Professional Documents

Culture Documents

Sample Trading Plan

Uploaded by

bubbajeff0 ratings0% found this document useful (0 votes)

269 views3 pagesTrade Plan, trading, candles, stocks, investing

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTrade Plan, trading, candles, stocks, investing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

269 views3 pagesSample Trading Plan

Uploaded by

bubbajeffTrade Plan, trading, candles, stocks, investing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Educating Tomorrow's Trader..... Today!

Sample Trading Plan

Below is a sample trading plan that you can use as an example and a guide to developing your own. It is your

business plan for your trading business. It should be written as a letter to yourself, as a promise that you will

keep no matter what. Your plan may be changed and updated from day to day, but NEVER stray from your

plan intra day. You must wait until after market to change your plan, then follow the new plan the next day.

You may need to adjust the numbers based on your account size, the numbers used here for maximum

lot sizes would max out a $35,000 margined account. Use this as your guide and for ideas to formulate

your ideal Trading Plan...

Notice: This is a sample only. It should not be used by you in your trading. It should only be a guide to

be used to develop your own plan. If you are a beginner trader you should paper trade first, then move

up to 100 shares, then 300, 500, etc. until reaching the maximum numbers that would be outlined on a

plan like this. You only move from paper trading to increasing lot sizes when you have proved yourself

successful at each level of shares.

OBJECTIVE

To consistently make 1 - 2 points per day, keeping my batting average above 55% and my sharp ratio over

1.8. Based on the share size below, this should translate to $1000-2000 per day on winning days, with the

ability to let some days grow beyond that based on money management techniques outlined below. I

want to keep winning days at 80% or greater.

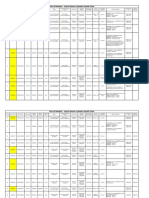

I. Share Size Lots

A. Below are what I consider to be my

maximum shares I will trade under

optimum conditions (my full 'lot').

D. Half lots will be used for entering positions half at a

time OR for share sizing trades that are worthy but

riskier for some reason.

B. This is the maximum I feel safe trading

based only on my account size.

E.

C. I will trade the LESSER of the sizes

listed below, or the size determined in

II, A, 2.., below, describing max loss per

trade.

Share Price

$100 - 130

$70-99

$50-69

$35-49

$20-34

$12-19

$5-11

$3-5

Full Lot Size

500

700

00

1000

10

1400

140

2000

00

2500

3000

4000

Half Lot Size

300

400

500

700

1000

1300

1500

2000

Educating Tomorrow's Trader..... Today!

II. Money Management

A. Maximum Loss Per Day

B. Trail Stopping the Profits

1. On any given day I will not lose more than

$1000.00. If my last trade puts me over this

amount I promise myself that I will shut off Real

Tick, walk away from the computer and return

only to evaluate my trades, print charts, and

listen to the PMTR, with Real Tick off.

1.

Since my goal in money terms is

$1000, at any time on any day that I

reach half that goal, $500, I will

enforce a 'break even' stop on the

day, ensuring that a winning day

does not turn into a loser.

2. On any given trade I will not lose more than

$400. To accomplish this I calculate my share size

on any trade by dividing 400 by the stop loss of

the proposed trade as dictated by the chart. I will

never change the stop loss as that would violate

the integrity of the play. The number of shares

traded will be the smaller of this calculation and

I, C, above. For example, a 51 dollar stock has a

play possible with a stop .5 away from entry. A

$51 stock has a maximum size of 1000 based on

my full lot size above. However, the .5 stop would

be a loss of $500 which is above my $400 per

trade loss limit. Since 800 shares would be the

share size needed to limit my loss to $500, I

would need to play 800 shares, which would be

the lesser of 1000 or 800 shares.

2.

Once my goal of $1000 is reached, I

will immediately enforce a $500

profit stop to ensure that once my

goal is reached, I will keep at least

half of my daily goal.

3.

Once I reach $1500, I will raise my

stop on the day to $1000 to ensure

that once I have exceeded my daily

goal, I will at least keep all of my

daily goal.

4.

From that point forward, I will

enforce a 60% trailing stop on my

profits, saving $1200 after reaching

$2000, etc.

III. Strategies and Times to Play

A. I will play the following strategies as they arise on good quality set ups with full lots, or the max

allowed based on my per trade loss limit using the given stops:

1. A gap down (up) to support (resistance) in a stock when the market is gapping down (up) as

well or is opening up (down) less than 20 Nas points. Support (resistance) must be found in

both a major moving average (see resource page for major moving averages) and either a trend

line or horizontal price support. If one of the above requirements is missing I may play with a

half lot. I will buy the stock over the 5 minute high, which may be adjusted down to as little as

a one minute high. The play must take place before 9.45. I will sell half of the shares into

reversal time and use a break even stop on the rest, and will have the option of selling all into

reversal time depending on the quality of the play. If I sell all I will reserve the right to

repurchase half on the reversal time pullback. Stop loss on these plays is the 5 minute low,

which is also the low of the day.

Educating Tomorrow's Trader..... Today!

III. Strategies and Times to Play

3. I will play one over (under) 30 minute high (low) on a gapped up (down) stock. I will sell half

this play at approximately a 1.5 % gain, keeping the back half for the day. The exact target on

the first half will be dictated first by the chart. I may do a second play if I have successfully sold

half of the first play. The stop will be the low of the pull back that happened prior to the break

out. If this is greater than 2% of the stock price, half lot or pass the trade.

4. I will look for late day basing stocks with a base width of less than 1% of the stock price. I will

play these stocks only after 3:00 unless there has been a strong one direction move in the

morning and one strong counter move all during lunch. I will anticipate these long if the

futures are in an uptrend for the day on a 15 minute chart and above their 200-15, and the

TRIN-Q is below 1.2. I will anticipate short if the reverse is true. My stop will be the other side

of the base and I will sell half for scalp profits and keep half for the end of the day.

5. I will play Reversal Day stocks exactly per the entry rules, on 5 minute highs (lows) for Novice

and Pro Gaps, or on a high volume break out from an intra day base if no gap or on the 30

minute highs (lows) if no gap. The daily chart must show above average volume on the average

of the last two days down (up). Total days down (up) must be at least 3 clean bars. Stock must

be at or played at a support (resistance) area on the chart, either a horizontal support,

trendline, or moving average. First half target will be determined by the chart and half will be

held for the day. Stop is low (high) of the day.

6. All other set ups and trading room calls I will treat as scalps, going for 200 dollar targets in

each case, and stops that are no greater than the profit potential.

IV. Continuing Education and Days Off

1. I will take a half day off every week, and a full day off any week in which I accomplish my goal

3 day in a row.

2. I will take a day off any time I have 3 losing days in a row, even if they were not maximum loss days.

3. I recognize that good traders never stop learning. I will continue my education in the following

ways on the following schedule.

Books...

Seminars...

Mentorships...

Web Research...

Self Improvement tapes or courses (non-trading)...

You might also like

- 103 Disempowering Beliefs About Money and Success Ebook AF PDFDocument53 pages103 Disempowering Beliefs About Money and Success Ebook AF PDFIuliana Dediu100% (3)

- Sample Day Trading PlanDocument1 pageSample Day Trading PlanJ R50% (2)

- Designing Your Life Worksheets PDFDocument10 pagesDesigning Your Life Worksheets PDFDee KayNo ratings yet

- Break Free 2020 GuideDocument12 pagesBreak Free 2020 GuidebubbajeffNo ratings yet

- Break Free 2020 GuideDocument12 pagesBreak Free 2020 GuidebubbajeffNo ratings yet

- DTT Bollinger Bands Strategy ChecklistDocument2 pagesDTT Bollinger Bands Strategy ChecklistEarl Jay ParasNo ratings yet

- The Consistent Traders BlueprintDocument15 pagesThe Consistent Traders BlueprintPaul Vu100% (2)

- How To Develop The Ultimate Trading PlanDocument32 pagesHow To Develop The Ultimate Trading PlanJibin N Rexi100% (5)

- Understanding Fibonacci Retracement and Extension LevelsDocument16 pagesUnderstanding Fibonacci Retracement and Extension Levelsbakchod BojackNo ratings yet

- Traders Journal Guide Alpha R CubedDocument15 pagesTraders Journal Guide Alpha R CubedEzequiel RodriguezNo ratings yet

- 7 Steps To A Good Trade Paul LangeDocument4 pages7 Steps To A Good Trade Paul LangescandalosoNo ratings yet

- Acetrades EbookDocument20 pagesAcetrades Ebookallegre50% (2)

- Reversal Patterns: Part 1Document16 pagesReversal Patterns: Part 1Oxford Capital Strategies LtdNo ratings yet

- STAT100 Fall19 Test 2 ANSWERS Practice Problems PDFDocument23 pagesSTAT100 Fall19 Test 2 ANSWERS Practice Problems PDFabutiNo ratings yet

- Scalping MethodsDocument4 pagesScalping Methodsmr.ajeetsingh100% (1)

- Successful Day TradingDocument12 pagesSuccessful Day TradingChristopher Michael Quigley100% (1)

- Trading Assignment 2Document7 pagesTrading Assignment 2Supreme EssaysNo ratings yet

- Trading Plan 2021 BILLIONAIRE - Daily Routine, Money Management, RulesDocument2 pagesTrading Plan 2021 BILLIONAIRE - Daily Routine, Money Management, RulesFrancisco Javier Escamilla RebollarNo ratings yet

- Trading Plan Template ContentsDocument29 pagesTrading Plan Template ContentsAndrea Davila100% (1)

- The "Sure-Fire" Forex Hedging StrategyDocument8 pagesThe "Sure-Fire" Forex Hedging StrategyAfifi FaiqNo ratings yet

- Trading To Win Second EditionDocument152 pagesTrading To Win Second EditionSatyendra Rawat100% (3)

- Trading Plan Example Breaks Down Key ElementsDocument4 pagesTrading Plan Example Breaks Down Key ElementsBasanthanesh Basan100% (2)

- How to Make Day Trades in 1 HourDocument66 pagesHow to Make Day Trades in 1 HourBernard Gagnon100% (3)

- Trading SetupsDocument7 pagesTrading SetupsHeretic87100% (1)

- My Trading Plan: Volatility Trading Equity TradingDocument10 pagesMy Trading Plan: Volatility Trading Equity Tradingdnyanesh_patil25100% (2)

- Appendix A - Trading Plan Template: Financial GoalDocument3 pagesAppendix A - Trading Plan Template: Financial GoalBrian KohlerNo ratings yet

- A Trader CheckList - ActiveTraderIQ ArticleDocument3 pagesA Trader CheckList - ActiveTraderIQ ArticleHussan MisthNo ratings yet

- Traders ChecklistDocument17 pagesTraders ChecklistManojkumar NairNo ratings yet

- Trading Setup Stop Loss GuideDocument7 pagesTrading Setup Stop Loss GuideWAHYU SUMANJAYANo ratings yet

- High Probability Ranging Market Reversal StrategyDocument9 pagesHigh Probability Ranging Market Reversal StrategyNikos Karpathakis100% (1)

- TRADING PLAN TEMPLATEDocument29 pagesTRADING PLAN TEMPLATEGeraldValNo ratings yet

- Trading ManualDocument24 pagesTrading Manualehsan453100% (1)

- The 3 Rules of Successful Swing TradingDocument12 pagesThe 3 Rules of Successful Swing TradingSandra Xavier100% (1)

- Trading 24h Clock Maximizes Currency Pair OpportunitiesDocument10 pagesTrading 24h Clock Maximizes Currency Pair Opportunitieskang_warsadNo ratings yet

- First Hour of Trading - How To Trade Like A Pro - TradingSimDocument21 pagesFirst Hour of Trading - How To Trade Like A Pro - TradingSimAbhishek2009GWUNo ratings yet

- Forex Trading Strategies PDFDocument24 pagesForex Trading Strategies PDFGabrė Francis100% (1)

- Crypto Trading Guide: 17 LessonsDocument1 pageCrypto Trading Guide: 17 LessonsprajwalNo ratings yet

- Forex Money ManagementDocument5 pagesForex Money Managementapi-3831818No ratings yet

- Trading Journal SheetsDocument2 pagesTrading Journal SheetsDiana LondonNo ratings yet

- How To Place Stop Losses Like A Pro TraderDocument6 pagesHow To Place Stop Losses Like A Pro Tradernrepramita100% (2)

- Pierce, Stephen A - Rapid Fire Swing TradingDocument45 pagesPierce, Stephen A - Rapid Fire Swing Tradingmysticbliss100% (1)

- Bullish confirmation patterns and technical analysisDocument6 pagesBullish confirmation patterns and technical analysisScott LuNo ratings yet

- Stop LossDocument3 pagesStop LosssalmanscribdNo ratings yet

- Planning Your Trades: Risk Management RiskDocument2 pagesPlanning Your Trades: Risk Management RiskdoremonNo ratings yet

- Five Day Trading Programme Amplify Trading 2014Document7 pagesFive Day Trading Programme Amplify Trading 2014RahulNo ratings yet

- The 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeDocument3 pagesThe 5 Secrets To Highly Profitable Swing Trading: Introduction - Why So Many Pros Swing TradeSweety DasNo ratings yet

- My Trading Ideas For The Forex and Fkli Spot Market 05022011Document63 pagesMy Trading Ideas For The Forex and Fkli Spot Market 05022011faizan ahmadNo ratings yet

- Jacko Trading StyleDocument25 pagesJacko Trading StyleMohammed NizamNo ratings yet

- Forex Trade Plan ExampleDocument5 pagesForex Trade Plan ExampleNagy100% (3)

- Point Zero: Trading ManualDocument23 pagesPoint Zero: Trading ManualBhisamS SallehNo ratings yet

- Building and Following Your Trading Plan:: Conversations With Vadym GraiferDocument17 pagesBuilding and Following Your Trading Plan:: Conversations With Vadym Graiferbiondimi100% (2)

- Triple S StrategyDocument18 pagesTriple S StrategyPayWorld BatasiNo ratings yet

- Proper Position Sizing Is THE Most Important Forex Trading SkillDocument13 pagesProper Position Sizing Is THE Most Important Forex Trading SkillSamuel AnemeNo ratings yet

- TP The Double Edged Trader ReportDocument18 pagesTP The Double Edged Trader ReportAdil BensellamNo ratings yet

- Trading Plan PDFDocument15 pagesTrading Plan PDFstormin640% (1)

- Candlestick Flashcards 101Document10 pagesCandlestick Flashcards 101Viet Nguyen DuyNo ratings yet

- Build You Own Trading StrategyDocument5 pagesBuild You Own Trading StrategyTajudeen Adebayo100% (1)

- Amazing Market SetupDocument9 pagesAmazing Market SetupongkeNo ratings yet

- The 10 Tasks of Top TradingDocument10 pagesThe 10 Tasks of Top TradingSudarsan PNo ratings yet

- How To Spot Trading ChannelsDocument54 pagesHow To Spot Trading ChannelsSundaresan SubramanianNo ratings yet

- SSRN Id3596245 PDFDocument64 pagesSSRN Id3596245 PDFAkil LawyerNo ratings yet

- Trading Plan 2Document4 pagesTrading Plan 2floriol_007284175% (4)

- As A Man Thinketh PDFDocument22 pagesAs A Man Thinketh PDFbubbajeffNo ratings yet

- Subway Nutrition ValuesDocument4 pagesSubway Nutrition ValuesbubbajeffNo ratings yet

- WorldHappinessReport2013 OnlineDocument172 pagesWorldHappinessReport2013 OnlineKo NgeNo ratings yet

- NTAP Large Print 212 PagesDocument222 pagesNTAP Large Print 212 PagesDario CespaNo ratings yet

- Gyertyák5 - Doji Long Legged - Candlestick Pattern DictionarDocument5 pagesGyertyák5 - Doji Long Legged - Candlestick Pattern DictionarTSXfx01No ratings yet

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNo ratings yet

- GLF550 Normal ChecklistDocument5 pagesGLF550 Normal ChecklistPetar RadovićNo ratings yet

- Free Radical TheoryDocument2 pagesFree Radical TheoryMIA ALVAREZNo ratings yet

- RACI Matrix: Phase 1 - Initiaton/Set UpDocument3 pagesRACI Matrix: Phase 1 - Initiaton/Set UpHarshpreet BhatiaNo ratings yet

- Astera Data Integration BootcampDocument4 pagesAstera Data Integration BootcampTalha MehtabNo ratings yet

- ABP - IO Implementing - Domain - Driven - DesignDocument109 pagesABP - IO Implementing - Domain - Driven - DesignddoruNo ratings yet

- Service and Maintenance Manual: Models 600A 600AJDocument342 pagesService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNo ratings yet

- CIT 3150 Computer Systems ArchitectureDocument3 pagesCIT 3150 Computer Systems ArchitectureMatheen TabidNo ratings yet

- 5054 w11 QP 11Document20 pages5054 w11 QP 11mstudy123456No ratings yet

- If V2 would/wouldn't V1Document2 pagesIf V2 would/wouldn't V1Honey ThinNo ratings yet

- Coffee Table Book Design With Community ParticipationDocument12 pagesCoffee Table Book Design With Community ParticipationAJHSSR JournalNo ratings yet

- Additional Help With OSCOLA Style GuidelinesDocument26 pagesAdditional Help With OSCOLA Style GuidelinesThabooNo ratings yet

- تاااتتاااDocument14 pagesتاااتتاااMegdam Sameeh TarawnehNo ratings yet

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- RUJUKANDocument3 pagesRUJUKANMaryTibanNo ratings yet

- 2014 mlc703 AssignmentDocument6 pages2014 mlc703 AssignmentToral ShahNo ratings yet

- QuickTransit SSLI Release Notes 1.1Document12 pagesQuickTransit SSLI Release Notes 1.1subhrajitm47No ratings yet

- 2023 Test Series-1Document2 pages2023 Test Series-1Touheed AhmadNo ratings yet

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- Modified Syllabus of Control SystemDocument2 pagesModified Syllabus of Control SystemDigambar PatilNo ratings yet

- Analytical Approach To Estimate Feeder AccommodatiDocument16 pagesAnalytical Approach To Estimate Feeder AccommodatiCleberton ReizNo ratings yet

- Fernandez ArmestoDocument10 pagesFernandez Armestosrodriguezlorenzo3288No ratings yet

- Final Thesis Report YacobDocument114 pagesFinal Thesis Report YacobAddis GetahunNo ratings yet

- Biology Mapping GuideDocument28 pagesBiology Mapping GuideGazar100% (1)

- Impact of IT On LIS & Changing Role of LibrarianDocument15 pagesImpact of IT On LIS & Changing Role of LibrarianshantashriNo ratings yet

- Pom Final On Rice MillDocument21 pagesPom Final On Rice MillKashif AliNo ratings yet

- Oracle Learning ManagementDocument168 pagesOracle Learning ManagementAbhishek Singh TomarNo ratings yet