Professional Documents

Culture Documents

Options Trading

Uploaded by

Soumya ChatterjeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Options Trading

Uploaded by

Soumya ChatterjeeCopyright:

Available Formats

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 1 of 9

About Us - Registration/Login - Contact Us - Message Board - Glossary - Features - B-School - Legal - Biz-End - Orange

'This site is a must read for investors ..' Forbes magazine

Business School

Options Trading: Using Techinical Analysis As An Effective

Tool For Trading ? A Live Study

Jargon Management

Student Speak

Wed, 16-Oct-2002 16:24:01

IST (GMT+5:30)

Options Trading: Using Techinical Analysis As An

Effective Tool For Trading A Live Study

INTRODUCTION TO OPTIONS AND TECHNICAL

ANALYSIS

Damagement lessons

l

Objective

What is an Option

Some Important Terms in Options

Operations Management

An Example

Financial Management

The Indian Scenario

HR Management

Advantages of Option trading over Share trading

Marketing Management

What is Technical Analysis

Cyber Trek

General Management

Message Boards

Post a message

Quick Search

Enter IIL company code

Look up code

l

Advantages of Technical Analysis

The Simple Moving Average Method

A Live Study of Trading in Option Markets using the

Simple Moving Average Method

Systems Management

Subscribe to IIL

Newsletters

Entrance Guide

Career Guide

Placement Guide

1. Methodology used for the study

2. Illustration

Case Studies Quiz

Drop us a line

Drop us your queries

& suggestions

3. Results

Entrepreneur MBA

4. Caution

About us

OBJECTIVE:

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Disclaimer

Page 2 of 9

Objective of this paper is to give an introduction to Options

and Technical Analysis and more importantly give an

idea as to how Technical Analysis could be used to get

handsome returns in the Options market.

WHAT IS AN OPTION:

An Option is a financial asset, which is linked to another

physical asset, in our case it is equity shares. A Share

Option is a right to buy or sell a share at a particular price

and the Option is exercisable at the choice of the Option

buyer.

Right to buy is known as a Call Option

Right to sell is known as a Put Option

Thus, for example if Mr. A buys a CALL OPTION from Mr.

B and the share price rises Mr. A will exercise the Option

and buy the share at the decided price, however if the price

falls, Mr. A has the option of not exercising his right.

IMPORTANT TERMS IN OPTIONS:

STRIKE PRICE: the price of the underlying share at which

the Option is taken

PREMIUM: the price paid for purchasing the Option

EXPIRY PERIOD: the period for which the Option is valid

and can be exercised

CONTRACT SIZE: there is a market lot for each Option ,

e.g. Infosys 100 shares , Satyam 1200 shares

AN EXAMPLE:

Let us take an example to understand the above terms:

Mr A. buys one contract of call Option of Infosys @

3700 for a premium of Rs. 120/- for the month of

October 2002.

*3700- Strike Price

*October 2002- Expiry Period

Thus, it basically it means that the Option buyer has the

right to buy the share of Infosys at a price of Rs. 3700/-,

whatever is the actual share price. Thus, if the share price

rises to Rs.4000/-, the Option seller will pay him the

difference of Rs. 300. However, if the share price falls to

Rs. 3400/-, the Option buyer does not have to pay anything

and loses the premium, which he initially paid.

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 3 of 9

THUS, AN OPTION BUYER HAS LIMITED LOSS AND

UNLIMITED GAINS WHEREAS AN OPTION SELLER

HAS LIMITED GAINS AND UNLIMITED LOSS

Depending upon the difference between the share price

and the strike price.

THE INDIAN SCENARIO:

Share Options were introduced in India from July 2001,

after the Ketan Parekh Scam. On May 14, 2001 the ageold carry forward system or badla, was banned from July 2,

200, which had basically allowed Ketan Parekh to rig

prices. Futures and Options were started in place of the

Badla system. This move was SEBIs attempt to adopt

practices in line with the norms of developed markets.

Also, to provide a hedging tool and to separate the

speculators from the cash market, so that only real

investors were present in the share market.

The Derivatives market is still in a nascent stage but is

rapidly growing. The Current Daily Turnover in Stock

Options is approximately Rs. 200 - 300 crores.

Another important feature of the Indian market is that there

is only cash settlement of Options. This means that one

cannot take or give delivery of shares by exercising his

Option.

ADVANTAGES OF BUYING

BUYING OF SHARES:

OF

OPTIONS

OVER

1. Limited Loss, Unlimited Gains

Thus we can see that in Options, the loss is restricted.

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 4 of 9

2. Lesser Investment, Thus Better returns

We can see that to purchase 100 shares of Infosys one

would require Rs. 3,60,000/-. However, to purchase the

same Option one would require in the range of Rs. 8000

10000. Thus, if the share rises to Rs. 3900, one would get

a 8% return, however the same would be a 200% return in

Options.

3. Double Sided Protection

A person can buy a Call as well as a Put Option, thus he

would make a profit as long as the share moves beyond

the premium he has paid.

However, no short selling is permitted in the share market;

hence one can make a profit only in case of a share price

rise.

Now, Let us know a bit about Technical Analysis:

WHAT IS TECHNICAL ANALYSIS:

It is essentially a tool, which on the basis of past trends in

the share price tells an investor whether to buy or sell or

hold a share

ADVANTAGES OF TECHNICAL ANALYSIS

With the help of Technical Analysis, the Investors and

traders can enter the stock (long or short) when it starts

trending, instead of locking their money during the periods

of consolidation.

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 5 of 9

Thus, it as a very good tool for short term investing.

SIMPLE MOVING AVERAGE METHOD:

For my analysis I have considered the simplest method of

Technical Analysis, the simple moving average method.

Steps for getting a Buy or Sell signal in the Simple

Moving Average Method:

Calculate the moving averages:

Plot the graph for both the share price and the moving

average:

Buy signal - the share price line cuts the moving average

from below or in the excel worksheet when the difference

becomes positive from negative

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 6 of 9

Sell signal - the share price line cuts the moving average

from above or in the excel worksheet when the difference

becomes negative from positive

Now let us get to the most important part of the paper:

A LIVE STUDY OF TRADING IN OPTION MARKETS

USING SIMPLE MOVING AVERAGE METHOD:

Methodology Followed for the Study:

Selection of stocks:

The ten most actively traded stocks in the Option market

on NSE were selected.

Period of Study:

1st August 2001 to 31st July 2002

Technical Analysis Method Used:

10-day simple moving average as explained earlier.

Strategy Used:

l

l

l

Trading in Options with expiry of ongoing month

Purchase of one contract at a time

Buy a call Option at each buy signal and sell the

already bought put Option

Buy a put Option at each sell signal and sell the

already bought call Option

The Option is bought and sold at the opening price

of the next the day the signal has been received

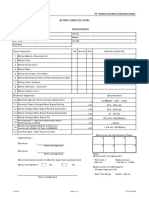

Illustration:

Let me illustrate to you for the month of October 2001 for

Infosys, how the trades would have taken place using the

above strategy.

The share prices are given in the above excel table. So we

start with a buy signal on 5th October 2001. For Infosys,

the market lot is 100 shares.

In the Options market:

BUY

SELL

Strike

Buy

Sell Profit /

Date Option

Premium

Date Premium

Price

Value#

Value@ (Loss)

8/10

Call

2500

9/10

Put

2200

10/10 Call

2600

http://www.indiainfoline.com/bisc/opti.html

96.00

9,900 9/10

100.20 10,320 10/10

85.00

8,800 24/10

102.00

9,900

94.00

9,100 (1,220)

**

51,950 43,150

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Total 29,020

Total

Page 7 of 9

70,950 41,930

# includes brokerage

@ is net off brokerage

** is the expiry date of the Option and the difference

between the strike price and the closing price on the

expiry date , will be received in cash. In this case

3123.50 (the closing price on 24th) less the strike price

i.e. 2600.

Thus, rate of return is approximately 320%. Net Profit of

Rs. 41,930/- on an average investment of Rs.10,000 /-.

In the shares market:

BUY

Date

SELL

Buy

Price

Buy

Value#

Date

Sell

Price

Sell

Value@

Profit /

(Loss)

8/10

2,375

2,37,800 9/10

2,402

2,40,500

2,700

10/10

2,540

2,54,300 24/10

3,022

3,01,900

(1,220)

Total

4,92,100

Total

5,42,400

50,300

# Includes brokerage

@ Is net off brokerage

Thus, rate of return is approximately 20%. Net Profit of

Rs.50,300/- on an average investment of Rs.2,46,000/-.

The same has been done for the ten most actively

traded Options and for the period August 2001 to July

2002.

Results of the Analysis:

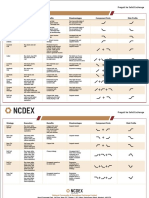

In the Options market:

Scrip

Market

Lot

Total Annual

Profit

Avg

Monthly

Investment

Monthly Rate

of Return

E = ( C / 12 ) /

D * 100

Hindustan

Petroluem

1300

202,520

10,146

166

Infosys

100

194,042

10,293

157

Digital

400

144,840

9,345

129

Satyam

1200

121,740

12,044

84

Telco

3300

118,995

9,568

104

Tisco

1800

60,390

6,480

78

Bharat Petroleum

1100

37,805

7,880

40

600

32,892

4,224

65

600

32,010

7,183

37

1000

20,600

9,472

18

965,834

86,635

93

Sterlite Optical

Reliance

Industries

L&T

TOTAL

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 8 of 9

In the shares market:

Scrip

Market

Lot

Total Annual

Profit

Avg

Monthly

Investment

Monthly Rate

of Return

E = ( C / 12 ) /

D * 100

Hindustan

Petroluem

1300

1,74,135

2,70,845

100

18,975

3,54,570

0.5

Digital

400

58,080

2,08,623

Satyam

1200

72,360

2,67,227

Telco

3300

2,07,900

3,76,411

Tisco

1800

1,02,420

1,82,484

Bharat Petroleum

1100

1,16,600

2,60,976

600

-5,580

82,505

600

5,670

1,73,800

0.2

1000

35,850

1,87,370

7,86,410

23,64,811

Infosys

Sterlite Optical

Reliance

Industries

L&T

TOTAL

Thus, we see that although the profits are high in both

cases , the investment required for shares is almost twenty

five times.

Lets see a graphical presentation of the annual profit and

the above rate of returns.

ANNUAL PROFIT:

MONTHLY RETURN:

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

Options Trading: Using Techinical Analysis As An Effective Tool For Trading ? A Live ...

Page 9 of 9

A Word of Caution:

Although the above profits have been calculated using

actual market data, there is no certainty that the same

trends will continue in the future and one needs to

keep on revising their strategy.

HAPPY TRADING ON OPTIONS

SOURCES OF DATA FOR ANALYSIS

www.nseindia.com

www.icicidirect.com

Sandeep Nene,

IIM Indore

Sectors: Auto - FMCG - Pharma - Oil & Gas - Infrastructure - Infotech - Steel - Special: Ketan Parekh Saga - Budget - Personal Finance Money - Orange-GTM

Copyright 2002 India Infoline Ltd. All rights reserved.Regd. Off: 24, Nirlon Complex, Off W E Highway, Goregaon(E) Mumbai-400 063.

Tel.: +(91 22) 685 0101/0505 Fax: 685 0585

http://www.indiainfoline.com/bisc/opti.html

12/6/2002

You might also like

- Quotex Success Blueprint: The Ultimate Guide to Forex and QuotexFrom EverandQuotex Success Blueprint: The Ultimate Guide to Forex and QuotexNo ratings yet

- Options Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)From EverandOptions Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)No ratings yet

- Options Trading: How To Get From Zero To Six Figures With Options Trading Strategies & Options Trading For Beginners - Forex Trading & Penny Stocks Trading Stocks - Options Trading 2018From EverandOptions Trading: How To Get From Zero To Six Figures With Options Trading Strategies & Options Trading For Beginners - Forex Trading & Penny Stocks Trading Stocks - Options Trading 2018Rating: 1 out of 5 stars1/5 (1)

- The Strategic Options Trader: A Complete Guide to Getting Started and Making Money with Stock OptionsFrom EverandThe Strategic Options Trader: A Complete Guide to Getting Started and Making Money with Stock OptionsNo ratings yet

- STOCK MARKET INVESTING FOR BEGINNERS (New Version): A Simplified Beginner’s Guide To Starting Investing In The Stock Market And Achieve Your Financial FreedomFrom EverandSTOCK MARKET INVESTING FOR BEGINNERS (New Version): A Simplified Beginner’s Guide To Starting Investing In The Stock Market And Achieve Your Financial FreedomNo ratings yet

- Options For Volatility: Sample Investing PlansDocument10 pagesOptions For Volatility: Sample Investing PlansNick's GarageNo ratings yet

- Iron Condor Option StrategyDocument6 pagesIron Condor Option Strategyarjun lakhani0% (1)

- Advancedoptionsspreads 141218174938 Conversion Gate01 PDFDocument4 pagesAdvancedoptionsspreads 141218174938 Conversion Gate01 PDFManoj Kumar SinghNo ratings yet

- 10 Commandments of Option Trading For Income PDFDocument31 pages10 Commandments of Option Trading For Income PDFGaro OhanogluNo ratings yet

- A Simple Options Trading Strategy Based On Technical IndicatorsDocument4 pagesA Simple Options Trading Strategy Based On Technical IndicatorsMnvd prasadNo ratings yet

- Hit and Run: - Number7Document31 pagesHit and Run: - Number7Siva PrakashNo ratings yet

- Bullish: Option Strategies For Bullish ViewDocument10 pagesBullish: Option Strategies For Bullish ViewAshutosh ChauhanNo ratings yet

- Option GreeksDocument2 pagesOption GreeksYarlagaddaNo ratings yet

- Pathfinders Traders TrainingsDocument58 pagesPathfinders Traders TrainingsSameer ShindeNo ratings yet

- WINNING Option Trading Strategies For Volatile MarketDocument4 pagesWINNING Option Trading Strategies For Volatile MarketDaknik CutieTVNo ratings yet

- Option Strategies Kay 2016Document78 pagesOption Strategies Kay 2016ravi gantaNo ratings yet

- Trading StrategiesDocument6 pagesTrading StrategiesCarl Ivan Gambala0% (1)

- Project 5.3 Option MarketDocument22 pagesProject 5.3 Option MarketKavita KohliNo ratings yet

- Options OracleDocument45 pagesOptions OraclenetygenNo ratings yet

- Ira Strategies 010615 Iwm Big LizardDocument7 pagesIra Strategies 010615 Iwm Big Lizardrbgainous2199No ratings yet

- Options Trading For Beginners: A Complete Step-By-Step Trading Guide To Profit In Options TradingFrom EverandOptions Trading For Beginners: A Complete Step-By-Step Trading Guide To Profit In Options TradingNo ratings yet

- Option SellingDocument5 pagesOption SellingSathishNo ratings yet

- Nifty Index Options: Open Interest Analysis of Options ChainDocument34 pagesNifty Index Options: Open Interest Analysis of Options ChainPraveen Rangarajan100% (1)

- Laththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty TrendDocument1 pageLaththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty Trend9952090083No ratings yet

- 7 Option Trading Strategies AnswersDocument4 pages7 Option Trading Strategies AnswersAssia ENo ratings yet

- Central Pivot Range (CPR)Document10 pagesCentral Pivot Range (CPR)Jaideep PoddarNo ratings yet

- Option StrategyDocument59 pagesOption StrategyTarkeshwar MahatoNo ratings yet

- Advance Options StrategiesDocument14 pagesAdvance Options StrategiesMahbubul Islam KoushickNo ratings yet

- Only Α- Sniper Shot 3: MyfnoDocument10 pagesOnly Α- Sniper Shot 3: MyfnoPhani KrishnaNo ratings yet

- Option Trading Lessons From The Man Who Sold His Trading System To JPMorganDocument8 pagesOption Trading Lessons From The Man Who Sold His Trading System To JPMorganShibnath SadhukhanNo ratings yet

- 10 Rules For Successful Long Term Investment 270112Document2 pages10 Rules For Successful Long Term Investment 270112Ganesh Subramanian100% (1)

- Options Trading StrategiesDocument19 pagesOptions Trading StrategiesAkshay SahooNo ratings yet

- Options for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesFrom EverandOptions for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesNo ratings yet

- CPR Tricks IntradayDocument1 pageCPR Tricks IntradayAyesha MariyaNo ratings yet

- Options SoftwaresDocument54 pagesOptions SoftwaresAmit Barman100% (1)

- 142a Banknifty Weekly Options StrategyDocument6 pages142a Banknifty Weekly Options StrategyudayNo ratings yet

- Options - FinalDocument12 pagesOptions - FinalNa Ri TaNo ratings yet

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- Advanced Option TraderDocument1 pageAdvanced Option TradergauravroongtaNo ratings yet

- New Option Income Trading Ideas For Week 9-17-18Document9 pagesNew Option Income Trading Ideas For Week 9-17-18tummalaajaybabuNo ratings yet

- Options Stratergies Payoff ChartDocument2 pagesOptions Stratergies Payoff ChartAbhijit ButalaNo ratings yet

- Selling Naked Puts For Profit and Avoiding AssignmentDocument7 pagesSelling Naked Puts For Profit and Avoiding AssignmentRed Dot SecurityNo ratings yet

- Six Costliest Trading Mistakes: (And How To Immediately Fix Them)Document13 pagesSix Costliest Trading Mistakes: (And How To Immediately Fix Them)Diego Ribeiro0% (1)

- MMTC Student's Manual 2021Document105 pagesMMTC Student's Manual 2021Scribd ReaderNo ratings yet

- Option Greeks and Management of Market RiskDocument14 pagesOption Greeks and Management of Market RiskSantosh More100% (1)

- Guruspeak - Optimisation and Back-Testing Key To Trading Success, Says Jitendra JainDocument9 pagesGuruspeak - Optimisation and Back-Testing Key To Trading Success, Says Jitendra JainPradipsinh ParamarNo ratings yet

- Options Trading for Beginners - The 7-Day Crash Course I Start Achieving Your Financial Freedoom Today I Options, Swing, Day & Forex TradingFrom EverandOptions Trading for Beginners - The 7-Day Crash Course I Start Achieving Your Financial Freedoom Today I Options, Swing, Day & Forex TradingNo ratings yet

- Trading Weekly Options: Pricing Characteristics and Short-Term Trading StrategiesFrom EverandTrading Weekly Options: Pricing Characteristics and Short-Term Trading StrategiesNo ratings yet

- What Are Some Basic Points Which We Must Know Before Go For Options TradingDocument7 pagesWhat Are Some Basic Points Which We Must Know Before Go For Options TradingAnonymous w6TIxI0G8lNo ratings yet

- Practical Guide To Swing Trading: Download HereDocument5 pagesPractical Guide To Swing Trading: Download HereRaju MondalNo ratings yet

- Lesson 1: Composition: Parts of An EggDocument22 pagesLesson 1: Composition: Parts of An Eggjohn michael pagalaNo ratings yet

- Refutation EssayDocument6 pagesRefutation Essayapi-314826327No ratings yet

- 1.co - Deb4113 - Industrial ManagementDocument10 pages1.co - Deb4113 - Industrial ManagementrohaizadNo ratings yet

- Digital Electronics Chapter 5Document30 pagesDigital Electronics Chapter 5Pious TraderNo ratings yet

- ACCA F2 2012 NotesDocument18 pagesACCA F2 2012 NotesThe ExP GroupNo ratings yet

- FINAL BÁO-CÁO-THỰC-TẬP.editedDocument38 pagesFINAL BÁO-CÁO-THỰC-TẬP.editedngocthaongothi4No ratings yet

- Body Systems Portfolio - Tommy JDocument8 pagesBody Systems Portfolio - Tommy Japi-554072790No ratings yet

- UFO Yukon Spring 2010Document8 pagesUFO Yukon Spring 2010Joy SimsNo ratings yet

- Loop Types and ExamplesDocument19 pagesLoop Types and ExamplesSurendran K SurendranNo ratings yet

- Gujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalDocument18 pagesGujarat Urja Vikas Nigam LTD., Vadodara: Request For ProposalABCDNo ratings yet

- Toshiba MotorsDocument16 pagesToshiba MotorsSergio Cabrera100% (1)

- DN102-R0-GPJ-Design of Substructure & Foundation 28m+28m Span, 19.6m Width, 22m Height PDFDocument64 pagesDN102-R0-GPJ-Design of Substructure & Foundation 28m+28m Span, 19.6m Width, 22m Height PDFravichandraNo ratings yet

- ABI TM 13 16 SL - EngDocument1 pageABI TM 13 16 SL - EngJuan Carlos Benitez MartinezNo ratings yet

- EQ JOURNAL 2 - AsioDocument3 pagesEQ JOURNAL 2 - AsioemanNo ratings yet

- Module-29A: Energy MethodsDocument2 pagesModule-29A: Energy MethodsjhacademyhydNo ratings yet

- KCG-2001I Service ManualDocument5 pagesKCG-2001I Service ManualPatrick BouffardNo ratings yet

- Classification of Books Using Python and FlaskDocument5 pagesClassification of Books Using Python and FlaskIJRASETPublicationsNo ratings yet

- Rotating Equipment & ServiceDocument12 pagesRotating Equipment & Servicenurkasih119No ratings yet

- 105 2Document17 pages105 2Diego TobrNo ratings yet

- Guideline - Research ProposalDocument38 pagesGuideline - Research ProposalRASNo ratings yet

- DR S GurusamyDocument15 pagesDR S Gurusamybhanu.chanduNo ratings yet

- Lalit Resume-2023-LatestDocument2 pagesLalit Resume-2023-LatestDrew LadlowNo ratings yet

- Additional Article Information: Keywords: Adenoid Cystic Carcinoma, Cribriform Pattern, Parotid GlandDocument7 pagesAdditional Article Information: Keywords: Adenoid Cystic Carcinoma, Cribriform Pattern, Parotid GlandRizal TabootiNo ratings yet

- Cosmopolitanism in Hard Times Edited by Vincenzo Cicchelli and Sylvie MesureDocument433 pagesCosmopolitanism in Hard Times Edited by Vincenzo Cicchelli and Sylvie MesureRev. Johana VangchhiaNo ratings yet

- Battery Checklist ProcedureDocument1 pageBattery Checklist ProcedureKrauser ChanelNo ratings yet

- Riqas Ri RQ9142 11aDocument6 pagesRiqas Ri RQ9142 11aGrescia Ramos VegaNo ratings yet

- Nescom Test For AM (Electrical) ImpDocument5 pagesNescom Test For AM (Electrical) Impشاہد یونسNo ratings yet

- SOCIAL MEDIA DEBATE ScriptDocument3 pagesSOCIAL MEDIA DEBATE Scriptchristine baraNo ratings yet

- UAV Design TrainingDocument17 pagesUAV Design TrainingPritam AshutoshNo ratings yet

- Paper 1 AnalysisDocument2 pagesPaper 1 AnalysisNamanNo ratings yet