.1

680.5

280.7

426.7

526.4

0.1

130.3

107.2

11.9

26.0

0.6

1.2

7.1

4.2

Shareholder's Equity

869.1

1,067.6

(3.2)

99.6

470.7

388.2

462.3

328.2

Common Stock

1,757.4

1,458.7

84.8

84.8

263.6

263.6

445.7

345.7

Capital Reserve

6.5

6.5

Reserve Valuation Adjustments

0.1

12.0

12.0

0.0

0.7

10.0

87.7

188.1

141.6

47.3

Accumulated Profit or Losses

(478.8)

(228.0)

(3.6)

(17.0)

(17.1)

(17.6)

(0.7)

Net Earnings

(419.6)

(250.7)

(102.9)

(3.6)

36.0

0.2

(13.8)

(16.8)

2,666.9

3,077.8

26.1

131.3

1,385.4

1,423.0

1,380.8

1,226.2

Long-Term Debt

Intercompany Loan / Payable

Provision for Losses

Others

Minority Interests

Profit Reserve

Advance for Future Capital Increase AFAC

Translation Adjustments

TOTAL LIABILITIES

25

4Q14 Earnings Release

VI.

Project Income Statement (Consolidated Projects)

Itaqui

Amapari

Parnaba I

Parnaba II

(R$ million)

4Q14

4Q13

4Q14

4Q13

4Q14

4Q13

4Q14

4Q13

Gross Operating Revenues

147.7

166.3

5.3

11.2

259.8

239.0

11.6

10.0

147.7

166.3

5.3

11.2

259.8

239.0

(0.2)

10.0

Energy Supply

11.8

Deductions from Gross Revenue

Energy Commercialization

(15.0)

(16.6)

(2.0)

(1.1)

(26.3)

(24.2)

(1.1)

(0.9)

Net Operating Revenues

132.7

149.7

3.4

10.1

233.4

214.8

10.5

9.1

Operating Costs

(179.4)

(147.8)

(40.0)

4.6

(178.6)

(194.2)

(11.1)

(20.9)

Personnel

(10.0)

(6.4)

(0.9)

(1.1)

(7.5)

(5.3)

(1.1)

(0.0)

(5.3)

(6.2)

(0.0)

(0.1)

(4.2)

(1.1)

(0.1)

0.0

Fuel

(61.4)

(63.7)

(0.2)

(19.7)

(77.1)

(87.7)

Outsourced Services

(22.2)

(27.8)

(0.1)

(0.5)

(12.4)

(7.4)

(2.7)

(0.0)

Depreciation and Amortization

(20.4)

(22.1)

(0.9)

(1.4)

(11.8)

(10.6)

(3.8)

(0.0)

(0.7)

(1.9)

(0.0)

(0.1)

(55.7)

(49.9)

(0.0)

(0.8)

27.6

(8.2)

(16.6)

(0.0)

(0.5)

0.3

(20.9)

(51.3)

(3.0)

(37.0)

(0.0)

(9.9)

(31.7)

(3.5)

0.0

(2.5)

(0.0)

(0.8)

(0.4)

(1.2)

0.7

(3.3)

(3.3)

Personnel

(0.9)

2.3

(0.4)

(0.1)

(0.0)

1.7

(1.6)

0.4

Material

(0.0)

(0.1)

(0.0)

(0.0)

(0.0)

0.2

(0.0)

(0.1)

Outsourced Services

(1.2)

(2.4)

(0.4)

(0.2)

(0.9)

(0.9)

(1.0)

(3.4)

Depreciation and Amortization

(0.1)

(0.1)

(0.0)

(0.0)

(0.1)

(0.1)

(0.0)

(0.0)

Leases and Rentals

(0.0)

0.3

(0.0)

(0.0)

(0.0)

0.1

(0.1)

(0.1)

Other Expenses

(0.3)

(0.1)

(0.0)

(0.0)

(0.1)

(0.4)

(0.6)

(0.1)

Material

Leases and Rentals

CCC Subsidy

Energy Acquired for Resale

Other costs

Operating Expenses

EBITDA

(28.7)

24.2

(36.5)

15.8

65.6

32.0

0.0

(15.1)

Net Financial Income

(38.5)

(37.8)

(6.2)

0.2

(20.4)

(18.2)

(9.2)

0.1

(359.1)

(0.2)

(62.4)

(24.6)

0.0

0.0

Other Revenues/ Expenses

26

4Q14 Earnings Release

Itaqui

(R$ million)

Equity Income

Earnings Before Taxes

CSLL/IR

Deferred Taxes Provision (IR/CSLL)

Minority Interest

NET INCOME

4Q14

Amapari

4Q13

4Q14

Parnaba I

4Q13

4Q14

Parnaba II

4Q13

4Q14

4Q13

(446.8)

(36.1)

(106.1)

(10.0)

33.3

3.1

(13.0)

(15.0)

0.7

0.8

(2.9)

1.3

8.8

(1.1)

1.8

0.1

5.1

4.3

4.9

(438.0)

(36.1)

(106.5)

(7.5)

30.5

9.4

(8.7)

(10.1)

27

4Q14 Earnings Release

VII. Project Balance Sheet Assets (Projects accounted as Equity Income)

ENEVA Part.

Holding

(R$ million)

Current Assets

Cash and Cash Equivalents

ENEVA Part.

Consolidated

Pecm I

Dec-14

Dec-13

Dec-14

Dec-13

22.1

9.6

131.2

224.0

535.4

Pecm II

Parnaba III

Parnaba IV

Dec-14 Dec-13 Dec-14 Dec-13 Dec-14 Dec-13 Dec-14 Dec-13

290.9

129.1

170.2

71.3

162.1

14.3

29.0

Parnaba

Comercializadora

Dec-14

Dec-13

20.6

0.0

1.2

9.0

11.3

67.9

151.7

46.0

22.0

40.0

14.1

62.8

0.3

5.1

4.6

0.0

Accounts Receivable

18.2

0.5

95.5

151.6

223.0

153.2

80.4

98.9

52.1

96.3

13.1

20.8

16.0

Gain on Derivatives

2.2

65.4

0.1

1.4

3.1

Subsidies CCC

Assets Disposed to Sale

Inventories

0.0

0.0

89.3

91.4

23.7

31.3

3.9

0.2

0.0

Escrow Accounts

2.6

24.4

0.1

0.3

0.0

0.3

Prepaid Expenses

0.0

2.1

5.9

3.1

0.0

1.2

1.3

0.6

0.1

Non-current Assets

Long-term Asset

57.4

32.1

108.2

209.5

619.0

479.9

109.0

108.3

86.3

10.5

22.2

0.1

0.0

Accounts Receivable - Related

Parties

56.3

32.0

84.6

203.5

7.4

2.5

3.0

2.2

68.1

0.2

18.9

0.1

0.0

1.1

0.1

1.0

Escrow Accounts

(0.0)

60.9

55.8

19.2

19.7

Deferred Taxes (IR/CSLL)

22.6

6.0

550.2

421.6

86.1

85.7

18.2

10.3

3.3

0.0

AFAC

Prepaid Expenses - R&D

Fixed Assets

Equity Interest

Property, Plant and Equipment

Intangible Assets

TOTAL ASSETS

0.5

0.7

0.7

208.8

270.5

182.1

282.8

3,441.4

3,426.7

1,904.1

1,920.8

181.5

156.2

161.2

118.3

176.8

240.5

137.3

6.6

5.3

19.0

214.1

3,439.6

3,425.1

1,903.9

1,920.4

181.5

156.2

161.2

118.3

25.4

24.7

25.8

68.6

1.6

1.4

0.3

0.3

288.3

312.2

421.5

716.3

4,595.9

4,197.5

2,142.3

2,199.3

339.2

328.8

197.7

147.4

20.6

0.0

28

4Q14 Earnings Release

VIII. Project Balance Sheet Liabilities (Projects accounted as Equity Income)

(R$ million)

Current Liabilities

ENEVA Part.

Holding

Dec-14 Dec-13

ENEVA Part.

Consolidated

Dec-14

Dec-13

Pecm I

Pecm II

Parnaba III

Parnaba IV

Dec-14 Dec-13 Dec-14 Dec-13 Dec-14 Dec-13 Dec-14 Dec-13

Parnaba

Comercializadora

Dec-14

Dec-13

16.3

12.9

72.8

335.3

694.7

548.8

164.4

221.7

164.1

149.7

5.7

83.6

6.0

0.0

Accounts Payable

0.9

1.1

55.3

199.6

193.8

112.0

33.2

28.9

33.7

28.3

1.8

7.9

1.6

0.0

Personnel

9.9

3.6

10.7

4.5

4.7

3.6

0.9

0.9

0.1

0.1

2.9

3.1

2.8

2.5

47.8

1.6

0.6

5.1

1.1

0.7

1.4

13.0

22.6

39.4

12.3

14.6

0.4

0.0

3.7

0.4

0.0

106.0

176.5

165.4

77.0

68.3

120.0

120.0

70.0

Charges on Debts

Taxes Payable

Short Term Debt

Losses on Derivatives

Other

Non-current Liabilities

37.7

5.6

4.3

7.5

5.4

9.4

256.4

220.1

38.4

61.1

8.4

0.8

0.1

0.0

4.4

39.5

30.8

126.8

86.3

2,962.3

2,487.9

1,379.6

1,346.5

38.0

39.1

174.9

44.3

27.3

Accounts Payable

Deferred Taxes (IR/CSLL)

(21.5)

(26.1)

(10.8)

(9.9)

Long-Term Debt

5.5

1,909.8

2,000.8

1,027.6

1,023.6

32.9

20.3

34.6

67.6

975.6

449.3

360.4

327.2

34.8

38.6

173.3

43.2

27.3

6.6

10.4

92.1

7.0

98.4

63.9

2.5

2.3

Long term Liabilities

Intercompany Loan / Payable

Provision for Losses

Others

6.4

3.4

3.3

0.5

1.6

1.1

36.9

Shareholder's Equity

232.6

268.6

222.0

257.7

938.9

1,160.7

598.4

631.1

137.1

140.0

17.2

19.5

(12.7)

0.0

Common Stock

266.8

266.8

266.8

266.8

1,886.9

1,886.9

799.2

799.2

160.3

160.3

15.9

15.9

0.1

0.1

Capital Reserve

62.0

62.0

62.0

62.0

1.0

1.0

0.0

(73.7)

(88.1)

71.3

71.3

0.3

3.6

25.5

25.8

7.2

Minority Interests

Reserve Valuation Adjustments

Profit Reserve

Advance for Future Capital Increase AFAC

Translation Adjustments

Accumulated Profit or Losses

Net Earnings

TOTAL LIABILITIES

0.0

0.0

(60.2)

(33.7)

(71.1)

(44.6)

(709.4)

(427.0)

(168.0)

(121.7)

(20.2)

(1.2)

0.0

0.0

(0.0)

(62.4)

(26.6)

(62.4)

(26.6)

(236.3)

(282.3)

(33.0)

(46.3)

(10.2)

(19.1)

(2.3)

3.6

(12.8)

(0.0)

288.3

312.2

421.5

716.3

4,595.9

4,197.5

2,142.3

2,199.3

339.2

328.8

197.7

147.4

20.6

0.0

29

4Q14 Earnings Release

IX.

Project Income Statement (Projects accounted as Equity Income)

ENEVA Part.

Holding

4Q14

4Q13

ENEVA Part.

Consolidated

4Q14

4Q13

Pecm I

Pecm II

Parnaba III

Parnaba IV

Parnaba

Comercializadora

4Q14

4Q13

4Q14

4Q13

4Q14

4Q13

4Q14

4Q13

4Q14

4Q13

108.1

481.6

340.9

373.1

171.2

163.6

62.2

99.1

7.9

6.4

1.8

Energy Supply

0.3

(1,079.9)

340.9

373.1

171.2

163.6

62.2

(58.9)

1.8

Energy Commercialization

107.8

1.561.4

0.0

158.0

7.9

6.4

(10.4)

(44.2)

(37.2)

(40.4)

(18.1)

(17.0)

(6.3)

(9.7)

(0.7)

(0.6)

(0.2)

(R$ million)

Gross Operating Revenues

Deductions from Gross Revenue

Net Operating Revenues

97.8

437.3

303.7

332.7

153.2

146.6

55.9

89.4

7.2

5.8

1.6

Operating Costs

(0.0)

(0.2)

(129.5)

(449.9)

(609.7)

(305.7)

(112.6)

(113.8)

(44.2)

(58.5)

(2.2)

(3.2)

(0.7)

(0.0)

Personnel

(0.5)

(0.9)

(9.4)

(10.9)

(2.3)

(2.2)

(0.0)

(0.1)

Material

(0.0)

(0.0)

(7.5)

(9.0)

(1.3)

(1.4)

(0.3)

Fuel

(9.6)

(114.6)

(70.8)

(69.1)

(48.3)

(15.4)

(16.7)

(2.6)

(0.0)

(0.2)

(0.1)

(4.8)

(31.1)

(18.6)

(14.5)

(15.8)

(2.2)

(8.9)

(0.1)

(0.3)

(0.4)

Depreciation and Amortization

(0.1)

(2.0)

(33.5)

(40.4)

(16.5)

(21.4)

(1.6)

(1.3)

(1.3)

(0.3)

Leases and Rentals

(0.1)

(14.2)

(2.5)

(1.6)

(1.4)

(1.4)

(21.7)

(24.3)

7.2

CCC Subsidy

1.1

1.4

Energy Acquired for Resale

(128.5)

(419.2)

(69.5)

(53.4)

(0.1)

(1.3)

(0.0)

(11.5)

(0.0)

(6.8)

(0.0)

(0.0)

(0.2)

0.9

(342.6)

(102.3)

(7.4)

(22.0)

(3.2)

4.2

(0.4)

(0.0)

(0.7)

(0.0)

26.9

(11.6)

24.5

(17.6)

(7.0)

(5.8)

(2.2)

1.2

(0.6)

(0.2)

(0.2)

(0.3)

(0.0)

(0.0)

17.3

(4.9)

15.2

(7.0)

(2.2)

(2.0)

(0.5)

(0.3)

(0.1)

(0.1)

(0.0)

(0.1)

(0.0)

(0.0)

(0.0)

(0.0)

(0.0)

0.0

(5.2)

(0.2)

(7.9)

(4.5)

(3.0)

(1.3)

0.5

(0.4)

(0.0)

(0.1)

(0.1)

(0.0)

(0.0)

Depreciation and Amortization

(0.0)

(0.0)

(0.0)

(0.2)

(0.0)

(0.0)

(0.0)

(0.0)

(0.0)

(0.0)

Leases and Rentals

(0.0)

(1.1)

(0.0)

(1.5)

(0.1)

(0.1)

(0.0)

(0.1)

(0.1)

9.6

(0.4)

9.5

(0.9)

(0.1)

(0.5)

(0.3)

1.1

(0.2)

(0.2)

(0.0)

(0.0)

(0.0)

(0.0)

Outsourced Services

Other costs

Operating Expenses

Personnel

Material

Outsourced Services

Other Expenses

EBITDA

26.9

(11.7)

(7.1)

(28.0)

(279.4)

61.7

54.9

55.4

12.7

32.0

6.1

2.6

1.0

(0.0)

Net Financial Income

0.1

3.9

1.2

(0.2)

(80.2)

(59.2)

(40.0)

(42.4)

(3.1)

(1.7)

(5.7)

(1.1)

(0.0)

(0.0)

Other Revenues/ Expenses

3.1

(0.9)

(2.1)

30.1

0.0

(0.0)

1.9

(17.7)

0.4

0.2

(36.2)

17.9

(10.5)

11.5

(6.0)

9.1

(18.7)

11.2

(393.2)

(38.0)

0.3

(8.4)

(9.8)

29.0

(0.5)

1.2

1.2

(0.0)

-

Equity Income

Earnings Before Taxes

CSLL/IR

Deferred Taxes Provision (IR/CSLL)

Minority Interest

NET INCOME

(1.4)

14.3

(144.7)

10.3

(0.2)

(0.6)

12.1

(0.7)

122.7

157.6

2.7

3.2

(20.1)

0.1

(0.2)

(6.6)

9.1

(6.6)

9.1

(256.1)

(25.1)

0.3

(5.7)

(6.5)

19.1

(0.3)

0.8

1.2

(0.0)

30

4Q14 Earnings Release

X.

Debt

R$ MM

Interest rates

Maturity

Itaqui

BNDES (Direto)

Short Term

Long Term

Total

101.2

2.0%

1,113.8

21.6%

1215.0

23.5%

TJLP+2.78%

06/15/26

69.3

5.7%

686.8

56.5%

756.1

14.6%

10%

12/15/26

3.4

0.3%

195.6

16.1%

199.0

3.9%

BNDES (Indireto)

IPCA + TR BNDES+ 4.8%

06/15/26

14.9

1.2%

96.7

8.0%

111.6

2.2%

BNDES (Indireto)

TJLP+4.8%

06/15/26

13.6

1.1%

134.7

11.1%

148.2

2.9%

142.4

2.8%

578.0

11.2%

720.4

14.0%

BNB

Parnaba I

Bradesco

Banco Ita BBA

CDI+3.00%

CDI+3.00%

04/22/15

04/15/15

30.4

53.4

4.2%

7.4%

0.0

0.0

0.0%

0.0%

30.4

53.4

0.6%

1.0%

BNDES (Direto)

TJLP+1.88%

06/15/27

36.2

5.0%

393.9

54.7%

430.1

8.3%

BNDES (Direto)

IPCA + TR BNDES + 1.88%

07/15/26

22.5

3.1%

184.1

25.6%

206.6

4.0%

846.4

16.4%

0.0

0.0%

846.4

16.4%

Parnaba II

Banco Ita BBA

CEF

CDI+3.00%

CDI+3.00%

12/30/14

12/30/14

228.5

319.8

31.7%

37.8%

0.0

0.0

0.0%

0.0%

228.5

319.8

4.4%

6.2%

BNDES

TJLP+2.40%

06/15/15

298.1

35.2%

0.0

0.0%

298.1

5.8%

2,199.1

42.6%

182.7

3.5%

2381.9

46.1%

CDI+2.65%

CDI+2.95%

12/16/14

09/22/14

119.9

121.2

5.0%

5.1%

0.0

0.0

0.0%

0.0%

119.9

121.2

2.3%

2.3%

Banco Citibank

Banco BTG Pactual

LIBOR 3M + 1.26%

CDI+3.75%

09/27/17

12/09/14

40.8

108.4

1.7%

4.6%

93.0

0.0

3.9%

0.0%

133.7

108.4

2.6%

2.1%

Banco BTG Pactual

Banco BTG Pactual

CDI+3.75%

CDI+3.75%

06/09/15

12/09/14

372.4

393.7

15.6%

16.5%

0.0

0.0

0.0%

0.0%

372.4

393.7

7.2%

7.6%

Banco HSBC

Banco Citibank

CDI+2.75%

CDI+4.00%

12/12/14

12/09/14

354.1

115.1

14.9%

4.8%

0.0

0.0

0.0%

0.0%

354.1

115.1

6.9%

2.2%

Banco Ita BBA

Banco Ita BBA

CDI+2.65%

CDI+2.65%

12/05/14

12/09/14

227.5

238.7

9.6%

10.0%

0.0

0.0

0.0%

0.0%

227.5

238.7

4.4%

4.6%

Banco Ita BBA

Banco BTG Pactual

CDI+3.15%

CDI+3.00%

01/19/16

10/13/14

0.0

42.7

0.0%

1.8%

89.8

0.0

3.8%

0.0%

89.8

42.7

1.7%

0.8%

Banco Ita BBA

Banco Citibank

CDI+3.00%

CDI+3.00%

10/13/14

10/13/14

31.0

17.9

1.3%

0.8%

0.0

0.0

0.0%

0.0%

31.0

17.9

0.6%

0.3%

Banco HSBC

CDI+3.00%

10/13/14

15.8

0.0

0.0

0.0

15.8

0.0

3,289.2

63.7%

1,874.5

36.3%

5,163.7

157.3

100.0%

Cash (b)

Net Debt (a) - (b)

5,006.4

ENEVA S/A

Banco Ita BBA

Banco Citibank

Gross Debt (a)

31

You might also like

- Election of Executive Vice-President and Investor Relations OfficerDocument1 pageElection of Executive Vice-President and Investor Relations OfficerMPXE_RINo ratings yet

- Minutes of The Meeting of The Board DirectorsDocument2 pagesMinutes of The Meeting of The Board DirectorsMPXE_RINo ratings yet

- 2016 Calendar of Corporate EventsDocument2 pages2016 Calendar of Corporate EventsMPXE_RINo ratings yet

- Quarterly Results Call 3Q15 ? PresentationDocument19 pagesQuarterly Results Call 3Q15 ? PresentationMPXE_RINo ratings yet

- Minutes of The Meeting of The Board DirectorsDocument1 pageMinutes of The Meeting of The Board DirectorsMPXE_RINo ratings yet

- ENEVA Corporate Presentation ? December 2015Document20 pagesENEVA Corporate Presentation ? December 2015MPXE_RINo ratings yet

- Calendar of Corporate Events 2015Document2 pagesCalendar of Corporate Events 2015MPXE_RINo ratings yet

- Calendar of Corporate Events 2015Document2 pagesCalendar of Corporate Events 2015MPXE_RINo ratings yet

- Change in The Annual Calendar of Corporate Events and Postponement of The Annual Public Meeting With AnalystsDocument1 pageChange in The Annual Calendar of Corporate Events and Postponement of The Annual Public Meeting With AnalystsMPXE_RINo ratings yet

- UntitledDocument2 pagesUntitledMPXE_RINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument132 pagesDemonstra??es Financeiras em Padr?es InternacionaisMPXE_RINo ratings yet

- Earnings Release - 3Q15Document29 pagesEarnings Release - 3Q15MPXE_RINo ratings yet

- Shareholding Position Held by Bullseye I LLCDocument4 pagesShareholding Position Held by Bullseye I LLCMPXE_RINo ratings yet

- Aneel Determines Recalculation of Payments For Unavailability of Parna?ba I, Parna?ba III and Pec?m IIDocument1 pageAneel Determines Recalculation of Payments For Unavailability of Parna?ba I, Parna?ba III and Pec?m IIMPXE_RINo ratings yet

- Earnings Release - 3Q15Document29 pagesEarnings Release - 3Q15MPXE_RINo ratings yet

- Notice To Shareholders - Result of The Exercise of The First Additional Period For The Subscription of Unsubscribed Shares and Second Additional Period For The Subscription of Unsubscribed SharesDocument3 pagesNotice To Shareholders - Result of The Exercise of The First Additional Period For The Subscription of Unsubscribed Shares and Second Additional Period For The Subscription of Unsubscribed SharesMPXE_RINo ratings yet

- Earnings Release - 3Q15Document29 pagesEarnings Release - 3Q15MPXE_RINo ratings yet

- Termination of Shareholders? Agreement Between E.ON and Eike BatistaDocument2 pagesTermination of Shareholders? Agreement Between E.ON and Eike BatistaMPXE_RINo ratings yet

- Result of The Exercise of The Second Additional Period and Cancellation of The Remaining Shares and Partial ApprovalDocument2 pagesResult of The Exercise of The Second Additional Period and Cancellation of The Remaining Shares and Partial ApprovalMPXE_RINo ratings yet

- Shareholding Position Held by Eike BatistaDocument2 pagesShareholding Position Held by Eike BatistaMPXE_RINo ratings yet

- Shareholding Position Held by FIA Din?mica EnergiaDocument2 pagesShareholding Position Held by FIA Din?mica EnergiaMPXE_RINo ratings yet

- Shareholding Position Held by E.ONDocument2 pagesShareholding Position Held by E.ONMPXE_RINo ratings yet

- Shareholding Position Held by Ice CanyonDocument5 pagesShareholding Position Held by Ice CanyonMPXE_RINo ratings yet

- UntitledDocument2 pagesUntitledMPXE_RINo ratings yet