Professional Documents

Culture Documents

Syllabus 534B 2015 Spring

Uploaded by

Sahit Chowdary GarapatiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus 534B 2015 Spring

Uploaded by

Sahit Chowdary GarapatiCopyright:

Available Formats

Washington University in St.

Louis

Olin Business School

FIN 534B Advanced Corporate Finance II: Financing

Meetings: Monday, Wednesday: Bauer Hall 230

Section 1: 11:30am 1:00pm

Section 2: 1:00 2:30pm

Professor Mark Leary

Office: 215 Simon Hall

Phone: 314-935 6394

E-mail: leary@wustl.edu

Office hours: Tuesday, Friday: 3:00 4:00 pm,

or by appointment

Teaching assistants:

Yun (Bella) Bai (ybai@wustl.edu

Rui Xu (rxu25@wustl.edu)

Course Objectives:

The purpose of this course is to provide an understanding of the financing decisions made by corporations.

While ACF I focuses on firms investment decisions, this course focuses on how firms fund those investments,

how they return capital to investors, and on the interaction between investing and financing decisions. By the

end of the course, you should be able to articulate how a variety of market frictions, such as taxes, financial

distress costs, asymmetric information and agency conflicts create costs for firms, and how managers can use

financial policy capital structure, debt structure, and payout policy to minimize these costs and create value

for the firm.

Course Material:

Course packet

The course packet includes copies of the case studies we will discuss in class, and should be available in

the book store.

Text book

I highly recommend using whichever Corporate Finance text you already own from Fin 5203 (finance

core) or equivalent. In the schedule below I have included the relevant chapters for each class session

from the following recommended texts:

Berk and DeMarzo (B&D): Corporate Finance (Pearson) (1st 2nd or 3rd Edition)

Brealey, Myers and Allen (BMA), Principles of Corporate Finance (McGraw-Hill) (10th or 11th Edition)

Lecture notes

At each class session I will hand out copies of lecture slides. Note that in order to facilitate engagement

in class, these notes will not contain answers to all the questions we will discuss or examples we will

work out in class. However, if you miss something, filled-in versions of the notes will be posted to

Blackboard following each class.

Evaluation:

Class Participation

Group Assignments (4)

Take-home quiz (Individual)

Final Exam

10%

30%

15%

45%

FIN 534B Spring 2015

Page 2

How to prepare for class

We will rely on four primary learning tools:

Interactive lectures

Case discussions

Assignments and practice problems

Text book readings

These are designed to complement one another. While some students may wish to emphasize some tools more

than others, depending on your learning style, I would not recommend neglecting any of them.

It is important that you come to class prepared on case discussion days. The better prepared you are, the better

will be the classroom experience and the more we will all learn.

Lectures:

In our lectures, we will try to address three broad types of questions for each topic.

1. What does financial theory say about a given market friction?

Why is it costly to the firm? How can financial policy mitigate these costs?

2. Do firms actually behave this way?

Is there evidence from case examples, manager surveys or empirical studies that firms follow the

predictions of the theory?

3. How then should I manage my firm?

To which types of firms does the theory apply most? What are the relationships between firm

characteristics and optimal financial policy?

How to do well on the assignments

The assignments are designed to help reinforce the material, apply concepts weve learned to actual firm data,

and prepare for the exams. They will include a combination of analytical problems and questions pertaining to

the cases we will discuss in class.

For the assignments, you may work independently or in groups of two to three people.

Important assignment policies:

1. Each group should submit one hard copy of the assignment, with each group members name indicated.

2. The assignments are due at the beginning of class. If you are not able to attend class, you may submit your

assignment electronically. Late assignments will not be accepted without prior permission.

3. Any re-grade requests must be submitted in writing, with an explanation of the proposed discrepancy.

Requests must be submitted within 2-weeks after the assignment is returned.

How to do well on the exam

The exam will contain both qualitative and quantitative questions.

In order to do well on the qualitative portion, you need to understand the concepts. Think through the issues

we have studied and apply them to the questions.

For questions with calculations, it is the justifications, logic and interpretations which are important and not the

actual number. Bring a calculator but it need not be a fancy one. Show all your work.

The final exam will be closed books and closed notes, but you may bring a one-page cheat sheet.

The final exam covers the entire course.

How to do well on class participation

My evaluation of class participation is based on the quality as well as quantity of your participation.

Answering questions, asking thoughtful questions and contributing comments that enhance our class discussion

are all great ways to participate.

FIN 534B Spring 2015

Page 3

Communication:

Please make use of the office hours or make an appointment to see me or one of the TAs. I am usually here and

more than happy to find some time to meet with you. Your feedback on what is interesting or difficult is

important. Finally, the course is short. If you find yourself lost, come see me as soon as possible. Do not wait for

the exam before coming for help.

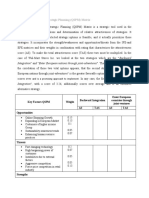

Schedule:

A tentative schedule appears below. The chapter numbers listed are guidelines. Since this is a 6-week course, not

everything in each chapter will be covered in class.

Week

Date

Topic

16-Mar

Introduction and core concepts

Leverage and risk in perfect markets

18-Mar

Applications of M&M

23-Mar

Recapitalization and the tax benefits A New Financial Policy

of debt

at Swedish Match

25-Mar

30-Mar

Case Readings

Text Readings

B&D

BMA

Assignments

Due

14, 24

14, 24

17

15

18.1 - 18.2

Credit ratings and debt capacity

15.1 - 15.3

18.1, 23.3

Costs of debt and the

tax-bankruptcy tradeoff

16.1 - 16.4

18.3, 23

16.8

18.4

23

15

16.5 - 16.7

18.3

Take-home Quiz

(Individual)

28.6, 19.5

19(review)

32.1

25

Group Assign. 3

1-Apr

Information asymmetry and security

issuance

6-Apr

IPOs

8-Apr

Moral hazard, agency costs and

financial structure

13-Apr

LBOs & ABS financing

15-Apr

More on debt structure

20-Apr

Payout policy

22-Apr

Payout policy (applications)

29-Apr

Final Exam 9:00am - 12:00 pm

Bauer Hall, Room 240 (Section 1)

Bauer Hall, Room 230 (Section 2)

Google IPO

Hertz LBO

24.1, 24.4

25

17

Dividend Policy

at FPL Group

17

Group Assign. 1

Group Assign. 2

16

16

Group Assign. 4

FIN 534B Spring 2015

Page 4

Academic Integrity:

The Olin Business School is a community of individuals with diverse backgrounds and interests who share

certain fundamental goals. Primary among these goals is the creation and maintenance of an atmosphere

conducive to learning and personal growth for everyone in the community. Becoming a member of the Olin

community is a privilege that brings certain responsibilities and expectations. The success of Olin in attaining its

goals and in maintaining its reputation of academic excellence depends on the willingness of its members, both

collectively and individually, to meet their responsibilities. All individuals associated with Olin should conduct

themselves with the utmost integrity in all aspects of their life, both on and off campus.

The MBA Code of Conduct outlines the following responsibilities for you, as the student, and me, as the instructor,

that we will follow in the context of this course:

Student Responsibilities

The Code of Professional Conduct (the Code) is meant to encourage and clarify appropriate classroom, interpersonal,

and extra-curricular etiquette that is expected of each individual by their peers, the faculty and the institution. It is also

intended to help describe the overall environment of excellence and professionalism that all members of the Olin

community seek to establish and to continually enhance. It is the responsibility of each member of the Olin community to

uphold the spirit, as well as the principles, of the Code.

Expectations Professional Standards of Conduct

In keeping with these shared expectations, Olin graduate students are expected to conduct themselves at all times

in a professional manner. Professional behavior includes, but is not limited to, the following:

In the Classroom

Attendance: Students are expected to attend each class session. Students who must miss a session for any reason

should make every effort to notify the instructor prior to the class meeting. Students should never register for

courses scheduled in conflict with one another.

Punctuality: Students are expected to arrive and be seated prior to the start of each class session. They should

display their name cards in all classes at all times.

Behavior: Classroom interaction will be conducted in a spirited manner, but always while displaying

professional courtesy and personal respect.

Preparation: Students are expected to complete the readings, case preparations and other assignments prior to

each class session and be prepared to actively participate in class discussion.

Distractions:

Exiting and Entering: Students are expected to remain in the classroom for the duration of the class

session unless an urgent need arises or prior arrangements have been made with the professor.

Laptop, PDA, and Other Electronic Device Usage: Students are expected to use laptops, PDAs and

other electronic devices only with the instructors consent and for activities directly related to the class

session. Accessing e-mail or the Internet during class is not permitted as they can be distracting for peers

and faculty.

Cellular Phone and Pager Usage: Students are expected to keep their mobile phones and pagers turned

off or have them set on silent/vibrate during class. Answering phones or pagers while class is in session

is not permitted.

Other distractions: Specifically identified by individual instructors, such as eating in the classroom.

Outside the Classroom:

FIN 534B Spring 2015

Page 5

Students are expected to conduct themselves professionally when dealing with all members of the Olin and

Washington University communities as well as in the career search process, at club activities, networking events,

job interviews, and other functions where they are representing the Olin community.

Facilities: Students are expected to help maintain the appearance and the functionality of the building,

classrooms, and other facilities.

Should Violations of this Code Occur:

The matter may be referred to the Code of Professional Conduct Council for review and possible sanctions. The

Council will consist of one appointed member from each of these groups: the graduate student body, the faculty,

and the staff.

Faculty Responsibilities

Members of the faculty teaching in the graduate programs will consistently and fully support the Code of

Professional Conduct which includes a uniform policy concerning behavior both in and outside the classroom

environment.

All Graduate Faculty members agree to treat students with professional courtesy and personal respect.

All Graduate Faculty members affirm that it is proper and appropriate to use the entire range of the existing

grading system.

All Graduate classes will include a final exam and/or other method(s) of individual evaluation.

Most Graduate classes will use cold calling or similar techniques in the classroom and will, as appropriate,

place grading value on class participation.

All Graduate classes agree to employ a mid-course student feedback mechanism (for the exclusive benefit of the

faculty member).

Faculty members assigned to Graduate classes will return assignments in a timely fashion and provide an

appropriate level of feedback on graded coursework.

Disabilities

Reasonable accommodations will be made for students with verifiable disabilities. Students who qualify for

accommodations must register through Washington Universitys Center for Advanced Learning Disability

Resources (DR) in Cornerstone. Their staff members will assist me in arranging appropriate accommodations.

FIN 534B Spring 2015

Page 6

Core Competencies

The following are the key concepts and skills that we will cover in each section of the course.

I. Intro to Capital Structure

a. Understand why firm value and WACC are unaffected by financial structure in perfect markets

b. Be able to show the effects of financial transactions on both book value and market value balance

sheets

c. Understand the effect of financial leverage on the risk and expected return of equity

II. Taxes and capital structure

a. Understand how debt financing reduces corporate tax payments

b. Understand the personal tax cost of debt financing

c. Be able to calculate the annual cash flow impact of interest tax shields with:

i. Corporate taxes only

ii. Corporate and personal taxes

d. Be able to calculate the capitalized present value of tax shields under different assumptions

i. Perpetual vs. finite maturity debt

ii. With and without personal tax penalty

iii. When to use rD or rU to discount future tax shields

iv. Adjusting for exhaustion of taxable income

e. Be able to calculate the effect of a change in capital structure on the after-tax WACC

f. Understand which types of firms should find interest tax shields most valuable

III. Swedish Match case discussion

a. Calculate the impact of a leverage increasing (or decreasing) recapitalization on share price in the

presence of corporate and personal taxes

b. Estimate the impact of a change in leverage on a firms credit rating

c. Estimate a firms appropriate debt level with various methods (Industry comparisons, target a

credit rating, cash flow versus debt service)

d. Understand the difference between expected yield and promised yield on risky debt and between

book value and market value of debt

e. Be able to approximate the cost of risky debt using debt betas or the adjusted yield-to-maturity

approach

IV. Tax-bankruptcy tradeoff

a. Understand the sources of financial distress costs

b. Calculate the net gain to leverage as PV of expected tax shield benefit minus expected financial

distress costs

c. Understand which types of firms should find financial distress most costly

V. Information asymmetry

a. Understand why asymmetric information makes outside equity financing costly for good quality

firms

b. Understand why internal funds and debt are less exposed to these information costs

c. Understand why rights offerings avoid the costs of information asymmetry

d. Calculate the impact of a rights offer on the number of shares outstanding, share price, value of a

right, and shareholder wealth.

FIN 534B Spring 2015

Page 7

VI. IPOs

a. Understand the major benefits and costs of going public

b. Be able to calculate:

i. Effect of an IPO on the number of shares outstanding (understanding the difference

between primary and secondary shares offered)

ii. Net proceeds raised by the firm

iii. Total underwriter costs

iv. Money left on the table due to underpricing

c. Understand the common explanations for IPO underpricing

d. Understand the role of investment banks in the IPO process

VII.

Agency conflicts

a. Understand the two roles of high debt in mitigating manager-shareholder agency conflicts

i. Preserving incentives of original owners

ii. Disciplining managers by pre-committing free cash flow to lenders

b. Understand why high debt can lead equity holders to:

i. Pass up safe, positive NPV projects

ii. Invest in high risk projects, even if negative NPV

c. Understand how convertible debt and short-term debt can mitigate the risk-shifting problem

d. Understand how the monitoring role of banks can mitigate agency conflicts

e. Understand which types of firms are most exposed to manager-shareholder and debtholderequityholder agency costs

VIII.

Hertz LBO case

a. Understand the major sources of value associated with LBO transactions (refer back to sections

on tax shield value and agency conflicts)

b. Understand the benefits of asset-backed (ABS) financing in minimizing financial distress costs,

avoiding debt overhang problems, and enhancing access to public market debt.

IX. Leasing

a. Be able to adjust a firms leverage ratio for operating lease obligations

b. Be able to evaluate whether a lease is more/less attractive to purchasing the same asset with

leverage

X. Payout Policy

a. Understand why payout policy does not affect firm (or equity) value in a perfect capital market

setting

b. Payout levels; Understand:

i. When corporate taxes create an incentive to increase/decrease payout

ii. Why financial distress costs create an incentive to reduce payout

iii. Why mgr-shareholder agency conflicts create an incentive to increase payout

iv. How payout policy can influence a firms shareholder clientele

c. Dividends vs. Share repurchases; Understand:

i. The tax incentive for repurchases

ii. The financial flexibility advantage of repurchases

You might also like

- Going Public and Private Course OutlineDocument7 pagesGoing Public and Private Course OutlineAnurag JainNo ratings yet

- Managerial Accounting at Xiamen UniversityDocument5 pagesManagerial Accounting at Xiamen UniversityEl Norway XuNo ratings yet

- Unit I Accounting Standards Part 1Document50 pagesUnit I Accounting Standards Part 1Chin FiguraNo ratings yet

- Subject OutlineDocument8 pagesSubject OutlineGurrajvin SinghNo ratings yet

- Edition, by PhilipDocument3 pagesEdition, by PhilipRajratan SinghNo ratings yet

- F S 2 0 1 2 MBA-1V (3) : ALL Emester YRSDocument7 pagesF S 2 0 1 2 MBA-1V (3) : ALL Emester YRSChaudhry KhurramNo ratings yet

- SyllabusDocument13 pagesSyllabusRaul GutierrezNo ratings yet

- Syllabus-Service-Excellence Sep 2023Document17 pagesSyllabus-Service-Excellence Sep 2023Duong BuiNo ratings yet

- MGT 321 Courseoutline Summer15Document5 pagesMGT 321 Courseoutline Summer15souravsamNo ratings yet

- Johnson MGMT 590 Online Spring 2023Document4 pagesJohnson MGMT 590 Online Spring 2023Fulton Abraham SanchezNo ratings yet

- Bus 152A-2 Marketing Management: Mondays and Wednesdays 5:00 - 6:20 PMDocument25 pagesBus 152A-2 Marketing Management: Mondays and Wednesdays 5:00 - 6:20 PMkuma;lNo ratings yet

- Intermediate Financial ManagementModule 3 Course Outline Module 3 2024Document18 pagesIntermediate Financial ManagementModule 3 Course Outline Module 3 2024Sashina GrantNo ratings yet

- MGMT 1001 Business Course Outline Part A and B S2 2015 Full FinalDocument22 pagesMGMT 1001 Business Course Outline Part A and B S2 2015 Full FinalRaymond YeNo ratings yet

- STRT4501 Strategy in ActionDocument6 pagesSTRT4501 Strategy in ActionNick JNo ratings yet

- ACTG 2011S - Pasquali - Course Outline - Winter 2014Document9 pagesACTG 2011S - Pasquali - Course Outline - Winter 2014Jaimee Joseph100% (1)

- Econ1101 Course OutlineDocument18 pagesEcon1101 Course OutlineJoannaNo ratings yet

- Acctg 103 Syllabus - 2014Document8 pagesAcctg 103 Syllabus - 2014patelp4026No ratings yet

- Australian School of Business Banking and Finance Course OutlineDocument17 pagesAustralian School of Business Banking and Finance Course OutlineDev LioNo ratings yet

- Course SyllabusDocument8 pagesCourse SyllabusKitty LiuNo ratings yet

- 1213MGNT4010ADocument6 pages1213MGNT4010AShailesh AtkariNo ratings yet

- Financial Accounting Course SyllabusDocument6 pagesFinancial Accounting Course SyllabusMarc YuNo ratings yet

- Individual & Group Dynamics - DCP - SyllabusDocument6 pagesIndividual & Group Dynamics - DCP - SyllabusAbhishek Jay KumarNo ratings yet

- Mcoombs@usc EduDocument17 pagesMcoombs@usc EduPhạm TrangNo ratings yet

- Accounting - Foundation Course 2023-24Document5 pagesAccounting - Foundation Course 2023-24Zoom MailNo ratings yet

- Online Learning OrientationDocument5 pagesOnline Learning Orientationapi-606640552No ratings yet

- Syllabus Fina6216 FinalDocument4 pagesSyllabus Fina6216 Finalobliv11No ratings yet

- FINS1612 Course OutlineDocument10 pagesFINS1612 Course OutlineJulie ZhuNo ratings yet

- Syllabus: ENT 2000 - Intro To EntrepreneurshipDocument7 pagesSyllabus: ENT 2000 - Intro To EntrepreneurshipBrandon E. PaulNo ratings yet

- UNIT 1 Fundamentals of Assurance ServicesDocument43 pagesUNIT 1 Fundamentals of Assurance ServicesDia Mae Ablao GenerosoNo ratings yet

- MKT 450 - Consumer Behavior and Marketing: Ourse EscriptionDocument12 pagesMKT 450 - Consumer Behavior and Marketing: Ourse EscriptionYepuru ChaithanyaNo ratings yet

- MHR 733 Training & Development Fall 2015 Section 011: L1pike@ryerson - CaDocument9 pagesMHR 733 Training & Development Fall 2015 Section 011: L1pike@ryerson - CaKiran ShNo ratings yet

- UT Dallas Syllabus For Ba4336.001.10f Taught by Fang Wu (fxw052000)Document11 pagesUT Dallas Syllabus For Ba4336.001.10f Taught by Fang Wu (fxw052000)UT Dallas Provost's Technology GroupNo ratings yet

- International Marketing Fall 2013Document6 pagesInternational Marketing Fall 2013api-232252123No ratings yet

- BU 481 2016S Course Syllabus - FinalDocument12 pagesBU 481 2016S Course Syllabus - FinalJoshNo ratings yet

- 15472Document12 pages15472baskarbaju1No ratings yet

- Princp of MKT Crs OutDocument4 pagesPrincp of MKT Crs OutWasifa Rahnuma IslamNo ratings yet

- 631 LittleDocument6 pages631 LittleJohnNo ratings yet

- ACCT 354 Financial Statement AnalysisDocument4 pagesACCT 354 Financial Statement AnalysisWoo JunleNo ratings yet

- GB 112 - Tools and Concepts in Accounting and FinanceDocument9 pagesGB 112 - Tools and Concepts in Accounting and FinanceZac Winkler100% (1)

- ESE - Module Handbook For Business 2022-23Document38 pagesESE - Module Handbook For Business 2022-23Mirela TomniucNo ratings yet

- Leadership and TeamworkDocument10 pagesLeadership and TeamworkLinh HoangNo ratings yet

- New York University Stern School of Business MBA Program COR1-GB-2310: Marketing Spring 2016Document7 pagesNew York University Stern School of Business MBA Program COR1-GB-2310: Marketing Spring 2016Joao CarneiroNo ratings yet

- Investments and Portfolio Selection Course OutlineDocument12 pagesInvestments and Portfolio Selection Course OutlineTanya HoNo ratings yet

- Sylabus Komuniakasi BisnisDocument4 pagesSylabus Komuniakasi Bisnisito_kaitoNo ratings yet

- Managerial Accounting at NortheasternDocument9 pagesManagerial Accounting at Northeasterndanya_1997No ratings yet

- FIN 501 Corporate Finance Course SyllabusDocument4 pagesFIN 501 Corporate Finance Course SyllabusAmandeep AroraNo ratings yet

- FINS3625 Course OutlineDocument18 pagesFINS3625 Course Outlineriders29No ratings yet

- Syllabus Marketing Management MGT 6300 EM - Fall 2011Document4 pagesSyllabus Marketing Management MGT 6300 EM - Fall 2011sourjoNo ratings yet

- MKTG 301Document7 pagesMKTG 301amolapf4No ratings yet

- Tips To Succeed in Home-Based Learning Via Printed ModuleDocument20 pagesTips To Succeed in Home-Based Learning Via Printed ModuleJhen-Jhen Geol-oh BaclasNo ratings yet

- FIN9792: Advanced Managerial Finance (3 Units)Document6 pagesFIN9792: Advanced Managerial Finance (3 Units)gfybyg yg yNo ratings yet

- Accounting Syllabus For A576Document11 pagesAccounting Syllabus For A576ScottHaleNo ratings yet

- MAR6805 Panama Alvarez 2012Document7 pagesMAR6805 Panama Alvarez 2012Gian Carlos BecciuNo ratings yet

- Bbi 1oi Course Outline 2016-17Document2 pagesBbi 1oi Course Outline 2016-17api-235442745No ratings yet

- Comparative Management Course OutlineDocument4 pagesComparative Management Course Outlinehamid_irfan_najmiNo ratings yet

- ECON3116 International Trade PartA S22013Document10 pagesECON3116 International Trade PartA S22013smith858No ratings yet

- MGT 444 Sannwald SP 14Document8 pagesMGT 444 Sannwald SP 14andersonnakano6724No ratings yet

- BU698n Spring 2014 Outline PDFDocument7 pagesBU698n Spring 2014 Outline PDFasdasddasd1No ratings yet

- Minksy's Five Steps To Contagion - Prospect MagazineDocument8 pagesMinksy's Five Steps To Contagion - Prospect MagazineSahit Chowdary GarapatiNo ratings yet

- GuidelinesDocument2 pagesGuidelinesSahit Chowdary GarapatiNo ratings yet

- Suntory 2013 Annual ReportDocument47 pagesSuntory 2013 Annual ReportSahit Chowdary GarapatiNo ratings yet

- BCG UspsDocument41 pagesBCG UspsSahit Chowdary GarapatiNo ratings yet

- Judy Shen Filerman - Dreambridge PartnersDocument2 pagesJudy Shen Filerman - Dreambridge PartnersSahit Chowdary GarapatiNo ratings yet

- Itinerary AtlantaDocument2 pagesItinerary AtlantaSahit Chowdary GarapatiNo ratings yet

- Traders Joe'sDocument17 pagesTraders Joe'sSahit Chowdary GarapatiNo ratings yet

- Credit Suisse IBD Case CompetitionDocument4 pagesCredit Suisse IBD Case CompetitionSahit Chowdary GarapatiNo ratings yet

- Darden Case Book 2013Document173 pagesDarden Case Book 2013Swapnika Nag0% (1)

- Top 25 Summer InternshipsDocument13 pagesTop 25 Summer InternshipsGaurav ThaparNo ratings yet

- Mutual Funds and Market Development in IndiaDocument6 pagesMutual Funds and Market Development in IndianithiananthiNo ratings yet

- Forus Brochure - 3nethra RoyalDocument8 pagesForus Brochure - 3nethra RoyalSahit Chowdary GarapatiNo ratings yet

- RamayanaDocument47 pagesRamayanaSahit Chowdary GarapatiNo ratings yet

- Docs DataBooks 2010 BEDBDocument271 pagesDocs DataBooks 2010 BEDByolepusaNo ratings yet

- Price SkimmingDocument3 pagesPrice SkimmingleighannNo ratings yet

- Hotel Accounting Procedures HS-3Document79 pagesHotel Accounting Procedures HS-3shivdas kaleNo ratings yet

- O M14Document5 pagesO M14PoojaSriNo ratings yet

- STEP 8 - Quantitative Strategic Planning (QSPM) MatrixDocument2 pagesSTEP 8 - Quantitative Strategic Planning (QSPM) Matrixdummy AccntNo ratings yet

- Tips Gratuities Policy 2022Document6 pagesTips Gratuities Policy 2022Ignacia LizanaNo ratings yet

- AP-300 (Audit of Liabilities)Document10 pagesAP-300 (Audit of Liabilities)Pearl Mae De VeasNo ratings yet

- Test Bank For Accounting Information Systems 1e by Turner and WeickgenanntDocument16 pagesTest Bank For Accounting Information Systems 1e by Turner and Weickgenanntcynthiaacostabsjeiaxmqk100% (35)

- Strategic AllianceDocument12 pagesStrategic AllianceMadhura GiraseNo ratings yet

- Garden Sillk MillDocument132 pagesGarden Sillk MillYogesh JasoliyaNo ratings yet

- Hyper Personalization in Bfsi A Wipro Thought Leadership ReportDocument30 pagesHyper Personalization in Bfsi A Wipro Thought Leadership Reportpmohan1105No ratings yet

- Nobles Acct10 Tif 21Document205 pagesNobles Acct10 Tif 21Marqaz MarqazNo ratings yet

- Sales & Marketing Plan The Emerald Hotel: Executive SummaryDocument14 pagesSales & Marketing Plan The Emerald Hotel: Executive SummaryFrancis ButalNo ratings yet

- Marketing Plan of AeroDocument32 pagesMarketing Plan of AeroNeroz ChhetriNo ratings yet

- Unified Audit StrategyDocument8 pagesUnified Audit StrategyvangieNo ratings yet

- CORPORATION Sec 1 17Document39 pagesCORPORATION Sec 1 17BroskipogiNo ratings yet

- Robert Vitale ContentDocument19 pagesRobert Vitale ContentJumly SheriffNo ratings yet

- Asynchronous - 01Document8 pagesAsynchronous - 01Joshua SantiagoNo ratings yet

- CoE-Tut 7Document2 pagesCoE-Tut 7kwintcomNo ratings yet

- Format Jurnal KhususDocument23 pagesFormat Jurnal KhususDewi RahmawatiNo ratings yet

- Naykaa 1 BDocument8 pagesNaykaa 1 Bfaisal95030No ratings yet

- 2020 - BCA 2 Sem Finanancial AccountingDocument13 pages2020 - BCA 2 Sem Finanancial AccountingLeah DesharNo ratings yet

- Kara 2005Document14 pagesKara 2005Nicolás MárquezNo ratings yet

- Segregation of DutiesDocument12 pagesSegregation of Dutiesnstr81No ratings yet

- CCM FinalDocument18 pagesCCM FinalAman SiddiquiNo ratings yet

- Seligram Case Study: Presented To: Dr. Khaled Hegazy Presented By: Mona Abdallah Student ID: 131239Document11 pagesSeligram Case Study: Presented To: Dr. Khaled Hegazy Presented By: Mona Abdallah Student ID: 131239monmona22100% (2)

- SecuritizationDocument28 pagesSecuritizationMohit MakhijaNo ratings yet

- 1.4 StakeholdersDocument8 pages1.4 StakeholdersTita RachmawatiNo ratings yet

- Understanding Market Forces with Demand and Supply MCQsDocument12 pagesUnderstanding Market Forces with Demand and Supply MCQsLe PhucNo ratings yet

- ACC 213 Budgeting for BLACKPINK CorpDocument2 pagesACC 213 Budgeting for BLACKPINK CorpRayden Faith VillasinNo ratings yet

- Use of Perpetual Inventory SystemDocument16 pagesUse of Perpetual Inventory Systemmysteriousgirl_83631No ratings yet