Professional Documents

Culture Documents

Website Liabilities

Uploaded by

Vimal Singh ChauhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Website Liabilities

Uploaded by

Vimal Singh ChauhanCopyright:

Available Formats

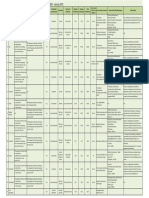

Fact sheet

Liabilities

Data in this paper are sourced from the Reserve Bank of Australia monthly statistics.

Liabilities

Banks liabilities consist of deposits, bill acceptances, other borrowings and other liabilities. Banks

borrowings include their short-term and long-term wholesale funding liabilities, both domestic and

offshore (see the section Bank Funding for more detail on this aspect of banks liabilities).

Note that liabilities are one side of the balance sheet of banks, the other is assets. Readers should refer

to the section on Assets for more information.

Summary

At the end of June 2013, total liabilities of Australian banks were $2.9 trillion, of which $2.2 trillion or 76%

were resident liabilities (i.e. liabilities on the books of banks with any individual, business or organization

domiciled in Australia), $552 billion were non-resident liabilities (i.e. liabilities on the books of banks with

any individual, business or organization domiciled overseas) and $139 billion was the amount due from

overseas operations of banks.

Source: RBA

1

ABA-#117451-v1-Website_-_Liabilities_(June_2013).docx

Australian Bankers Association Inc

Liabilities

The largest component of banks liabilities is deposits (i.e. household deposits, business deposits and

other deposits). As at June 2013, deposits of banks by residents made up 61% of total bank liabilities

and 81% of banks resident liabilities.

At the height of the global financial crisis, deposits as a proportion of total bank liabilities were 52%.

Growth in banks resident liabilities

At June 2013, banks resident liabilities were $2.2 trillion.

Over the 10 years prior to the start of the global financial crisis (August 1997 August 2007), the

average annual growth rate for banks resident liabilities was 13%.

Over the 12 months ending June 2013 growth in banks resident liabilities was 4.5% or $95 billion.

Source: RBA

Australian Bankers Association Inc

Liabilities

Deposits

At the end of June 2013, deposits of residents with banks were $1.78 trillion. This includes household

deposits, business deposits and other deposits.

Growth in resident deposits reached record levels, as high as 35% over the 12 months to the end of

January 2008. In particular, deposits grew at record levels in late 2007/early 2008.

Over the 1990s, growth in resident deposits averaged 9% per annum.

The very high growth rates for deposits from August 2007 were a result of a combination of factors.

Over this period:

households were shifting their asset mix away from equities and housing to bank deposits,

particularly in response to large falls in the equities market.

as the cost of bank funding increased, bank competition for deposit funding was strong. As

such, interest rates on deposits were attractive (especially at a time when other assets

such as equities and housing were not performing well).

large falls in housing interest rates over late 2008, as well as the fiscal stimulus, assisted in

keeping the level of deposits high.

Source: RBA

Australian Bankers Association Inc

Liabilities

Retail deposits

The definition of deposits used above is broad. More commonly, the concept used is retail deposits.

These are deposits from households and businesses (i.e. non-financial corporations).

At the end of June 2013, a total of $969 billion of retail deposits were held by ABA member banks (i.e.

from households and businesses). This is an increase of $47 billion or 5.0% over the past year.

Households made up $585 billion (60%) of these deposits and businesses made up $385 billion (40%).

Source APRA

Over the past year, to the end of June 2013, annual growth for deposits from households was 7.5% an

increase of $41 billion.

Source APRA

Australian Bankers Association Inc

Liabilities

For businesses, growth rates for deposits peaked in the August 2007 at 23.8%. Over the past year to

the end of June 2013, the annual growth for deposits from businesses was 1.5%.

Source APRA

Borrowings

A significant part of banks liabilities are the borrowings they take out to support their funding needs in

order to carry out their day to day business operations such as lending to customers. These borrowings

can be sourced either from domestic markets or from overseas.

RBA statistics for June 2013 show that non-resident liabilities of banks were at $552 billion or 19% of

total liabilities (a significant proportion of this is borrowings) while other borrowings (which are resident

liabilities) were $179 billion or 7% of total liabilities.

Document created: September 2013

For further information, please contact ABA Director Public Relations Heather Wellard on 02 8298 0411,

e-mail Heather Wellard or write to the ABA at Level 3, 56 Pitt Street, Sydney, NSW 2000.

Internet: www.bankers.asn.au Ph: 02 8298 0417 Fax: 02 8298 0402

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Nouriel Roubini - Megathreats-Little, Brown and Company (2022)Document370 pagesNouriel Roubini - Megathreats-Little, Brown and Company (2022)Francisco Pires100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Li Lu's 2010 Lecture at Columbia: My Previous Transcript View A More Recent LectureDocument21 pagesLi Lu's 2010 Lecture at Columbia: My Previous Transcript View A More Recent Lecturearunabharathi100% (4)

- FX market language conventionsDocument2 pagesFX market language conventionsCindyNo ratings yet

- Post 1q 2014 Ims Meeting With Analysts PresentationDocument11 pagesPost 1q 2014 Ims Meeting With Analysts PresentationVimal Singh ChauhanNo ratings yet

- ABA-111061-V1-Fact Sheet - A Strong Banking SystemDocument9 pagesABA-111061-V1-Fact Sheet - A Strong Banking SystemVimal Singh ChauhanNo ratings yet

- UyuyuuDocument327 pagesUyuyuuVimal Singh ChauhanNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- Labour Welfare Fund - 2015Document2 pagesLabour Welfare Fund - 2015saraeduNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- UyuyuuDocument327 pagesUyuyuuVimal Singh ChauhanNo ratings yet

- McKinsey Compete To Prosper Improving Australias Global Competitiveness FINAL 28.7.2014Document67 pagesMcKinsey Compete To Prosper Improving Australias Global Competitiveness FINAL 28.7.2014Vimal Singh ChauhanNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- UyuyuuDocument327 pagesUyuyuuVimal Singh ChauhanNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- FdshdsffdsfdsDocument326 pagesFdshdsffdsfdsVimal Singh ChauhanNo ratings yet

- QwweewewrDocument326 pagesQwweewewrVimal Singh ChauhanNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- JBBBBDocument326 pagesJBBBBVimal Singh ChauhanNo ratings yet

- Art TraceDocument219 pagesArt TraceVimal Singh ChauhanNo ratings yet

- FdshdsffdsfdsDocument326 pagesFdshdsffdsfdsVimal Singh ChauhanNo ratings yet

- E-Waste in IndiaDocument128 pagesE-Waste in Indiaabhishekmohanty2No ratings yet

- GlacialLandscapes BowenDocument33 pagesGlacialLandscapes BowenMoeHouraniNo ratings yet

- Rajesh DetailDocument1 pageRajesh DetailVimal Singh ChauhanNo ratings yet

- Short document with random textDocument1 pageShort document with random textVimal Singh ChauhanNo ratings yet

- SDocument1 pageSVimal Singh ChauhanNo ratings yet

- Short document with random textDocument1 pageShort document with random textVimal Singh ChauhanNo ratings yet

- Philips India Labor Problems at Salt LakeDocument4 pagesPhilips India Labor Problems at Salt LakeAbhishek JainNo ratings yet

- 123Document1 page123Vimal Singh ChauhanNo ratings yet

- SDSGDDocument1 pageSDSGDVimal Singh ChauhanNo ratings yet

- India's Got Talent - NDocument5 pagesIndia's Got Talent - NVimal Singh ChauhanNo ratings yet

- File DownloadDocument15 pagesFile DownloadVimal Singh ChauhanNo ratings yet

- PRESS RELEASE - Suspension of Payments On Selected External Debts of The Government of Ghana - For IMMEDIATE RELEASEDocument2 pagesPRESS RELEASE - Suspension of Payments On Selected External Debts of The Government of Ghana - For IMMEDIATE RELEASEKMNo ratings yet

- GE113 Module 1Document4 pagesGE113 Module 1Jean Ann Catanduanes100% (1)

- FINAL - Crisis Lore - JOINMUN2023Document95 pagesFINAL - Crisis Lore - JOINMUN2023Darryl Rafa Vinan HalpitoNo ratings yet

- Ray Dalio - Were Heading Into A Great Depression PDFDocument3 pagesRay Dalio - Were Heading Into A Great Depression PDFFredy AkalNo ratings yet

- Asia-Pacific Fixed Income Markets Evolvi PDFDocument163 pagesAsia-Pacific Fixed Income Markets Evolvi PDFtanviNo ratings yet

- ENG329 case3-2Document12 pagesENG329 case3-2Болор ЧимэгNo ratings yet

- Basel Norms and its implications for banks’ treasurersDocument20 pagesBasel Norms and its implications for banks’ treasurersAbhilasha Mathur100% (1)

- Members: Paras Shah Kedar Baliga Shankar Shridhar Siddarth KannanDocument24 pagesMembers: Paras Shah Kedar Baliga Shankar Shridhar Siddarth KannanKedar BaligaNo ratings yet

- American Hegemony After The Great Recession - A Transformation in World Order (PDFDrive)Document160 pagesAmerican Hegemony After The Great Recession - A Transformation in World Order (PDFDrive)Khayom NazarovNo ratings yet

- Money and Capital Market AssignmentDocument51 pagesMoney and Capital Market Assignmenttanj-wp21No ratings yet

- 1997 Asian Financial CrisisDocument14 pages1997 Asian Financial CrisisJimuel AndeoNo ratings yet

- G20 Write Up For Students of Classes VI To VIIIDocument8 pagesG20 Write Up For Students of Classes VI To VIIIThe Better World indiaNo ratings yet

- Lucas - in Defense of The Dismal ScienceDocument3 pagesLucas - in Defense of The Dismal ScienceLucianaNo ratings yet

- Impact of Covid On Indian EconomyDocument4 pagesImpact of Covid On Indian EconomyKiran JNo ratings yet

- Global Financial Crisis Vocabulary 2022Document7 pagesGlobal Financial Crisis Vocabulary 2022Roney PlazasNo ratings yet

- Give Some News About Today Economic CrisisDocument2 pagesGive Some News About Today Economic CrisisSAJIT SAPKOTANo ratings yet

- Banking Crisis in IndiaDocument3 pagesBanking Crisis in IndiaLado BahadurNo ratings yet

- Description of Albanian Pyramid SchemeDocument3 pagesDescription of Albanian Pyramid SchemeMaria Kathreena Andrea AdevaNo ratings yet

- The Eternal ZeroDocument4 pagesThe Eternal ZeroThuy NguyenNo ratings yet

- MBA405 - Task 2: Individual Presentation: The Key External Challenges Facing Evn Finance JSC in 2011Document13 pagesMBA405 - Task 2: Individual Presentation: The Key External Challenges Facing Evn Finance JSC in 2011Nguyễn LanNo ratings yet

- Mini Case 4 Venezuelan Bolivar Black MarketDocument3 pagesMini Case 4 Venezuelan Bolivar Black MarketChia Xin JenNo ratings yet

- Abstract ICEBAST - Sinta Wulandari and Rina RosalinaDocument5 pagesAbstract ICEBAST - Sinta Wulandari and Rina RosalinaTerieChoi LyceeNo ratings yet

- Financial GlobalizationDocument10 pagesFinancial GlobalizationAlie Lee GeolagaNo ratings yet

- The Current Economic Crisis in Pakistan - Paradigm ShiftDocument9 pagesThe Current Economic Crisis in Pakistan - Paradigm ShiftSaqibullahNo ratings yet

- Matching assets and liabilitiesDocument30 pagesMatching assets and liabilitiesvinayvin19No ratings yet

- Polytice Assigment. Valentina de Los Ángeles Rojas Garrido.Document9 pagesPolytice Assigment. Valentina de Los Ángeles Rojas Garrido.valentina rojas garridoNo ratings yet

- The Great Economic DepressionDocument7 pagesThe Great Economic DepressionMehmood MaharNo ratings yet