Professional Documents

Culture Documents

2014 General Insurance 06 PDF

Uploaded by

ascap77Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 General Insurance 06 PDF

Uploaded by

ascap77Copyright:

Available Formats

Session 6 General Insurance and Takaful

industry market trend in Malaysia

NurulSyuhadaNurazmi,FCAS,FASM

8/25/2014

General Insurance and Takaful Industry

Market Trends in Malaysia

Nurul Syuhada Nurazmi, FCAS, FASM

Partner, Actuarial Partners Consulting

General Insurance and Takaful Industry Market Trends in Malaysia

BUSINESS OVERVIEW

8/25/2014

BUSINESS GROWTH

There has been persistent and significant growth in General Takaful

business in Malaysia. This growth has consistently outpaced the

growth of the conventional General Insurance business.

7%

16,000,000

8%

8%

14,000,000

9%

6%

RM'000

12,000,000

8%

10,000,000

8,000,000

6,000,000

4,000,000

2,000,000

0

GeneralTakaful(RM'000)

ConventionalGeneralInsurance

(RM'000)

28%

21%

14%

10%

9%

19%

2007

2008

2009

2010

2011

2012

2013

767,600

873,800

1,053,700

1,345,900

1,599,800

1,746,500

1,918,500

10,046,400

10,894,000

11,531,200

12,584,700

13,604,900

14,692,200

15,721,300

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source:BankNegaraMalaysiaAnnualInsurance/TakafulStatistics,FinancialYears2007to2013

GENERAL INSURANCE

BY LINE OF BUSINESS

GrossPremiums DirectBusiness(Jan Dec2013)

NetPremiums Direct Business(Jan Dec2013)

(RM'000)

(RM'000)

WC&EL,

RM232,400,

1%

Liability,

RM464,000,

3%

PA&Medical,

RM2,129,400,

14%

CAR&Eng,

RM601,700,

4%

MAT,

RM1,451,800,

9%

Fire,

RM2,622,700,

17%

Others,

RM771,700,

5%

Motor(Total)

Fire

MAT

CAR&Eng

PA&Medical

WC&EL

Liability

Others

Motor(Total),

RM7,447,600,

47%

WC&EL,

RM227,500,

2%

Liability,

RM253,600,

2%

PA&Medical,

RM1,927,600,

15%

Others,

RM555,600,

4%

Motor(Total)

Fire

MAT

CAR&Eng

PA&Medical

CAR&Eng,

RM314,200,

2%

WC&EL

Liability

Others

MAT,

RM464,500,

4%

Fire,

RM1,873,100,

14%

Motor(Total),

RM7,315,600,

57%

Source:BankNegaraMalaysiaAnnualInsuranceStatistics,FinancialYear2013

Predominance of Motor, especially net of reinsurance.

MAT, CAR & Eng and Liability are more heavily reinsured than PA &

Medical, Motor and WC & EL, with Fire and Others showing moderate

retention.

8/25/2014

GENERAL TAKAFUL

BY LINE OF BUSINESS

GrossContributions DirectBusiness(Jan Dec2013)

(RM'000)

PA&Medical,

RM191,200,

10%

WC&EL,

RM10,200,1%

Liability,

RM33,000,2%

Others,

RM61,500,3%

Motor(Total)

Fire

GrossContributions DirectBusiness(Jan Dec2013)

(RM'000)

PA&Medical,

RM161,000,

11%

MAT

CAR&Eng,

RM56,200,3%

CAR&Eng

PA&Medical

CAR&Eng,

RM11,100,

1%

WC&EL

MAT,

RM44,700,2%

Fire,

RM386,600,

20%

Liability

Others

Motor(Total),

RM1,135,200,

59%

Liability,

WC&EL,

RM9,000,1%

RM7,400,1%

Motor(Total)

Others,

RM29,500,

2%

Fire

MAT

CAR&Eng

PA&Medical

WC&EL

MAT,

RM6,200,0%

Fire,

RM221,200,

16%

Liability

Others

Motor(Total),

RM955,300,

68%

Source:BankNegaraMalaysiaAnnualTakafulStatistics,FinancialYear2013

Predominance of Motor in Takaful is even more distinct than in

conventional insurance.

Heavy reliance on Motor, and Fire and PA & Medical to a lesser extent,

with low penetration and retakaful retention for the other classes.

OBSERVATIONS

Mix of business between conventional General Insurance and

Takaful is similar, with Motor and Fire forming the bulk of the

business.

Conventional insurers tend to have higher exposure to

commercial risks such as MAT and CAR & Eng as compared to

Takaful Operators (TOs). These risks require higher capacity and

expertise to write, hence the reason why the smaller and

younger TOs are providing less or no such cover.

On the other hand, TOs are writing less Medical business as

compared to their conventional peers. This follows the

conventional insurers trend 15 years ago, where Medical was

predominantly written by their Life counterparts. This has

changed with the introduction of Sihat Malaysia in 1998/1999.

8/25/2014

General Insurance and Takaful Industry Market Trends in Malaysia

GeneralInsuranceandTakaful

Market

GROWTH

ON GROSS BASIS

ByLineofBusiness

BY LINE

OF BUSINESS

MOTOR

Motor Takaful exhibits strong growth, consistently outpacing the

growth in the conventional General Insurance market, although

Takaful is still only 13% of the combined Motor market.

8,000,000

9%

8%

7,000,000

7%

13%

RM'000

6,000,000

7%

10%

5,000,000

4,000,000

3,000,000

2,000,000

1,000,000

0

GeneralTakaful(RM'000)

ConventionalGeneralInsurance

(RM'000)

16%

28%

28%

23%

18%

10%

2007

2008

2009

2010

2011

2012

2013

374,800

436,300

557,600

715,600

878,300

1,036,100

1,135,200

4,447,700

4,893,900

5,254,200

5,922,200

6,317,100

6,845,600

7,447,600

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2007 to 2013

8/25/2014

FIRE

The growth in Fire Insurance is more stable than in Fire Takaful,

although at a lower average growth rate.

3,000,000

9%

8%

2,500,000

RM'000

2,000,000

7%

3%

6%

7%

1,500,000

1,000,000

500,000

14%

9%

0

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

37%

17%

17%

6%

2007

2008

2009

2010

2011

2012

2013

211,800

191,900

218,900

299,200

280,800

329,900

386,600

1,786,900

1,910,000

2,029,500

2,100,300

2,240,100

2,410,000

2,622,700

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2007 to 2013

MAT

The growth of this business in both General Takaful and Insurance

markets has been more volatile than for Motor and Fire.

1,600,000

2%

5%

10%

1,400,000

1%

10%

1%

RM'000

1,200,000

1,000,000

800,000

600,000

400,000

200,000

30%

0

GeneralTakaful(RM'000)

ConventionalGeneralInsurance

(RM'000)

3%

67%

28%

23%

44%

2007

2008

2009

2010

2011

2012

2013

36,400

47,200

48,600

81,400

104,200

80,400

44,700

1,186,200

1,179,500

1,168,600

1,283,600

1,412,500

1,478,500

1,451,800

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2007 to 2013

8/25/2014

CAR & ENG

The conventional market has been growing consistently except in

2010 as opposed to the Takaful market which has been more

volatile.

700,000

6%

600,000

16%

RM'000

500,000

25%

1%

6%

5%

400,000

300,000

200,000

124%

100,000

27%

28%

38%

14%

50%

2007

2008

2009

2010

2011

2012

2013

GeneralTakaful(RM'000)

43,700

55,600

34,400

44,000

98,600

49,500

56,200

ConventionalGeneralInsurance(RM'000)

385,600

407,500

410,700

391,700

488,200

567,600

601,700

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2007 to 2013

PA & MEDICAL

PA & Medical Takaful business has grown significantly since 2011;

its growth continues to outperform the conventional market, except

in 2010.

2,500,000

5%

5%

14%

2,000,000

RM'000

12%

1,500,000

1,000,000

500,000

2%

0

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

15%

15%

22%

2009

2010

2011

2012

2013

117,000

118,900

136,700

157,000

191,200

1,523,200

1,699,300

1,930,100

2,030,100

2,129,400

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2009 to 2013

8/25/2014

WC & EL

The WC & EL business in the conventional market has been

growing steadily, whilst the Takaful market has had mixed success,

barely having grown from 2009 to 2013.

250,000

14%

20%

200,000

8%

RM'000

8%

150,000

100,000

50,000

2009

GeneralTakaful(RM'000)

ConventionalGeneralInsurance

(RM'000)

19%

12%

7%

32%

2010

2011

2012

2013

9,100

7,400

8,300

7,700

10,200

146,200

158,500

170,500

204,700

232,400

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2009 to 2013

LIABILITY

The growth in Liability Takaful business outpaced that of the

conventional market except in 2012.

500,000

0%

12%

450,000

9%

400,000

2%

RM'000

350,000

300,000

250,000

200,000

150,000

100,000

19%

50,000

0

2009

2010

21%

2011

21%

2012

28%

2013

GeneralTakaful(RM'000)

22,700

27,000

32,700

25,700

33,000

ConventionalGeneralInsurance(RM'000)

374,900

381,000

414,100

465,000

464,000

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2009 to 2013

8/25/2014

OTHERS

This consists of all other classes of business such as Bonds, All

Risks, Machinery & Equipment, Fidelity Guarantee and Burglary. Both

the conventional and Takaful markets are consistently growing over

the years except in 2011 for conventional and in 2012 for Takaful.

800,000

12%

700,000

9%

2%

4%

RM'000

600,000

500,000

400,000

300,000

200,000

100,000

0

16%

15%

0%

2%

2009

2010

2011

2012

2013

GeneralTakaful(RM'000)

45,300

52,400

60,200

60,200

61,500

ConventionalGeneralInsurance(RM'000)

623,900

648,100

632,200

690,800

771,700

GeneralTakaful(RM'000)

ConventionalGeneralInsurance(RM'000)

Source: Bank Negara Malaysia Annual Insurance/Takaful Statistics, Financial Years 2009 to 2013

General Insurance and Takaful Industry Market Trends in Malaysia

DISTRIBUTION CHANNEL

8/25/2014

DISTRIBUTION CHANNEL

Depends on each companys business profile.

Companies that focus on writing Motor business

would depend heavily on their agency force.

Companies that focus on commercial risk would rely

on their brokers.

Banca tied-up companies would depend on their

banca partner to distribute their products e.g. via

DMTM.

NUMBER OF AGENTS

CAGRfrom2007

to2013

NumberofGeneralInsuranceandTakafulAgentsinMalaysia

80,000

GeneralTakaful

70,000

NumberofAgents

60,000

48%

50,000

22%

47%

49%

48%

29%

34%

40,000

10%

30,000

78%

71%

52%

53%

51%

52%

66%

GeneralTakaful

2007

10,856

2008

15,975

2009

32,997

2010

31,391

2011

33,970

2012

37,543

2013

18,820

ConventionalGeneralInsurance

39,165

38,766

35,930

35,236

35,609

35,354

36,374

20,000

10,000

0

ConventionalGeneralInsurance

Conventional

GeneralInsurance

-1%

GeneralTakaful

Source: Actuarial Partners analysis of Takaful and Insurance Statistics by Bank Negara Malaysia

8/25/2014

General Insurance and Takaful Industry Market Trends in Malaysia

REGULATIONS AND

GUIDELINES

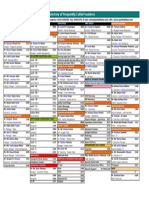

GENERAL INSURANCE / TAKAFUL

Jan

1992

1st Jan1992

Guidelineson

Accountingfor

InsuranceBusiness

Dec

1993

31st Dec1993

Guidelineson

Mathematical

EstimationofIBNR

ClaimsProvision

August

2003

1st August2003

GuidelinesonMedical

andHealthInsurance

Business

&

MinimumStandardon

ProductDisclosure

andTransparencyin

theSaleofMedical

andHealthInsurance

Policies

Jan

2004

31st Jan2004

MinimumStandard

onProduct

Disclosureand

Transparencyin

Marketingof

MedicalandHealth

TakafulPlans

10

8/25/2014

GENERAL INSURANCE / TAKAFUL

Dec

2004

9th Dec2004Test

ExerciseonDraft

Guidelineson

ReservingforGeneral

InsuranceBusiness

Dec

2004

15th Dec2004

ConceptPaperofthe

RiskBasedCapital

Frameworkfor

Insurers

Jan

2006

1st January2006

GuidelinesonMedical

andHealthInsurance

Business(Revised)

&

Hospitalisation&

SurgicalInsurance

(HSI)Underwriting

Guide

Jan

2008

2nd January2008

Guidelineson

MedicalandHealth

TakafulBusiness

GENERAL INSURANCE / TAKAFUL

Dec

2008

1st Dec2008

GuidelinesonStress

TestingforInsurers

&

GuidelinesonStress

TestingforTakaful

Operators

Jan

2009

Jan

2010

1st January2009

RiskBasedCapital

(RBC)Frameworkfor

Insurerswithparallel

calculationinApril

2007

1st January2010

Guidelineson

Product

Transparencyand

Disclosure

Sept

2010

September2010

Guidelineson

Introductionof

NewProductsfor

Insurance

Companiesand

TakafulOperators

11

8/25/2014

GENERAL INSURANCE / TAKAFUL

May

2011

July

2011

1st May2011

1st July2011

TemporaryMeasure

Guidelineson

ontheCapital

ValuationBasisfor

Requirementsforthe LiabilitiesofGeneral

MalaysianMotor

TakafulBusiness

InsurancePool

&

(MMIP)Liabilities

Guidelineson

undertheRiskBased FinancialReporting

CapitalFrameworkfor forTakafulOperators

Insurers

Jan

2012

1st January2012

Guidelineson

TakafulOperational

Framework

&

Guidelineson

FinancialReporting

forInsurers

Sept

2012

1st Sept2012

Guidelineson

InternalCapital

Adequacy

Assessment

Process(ICAAP)for

Insurers

GENERAL INSURANCE / TAKAFUL

June

2013

June

2013

7th June2013 30th June2013

AppointedActuary:

FinancialServicesAct

Appointmentand

2013(exceptsection

DutiesConceptPaper 129andSchedule9)

&

IslamicFinancial

ServicesAct2013

(exceptparagraphs1

to10ofSchedule9

andparagraphs13to

19ofSchedule9)

Jan

2014

1st January2014

RiskBasedCapital

(RBC)Framework

forTakaful

Operators

April

2014

28th April2014

AppointedActuary:

Appointmentand

DutiesGuidelines

12

8/25/2014

General Insurance and Takaful Industry Market Trends in Malaysia

FINANCIAL SERVICES ACT /

ISLAMIC FINANCIAL SERVICES

ACT 2013 (FSA / IFSA 2013)

FSA/IFSA 2013

SCOPE OF APPLICABILITY

Appliestoall

Banksand

Insurers/Takaful

Operatorsin

Malaysia

Includes

reinsurers/

retakafulplayers

Includesthose

inLabuan,

Malaysia

13

8/25/2014

FSA/IFSA 2013

IMPLICATIONS

1.RequirementtosplittheLife/Familyand

GeneralInsurance/Takafulbusinesses

Likely to see a number of M&A activities in the next few

years.

Currently RM100 million paidup capital is required for

each company, even for composite company that writes

both General and Life / Family businesses.

From July 2018 onwards, splitting would mean a

separate capital requirement for each entity, where a

composite company would need RM200 million capital

to support its General and Life / Family businesses.

FSA/IFSA 2013

IMPLICATIONS

2.Requirementtosetupaholding

company

Enable insurer / TO access to money from holding

company.

Capital requirements of insurance subsidiaries outside

Malaysia potentially at least as large/strong as Malaysia.

Potentially challenging to be competitive in other markets

with weaker capital requirements compared to other local

players.

Impact on group capital requirements, corporate

governance, risk management standards etc.

14

8/25/2014

FSA/IFSA

IMPLICATIONS

3.IncreasedonusonBoardofDirectors

Criminal offence punishments; i.e. imprisonment up to

8 years or fine up to RM25 million.

Policyholders interest is prioritized when in conflict

with shareholders interest.

General Insurance and Takaful Industry Market Trends in Malaysia

APPOINTED ACTUARY:

APPOINTMENT AND DUTIES

15

8/25/2014

BACKGROUND

The current statutory role of an Actuary in the General Insurance

/ Takaful industry is limited to reserving / valuation work with

minimal pricing work on Medical products only.

General / Casualty / Non-Life Actuary is given the title Signing

Actuary (SA) as compared to Life / Family Actuarys Appointed

Actuary (AA).

The current practice is that most companies would engage

external consultants as their SA, due to the limited number of

General Actuaries in the market (i.e. around 15 qualified General

Actuaries in Malaysia).

AA: APPOINTMENT AND DUTIES

The Concept Paper was issued on 7th June 2013 for comments

from the industry, and was finalized on 28th April 2014.

This new guideline aims to create a level playing field for

Actuaries in both the General and Family industry where the

General Actuaries would be required to perform the same roles

as the Family Actuaries, which encompass valuation,

preparation of the companys Financial Condition Report

(FCR) and providing recommendations on surplus

distribution.

The AA will also need to provide an opinion on pricing matters

(e.g. appropriateness of assumptions and adequacy of buffers in

premiums). However, the AA will not assume accountability for

product pricing. Hence, this implies the need for a separate

Pricing Actuary role. This is to reduce conflicts of interest and

enhance the objectivity and independence of the role of an AA.

As a result, one company would need to hire 2 Actuaries.

16

8/25/2014

AA: APPOINTMENT AND DUTIES

In addition, the AA role will be restricted to in-house only (instead

of using external consultant). However, in the short-term, BNM

may grant an exemption under exceptional circumstances.

At the moment, there are around 15 qualified General Actuaries

in Malaysia to support 23 General insurers and 8 General

Takaful Operators.

Given the current limited number of qualified General Actuaries

in Malaysia, the General Insurance and Takaful companies

would need to start setting up and enhance their own in-house

actuarial teams, and groom them up for the AA and Pricing

Actuary roles in the future.

APPOINTMENT AND DUTIES

The following time frame has been set by BNM for General insurers

and Takaful Operators to fully comply to the following requirements

of the guidelines:

By 1 January 2015

The AA must prepare the FCR and be responsible for engaging

the Board and senior management in communicating the key

analyses of the FCR.

By 1 January 2017

The AA must be an in-house Actuary. Also, he/she must readily

investigate and provide an opinion on matters related to

product pricing.

17

8/25/2014

General Insurance and Takaful Industry Market Trends in Malaysia

CHALLENGES AND

OPPORTUNITIES

CHALLENGES AND OPPORTUNITIES

MOTOR

Problemarises

whenrateis

Tariff

(underpriced)

MalaysiaTakaful

experience to

refrain

Recentproposal

istoincludeall

GeneralTOsinto

MMIPtogether

withthe

conventional

insurers

Provides

volumetocover

overheads

Compulsory

cover

18

8/25/2014

CHALLENGES AND OPPORTUNITIES

DE-TARIFFING MOTOR

In 2011, BNM issued a New Motor Cover Framework which paved

the way for de-tariffing of the Motor business. Under this

Framework, the Act component of the Tariff rate is revised upwards

every year from 2012 onwards leading up to the de-tariffing in 2016.

2014 marks the third year of the premium revision with an average

premium increase of around 10% to 15% p.a.

However, it is still not clear how the Motor pricing structure would

look like once de-tariffing comes into effect in 2016:

Will the revised Act rates still serve as the minimum / floor

rates?

Would NCD still be applied to the total Act and Non-Act

premiums? Still maintain the current structure of maximum

55%? Will we even have / need an Act and Non-Act split?

How about the loadings structure? Would it be made the

same for Comprehensive and Third Party covers? What limits

would be imposed on loadings or discounts?

CHALLENGES AND OPPORTUNITIES

DE-TARIFFING FIRE

Fire class is also expected to be de-tariffed in 2016.

De-tariffing would have an impact on the Fire rates, especially in

the case of the Houseowner and Householders policies which are

strictly based on tariff rate.

Given the current low loss ratio of the Fire business, the

expectation is that the loss ratio for Fire class will deteriorate upon

de-tariffing due to competition.

19

8/25/2014

CHALLENGES AND OPPORTUNITIES

DE-TARIFFING: FIRE AND MOTOR

Upon de-tariffing of the Fire and Motor businesses in 2016, the

premium rates are expected to:

Go down for Fire business due to steep competition which would

result in an increase / deterioration in the Fire loss ratio.

Go up for Motor business which would result in an improvement to

the Motor loss ratio from the current loss making or breakeven

position. Nonetheless, as the market gets more competitive, there

is a possibility of rate undercutting which would push the loss ratio

up before it stabilizes as the market becomes more disciplined.

Hence, we expect that the de-tariffing would result in an increase to

the Houseowner Takaful loss ratio while Motor loss ratio would

improve over time.

CHALLENGES AND OPPORTUNITIES

SHARIAH-COMPLIANT MMIP ISSUES AND CHALLENGES

HowtomakeitShariahcompliant?

ThefutureofMMIPwhende

tariffingcomesintoeffectin2016?

Cantseemtoagreeonthebasisof

sharing?

20

8/25/2014

CHALLENGES AND OPPORTUNITIES

MOTOR REINSURANCE/RETAKAFUL

Reinsurance / Retakaful arrangement for Motor is mainly on an

Excess-of-Loss (XOL) cover.

With RBC / RBCT implementation and current rate still under Tariff,

more and more insurers / TOs are taking up Quota-Share (QS)

arrangement for capital relief.

As a matter of fact, the reinsurers / retakaful operators who are

offering such QS cover are multinationals and foreign companies.

This implies that there are underlying profits in the Motor business.

Furthermore, this would change the net-to-gross or retention ratio

of Motor business in the future.

CHALLENGES AND OPPORTUNITIES

DE-TARIFFING PRICING IS AN ITERATIVE PROCESS

Insurance / Takaful companies that have already begun the

pricing exercise will be able to identify and target the more

profitable sectors.

But technical pricing based on a certain set of assumptions prede-tariffing may not hold once the landscape changes.

Market leaders need to be able to react to changes in the market,

be it to prevent anti-selection or to gain market share.

Followers may end up with undesirable risks.

21

8/25/2014

syuhada.nurazmi@actuarialpartners.com

Q&A

22

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Motor Private Car ENGDocument4 pagesMotor Private Car ENGascap77No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Package - Financing AnalysisDocument2 pagesPackage - Financing Analysisascap77No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Package Facilities - Financial RatiosDocument4 pagesPackage Facilities - Financial Ratiosascap77No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Package Facilities - Financial RatiosDocument4 pagesPackage Facilities - Financial Ratiosascap77No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Nursing Diagnosis TemplateDocument6 pagesNursing Diagnosis Templatesdk6972No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- MLS 321 Aubf M6u2 Other Metabolic Diseases V2122Document7 pagesMLS 321 Aubf M6u2 Other Metabolic Diseases V2122proximusNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- PERSONS Finals Reviewer Chi 0809Document153 pagesPERSONS Finals Reviewer Chi 0809Erika Angela GalceranNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Stress and FilipinosDocument28 pagesStress and FilipinosDaniel John Arboleda100% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- HVDC BasicDocument36 pagesHVDC BasicAshok KumarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Board Review Endocrinology A. ApiradeeDocument47 pagesBoard Review Endocrinology A. ApiradeePiyasak NaumnaNo ratings yet

- Cipac MT 185Document2 pagesCipac MT 185Chemist İnançNo ratings yet

- Health 6 Q 4 WK 6 Module 6 Version 4Document16 pagesHealth 6 Q 4 WK 6 Module 6 Version 4Kassandra BayogosNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 10059-DC-K-01-A Design BasisDocument34 pages10059-DC-K-01-A Design BasisAnonymous RvIgDUNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Operating Instructions: Katflow 100Document52 pagesOperating Instructions: Katflow 100Nithin KannanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- SM RSJ 420 800Document77 pagesSM RSJ 420 800elshan_asgarovNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDocument1 pageDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoNo ratings yet

- The Secret of The House WTDocument22 pagesThe Secret of The House WTPetr -50% (2)

- Jairo Garzon 1016001932 G900003 1580 Task4Document12 pagesJairo Garzon 1016001932 G900003 1580 Task4Jairo Garzon santanaNo ratings yet

- Cot 1 Vital SignsDocument22 pagesCot 1 Vital Signscristine g. magatNo ratings yet

- Journalize The Following Transactions in The Journal Page Below. Add Explanations For The Transactions and Leave A Space Between EachDocument3 pagesJournalize The Following Transactions in The Journal Page Below. Add Explanations For The Transactions and Leave A Space Between EachTurkan Amirova100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Indonesia Organic Farming 2011 - IndonesiaDOCDocument18 pagesIndonesia Organic Farming 2011 - IndonesiaDOCJamal BakarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- XDocument266 pagesXTrần Thanh PhongNo ratings yet

- BIRADS Lexicon and Its Histopathological Corroboration in The Diagnosis of Breast LesionsDocument7 pagesBIRADS Lexicon and Its Histopathological Corroboration in The Diagnosis of Breast LesionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- EcoLettsandSOM, Dulvy Et Al 2004Document25 pagesEcoLettsandSOM, Dulvy Et Al 2004Nestor TorresNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Poverty and Crime PDFDocument17 pagesPoverty and Crime PDFLudwigNo ratings yet

- Cap 716 PDFDocument150 pagesCap 716 PDFjanhaviNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetRaheel Neo AhmadNo ratings yet

- PT6 Training ManualDocument64 pagesPT6 Training ManualAnderson Guimarães100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Dip Obst (SA) Past Papers - 2020 1st Semester 1-6-2023Document1 pageDip Obst (SA) Past Papers - 2020 1st Semester 1-6-2023Neo Latoya MadunaNo ratings yet

- Theories of Motivation and Child Moral DevelopmentDocument5 pagesTheories of Motivation and Child Moral DevelopmentPamela mirandaNo ratings yet

- Family MedicineDocument156 pagesFamily MedicinedtriggNo ratings yet

- MEDICO-LEGAL ASPECTS OF ASPHYXIADocument76 pagesMEDICO-LEGAL ASPECTS OF ASPHYXIAAl Giorgio SyNo ratings yet

- Analisis Dampak Reklamasi Teluk Banten Terhadap Kondisi Lingkungan Dan Sosial EkonomiDocument10 pagesAnalisis Dampak Reklamasi Teluk Banten Terhadap Kondisi Lingkungan Dan Sosial EkonomiSYIFA ABIYU SAGITA 08211840000099No ratings yet

- BOF, LF & CasterDocument14 pagesBOF, LF & CastermaklesurrahmanNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)