Professional Documents

Culture Documents

Practice Questions For MT

Uploaded by

David LimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Questions For MT

Uploaded by

David LimCopyright:

Available Formats

Practice Questions for Midterm, FIN 623

1.

Consider the following probability distribution for some stock:

State

Good

Bad

E(r)

10

4

prob.

0.40

0.60

If you are risk averse, what would a reasonable certainty equivalent be?

a. 14.0 %

b. 10.0

c. 8.0

d. 6.4

e. None of the above are possible.

3.

A set of convex indifference curves indicates which one of the following about an investor's

tradeoff between risk and expected returns?

a. An investor requires an increasingly larger increment of expected return for each additional

unit of risk incurred.

b. An investor derives less additional satisfaction from each extra dollar earned.

c. Portfolios on two separate indifference curves would be equally attractive to the investor.

d. Risk averse investors require higher expected returns.

4.

A T-bill pays 6 percent rate of return. Would risk averse investors invest in a risky portfolio that

pays 12 percent with a probability of 40 percent or 2 percent with a probability of 60 percent?

a. Yes, because they are rewarded with a risk premium.

b. No, because they are not rewarded with a risk premium.

c. No, because the risk premium is small.

d. Cannot be determined.

e. None of the above.

5.

If an investor's portfolio is composed of an investment in the Magellan fund (with 14% expected

return and a 25% standard deviation) and a risk free asset with a 5% return, what is the expected

return if the total portfolio has a standard deviation of 20%?

a. 12.2%

b. 11.9%

c. 13.1%

d. 14%

6.

The exact location of the investor's portfolio on the extended efficient frontier that results from a

combination of the risk free asset and a risky asset depends upon

a. the location of the investor's indifference curve

b. the risk free rate

c. the expected risk and return tradeoff

d. the relative proportions invested in the two assets

7.

When risk free borrowing or lending is included, what is the difference between the efficient set for

the risk seeking and risk averse investors?

a. the difference between the risky asset return and risk free rate

b. the efficient set will be the same for both investors

c. the more risk averse will lie to the southwest of the tangency portfolio

d. the more risk averse investor's indifference curves will be more steeply sloped

Use the following to answer question 8:

You have been given this probability distribution for the holding period return for XYZ stock:

State of the economy

Boom

Normal growth

Recession

8.

a.

b.

c.

d.

e.

Probability

.30

.50

.20

HPR

18%

12%

- 5%

What is the expected standard deviation for XYZ stock?

2.07%

9.96%

7.04%

1.44%

8.13%

Use the following to answer question 9:

Assume an investor with the following utility function: U = E(r) - 3/2(2).

9.

To maximize her expected utility, which one of the following investment alternatives would she

choose?

a.

A portfolio that pays 10 percent with a 60 percent probability or 5 percent with

40 percent probability.

b.

A portfolio that pays 10 percent with 40 percent probability or 5 percent with a

60 percent probability.

c.

A portfolio that pays 12 percent with 60 percent probability or 5 percent with 40

percent probability.

d.

A portfolio that pays 12 percent with 40 percent probability or 5 percent with 60

percent probability.

e.

none of the above.

Use the following to answer questions 10-11:

Investment

1

2

3

4

Expected Return E(r)

0.12

0.15

0.21

0.24

Standard Deviation

0.3

0.5

0.16

0.21

U = E(r) - (A/2) 2, where A = 4.0.

10.

a.

b.

c.

d.

e.

Based on the utility function above, which investment would you select?

1

2

3

4

cannot tell from the information given

11.

Which investment would you select if you were risk neutral?

a.

1

b.

2

c.

3

d.

4

e.

cannot tell from the information given

12.

A portfolio has an expected rate of return of 0.15 and a standard deviation of 0.15. The risk-free

rate is 6 percent. An investor has the following utility function: U = E(r) - (A/2)2. Which value

of A makes this investor indifferent between the risky portfolio and the risk-free asset?

a.

5

b.

6

c.

7

d.

8

e.

none of the above

13.

According to the mean-variance criterion, which one of the following investments dominates all

others?

a.

E(r) = 0.15; Variance = 0.20

b.

E(r) = 0.10; Variance = 0.20

c.

E(r) = 0.10; Variance = 0.25

d.

E(r) = 0.15; Variance = 0.25

f.

none of these is dominates the other alternatives.

14.

Consider a T-bill with a rate of return of 5 percent and the following risky securities:

Security A: E(r) = 0.15; Variance = 0.04

Security B: E(r) = 0.10; Variance = 0.0225

Security C: E(r) = 0.12; Variance = 0.01

Security D: E(r) = 0.13; Variance = 0.0625

a.

b.

c.

d.

e.

15.

From which set of portfolios, formed with the T-bill and any one of the 4 risky securities, would a

risk averse investor always choose his portfolio?

The set of portfolios formed with the T-bill and security A.

The set of portfolios formed with the T-bill and security B.

The set of portfolios formed with the T-bill and security C.

The set of portfolios formed with the T-bill and security D.

Cannot be determined.

The Capital Allocation Line can be described as the

investment opportunity set formed with a risky asset and a risk-free asset.

investment opportunity set formed with two risky assets.

line on which lie all portfolios that offer the same utility to a particular investor.

line on which lie all portfolios with the same expected rate of return and different

standard deviations.

e.

none of the above.

a.

b.

c.

d.

16.

Which of the following statements regarding the Capital Allocation Line (CAL) is false?

The CAL shows risk-return combinations.

The slope of the CAL equals the increase in the expected return of a risky portfolio per

unit of additional standard deviation.

c.

The slope of the CAL is also called the reward-to-variability ratio.

d.

The CAL is also called the efficient frontier of risky assets.

a.

b.

17.

a.

b.

c.

d.

e.

An investor invests 20 percent of his wealth in a risky asset with an expected rate of return of

0.20 and a variance of 0.04 and 80 percent in a T-bill that pays 5 percent. Her portfolio's

expected return and standard deviation are __________ and __________, respectively.

0.114; 0.12

0.087;0.06

0.080; 0.04

0.087; 0.12

none of the above

Use the following to answer question 18:

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15

and a T-bill with a rate of return of 0.05.

18.

a.

b.

c.

d.

e.

The slope of the Capital Allocation Line formed with the risky asset and the risk-free asset is

equal to

0.4667

0.8000

2.14

0.41667

Cannot be determined.

Use the following to answer questions 19-20:

Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of

10% and a standard deviation of 16%. B has an expected rate of return of 8% and a standard deviation of

12%.

19.

a.

b.

c.

d.

e.

The weights of A and B in the portfolio with the lowest possible variance are

respectively.

0.24; 0.76

0.50; 0.50

0.57; 0.43

0.43; 0.57

0.76; 0.24

20.

The risk-free portfolio that can be formed with the two securities will earn _

a.

8.5%

b.

9.0%

c.

8.9%

d.

9.9%

e.

none of the above

Use the following to answer Question 21:

and

rate of return.

Consider a portfolio of Microsoft and General Electric stock with the following characteristics:

Stock

Microsoft

G.E.

E(r)

8%

12

Weight in portfolio

0.20

0.80

18%

25

21. For varying levels of correlation, what is the maximum level of standard deviation for the portfolio?

a.

b.

c.

d.

e.

11.2 %

18.0

23.6

25.0

Not enough information to tell.

22.

a.

b.

c.

d.

e.

23.

24.

25.

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation

of 0.15 and a T-bill with a rate of return of 0.05.

What percentages of your money must be invested in the risky asset and the risk-free asset,

respectively, to form a portfolio with an expected return of 0.09?

85% and 15%

75% and 25%

67% and 33%

57% and 43%

cannot be determined

Suppose that asset A has a 0.45 chance of tripling its value in one year and a 0.55 chance of going

to half its value in one year. What is asset As expected return?

a. 0.355

b. 0.500

c. 0.625

d. 0.790

a. Impossible to answer.

Which of the following statements regarding risk averse investors is true?

a.

They only care about the rate of return.

b.

They accept investments that offer a weighted average of expected outcomes.

c.

They only accept risky investments that offer a risk premium.

d.

They are willing to accept lower returns and high risk.

e.

a and b.

Assume there are two assets to invest in: An S&P600 Index Fund (with 10% expected return and a

15% standard deviation) and a risk-free asset (with 5% expected return). What is the slope of the

capital asset line (CAL) of an investor who invests 50% of his/her funds in each asset?

a. 0.50

b. 0.165

c. 0.33

d. Need more information.

You might also like

- Contract Law Notes v2 0Document47 pagesContract Law Notes v2 0David Lim100% (4)

- Cffinals SolutionDocument121 pagesCffinals SolutionDavid Lim0% (1)

- How ETF WorksDocument40 pagesHow ETF WorksDavid LimNo ratings yet

- Closed End Funds 2014Document22 pagesClosed End Funds 2014David LimNo ratings yet

- What Does An Option Pricing Model Tell Us About Opton PricesDocument5 pagesWhat Does An Option Pricing Model Tell Us About Opton PricesDavid LimNo ratings yet

- Do Commodities Belong in Your AllocationDocument8 pagesDo Commodities Belong in Your AllocationDavid LimNo ratings yet

- Ici Research: PerspectiveDocument32 pagesIci Research: PerspectiveDavid LimNo ratings yet

- CH 03Document67 pagesCH 03Khoirunnisa Dwiastuti100% (2)

- SecDocument7 pagesSecDavid LimNo ratings yet

- Investor Sentiment and The Closed-End Fund Puzzle (Nice Page)Document36 pagesInvestor Sentiment and The Closed-End Fund Puzzle (Nice Page)David LimNo ratings yet

- Creating An Investment Policy StatementDocument15 pagesCreating An Investment Policy StatementDavid Lim100% (1)

- Warning: Commonwealth of AustraliaDocument11 pagesWarning: Commonwealth of AustraliaDavid LimNo ratings yet

- DCF Val Tests ModDocument4 pagesDCF Val Tests ModDavid LimNo ratings yet

- CaseDocument39 pagesCaseHana Candra PrastutiNo ratings yet

- Useful FormulasDocument1 pageUseful FormulasDavid LimNo ratings yet

- Chap 003Document22 pagesChap 003David LimNo ratings yet

- Chap 003Document22 pagesChap 003David LimNo ratings yet

- Energy AuditDocument204 pagesEnergy AuditCraig RobartNo ratings yet

- The Yield CurveDocument5 pagesThe Yield CurveDavid LimNo ratings yet

- Formula Sheet: Statistics and ProbabilityDocument11 pagesFormula Sheet: Statistics and ProbabilityDavid LimNo ratings yet

- Modlin 3 QuestionsDocument13 pagesModlin 3 QuestionsDavid LimNo ratings yet

- List of Formulas For Midterm Exam 3Document1 pageList of Formulas For Midterm Exam 3David LimNo ratings yet

- Studyguidev Part4 Solutions HyptestandregDocument21 pagesStudyguidev Part4 Solutions HyptestandregAmingSoejitno0% (1)

- Hubbard 4e Practice QuizzesDocument38 pagesHubbard 4e Practice QuizzesF_Community100% (1)

- Student invoice and statement for $12,852 feesDocument1 pageStudent invoice and statement for $12,852 feesDavid LimNo ratings yet

- Hypothesis TestingDocument8 pagesHypothesis TestingPriyanka SinghNo ratings yet

- CFA Quantitative Methods III UpdatedDocument73 pagesCFA Quantitative Methods III UpdatedDavid LimNo ratings yet

- Hypotheses Testing Practice (Answers)Document16 pagesHypotheses Testing Practice (Answers)David LimNo ratings yet

- Pass 1013 QuestionsDocument4 pagesPass 1013 QuestionsDavid LimNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- VNC Function Operation InstructionDocument11 pagesVNC Function Operation InstructionArnaldo OliveiraNo ratings yet

- All MeterialsDocument236 pagesAll MeterialsTamzid AhmedNo ratings yet

- Interna Medicine RheumatologyDocument15 pagesInterna Medicine RheumatologyHidayah13No ratings yet

- Maximizing modular learning opportunities through innovation and collaborationDocument2 pagesMaximizing modular learning opportunities through innovation and collaborationNIMFA SEPARANo ratings yet

- Hardware Purchase and Sales System Project ProfileDocument43 pagesHardware Purchase and Sales System Project Profilesanjaykumarguptaa100% (2)

- HP 5973 Quick ReferenceDocument28 pagesHP 5973 Quick ReferenceDavid ruizNo ratings yet

- Believer - Imagine Dragons - CIFRA CLUBDocument9 pagesBeliever - Imagine Dragons - CIFRA CLUBSilvio Augusto Comercial 01No ratings yet

- Mythic Magazine 017Document43 pagesMythic Magazine 017William Warren100% (1)

- Turbine 1st Stage Nozzle - DPTDocument15 pagesTurbine 1st Stage Nozzle - DPTAnonymous gWKgdUBNo ratings yet

- Relay Coordination Using Digsilent PowerFactoryDocument12 pagesRelay Coordination Using Digsilent PowerFactoryutshab.ghosh2023No ratings yet

- The Invisible Hero Final TNDocument8 pagesThe Invisible Hero Final TNKatherine ShenNo ratings yet

- Panasonic TC-P42X5 Service ManualDocument74 pagesPanasonic TC-P42X5 Service ManualManager iDClaimNo ratings yet

- AC7114-2 Rev N Delta 1Document34 pagesAC7114-2 Rev N Delta 1Vijay YadavNo ratings yet

- Mba Project GuidelinesDocument8 pagesMba Project GuidelinesKrishnamohan VaddadiNo ratings yet

- Trimble Oem Gnss Bro Usl 0422Document3 pagesTrimble Oem Gnss Bro Usl 0422rafaelNo ratings yet

- LLoyd's Register Marine - Global Marine Safety TrendsDocument23 pagesLLoyd's Register Marine - Global Marine Safety Trendssuvabrata_das01100% (1)

- C ClutchesDocument131 pagesC ClutchesjonarosNo ratings yet

- Hotel and Restaurant at Blue Nile FallsDocument26 pagesHotel and Restaurant at Blue Nile Fallsbig johnNo ratings yet

- HP OpenVMS Alpha Version 8.3 and HP OpenVMS Version 8.3-1H1 For IntegrityDocument65 pagesHP OpenVMS Alpha Version 8.3 and HP OpenVMS Version 8.3-1H1 For IntegrityAlexandru BotnariNo ratings yet

- Learning Online: Veletsianos, GeorgeDocument11 pagesLearning Online: Veletsianos, GeorgePsico XavierNo ratings yet

- JR Hydraulic Eng. Waterways Bed Protection Incomat BelfastDocument2 pagesJR Hydraulic Eng. Waterways Bed Protection Incomat Belfastpablopadawan1No ratings yet

- Startups Helping - India Go GreenDocument13 pagesStartups Helping - India Go Greensimran kNo ratings yet

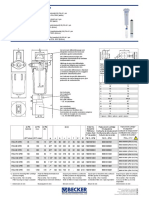

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiNo ratings yet

- BSC6900 UMTS V900R011C00SPC700 Parameter ReferenceDocument1,010 pagesBSC6900 UMTS V900R011C00SPC700 Parameter Referenceronnie_smgNo ratings yet

- Prof. Michael Murray - Some Differential Geometry ExercisesDocument4 pagesProf. Michael Murray - Some Differential Geometry ExercisesAnonymous 9rJe2lOskxNo ratings yet

- Color Codes and Irregular Marking-SampleDocument23 pagesColor Codes and Irregular Marking-Samplemahrez laabidiNo ratings yet

- Daughters of The Storm by Kim Wilkins - Chapter SamplerDocument32 pagesDaughters of The Storm by Kim Wilkins - Chapter SamplerHarlequinAustraliaNo ratings yet

- Marksmanship: Subject: III. Definition of TermsDocument16 pagesMarksmanship: Subject: III. Definition of TermsAmber EbayaNo ratings yet

- OLA CAB MARKET ANALYSIS AND TRENDSDocument55 pagesOLA CAB MARKET ANALYSIS AND TRENDSnitin gadkariNo ratings yet

- Front Cover Short Report BDA27501Document1 pageFront Cover Short Report BDA27501saperuddinNo ratings yet