Professional Documents

Culture Documents

Chapter 3a

Uploaded by

ObeydullahKhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3a

Uploaded by

ObeydullahKhanCopyright:

Available Formats

3/31/2015

MS-291: Engineering Economy

(3 Credit Hours)

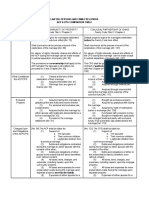

Pervious Lecture!!!

3/31/2015

Single payment Factors

F=?

F/P Factor

F= P(F/P, i%, n)

n and i is given

P is given

P/F Factor

P =?

P= F(P/F, i%, n)

n and i is given

F = given

Uniform Series Factors

P/A Factor

P = A(P/A, i%, n)

A/P Factor

A = P(A/P, i%, n)

F/A Factor

F = A(F/A, i%, n)

A/F Factor

A = F(A/F, i%, n)

3/31/2015

Athematic Gradient

FG = ?

F = PT(F/P, i%, n)

or

PA = A(P/A, i%, n)

PG = G(P/G, i%, n)

1 (1 + ) 1

Athematic Gradient

A = PT(A/P, i%, n)

or

AT =

PA = A(P/A, i%, n)

PG = G(P/G, i%, n)

AA

AG

AA = A (Annual Worth) &

AG = G(A/G, i, n)

(1 + ) 1

3/31/2015

Geometric Gradient

Fg = ?

Pg = ?

for g i:

=

1+

1 1+

F = Pg(F/P, i%, n)

Similarly

for g = i:

=

1+

A = Pg(A/P, i%, n)

Chapter 3

Combining Factors

and Spreadsheet

Functions

Engineering Economy

3/31/2015

This Chapter Objectives

1. Shifted uniform series

2. Shifted series and single cash flows

3. Shifted gradients

Example

P=?

P3 = ?

10

11

12

13

Year

A = $50

How can we get Present worth of this series ?

Use the P/F factor to find the present worth of each disbursement at year 0 and add

them.

Use the F/P factor to find the future worth of each disbursement in year 13, add

them, and then find the present worth of the total, using P/F= F( P/F, i ,13).

Use the F/A factor to find the future amount F/A =A( F/A, i ,10), and then compute

the present worth, using P/F=F(P/F, i ,13).

Use the P/A factor to compute the present worth P3 =A( P/A , i ,10) (which will be

located in year 3, not year 0), and then find the present worth in year 0 by using the

(P/F , i ,3) factor.

3/31/2015

Shifted Uniform Series

Typically the last method is used for calculating the present worth

of a uniform series that does not begin at the end of period 1.

Note that a P value is always located 1 year or period prior to the

beginning of the first series amount. Why? Because the P/A factor

was derived with P in time period 0 and A beginning at the end of

period 1.

The most common mistake made in working problems of this type

is improper placement of P .

Remember:

When using P/A or A/P factor, PA is always one year ahead of first A

When using F/A or A/F factor, FA is in same year as last A

The number of periods n in the P/A or F/A factor is equal to the number of uniform

series values

P3 = ?

PA is always one year ahead

of first A

4

10

11

12

13

Year

A = $50

F=?

FA is in same year as last A

0

A = $50

The number of periods n in the P/A or

F/A factor is equal to the number of

uniform series values

10

11

12

13

Year

3/31/2015

Steps for applying factors to

Shifted Cash Flows

1. Draw a diagram of the positive and negative cash flows.

2. Locate the present worth or future worth of each series on

the cash flow diagram.

3. Determine n for each series by renumbering the cash flow

diagram.

4. Draw another cash flow diagram representing the desired

equivalent cash flow. (Optional)

5. Set up and solve the equations.

Example

The offshore design group at Bechtel just purchased

upgraded CAD software for $5000 now and annual

payments of $500 per year for 6 years starting 3 years

from now for annual upgrades. What is the present

worth in year 0 of the payments if the interest rate is

8% per year?

Solution 1. Draw a diagram of the positive and negative cash flows.

PT = ?

2. Locate the present

worth or future worth of

each series on the cash

PA = ?

PA = ?

i= 8% per year

flow diagram.

6

7 8 Year

4 5

3

0 1

2

2 3

n

0 1

4

6

5

A = $500

P0 = $5000

3. Determine n for each

series by renumbering the

cash flow diagram.

3/31/2015

P' A = $500( P /A ,8%,6)

5. Set up

and solve

the

equations.

P = P' ( P /F ,8%, 2)

P = $500( P /A ,8%,6) ( P /F ,8%, 2)

A

PT = P0 + PA

=5000 + 500( P /A ,8%,6)( P / F ,8%,2)

=5000 +500(4.6229)(0.8573)

$6981.60

Class Practice 5 Minutes Time

Calculate the present worth of the cash flow shown below at i = 10%

i = 10%

0

Actual year

A = $10,000

10%

Single Payments

Uniform Series Factors

Compoun

d Amount

(F/P)

Present

Worth

(P/F)

Sinking

Fund

(A/F)

Compound Capital

Amount

Recovery

(F/A)

(A/P)

Present

Worth

(P/A)

1.1000

0.9091

1.00000 1.0000

1.10000

0.9091

1.6105

0.6209

0.16380 6.1051

0.26380

3.7908

3/31/2015

Class Practice 5 Minutes Time

Calculate the present worth of the cash flow shown below at i = 10%

PT = ?

i = 10%

PA = ?

0

Actual year

Series year

A = $10,000

Solution

(1) Use P/A factor with n = 5 (for 5 arrows) to get PA in year 1

---- A(P/A,10%, 5)

(2) Use P/F factor with n = 1 to move PA back for PT in year 0

---- (P/F,10%, 1)

PT = A(P/A,10%, 5) (P/F,10%,1)

= 10,000(3.7908)(0.9091)

$34462

Shifted Series and Random

Single Amounts

For cash flows that include uniform series and randomly placed

single amounts:

Uniform series procedures are applied to the series amounts

Single amount formulas are applied to the one-time cash flows

The resulting values are then combined per the problem statement

3/31/2015

Example

Find the present worth in year 0 for the cash flows shown using an interest

rate of 10% per year.

i = 10%

0

10

A = $5000

Solution:

$2000

PT = ?

0

i = 10%

1

Actual year

8

6

10

Series year

A = $5000

$2000

Find the cash flows both positive and negatives

Locate the present worth/ future worth

Determine the n by re-numbering the cash flows series

Uniform series procedures are applied to the series amounts. Single amount

formulas are applied to the one-time cash flows

The resulting values are then combined per the problem statement

Example:

PA = ?

Use P/A to get PA in year 2: PA = 5000(P/A,10%,8) = 5000(5.3349) = $26,675

Move PA back to year 0 using P/F: P0 = 26,675(P/F,10%,2) = 26,675(0.8264) = $22,044

Move $2000 single amount back to year 0: P2000 = 2000(P/F,10%,8) = 2000(0.4665) = $933

Now, add P0 and P2000 to get PT: PT = 22,044 + 933 = $22,977

3/31/2015

Class Practice: 8 Minutes

An engineering company lease the mineral rights to a mining

company on its land. The engineering company makes a

proposal to the mining company that it pay $20,000 per year for

20 years beginning 1 year from now, plus $10,000 six years from

now and $15,000 sixteen years from now. If the mining company

wants to pay off its lease immediately, how much should it pay

now if the investment is to make 16% per year?

Single Payments

16%

Uniform Series Factors

Compound

Amount (F/P)

Present Worth

(P/F)

Capital

Recovery (A/P)

Present Worth

(P/A)

2.4364

0.4104

0.27139

3.6847

2.8262

0.3538

0.24761

4.0386

16

10.7480

0.0930

0.17641

5.6685

17

12.4677

0.0802

0.17395

5.7487

20

19.4608

0.0514

0.16867

5.9228

Solution

P=?

$15,000

$10,000

A =$20,000

16

17

18

19

20

P = 20,000(P/A ,16%,20)+

10,000( P /F ,16%,6) +

15,000(P/F,16%,16)

P = $20,000(5.9288)+ $ 10,000( 0.4104) + $ 15,000(0.0930)

= $124,075

3/31/2015

Shifted Gradient Series

We already learnt how to get P (Present

value) or A ( Annuity or a Uniform series)

from a Gradient Series

We will now discuss how to calculate P or

A from Shifted Gradient Series a

gradient series not starting from year 1.

P from Shifted Gradient Series

P from Normal Arithmetic Gradient Series

Shifted Arithmetic gradient Series

PT = ?

PA = A(P/A, i%, n)

PG = G(P/G, i%, n)

PA = ?

PG = ?

Shifted gradient begins at a

time other than between periods

1 and 2

Must use multiple factors to find PT

in actual year 0

PG = ?

Present worth PG is located 2

periods before gradient starts

P T =P A +P G

=100(P/A , i ,8) + 50(P/G, i ,5)(P/F, i ,3)

3/31/2015

What will be the procedure for calculating P from

Shifted Geometric Gradient Series?

Lets discuss it directly from a Numerical Example

Example:

Shifted Geometric Gradient

Weirton Steel signed a 5-year contract to purchase water treatment chemicals from a

local distributor for $7000 per year. When the contract ends, the cost of the chemicals is

expected to increase by 12% per year for the next 8 years. If an initial investment in

storage tanks is $35,000, determine the equivalent present worth in year 0 of all of the

cash flows at i = 15% per year.

Pg = ?

PT = ?

0 1

3 4

5 6 7 8

0

$7000

i =15% per year

1 2 3

9 10 11 12 13

4

5 6

7 8

$7840

$35000

$17331

12% increase

per year

Year

Geometric

Gradient n

3/31/2015

P from Shifted Gradient Series

PT = 35,000 + A ( P /A ,15%, 4) + A1 ( P/A ,12%,15%,9) (P/F ,15%,4)

PT = 35,000 + 7000 ( 2.8550) + 7000

$83,232

.

.

(0.5718)

A from Shifted Gradient Series

Shifted gradient Series

A (Annuity or Uniform Series)

To calculate A for shifted Gradient Series (Arithmetic or

Geometric), there are several possibilities.

The easiest way (and recommended also) is to get the P of

shifted Gradient Series first (procedure just explained in pervious slides) then

use A/P factor to get A for the shifted gradient series

A, for above example will be: A = PT (A/PT, i%, n),

where PT refers to the present value of the shifted gradient series that procedure is

already explained on pervious slide.

3/31/2015

Important Points for P and A

of Shifted Gradient Series

Must use multiple factors to find P in actual year 0, for shifted

gradient series

The present worth (P) of an arithmetic gradient will always be

located two periods before the gradient starts.

To find the equivalent A series of a shifted gradient through

all the n periods, first find the present worth of the gradient at

actual time 0, then apply the (A/P, i, n) factor.

F from gradient series can also be find by first calculating P

and then using F/P factor

Example: Shifted Arithmetic

Gradient

John Deere expects the cost of a tractor part to increase by $5 per year beginning 4 years from

now. If the cost in years 1-3 is $60, determine the present worth in year 0 of the cost through year

10 at an interest rate of 12% per year.

P2 = ? i = 12%

PT = ?

0

0

60

60

Actual years

10

Gradient years

60

65

70

G=5

Solution:

95

First find P2 for G = $5 and base amount ($60) in actual year 2

P2 = 60(P/A,12%,8) + 5(P/G,12%,8) = $370.41

Next, move P2 back to year 0

P0 = P2(P/F,12%,2) = $295.29

Next, find PA for the $60 amounts of years 1 and 2

Finally, add P0 and PA to get PT in year 0

PA = 60(P/A,12%,2) = $101.41

PT = P0 + PA = $396.70

3/31/2015

Class Question.. 5 minutes

For the cash flows shown, find the future value in year 7 at i = 10% per year

PG

PG = ?

Set up the

equations

only

F=?

i = 10%

1

0

600

700

5

4

550

6

5

500

Actual years

7

6

Gradient years

450

650

G = $-50

Solution:

PG is located in gradient year 0 (actual year 1); base amount of $700 is in gradient years 1-6

PG = A(P/A,10%,6) G(P/G,10%,6)

PG = 700(P/A,10%,6) 50(P/G,10%,6) = 700(4.3553) 50(9.6842) = $2565

PG= PG(F/P,10%,1) = 2565(0.9091) = $2331.84

F = PG(F/P,10%,7) = 2331.84(1.9487) = $4544

Method 1

F = PG(F/P,10%,6) = 2565(1.7716) = $4544

Method 2

Using Single Amount factors (Correct

but not Standard methods)

Method 3

Method 4

3/31/2015

THANK YOU

You might also like

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- Chapter 3-Combining Factors and Spread Sheet Functions - 0Document22 pagesChapter 3-Combining Factors and Spread Sheet Functions - 0dalbaas100% (1)

- Factors: How Time and Interest Affect Money: FoundationsDocument64 pagesFactors: How Time and Interest Affect Money: FoundationsangelicastefanieNo ratings yet

- Combining FactorsDocument34 pagesCombining FactorsOrangeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Pe Civil Cost Analysis Fall 2012Document67 pagesPe Civil Cost Analysis Fall 2012Anonymous PkeI8e84Rs100% (1)

- Review CH - 02 AnnuityDocument30 pagesReview CH - 02 AnnuityNelson Cabingas100% (1)

- Week 4 PDFDocument23 pagesWeek 4 PDFKHAKSARNo ratings yet

- Emgt6225 M2Document80 pagesEmgt6225 M2Vatsal PrakashNo ratings yet

- CHPTR 3Document33 pagesCHPTR 3KenDaniswaraNo ratings yet

- Chap. 3Document20 pagesChap. 3Khuram MaqsoodNo ratings yet

- Lecture 8Document37 pagesLecture 8Muhammad UsmanNo ratings yet

- MEC210 - Lecture 05 - 241Document25 pagesMEC210 - Lecture 05 - 241Mina NasserNo ratings yet

- Chapter 4 (Part2)Document49 pagesChapter 4 (Part2)Aidi RedzaNo ratings yet

- GEN331 - Lecture 04 - 232Document38 pagesGEN331 - Lecture 04 - 232Omar ShrefNo ratings yet

- 5.1 Usage of Compound Interest Tables. Feb 8-12 - 1Document11 pages5.1 Usage of Compound Interest Tables. Feb 8-12 - 1John GarciaNo ratings yet

- Solutions Avec Chapitre 3: $3.1 For Bank ADocument8 pagesSolutions Avec Chapitre 3: $3.1 For Bank AazizhaggarNo ratings yet

- Chapter 2Document13 pagesChapter 2ObeydullahKhanNo ratings yet

- Inde 232 Chapter 2Document44 pagesInde 232 Chapter 2Abdullah AfefNo ratings yet

- Lecture No. 2 Factors: How Time and Interest Affect Money 1. Single Payment FactorsDocument11 pagesLecture No. 2 Factors: How Time and Interest Affect Money 1. Single Payment FactorsBeverly PamanNo ratings yet

- Solution Assigment Chapter 5Document11 pagesSolution Assigment Chapter 5Hoang Thao NhiNo ratings yet

- Lecture No. 3 Combining Factors Shifted Uniform SeriesDocument4 pagesLecture No. 3 Combining Factors Shifted Uniform Seriesangry_birdNo ratings yet

- AMortizationDocument17 pagesAMortizationdela rosaNo ratings yet

- W2-3 - Ch3 Combining FactorsDocument27 pagesW2-3 - Ch3 Combining FactorsSafwan KamaruzzamanNo ratings yet

- Tugas 1Document12 pagesTugas 1Nursafitri Ruchyat MarioenNo ratings yet

- CH 2 FactorsDocument11 pagesCH 2 FactorsRashadafanehNo ratings yet

- Chapter 3 - Combining Factors: Reminder ReminderDocument5 pagesChapter 3 - Combining Factors: Reminder ReminderLê Thanh TùngNo ratings yet

- Engineering Economic Lecture 3Document32 pagesEngineering Economic Lecture 3omar meroNo ratings yet

- Chapter 2 - Factors, Effect of Time & Interest On MoneyDocument33 pagesChapter 2 - Factors, Effect of Time & Interest On MoneyAsif HameedNo ratings yet

- IV. Combining FactorsDocument7 pagesIV. Combining FactorsKevin Giovani TanotoNo ratings yet

- GE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1Document14 pagesGE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1John ZhaoNo ratings yet

- Engineering Economy: Name: Hernandez, Arvin D. CH040 - C11Document5 pagesEngineering Economy: Name: Hernandez, Arvin D. CH040 - C11Patricia DavidNo ratings yet

- Chapter 2 BDocument29 pagesChapter 2 BKenDaniswaraNo ratings yet

- EE - Assignment Chapter 5 SolutionDocument10 pagesEE - Assignment Chapter 5 SolutionXuân ThànhNo ratings yet

- Advanced Engineering Economics: Combining FactorsDocument19 pagesAdvanced Engineering Economics: Combining FactorsA GlaumNo ratings yet

- Engineering Economics Exercises - SolutionsDocument4 pagesEngineering Economics Exercises - SolutionsMehmet ZirekNo ratings yet

- 03 Combining FactorsDocument25 pages03 Combining Factors王泓鈞No ratings yet

- MEC210 - Lecture 06 - 241Document28 pagesMEC210 - Lecture 06 - 241Mina NasserNo ratings yet

- Engineering EconomyDocument15 pagesEngineering Economyjm1310% (1)

- Chapter 2 Factors: How Time and Interest Affect MoneyDocument40 pagesChapter 2 Factors: How Time and Interest Affect Moneyaziziakira93No ratings yet

- Exercise 1 Chapter 2Document3 pagesExercise 1 Chapter 2Ain Fatihah AzlanNo ratings yet

- D076288233Document20 pagesD076288233Sulaim Al KautsarNo ratings yet

- Chapter6E2010 PDFDocument12 pagesChapter6E2010 PDFutcm77No ratings yet

- 394 Tutorial 2Document26 pages394 Tutorial 2You And usNo ratings yet

- EE - L12 Annual Equivalent AmountDocument22 pagesEE - L12 Annual Equivalent AmountshashwatNo ratings yet

- Topic: Time Value of Money: BY Kajal VipaniDocument50 pagesTopic: Time Value of Money: BY Kajal VipaniAakarshak nandwaniNo ratings yet

- Engineering Economy Umak: Time Value of MoneyDocument26 pagesEngineering Economy Umak: Time Value of MoneyTangina DenNo ratings yet

- Basics of Engineering Economy - Every - Third - SolutionDocument75 pagesBasics of Engineering Economy - Every - Third - SolutionTrolldaddy82% (11)

- Chapter 4Document8 pagesChapter 4ObeydullahKhanNo ratings yet

- 1 - Solution 2013Document10 pages1 - Solution 2013Yamer YusufNo ratings yet

- Engineering EconomicsDocument24 pagesEngineering EconomicsSurya Prakash Reddy PutluruNo ratings yet

- Engineering Economic AnalysisDocument70 pagesEngineering Economic AnalysisRasmya NazzalNo ratings yet

- Notes in Engineering EconomyDocument6 pagesNotes in Engineering EconomyAlbert Lapinid SucalipNo ratings yet

- Engineering Economy IE307: Combining FactorsDocument10 pagesEngineering Economy IE307: Combining FactorsMansor MajbriNo ratings yet

- Decision Criteria Formula DerivationDocument9 pagesDecision Criteria Formula Derivationabu tonNo ratings yet

- Lecture 2 - How Time and Interest Affect MoneyDocument50 pagesLecture 2 - How Time and Interest Affect MoneyDanar AdityaNo ratings yet

- Lecture 3 2016 - RamzanDocument21 pagesLecture 3 2016 - RamzanQed VioNo ratings yet

- Abdullah by Hashim Nadeem Part 2Document91 pagesAbdullah by Hashim Nadeem Part 2BTghazwa100% (3)

- Shahab NamaDocument994 pagesShahab NamaObeydullahKhanNo ratings yet

- Abdullah by Hashim Nadeem Part 1Document87 pagesAbdullah by Hashim Nadeem Part 1BTghazwa70% (10)

- Chapter 5aDocument28 pagesChapter 5aObeydullahKhanNo ratings yet

- Abdullah by Hashim Nadeem Part 2Document91 pagesAbdullah by Hashim Nadeem Part 2BTghazwa100% (3)

- Chapter 4Document8 pagesChapter 4ObeydullahKhanNo ratings yet

- Chapter 5Document10 pagesChapter 5ObeydullahKhanNo ratings yet

- Binary Solutions With Miscibility GapDocument6 pagesBinary Solutions With Miscibility GapObeydullahKhanNo ratings yet

- Chapter 2Document13 pagesChapter 2ObeydullahKhanNo ratings yet

- MM222 Lec 23Document7 pagesMM222 Lec 23ObeydullahKhanNo ratings yet

- MM222 Lec 21Document8 pagesMM222 Lec 21ObeydullahKhanNo ratings yet

- Tata Project PDFDocument16 pagesTata Project PDFhow toNo ratings yet

- Capital Budgeting 1 - 1Document103 pagesCapital Budgeting 1 - 1Subhadeep BasuNo ratings yet

- Corporate Finance Assignment Questions 2019Document6 pagesCorporate Finance Assignment Questions 2019Rup Singh Chauhan100% (2)

- Baffinland Preliminary Offering CircularDocument722 pagesBaffinland Preliminary Offering CircularNunatsiaqNews100% (1)

- AnamikaDocument23 pagesAnamikaAnamika VermaNo ratings yet

- GFMP Brochure PDFDocument16 pagesGFMP Brochure PDFLewyyNo ratings yet

- Pest AnalysisDocument8 pagesPest AnalysisqorkiNo ratings yet

- Final Placement Report 2012 SJMSOM IITBDocument4 pagesFinal Placement Report 2012 SJMSOM IITBRKNo ratings yet

- Advanced Accounting Baker Test Bank - Chap014Document34 pagesAdvanced Accounting Baker Test Bank - Chap014donkazotey100% (1)

- Composition of Cash and Cash EquivalentDocument20 pagesComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanNo ratings yet

- Adani Enterprises PresentationDocument75 pagesAdani Enterprises PresentationPoonam AggarwalNo ratings yet

- Quiz 1 - Estate TaxDocument7 pagesQuiz 1 - Estate TaxKevin James Sedurifa Oledan100% (4)

- Notes AccountingDocument9 pagesNotes AccountingRudyNo ratings yet

- TBChap 021Document18 pagesTBChap 021varun cyw100% (1)

- Equity Valuation Report - Snap Inc.Document3 pagesEquity Valuation Report - Snap Inc.FEPFinanceClubNo ratings yet

- NPV MethodDocument37 pagesNPV MethodChandran Nepolean100% (1)

- Financial ManagementDocument49 pagesFinancial ManagementBabasab Patil (Karrisatte)No ratings yet

- Zumbro Shopper 49Document12 pagesZumbro Shopper 49Kristina HicksNo ratings yet

- IDBI MergerDocument5 pagesIDBI MergerprajuprathuNo ratings yet

- ACP Vs CPGDocument3 pagesACP Vs CPGSGT100% (4)

- Documents Used For ForeclosureDocument3 pagesDocuments Used For ForeclosureRazmik BoghossianNo ratings yet

- WiproDocument5 pagesWiproengrohitsinghalNo ratings yet

- Joseph Cresta ResumeDocument1 pageJoseph Cresta Resumewilliam schwartzNo ratings yet

- Chapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisDocument32 pagesChapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisMichael SmithNo ratings yet

- Finm3404 NotesDocument20 pagesFinm3404 NotesHenry WongNo ratings yet

- Internship Report On Performance of Eskaton Branch in BRAC Bank Ltd.Document70 pagesInternship Report On Performance of Eskaton Branch in BRAC Bank Ltd.Rashed55No ratings yet

- Portfolio Performance EvalutionDocument51 pagesPortfolio Performance EvalutionRita NyairoNo ratings yet

- TB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesDocument24 pagesTB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesMarie Bernadette AranasNo ratings yet

- Diminishing DMDocument13 pagesDiminishing DMhanzalakhan50No ratings yet

- CV SandeepDocument4 pagesCV SandeepSaurabh GawadeNo ratings yet