Professional Documents

Culture Documents

Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDF

Uploaded by

Randora LkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDF

Uploaded by

Randora LkCopyright:

Available Formats

Earnings Review - Q4 FY 14

65, Braybrooke Place, Colombo 2, Sri Lanka

research@bartleetreligare.com, +94 11 5220200

16 April 2015

BRS Research

Chevron Lubricants Lanka PLC (LLUB: LKR 395.00)

Lower volumes and super gains tax may slow down payout SELL

LLUBs bottom line dropped 5.9% YoY to LKR 555mn in Q4 FY 14 resulting in an EPS of LKR

4.63 (BRS forecast LKR 5.86) caused by lower volumes and 41% reduction in finance income. EBIT margin dropped marginally to 24.5% compared to 26% YoY mainly due to a

8.8% rise in SG & A expenses whilst the GP margin remained flat at 35%. Net revenue

dipped 2.9% YoY to LKR 2.74bn. The company completed the plant relocation to Saupugaskanda in November 14 with ~20% additional capacity and we believe the cash position

would strengthen eventually. However, with the company being hit by the one-off super

gains tax imposed by the interim budget, we expect a minor impact on FY 2015E dividends.

Since the last review the MPS has increased by ~14% and the risk free rate by >1%. Hence,

our DCF based target price is reduced to LKR 290 with a total return (including FY 2015E

DPS) of LKR 308 (-22% on CMP). We downgrade to SELL.

All figures in LKR mn

Revenue

Revenue growth (%)

Gross profit

Gross profit margin (%)

EBIT recurring

EBIT margin (%)

Profit attributable to equity holders

BRS EPS As Adjusted (LKR)

BRS EPS growth (%)

NAV per share (LKR)

DPS (LKR)

Dividend yield (%)

P/E (x)

P/BV (x)

ROE %

2011

11,040

16.6%

3,474

31.5%

2,713

24.6%

1,988

16.57

32.4%

26.32

9.00

5.3%

10.3 x

6.5 x

73.7%

2012

11,754

6.5%

3,804

32.4%

2,913

24.8%

2,261

18.84

13.7%

34.45

11.00

5.4%

10.7 x

5.9 x

62.0%

2013

11,197

-4.7%

4,120

36.8%

3,174

28.3%

2,531

21.10

11.9%

40.33

15.00

5.6%

12.7 x

6.6 x

56.4%

2014

11,520

2.9%

4,603

40.0%

3,566

31.0%

2,742

22.85

8.3%

43.33

20.00

5.0%

17.5 x

9.2 x

54.6%

2015E

11,774

2.2%

4,823

41.0%

3,748

31.8%

2,779

23.16

1.3%

41.29

18.00

4.6%

17.1 x

9.6 x

54.7%

2016E

12,339

4.8%

5,041

40.9%

3,915

31.7%

2,875

23.96

3.5%

44.25

21.00

5.3%

16.5 x

8.9 x

56.0%

Head of Research - Nikita Tissera

Senior Research Analyst - Jennita Fernando

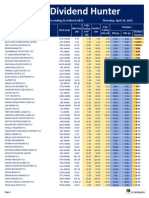

Trading Snapshot

Market cap (LKR mn)

47,400

Market cap (USD mn)

352

Outstanding equity shares (mn)

49.00%

52-week High/Low (LKR)

456.50/267.00

YTD ASPI return (%)

-4.4%

YTD Stock return (%)

-1.2%

Beta

0.45

Valuation Summary

CMP (LKR)

395.00

Intrinsic value (LKR)

290.14

DPS (LKR)

18.00

Target price based on total return (LKR)

Valuation method

308.14

DCF valuation

Total return %

-22.0%

Rating

Source: Company data and BRS Equity Research

Bottom line down 5.9% YoY in Q4 FY 14; however margins maintained

LLUB recorded a 5.9% earnings decline in Q4 FY 14 to LKR 555mn with a NP margin of 20.2%

(Q4 FY 13 20.9%). Lower overall volumes, finance income (-41% YoY to LKR 39mn), higher SG

& A expenses contributed to the drop. However, for FY 2014 LLUB recorded an 8.3% YoY growth

in earnings to LKR 2.74bn aided by lower base oil prices in the latter part, stable exchange rate

and improved volumes from the premium brands despite overall volumes shrinking. The company has however been successful in maintaining healthy margins through their focus on marketing premium brands. We expect GP margins to hover at ~41% and EBIT margins at ~32% in

the forecast period.

120

Public Holding (%) -Dec'14

Sell

LLUB Price Vs ASPI Movement

ASPI

LLUB

ASPI

LLUB

8000

500

450

7000

400

6000

350

300

5000

250

4000

Super gains tax likely to hinder short term dividend payout; long term positive

As LLUB would be impacted by the 25% super gains tax imposed in the interim budget, we have

factored in a LKR 863mn cash outflow in FY 2015E. Hence, we forecast a reduction in FY 2015E

payout to ~78% from ~88% in the last FY. However, with the completion of the plant relocation

in November 2014, LLUB would regain their strong cash position enabling to distribute higher

dividends as in the past from FY 2016E onwards.

Valuation 22% downside to CMP on total return: SELL

The DCF based target price is downgraded to LKR 290 with the increase in risk free rate by 119

basis points since the last review and the slow growth in the industry. The total return, inclusive

of the FY 2015E DPS of LKR 18.00 is at LKR 308.00 and we recommend SELL. On relative valuation terms, the stock is trading at a forward PER of 17.1x (FY 2015E EPS LKR 23.16) and 16.5x

(FY 2016E EPS LKR 23.96) based on CMP. The sector PER stood at 20.9x as at 15.04.2015.

For analyst certification and other important disclosures, please refer to the Disclosure and

Disclaimer section at the end of this report.

200

Mar-13

Nov-13

Jul-14

Apr-15

DPS and Payout Ratio

DPS

%

DPS

24.00

Payout ratio

120%

20.00

100%

16.00

80%

12.00

60%

8.00

40%

4.00

20%

2011

2012

2013

2014

2015E 2016E

Page 1

Company Information Note

65, Braybrooke Place, Colombo 2, Sri Lanka

research@bartleetreligare.com, +94 11 5220200

16 April 2015

Chevron Lubricants Lanka PLC (LLUB)

Company profile

Chevron is in the business of importing, manufacturing and marketing of lubricants, greases,

brake fluid and specialty products. It is the market leader with ~52% market share in a very

competitive industry with 13 licensed players. It

also exports finished goods to Maldives and

Bangladesh, though on a relatively smaller scale.

The company relocated its blending plant to

Sapugaskande in November 2014 with an additional capacity of ~20%.

Revenue LKR 'mn % Growth (2011-16E)

6%

5%

12,339

2016E

2016E

2%

-5%

3%

11,040

2011

2012

2013

2014

2015E

Revenue breakdown

Local sales

Export sales

8%

6%

FY 2014

FY 2013

92%

94%

Trend in EPS and DPS

EPS (LKR)

DPS (LKR)

24.00

33.00

EPS

28.00

DPS

20.00

23.00

16.00

18.00

12.00

13.00

8.00

8.00

3.00

4.00

2011

2012

2013

2014

2015E

2016E

Source: LLUB Annual Reports and BRS Research

Year Ending 31st December

Summary Information

BRS EPS As Adjusted (LKR)

BRS EPS growth (%)

P/E (x)

Reported EPS adjusted for split (LKR)

Sector PE (x)

P/E on reported EPS (x)

NAV per share (LKR)

P/BV (x)

Sector PBV (x)

DPS (LKR)

Dividend yield (%)

FCFF (LKR 000)

FCFE (LKR 000)

CFPS (LKR)

P/CFPS (x)

Mkt price adjusted for splits

Weighted average shares (000)

Average mkt cap (LKR 000)

Enterprise value (LKR 000)

EV/Sales

EV/EBITDA

Income Statement (LKR 000)

Revenue

Gross profit

EBITDA recurring

Depreciation and amortisation

EBIT recurring

Interest income

Interest expense

Share of associates

Exceptionals/non-recurrings

Tax expense

Net income

Minorities & preference dividends

Profit attributable to equity holders

Statement of Financial Position (LKR 000)

Cash and cash equivalents

Inventories

Trade receivables

Fixed assets

Shortterm investments

Total assets

Trade payables

Interest bearing debt -short term

Interest bearing debt -long term

Total liabilities

Shareholders equity

Minorities

Total equity

Net debt (cash)

Total capital employed

Casf flow (LKR 000)

Cash flow from operations

Net working capital

Capital expenditure

Free cash flow

Investing cash flows

Equity capital

Dividends paid

Net borrowings

Other financing cash flows

Net cash flow

Key ratios

Revenue growth (%)

EBIT growth (%)

Gross profit margin (%)

EBITDA margin (%)

EBIT margin (%)

Net profit margin

ROCE %

ROE %

Payout ratio (%)

Debt/equity (%)

Net debt/equity (%)

Gearing (%)

Interest cover (x)

2011

2012

2013

2014

2015E

2016E

16.57

32.4%

10.3 x

16.67

15.8x

10.2 x

26.32

6.5 x

2.2x

9.00

5.3%

1,364,308

1,365,360

2.97

57.3 x

170.00

120,000

20,400,000

19,387,939

1.8 x

7.0 x

18.84

13.7%

10.7 x

18.88

9.9x

10.7 x

34.45

5.9 x

1.6x

11.00

5.4%

2,846,205

2,846,427

12.25

16.5 x

202.00

120,000

24,240,000

21,722,756

1.8 x

7.3 x

21.10

11.9%

12.7 x

21.10

13.0X

12.7 x

40.33

6.6 x

1.8x

15.00

5.6%

1,587,596

1,587,680

(0.27)

nm

267.80

120,000

32,136,000

29,650,826

2.6 x

9.2 x

22.85

8.3%

17.5 x

22.89

22.1x

17.5 x

43.33

9.2 x

2.7x

20.00

5.0%

1,740,841

1,741,166

(9.96)

nm

399.60

120,000

47,952,000

46,661,470

4.1 x

12.9 x

23.16

1.3%

17.1 x

na

na

na

41.29

9.6 x

na

18.00

4.6%

843,820

844,108

(3.97)

nm

395.00

120,000

47,400,000

46,585,938

4.0 x

12.2 x

23.96

3.5%

16.5 x

na

na

na

44.25

8.9 x

na

21.00

5.3%

2,820,043

2,820,475

2.50

158.2 x

395.00

120,000

47,400,000

46,286,327

3.8 x

11.6 x

11,039,945

3,474,497

2,760,084

(47,307)

2,712,777

61,507

(1,461)

12,455

(767,163)

1,988,162

1,988,162

11,754,046

3,804,084

2,956,746

(43,836)

2,912,910

34,638

(309)

4,563

(845,630)

2,261,263

2,261,263

11,197,152

4,120,303

3,220,484

(46,234)

3,174,250

279,044

(117)

421

(921,697)

2,531,480

2,531,480

11,519,891

4,602,816

3,613,771

(48,009)

3,565,762

91,810

(451)

4,839

(952,800)

2,741,995

11,773,598

4,822,989

3,812,176

(64,209)

3,747,967

59,092

(400)

(1,027,798)

2,778,861

12,339,012

5,041,357

3,981,266

(65,805)

3,915,461

50,649

(600)

(1,090,515)

2,874,995

2,741,995

2,778,861

2,874,995

1,012,061

1,870,032

1,199,131

193,113

4,353,919

301,439

1,195,773

3,158,146

2,517,244

2,132,118

986,882

215,813

5,947,508

897,497

1,813,195

4,134,313

2,485,174

1,928,704

1,252,068

1,296,651

7,052,472

1,059,802

2,212,451

4,840,021

1,290,530

1,746,241

1,130,140

2,243,616

6,476,801

652,962

1,277,590

5,199,210

814,062

2,094,251

1,372,898

2,297,143

6,659,797

90,778

1,705,020

4,954,777

1,113,673

2,232,704

1,386,627

2,354,728

7,181,741

194,095

1,871,969

5,309,772

3,158,146

(1,012,061)

3,158,146

4,134,313

(2,517,244)

4,134,313

4,840,021

(2,485,174)

4,840,021

5,199,210

(1,290,530)

5,199,210

4,954,777

(814,062)

4,954,777

5,309,772

(1,113,673)

5,309,772

1,384,049

(656,249)

(20,793)

1,363,256

(8,139)

(1,020,000)

355,910

2,913,609

494,835

(67,627)

2,845,982

(63,064)

(1,380,000)

1,470,545

2,715,618

72,850

(1,128,106)

1,587,512

(1,127,685)

(1,620,000)

(32,067)

2,735,614

(120,785)

(995,097)

1,740,517

(990,258)

(2,940,000)

961,268

(1,168,121)

(117,736)

843,532

(117,736)

(1,320,000)

2,943,001

(61,431)

(123,390)

2,819,611

(123,390)

(2,520,000)

(1,194,644)

(476,468)

299,611

16.6%

19.6%

31.5%

25.0%

24.6%

18.0%

100.6%

73.7%

54.3%

0.0%

-32.0%

0.0%

nm

6.5%

7.4%

32.4%

25.2%

24.8%

19.2%

79.9%

62.0%

58.4%

0.0%

-60.9%

0.0%

nm

-4.7%

9.0%

36.8%

28.8%

28.3%

22.6%

70.7%

56.4%

71.1%

0.0%

-51.3%

0.0%

nm

2.9%

12.3%

40.0%

31.4%

31.0%

23.8%

71.0%

54.6%

87.5%

0.0%

-24.8%

0.0%

nm

2.2%

5.1%

41.0%

32.4%

31.8%

23.6%

73.8%

54.7%

77.7%

0.0%

-16.4%

Page0.0%

2

nm

4.8%

4.5%

40.9%

32.3%

31.7%

23.3%

76.3%

56.0%

87.7%

0.0%

-21.0%

0.0%

nm

BRS Equity Research

Q4 FY 14 Performance

Q4 FY 14

All figures in LKR 'mn

Revenue

Q4 FY 13

2,743

Q3 FY 14

2,824

3,083

YoY growth %

-2.9%

-1.3%

10.8%

QoQ growth%

-11.0%

16.3%

3.1%

Cost of sales

(1,797)

(1,838)

(1,821)

Gross Profit

Gross Profit margin %

Recurring Net Profit

BRS EPS as adjusted (LKR)

946

986

1,261

34.5%

34.9%

40.9%

555

590

748

4.63

4.92

6.23

YoY growth %

-5.9%

8.2%

22.7%

QoQ growth%

-25.8%

-3.2%

10.8%

NAV per share (LKR)

43.33

40.33

49.57

ROCE %

71.0%

70.7%

64.2%

ROE %

54.6%

56.4%

49.2%

EV/Sales (x)

2.7

2.6

3.3

EV/EBITDA (x)

8.5

9.2

10.4

Valuations assumptions

Based on a free cash flow valuation we have arrived at a target price of LKR 290.14 . Our valuations are based

on the following assumptions:

WACC 10.6%

Terminal growth rate - 3%

Risk free rate 8.79% (previous - 7.6%)

Beta - 0.45 (based on LLUB share price vs. ASPI movement)

Equity risk premium - 4%

Sensitivity of target price to risk free rate & growth rate

Risk free rate (Five year bond rate)

290.14

Growth rate

7.0%

8.0%

8.8%

9.0%

10.0%

11.0%

2%

341.25

297.13

269.59

263.11

236.09

214.13

3%

379.34

323.69

290.14

282.37

250.48

225.14

4%

433.31

359.41

316.92

307.29

268.57

238.66

www.bartleetreligare.com

Page 3

BRS Equity Research

Financial Analysis

Income statement - Chevron Lubricants Lanka PLC

Year Ending 31st December

2011

2012

2013

2014

2015E

2016E

Net turnover

11,039,945

11,754,046

11,197,152

11,519,891

11,773,598

YoY growth %

16.6%

6.5%

-4.7%

2.9%

2.2%

4.8%

(7,565,448)

(7,949,962)

(7,076,850)

(6,917,075)

(6,950,608)

(7,297,654)

17.7%

5.1%

-11.0%

-2.3%

0.5%

5.0%

5,041,357

Cost of Sales

YoY growth %

Gross Profit

12,339,012

3,474,497

3,804,084

4,120,303

4,602,816

4,822,989

YoY growth %

14.1%

9.5%

8.3%

11.7%

4.8%

4.5%

Gross profit margin

31.5%

32.4%

36.8%

40.0%

41.0%

40.9%

31,176

12,294

7,061

13,140

6,000

6,000

(780,441)

(898,904)

Other operating Income

Total SG & A expenses

YoY growth %

Total depreciation

EBIT including non-recurring items

Non-recurring items

EBIT excluding non-recurring items

(952,694)

(1,045,356)

(1,081,023)

(1,131,897)

0.1%

15.2%

6.0%

9.7%

3.4%

4.7%

(47,307)

(43,836)

(46,234)

(48,009)

(64,209)

(65,805)

2,725,232

2,917,473

3,174,670

3,570,601

12,455

4,563

421

4,839

2,712,777

2,912,910

3,174,250

3,565,762

3,747,967

3,915,461

3,747,967

3,915,461

YoY growth %

19.6%

7.4%

9.0%

12.3%

5.1%

4.5%

EBIT margin

24.6%

24.8%

28.3%

31.0%

31.8%

31.7%

2,760,084

2,956,746

3,220,484

3,613,771

3,812,176

3,981,266

EBITDA excluding non-recurring items

YoY growth %

18.4%

7.1%

8.9%

12.2%

5.5%

4.4%

EBITDA margin

25.0%

25.2%

28.8%

31.4%

32.4%

32.3%

42,548

193,983

278,927

129,033

58,692

50,049

2,755,325

3,106,893

3,453,177

3,694,795

3,806,659

3,965,510

Finance Income / Cost

Recurring profit before tax

YoY growth %

Income tax expense

Profit after taxation

18.1%

12.8%

11.1%

7.0%

3.0%

4.2%

(767,163)

(845,630)

(921,697)

(952,800)

(1,027,798)

(1,090,515)

1,988,162

2,261,263

2,531,480

2,741,995

2,778,861

2,874,995

YoY growth %

32.4%

13.7%

11.9%

8.3%

1.3%

3.5%

Super gains tax

Profit after Super gains tax

(863,294)

1,988,162

2,261,263

2,531,480

2,741,995

1,915,567

2,874,995

Earnings per share - unadjusted (1)

16.67

18.88

21.10

22.89

15.96

23.96

Earnings per share - BRS adjusted (2)

16.57

18.84

21.10

22.85

23.16

23.96

Source: Company Financial Reports and BRS Equity Research

Note 1: Based on earnings as reported (unadjusted for non-recurring) share data adjusted for splits and super gains tax

Note 2: EPS adjusted for share split, consolidations and non recurring information

www.bartleetreligare.com

Page 4

BRS Equity Research

Financial Analysis

Statement of Financial Position - Chevron Lubricants Lanka PLC

As at 31st December

2011

2012

2013

2014

2015E

2016E

193,113

215,813

1,296,651

2,243,616

2,297,143

2,354,728

74,377

94,109

81,152

66,274

81,443

94,009

5,205

1,341

8,723

272,695

311,263

1,386,526

Non Current Assets

Property Plant & Equipment

Non Current Receivables

Deffered Tax Asset

2,309,890

2,378,586

2,448,736

2,232,704

Current Assets

Inventories

1,870,032

2,132,118

1,928,704

1,746,241

2,094,251

Receivables and Prepayments

1,199,131

986,882

1,252,068

1,130,140

1,372,898

1,386,627

Cash and Cash Equivalents

1,012,061

2,517,244

2,485,174

1,290,530

814,062

1,113,673

4,081,224

5,636,245

5,665,946

4,166,911

4,281,211

4,733,004

4,353,919

5,947,508

7,052,472

6,476,801

6,659,797

7,181,741

Total Assets

Equity and Reserves

Stated Capital

600,000

600,000

600,000

600,000

600,000

600,000

Retained Earnings

2,558,146

3,534,313

4,240,021

4,599,210

4,354,777

4,709,772

Shareholders funds

3,158,146

4,134,313

4,840,021

5,199,210

4,954,777

5,309,772

101,769

-

87,328

-

122,060

-

119,902

101,596

133,417

101,596

145,883

101,596

101,769

87,328

122,060

221,498

235,013

247,479

Trade and Other payables

301,439

897,497

1,059,802

652,962

90,778

194,095

Current Tax

372,565

468,370

490,590

403,131

539,228

590,394

Dividends payable

420,000

360,000

540,000

840,000

840,000

Non Current Liabilities

Defined Benefit Obligation

Deffered Tax

Current Liabilities

Bank Borrowings

1,094,004

1,725,867

2,090,392

1,056,093

1,470,007

1,624,489

Total Liabilities

1,195,773

1,813,195

2,212,451

1,277,590

1,705,020

1,871,969

Total Equity and Liabilities

4,353,919

5,947,508

7,052,472

6,476,801

6,659,797

7,181,741

Source: Company Financial Reports and BRS Equity Research

www.bartleetreligare.com

Page 5

BRS Equity Research

Financial Analysis

Cash flow - Chevron Lubricants Lanka PLC

Year Ending 31st December

2011

2012

2013

2014

2015E

2016E

2,725,232

2,917,473

3,174,670

3,570,601

3,747,967

3,915,461

47,307

43,836

46,234

48,009

64,209

65,805

Cash flow from operating activity

EBIT

Depreciation

Property, plant & equipment written off

(Profit)/loss on disposal of PPE

Provision for bad and doubtful debt

Finance income/expense adjustment

Defined benefit obligation

Operating cash flow before changes in working capital

Changes in Working Capital

Cash generated from Operations

513

1,090

1,034

123

(12,455)

(4,563)

(420)

(4,839)

(1,902)

11,102

(2,506)

8,324

159,654

43,356

37,674

17,830

16,600

19,813

22,477

24,000

24,000

2,784,849

3,165,745

3,325,328

3,700,630

3,836,176

4,005,266

(656,249)

494,835

72,850

(120,785)

(1,168,121)

(61,431)

2,128,600

3,660,580

3,398,178

3,579,845

2,668,055

3,943,835

50,649

Interest received

35,685

235,690

97,834

59,092

Interest paid

(1,461)

(309)

(117)

(451)

(400)

(600)

(25,006)

(701)

(9,662)

(7,473)

(10,484)

(11,534)

(753,769)

(745,961)

(908,471)

(934,141)

(891,700)

(1,039,349)

Denfined benefit obligation paid

Tax paid

Super gains tax paid

Net Cash from Operating Activities

(863,294)

1,384,049

2,913,609

2,715,618

2,735,614

961,268

2,943,001

Purchase of property, plant & equipment

(20,793)

(67,627)

(1,128,106)

(995,097)

(117,736)

(123,390)

Proceeds from disposal of PPE

421

Investing Activities

12,654

4,563

4,839

Short term investments uplifted & maturity

ST Investments made during the year

Net cash used in investing activities

(8,139)

(63,064)

(1,127,685)

(990,258)

(117,736)

(123,390)

Financing Activities

Short term loans obtained / (settled) to related parties

Dividends paid

(1,020,000)

(1,380,000)

(1,620,000)

(2,940,000)

(1,320,000)

(2,520,000)

Net Cash in financing activities

(1,020,000)

(1,380,000)

(1,620,000)

(2,940,000)

(1,320,000)

(2,520,000)

355,910

1,470,545

(32,067)

(1,194,644)

(476,468)

299,611

Increase Decrease In Cash and Cash Equivalents

Source: Company Financial Reports and BRS Equity Research

www.bartleetreligare.com

Page 6

BRS Equity Research

Top 20 shareholders as at 31 December 2014

Name of the shareholder

No of shares

1 Chevron Ceylon Limited

61,200,000

51.00

2 HSBC INTL NOM LTD-SSBT WASATCH FRONTIER EMERGING SMALL Countries Fund

6,300,185

5.25

3 Caceis Bank Luxembourg S/A BARCA GLOBAL MASTER FUND LPOGIER

2,716,306

2.26

4 Cigroup Global Markets Limited Agency Trading Prop Securies A/C

2,403,670

2.00

5 HSBC Internaonal Nominees Ltd-BPSS Lux Aberdeen Global- Asian smaller companies fund

2,234,700

1.86

6 RBC Investor services Bank- COELI SCAV I- Froner Markets Funds

2,223,027

1.85

7 BNYM SA/NV-Blackrock Froners Investment Trust PLC

2,107,175

1.76

8 HSBC Internaonal Nominees Ltd-SSBT Aberdeen Instuonal Commingled Funds LLC

1,880,000

1.57

9 HSBC INTL NOM LTD-BP2S LUXEMBOURG-ABERDEEN GLOBAL FRONTIER MARKETS EQUITY FUND

1,830,800

1.53

10 Northern Trust CO S/A - Northern Trust Fiduciary Services (Ireland) Ltd AS TRUSTEE TO BARING ASEAN FRO

1,825,368

1.52

11 HSBC Internaonal Nominees Ltd-BP2S London- Aberdeen Asia SmallerCompanies Investment Trust

1,490,800

1.24

12 Renuka Hotels Limited

1,400,000

1.17

13 Cargo Boat Development Company Limited

1,400,000

1.17

14 HSBC INTL NOM LTD-JPMCB-INVESTERINGSFORENINGEN BANKINVEST,AFD NEW EMERGING MARKETS AKTIER

1,206,844

1.01

15 Nothern Trust Global Services London S/A VERDIPAPIRONDET ODIN EMERGING MARKETS

1,191,184

0.99

16 Mellon Bank N.A.- Florida Rerement system

1,100,000

0.92

17 Employees Provident Fund

1,007,958

0.84

18 HSBC Internaonal Nominees Ltd-BPSS Lux Aberdeen Global- Emerging markets smaller companies fund

1,000,000

0.83

19 Crescent Launderers & Dry Cleaners (Pvt) Ltd

1,000,000

0.83

950,060

0.79

20 CB NY S/A WASATCH FRONTIER EMERGING SMALL COUNTRIES CIT FUND

Source: Q4 FY 14 interim financial statements

www.bartleetreligare.com

Page 7

BRS Equity Research

DISCLAIMER

Important Disclosures

This report was prepared by Strategic Research Limited for clients of Bartleet Religare Securities.

Special Disclosures

Special Disclosures for certain additional disclosure statements (if applicable).

Intended Recipients

This report is intended only for the use of the individual or entity named above and may contain information that is confidential and privileged. It is intended only

for the perusal of the individual or entity to whom it is addressed and others who are authorized to receive it. If you are not the intended recipient of this report,

you are hereby on notice that any disclosure, dissemination, distribution, copying or taking action relying on the contents of this information is strictly prohibited

and illegal.

BRS, is not liable for the accurate and complete transmission of the information contained herein nor any delay in its receipt. If you have received this email in

error, please notify us immediately by return email and please destroy the original message

This report is not intended for citizens (individual or corporate) based in the United States of America.

Analyst Certification

Each of the analysts identified in this report certifies, with respect to the companies or securities that the individual analyses, that the views expressed in this report

reflect his or her personal views about all of the subject companies and all of the securities and No part of his or her compensation was, is or will be directly or

indirectly dependent on the specific recommendations or views expressed in this report. If the lead analyst holds shares of the coverage; that will be listed here.

Stock Ratings

Recommendation

Expected absolute returns (%) over 12 months

Buy

More than 10%

Hold

Between 10% and 0

Sell

Less than 0%

Expected absolute returns are based on the share price at market close unless otherwise stated. Stock recommendations are based on absolute upside (downside)

and have a 12-month horizon. Our target price represents the fair value of the stock based upon the analysts discretion. We note that future price fluctuations

could lead to a temporary mismatch between upside/downside for a stock and our recommendation.

General Disclaimers

This report is strictly confidential and is being furnished to you solely for your information purposes.

The information, tools and material presented in this report are not to be used or considered as an offer or solicitation of an offer to sell or to purchase

or subscribe for securities.

SRL has not taken any measures to guarantee in any way that the securities referred to herein are suitable investments for any particular investor. SRL

will not under any circumstance, consider recipients as its customers by virtue of them receiving the report. The investments or services contained or

referred to in this report may not be suitable for you and it is highly recommended that you consult an independent investment advisor if you are in

any doubt about such investments or related services.

Further, nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or

appropriate to your individual circumstances, investment needs or otherwise construes a personal recommendation to you.

Information and opinions presented herein were obtained or derived from sources that SRL believes to be relied upon, but SRL makes no representations or warranty, express or implied, as to their accuracy or completeness or correctness.

SRL accepts no liability whatsoever for any loss arising from the use of the material presented in this report.

This report is not to be relied upon as a substitute for the exercise of independent judgment. SRL may have issued, and may in the future issue, a

trading call regarding this security. Trading calls are short term trading opportunities based on market events and catalysts, while stock ratings reflect

investment recommendations based on expected absolute return over a 12-month period as defined in the disclosure section. Because trading calls

and stock ratings reflect different assumptions and analytical methods, trading calls may differ directionally from the stock rating.

Past performance should not be taken as any indication or guarantee of future performance, and no representation or warranty, express or implied, is

made regarding future performance.

Information, opinions and estimates contained in this report reflect a judgment of its original date of publication by SRL and are subject to change

without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The

value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of

such securities.

SRL may or may not seek to do business with companies covered in our research report. As a result, investors should be aware that the firm may have

a conflict of interest that could affect the objectivity of research produced by SRL. Investors should consider our research as only a single factor in

making their investment decision.

Any reference to a third party research material or any other report contained in this report represents the respective research organization's estimates and views

and does not represent the views and opinions of SRL. SRL, its officers and employees do not accept any liability or responsibility whatsoever with respect to the

accuracy or correctness of such information. Further, SRL has included such reports or made reference to such reports in good faith (bona fide).

www.bartleetreligare.com

Page 8

Bartleet Religare Securities (Pvt) Ltd

www.bartleetreligare.com

BRS Equity Research - research@bartleetreligare.com

Page 9

You might also like

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNo ratings yet

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Demand and Need For Transparency and Disclosure in Corporate GovernanceDocument9 pagesThe Demand and Need For Transparency and Disclosure in Corporate GovernanceAnis Ur Rehman KakakhelNo ratings yet

- Dow Chemical Company Annual Report - 1945Document17 pagesDow Chemical Company Annual Report - 1945fresnoNo ratings yet

- Target Corporation: Ackman Versus The Board: FM2 Case Study AnalysisDocument6 pagesTarget Corporation: Ackman Versus The Board: FM2 Case Study AnalysisSuman MandalNo ratings yet

- Occidental Petrolium CorporationDocument10 pagesOccidental Petrolium CorporationblockeisuNo ratings yet

- Stockholders of F. Guanzon v. RDDocument1 pageStockholders of F. Guanzon v. RDJL A H-Dimaculangan0% (1)

- Investment BooksDocument2 pagesInvestment BooksRohan GhoshNo ratings yet

- Court upholds venue in shareholder disputeDocument11 pagesCourt upholds venue in shareholder disputeJM RagazaNo ratings yet

- Shareholder Loan AgreementDocument3 pagesShareholder Loan AgreementPatbauNo ratings yet

- Accounting TermsDocument4 pagesAccounting TermsKapil GuptaNo ratings yet

- Beams AdvAcc11 ChapterDocument27 pagesBeams AdvAcc11 ChapterSt Teresa AvilaNo ratings yet

- Introduction to Financial ManagementDocument41 pagesIntroduction to Financial ManagementRonan PermejoNo ratings yet

- Assignment MF0001: (2 Credits) Set 1Document9 pagesAssignment MF0001: (2 Credits) Set 1470*No ratings yet

- Applications FinalDocument50 pagesApplications FinalShwetank SinghNo ratings yet

- A Presentation On Alcar Approach of Value Based NewDocument10 pagesA Presentation On Alcar Approach of Value Based NewMoinuddin FahadNo ratings yet

- Corporate Finance Ppt. SlideDocument24 pagesCorporate Finance Ppt. SlideMd. Jahangir Alam100% (1)

- NISM Series IX Merchant Banking Workbook February 2019 PDFDocument211 pagesNISM Series IX Merchant Banking Workbook February 2019 PDFBiswajit SarmaNo ratings yet

- Business Ethics Ethical Decision Making and Cases 10th Edition Ferrell Test BankDocument11 pagesBusiness Ethics Ethical Decision Making and Cases 10th Edition Ferrell Test BankRobertAdamswsqf100% (36)

- Franklin India Flexicap FundDocument1 pageFranklin India Flexicap FundSandeep BorseNo ratings yet

- Cimmco LTD Reply To Clarification Sought by The Exchange (Company Update)Document6 pagesCimmco LTD Reply To Clarification Sought by The Exchange (Company Update)Shyam SunderNo ratings yet

- CGC APPLICATION FORMDocument17 pagesCGC APPLICATION FORMslipargolok0% (1)

- Report On Common Size StatementDocument12 pagesReport On Common Size StatementMahi Salman Thawer0% (1)

- Stocks and Shares Case of StudyDocument4 pagesStocks and Shares Case of StudyBrayan Manuel Cabrera DuvergeNo ratings yet

- Companies Act Unit 1 Questions PMDocument5 pagesCompanies Act Unit 1 Questions PMAsmita RustagiNo ratings yet

- Session 32 TestDocument3 pagesSession 32 TestAnshik BansalNo ratings yet

- Chapter 1-Solution To ProblemsDocument7 pagesChapter 1-Solution To ProblemsawaisjinnahNo ratings yet

- Answer For Exercises Online Learning 1Document4 pagesAnswer For Exercises Online Learning 1Xiao Yun YapNo ratings yet

- Final - NFC Perpetual Bonds - Prospectus - Clean PDFDocument90 pagesFinal - NFC Perpetual Bonds - Prospectus - Clean PDFCharlie PhillipsNo ratings yet

- AFAR - BC OneDocument2 pagesAFAR - BC OneJoanna Rose DeciarNo ratings yet

- Weekly Assignment 4 - Mohit Sharma - 55Document2 pagesWeekly Assignment 4 - Mohit Sharma - 55amyna abhavaniNo ratings yet

- CH 6 - Cost of Capital PDFDocument49 pagesCH 6 - Cost of Capital PDFJanta RajaNo ratings yet