Professional Documents

Culture Documents

KMJ Property Chart

Uploaded by

KMJonesUS100%(2)100% found this document useful (2 votes)

2K views1 pageCurrent Interest Estates Confers rights to enjoyment of property at a future time. Contingent Freehold Fee Tail (not in Texas - Attempts to create will result in Fee Simple Defeasible) Class Gift Usually reserved by Government or Sovereign Entities Executory Interest Must divest the prior estate Fee Simple subject to Executory Limitation.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCurrent Interest Estates Confers rights to enjoyment of property at a future time. Contingent Freehold Fee Tail (not in Texas - Attempts to create will result in Fee Simple Defeasible) Class Gift Usually reserved by Government or Sovereign Entities Executory Interest Must divest the prior estate Fee Simple subject to Executory Limitation.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

2K views1 pageKMJ Property Chart

Uploaded by

KMJonesUSCurrent Interest Estates Confers rights to enjoyment of property at a future time. Contingent Freehold Fee Tail (not in Texas - Attempts to create will result in Fee Simple Defeasible) Class Gift Usually reserved by Government or Sovereign Entities Executory Interest Must divest the prior estate Fee Simple subject to Executory Limitation.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

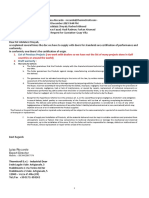

Tenurial Estates

”Possessory Estates”

Current Interest Estates Future Interest Estates

Vested

Confers rights to enjoyment of property at a future time. Defeasible

Contingent

Freehold

Fee Tail Interested created in Transferee

(Not in Texas – Attempts

Fee Simple Absolute

to create will result in Fee Class Gift

“To A and his heirs”

Simple or Fee Simple

Defeasible) Executory Interest

Must divest the prior estate If no RAP: Vested subject to open

Usually reserved by Government or Sovereign Entities

Created as Shifting Executory Interest If RAP applies: A class gift must

Life Estate Fee Simple Future interest that must cut short some vest in all of the members of the class

“To A for Life” Subject to interest in another transferee to become or it vest in none of the members of

Always followed by a future Executory possessory the class.

interest (Reversion or Remainder) Limitation To vest, a class must be closed, and

Springing Executory Interest all conditions satisfied within the

Future interest that must divest the transferor perpetuities period.

in the future to become possessory

Left over Interest after conveyance

Rules:

Leasehold Estates - Remainder can not follow Vested Fee Simple

Non-Freehold Possessory Remainder - Rule of Destructibility of Contingent Remainders: A

Estates Reversionary Interest Future Interest which waits until termination remainder in land is destroyed if it does not vest at or before

Defeasible Fees Future interest in the transferor of proceeding possessory estate the termination of the proceeding freehold estate. (Not

Term of Years Can only be created in the Must be vested when created applicable in TX)

Estate ending on a fixed transferee Reversion - Doctrine of Merger: If the life estate and the next vested

calendar date (may be less Interest left in grantor after estate in fee simple come into the hands of one person, the

than a year) transferring less than his full lesser estate merges in to the larger. (Does not apply to

Fee Simple Contingent Remainder executory interest)

interest

Determinable Condition to be met, or - Rule in Shelly’s Case: If 1 instrument creates a life estate in

Inter vivos transfer allowed

Ends automatically unascertained person land in A and purports to create a remainder in persons

Periodic Tenancy when event occurs described as A’s Heirs and the Life Estate are both legal, then

the remainder becomes a remainder in fee simple in A.

Magic Words (i.e. (Abolished in Texas since Jan 1, 1964)

with Durational Spring Possibility of Reverter Vested Remainder

Ascertained person and no - Doctrine of Worthier Title: Where there is a inter vivos

Aspect): So long as, conveyance of land by a grantor to a person with a limitation

While, During, Until. condition precedent

Tenancy at Will over to the grantor’s own heirs either by way of remainder or

executory interest, no future interest in the heirs is created,

Vested Subject to Open rather a reversion is retained by the grantor. (Furthers

Fee Simple Subject to aka Vested Subject to Partial alienability, But was Abolished in Texas since Jan 1, 1964)

Condition Subsequent Divestment - RAP: No interest is good unless it must vest if at all not later

May last forever, or may Right of Entry than 21 years after some life in being at the creation of the

terminate when event interest. (Only 3 interest subject to RAP, Contingent

occurs (at transferor’s CL: No inter vivos. transfer Indefeasibly Vested

String Certain to become possessory Remainder, Executory Interest, Class Gift)

election) Maj: inter vivos transfer - USRAP: Wait and See, 90 year vesting period., (TX shows

permitted. in the future and can not be

divested. no interest in adopting.)

Magic Words: But it, TX: ?

Provided, However, On Definitions:

Condition. Trust: Separation of Equitable and Legal Title

Hierarchy of Estates: Fee Simple -> Fee Tail -> Life Estate ->

Leasehold Estate

Kevin M. Jones, Spring 2007

You might also like

- Possessory Estates ChartDocument8 pagesPossessory Estates ChartJudy123No ratings yet

- Possessory Estates & Future InterestsDocument1 pagePossessory Estates & Future InterestsAnnaNo ratings yet

- Freehold Estates ChartDocument1 pageFreehold Estates Chartpardis_saleki100% (1)

- Future Interest FlowchartDocument1 pageFuture Interest FlowchartwittclayNo ratings yet

- Possessory Estates ChartDocument8 pagesPossessory Estates Charthel101189hotmailcom100% (1)

- Present Interest ChartDocument2 pagesPresent Interest ChartpowellpmNo ratings yet

- Interest in Land Chart - Property Law - Property ChartDocument1 pageInterest in Land Chart - Property Law - Property Chartslow2fear100% (8)

- Property Attack Outline1Document5 pagesProperty Attack Outline1DMStom0% (2)

- Property ChartDocument2 pagesProperty Chartluckystar384100% (2)

- RAP AnswersDocument7 pagesRAP AnswersAttaxNo ratings yet

- Property Outline '11Document25 pagesProperty Outline '11Malik DeanNo ratings yet

- The Erie Doctrine: Erie Railroad Co V Tompkins, 1938Document5 pagesThe Erie Doctrine: Erie Railroad Co V Tompkins, 1938Onyi IbeNo ratings yet

- Constitutional Law Cheat Sheet by ParkerazDocument3 pagesConstitutional Law Cheat Sheet by Parkerazellie100% (1)

- Property Rule StatementsDocument9 pagesProperty Rule Statementsmaxcharlie1100% (1)

- Property Flow ChartDocument1 pageProperty Flow ChartAri BernsteinNo ratings yet

- Exam RoadmapsDocument41 pagesExam Roadmapsnathanlawschool100% (2)

- Property Review OutlineDocument22 pagesProperty Review OutlineLazinessPerSe100% (1)

- Black Letter Law Grid - Property Law II Study Guide - Quick Reference Law School GuideDocument1 pageBlack Letter Law Grid - Property Law II Study Guide - Quick Reference Law School GuideJJ850100% (7)

- Intestate Disposition ChartDocument1 pageIntestate Disposition ChartseabreezeNo ratings yet

- Black Letter Law Grid - Constitutional Law Study Guide - Quick Reference Law School GuideDocument2 pagesBlack Letter Law Grid - Constitutional Law Study Guide - Quick Reference Law School GuideJJ850100% (5)

- Possessory Estates ChartDocument8 pagesPossessory Estates ChartJulia Bienstock100% (10)

- Sarah Property Outline 4.20Document14 pagesSarah Property Outline 4.20Sarah Kurtz DanowitzNo ratings yet

- Civ Pro Rule Statements DraftDocument3 pagesCiv Pro Rule Statements DraftkoreanmanNo ratings yet

- Chart PropertyDocument15 pagesChart PropertyEric Erics100% (2)

- Property OutlineDocument67 pagesProperty Outlinemitchturb100% (6)

- Con LAW Good OutlineDocument144 pagesCon LAW Good Outlinelost4985100% (8)

- Outline Contracts Knapp SP 02Document103 pagesOutline Contracts Knapp SP 02adlahc1234567100% (1)

- Property Freehold Estates Chart F2010Document1 pageProperty Freehold Estates Chart F2010krzyreeesh100% (1)

- Property Outline A+ TestDocument80 pagesProperty Outline A+ TestMaria Ariadna97% (35)

- SERVITUDESDocument5 pagesSERVITUDESmfarooqi21100% (1)

- Constitutional Law Essay OneDocument8 pagesConstitutional Law Essay OneshizukababyNo ratings yet

- Property Law OutlineDocument19 pagesProperty Law OutlinePaige Morgan100% (1)

- Constitutional Law ChecklistDocument3 pagesConstitutional Law Checklistbdittman2975% (4)

- Appointment Powers Flow ChartDocument1 pageAppointment Powers Flow ChartcoppercowNo ratings yet

- Real PropertyDocument20 pagesReal PropertyTiffany BrooksNo ratings yet

- Personal Jurisdiction FlowchartsDocument2 pagesPersonal Jurisdiction FlowchartsAlodieEfamba100% (5)

- Property Course OutlineDocument40 pagesProperty Course OutlineKatlyn Cinelli100% (1)

- Contracts PrewritesDocument22 pagesContracts PrewritesStephanie Haro100% (1)

- Property Law Outline EDITDocument17 pagesProperty Law Outline EDITChris BurgeNo ratings yet

- Property OutlineDocument17 pagesProperty OutlinecwoodisthemanNo ratings yet

- Constitutional Law OutlineDocument43 pagesConstitutional Law OutlineKaetlin MartinNo ratings yet

- Future InterestsDocument1 pageFuture Interestsluckystar384No ratings yet

- OutlineDocument58 pagesOutlineSpencer HardyNo ratings yet

- Acquisition by First Possession: ChecklistDocument2 pagesAcquisition by First Possession: ChecklistDiobel RodriguezNo ratings yet

- Estates and Future Interests OutlineDocument21 pagesEstates and Future Interests OutlineManny Foster100% (2)

- Property OutlineDocument78 pagesProperty Outlinejdfdf100% (2)

- Property Attack Outline Eslund Spring 2011Document22 pagesProperty Attack Outline Eslund Spring 2011Patricia Torres TorresNo ratings yet

- EP Flow ChartDocument6 pagesEP Flow Chartmikunta100% (1)

- Civil Procedure Rule ProofsDocument18 pagesCivil Procedure Rule Proofsang3lwings100% (2)

- Property Attack + ReferenceDocument3 pagesProperty Attack + ReferencenathanlawschoolNo ratings yet

- Torts OutlineDocument23 pagesTorts OutlineCamille2221No ratings yet

- Con Law Outline ExcellentDocument40 pagesCon Law Outline ExcellentRyan Hiler100% (9)

- Property II OutlineDocument8 pagesProperty II OutlineMegan McCormackNo ratings yet

- Contracts 2 OutlineDocument37 pagesContracts 2 OutlineBrandon YeboahNo ratings yet

- Contracts Outline II Professor Knapp I. Parol Evidence Under The UCCDocument43 pagesContracts Outline II Professor Knapp I. Parol Evidence Under The UCCieaeaea100% (1)

- Con Law OutlineDocument14 pagesCon Law Outlinetm05101No ratings yet

- Real Property Outline: Intro/ Acquisition of Property/Capture Rule/Finder's LawDocument46 pagesReal Property Outline: Intro/ Acquisition of Property/Capture Rule/Finder's LawvinNo ratings yet

- Elward Evidence OutlineDocument31 pagesElward Evidence OutlineAnonymous 13FhBKlNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- Non-Disclosure Agreement TemplateDocument4 pagesNon-Disclosure Agreement TemplateAnonymous 9hNRlV2100% (2)

- Referencer - All India Services Conduct Rules 1968 - Rule 16Document3 pagesReferencer - All India Services Conduct Rules 1968 - Rule 16whatzinaname2009No ratings yet

- CreditReport Piramal - Mahendra Jain - 2023 - 05 - 12 - 11 - 43 - 04.pdf 12-May-2023 PDFDocument7 pagesCreditReport Piramal - Mahendra Jain - 2023 - 05 - 12 - 11 - 43 - 04.pdf 12-May-2023 PDFGamer SinghNo ratings yet

- Ingles Taxation Two CompleteDocument151 pagesIngles Taxation Two Completevelasquez0731No ratings yet

- Hearne - Whats Wrong With Animal RightsDocument6 pagesHearne - Whats Wrong With Animal RightsAnonymous slVH85zYNo ratings yet

- Chitfund PDFDocument32 pagesChitfund PDFPranali TandelNo ratings yet

- Family LawDocument589 pagesFamily LawAshish Rai100% (4)

- Requirements of A Valid ProxyDocument10 pagesRequirements of A Valid ProxyMhatet Malanum Tagulinao-TongcoNo ratings yet

- ABC Commercial FormDocument8 pagesABC Commercial FormwellersondNo ratings yet

- Fort Bonifacio Development Corporation V Valentin L FongDocument4 pagesFort Bonifacio Development Corporation V Valentin L Fongeunicesaavedra11No ratings yet

- V BBM B' Business Law ClassDocument423 pagesV BBM B' Business Law ClassshivangiNo ratings yet

- DBP Vs CA and Sps. Timoteo and PinedaDocument2 pagesDBP Vs CA and Sps. Timoteo and PinedathesarahkristinNo ratings yet

- Joint Venture Agreement Template 07Document26 pagesJoint Venture Agreement Template 07Maria AlvarezNo ratings yet

- Reliance Commodities, Inc. v. Daewoo Industrial Co., Ltd.Document1 pageReliance Commodities, Inc. v. Daewoo Industrial Co., Ltd.vallie21No ratings yet

- 2021 Ughccd 72Document16 pages2021 Ughccd 72BALUKU JIMMYNo ratings yet

- Feati Bank & Trust Company vs. Court of AppealsDocument20 pagesFeati Bank & Trust Company vs. Court of AppealsT Cel MrmgNo ratings yet

- Labor Standards (Azucena, JR., 2013) 75Document1 pageLabor Standards (Azucena, JR., 2013) 75Marlo Caluya ManuelNo ratings yet

- UK P&I Bolero Sample Power of Attorney 2017 06Document1 pageUK P&I Bolero Sample Power of Attorney 2017 06Toheid AsadiNo ratings yet

- Equipment Rental Agreement Free Template DownloadDocument5 pagesEquipment Rental Agreement Free Template DownloadBatoshie MuradNo ratings yet

- Rationale For Grant of Retention RightsDocument5 pagesRationale For Grant of Retention RightsJennica Gyrl G. DelfinNo ratings yet

- Stronghold Insurance VS Republic PDFDocument15 pagesStronghold Insurance VS Republic PDFJohn Dy Castro FlautaNo ratings yet

- 6 - Dismissal - Operational Requirements PDFDocument15 pages6 - Dismissal - Operational Requirements PDFTeboho Tebu MofokengNo ratings yet

- Professional Practice 1Document3 pagesProfessional Practice 1Kriti GrotraNo ratings yet

- LIST OF PLATINUM IN INTRANET (Data Generated As of 18-05-2020 01'09PM)Document854 pagesLIST OF PLATINUM IN INTRANET (Data Generated As of 18-05-2020 01'09PM)Christelle Fatima CreaylaNo ratings yet

- QUIZ C4 Sec. 35-58 CORP. NAME - Set-A True or FalseDocument1 pageQUIZ C4 Sec. 35-58 CORP. NAME - Set-A True or FalseLyka mae LabadanNo ratings yet

- MA0028Document2 pagesMA0028Tenzin KunchokNo ratings yet

- Rached Abboud: List of Previous Projects Draft WarrantyDocument1 pageRached Abboud: List of Previous Projects Draft WarrantyRACHED ABBOUDNo ratings yet

- Testate Estate of The Late Alipio Abada GR No 147145 January 31 2005Document2 pagesTestate Estate of The Late Alipio Abada GR No 147145 January 31 2005Christan AxeNo ratings yet

- Construction Contract and LawsDocument48 pagesConstruction Contract and LawsFunkie Moroka75% (4)

- Dream YatraDocument23 pagesDream YatraLegal ClawsNo ratings yet