Professional Documents

Culture Documents

Break Even Analysis

Uploaded by

Chandramouli Kolavasi100%(1)100% found this document useful (1 vote)

79 views2 pagesBreak - Even Analysis is based on fixed costs, variable costs and total revenue. Semivariable costs and depreciation are not accounted which is significant in any manufacturing firm. Break - even chart is not suitable under fluctuating business environment.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBreak - Even Analysis is based on fixed costs, variable costs and total revenue. Semivariable costs and depreciation are not accounted which is significant in any manufacturing firm. Break - even chart is not suitable under fluctuating business environment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

79 views2 pagesBreak Even Analysis

Uploaded by

Chandramouli KolavasiBreak - Even Analysis is based on fixed costs, variable costs and total revenue. Semivariable costs and depreciation are not accounted which is significant in any manufacturing firm. Break - even chart is not suitable under fluctuating business environment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Break - even analysis

Formulas :

Total cost = Fixed costs + Variable costs

TC = FC+VC

Total revenue (TR) = Selling price per unit x number of units sold.

Profit = Total revenue Total cost (fixed cost + variable cost)

Profit = TR TC

Break even point in terms of sales value (Rs.)

Total Fixed cost

= -------------------------------------------BEP(Rs)

Total revenue Total variable cost

Break even point in terms of quantity (units)

Q

x Selling price

Total Fixed cost

Q

= -------------------------------------------------------------BEP(units)

{Selling price per unit} Variable cost per unit

Margin of safety = Actual (Budgeted) sales Sales at B.E.P.

Profit volume ratio (P/V ratio)

contribution

P/V ratio = ------------------------ x 100

Total sales revenue

Change in profit

P/V ratio= ---------------------Change in sales

Change in contribution

P/V ratio = ----------------------------Change in sales

Contribution = [Selling price per unit Variable cost per unit]

Contribution = [Fixed cost per unit + Profit per unit ]

Limitations of Break Even Analysis

1. The analysis is based on fixed costs, variable costs and total revenue. Any change in one

variable affects break even point.

2. Semivariable costs and depreciation are not accounted which is significant in any

manufacturing firm.

3. Multiple charts are to be produced in case of multi product firm.

4. The effect of technological development, managerial effectiveness also determines

profitability. These factors are not considered in break - even chart.

5. The break even chart is based on fixed cost concept and hence holds good for a short

period.

6. Break even analysis is not suitable under fluctuating business environment.

Problems

1. If sales is 10,000 units and selling price is Rs.20 per unit, variable cost Rs.10 per unit and

fixed cost is Rs.80,000. Find out BEP in units and in sales revenue. What is profit

earned ? what should be the sales for earning a profit of Rs.60,000?.

2. The PV ratio of Matrix books Ltd. Is 40% and margin of safety is 30%. You are required

to workout the BEP and Net profit if the sales volume is Rs.14,000/3. Sale of a product amounts to 20 units per month Rs. 10 per unit. Fixed overheads are

Rs.400 per month and variable cost is Rs. 6 per unit. There is a proposal to reduce prices

by 10%. Calculate present and future PV ratio.

4. Sale of rs. 1,10,000 producing a profit of Rs.4000 in period-1. Sales of Rs.1,50,000

producing a profit of Rs.12,000 in period-11. Determine BEP and fixed expenses

5. A concern is manufacturing a product which is sold for Rs.10.50 per unit and the fixed

cost of assets is Rs.50,000 with a variable cost of Rs.6.50 per unit. How many units must

be produced to break-even? How many units must be produced to earn profit of

Rs.10,000? What would be the profit for sales volume of 20,000 units ?

6. A gear manufacturing company sells gears at a selling price of Rs.250 per unit. The

company cost commitment at Rs.20 lakhs and variable cost of Rs.125/- per unit calculate

a) Break even sales quantity

b) Break even sales

c) Contribution

d) Margin of safety if actual production quantity is 60,000 units.

You might also like

- StopHunt Mastery PDFDocument115 pagesStopHunt Mastery PDFoli100% (10)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- CVP NotesDocument7 pagesCVP NotesKerrice RobinsonNo ratings yet

- Advanced Topics in Types and Programming LanguagesDocument589 pagesAdvanced Topics in Types and Programming LanguagesChandramouli Kolavasi100% (1)

- Uber Porter's Five Forces Analysis PresentationDocument12 pagesUber Porter's Five Forces Analysis PresentationAshish Singh100% (1)

- CVP Analysis Final 1Document92 pagesCVP Analysis Final 1Utsav ChoudhuryNo ratings yet

- Procter and GambleDocument36 pagesProcter and Gambleamnaarshad100% (1)

- Break Even AnalysisDocument6 pagesBreak Even Analysisemmanuel Johny100% (1)

- Session 10-11, CVP Analysis - PPTX (Repaired)Document35 pagesSession 10-11, CVP Analysis - PPTX (Repaired)Nikhil ChitaliaNo ratings yet

- Group 7 BreakevenquantiDocument56 pagesGroup 7 BreakevenquantiAndrei Nicole Mendoza Rivera67% (3)

- Cost-Volume Profit AnalysisDocument26 pagesCost-Volume Profit AnalysisClarizza20% (5)

- Ice Fili Case AnalysisDocument11 pagesIce Fili Case AnalysisZahid KhanNo ratings yet

- Development and Role of Selling in Marketing (2 of 2)Document18 pagesDevelopment and Role of Selling in Marketing (2 of 2)Shoaib ImtiazNo ratings yet

- Fundamentals of Marketing Management PDFDocument6 pagesFundamentals of Marketing Management PDFAli RizviNo ratings yet

- Cost Volume Profit AnalysisDocument20 pagesCost Volume Profit AnalysisSidharth RayNo ratings yet

- Logistic Supply and Chain Management Multiple Choice QuestionsDocument37 pagesLogistic Supply and Chain Management Multiple Choice QuestionsAbhishek A. Nadgire100% (1)

- Software Engineering MarsicDocument389 pagesSoftware Engineering MarsicAdarsh NairNo ratings yet

- Cost Volume Profit Analysis (Decision Making) - TaskDocument9 pagesCost Volume Profit Analysis (Decision Making) - TaskAshwin KarthikNo ratings yet

- Module 4 Cost Volume Profit AnalysisDocument6 pagesModule 4 Cost Volume Profit AnalysisJackielyn RavinaNo ratings yet

- CVP AnalysisDocument41 pagesCVP AnalysisRahul Kumar Jain100% (1)

- Break-Even Analysis ExplainedDocument17 pagesBreak-Even Analysis Explainedsana khanNo ratings yet

- BREAK EVEN ANALYSIS EXPLAINEDDocument21 pagesBREAK EVEN ANALYSIS EXPLAINEDpurn kaur100% (1)

- Pricing DecisionDocument10 pagesPricing DecisionVenkat RajuNo ratings yet

- Breakeven Analysis 0Document35 pagesBreakeven Analysis 0Nistha Bisht100% (1)

- Module - 8 Profits and Break - Even AnalysisDocument20 pagesModule - 8 Profits and Break - Even AnalysisArun KumarNo ratings yet

- Break Even AnalysisDocument10 pagesBreak Even AnalysisSai MalaNo ratings yet

- Session 12 CVP AnalysisDocument52 pagesSession 12 CVP Analysismuskan mittalNo ratings yet

- CVP Analysis Helps Evaluate Effects of ChangesDocument41 pagesCVP Analysis Helps Evaluate Effects of ChangesAbdulyunus Amir100% (1)

- Management AccountingDocument68 pagesManagement AccountingNekibur DeepNo ratings yet

- 01 BreakEvenAnalysisDocument4 pages01 BreakEvenAnalysisss4mickyNo ratings yet

- CVP Analysis and Relevant CostingDocument39 pagesCVP Analysis and Relevant CostingJai AceNo ratings yet

- Math Accounting by AtaurDocument28 pagesMath Accounting by AtaurShajib KhanNo ratings yet

- CVP AnalysisDocument37 pagesCVP Analysis20B81A1235cvr.ac.in G RUSHI BHARGAVNo ratings yet

- Lecture 4b Cost Volume Profit EditedDocument24 pagesLecture 4b Cost Volume Profit EditedJinnie QuebrarNo ratings yet

- 1 CVP RelationshipDocument22 pages1 CVP RelationshipmedrekNo ratings yet

- Marginal CostingDocument2 pagesMarginal Costingrupeshdahake8586No ratings yet

- Business & Finance Chapter-7 Part-02 PDFDocument12 pagesBusiness & Finance Chapter-7 Part-02 PDFRafidul IslamNo ratings yet

- Marginal Costing Tutorial: Learn Key Concepts With ExamplesDocument5 pagesMarginal Costing Tutorial: Learn Key Concepts With ExamplesRajyaLakshmiNo ratings yet

- Marginal Costing Numericals PDFDocument7 pagesMarginal Costing Numericals PDFSubham PalNo ratings yet

- Marginal CostingDocument9 pagesMarginal CostingSharika EpNo ratings yet

- Module 4Document42 pagesModule 4Eshael FathimaNo ratings yet

- 03 NotesDocument5 pages03 NotesMahendra JarwalNo ratings yet

- CVP AnalysisDocument17 pagesCVP AnalysisDave AguilaNo ratings yet

- Cost Volume Profit Analysis Decision MakingDocument37 pagesCost Volume Profit Analysis Decision MakingAmritesh Mishra100% (1)

- Unit 11 Break-Even Cost Volume Profit AnalysisDocument30 pagesUnit 11 Break-Even Cost Volume Profit Analysisjatin4verma-2No ratings yet

- Vol 2. SampleDocument23 pagesVol 2. SamplevishnuvermaNo ratings yet

- Absorption and Marginal CostingDocument58 pagesAbsorption and Marginal CostingtokyadaluNo ratings yet

- Chapter 5, CVP AnalysisDocument3 pagesChapter 5, CVP AnalysisAhad SultanNo ratings yet

- CVP analysis guideDocument6 pagesCVP analysis guidetahir abbasNo ratings yet

- 03-04-2012Document62 pages03-04-2012Adeel AliNo ratings yet

- 3.71-3.7.4 Firm'S Costs & RevenueDocument12 pages3.71-3.7.4 Firm'S Costs & RevenueZati Zhafarina Che RazaliNo ratings yet

- Cost VolumeDocument2 pagesCost VolumeChristieJoyCaballesParadelaNo ratings yet

- 8-Module Break Even AnalysisDocument23 pages8-Module Break Even AnalysisRAJASHEKAR REDDY SNo ratings yet

- 2.1 Powerpoint - Slides - To - Chapter - 16Document40 pages2.1 Powerpoint - Slides - To - Chapter - 16Sarthak PatidarNo ratings yet

- Chap1 Marginal Costing & Decision MakingDocument31 pagesChap1 Marginal Costing & Decision Makingrajsingh15No ratings yet

- PRICING EXERCISES ANALYSISDocument14 pagesPRICING EXERCISES ANALYSISvineel kumarNo ratings yet

- CVP 1909Document16 pagesCVP 1909Sayan RoyNo ratings yet

- Break Even AnalysisDocument9 pagesBreak Even AnalysisRoselle Manlapaz LorenzoNo ratings yet

- 30 12 22Document8 pages30 12 22vasanthgurusamynsNo ratings yet

- CVP AnalysisDocument41 pagesCVP AnalysisMasud Khan ShakilNo ratings yet

- Marginal costing techniques for profit planning and decision makingDocument18 pagesMarginal costing techniques for profit planning and decision makingKishor Nag0% (1)

- Arch Presentation 17Document16 pagesArch Presentation 17shanto tpiNo ratings yet

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNo ratings yet

- MMPC 4 em 2023 24Document22 pagesMMPC 4 em 2023 24Rajni KumariNo ratings yet

- Five Important Factors Influence Cost Volume Profit Analysis AreDocument9 pagesFive Important Factors Influence Cost Volume Profit Analysis Aresuraj banNo ratings yet

- Practie Question-Break Even AnalysisDocument6 pagesPractie Question-Break Even AnalysismuraleejNo ratings yet

- Presented By: Lutfi Ms Ananthakrishnan Malavika Sreekumar Manilal Kasera Mitesh KumarDocument14 pagesPresented By: Lutfi Ms Ananthakrishnan Malavika Sreekumar Manilal Kasera Mitesh KumarManilal kaseraNo ratings yet

- CVP Solved QAsDocument272 pagesCVP Solved QAsKhalid Mahmood63% (8)

- Nature, Functions and Importance of ManagementDocument9 pagesNature, Functions and Importance of ManagementChandramouli KolavasiNo ratings yet

- Uml Lab MaterialDocument149 pagesUml Lab MaterialChandramouli KolavasiNo ratings yet

- Joins SubqueryDocument17 pagesJoins SubqueryChandramouli KolavasiNo ratings yet

- Functional ManagementDocument6 pagesFunctional ManagementChandramouli KolavasiNo ratings yet

- JSP: Java Server Pages: Based On A Presentation by Richard Cannings and Vicky TsangDocument45 pagesJSP: Java Server Pages: Based On A Presentation by Richard Cannings and Vicky TsangChandramouli KolavasiNo ratings yet

- I Unit Os OverviewDocument14 pagesI Unit Os OverviewChandramouli KolavasiNo ratings yet

- DBMS Notes: Data, Models, StructureDocument34 pagesDBMS Notes: Data, Models, StructureChandramouli KolavasiNo ratings yet

- Management Science NOTESDocument15 pagesManagement Science NOTESChandramouli Kolavasi100% (1)

- UNIT 1A2ZjntuSpecialDocument15 pagesUNIT 1A2ZjntuSpecialnazi1945No ratings yet

- Basics of ORDBMS and Object-Oriented Database DesignDocument6 pagesBasics of ORDBMS and Object-Oriented Database DesignChandramouli KolavasiNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- Unit 1Document40 pagesUnit 1Chetan Singh100% (1)

- Unit 1Document40 pagesUnit 1Chetan Singh100% (1)

- Deregulated Power System: Presented byDocument21 pagesDeregulated Power System: Presented bySurya TejaNo ratings yet

- What Is Visual MerchandisingDocument2 pagesWhat Is Visual Merchandisingaman rajNo ratings yet

- Bep TestDocument27 pagesBep TestLovepreetNo ratings yet

- Pengaruh Integrated Marketing Communication Terhadap Kepuasan Nasabah Yang Dimediasi Oleh Citra Bank Sumsel BabelDocument12 pagesPengaruh Integrated Marketing Communication Terhadap Kepuasan Nasabah Yang Dimediasi Oleh Citra Bank Sumsel BabelAnonymous Fjh4I2Fk1No ratings yet

- 5033 - AssignmentDocument6 pages5033 - AssignmentVũ Huy100% (2)

- Derivative Strategies For Managing Portfolio Risk-Keith C. Brown-1932495568Document133 pagesDerivative Strategies For Managing Portfolio Risk-Keith C. Brown-1932495568todkarvijayNo ratings yet

- Chapter 1Document32 pagesChapter 1Sheri Dean100% (1)

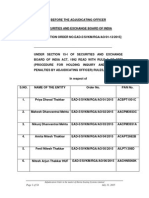

- Adjudication Order in The Matter of Harita Seating Systems Ltd.Document54 pagesAdjudication Order in The Matter of Harita Seating Systems Ltd.Shyam SunderNo ratings yet

- Chartered Economics - Detailed CurriculumDocument43 pagesChartered Economics - Detailed CurriculumRAVI KUMAR DWIVEDI100% (2)

- Marketing Management: Managing Personal Communications Direct Marketing, Personal Selling, and Extended Marketing MixDocument26 pagesMarketing Management: Managing Personal Communications Direct Marketing, Personal Selling, and Extended Marketing MixBilal Raja100% (2)

- The Scope of Industrial Marketing: Industrial Marketing Is DifferentDocument11 pagesThe Scope of Industrial Marketing: Industrial Marketing Is DifferentAamir Shehzad100% (2)

- Financial Market Part 1 PDFDocument23 pagesFinancial Market Part 1 PDFsanjayifmNo ratings yet

- Evolution of MarketingDocument4 pagesEvolution of MarketingGIDEON KATONo ratings yet

- A Economics Gr. 12 Monopoly PresentationDocument22 pagesA Economics Gr. 12 Monopoly PresentationHari prakarsh NimiNo ratings yet

- Consumer Choice: 2.1 Utility Functions and Marginal Utility FunctionsDocument7 pagesConsumer Choice: 2.1 Utility Functions and Marginal Utility FunctionsLaxman KeshavNo ratings yet

- Instruments of Money MarketDocument17 pagesInstruments of Money MarketTanvir Hasan SohanNo ratings yet

- Microeconomics Fall Exam QuestionsDocument3 pagesMicroeconomics Fall Exam QuestionsAhmad Sina SabawoonNo ratings yet

- Squash Kalamay Business PlanDocument31 pagesSquash Kalamay Business PlanDENXIONo ratings yet

- Chapter 23 Answer PDFDocument4 pagesChapter 23 Answer PDFJessa SaplacoNo ratings yet

- Week 3 - Quiz - PDF 1 EC102Document3 pagesWeek 3 - Quiz - PDF 1 EC102AisakeNo ratings yet

- Chuck LeBeau - Founder of System Traders ClubDocument2 pagesChuck LeBeau - Founder of System Traders ClubcoachbiznesuNo ratings yet

- Review Questions on Private Placement, Derivatives, and Securities Market RegulationsDocument4 pagesReview Questions on Private Placement, Derivatives, and Securities Market RegulationsshamiullahNo ratings yet

- Managerial Economics Midterm Exam MCQDocument4 pagesManagerial Economics Midterm Exam MCQBeautiful Disaster100% (1)